Form 8-K - Current report

14 September 2023 - 10:15PM

Edgar (US Regulatory)

0001428205false00014282052023-09-142023-09-140001428205us-gaap:SeriesCPreferredStockMember2023-09-142023-09-140001428205us-gaap:CommonStockMember2023-09-142023-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 8-K

______________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 14, 2023

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3001 Ocean Drive, Suite 201 | | |

| Vero Beach, | Florida | | 32963 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbols | | Name of Exchange on which registered |

| Preferred Stock, 7.00% Series C Cumulative Redeemable | | ARR-PRC | | New York Stock Exchange |

| Common Stock, $0.001 par value | | ARR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 7.01. Regulation FD Disclosure.

On September 14, 2023, ARMOUR Residential REIT, Inc. (“ARMOUR”) produced for distribution a slide deck presentation, which contains updates on ARMOUR's financial position, business and operations. Attached as Exhibit 99.1 to this report is the slide deck presentation produced by ARMOUR.

The slide deck presentation attached to this report as Exhibit 99.1 is furnished pursuant to this Item 7.01 and shall not be deemed filed in this or any other filing of ARMOUR under the Securities Exchange Act of 1934, as amended, unless expressly incorporated by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 14, 2023

ARMOUR RESIDENTIAL REIT, INC.

By: /s/ Mark Gruber

Name: Mark Gruber

Title: Chief Investment Officer

ARMOUR RESIDENTIAL REIT, Inc. Company Update 9/14/2023 ARMOUR seeks to create shareholder value through thoughtful investment and risk management that produces current yield and superior risk adjusted returns over the long term. Our focus on residential real estate finance supports home ownership for a broad and diverse spectrum of Americans by bringing private capital into the mortgage markets.

2 • Certain statements made in this presentation regarding ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”), and any other statements regarding ARMOUR’s future expectations, beliefs, goals or prospects constitute “forward-looking statements” made within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions) should also be considered forward-looking statements. Forward-looking statements include but are not limited to statements regarding the projections and future plans for ARMOUR’s business, growth and operational improvements. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of ARMOUR’s control. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements. Additional information concerning these factors and risks are contained in the Company’s most recent annual and quarterly reports and other reports filed with the Securities and Exchange Commission. ARMOUR assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. • This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities or financial instruments. The statements, information and estimates contained herein are based on information that the Company believes to be reliable as of today's date unless otherwise indicated. ARMOUR cannot guarantee future results, levels of activity, performance or achievements. • Pricing and duration information are estimates provided by independent third-party providers based on models that require inputs and assumptions. Actual realized prices and durations will depend on a number of factors that cannot be predicted with certainty and may be materially different from estimates. • Estimates do not reflect any costs of operation of ARMOUR. • THE INFORMATION PRESENTED HEREIN IS UNAUDITED AND NOT REVIEWED BY OUR INDEPENDENT PUBLIC ACCOUNTANTS. PLEASE READ: Important Note Regarding Forward Looking Statements and Estimates

3 Stockholders' Equity and Liquidity Dividend Policy Shareholder Alignment Transparency and Governance ARMOUR REIT Manager • Stockholders' Equity as of June 30, 2023 totaled $1.3 billion, including the 7.00% Series C Cumulative Redeemable Preferred Stock ("Series C Preferred") with liquidation preference totaling $171 million. • August 31, 2023 liquidity was approximately $628 million, consisting of $88 million cash and $541 million unlevered Agency and US Treasury securities. • ARMOUR pays dividends monthly. • The Company previously announced the September common stock dividend of $0.08 per share payable on September 28, 2023 to holders of record on September 15, 2023. • Since inception in November 2009, ARMOUR has paid out $2.0 billion in dividends.(1) • Returned $282 million to common shareholders through share repurchases since 2013. • Senior management maintains common stock ownership basis in excess of $5.75 million aggregate target. • Managed preferred shares through repurchases, calls, and refinancing to maximize value in capital structure. • Updated portfolio and liability details can be found monthly at www.armourreit.com. • Non-Executive Board Chairman and separate Lead Independent Director. • ARMOUR REIT is externally managed by ARMOUR Capital Management LP. • ARMOUR Capital Management LP is the majority owner of BUCKLER Securities, a FINRA registered broker-dealer. ARMOUR Overview 1 (1) Includes both common and preferred stock dividends through August 2023. Information as of 08/31/2023. 2 3 4 5 ARMOUR manages an investment portfolio consisting of mortgage-backed securities issued or guaranteed by U.S. Government-sponsored enterprises (“GSEs”), Treasury securities, and cash; a financing position consisting primarily of repurchase agreements and preferred equity and a hedge book consisting primarily of interest rate swaps, Treasury futures and Treasury shorts.

4 ARMOUR Portfolio Securities % of Portfolio Current Value (millions) Weighted Average Book Price Weighted Average Market Price Weighted Average Net/Gross Coupon Estimated Effective Duration Agency Multifamily Ballooning in 120 Months or Less 4.8% $595 99.8% 97.0% 4.48/5.36 7.90 Agency Fixed Rates MBS Maturing Between 0 and 360 Months 98.7% $12,155 99.6% 96.3% 4.97/5.79 4.93 Agency 30Y TBA Short Positions(1) -3.5% -$431 86.6% 86.2% 3.00/ N/A -7.18 Total Portfolio 100.0% $12,318 ARMOUR Portfolio and Financing Composition (1) The Agency 30Y TBA Short Positions effectively pare down certain specified pools. (2) BUCKLER Securities LLC is a FINRA registered broker-dealer affiliated with ARMOUR REIT. Information as of 08/31/2023. Portfolio value is based on independent third-party pricing. Information includes estimates of the effect of forward settling trades. Some totals may not foot due to rounding. ARMOUR Repurchase Agreements Repo Counterparty Principal Borrowed (millions) % of Repo Positions Wtd. Avg. Original Term Wtd. Avg. Remaining Days Longest Remaining Term in Days BUCKLER Securities LLC (2) $5,613 50.4% 43 20 42 All Other Counterparties $5,534 49.6% 37 19 50 Total or Wtd. Avg. $11,146 100.0% 40 19

5 Information as of 08/31/2023. Some totals may not foot due to rounding. ARMOUR Hedging Composition 6 Remaining Term (in months) N ot io na l ( in m ill io ns ) Interest Rate Swap Breakdown by Months to Maturity 0 - 12 M on th s 13 - 2 4 M on th s 25 - 3 6 M on th s 37 - 4 8 M on th s 49 - 6 0 M on th s 61 - 7 2 M on th s 73 - 8 4 M on th s 85 - 9 6 M on th s 97 - 1 08 M on th s 10 9 - 12 0 M on th s 0 500 1,000 1,500 2,000 2,500 Total Swap Notional is $8.4B with a weighted average maturity of 81 months.

6 Constant Prepayment Rate ("CPR") is the annualized equivalent of single monthly mortality ("SMM"). CPR attempts to predict the percentage of principal that will prepay over the next twelve months based on historical principal pay downs. CPR is reported on the 4th business day of the month for the previous month's prepayment activity. ARMOUR's Agency Portfolio Constant Prepayment Rates ("CPR") Monthly Portfolio CPR Jan ua ry 20 18 M ay 20 18 Se pt em be r 2 01 8 Jan ua ry 20 19 M ay 20 19 Se pt em be r 2 01 9 Jan ua ry 20 20 M ay 20 20 Se pt em be r 2 02 0 Jan ua ry 20 21 M ay 20 21 Se pt em be r 2 02 1 Jan ua ry 20 22 M ay 20 22 Se pt em be r 2 02 2 Jan ua ry 20 23 M ay 20 23 Se pt em be r 2 02 3 0 5 10 15 20

7ARMOUR Net Interest Margin Pe rc en t Asset Yield Cost of Funds including Hedges Net Interest Margin 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 0 1 2 3 4 Information as of Q2 2023.

ARMOUR Residential REIT, Inc. 3001 Ocean Drive Suite 201 Vero Beach, FL 32963 armourreit.com 772-617-4340

v3.23.2

Cover Document

|

Sep. 14, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 14, 2023

|

| Entity Registrant Name |

ARMOUR Residential REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34766

|

| Entity Tax Identification Number |

26-1908763

|

| Entity Address, Address Line One |

3001 Ocean Drive, Suite 201

|

| Entity Address, City or Town |

Vero Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

617-4340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001428205

|

| Amendment Flag |

false

|

| Series C Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.00% Series C Cumulative Redeemable

|

| Trading Symbol |

ARR-PRC

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

ARR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

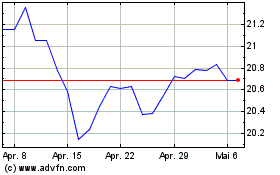

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Mai 2023 bis Mai 2024