0001736946false00017369462024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 29, 2024

ARLO TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-38618 | 38-4061754 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| 2200 Faraday Ave., | Suite #150 | | | |

| Carlsbad, | California | | | 92008 |

| (Address of principal executive offices) | | | (Zip Code) |

(408) 890-3900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | ARLO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2024, Arlo Technologies, Inc. issued a press release announcing its financial results for the fourth quarter and full year ended December 31, 2023. A copy of this press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including Exhibit 99.1 hereto, are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, unless expressly incorporated by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

ARLO TECHNOLOGIES, INC. |

| Registrant |

|

|

|

| /s/ KURTIS BINDER |

| Kurtis Binder |

| Chief Financial Officer |

Dated: February 29, 2024

NEWS RELEASE

Arlo Reports Fourth Quarter and Full Year 2023 Results

Record fourth quarter service revenue of $55.9 million, growing 45.9% year over year

Record GAAP net earnings per diluted share (EPS) of $0.01 and record non-GAAP EPS of $0.11 in the fourth quarter

Annual recurring revenue (ARR) ended at $210.1 million, growing 52.5% year over year (1)

Full year service revenue of $201.2 million, growing 47.4% year over year

Full year free cash flow (FCF) of $35.5 million with FCF margin of 7.2% (2)

Full year GAAP net loss per share of $(0.24); record non-GAAP EPS of $0.28

Carlsbad, California - February 29, 2024 - Arlo Technologies, Inc. (NYSE: ARLO), a leading smart home security company, today reported financial results for the fourth quarter and full year ended December 31, 2023.

“Arlo finished the year strong with the largest product launch in our company history contributing to solid revenue growth of 14% and ARR growth of over 50% compared to Q4 of the prior year. This culminated in record non-GAAP earnings of $0.11 per share and our first ever profit on a GAAP basis,” said Matthew McRae, Chief Executive Officer of Arlo technologies. “The growth is even more impressive when looking at Arlo’s full year results with our annual service revenue growing 47% to more than $200 million and an $83 million increase in our free cash flow from the prior year. Arlo is clearly well positioned for success in 2024 as evidenced by our announcement that we crossed the 3 million subscribers milestone, substantially earlier than originally projected in our Long-Range Plan.”

Financial and Business Highlights

Q4 2023 Summary

•Total revenue of $135.1 million, an increase of 14.0% year over year.

•Record service revenue of $55.9 million, growing 45.9% year over year.

•GAAP services gross margin of 73.9% and non-GAAP services gross margin of 74.4%.

•GAAP gross profit of $47.3 million, an increase of 48.1% year over year; non-GAAP gross profit of $48.3 million, an increase of 45.6% year over year.

•GAAP gross margin of 35.0%; non-GAAP gross margin of 35.8%.

•Record GAAP net earnings per diluted share of $0.01; record non-GAAP earnings per diluted share of $0.11.

•Cumulative paid accounts increased to 2.8 million, growing 51.1% year over year.

•Ended the quarter with ARR(1) of $210.1 million, growing 52.5% year over year.

FY2023 Summary

• Total revenue of $491.2 million, a slight increase year over year.

•Record service revenue of $201.2 million, growing 47.4% year over year.

• GAAP gross profit of $167.6 million, an increase of 23.2% year over year; non-GAAP gross profit of $171.7 million, an increase of 21.9% year over year.

•GAAP gross margin of 34.1% up 640 basis points year over year; non-GAAP gross margin of 35.0% up 630 basis points year over year.

• GAAP net loss per share - basic and diluted of $(0.24); non-GAAP net earnings per diluted share of $0.28.

•Ended with cash and cash equivalents and short-term investments balance of $136.5 million, up $22.8 million year over year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage and per share data) |

| Revenue | $ | 135,093 | | | $ | 130,003 | | | $ | 118,527 | | | $ | 491,176 | | | $ | 490,414 | |

| GAAP Gross Margin | 35.0 | % | | 33.2 | % | | 27.0 | % | | 34.1 | % | | 27.7 | % |

Non-GAAP Gross Margin (3) | 35.8 | % | | 34.0 | % | | 28.0 | % | | 35.0 | % | | 28.7 | % |

GAAP Net Income (Loss) per Share - Basic and Diluted | $ | 0.01 | | | $ | (0.01) | | | $ | (0.25) | | | $ | (0.24) | | | $ | (0.65) | |

Non-GAAP Net Income (Loss) per Share - Basic and Diluted (3) | $ | 0.11 | | | $ | 0.09 | | | $ | (0.04) | | | $ | 0.28 | | | $ | (0.07) | |

_________________________(1) ARR is calculated by taking our recurring paid service revenue for the last calendar month in the fiscal quarter, multiplied by 12 months. Recurring paid service revenue represents the revenue we recognized from our paid accounts and excludes prepaid service revenue.

(2) FCF is calculated as net cash provided by (used in) operating activities less capital expenditures. FCF margin is the FCF divided by revenue.

(3) Reconciliation of financial measures computed on a GAAP basis to the most directly comparable financial measures computed on a non-GAAP basis is provided at the end of this press release.

First Quarter 2024 Business Outlook (4)

A reconciliation of our business outlook on a GAAP and non-GAAP basis is provided in the following table:

| | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Revenue | | Net Income (Loss)

per Diluted Share |

| (In millions, except per share data) |

| GAAP | $117 - $127 | | $(0.08) - $(0.02) |

| Estimated adjustment for stock-based compensation and other expense | — | | 0.13 |

| Non-GAAP | $117 - $127 | | $0.05 - $0.11 |

_________________________

(4) Business outlook does not include estimates for any currently unknown income and expense items which, by their nature, could arise late in a quarter, including: litigation reserves, net; impairment charges; discrete tax benefits or detriments relating to tax windfalls or shortfalls from equity awards; and any additional impacts relating to the implementation of U.S. tax reform. New material income and expense items such as these could have a significant effect on our guidance and future results.

Investor Conference Call / Webcast Details

Arlo will review the fourth quarter and full-year 2023 results, discuss management’s expectations for the first quarter and full-year 2024, and discuss new long-range plan targets today, Thursday, February 29, 2024 at 5:00 p.m. ET (2:00 p.m. PT). To view the accompanying presentation a live webcast of the conference call will be available on Arlo’s Investor Relations website at https://investor.arlo.com. The toll-free dial-in number for the live audio call is (888) 660-6387. The international dial-in number for the live audio call is +1 (929) 203-1909. The conference ID for the call is 7749064. A replay of the call will be available via the web at https://investor.arlo.com.

About Arlo Technologies, Inc.

Arlo is an award-winning, industry leader that is transforming the ways in which people can protect everything that matters to them with advanced home, business, and personal security solutions. Arlo’s deep expertise in AI- and CV-powered analytics, cloud services, user experience and product design, and innovative wireless and RF connectivity enables the delivery of a seamless, smart security experience for Arlo users that is easy to set up and interact with every day. Arlo’s cloud-based platform provides users with visibility, insight and a powerful means to help protect and connect in real-time with the people and things that matter most, from any location with a Wi-Fi or a cellular connection. To date, Arlo has launched several categories of award-winning connected devices, software and services. These include wire-free, smart Wi-Fi and LTE-enabled security cameras, video doorbells, floodlights, security system, and Arlo's subscription services: Arlo Secure, and Arlo Safe.

With a mission to bring users peace of mind, Arlo is as passionate about protecting user privacy as it is about safeguarding homes and families. Arlo is committed to implementing industry standards for data protection designed to keep users' personal information private and in their control. Arlo does not monetize personal data, provides enhanced controls for user data, supports privacy legislation, keeps user data safely secure, and puts security at the forefront of company culture.

© 2024 Arlo Technologies, Inc., Arlo and the Arlo logo are trademarks and/or registered trademarks of Arlo Technologies, Inc. and/or certain of its affiliates in the United States and/or other countries. Other brand and product names are for identification purposes only and may be trademarks or registered trademarks of their respective holder(s). The information contained herein is subject to change without notice. Arlo shall not be liable for technical or editorial errors or omissions contained herein. All rights reserved.

Contact:

Arlo Investor Relations

Tahmin Clarke

investors@arlo.com

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 for Arlo Technologies, Inc.:

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “anticipate,” “expect,” “believe,” “will,” “may,” “should,” “estimate,” “project,” “outlook,” “forecast” or other similar words are used to identify such forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. The forward-looking statements represent our expectations or beliefs concerning future events based on information available at the time such statements were made and include statements regarding our potential future business, operating performance and financial condition, including descriptions of our expected revenue and profitability (and related timing), GAAP and non-GAAP gross margins, operating margins, tax rates, expenses, cash outlook, free cash flow and free cash flow margins; the ability of our subscription services and security product portfolio to position us for a successful 2024; strategic objectives and initiatives; the recurring revenue business model; expectations regarding market expansion and future growth; and others. These statements are based on management's current expectations and are subject to certain risks and uncertainties, including the following: future demand for our products may be lower than anticipated, including due to inflation, fluctuating consumer confidence, banking failures and rising interest rates; we may be unsuccessful in developing and expanding our sales and marketing capabilities; we may not be able to increase sales of our paid subscription services; consumers may choose not to adopt our new product offerings or adopt competing products; product performance may be adversely affected by real world operating conditions; we may be unsuccessful or experience delays in manufacturing and distributing our new and existing products; we may fail to manage costs and cost saving initiatives, the cost of developing new products and manufacturing and distribution of our existing offerings. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Further information on potential risk factors that could affect our business are detailed in our periodic filings with the Securities and Exchange Commission, including, but not limited to, those risks and uncertainties listed in the section entitled “Risk Factors” in the most recently filed Annual Report and Quarterly Report filed with the Securities and Exchange Commission (the “SEC”) and subsequent filings with the SEC. Given these circumstances, you should not place undue reliance on these forward-looking statements. We undertake no obligation to release publicly any revisions to any forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Information:

To supplement our unaudited selected financial data presented on a basis consistent with U.S. Generally Accepted Accounting Principles (“GAAP”), we disclose certain non-GAAP financial measures that exclude certain charges, including non-GAAP gross profit, non-GAAP gross margin, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, non-GAAP total operating expenses, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP other income (expenses), net, non-GAAP provision for income taxes, non-GAAP net income (loss) and non-GAAP net income (loss) per diluted share. These supplemental measures exclude adjustments for stock-based compensation expense, restructuring charges, impairment charges, separation expense, amortization of development of software cost, litigation reserves, net, employee retention credit and the related tax effects. In addition, we use free cash flow as non-GAAP measure when assessing the sources of liquidity, capital resources, and quality of earnings. We believe that free cash flow (usage) is helpful in understanding our capital requirements and provides an additional means to reflect the cash flow trends in our business. These non-GAAP measures are not in accordance with or an alternative for GAAP, and may be different from similarly-titled non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our operating performance on a period-to-period basis because such items are not, in our view, related to our ongoing operational performance. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, and for benchmarking performance externally against competitors. In addition, management’s incentive compensation is determined using certain non-GAAP measures. Since we find these measures to be useful, we believe that investors benefit from seeing results “through the eyes” of management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP measures, provide useful information to investors by offering:

•the ability to make more meaningful period-to-period comparisons of our on-going operating results;

•the ability to better identify trends in our underlying business and perform related trend analyses;

•a better understanding of how management plans and measures our underlying business; and

•an easier way to compare our operating results against analyst financial models and operating results of competitors that supplement their GAAP results with non-GAAP financial measures.

The following are explanations of the adjustments that we incorporate into non-GAAP measures, as well as the reasons for excluding them in the reconciliations of these non-GAAP financial measures:

Stock-based compensation expense consists of non-cash charges for the estimated fair value of stock options, performance-based stock options, restricted stock units (RSU), performance-based restricted stock units, shares under the employee stock purchase plan granted to employees and employees' annual bonus in RSU form. We believe that the exclusion of these charges provides for more accurate comparisons of our operating results to peer companies due to the varying available valuation methodologies, subjective assumptions and the variety of award types. In addition, we believe it is useful to investors to understand the specific impact stock-based compensation expense has on our operating results.

Other non-GAAP items are the result of either unique or unplanned events, including, when applicable: restructuring charges, impairment charges, separation expense, amortization of development of software cost, litigation reserves, net and employee retention credit. It is difficult to predict the occurrence or estimate the amount or timing of these items in advance. Although these events are reflected in our GAAP financial statements, these unique transactions may limit the comparability of our on-going operations with prior and future periods. The amounts result from events that often arise from unforeseen circumstances, which often occur outside of the ordinary course of continuing operations. Therefore, the amounts do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred.

Source: Arlo-F

***Financial Tables

| | |

| ARLO TECHNOLOGIES, INC. |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 |

| (In thousands, except share and per share data) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 56,522 | | | $ | 84,024 | |

| Short-term investments | 79,974 | | | 29,700 | |

| Accounts receivable, net | 65,360 | | | 65,960 | |

| Inventories | 38,408 | | | 46,554 | |

| Prepaid expenses and other current assets | 10,271 | | | 6,544 | |

| Total current assets | 250,535 | | | 232,782 | |

| Property and equipment, net | 4,761 | | | 7,336 | |

| Operating lease right-of-use assets, net | 11,450 | | | 12,809 | |

| Goodwill | 11,038 | | | 11,038 | |

| Restricted cash | 4,131 | | | 4,155 | |

| Other non-current assets | 3,623 | | | 4,081 | |

| Total assets | $ | 285,538 | | | $ | 272,201 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 55,201 | | | $ | 52,132 | |

| Deferred revenue | 18,041 | | | 11,291 | |

| Accrued liabilities | 88,209 | | | 98,855 | |

| Total current liabilities | 161,451 | | | 162,278 | |

| Non-current operating lease liabilities | 17,021 | | | 19,279 | |

| Other non-current liabilities | 3,790 | | | 2,949 | |

| Total liabilities | 182,262 | | | 184,506 | |

| Commitments and contingencies | | | |

| Stockholders’ Equity: | | | |

Preferred stock: $0.001 par value; 50,000,000 shares authorized; none issued or outstanding | — | | | — | |

Common stock: $0.001 par value; 500,000,000 shares authorized; shares issued and outstanding: 95,380,281 at December 31, 2023 and 88,887,139 at December 31, 2022 | 95 | | | 89 | |

| Additional paid-in capital | 470,322 | | | 433,138 | |

| Accumulated other comprehensive income (loss) | 320 | | | (107) | |

| Accumulated deficit | (367,461) | | | (345,425) | |

| Total stockholders’ equity | 103,276 | | | 87,695 | |

| Total liabilities and stockholders’ equity | $ | 285,538 | | | $ | 272,201 | |

| | |

| ARLO TECHNOLOGIES, INC. |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage and per share data) |

| Revenue: | | | | | | | | | |

| Products | $ | 79,168 | | | $ | 78,961 | | | $ | 80,199 | | | $ | 289,938 | | | $ | 353,935 | |

| Services | 55,925 | | | 51,042 | | | 38,328 | | | 201,238 | | | 136,479 | |

| Total revenue | 135,093 | | | 130,003 | | | 118,527 | | | 491,176 | | | 490,414 | |

| Cost of revenue: | | | | | | | | | |

| Products | 73,143 | | | 73,335 | | | 74,700 | | | 270,663 | | | 308,692 | |

| Services | 14,601 | | | 13,529 | | | 11,857 | | | 52,950 | | | 45,687 | |

| Total cost of revenue | 87,744 | | | 86,864 | | | 86,557 | | | 323,613 | | | 354,379 | |

| Gross profit | 47,349 | | | 43,139 | | | 31,970 | | | 167,563 | | | 136,035 | |

| Gross margin | 35.0 | % | | 33.2 | % | | 27.0 | % | | 34.1 | % | | 27.7 | % |

| Operating expenses: | | | | | | | | | |

| Research and development | 16,450 | | | 16,829 | | | 14,457 | | | 68,647 | | | 64,709 | |

| Sales and marketing | 18,004 | | | 15,863 | | | 20,214 | | | 66,141 | | | 70,081 | |

| General and administrative | 13,282 | | | 12,460 | | | 17,909 | | | 56,371 | | | 55,932 | |

| Others | 71 | | | 263 | | | 1,815 | | | 1,307 | | | 2,192 | |

| Total operating expenses | 47,807 | | | 45,415 | | | 54,395 | | | 192,466 | | | 192,914 | |

| Loss from operations | (458) | | | (2,276) | | | (22,425) | | | (24,903) | | | (56,879) | |

| Operating margin | (0.3) | % | | (1.8) | % | | (18.9) | % | | (5.1) | % | | (11.6) | % |

| Interest income, net | 1,199 | | | 1,175 | | | 512 | | | 3,935 | | | 926 | |

| Other income (loss), net | 84 | | | 10 | | | (12) | | | 107 | | | 302 | |

| Income (loss) before income taxes | 825 | | | (1,091) | | | (21,925) | | | (20,861) | | | (55,651) | |

| Provision for income taxes | 133 | | | 29 | | | 230 | | | 1,175 | | | 975 | |

| Net income (loss) | $ | 692 | | | $ | (1,120) | | | $ | (22,155) | | | $ | (22,036) | | | $ | (56,626) | |

| | | | | | | | | |

| Net income (loss) per share: | | | | | | | | | |

| Basic | $ | 0.01 | | | $ | (0.01) | | | $ | (0.25) | | | $ | (0.24) | | | $ | (0.65) | |

| Diluted | $ | 0.01 | | | $ | (0.01) | | | $ | (0.25) | | | $ | (0.24) | | | $ | (0.65) | |

| Weighted average shares used to compute net income (loss) per share: | | | | | | | | | |

| Basic | 94,819 | | | 94,243 | | | 88,743 | | | 92,754 | | | 87,173 | |

| Diluted | 101,938 | | | 94,243 | | | 88,743 | | | 92,754 | | | 87,173 | |

| | |

| ARLO TECHNOLOGIES, INC. |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | | | | | | | | | | |

| | Year Ended December 31, |

| 2023 | | 2022 |

| (In thousands) |

| Cash flows from operating activities: | | | |

| Net loss | $ | (22,036) | | | $ | (56,626) | |

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: | | | |

| Stock-based compensation expense | 47,948 | | | 48,476 | |

| Depreciation and amortization | 4,661 | | | 4,768 | |

| Allowance for credit losses and inventory reserves | 279 | | | (190) | |

| Deferred income taxes | 112 | | | 181 | |

| Others | (2,005) | | | 24 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable, net | 690 | | | 13,517 | |

| Inventories | 7,777 | | | (7,887) | |

| Prepaid expenses and other assets | (1,498) | | | 3,427 | |

| Accounts payable | 3,723 | | | (32,520) | |

| Deferred revenue | 6,610 | | | (19,281) | |

| Accrued and other liabilities | (7,959) | | | 149 | |

| Net cash provided by (used in) operating activities | 38,302 | | | (45,962) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (2,847) | | | (2,010) | |

| Purchases of short-term investments | (149,870) | | | (69,305) | |

| Proceeds from maturities of short-term investments | 102,031 | | | 39,542 | |

| Net cash used in investing activities | (50,686) | | | (31,773) | |

| Cash flows from financing activities: | | | |

| Proceeds related to employee benefit plans | 8,493 | | | 4,260 | |

| Restricted stock unit withholdings | (23,635) | | | (18,202) | |

| Net cash used in financing activities | (15,142) | | | (13,942) | |

Net decrease in cash, cash equivalents and restricted cash | (27,526) | | | (91,677) | |

| Cash, cash equivalents and restricted cash, at beginning of period | 88,179 | | | 179,856 | |

| Cash, cash equivalents and restricted cash, at end of period | $ | 60,653 | | | $ | 88,179 | |

| | | |

| Non-cash investing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 189 | | | $ | 946 | |

| Supplemental cash flow information: | | | |

| Cash paid for income taxes, net | $ | 1,196 | | | $ | 415 | |

| | |

| ARLO TECHNOLOGIES, INC. |

| RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNAUDITED STATEMENT OF OPERATIONS DATA: | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage data) |

| GAAP gross profit: | | | | | | | | | |

| Products | $ | 6,025 | | | $ | 5,626 | | | $ | 5,499 | | | $ | 19,275 | | | $ | 45,243 | |

| Services | 41,324 | | | 37,513 | | | 26,471 | | | 148,288 | | | 90,792 | |

| Total GAAP gross profit | 47,349 | | | 43,139 | | | 31,970 | | | 167,563 | | | 136,035 | |

| GAAP gross margin: | | | | | | | | | |

| Products | 7.6 | % | | 7.1 | % | | 6.9 | % | | 6.6 | % | | 12.8 | % |

| Services | 73.9 | % | | 73.5 | % | | 69.1 | % | | 73.7 | % | | 66.5 | % |

| Total GAAP gross margin | 35.0 | % | | 33.2 | % | | 27.0 | % | | 34.1 | % | | 27.7 | % |

| Stock-based compensation expense - Products | 692 | | | 723 | | | 1,001 | | | 3,175 | | | 4,136 | |

| Stock-based compensation expense - Services | 145 | | | 145 | | | 230 | | | 358 | | | 705 | |

| Amortization of development of software cost - Services | 151 | | | 152 | | | — | | | 605 | | | — | |

| Non-GAAP gross profit: | | | | | | | | | |

| Products | 6,717 | | | 6,349 | | | 6,500 | | | 22,450 | | | 49,379 | |

| Services | 41,620 | | | 37,810 | | | 26,701 | | | 149,251 | | | 91,497 | |

| Total Non-GAAP gross profit | $ | 48,337 | | | $ | 44,159 | | | $ | 33,201 | | | $ | 171,701 | | | $ | 140,876 | |

| Non-GAAP gross margin: | | | | | | | | | |

| Products | 8.5 | % | | 8.0 | % | | 8.1 | % | | 7.7 | % | | 14.0 | % |

| Services | 74.4 | % | | 74.1 | % | | 69.7 | % | | 74.2 | % | | 67.0 | % |

| Total Non-GAAP gross margin | 35.8 | % | | 34.0 | % | | 28.0 | % | | 35.0 | % | | 28.7 | % |

| | | | | | | | | |

| GAAP research and development | $ | 16,450 | | | $ | 16,829 | | | $ | 14,457 | | | $ | 68,647 | | | $ | 64,709 | |

| Stock-based compensation expense | (2,631) | | | (2,847) | | | (3,715) | | | (12,700) | | | (12,317) | |

| Non-GAAP research and development | $ | 13,819 | | | $ | 13,982 | | | $ | 10,742 | | | $ | 55,947 | | | $ | 52,392 | |

| Percentage of revenue | 10.2 | % | | 10.8 | % | | 9.1 | % | | 11.4 | % | | 10.7 | % |

| | | | | | | | | |

| GAAP sales and marketing | $ | 18,004 | | | $ | 15,863 | | | $ | 20,214 | | | $ | 66,141 | | | $ | 70,081 | |

| Stock-based compensation expense | (1,283) | | | (1,224) | | | (1,731) | | | (5,899) | | | (6,290) | |

| Non-GAAP sales and marketing | $ | 16,721 | | | $ | 14,639 | | | $ | 18,483 | | | $ | 60,242 | | | $ | 63,791 | |

| Percentage of revenue | 12.4 | % | | 11.3 | % | | 15.6 | % | | 12.3 | % | | 13.0 | % |

| | | | | | | | | |

| GAAP general and administrative | $ | 13,282 | | | $ | 12,460 | | | $ | 17,909 | | | $ | 56,371 | | | $ | 55,932 | |

| Stock-based compensation expense | (5,346) | | | (5,348) | | | (10,012) | | | (25,816) | | | (25,028) | |

| Litigation reserves, net | — | | | — | | | (30) | | | — | | | (147) | |

| Non-GAAP general and administrative | $ | 7,936 | | | $ | 7,112 | | | $ | 7,867 | | | $ | 30,555 | | | $ | 30,757 | |

| Percentage of revenue | 5.9 | % | | 5.5 | % | | 6.6 | % | | 6.2 | % | | 6.3 | % |

| | |

| ARLO TECHNOLOGIES, INC. |

|

| RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNAUDITED STATEMENT OF OPERATIONS DATA (CONTINUED): | | | | |

| | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage data) |

| GAAP total operating expenses | $ | 47,807 | | | $ | 45,415 | | | $ | 54,395 | | | $ | 192,466 | | | $ | 192,914 | |

| Stock-based compensation expense | (9,260) | | | (9,419) | | | (15,458) | | | (44,415) | | | (43,635) | |

| Others | (71) | | | (263) | | | (1,845) | | | (1,307) | | | (2,339) | |

| Non-GAAP total operating expenses | $ | 38,476 | | | $ | 35,733 | | | $ | 37,092 | | | $ | 146,744 | | | $ | 146,940 | |

| | | | | | | | | |

| GAAP operating loss | $ | (458) | | | $ | (2,276) | | | $ | (22,425) | | | $ | (24,903) | | | $ | (56,879) | |

| GAAP operating margin | (0.3) | % | | (1.8) | % | | (18.9) | % | | (5.1) | % | | (11.6) | % |

| Stock-based compensation expense | 10,097 | | | 10,287 | | | 16,689 | | | 47,948 | | | 48,476 | |

| Others | 222 | | | 415 | | | 1,845 | | | 1,912 | | | 2,339 | |

| Non-GAAP operating income (loss) | $ | 9,861 | | | $ | 8,426 | | | $ | (3,891) | | | $ | 24,957 | | | $ | (6,064) | |

| Non-GAAP operating margin | 7.3 | % | | 6.5 | % | | (3.3) | % | | 5.1 | % | | (1.2) | % |

| | | | | | | | | |

| GAAP other income (loss), net | $ | 84 | | | $ | 10 | | | $ | (12) | | | $ | 107 | | | $ | 302 | |

| Employee retention credit | — | | | — | | | — | | | — | | | (65) | |

| Non-GAAP other income (loss), net | $ | 84 | | | $ | 10 | | | $ | (12) | | | $ | 107 | | | $ | 237 | |

| | | | | | | | | |

| GAAP provision for income taxes | $ | 133 | | | $ | 29 | | | $ | 230 | | | $ | 1,175 | | | $ | 975 | |

| GAAP income tax rate | 16.1 | % | | (2.7) | % | | (1.0) | % | | (5.6) | % | | (1.8) | % |

| Non-GAAP provision for income taxes | $ | 133 | | | $ | 29 | | | $ | 230 | | | $ | 1,175 | | | $ | 975 | |

| Non-GAAP income tax rate | 1.2 | % | | 0.3 | % | | (6.8) | % | | 4.1 | % | | (19.9) | % |

| | |

| ARLO TECHNOLOGIES, INC. |

|

| RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES (CONTINUED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNAUDITED STATEMENT OF OPERATIONS DATA (CONTINUED): | | | | |

| | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage and per share data) |

| GAAP net income (loss) | $ | 692 | | | $ | (1,120) | | | $ | (22,155) | | | $ | (22,036) | | | $ | (56,626) | |

| Stock-based compensation expense | 10,097 | | | 10,287 | | | 16,689 | | | 47,948 | | | 48,476 | |

| Others | 222 | | | 415 | | | 1,845 | | | 1,912 | | | 2,274 | |

| Non-GAAP net income (loss) | $ | 11,011 | | | $ | 9,582 | | | $ | (3,621) | | | $ | 27,824 | | | $ | (5,876) | |

| | | | | | | | | |

| GAAP net income (loss) per share - basic and diluted | $ | 0.01 | | | $ | (0.01) | | | $ | (0.25) | | | $ | (0.24) | | | $ | (0.65) | |

| Stock-based compensation expense | 0.10 | | | 0.10 | | | 0.19 | | | 0.52 | | | 0.56 | |

| Others | — | | | — | | | 0.02 | | | — | | | 0.02 | |

| Non-GAAP net income (loss) - diluted | $ | 0.11 | | | $ | 0.09 | | | $ | (0.04) | | | $ | 0.28 | | | $ | (0.07) | |

| | | | | | | | | |

| Shares used in computing GAAP net income (loss) - basic | 94,819 | | | 94,243 | | | 88,743 | | | 92,754 | | | 87,173 | |

| Shares used in computing non-GAAP net income (loss) - diluted | 101,938 | | | 102,116 | | | 88,743 | | | 100,217 | | | 87,173 | |

| | | | | | | | | |

| Free cash flow (usage): | | | | | | | | | |

| Net cash provided by (used in) operating activities | $ | 7,935 | | | $ | 7,459 | | | $ | (11,181) | | | $ | 38,302 | | | $ | (45,962) | |

| Less: Purchases of property and equipment | (399) | | | (494) | | | (1,194) | | | (2,847) | | | (2,010) | |

Free cash flow (usage) (1) | $ | 7,536 | | | $ | 6,965 | | | $ | (12,375) | | | $ | 35,455 | | | $ | (47,972) | |

Free cash flow (usage) margin (1) | 5.6 | % | | 5.4 | % | | (10.4) | % | | 7.2 | % | | (9.8) | % |

_________________________

(1) Free cash flow (usage) is calculated as net cash provided by (used in) operating activities less capital expenditures. Free cash flow (usage) margin is the free cash flow (usage) divided by revenue.

| | |

| ARLO TECHNOLOGIES, INC. |

|

UNAUDITED SUPPLEMENTAL FINANCIAL INFORMATION |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| December 31,

2023 | | October 1,

2023 | | July 2,

2023 | | April 2,

2023 | | December 31,

2022 |

| (In thousands, except headcount and per share data) |

| Cash, cash equivalents and short-term investments | $ | 136,496 | | | $ | 126,049 | | | $ | 123,675 | | | $ | 118,673 | | | $ | 113,724 | |

| Cash, cash equivalents and short-term investments per diluted share | $ | 1.34 | | | $ | 1.23 | | | $ | 1.25 | | | $ | 1.27 | | | $ | 1.28 | |

| | | | | | | | | |

| Accounts receivable, net | $ | 65,360 | | | $ | 70,313 | | | $ | 57,327 | | | $ | 52,837 | | | $ | 65,960 | |

| Days sales outstanding | 44 | | | 49 | | | 45 | | | 44 | | | 50 | |

| | | | | | | | | |

| Inventories | $ | 38,408 | | | $ | 53,496 | | | $ | 39,429 | | | $ | 39,922 | | | $ | 46,554 | |

| Inventory turns | 7.6 | | | 5.5 | | | 6.1 | | | 6.4 | | | 6.4 | |

| | | | | | | | | |

| Weeks of channel inventory: | | | | | | | | | |

| U.S. retail channel | 11.1 | | | 10.9 | | | 9.7 | | | 14.6 | | | 11.9 | |

| U.S. distribution channel | 20.5 | | | 7.4 | | | 9.3 | | | 17.6 | | | 14.1 | |

| APAC distribution channel | 3.9 | | | 7.2 | | | 7.7 | | | 5.8 | | | 4.7 | |

| | | | | | | | | |

Deferred revenue

(current and non-current) | $ | 18,114 | | | $ | 17,706 | | | $ | 17,702 | | | $ | 15,289 | | | $ | 11,503 | |

| | | | | | | | | |

Cumulative registered accounts (1) | 8,652 | | | 8,193 | | | 7,860 | | | 7,510 | | | 7,220 | |

Cumulative paid accounts (2) | 2,813 | | | 2,486 | | | 2,289 | | | 2,044 | | | 1,862 | |

Annual recurring revenue (ARR) (3) | $ | 210,078 | | | $ | 199,993 | | | $ | 193,633 | | | $ | 182,583 | | | $ | 137,764 | |

| | | | | | | | | |

| Headcount | 363 | | | 353 | | | 345 | | | 334 | | | 343 | |

| Non-GAAP diluted shares | 101,938 | | | 102,116 | | | 99,187 | | | 93,236 | | | 88,743 | |

_________________________

(1) We define our registered accounts at the end of a particular period as the number of unique registered accounts on the Arlo platform as of the end of such period. The number of registered accounts does not necessarily reflect the number of end-users on the Arlo platform as one registered account may be used by multiple end-users to monitor the devices attached to that household.

(2) Paid accounts are defined as any account worldwide where a subscription to a paid service is being collected (either by us or by our customers or channel partners, including Verisure).

(3) ARR represents the amount of paid service revenue that we expect to recur annually and is calculated by taking our recurring paid service revenue for the last calendar month in the fiscal quarter, multiplied by 12 months. Recurring paid service revenue represents the revenue we recognize from our paid accounts and excludes prepaid service revenue. ARR is a performance metric and should be viewed independently of revenue and deferred revenue, and is not intended to be a substitute for, or combined with, any of these items.

REVENUE BY GEOGRAPHY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 31,

2023 | | October 1,

2023 | | December 31,

2022 | | December 31,

2023 | | December 31,

2022 |

| (In thousands, except percentage data) |

| Americas | $ | 86,702 | | 64.2 | % | | $ | 79,948 | | 61.5 | % | | $ | 74,131 | | 62.5 | % | | $ | 301,418 | | 61.4 | % | | $ | 273,981 | | 55.8 | % |

| EMEA | 42,433 | | 31.4 | % | | 42,887 | | 33.0 | % | | 39,464 | | 33.3 | % | | 164,750 | | 33.5 | % | | 196,465 | | 40.1 | % |

| APAC | 5,958 | | 4.4 | % | | 7,168 | | 5.5 | % | | 4,932 | | 4.2 | % | | 25,008 | | 5.1 | % | | 19,968 | | 4.1 | % |

| Total | $ | 135,093 | | 100.0 | % | | $ | 130,003 | | 100.0 | % | | $ | 118,527 | | 100.0 | % | | $ | 491,176 | | 100.0 | % | | $ | 490,414 | | 100.0 | % |

v3.24.0.1

Cover Page

|

Feb. 29, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001736946

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| City Area Code |

408

|

| Entity Tax Identification Number |

38-4061754

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

ARLO TECHNOLOGIES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38618

|

| Entity Address, Address Line Two |

Suite #150

|

| Entity Address, Address Line One |

2200 Faraday Ave.,

|

| Entity Address, City or Town |

Carlsbad,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92008

|

| Local Phone Number |

890-3900

|

| Trading Symbol |

ARLO

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

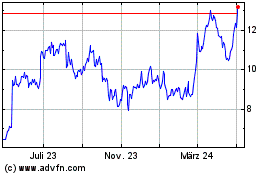

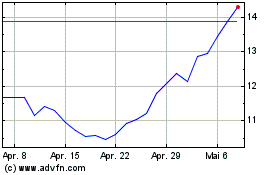

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024