Sequential Revenue Improvement Due to Durable

Business Model; Company Generates $0.15 of GAAP EPS in Q2, $0.19 of

Non-GAAP EPS

A10 Networks (NYSE: ATEN), a leading provider of cybersecurity

and infrastructure solutions, today announced financial results for

its second quarter ended June 30, 2023.

Second Quarter 2023 Financial

Summary

- Revenue of $65.8 million, up 14.1% sequentially from Q1 and

in-line with expectations.

- GAAP gross margin of 79.5%; non-GAAP gross margin of 80.2% as a

result of continued successful navigation of short-term input cost

pressures.

- GAAP net income of $11.6 million, or $0.15 per diluted share,

compared with GAAP net income of $10.4 million, or $0.13 per

diluted share in the second quarter of 2022.

- Non-GAAP net income of $14.5 million, or $0.19 per diluted

share (non-GAAP EPS), compared with non-GAAP net income of $13.4

million, or $0.17 per diluted share in the second quarter of

2022.

- Adjusted EBITDA of $17.4 million, representing 26.4% of

revenue, in line with stated business model goals and unchanged as

a percent of revenue compared to the second quarter last year.

- Company repurchased 437,000 shares at an average price of

$14.27 for a total of $6.2 million.

- The Board of Directors approved a quarterly cash dividend of

$0.06 per share, payable on September 1, 2023 to stockholders of

record at the close of business on August 15, 2023.

A reconciliation between GAAP and non-GAAP information is

contained in the financial statements below.

“The second quarter results demonstrated sequential improvements

consistent with our expectations and our continued focus on our

business model,” said Dhrupad Trivedi, President and Chief

Executive Officer of A10 Networks. “Spending from large enterprises

and tier-one service providers in North America remains volatile,

but we are seeing encouraging signs, particularly for security

solutions, that support our confidence for continuing improvements

in the second half of the year.”

“A10 remains solidly profitable, with earnings per share

exceeding last year’s levels even on slightly lower revenue,

demonstrating our systemic profitability and the focus on our

business model,” continued Trivedi. “For the first six months of

2023, our Adjusted EBITDA margin increased by 248 basis points to a

record 26.6%, compared to 24.1% last year. We continue to balance

profitability and growth as we navigate headwinds.”

Conference Call

Management will host a call at 1:30 p.m. Pacific time (4:30 p.m.

Eastern time) today, July 26, 2023, to discuss these results.

Interested parties may access the conference call by dialing (833)

470-1428 (toll-free) or (404) 975-4839 and referencing access code:

983165.

A live audio webcast of the conference call will be accessible

from the “Investor Relations” section of A10 Network’s website at

investors.a10networks.com. The webcast will be archived for at

least 90 days. A telephonic replay of the conference call will be

available two hours after the conclusion of the live call and will

run for seven days and may be accessed by dialing (866) 813-9403

(toll-free) or (929) 458-6194 and entering the passcode 923761.

Forward-Looking

Statements

This press release contains “forward-looking statements,”

including statements regarding our anticipated future financial

results, confidence for continuing improvements in the second half

of the year, quarterly dividend payments, strategy, demand and

positioning. Forward-looking statements are subject to known and

unknown risks and uncertainties and are based on assumptions that

may prove to be incorrect, which could cause actual results to

differ materially from those expected or implied by the

forward-looking statements. Factors that may cause actual results

to differ include a significant decline in global macroeconomic or

political conditions that have an adverse impact on our business

and financial results; business interruptions related to our supply

chain; our ability to manage our business and expenses if customers

cancel or delay orders; execution risks related to closing key

deals and improving our execution; the continued market adoption of

our products; our ability to successfully anticipate market needs

and opportunities; our timely development of new products and

features; our ability to achieve or maintain profitability; any

loss or delay of expected purchases by our largest end-customers;

our ability to maintain or improve our competitive position;

competitive and execution risks related to cloud-based computing

trends; our ability to attract and retain new end-customers and our

largest end-consumers; our ability to maintain and enhance our

brand and reputation; changes demanded by our customers in the

deployment and payment model for our products; continued growth in

markets relating to network security; the success of any future

acquisitions or investments in complementary companies, products,

services or technologies; the ability of our sales team to execute

well; our ability to shorten our close cycles; the ability of our

channel partners to sell our products; variations in product mix or

geographic locations of our sales; risks associated with our

presence in international markets; weaknesses or deficiencies in

our internal control over financial reporting; our ability to

timely file periodic reports required to be filed under the

Securities Exchange Act of 1934; the impact of any cybersecurity

incidents and other risks that are described in “Risk Factors” in

our periodic filings with the Securities and Exchange Commission,

including our Form 10-K filed with the Securities and Exchange

Commission on February 27, 2023. We do not intend to update or

alter our forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

Non-GAAP Financial

Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), we refer to certain non-GAAP financial measures, including

non-GAAP net income, non-GAAP net income per basic and diluted

share (or non-GAAP EPS), non-GAAP gross profit and gross margin,

non-GAAP operating income and operating margin, non-GAAP operating

expenses, Adjusted EBITDA and Adjusted EBITDA margin. Non-GAAP

financial measures do not have any standardized meaning and are

therefore unlikely to be comparable to similarly titled measures

presented by other companies.

A10 Networks considers these non-GAAP financial measures to be

important because they provide useful measures of the operating

performance of the company, exclusive of unusual events or factors

that do not directly affect what we consider to be our core

operating performance and are used by the company's management for

that purpose.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP.

We define non-GAAP net income as our GAAP net income excluding:

(i) stock-based compensation and related payroll tax, (ii) cyber

incident remediation expense, (iii) restructuring expense and (iv)

income tax effect of excluding non-GAAP items (i) to (iii) listed

above. We define non-GAAP net income per basic and diluted share as

our non-GAAP net income divided by our basic and diluted

weighted-average shares outstanding. We define non-GAAP gross

profit as our GAAP gross profit excluding (i) stock-based

compensation and related payroll tax, (ii) cyber incident

remediation expense and (iii) restructuring expense. We define

non-GAAP gross margin as our non-GAAP gross profit divided by our

GAAP revenue. We define non-GAAP operating income as our GAAP

income from operations excluding (i) stock-based compensation and

related payroll tax, (ii) cyber incident remediation expense and

(iii) restructuring expense. We define non-GAAP operating margin as

our non-GAAP operating income divided by our GAAP revenue. We

define non-GAAP operating expenses as our GAAP operating expenses

excluding (i) stock-based compensation and related payroll tax,

(ii) cyber incident remediation expense and (iii) restructuring

expense. We define Adjusted EBITDA as our GAAP net income excluding

(i) interest and other (income) expense, net, (ii) depreciation and

amortization expense, (iii) provision for income taxes, (iv)

stock-based compensation and related payroll tax, (v) cyber

incident remediation expense and (vi) restructuring expense. We

define Adjusted EBITDA margin as our Adjusted EBITDA divided by our

GAAP revenue.

Non-GAAP financial measures are presented for supplemental

informational purposes only for understanding the company's

operating results.

About A10 Networks

A10 Networks (NYSE: ATEN) provides secure application services

and solutions for on-premises, multi-cloud and edge-cloud

environments at hyperscale. Our mission is to enable service

providers and enterprises to deliver business-critical applications

that are secure, available and efficient for multi-cloud

transformation and 5G readiness. We deliver better business

outcomes that support investment protection, new business models

and help future-proof infrastructures, empowering our customers to

provide the most secure and available digital experience. Founded

in 2004, A10 Networks is based in San Jose, Calif. and serves

customers globally. For more information, visit

https://www.a10networks.com/ and follow us @A10Networks.

The A10 logo and A10 Networks are trademarks or registered

trademarks of A10 Networks, Inc. in the United States and other

countries. All other trademarks are the property of their

respective owners.

Source: A10 Networks, Inc.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except per share amounts, on a GAAP Basis)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenue:

Products

$

39,090

$

41,475

$

70,272

$

78,520

Services

26,727

26,498

53,236

52,125

Total revenue

65,817

67,973

123,508

130,645

Cost of revenue:

Products

9,436

9,518

15,519

18,151

Services

4,027

3,967

8,160

8,173

Total cost of revenue

13,463

13,485

23,679

26,324

Gross profit

52,354

54,488

99,829

104,321

Operating expenses:

Sales and marketing

20,868

21,773

43,202

44,555

Research and development

13,965

14,235

25,630

27,122

General and administrative

5,255

5,337

12,564

11,499

Total operating expenses

40,088

41,345

81,396

83,176

Income from operations

12,266

13,143

18,433

21,145

Non-operating income (expense), net:

Interest income

662

184

1,635

304

Other income (expense), net

1,884

301

(334

)

(332

)

Non-operating income (expense), net

2,546

485

1,301

(28

)

Income before provision for income

taxes

14,812

13,628

19,734

21,117

Provision for income taxes

3,186

3,212

4,150

4,352

Net income

$

11,626

$

10,416

$

15,584

$

16,765

Net income per share:

Basic

$

0.16

$

0.14

$

0.21

$

0.22

Diluted

$

0.15

$

0.13

$

0.21

$

0.21

Weighted-average shares used in computing

net income per share:

Basic

74,017

75,893

74,009

76,343

Diluted

75,428

78,306

75,512

78,809

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME

(unaudited, in thousands,

except per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

GAAP net income

$

11,626

$

10,416

$

15,584

$

16,765

Non-GAAP items:

Stock-based compensation and related

payroll tax

3,527

2,944

7,497

6,625

Restructuring expense

—

—

1,861

—

Cyber incident remediation expense

(621

)

—

732

—

Adoption of tax-effecting non-GAAP items

(1)

(3

)

—

(1,218

)

—

Total non-GAAP items

2,903

2,944

8,872

6,625

Non-GAAP net income (1)(2)

14,529

13,360

24,456

23,390

GAAP net income per share:

Basic

$

0.16

$

0.14

$

0.21

$

0.22

Diluted

$

0.15

$

0.13

$

0.21

$

0.21

Non-GAAP items:

Stock-based compensation and related

payroll tax

0.05

0.04

0.10

0.09

Restructuring expense

0.01

—

0.02

—

Cyber incident remediation expense

(0.01

)

—

0.01

—

Adoption of tax-effecting non-GAAP items

(1)

—

—

(0.02

)

—

Total non-GAAP items

0.04

0.04

0.12

0.09

Non-GAAP net income per share: (1)(2)

Basic

$

0.20

$

0.18

$

0.33

$

0.31

Diluted

$

0.19

$

0.17

$

0.32

$

0.30

Weighted average shares used in computing

net income per share:

Basic

74,017

75,893

74,009

76,343

Diluted

75,428

78,306

75,512

78,809

1)

For 2023, we adopted presenting non-GAAP

net income impacted for the income tax effect of excluding non-GAAP

items. In the three and six months ended June 30, 2023, the income

tax effect represents a non-GAAP profit before tax rate of 18.0%.

For the three months ended June 30, 2022, the income tax effect of

excluding non-GAAP items would be $1,409 thousand and non-GAAP net

income adjusted for the income tax effect of excluding non-GAAP

items would be $11,951 thousand, representing a $0.02 decrease in

reported non-GAAP net income per share in the table above. The tax

effect of $1,409 thousand represents a non-GAAP profit before tax

rate of 27.9%. For the six months ended June 30, 2022, the income

tax effect of excluding non-GAAP items would be $3,045 thousand and

non-GAAP net income adjusted for the income tax effect of excluding

non-GAAP items would be $20,345 thousand, representing a $0.04

decrease in reported non-GAAP net income per share in the table

above. The tax effect of $3,045 thousand represents a non-GAAP

profit before tax rate of 26.7%.

2)

Net income and earnings per share

excluding adjustments are non-GAAP financial measures presented as

supplemental financial measures to enable a user of the financial

information to understand the impact of these adjustments on

reported results. These financial measures should not be considered

an alternative to net income, operating income, cash flows provided

by operating activities, or any other measure of financial

performance or liquidity presented in accordance with U.S. GAAP.

Our adjusted net income and earnings per share may not be

comparable to similarly titled measures of another company because

companies may not all calculate adjusted net income and earnings

per share in the same manner.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands,

except par value, on a GAAP Basis)

June 30, 2023

December 31,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

111,181

$

67,971

Marketable securities

42,730

83,018

Accounts receivable, net of allowances of

$223 and $32, respectively

69,171

72,928

Inventory

20,438

19,693

Prepaid expenses and other current

assets

12,945

13,381

Total current assets

256,465

256,991

Property and equipment, net

25,210

19,743

Goodwill

1,307

1,307

Deferred tax assets, net

59,871

63,183

Other non-current assets

25,379

27,881

Total assets

$

368,232

$

369,105

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

6,399

$

6,725

Accrued liabilities

22,656

37,183

Deferred revenue

78,023

74,340

Total current liabilities

107,078

118,248

Deferred revenue, non-current

53,590

52,652

Other non-current liabilities

14,626

17,193

Total liabilities

175,294

188,093

Stockholders' equity:

Common stock, $0.00001 par value: 500,000

shares authorized; 87,904 and 87,123 shares issued and 74,083 and

73,738 shares outstanding, respectively

1

1

Treasury stock, at cost: 13,821 and 13,384

shares, respectively

(141,164

)

(134,934

)

Additional paid-in-capital

477,111

466,927

Dividends paid

(28,682

)

(19,802

)

Accumulated other comprehensive income

542

(726

)

Accumulated deficit

(114,870

)

(130,454

)

Total stockholders' equity

192,938

181,012

Total liabilities and stockholders'

equity

$

368,232

$

369,105

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in thousands, on a

GAAP Basis)

Six Months Ended June

30,

2023

2022

Cash flows from operating activities:

Net income

$

15,584

$

16,765

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

4,307

3,712

Stock-based compensation

7,214

6,313

Other non-cash items

(270

)

113

Changes in operating assets and

liabilities:

Accounts receivable

3,698

(5,580

)

Inventory

(1,705

)

(31

)

Prepaid expenses and other assets

3,827

(2,163

)

Accounts payable

(1,460

)

(1,283

)

Accrued liabilities

(17,094

)

655

Deferred revenue

4,621

6,239

Net cash provided by operating

activities

18,722

24,740

Cash flows from investing activities:

Proceeds from sales of marketable

securities

42,252

4,550

Proceeds from maturities of marketable

securities

44,532

39,148

Purchases of marketable securities

(44,680

)

(21,649

)

Purchases of property and equipment

(5,065

)

(5,021

)

Net cash provided by investing

activities

37,039

17,028

Cash flows from financing activities:

Proceeds from issuance of common stock

under employee equity incentive plans

2,559

2,970

Repurchase of common stock

(6,230

)

(31,758

)

Payments for dividends

(8,880

)

(7,663

)

Net cash used in financing activities

(12,551

)

(36,451

)

Net increase in cash and cash

equivalents

43,210

5,317

Cash and cash equivalents—beginning of

period

67,971

78,925

Cash and cash equivalents—end of

period

$

111,181

$

84,242

Non-cash investing and financing

activities:

Transfers between inventory and property

and equipment

$

959

$

567

Purchases of property and equipment

included in accounts payable

$

1,134

$

1

A10 NETWORKS, INC.

RECONCILIATION OF GAAP GROSS

PROFIT TO NON-GAAP GROSS PROFIT

(unaudited, in thousands,

except percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

GAAP gross profit

$

52,354

$

54,488

$

99,829

$

104,321

GAAP gross margin

79.5

%

80.2

%

80.8

%

79.9

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

417

331

861

759

Restructuring expense

—

—

42

—

Cyber incident remediation expense

—

—

3

—

Non-GAAP gross profit

$

52,771

$

54,819

$

100,735

$

105,080

Non-GAAP gross margin

80.2

%

80.6

%

81.6

%

80.4

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP TOTAL

OPERATING EXPENSES

TO NON-GAAP TOTAL OPERATING

EXPENSES

(unaudited, in

thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

GAAP total operating expenses

$

40,088

$

41,345

$

81,396

$

83,176

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

(3,110

)

(2,613

)

(6,636

)

(5,866

)

Restructuring expense

—

—

(1,819

)

—

Cyber incident remediation expense

621

—

(729

)

—

Non-GAAP total operating expenses

$

37,599

$

38,732

$

72,212

$

77,310

A10 NETWORKS, INC.

RECONCILIATION OF GAAP INCOME

FROM OPERATIONS

TO NON-GAAP OPERATING

INCOME

(unaudited, in thousands,

except percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

GAAP income from operations

$

12,266

$

13,143

$

18,433

$

21,145

GAAP operating margin

18.6

%

19.3

%

14.9

%

16.2

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

3,527

2,944

7,497

6,625

Restructuring expense

—

—

1,861

—

Cyber incident remediation expense

(621

)

—

732

—

Non-GAAP operating income

$

15,172

$

16,087

$

28,523

$

27,770

Non-GAAP operating margin

23.1

%

23.7

%

23.1

%

21.3

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO

EBITDA AND ADJUSTED EBITDA

(NON-GAAP)

(unaudited, in

thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

GAAP net income

$

11,626

$

10,416

$

15,584

$

16,765

GAAP net income margin

17.7

%

15.3

%

12.6

%

12.8

%

Exclude: Interest and other (income)

expense, net

(2,546

)

(485

)

(1,301

)

28

Exclude: Depreciation and amortization

2,202

1,868

4,308

3,712

Exclude: Provision for income taxes

3,186

3,212

4,150

4,352

EBITDA

14,468

15,011

22,741

24,857

Exclude: Stock-based compensation and

related payroll tax

3,527

2,944

7,497

6,625

Exclude: Restructuring expense

—

—

1,861

—

Exclude: Cyber incident remediation

expense

(621

)

—

732

—

Adjusted EBITDA

$

17,374

$

17,955

$

32,831

$

31,482

Adjusted EBITDA margin

26.4

%

26.4

%

26.6

%

24.1

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726104563/en/

Investor Contact: Rob Fink / Tom Baumann FNK IR

646.809.4048 / 646.349.6641 aten@fnkir.com

Brian Becker Chief Financial Officer

investors@a10networks.com

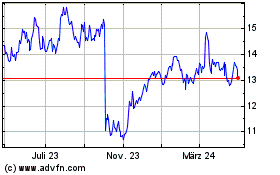

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

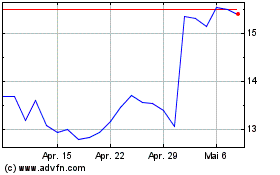

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024