Management demonstrates durable and sustainable

business model despite macro headwinds

A10 Networks (NYSE: ATEN), a leading provider of cybersecurity

and infrastructure solutions, today announced financial results for

its first quarter ended March 31, 2023.

First Quarter 2023 Financial

Summary

- Revenue of $57.7 million, declined 7.9% year-over-year due to

the impact of macro headwinds and project delays.

- GAAP gross margin of 82.3%; non-GAAP gross margin of 83.1% as a

result of better product mix and continued successful navigation of

short-term input cost pressures.

- GAAP net income of $4.0 million, or $0.05 per diluted share,

compared with GAAP net income of $6.3 million, or $0.08 per diluted

share in the first quarter of 2022.

- Non-GAAP net income of $9.9 million, or $0.13 per diluted share

(non-GAAP EPS), compared with non-GAAP net income of $10.0 million,

or $0.13 per diluted share in the first quarter of 2022.

- Adjusted EBITDA of $15.5 million, representing 26.8% of

revenue, in line with stated business model goals and compared to

adjusted EBITDA as a percent of revenue of 21.6% in the first

quarter last year.

- The Board of Directors approved a quarterly cash dividend of

$0.06 per share, payable on June 1, 2023 to stockholders of record

at the close of business on May 15, 2023.

A reconciliation between GAAP and non-GAAP information is

contained in the financial statements below.

“We delivered profitability that was in-line with our trended

financials and revenue towards the high-end of our pre-announced

results,” said Dhrupad Trivedi, President and Chief Executive

Officer of A10 Networks. “We have taken proactive actions to flex

our cost structure to address the headwinds we experienced at the

start of the year and to better enable us to achieve our full-year

earnings guidance without compromising long-term growth. Demand for

our security-led solutions remains robust, but project delays from

tier-one North American customers impacted our ability to deliver

upon our originally targeted revenue level. Our value proposition

remains intact, and orders have been delayed, but not lost to

competitors. As a result, and as expected, our first quarter

represents what we believe will be the low-point for the year, and

we continue to believe we can achieve revenue growth that outpaces

the market, and importantly, double-digit growth in 2023 full-year

non-GAAP EPS.”

“A10’s strategic diversification, in terms of customer base,

geographic presence and product revenue, help offset the

macro-economic pockets of weakness,” continued Trivedi. “This

quarter demonstrates that we are not immune from recessionary

impacts, but we remain confident we can perform better than others

in our peer set. Additionally, we grew our recurring revenue, which

increased 10% in the first quarter, giving us greater visibility

and mitigating the impact of longer sales cycles. With $145 million

in cash, no debt, increasing recurring revenue and systemic

diversification, we are well-positioned for continued success.”

Conference Call

Management will host a call at 1:30 p.m. Pacific time (4:30 p.m.

Eastern time) today, May 4, 2023, to discuss these results.

Interested parties may access the conference call by dialing (833)

470-1428 (toll-free) or (404) 975-4839 and referencing access code:

820278.

A live audio webcast of the conference call will be accessible

from the “Investor Relations” section of A10 Network’s website at

investors.a10networks.com. The webcast will be archived for at

least 90 days. A telephonic replay of the conference call will be

available two hours after the conclusion of the live call and will

run for seven days and may be accessed by dialing (866) 813-9403

(toll-free) or (929) 458-6194 and entering the passcode 360894.

Forward-Looking

Statements

This press release contains “forward-looking statements,”

including statements regarding our anticipated future financial

results, quarterly dividend payments, strategy, demand, supply

chain and order pattern challenges, positioning, growth and revenue

and non-GAAP EPS expectations. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on assumptions that may prove to be incorrect, which could cause

actual results to differ materially from those expected or implied

by the forward-looking statements. Factors that may cause actual

results to differ include the impact of the COVID-19 pandemic on

our business and the business of our customers; a significant

decline in global macroeconomic or political conditions that have

an adverse impact on our business and financial results; business

interruptions related to our supply chain; our ability to manage

our business and expenses if customers cancel or delay orders;

execution risks related to closing key deals and improving our

execution; the continued market adoption of our products; our

ability to successfully anticipate market needs and opportunities;

our timely development of new products and features; our ability to

achieve or maintain profitability; any loss or delay of expected

purchases by our largest end-customers; our ability to maintain or

improve our competitive position; competitive and execution risks

related to cloud-based computing trends; our ability to attract and

retain new end-customers and our largest end-consumers; our ability

to maintain and enhance our brand and reputation; changes demanded

by our customers in the deployment and payment model for our

products; continued growth in markets relating to network security;

the success of any future acquisitions or investments in

complementary companies, products, services or technologies; the

ability of our sales team to execute well; our ability to shorten

our close cycles; the ability of our channel partners to sell our

products; variations in product mix or geographic locations of our

sales; risks associated with our presence in international markets;

weaknesses or deficiencies in our internal control over financial

reporting; our ability to timely file periodic reports required to

be filed under the Securities Exchange Act of 1934; and other risks

that are described in “Risk Factors” in our periodic filings with

the Securities and Exchange Commission, including our Form 10-K

filed with the Securities and Exchange Commission on February 27,

2023. We do not intend to update or alter our forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by applicable law.

Non-GAAP Financial

Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), we refer to certain non-GAAP financial measures, including

non-GAAP net income, non-GAAP net income per basic and diluted

share (or non-GAAP EPS), non-GAAP gross profit and gross margin,

non-GAAP operating income and operating margin, non-GAAP operating

expenses, and Adjusted EBITDA. Non-GAAP financial measures do not

have any standardized meaning and are therefore unlikely to be

comparable to similarly titled measures presented by other

companies.

A10 Networks considers these non-GAAP financial measures to be

important because they provide useful measures of the operating

performance of the company, exclusive of unusual events or factors

that do not directly affect what we consider to be our core

operating performance and are used by the company's management for

that purpose.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP.

We define non-GAAP net income as our GAAP net income excluding:

(i) stock-based compensation and related payroll tax, (ii) cyber

incident remediation expense, (iii) restructuring expense and (iv)

income tax effect of excluding non-GAAP items (i) to (iii) listed

above. We define non-GAAP net income per basic and diluted share as

our non-GAAP net income divided by our basic and diluted

weighted-average shares outstanding. We define non-GAAP gross

profit as our GAAP gross profit excluding (i) stock-based

compensation and related payroll tax, (ii) cyber incident

remediation expense and (iii) restructuring expense. We define

non-GAAP gross margin as our non-GAAP gross profit divided by our

GAAP revenue. We define non-GAAP operating income as our GAAP

income from operations excluding (i) stock-based compensation and

related payroll tax, (ii) cyber incident remediation expense and

(iii) restructuring expense. We define non-GAAP operating margin as

our non-GAAP operating income divided by our GAAP revenue. We

define non-GAAP operating expenses as our GAAP operating expenses

excluding (i) stock-based compensation and related payroll tax,

(ii) cyber incident remediation expense and (iii) restructuring

expense. We define Adjusted EBITDA as our GAAP net income excluding

(i) interest and other (income) expense, net, (ii) depreciation and

amortization expense, (iii) provision for income taxes, (iv)

stock-based compensation and related payroll tax, (v) cyber

incident remediation expense and (vi) restructuring expense.

Non-GAAP financial measures are presented for supplemental

informational purposes only for understanding the company's

operating results.

About A10 Networks

A10 Networks (NYSE: ATEN) provides secure application services

and solutions for on-premises, multi-cloud and edge-cloud

environments at hyperscale. Our mission is to enable service

providers and enterprises to deliver business-critical applications

that are secure, available and efficient for multi-cloud

transformation and 5G readiness. We deliver better business

outcomes that support investment protection, new business models

and help future-proof infrastructures, empowering our customers to

provide the most secure and available digital experience. Founded

in 2004, A10 Networks is based in San Jose, Calif. and serves

customers globally. For more information, visit

https://www.a10networks.com/ and follow us @A10Networks.

The A10 logo and A10 Networks are trademarks or registered

trademarks of A10 Networks, Inc. in the United States and other

countries. All other trademarks are the property of their

respective owners.

Source: A10 Networks, Inc.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except per share amounts, on a GAAP Basis)

Three Months Ended March

31,

2023

2022

Revenue:

Products

$

31,182

$

37,045

Services

26,509

25,627

Total revenue

57,691

62,672

Cost of revenue:

Products

6,083

8,633

Services

4,133

4,206

Total cost of revenue

10,216

12,839

Gross profit

47,475

49,833

Operating expenses:

Sales and marketing

22,334

22,782

Research and development

11,665

12,887

General and administrative

7,309

6,162

Total operating expenses

41,308

41,831

Income from operations

6,167

8,002

Non-operating income (expense), net:

Interest income

973

119

Other income (expense), net

(2,218

)

(632

)

Non-operating income (expense), net

(1,245

)

(513

)

Income before provision for income

taxes

4,922

7,489

Provision for income taxes

964

1,140

Net income

$

3,958

$

6,349

Net income per share:

Basic

$

0.05

$

0.08

Diluted

$

0.05

$

0.08

Weighted-average shares used in computing

net income per share:

Basic

74,001

76,795

Diluted

75,541

79,285

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME

(unaudited, in thousands,

except per share amounts)

Three Months Ended March

31,

2023

2022

GAAP net income

$

3,958

$

6,349

Non-GAAP items:

Stock-based compensation and related

payroll tax

3,970

3,681

Restructuring expense

1,861

—

Cyber incident remediation expense

1,353

—

Adoption of tax-effecting non-GAAP items

(1)

(1,215

)

—

Total non-GAAP items

5,969

3,681

Non-GAAP net income (1)(2)

$

9,927

$

10,030

GAAP net income per share:

Basic

$

0.05

$

0.08

Diluted

$

0.05

$

0.08

Non-GAAP items:

Stock-based compensation and related

payroll tax

0.05

0.05

Restructuring expense

0.03

—

Cyber incident remediation expense

0.02

—

Adoption of tax-effecting non-GAAP items

(1)

(0.02

)

—

Total non-GAAP items

0.08

0.05

Non-GAAP net income per share: (1)(2)

Basic

$

0.13

$

0.13

Diluted

$

0.13

$

0.13

Weighted average shares used in computing

net income per share:

Basic

74,001

76,795

Diluted

75,541

79,285

1)

For the three months ended March

31, 2023, we adopted presenting non-GAAP net income impacted for

the income tax effect of excluding non-GAAP items. The income tax

effect of $1,215 thousand represents a non-GAAP profit before tax

rate of 18.0%. For the three months ended March 31, 2022, the

income tax effect of excluding non-GAAP items would be $1,636

thousand and non-GAAP net income adjusted for the income tax effect

of excluding non-GAAP items would be $8,394 thousand, representing

a $0.02 decrease in reported non-GAAP net income per share in the

table above. The tax effect of $1,636 thousand represents a

non-GAAP profit before tax rate of 24.9%.

2)

Net income and earnings per share

excluding adjustments are non-GAAP financial measures presented as

supplemental financial measures to enable a user of the financial

information to understand the impact of these adjustments on

reported results. These financial measures should not be considered

an alternative to net income, operating income, cash flows provided

by operating activities, or any other measure of financial

performance or liquidity presented in accordance with U.S. GAAP.

Our adjusted net income and earnings per share may not be

comparable to similarly titled measures of another company because

companies may not all calculate adjusted net income and earnings

per share in the same manner.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands,

except par value, on a GAAP Basis)

March 31, 2023

December 31,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

68,519

$

67,971

Marketable securities

76,022

83,018

Accounts receivable, net of allowances of

$78 and $32, respectively

67,007

72,928

Inventory

20,391

19,693

Prepaid expenses and other current

assets

13,054

13,381

Total current assets

244,993

256,991

Property and equipment, net

22,305

19,743

Goodwill

1,307

1,307

Deferred tax assets, net

62,116

63,183

Other non-current assets

26,564

27,881

Total assets

$

357,285

$

369,105

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

5,906

$

6,725

Accrued liabilities

21,410

37,183

Deferred revenue

75,729

74,340

Total current liabilities

103,045

118,248

Deferred revenue, non-current

52,769

52,652

Other non-current liabilities

15,970

17,193

Total liabilities

171,784

188,093

Stockholders' equity:

Common stock, $0.00001 par value: 500,000

shares authorized; 87,581 and 87,123 shares issued and 74,197 and

73,738 shares outstanding, respectively

1

1

Treasury stock, at cost: 13,384 and 13,384

shares, respectively

(134,934

)

(134,934

)

Additional paid-in-capital

471,341

466,927

Dividends paid

(24,248

)

(19,802

)

Accumulated other comprehensive income

(163

)

(726

)

Accumulated deficit

(126,496

)

(130,454

)

Total stockholders' equity

185,501

181,012

Total liabilities and stockholders'

equity

$

357,285

$

369,105

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in thousands, on a

GAAP Basis)

Three Months Ended March

31,

2023

2022

Cash flows from operating activities:

Net income

$

3,958

$

6,349

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

2,106

1,844

Stock-based compensation

3,742

3,452

Other non-cash items

(169

)

287

Changes in operating assets and

liabilities:

Accounts receivable

5,687

12,535

Inventory

(1,522

)

1,433

Prepaid expenses and other assets

1,519

(1,568

)

Accounts payable

(676

)

(1,857

)

Accrued liabilities

(16,997

)

(6,287

)

Deferred revenue

1,506

(280

)

Net cash provided by (used in) operating

activities

(846

)

15,908

Cash flows from investing activities:

Proceeds from sales of marketable

securities

—

4,550

Proceeds from maturities of marketable

securities

29,263

17,173

Purchases of marketable securities

(21,221

)

(13,635

)

Purchases of property and equipment

(2,675

)

(3,137

)

Net cash provided by investing

activities

5,367

4,951

Cash flows from financing activities:

Proceeds from issuance of common stock

under employee equity incentive plans

473

165

Repurchase of common stock

—

(28,322

)

Payments for dividends

(4,446

)

(3,869

)

Net cash used in financing activities

(3,973

)

(32,026

)

Net increase (decrease) in cash and cash

equivalents

548

(11,167

)

Cash and cash equivalents—beginning of

period

67,971

78,925

Cash and cash equivalents—end of

period

$

68,519

$

67,758

Non-cash investing and financing

activities:

Transfers between inventory and property

and equipment

$

824

$

196

Purchases of property and equipment

included in accounts payable

$

142

$

1

A10 NETWORKS, INC.

RECONCILIATION OF GAAP GROSS

PROFIT TO NON-GAAP GROSS PROFIT

(unaudited, in thousands,

except percentages)

Three Months Ended March

31,

2023

2022

GAAP gross profit

$

47,475

$

49,833

GAAP gross margin

82.3

%

79.5

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

444

428

Restructuring expense

42

—

Cyber incident remediation expense

3

—

Non-GAAP gross profit

$

47,964

$

50,261

Non-GAAP gross margin

83.1

%

80.2

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP TOTAL

OPERATING EXPENSES

TO NON-GAAP TOTAL OPERATING

EXPENSES

(unaudited, in

thousands)

Three Months Ended March

31,

2023

2022

GAAP total operating expenses

$

41,308

$

41,831

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

(3,526

)

(3,253

)

Restructuring expense

(1,819

)

—

Cyber incident remediation expense

(1,350

)

—

Non-GAAP total operating expenses

$

34,613

$

38,578

A10 NETWORKS, INC.

RECONCILIATION OF GAAP INCOME

FROM OPERATIONS

TO NON-GAAP OPERATING

INCOME

(unaudited, in thousands,

except percentages)

Three Months Ended March

31,

2023

2022

GAAP income from operations

$

6,167

$

8,002

GAAP operating margin

10.7

%

12.8

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

3,970

3,681

Restructuring expense

1,861

—

Cyber incident remediation expense

1,353

—

Non-GAAP operating income

$

13,351

$

11,683

Non-GAAP operating margin

23.1

%

18.6

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO

EBITDA AND ADJUSTED EBITDA

(NON-GAAP)

(unaudited, in

thousands)

Three Months Ended March

31,

2023

2022

GAAP net income

$

3,958

$

6,349

GAAP net income margin

6.9

%

10.1

%

Exclude: Interest and other (income)

expense, net

1,245

513

Exclude: Depreciation and amortization

2,106

1,844

Exclude: Provision for income taxes

964

1,140

EBITDA

8,273

9,846

Exclude: Stock-based compensation and

related payroll tax

3,970

3,681

Exclude: Restructuring expense

1,861

—

Exclude: Cyber incident remediation

expense

1,353

—

Adjusted EBITDA

$

15,457

$

13,527

Adjusted EBITDA margin

26.8

%

21.6

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504006019/en/

Investor Contact: Rob Fink / Tom Baumann FNK IR

646.809.4048 / 646.349.6641 aten@fnkir.com

Brian Becker Chief Financial Officer

investors@a10networks.com

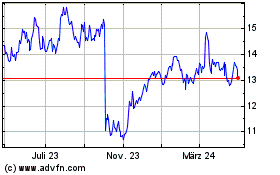

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

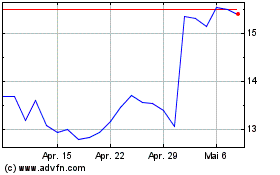

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024