UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

GRUPO AEROPORTUARIO DEL SURESTE, S.A.B. de C.V.

(SOUTHEAST AIRPORT GROUP)

(Translation of Registrant’s Name Into English)

México

(Jurisdiction of incorporation or organization)

Bosque de Alisos No. 47A– 4th Floor

Bosques de las Lomas

05120 México, D.F.

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

|

|

|

|

Form 20-F x |

Form 40-F ____ |

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Grupo Aeroportuario del Sureste, S.A.B. de C.V. |

|

By: /s/ ADOLFO CASTRO RIVAS |

|

|

Adolfo Castro Rivas |

|

|

Chief Executive Officer |

Date: July 24, 2023

Exhibit 99.1

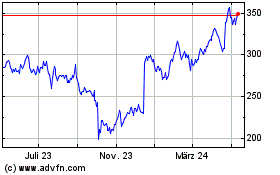

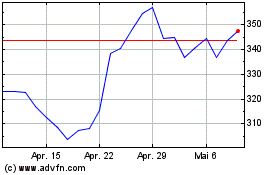

ASUR Reports 2Q23 Financial Results

Total passenger traffic in 2Q23 increased 3.5% YoY

Mexico City, July 24, 2023 – Grupo Aeroportuario del Sureste, S.A.B. de C.V. (NYSE: ASR; BMV: ASUR) (ASUR), a leading international airport group with operations in Mexico, the U.S., and Colombia, today announced results for the three- and six-month month periods ended June 30, 2023.

2Q23 Highlights1

|

|

|

|

Table 1: Financial & Operational Highlights 1 |

|

Second Quarter |

% Chg |

|

2022 |

2023 |

Financial Highlights |

|

|

|

Total Revenue |

6,319,709 |

6,156,443 |

(2.6) |

Mexico |

4,557,925 |

4,541,133 |

(0.4) |

San Juan |

1,065,470 |

1,036,616 |

(2.7) |

Colombia |

696,314 |

578,694 |

(16.9) |

Commercial Revenues per PAX |

119.6 |

122.3 |

2.3 |

Mexico |

142.8 |

141.7 |

(0.8) |

San Juan |

159.0 |

146.4 |

(7.9) |

Colombia |

39.7 |

40.7 |

2.5 |

EBITDA |

4,040,629 |

4,160,306 |

3.0 |

Net Income |

2,844,469 |

2,649,413 |

(6.9) |

Majority Net Income |

2,661,548 |

2,444,711 |

(8.1) |

Earnings per Share (in pesos) |

8.8718 |

8.1490 |

(8.1) |

Earnings per ADS (in US$) |

5.1774 |

4.7556 |

(8.1) |

Capex |

436,865 |

152,927 |

(65.0) |

Cash & Cash Equivalents |

7,331,083 |

14,474,035 |

97.4 |

Net Debt |

5,047,003 |

(1,326,708.00) |

n/a |

Net Debt/ LTM EBITDA |

0.4 |

(0.1) |

n/a |

Operational Highlights |

|

|

|

Passenger Traffic |

|

|

|

Mexico |

9,817,127 |

10,697,831 |

9.0 |

San Juan |

2,783,495 |

3,198,859 |

14.9 |

Colombia |

4,106,959 |

3,389,611 |

(17.5) |

•Total passenger traffic increased 3.5% compared to 2Q22. By country of operations, 2Q23 passenger traffic showed the following YoY variations:

•Mexico: increased by 9.0%, reflecting increases of 16.5% and 2.5% in domestic and international traffic, respectively.

•Puerto Rico (Aerostar): increased by 14.9%, resulting from increases of 12.1% and 44.1% in domestic and international traffic, respectively.

•Colombia (Airplan): decreased 17.5%, with declines of 20.3% and 3.5% in domestic and international traffic, respectively, mainly reflecting the suspension of operations of Viva Air and Ultra Air in 1Q23.

•Revenues declined 2.6% year-over-year to Ps.6,156.4 million. Excluding construction revenue, revenue increased 5.2% compared to 2Q22.

•Consolidated commercial revenue per passenger reached Ps.122.3 million.

•Consolidated EBITDA increased 3.0% year-over-year to Ps.4,160.3 million.

•Adjusted EBITDA margin (excluding the effect of IFRIC 12) declined to 69.1% from 70.5% in 2Q22.

•Cash position of Ps.14,474.0 million, with Net Debt to EBITDA LTM ratio of negative 0.1x.

2Q23 Earnings Call

Date & Time: Tuesday, July 25, 2023 and 10:00 AM US ET; 8:00 AM Mexico City Time

Dial-in: 1-877-407-4018 (Toll-Free) and 1-201-689-8471 (International)

Access Code: 13740169

Replay: Tuesday, July 25, 2023 at 1:00 PM US ET, ending at 11:59 PM US ET on Tuesday, August 1, 2023. Dial-in: 1-844-512-2921 (Toll-Free); 1-412-317-6671 (International). Access Code: 13740169.

1 Unless otherwise stated, all financial figures discussed in this press release are unaudited, prepared in accordance with International Financial Reporting Standards (IFRS), and represent comparisons between the three- and six-month periods ended June 30, 2023, and the equivalent three- and six-month periods ended June 30, 2022. All figures in this report are expressed in Mexican pesos, unless otherwise noted. Tables state figures in thousands of Mexican pesos, unless otherwise noted. Passenger figures for Mexico and Colombia exclude transit and general aviation passengers, unless otherwise noted. Commercial revenues include revenues from non-permanent ground transportation and parking lots. All U.S. dollar figures are calculated at the exchange rate of US$1.00 = Mexican Ps. 17.1358 (source: Diario Oficial de la Federación de México), while Colombian peso figures are calculated at the exchange rate of COP243.4300 = Mexican Ps.1.00 (source: Investing). Definitions for EBITDA, Adjusted EBITDA Margin, Majority Net Income can be found on page 17 of this report.

Passenger Traffic

ASUR's total passenger traffic in 2Q23 increased by 3.5% year-over-year to 17.3 million.

Total passenger traffic in Mexico increased by 9.0% year-over-year to 10.7 million in 2Q13, with domestic and international traffic showing increases of 16.5% and 2.5%, respectively.

In Puerto Rico, total passenger traffic in 2Q23 increased by 14.9% year-over-year to 3.2 million, reflecting increases of 12.1% in domestic traffic and 44.1% in international traffic.

Total passenger traffic in Colombia for 2Q23 declined 17.5% YoY to 3.4 million passengers, with domestic and international traffic declining by 20.3% and 3.5%, respectively, mainly reflecting the suspension of operations of Viva Air and Ultra Air since 1Q23.

On page 19 of this report you will find the tables with detailed information on passenger traffic for each airport.

|

|

|

|

|

|

|

|

Table 2: Passenger Traffic Summary |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total México |

9,817,127 |

10,697,831 |

9.0 |

|

18,837,881 |

21,771,122 |

15.6 |

- Cancun |

7,573,042 |

8,153,866 |

7.7 |

|

14,614,988 |

16,638,564 |

13.8 |

- 8 Others Airports |

2,244,085 |

2,543,965 |

13.4 |

|

4,222,893 |

5,132,558 |

21.5 |

Domestic Traffic |

4,518,674 |

5,265,236 |

16.5 |

|

8,264,362 |

10,049,424 |

21.6 |

- Cancun |

2,559,200 |

3,006,582 |

17.5 |

|

4,640,847 |

5,603,062 |

20.7 |

- 8 Others Airports |

1,959,474 |

2,258,654 |

15.3 |

|

3,623,515 |

4,446,362 |

22.7 |

International traffic |

5,298,453 |

5,432,595 |

2.5 |

|

10,573,519 |

11,721,698 |

10.9 |

- Cancun |

5,013,842 |

5,147,284 |

2.7 |

|

9,974,141 |

11,035,502 |

10.6 |

- 8 Others Airports |

284,611 |

285,311 |

0.2 |

|

599,378 |

686,196 |

14.5 |

Total San Juan, Puerto Rico |

2,783,495 |

3,198,859 |

14.9 |

|

5,174,214 |

6,105,897 |

18.0 |

Domestic Traffic |

2,542,024 |

2,850,826 |

12.1 |

|

4,755,038 |

5,492,755 |

15.5 |

International traffic |

241,471 |

348,033 |

44.1 |

|

419,176 |

613,142 |

46.3 |

Total Colombia |

4,106,959 |

3,389,611 |

(17.5) |

|

7,678,932 |

7,274,928 |

(5.3) |

Domestic Traffic |

3,415,937 |

2,723,025 |

(20.3) |

|

6,467,279 |

5,899,180 |

(8.8) |

International traffic |

691,022 |

666,586 |

(3.5) |

|

1,211,653 |

1,375,748 |

13.5 |

Total traffic |

16,707,581 |

17,286,301 |

3.5 |

|

31,691,027 |

35,151,947 |

10.9 |

Domestic Traffic |

10,476,635 |

10,839,087 |

3.5 |

|

19,486,679 |

21,441,359 |

10.0 |

International traffic |

6,230,946 |

6,447,214 |

3.5 |

|

12,204,348 |

13,710,588 |

12.3 |

Note: Passenger figures for Mexico and Colombia exclude transit and general aviation passengers, while Puerto Rico includes transit passengers and general aviation. |

|

|

|

|

|

|

|

|

|

|

|

|

Table 3: % YoY Change in Passenger Traffic 2023 & 2022 |

Region |

January |

February |

March |

April |

May |

June |

Total |

México |

33.6% |

25.6% |

11.8% |

9.8% |

6.8% |

10.3% |

15.6% |

Domestic Traffic |

35.0% |

29.3% |

20.1% |

16.8% |

13.9% |

19.0% |

21.6% |

International Traffic |

32.4% |

22.9% |

6.2% |

4.2% |

0.1% |

3.0% |

10.9% |

Puerto Rico |

37.8% |

20.5% |

9.3% |

6.5% |

15.5% |

22.3% |

18.0% |

Domestic Traffic |

36.8% |

18.1% |

6.4% |

3.0% |

12.6% |

20.5% |

15.5% |

International Traffic |

49.6% |

50.3% |

47.9% |

49.9% |

50.0% |

36.4% |

46.3% |

Colombia |

16.6% |

21.7% |

(9.1%) |

(18.2%) |

(14.2%) |

(19.8%) |

(5.3%) |

Domestic Traffic |

10.5% |

16.8% |

(12.2%) |

(21.2%) |

(16.5%) |

(22.9%) |

(8.8%) |

International Traffic |

50.8% |

51.3% |

9.1% |

(2.7%) |

(2.9%) |

(4.9%) |

13.5% |

Total |

29.8% |

23.9% |

6.7% |

2.7% |

3.2% |

4.5% |

10.9% |

Domestic Traffic |

26.6% |

22.4% |

6.0% |

1.2% |

4.1% |

5.0% |

10.0% |

International Traffic |

34.9% |

26.0% |

7.6% |

4.9% |

1.6% |

3.8% |

12.3% |

Review of Consolidated Results

|

|

|

|

|

|

|

|

Table 4: Summary of Consolidated Results |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Revenues |

6,319,709 |

6,156,443 |

(2.6) |

|

11,745,514 |

12,605,852 |

7.3 |

Aeronautical Services |

3,533,790 |

3,710,976 |

5.0 |

|

6,715,806 |

7,588,394 |

13.0 |

Non-Aeronautical Services |

2,194,402 |

2,313,978 |

5.4 |

|

4,186,884 |

4,736,590 |

13.1 |

Total Revenues Excluding Construction Revenues |

5,728,192 |

6,024,954 |

5.2 |

|

10,902,690 |

12,324,984 |

13.0 |

Construction Revenues |

591,517 |

131,489 |

(77.8) |

|

842,824 |

280,868 |

(66.7) |

Total Operating Costs & Expenses |

2,609,840 |

2,252,366 |

(13.7) |

|

4,707,385 |

4,688,124 |

(0.4) |

Other Revenues |

|

|

|

|

45,547 |

|

n/a |

Operating Profit |

3,709,869 |

3,904,077 |

5.2 |

|

7,083,676 |

7,917,728 |

11.8 |

Operating Margin |

58.7% |

63.41% |

471 bps |

|

60.3% |

62.81% |

250 bps |

Adjusted Operating Margin 1 |

64.8% |

64.80% |

0 bps |

|

65.0% |

64.24% |

(73 bps) |

EBITDA |

4,040,629 |

4,160,306 |

3.0 |

|

7,716,914 |

8,690,708 |

12.6 |

EBITDA Margin |

63.94% |

67.58% |

364 bps |

|

65.70% |

68.94% |

324 bps |

Adjusted EBITDA Margin 2 |

70.54% |

69.05% |

(149 bps) |

|

70.78% |

70.51% |

(27 bps) |

Net income |

2,844,469 |

2,649,413 |

(6.9) |

|

5,194,231 |

5,251,658 |

1.1 |

Net majority income |

2,661,548 |

2,444,711 |

(8.1) |

|

4,855,257 |

4,957,073 |

2.1 |

Earnings per Share |

8.8718 |

8.1490 |

(8.1) |

|

16.1842 |

16.5236 |

2.1 |

Earnings per ADS in US$ |

5.1774 |

4.7556 |

(8.1) |

|

9.4447 |

9.6427 |

2.1 |

|

|

|

|

|

|

|

|

Total Commercial Revenues per Passenger 3 |

119.6 |

122.3 |

2.3 |

|

120.2 |

122.8 |

2.1 |

Commercial Revenues |

2,019,045 |

2,135,266 |

5.8 |

|

3,849,500 |

4,363,641 |

13.4 |

Commercial Revenues from Direct Operations per Passenger 4 |

22.0 |

23.2 |

5.8 |

|

22.5 |

23.7 |

5.2 |

Commercial Revenues Excl. Direct Operations per Passenger |

97.6 |

99.1 |

1.5 |

|

97.7 |

99.1 |

1.4 |

1 Adjusted operating margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets in Mexico, Puerto Rico and Colombia and is equal to operating income divided by total revenues minus revenues from construction services. |

2 Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets in Mexico, Puerto Rico and Colombia, and is calculated by dividing EBITDA by total revenues less construction services revenues. |

3 Passenger figures include transit and general aviation passengers Mexico, Puerto Rico y Colombia. |

4 Represents ASUR´s operations in convenience stores |

Consolidated Revenues

Consolidated Revenues for 2Q23 declined 2.6% YoY, or Ps.163.3 million, to Ps.6,156.4 million, mainly due to the following increases:

•5.0% in revenues from aeronautical services to Ps.3,711.0 million. Mexico contributed Ps.2,766.4 million, while Puerto Rico and Colombia accounted for Ps.470.7 million and Ps.142.3 million, respectively; and

•5.4% in revenues from non-aeronautical services to Ps.2,314.0 million. Mexico contributed Ps.1,701.0 million, while Puerto Rico and Colombia accounted for Ps.508.9 million and Ps.435.7 million, respectively.

These increases were partially offset by a 77.8%, or Ps.460.0 million, YoY decline in construction services revenues to Ps.131.5 million, principally in Mexico.

Excluding revenues from construction services, for which there is an equivalent expense recorded under IFRS accounting standards, total revenues would have increased 5.2% YoY, to Ps.6,024.9 million.

Excluding revenues from construction services, Mexico represented 74.1% of ASUR´s total revenues in 2Q23, while Puerto Rico and Colombia represented 16.3% and 9.6%, respectively.

Commercial Revenues in 2Q23 increased 5.8% YoY to Ps.2,135.3 million, mainly reflecting the 3.4% increase in passenger traffic (including transit and general aviation passengers). This increase was driven by increases in commercial revenues of 8.2% to Ps.1,524.8 million in Mexico and 5.9% to Ps.468.3 million in Puerto Rico, partly offset by a 15.4% decline to Ps.142.1 million in Colombia.

Commercial Revenues per Passenger was Ps.122.3 in 2Q23, compared to Ps.119.6 in 2Q22.

Consolidated Operating Costs and Expenses

Consolidated Operating Costs and Expenses, including construction costs, declined 13.7% YoY, or Ps.357.5 million, to Ps.2,252.4 million in 2Q23.

Excluding construction costs, operating costs and expenses increased 5.1% YoY, or Ps.102.5 million, reflecting the following factors:

•Mexico: increased 16.1%, or Ps.194.9 million, mainly reflecting higher costs in connection to personnel, technical assistance, energy, concession fees, security, maintenance, materials and supplies, taxes and duties, and marketing expenses. Higher professional fees, together with higher cost of sales from directly operated stores also contributed to the increase.

•Puerto Rico: declined 14.5%, or Ps.60.0 million primarily due to the recovery of expenses under the CRRSAA Act for an amount of Ps.252.3 million in 2Q23, compared to a benefit of Ps.175.2 million in 2Q22. Excluding this effect, expenses would have increased 2.9%, mainly reflecting increases in professional fees, materials and supplies, and maintenance costs, all of which were partially offset by a decrease in personnel and energy costs.

•Colombia: declined 8.2%, or Ps.32.3 million, mainly reflecting higher concession fee payments, along with depreciation and amortization. This was partly offset by increases in professional fees and bad debt provisions resulting from the suspension of operations of Viva Air and Ultra Air in 1Q23.

Cost of Services increased 11.8%, or Ps.105.2 million, mainly reflecting YoY increases in personnel costs, surveillance and cleaning services, maintenance and conservation, electricity, materials and supplies, taxes and duties; as well as in the cost of revenues from concession stores operated directly by ASUR. These increases were partially offset by the impact from the recovery of expenses in 2Q23 in connection with the application of the CRRSAA Act for an amount of Ps.252.3 million compared to Ps.175.2 million in 2Q22.

Construction Costs declined 77.8% YoY, or Ps.460.0 million. This was mainly driven by YoY declines in construction costs of 85.6%, or Ps.436.9 million in Mexico and 28.9%, or Ps.23.1 million in Puerto Rico, partially offset by an increase of 2.0% in Colombia.

Administrative Expenses that reflect administrative costs in Mexico increased 4.8% YoY.

Consolidated Technical Assistance declined by 4.7% YoY mainly reflecting the consolidation in 2Q23 of a subsidiary in Colombia 100% owned by ASUR, thus eliminating intercompany effects.

Concession Fees declined 0.1% YoY, principally reflecting the decline in concession fees in Colombia, offset by increases of 9.8% in Mexico, and 2.0% in Puerto Rico, mainly due to higher regulated revenues in these two counties which is a factor in the calculation of the concession fee.

Depreciation and Amortization increased 0.5% YoY, or Ps.2.5 million, principally due to an increase of 17.4%, or Ps.38.7 million in Mexico, partly offset by declines of 13.0%, or Ps.13.1 million in Colombia and 12.7%, or Ps.23.1 million in Puerto Rico.

Consolidated Operating Profit and EBITDA

ASUR reported a Consolidated Operating Profit of Ps.3,904.1 million in 2Q23 representing an operating margin of 63.4%, up from Ps.3,709.9 million in 2Q22 and an operating margin of 58.7% in 2Q22.

Adjusted Operating Margin, which excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned assets in Mexico, Colombia and Puerto Rico was 64.8% in 2Q23 compared to 64.8% in 2Q22. Adjusted operating margin is calculated as operating profit or loss divided by total revenues less construction services revenues.

EBITDA increased 3.0%, or Ps.119.7 million, to Ps.4,160.3 million in 2Q23, from Ps.4,040.6 million in 2Q22. By country of operations, EBITDA increased YoY by 8.6% or Ps.264.1 million to Ps.3,322.4 million in Mexico, and declined by 7.9%, or Ps.46.0 million, to Ps.533.7 million in Puerto Rico, and by 24.4%, or Ps.98.4 million, to Ps.304.2 million in Colombia. Consolidated EBITDA margin in 2Q23 was 67.6% up from 63.9% in 2Q22.

Adjusted EBITDA Margin, which excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned assets in Mexico, Puerto Rico, and Colombia, was 69.1% in 2Q23, compared to 70.5% in 2Q22.

Consolidated Comprehensive Financing Gain (Loss)

|

|

|

|

|

|

|

|

Table 5: Consolidated Comprehensive Financing Gain (Loss) |

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six – Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Interest Income |

74,129 |

296,670 |

300.2 |

|

154,497 |

561,730 |

263.6 |

Interest Expense |

(20,828) |

(281,678) |

1,252.4 |

|

(246,929) |

(587,670) |

138.0 |

Foreign Exchange Gain (Loss), Net |

55,020 |

(344,984) |

n/a |

|

(40,876) |

(831,892) |

1,935.2 |

Total |

108,321 |

(329,992) |

n/a |

|

(133,308) |

(857,832) |

543.5 |

In 2Q23 ASUR reported a Ps.330.0 million Consolidated Comprehensive Financing Loss, compared to a Ps.108.3 million gain in 2Q22.

During 2Q23 ASUR reported a foreign exchange loss of Ps.345.0 million, resulting from the 5.0% quarter-end appreciation of the Mexican peso against the U.S. dollar (1.9% average appreciation) during the period, together with a U.S. dollar net asset position. This compares to a Ps.55.0 million foreign exchange gain in 2Q22 resulting from the 1.1% quarter-end depreciation of the Mexican peso (0.6% average depreciation) on a U.S. dollar net asset position.

Interest expense increased Ps.260.8 million, or 1,252.4% YoY, mainly reflecting a Ps.223.7 million benefit in 2Q22 from the amortization of the fair value of the loan originated in the acquisition of Airplan in Colombia, which did not occur in 2Q23, as well as higher interest rates in Mexico and the issuance of bonds in Puerto Rico in July 2022.

Interest income increased Ps.222.5 million, or 300.2% YoY reflecting a higher cash balance position.

Income Taxes

Income Taxes for 2Q23 declined Ps.49.6 million YoY, principally due to the following variations:

•A Ps.63.1 million decline in income taxes, reflecting mainly a lower taxable income base in Mexico and Colombia.

•A Ps.14.1 million increase in deferred income taxes, mainly in Mexico resulting from an increase in the taxable base caused by deflation of 0.1% 2Q23, compared to inflation of 1.6% in 2Q22, partially offset by a lower taxable

base in Colombia reflecting the amortization in 2Q22 of the fair value of the loan originated from the acquisition of this business.

Majority Net Income

ASUR reported Majority Net Income of Ps.2,444.7 million in 2Q23, compared to Ps.2,661.5 million in 2Q22. This resulted in earnings per common share in 2Q23 of Ps.8.1490, or earnings per ADS of US$4.7556 (one ADS represents ten series B common shares). This compares to earnings per share of Ps.8.8718, or earnings per ADS of US$5.1774 for 2Q22.

Net Income

ASUR reported Net Income of Ps.2,649.4 million in 2Q23, declining 6.9%, or Ps.195.0 million, from Ps.2,844.5 million in 2Q22.

Consolidated Financial Position

Airport concessions represented 71.8% of ASUR’s total assets on June 30, 2023, with current assets representing 27.5% and other assets 0.7%.

Cash and cash equivalents as of June 30, 2023, amounted to Ps.14,474.0 million, a 9.9% increase from Ps.13,175.0 million as of December 31, 2022. Mexico, Colombia and Puerto Rico contributed with Ps.10,013.0 million, Ps.1,676.8 million and Ps.2,784.2 million in cash and cash equivalents, respectively.

As of June 30, 2022, the valuation of ASUR’s investment in Aerostar in accordance with IFRS 3 "Business Combinations," had the following effects on its balance sheet: (i) the recognition of a net intangible asset of Ps.4,635.7 million, (ii) goodwill of Ps.818.6 million (net of an impairment of Ps.4,719.1 million), (iii) deferred taxes of Ps.463.6 million, and (iv) a minority interest of Ps.4,842.7 million in stockholders' equity.

The valuation of ASUR’s investment in Airplan, in accordance with IFRS 3 “Business Combinations”, resulted in the following effects on the balance sheet as of June 30, 2023: (i) the recognition of a net intangible asset of Ps.832.4 million, (ii) goodwill of Ps.1,344.2 million, (iii) deferred taxes of Ps.216.7 million, and (iv) a Ps.213.1 million recognition of bank loans at fair value.

Stockholders’ equity as of June 30, 2023, was Ps. 46,708.3 million and total liabilities were Ps. 22,035.8 million, representing 67.9% and 32.1% of ASUR’s total assets, respectively. Deferred liabilities represented 13.4% of ASUR’s total liabilities.

Total Debt at quarter-end declined 13.5% to Ps.13,147.3 million from Ps.15,204.8 million on December 31, 2022, mainly reflecting the FX conversion impact on the Notes issued by Aerostar in Puerto Rico reflecting peso appreciation against the U.S. dollar. This was partially offset by principal payments of Ps.712.5 million in Mexico and Ps.99.8 million in Puerto Rico.

On June 30, 2023, 25.0% of ASUR’s Total Debt was denominated in Mexican pesos, 68.1% in U.S. Dollars (at Aerostar in Puerto Rico) and 6.9% in Colombian pesos.

In July 2022, Aerostar in Puerto Rico issued US$200 million principal amount of 4.92% senior secured notes due March 22, 2035. In May 2022, Aerostar renegotiated the terms of its US$50 million principal amount of 6.75% senior secured notes originally due on June 24, 2015, and extended their maturity through 2035. All long-term debt is collateralized by Aerostar’s assets.

LTM Net Debt-to-LTM EBITDA stood at negative 0.1x at the close of 2Q23, while the Interest Coverage Ratio was 11.5x. This compares with LTM Net Debt-to-LTM EBITDA of 0.4x and an Interest Coverage Ratio of 10.5x at June 30, 2022, respectively.

|

|

|

|

Table 6: Consolidated Debt Indicators |

|

|

|

|

June 30, 2022 |

December 31, 2022 |

June 30, 2023 |

Leverage |

|

|

|

|

|

|

|

Total Debt/ LTM EBITDA (Times) 1 |

0.9 |

0.9 |

0.8 |

Total Net Debt/ LTM EBITDA (Times) 2 |

0.4 |

0.1 |

(0.1) |

Interest Coverage Ratio 3 |

10.5 |

12.6 |

11.5 |

Total Debt |

12,378,086 |

15,204,761 |

13,147,327 |

Short-term Debt |

1,052,187 |

1,869,996 |

1,881,660 |

Long-term Debt |

11,325,899 |

13,334,765 |

11,265,667 |

Cash & Cash Equivalents |

7,331,083 |

13,174,991 |

14,474,035 |

Total Net Debt 4 |

5,047,003 |

2,029,770 |

(1,326,708) |

1 The Total Debt to EBITDA Ratio is calculated as ASUR’s interest-bearing liabilities divided by its EBITDA. |

2 The Total Net Debt to EBITDA Ratio is calculated as ASUR’s interest-bearing liabilities minus Cash & Cash Equivalents, divided by its EBITDA. |

3 The Interest Coverage Ratio for Mexico is calculated as ASUR’s LTM EBIDA divided by its LTM interest expenses. For Puerto Rico, it is calculated as LTM Cash Flow Generation divided LTM debt service, and for Colombia as LTM EBITDA minus LTM taxes divided by LTM debt service. |

4 Total net debt is calculated as Asur´s total debt without cash & cash Equivalents |

|

|

|

|

|

|

|

Table 7: Consolidated Debt Profile (million)* |

|

|

|

|

|

Aerostar

US$ |

Canun Airport Thousand Mexican Pesos |

Airplan

Million COP |

Original Amount |

350´M |

200´M |

50´M |

BBVA

2,000 M |

Santander 2,650 M |

Syndicated Loan 440,000 M |

Interest rate |

5.75% |

4.92% |

6.75% |

TIIE + 1.4 pp |

TIIE +1.5 pp |

DTF + 4pp |

Principal Balance as of June 30, 2023 |

283.0 |

200.0 |

42.0 |

1,950.0 |

1,337.5 |

167,897.5 |

2023 |

5.8 |

- |

- |

100.0 |

662.5 |

- |

2024 |

12.4 |

- |

- |

200.0 |

675.0 |

- |

2025 |

13.6 |

- |

- |

275.0 |

- |

57,900.1 |

2026 |

15.0 |

- |

- |

375.0 |

- |

72,600.0 |

2027 |

16.6 |

- |

- |

475.0 |

- |

37,397.5 |

2028 |

16.2 |

- |

- |

525.0 |

- |

- |

2029 |

17.3 |

- |

- |

- |

- |

- |

2030 |

20.9 |

- |

- |

- |

- |

- |

2031 |

27.0 |

- |

- |

- |

- |

- |

2032 |

34.4 |

- |

- |

- |

- |

- |

2033 |

38.5 |

- |

- |

- |

- |

- |

2034 |

42.6 |

- |

- |

- |

- |

- |

2035 |

22.6 |

200.0 |

42.0 |

- |

- |

- |

*Expressed in the original currency of each loan. |

Note: the loans in Mexico were incurred in October 2017 with Bancomer and Santander. The Puerto Rico bonds were issued in March 2013 and June 2015. In both cases, the maturity date was modified to 2035. The syndicated loan in Colombia was obtained in June 2015 with a grace period of three years. In April 2022, Airplan made principal payments amounting to Cop.150,000 million, and the next principal payment is due in 2025. In July 2022, Aerostar issued US$200 million senior secured notes due March 22, 2035. On November 30, 2022 Cancun Airport pre-paid Ps.650 million of the loan from Santander. |

1 DTF is an average 90-day rate to which the credit facilities in Colombia are pegged. |

Strong Liquidity Position and Healthy Debt Maturity Profile

ASUR closed 2Q23 with a solid financial position, with cash and cash equivalents totaling Ps.14,474.0 million and Ps.13,147.3 million in Total Debt. A total of Ps.812.3 million in principal amount of outstanding debt payments is due in 3Q23.

The following table shows the liquidity position for each of ASUR’s regions of operations:

|

|

|

|

|

|

Table 8: Liquidity Position at March 31, 2023 |

|

Figures in Thousands of Mexican Pesos |

|

|

|

Figures in Thousands of Mexican Pesos |

Cash & Equivalents |

Total Debt |

Short-term Debt |

Long-term Debt |

Principal payments (July – September 2023) |

|

Mexico |

10,012,963 |

3,282,061 |

1,535,964 |

1,746,097 |

712,500 |

Puerto Rico |

2,784,289 |

8,952,393 |

339,123 |

8,613,270 |

99,845 |

Colombia |

1,676,783 |

912,873 |

6,573 |

906,300 |

0 |

Total |

14,474,035 |

13,147,327 |

1,881,660 |

11,265,667 |

812,345 |

|

|

|

|

|

|

|

Table 9: Principal Debt Payments as of June 30, 2023 |

Figures in Thousands of Mexican Pesos |

|

|

|

Region of Operation |

2023 |

2024 |

2025 |

2026/2035 |

México |

762,500 |

875,000 |

275,000 |

1,375,000 |

Puerto Rico |

99,845 |

212,275 |

233,081 |

8,450,482 |

Colombia |

0 |

0 |

204,881 |

389,219 |

Total |

862,345 |

1,087,275 |

712,962 |

10,214,701 |

1 Figures in pesos converted at the exchange rate at the close of the quarter Ps.17.1358= US$1.00 2 Figures in pesos converted at the exchange rate at the close of the quarter of COP.243.4300=Ps.1.00 Note: Figures only reflects principal payments. |

Table 10: Debt Ratios at June 30, 2023 |

Region |

LTM EBITDA |

LTM Interest Expense |

Debt Coverage

Ratio |

Minimum Coverage Requirement as per Agreements |

|

Mexico 1 |

13,290,597 |

473,382 |

28.1 |

3.0 |

Puerto Rico 2 |

1,999,703 |

678,656 |

2.9 |

1.1 |

Colombia 3 |

1,192,531 |

286,066 |

4.2 |

1.2 |

Total |

16,482,831 |

1,438,104 |

11.5 |

|

|

|

|

|

|

1 Per the applicable debt agreement, the formula for the Interest Coverage ratio is: LTM EBITDA/ LTM Interest Expense. |

2 Per the applicable debt agreement, the formula for the Debt Coverage ratio is: LTM Cash Flow Generation / LTM Debt Service. LTM Cash Flow Generation for the period was Ps.1,999,7 million and LTM Debt Service was Ps.678,6 million. |

3 Per the applicable debt agreement, the formula for the Debt Coverage ratio is: (LTM EBITDA minus LTM Taxes)/ LTM Debt Service. EBITDA minus Taxes for the period amounted to Ps.1,192.5 million and Debt Service was Ps.286.1 million. |

Accounts Receivables

Accounts receivables increased 7.2% YoY in 2Q23, reflecting higher business activity as passenger traffic increased across ASUR’ s airport network.

On February 28 and March 29, 2023, Viva Colombia and Ultra Air suspended operations. During 2022, these two companies accounted for 17.4% and 1.9% of passenger traffic in Colombia, respectively. At the end of 2Q23, these two companies owed ASUR Ps.13.5 million and Ps.9.5 million, respectively.

Table 11: Accounts Receivable as of June 30, 2023

Figures in Thousands of Mexican Pesos

|

|

|

|

Mexico |

1,529,112 |

1,741,418 |

13.9 |

Puerto Rico |

150,557 |

156,871 |

4.2 |

Colombia |

139,889 |

52,180 |

(62.7) |

Total |

1,819,558 |

1,950,469 |

7.2 |

Note: Net of allowance for bad debts.

Capital Expenditures

ASUR made capital expenditures of Ps.152.9 million in 2Q23. Of this amount, Ps.81.3 million were allocated to modernizing the Company´s Mexican airports pursuant to its master development plans, Ps.70.9 million were invested by Aerostar in Puerto Rico and Ps.0.7 million were invested by Airplan in Colombia. This compares to Ps.436.9 million invested in 2Q22, of which Ps.346.3 million were invested in Mexico, Ps.89.7 million in Puerto Rico and Ps.0.8 million in Colombia.

During 1H23, ASUR invested Ps.295.9 million in CapEx, of which Ps.151.5 million were allocated to the modernization of its Mexican airports within the framework of its development plan, Ps.137.6 million to Aerostar in Puerto Rico and Ps.6.7 million to Airplan in Colombia. This compares with Ps.752.7 million invested in 2Q22, of which Ps.586.4 million were allocated to its Mexican airports, Ps.164.6 million to Puerto Rico and Ps.1.7 million to Colombia.

2Q23 Relevant Events

Joint Business Investment to Develop and Build and International Airport in Bavaro, Dominican Republic

In 2023, ASUR, through a subsidiary in the United States, entered into an investment agreement with CVC One, Inc. and Grupo Abrisa, S.R.L. for the purposes of developing and constructing an international airport in Bavaro, Dominican Republic. As of June 30, 2023, ASUR has made equity investments in Aeropuerto Internacional de Bavaro AIB, S.A.S. (i.e. the venture created to develop this project) totaling US$17.8 million before the start of the construction. ASUR expects to maintain a 25% stake in the venture with a total estimated investment amount of US$66.0 million once construction is completed.

Review of Mexico Operations

|

|

|

|

|

|

|

|

Table 12: Mexico Revenues & Commercial Revenues Per Passenger |

|

|

Second Quarter |

% Chg |

|

Six – Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Passengers |

9,868 |

10,764 |

9.1 |

|

18,939 |

21,899 |

15.6 |

|

|

|

|

|

|

|

|

Total Revenues |

4,557,925 |

4,541,133 |

(0.4) |

|

8,431,401 |

9,316,279 |

10.5 |

Aeronautical Services |

2,466,285 |

2,766,378 |

12.2 |

|

4,680,279 |

5,631,981 |

20.3 |

Non-Aeronautical Services |

1,580,944 |

1,700,963 |

7.6 |

|

3,063,730 |

3,527,025 |

15.1 |

Construction Revenues |

510,696 |

73,792 |

(85.6) |

|

687,392 |

157,273 |

(77.1) |

Total Revenues Excluding Construction Revenues |

4,047,229 |

4,467,341 |

10.4 |

|

7,744,009 |

9,159,006 |

18.3 |

|

|

|

|

|

|

|

|

Total Commercial Revenues |

1,408,624 |

1,524,765 |

8.2 |

|

2,732,365 |

3,161,011 |

15.7 |

Commercial Revenues from Direct Operations |

274,994 |

334,650 |

21.7 |

|

545,492 |

334,650 |

(38.7) |

Commercial Revenues Excluding Direct Operations |

1,133,630 |

1,190,115 |

5.0 |

|

2,186,873 |

2,826,361 |

29.2 |

|

|

|

|

|

|

|

|

Total Commercial Revenues per Passenger |

142.8 |

141.6 |

(0.8) |

|

144.3 |

144.3 |

0.0 |

Commercial Revenues from Direct Operations per Passenger 1 |

27.9 |

31.1 |

11.6 |

|

28.8 |

15.3 |

(46.9) |

Commercial Revenues Excl. Direct Operations per Passenger |

114.9 |

110.6 |

(3.8) |

|

115.5 |

129.1 |

11.8 |

For the purposes of this table, approximately 50.5 and 66.6 thousand transit and general aviation passengers are included in 2Q22 and 2Q23 respectively. while 100.9 and 127.6 thousand transit and general aviation passengers are included in 6M22 and 6M23. |

1 Represents the operation of ASUR in its convenience stores in Mexico. |

|

|

|

|

Mexico Revenues

Mexico Revenues declined 0.4% YoY to Ps.4,541.1 million.

Excluding construction, revenues increased 10.4% YoY, mainly reflecting increases of 12.2% in revenues from aeronautical services and 7.6% in revenues from non-aeronautical services, resulting principally from the 9.0% increase in passenger traffic (including transit and general aviation passengers).

Commercial Revenues increased 8.2% YoY, principally reflecting the 9.1% increase in passenger traffic as shown in Table 12. Commercial Revenues per Passenger for 2Q23 was Ps.141.6 compared to Ps.142.8 in 2Q22.

ASUR classifies commercial revenues as those derived from the following activities: duty-free stores, car rentals, retail operations, banking and currency exchange services, advertising, teleservices, non-permanent ground transportation, food and beverage operations, parking lot fees, and other.

As shown in Table 14, during the last 12 months, ASUR opened 20 new commercial spaces, 10 of which were opened at Cancun, one each at Cozumel and Huatulco airports, three at Oaxaca airport and 4 at Merida airports. More details of these openings can be found on page 20 of this report.

|

|

|

|

|

|

Table 13: Mexico Commercial Revenue Performance |

|

|

Table 14: Mexico Summary Retail and Other Commercial Space Opened since June 30,2022 |

Bussines Line |

YoY Chg |

|

Type of Commercial Space 1 |

# Of Spaces Opened |

2Q23 |

6M23 |

|

Advertising |

52.3% |

51.9% |

|

Cancun |

10 |

Car rental |

29.4% |

26.0% |

|

Retail |

5 |

Car parking |

28.7% |

33.6% |

|

Car rental |

2 |

Food and Beverage |

19.7% |

21.4% |

|

Other Revenues |

2 |

Ground Transportation |

9.1% |

17.5% |

|

Banks and foreign exchange |

1 |

Other Revenues |

4.2% |

10.1% |

|

8 Others airports |

9 |

Retail |

1.8% |

13.8% |

|

Retail |

5 |

Duty Free |

(0.2%) |

9.3% |

|

Banks and foreign exchange |

1 |

Teleservices |

(9.9%) |

11.0% |

|

Car rental |

2 |

Banks and foreign exchange |

(20.2%) |

(4.5%) |

|

Ground Transportation |

1 |

Total Commercial Revenues |

8.2% |

15.7% |

|

Mexico |

19 |

|

|

|

|

1 Only includes new stores opened during the period and excludes remodelings or contract renewals. |

Mexico Operating Costs and Expenses

|

|

|

|

|

|

|

|

Table 15: Mexico Operating Costs & Expenses |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Cost of Services |

569,347 |

689,629 |

21.1 |

|

1,086,037 |

1,312,734 |

20.9 |

Administrative |

72,825 |

76,325 |

4.8 |

|

142,130 |

153,566 |

8.0 |

Technical Assistance |

160,408 |

174,434 |

8.7 |

|

308,803 |

364,745 |

18.1 |

Concession Fees |

186,475 |

204,826 |

9.8 |

|

346,987 |

411,827 |

18.7 |

Depreciation and Amortization |

222,712 |

261,444 |

17.4 |

|

438,296 |

517,681 |

18.1 |

Operating Costs and Expenses Excluding Construction Costs |

1,211,767 |

1,406,658 |

16.1 |

|

2,322,253 |

2,760,553 |

18.9 |

Construction Costs |

510,696 |

73,792 |

(85.6) |

|

687,392 |

157,273 |

(77.1) |

Total Operating Costs & Expenses |

1,722,463 |

1,480,450 |

(14.1) |

|

3,009,645 |

2,917,826 |

(3.1) |

Total Mexico Operating Costs and Expenses declined 14.1% YoY, or Ps.242.0 million. Excluding construction costs, operating costs and expenses increased 16.1%, or Ps.194.9 million, mainly reflecting higher personnel expenses, technical assistance, energy, concession fees, security and maintenance costs, materials and supplies, taxes and duties, professional fees and marketing expenses. Higher cost of sales at stores operated by ASUR also contributed to the increase in costs.

Cost of Services increased 21.1% YoY, primarily due to increases in surveillance and cleaning services, maintenance and conservation, materials and supplies, insurance and bonds, electricity, taxes and fees, professional fees and marketing expenses; together with higher cost of sales at stores directly operated by ASUR along with personnel expenses.

Administrative Expenses increased 4.8% YoY.

The Technical Assistance fee paid to ITA increased 8.7% YoY reflecting higher EBITDA in Mexico, which is used in the calculation of the fee.

Concession Fees, which include fees paid to the Mexican government, increased 9.8%, principally due to the increase in regulated revenues which is used in the calculation of the concession fee.

Depreciation and Amortization increased 17.4% YoY, reflecting the recognition of investments made to date.

Mexico Consolidated Comprehensive Financing Gain (Loss)

|

|

|

|

|

|

|

|

Table 16: Mexico Comprehensive Financing Gain (Loss) |

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Interest Income |

63,054 |

216,770 |

243.8 |

|

132,626 |

401,189 |

202.5 |

Interest Expense |

(106,615) |

(117,682) |

10.4 |

|

(201,574) |

(253,060) |

25.5 |

Foreign Exchange Gain (Loss), Net |

55,518 |

(344,478) |

n/a |

|

(40,388) |

(831,371) |

1,958.5 |

Total |

11,957 |

(245,390) |

n/a |

|

(109,336) |

(683,242) |

524.9 |

ASUR’s Mexico operations reported a Ps.245.4 million Comprehensive Financing Loss in 2Q23, compared to an Ps.11.9 million gain in 2Q22. This was mainly due to a foreign exchange gain loss of Ps.344.5 million in 2Q23 resulting from the 5.0% quarter-end appreciation of the Mexican peso (1.9% average appreciation) against the U.S. dollar on a foreign currency net asset position. This compares to a Ps.55.5 million foreign exchange gain in 2Q22, resulting from the 1.1% quarter-end depreciation of the Mexican peso during that period (0.6% average depreciation) against the U.S. dollar on a foreign currency net asset position.

Interest expenses increased 10.4% YoY, or Ps.11.1 million reflecting interest rate increases. Interest income increased 243.8% YoY or Ps.153.7 million, resulting from a higher cash balance.

Mexico Operating Profit (Loss) and EBITDA

|

|

|

|

|

|

|

|

Table 17: Mexico Profit & EBITDA |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Revenue |

4,557,925 |

4,541,133 |

(0.4) |

|

8,431,401 |

9,316,279 |

10.5 |

Total Revenues Excluding Construction Revenues |

4,047,229 |

4,467,341 |

10.4 |

|

7,744,009 |

9,159,006 |

18.3 |

Operating Profit |

2,835,462 |

3,060,683 |

7.9 |

|

5,421,756 |

6,398,453 |

18.0 |

Operating Margin |

62.2% |

67.4% |

519 bps |

|

64.3% |

68.7% |

438 bps |

Adjusted Operating Margin 1 |

70.1% |

68.5% |

(155 bps) |

|

70.0% |

69.9% |

(15 bps) |

Net Profit 2 |

2,053,242 |

1,978,141 |

(3.7) |

|

3,934,765 |

4,128,265 |

4.9 |

EBITDA |

3,058,270 |

3,322,367 |

8.6 |

|

5,860,677 |

6,916,382 |

18.0 |

EBITDA Margin |

67.1% |

73.2% |

606 bps |

|

69.5% |

74.2% |

473 bps |

Adjusted EBITDA Margin 3 |

75.6% |

74.4% |

(119 bps) |

|

75.7% |

75.5% |

(17 bps) |

1 Adjusted Operating Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is equal to operating profit divided by total revenues less construction services revenues. |

2 This result includes revenues from the participation of Aerostar Ps.299.4 million and 327.6 million in 2Q23 and 2Q22, respectively, for Airplan Ps.205.6 million and Ps.142.3 million in 2Q23 and 2Q22, respectively. |

3 Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is calculated by dividing EBITDA by total revenues less construction services revenues. |

Mexico reported an Operating Gain of Ps.3,060.7 million in 2Q23 and an Operating Margin of 67.4%. This compares to an Operating Gain of Ps.2,835.5 million and an Operating Margin of 62.2% in 2Q22.

Adjusted Operating Margin, which excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned assets and which is calculated as operating profit divided by total revenues excluding construction services revenues, was 68.5% in 2Q23, compared to 70.1% in 2Q22.

EBITDA increased 8.6%, or Ps.264.1 million, to Ps.3,322.4 million in 2Q23, from Ps.3,058.3 million in 2Q22. EBITDA margin in 2Q23 was 73.2% compared to 67.1% in 2Q22.

Adjusted EBITDA Margin, which excludes the effect of IFRIC 12 with respect to the construction of or improvements to concessioned assets, was 74.4% in 2Q23, compared to 75.6% in 2Q22.

Mexico Tariff Regulation

The Mexican Ministry of Communications and Transportation regulates the majority of ASUR’s activities by setting maximum rates, which represent the maximum possible revenues allowed per traffic unit at each airport.

ASUR’s accumulated regulated revenues at its Mexican operations, as of June 30, 2023 totaled Ps.5,862.4 million, with an average tariff per workload unit of Ps.262.2 (December 2022 Mexican pesos), representing approximately 64.0% of total income in Mexico (excluding construction revenues) for the period.

The Mexican Ministry of Communications and Transportation reviews compliance with maximum rate regulations at the end of each year.

Mexico Capital Expenditures

During 2Q23 ASUR invested Ps.81.3 million in connection with its plan to modernize its Mexican airports under its master development plans, compared to an investment of Ps.346.3 million in 2Q22. During 1H23, capital investments amounted to Ps.151.5 million compared to Ps.586.4 million in 1H22.

Review of Puerto Rico Operations

The following discussion compares Aerostar’s independent results for the three- and six-month periods ended June 30, 2022 and 2023.

As of June 30, 2022, the valuation of ASUR’s investment in Aerostar in accordance with IFRS 3 "Business Combinations," had the following effects on its balance sheet: (i) the recognition of a net intangible asset of Ps.4,635.7 million, (ii) goodwill of Ps.818.6 million (net of an impairment of Ps.4,719.1 million), (iii) deferred taxes of Ps.463.6 million, and (iv) a minority interest of Ps.4,842.7 million in stockholders' equity.

|

|

|

|

|

|

|

|

Table 18: Puerto Rico Revenues & Commercial Revenues Per Passenger |

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Passenger |

2,783 |

3,199 |

14.9 |

|

5,174 |

6,106 |

18.0 |

|

|

|

|

|

|

|

|

Total Revenues |

1,065,470 |

1,036,616 |

(2.7) |

|

2,013,794 |

2,047,559 |

1.7 |

Aeronautical Services |

540,053 |

508,939 |

(5.8) |

|

1,057,131 |

1,037,234 |

(1.9) |

Non-Aeronautical Services |

445,305 |

470,703 |

5.7 |

|

803,136 |

893,520 |

11.3 |

Construction Revenues |

80,112 |

56,974 |

(28.9) |

|

153,527 |

116,805 |

(23.9) |

Total Revenues Excluding Construction Revenues |

985,358 |

979,642 |

(0.6) |

|

1,860,267 |

1,930,754 |

3.8 |

|

|

|

|

|

|

|

|

Total Commercial Revenues |

442,364 |

468,358 |

5.9 |

|

797,479 |

889,014 |

11.5 |

Commercial Revenues from Direct Operations |

95,788 |

108,903 |

13.7 |

|

174,627 |

209,510 |

20.0 |

Commercial Revenues Excluding Direct Operations |

346,576 |

359,455 |

3.7 |

|

622,852 |

679,504 |

9.1 |

|

|

|

|

|

|

|

|

Total Commercial Revenues per Passenger |

159.0 |

146.4 |

(7.9) |

|

154.1 |

145.6 |

(5.5) |

Commercial Revenues from Direct Operations per Passenger 1 |

34.4 |

34.0 |

(1.1) |

|

33.8 |

34.3 |

1.7 |

Commercial Revenues Excl. Direct Operations per Passenger |

124.5 |

112.4 |

(9.8) |

|

120.4 |

111.3 |

(7.6) |

Figures in pesos at the average exchange rate Ps.17.7012 = US. 1.00 |

|

|

|

|

1 Represents ASUR´s operations in convenience stores in Puerto Rico. |

|

|

|

|

|

|

|

Puerto Rico Revenues

Total Puerto Rico Revenues declined 2.7% YoY to Ps.1,036.6 million in 2Q23.

Excluding construction services, revenues declined by 0.6%, mainly due to the following YoY variations:

•A 5.7% increase in revenues from non-aeronautical services; and

•A 5.8% decline in revenues from aeronautical services.

Commercial Revenues per Passenger were Ps.146.4 in 2Q23, compared to Ps.159.0 in 2Q22.

Four commercial spaces were opened at Luis Muñoz Marin (LMM) Airport over the last 12 months, as shown in Table 20. More details can be found on page 20 of this report.

ASUR classifies commercial revenues as those derived from the following activities: duty-free stores, car rentals, retail operations, advertising, non-permanent ground transportation, food and beverage operations, parking lot fees, banking and currency exchange services, and other.

|

|

|

|

|

|

Table 19: Puerto Rico Commercial Revenue Performance |

|

Table 20: Puerto Rico Summary Retail and Other Commercial Space Opened since June 30, 2022 |

Bussines Line |

YoY Chg |

|

Type of Commercial Space 1 |

# of Spaces Opened |

2Q23 |

6M23 |

|

Duty Free |

40.6% |

20.9% |

|

Duty Free |

1 |

Food and beverage |

25.6% |

30.3% |

|

Food and beverage |

2 |

Others revenues |

17.6% |

24.7% |

|

Others revenues |

1 |

Retail |

12.3% |

18.8% |

|

Total Commercial space |

4 |

Car parking |

6.2% |

9.7% |

|

|

|

Ground Transportation |

(3.2%) |

5.4% |

|

|

|

Banks and foreign exchange |

(3.4%) |

(2.6%) |

|

|

|

Car rentals |

(5.5%) |

3.0% |

|

1 Only includes new stores opened during the period and excludes remodelings or contract renewals. |

Advertising |

(9.2%) |

(10.2%) |

|

Total Commercial Revenues |

5.9% |

11.5% |

|

|

|

Puerto Rico Operating Costs and Expenses

|

|

|

|

|

|

|

|

Table 21: Puerto Rico Operating Costs & Expenses |

|

|

|

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Cost of Services |

184,739 |

146,935 |

(20.5) |

|

363,212 |

531,680 |

46.4 |

Concession Fees |

45,695 |

46,628 |

2.0 |

|

89,758 |

92,766 |

3.4 |

Depreciation and Amortization |

182,505 |

159,398 |

(12.7) |

|

369,105 |

329,068 |

(10.8) |

Operating Costs and Expenses Excluding Construction Costs |

412,939 |

352,961 |

(14.5) |

|

822,075 |

953,514 |

16.0 |

Construction Costs |

80,112 |

56,974 |

(28.9) |

|

153,527 |

116,805 |

(23.9) |

Total Operating Costs & Expenses |

493,051 |

409,935 |

(16.9) |

|

975,602 |

1,070,319 |

9.7 |

Figures in pesos at the average exchange rate Ps.17.7012 = US. 1.00 |

|

|

|

|

Total Operating Costs and Expenses in Puerto Rico decreased 16.9% YoY to Ps.409.9 million in 2Q22. Construction costs in the quarter decreased 28.9% to Ps.57.0 million from Ps.80.1 million in 2Q22.

Excluding construction costs, operating costs and expenses decreased 14.5% YoY, or Ps.60.0 million. The decrease was primarily due to the recovery of expenses under the CRRSAA Act for an amount of Ps.252.3 million in 2Q23, compared to a benefit of Ps.175.2 million in 2Q22. Excluding this effect, expenses would have increased 10.9%, or Ps.39.3 million, mainly reflecting increases in professional fees, materials and supplies, and maintenance costs, all of which were partially offset by a decrease in personnel and energy costs.

Cost of Services decreased 20.5% or Ps.37.8 million in 2Q23, principally reflecting the recovery of expenses from the grant received under the CRRSAA Act for an amount of Ps.252.3 million in 2Q23 compared to Ps.175.2 million in 2Q22. Excluding this effect, expenses would have increased 10.9% or Ps.39.3 million, driven by higher professional fees, materials and supplies, maintenance costs, and security services, all of which were partially offset by a decrease in personnel and energy costs.

Concession Fees paid to the Puerto Rican government increased 2.0% YoY, or Ps.0.9 million in 2Q23, in line with the terms of the concession agreement.

Depreciation and Amortization decreased 12.7% YoY, or Ps.23.1 million, principally reflecting the foreign exchange translation impact as the quarter-end and average Mexican peso exchange rate fluctuated from Ps.17.1358 and Ps.17.7012 per U.S. dollar in 2Q22, to Ps.20.1375 and Ps.20.0317 per U.S. dollar, respectively in 2Q23.

Puerto Rico Comprehensive Financing Gain (Loss)

|

|

|

|

|

|

|

|

Table 22: Puerto Rico Comprehensive Financing Gain (Loss) |

|

|

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Interest Income |

3,549 |

33,585 |

846.3 |

|

5,428 |

64,928 |

1,096.2 |

Interest Expense |

(108,885) |

(138,462) |

27.2 |

|

(221,663) |

(285,878) |

29.0 |

Total |

(105,336) |

(104,877) |

(0.4) |

|

(216,235) |

(220,950) |

2.2 |

Figures in pesos at the average exchange rate Ps.17.7012 = US. 1.00 |

|

|

|

|

During 2Q23, Puerto Rico reported a Ps.104.9 million Comprehensive Financing Loss, compared to a Ps.105.3 million loss in 2Q22, principally due to interest accrued from the US$200.0 million bond issuance in July 2022.

On March 22, 2013, Aerostar carried out a private bond placement for a total of US$350.0 million to finance a portion of the Concession Agreement payment to the Puerto Rico Ports Authority, and certain other costs and expenditures associated with it. On June 24, 2015, Aerostar carried out a private bond placement for a total of US$50.0 million.

In December 2020, Aerostar entered into a three-year revolving line of credit with Banco Popular de Puerto Rico for the amount of US$20.0 million. Funds have not yet been withdrawn.

In May 2022, Aerostar renegotiated the terms of its US$50.0 million principal amount of 6.75% senior secured notes extending the maturity to March 22, 2035.

In July 2022, Aerostar in Puerto Rico issued US$200.0 million principal amount of 4.92% senior secured notes due March 22, 2035. All long-term debt is collateralized by Aerostar’s assets.

Puerto Rico Operating Profit and EBITDA

|

|

|

|

|

|

|

|

Table 23: Puerto Rico Profit & EBITDA |

|

|

|

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Revenue |

1,065,470 |

1,036,616 |

(2.7) |

|

2,013,794 |

2,047,559 |

1.7 |

Total Revenues Excluding Construction Revenues |

985,358 |

979,642 |

(0.6) |

|

1,860,267 |

1,930,754 |

3.8 |

Other Revenues |

|

|

|

|

45,547 |

|

n/a |

Operating Profit |

572,419 |

626,681 |

9.5 |

|

1,083,739 |

977,240 |

(9.8) |

Operating Margin |

53.7% |

60.5% |

673 bps |

|

53.8% |

47.7% |

(609 bps) |

Adjusted Operating Margin1 |

58.1% |

64.0% |

588 bps |

|

58.3% |

50.6% |

(764 bps) |

Net Income |

457,302 |

511,751 |

11.9 |

|

847,435 |

736,460 |

(13.1) |

EBITDA |

579,751 |

533,715 |

(7.9) |

|

1,081,293 |

1,053,944 |

(2.5) |

EBITDA Margin |

54.4% |

51.5% |

(293 bps) |

|

53.7% |

51.5% |

(222 bps) |

Adjusted EBITDA Margin2 |

58.8% |

54.5% |

(436 bps) |

|

58.1% |

54.6% |

(354 bps) |

Figures in pesos at the average exchange rate Ps.17.7012 = US. 1.00 |

|

|

|

|

|

1 Adjusted Operating Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is equal to operating profit divided by total revenues less construction services revenues. |

2 Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is calculated by dividing EBITDA by total revenues less construction services revenues. |

Operating Profit at Puerto Rico increased 9.5% to Ps.626.7 million resulting in an Operating Margin of 60.5%, from an operating profit of Ps.572.4 million and an Operating Margin of 53.7% in 2Q22.

EBITDA decreased 7.9% to Ps.533.7 million in 1Q22 from Ps.579.7 million in 2Q22. EBITDA Margin, in turn, decreased to 51.5% in 2Q23 from 54.4% in 2Q22.

Adjusted EBITDA Margin (which excludes IFRIC 12) decreased to 54.5% in 2Q23, from 58.8% in 2Q22.

Puerto Rico Capital Expenditures

During 2Q23, Aerostar made capital expenditures of Ps.70.9 million, compared to investments of Ps.89.7 million in 2Q22. Capex for 1H23 amounted to Ps.137.6 million compared to Ps.164.6 million in 1H22.

Puerto Rico Tariff Regulation

The Airport Use Agreement entered into by and among Aerostar, the airlines serving LMM Airport, and the Puerto Rico Ports Authority governs the relationship between Aerostar and the principal airlines serving LMM Airport. The agreement entitles Aerostar to an annual contribution from the airlines of US$62.0 million during the first five years of the term. From year six onwards, the total annual contribution for the prior year increases in accordance with an adjusted consumer price index factor based on the U.S. non-core consumer price index. The annual fee is divided between the airlines that operate at LMM Airport in accordance with the regulations and structure defined under the Airport Use Agreement to establish the contribution of each airline for each particular year.

Review of Colombia Operations

The following discussion compares Airplan's independent results for the three- and six-month periods ended June 30, 2023 and 2022.

The valuation of ASUR’s investment in Airplan, in accordance with IFRS 3 “Business Combinations”, resulted in the following effects on the balance sheet as of June 30, 2023: (i) the recognition of a net intangible asset of Ps.832.4 million, (ii) goodwill of Ps.1,344.2 million, (iii) deferred taxes of Ps.216.7 million, and (iv) a Ps.213.1 million recognition of bank loans at fair value.

|

|

|

|

|

|

|

|

Table 24: Colombia Revenues & Commercial Revenues Per Passenger |

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Passenger |

4,230 |

3,490 |

(17.5) |

|

7,913 |

7,543 |

(4.7) |

|

|

|

|

|

|

|

|

Total Revenues |

696,314 |

578,694 |

(16.9) |

|

1,300,319 |

1,242,014 |

(4.5) |

Aeronautical Services |

527,452 |

435,659 |

(17.4) |

|

978,396 |

919,179 |

(6.1) |

Non-Aeronautical Services |

168,153 |

142,312 |

(15.4) |

|

320,018 |

316,045 |

(1.2) |

Construction Revenues 1 |

709 |

723 |

2.0 |

|

1,905 |

6,790 |

256.4 |

Total Revenues Excluding Construction Revenues |

695,605 |

577,971 |

(16.9) |

|

1,298,414 |

1,235,224 |

(4.9) |

|

|

|

|

|

|

|

|

Total Commercial Revenues |

168,057 |

142,143 |

(15.4) |

|

319,656 |

313,616 |

(1.9) |

|

|

|

|

|

|

|

|

Total Commercial Revenues per Passenger |

39.7 |

40.7 |

2.5 |

|

40.4 |

41.6 |

3.0 |

Figures in Colombian pesos at an average exchange rate of COP.250.0574 = Ps.1.00 Mexican pesos. |

For the purposes of this table, approximately 122.8 and 100.7 thousand transit and general aviation passengers are included in 2Q22 and 2Q23, respectively, while 234.13 and 267.9 thousand transit and general aviation passengers are included in 6M22 and 6M23. |

Colombia Revenues

Total Revenues in Colombia declined 16.9% YoY to Ps.578.7 million. Excluding construction services, revenues declined 16.9% YoY, primarily due to the 17.5% decline in passenger traffic resulting from the suspension of operations of Viva Air and Ultra Air as of 1Q23.

Commercial Revenues per Passenger was Ps.40.7 compared to Ps.39.7 in 2Q22.

As shown in Table 26, 44 new commercial spaces were opened in Colombia in the last twelve months. Further detail of these openings can be found on page 20 of this report.

ASUR classifies commercial revenues as those derived from the following activities: duty-free stores, car rentals, retail operations, advertising, non-permanent ground transportation, food and beverage operations, parking lot fees, teleservices, banking and currency exchange services and other.

|

|

|

|

|

|

Table 25: Colombia Commercial Revenue Performance |

|

|

|

Table 26: Colombia Summary Retail and Other Commercial Space Opened since June 30, 2022 |

Bussines Line |

YoY Chg |

|

Type of Commercial Space 1 |

# of Spaces Opened |

2Q23 |

6M23 |

|

Retail |

3.9% |

11.6% |

|

Food and beverage |

12 |

Car rental |

(0.7%) |

17.0% |

|

Retail |

1 |

Duty free |

(1.5%) |

23.9% |

|

Car rental |

1 |

Banks and foreign exchange |

(13.1%) |

12.1% |

|

Others revenues |

29 |

Others revenues |

(14.8%) |

(9.2%) |

|

Banks and foreign exchange |

1 |

Teleservices |

(18.2%) |

(19.6%) |

|

Total Commercial Spaces |

44 |

Food and beverage |

(20.6%) |

18.8% |

|

|

|

Car parking |

(23.1%) |

(18.4%) |

|

|

|

Ground Transportation |

(41.3%) |

12.4% |

|

1 Only includes new stores opened during the period and excludes remodelings or contract renewals. |

Advertising |

(68.3%) |

(38.7%) |

|

Total Commercial Revenues |

(15.4%) |

(1.9%) |

|

|

|

Colombia Costs & Expenses

|

|

|

|

|

|

|

|

Table 27: Colombia Costs & Expenses |

|

|

|

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Cost of Services |

136,889 |

159,580 |

16.6 |

|

253,809 |

276,241 |

8.8 |

Technical Assistance |

22,537 |

|

n/a |

|

23,567 |

|

n/a |

Concession Fees |

133,571 |

114,166 |

(14.5) |

|

246,094 |

238,600 |

(3.0) |

Depreciation and Amortization |

100,620 |

87,512 |

(13.0) |

|

196,763 |

178,348 |

(9.4) |

Operating Costs and Expenses Excluding Construction Costs |

393,617 |

361,258 |

(8.2) |

|

720,233 |

693,189 |

(3.8) |

Construction Costs |

709 |

723 |

2.0 |

|

1,905 |

6,790 |

256.4 |

Total Operating Costs & Expenses |

394,326 |

361,981 |

(8.2) |

|

722,138 |

699,979 |

(3.1) |

Figures in pesos at an average exchange rate of COP.250.0574 = Ps.1.00 Mexican pesos. |

Total Operating Costs and Expenses in Colombia declined 8.2% YoY to Ps.362.0 million. Excluding construction costs, operating costs and expenses declined 8.2% YoY to Ps.361.3 million. This decrease was mainly driven by a lower concession, depreciation and amortization costs, which were partially offset by increases in professional fees, and provisions for uncollectible accounts resulting mainly from the suspension of operations of Viva Air and Ultra Air.

Cost of Services increased 16.6% YoY, or Ps.22.7 million.

Construction Costs increased 2.0% YoY, or Ps.0.01 million due to investments in furniture and equipment.

Concession Fees, which include fees paid to the Colombian government, declined 14.5% YoY, mainly reflecting the decrease in regulated and non-regulated revenues during the period.

Depreciation and Amortization declined 13.0%.

Colombia Comprehensive Financing Gain (Loss)

|

|

|

|

|

|

|

|

Table 28: Colombia, Comprehensive Financing Gain (Loss) |

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Interest Income |

7,526 |

46,315 |

515.4 |

|

16,443 |

95,613 |

481.5 |

Interest Expense |

194,672 |

(25,534) |

n/a |

|

176,308 |

(48,732) |

n/a |

Foreign Exchange Gain (Loss), Net |

(498) |

(506) |

1.6 |

|

(488) |

(521) |

6.8 |

Total |

201,700 |

20,275 |

(89.9) |

|

192,263 |

46,360 |

(75.9) |

Figures in pesos at an average exchange rate of COP.250.0574 = Ps.1.00 Mexican pesos. |

During 2Q23, Airplan reported a Ps.20.3 million Comprehensive Financing Gain, compared to a Ps.201.7 million gain in 2Q22. This mainly reflects a Ps.223.7 million benefit obtained in 2Q22 from the amortization of the fair value of the loan originated by the acquisition of the Colombia business, which did not occur in 2Q23.

Colombia Operating Profit (Loss) and EBITDA

|

|

|

|

|

|

|

|

Table 29: Colombia Profit & EBITDA |

|

|

|

|

|

|

|

In thousands of Mexican pesos |

|

|

|

|

|

|

|

|

Second Quarter |

% Chg |

|

Six - Months |

% Chg |

|

2022 |

2023 |

|

2022 |

2023 |

Total Revenues |

696,314 |

578,694 |

(16.9) |

|

1,300,319 |

1,242,014 |

(4.5) |

Total Revenues Excluding Construction Revenues |

695,605 |

577,971 |

(16.9) |

|

1,298,414 |

1,235,224 |

(4.9) |

Operating Profit |

301,988 |

216,713 |

(28.2) |

|

578,181 |

542,035 |

(6.3) |

Operating Margin |

43.4% |

37.4% |

(592 bps) |

|

44.5% |

43.6% |

(82 bps) |

Adjusted Operating Margin1 |

43.4% |

37.5% |

(592 bps) |

|

44.5% |

43.9% |

(65 bps) |

Net Profit |

333,925 |

159,521 |

(52.2) |

|

412,031 |

386,933 |

(6.1) |

EBITDA |

402,608 |

304,224 |

(24.4) |

|

774,944 |

720,382 |

(7.0) |

EBITDA Margin |

57.8% |

52.6% |

(525 bps) |

|

59.6% |

58.0% |

(160 bps) |

Adjusted EBITDA Margin2 |

57.9% |

52.6% |

(524 bps) |

|

59.7% |

58.3% |

(136 bps) |

Figures in pesos at an average exchange rate of COP.250.0574 = Ps.1.00 Mexican pesos. |

1 Adjusted Operating Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is equal to operating profit divided by total revenues less construction services revenues. |

2 Adjusted EBITDA Margin excludes the effect of IFRIC12 with respect to the construction or improvements to concessioned assets, and is calculated by dividing EBITDA by total revenues less construction services revenues. |

In 2Q23, ASUR's operations in Colombia reported an Operating Profit of Ps.216.7 million, compared to Ps.302.0 million in 2Q22. Operating margin was 37.4% in 2Q23 compared to an operating margin of 43.4% in 2Q22. Adjusted operating margin, which excludes the effect of IFRIC12 with respect to construction or improvements to concessioned assets, was 37.5% in 2Q23 compared to an adjusted operating margin of 43.4% in 2Q22.

EBITDA in 2Q23 was Ps.304.2 million resulting in an EBITDA margin of 52.6%. This compares to an EBITDA of Ps.402.6 million and an EBITDA margin of 57.8% in 2Q22.

The Adjusted EBITDA Margin, which excludes the effect of IFRIC12 with respect to the construction or improvements of the concessioned assets, was 52.6% in 2Q23, compared to an adjusted EBITDA margin of 57.9% in 2Q22, mainly reflecting the impact in passenger traffic and bad debt provisions resulting from the suspension of two local airlines in Colombia in 1Q23.

Colombia Capital Expenditures

During 2Q23, Airplan made capital investments of Ps.0.7 million compared to Ps.0.8 million in 2Q22. Accumulated capital investments for 1H23 amounted to Ps.6.7 million compared to Ps.1.7 million in 1H22.

Colombia Tariff Regulation