American Realty Investors, Inc. reports Earnings for Quarter Ended June 30, 2023

10 August 2023 - 11:30PM

Business Wire

American Realty Investors, Inc. (NYSE:ARL) is reporting its

results of operations for the quarter ended June 30, 2023. For the

three months ended June 30, 2023, we reported net income

attributable to common shares of $0.1 million or $0.01 per diluted

share, compared to net income attributable to common shares of

$16.3 million or $1.01 per diluted share for the same period in

2022.

Financial Highlights

- Total occupancy was 81% at June 30, 2023, which includes 93% at

our multifamily properties and 59% at our commercial

properties.

- On January 31, 2023, we paid off our $67.5 million Series C

bonds from cash received from the sale of the VAA Sale

Portfolio.

- On May 4, 2023, we paid off the remaining $42.9 million

balances of our Series A and Series B Bonds. In connection with the

repayment of the bonds, our wholly-owned subsidiary, Southern

Properties Capital Ltd. withdrew from the Tel-Aviv Stock Exchange

(“TASE”).

Financial Results

Rental revenues increased $4.1 million from $7.3 million for the

three months ended June 30, 2022 to $11.4 million for the three

months ended June 30, 2023. The increase in rental revenue is

primarily due to a $4.7 million increase at our multifamily

properties offset in part by a decrease of $0.6 million from the

commercial properties. The increase in revenue from the multifamily

properties is primarily due to the acquisition of the VAA Holdback

Portfolio in 2022.

Net operating loss increased $0.8 million from $3.0 million for

three months ended June 30, 2022 to $3.9 million for the three

months ended June 30, 2023. The increase in net operating loss is

primarily due to an increase in legal costs offset in part by an

increase in operating profit from the multifamily portfolio.

Net income attributable to common shares decreased $16.2 million

from $16.3 million for the three months ended June 30, 2022 to $0.1

million for the three months ended June 30, 2023. The decrease in

net income is primarily attributed to the $14.1 million decrease in

gain on foreign currency transactions, which is attributed to our

repayment of our bonds payable and exit from the TASE in 2023.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. The Company’s primary

asset and source of its operating results is its investment in

Transcontinental Realty Investors, Inc. (NYSE:TCI). For more

information, visit the Company’s website at

www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (Dollars in thousands, except per share

amounts) (Unaudited) Three Months Ended June

30, Six Months Ended June 30,

2023

2022

2023

2022

Revenues: Rental revenues

$

11,389

$

7,259

$

22,398

$

14,740

Other income

850

870

1,529

1,176

Total revenue

12,239

8,129

23,927

15,916

Expenses: Property operating expenses

7,031

3,812

13,137

7,840

Depreciation and amortization

3,200

2,298

6,302

4,647

General and administrative

3,684

2,194

6,845

4,914

Advisory fee to related party

2,183

2,858

4,588

6,043

Total operating expenses

16,098

11,162

30,872

23,444

Net operating loss

(3,859

)

(3,033

)

(6,945

)

(7,528

)

Interest income

7,898

7,625

16,193

12,902

Interest expense

(2,480

)

(4,595

)

(5,620

)

(9,257

)

Gain on foreign currency transactions

22

14,132

993

17,904

Loss on extinguishment of debt

(1,710

)

-

(1,710

)

(1,639

)

Equity in income from unconsolidated joint venture

293

2,048

2,712

7,242

Gain on sale or write-down of assets, net

188

3,893

188

15,041

Income tax provision

(49

)

(40

)

(1,289

)

(68

)

Net income

303

20,030

4,522

34,597

Net income attributable to noncontrolling interest

(178

)

(3,718

)

(1,419

)

(6,971

)

Net income attributable to the common shares

$

125

$

16,312

$

3,103

$

27,626

Earnings per share Basic and diluted

$

0.01

$

1.01

$

0.19

$

1.71

Weighted average common shares used in computing earnings per share

Basic and diluted

16,512,043

16,152,043

16,152,043

16,152,043

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230810298656/en/

American Realty Investors, Inc. Investor Relations Erik Johnson

(469) 522-4200 Investor.relations@americanrealtyinvest.com

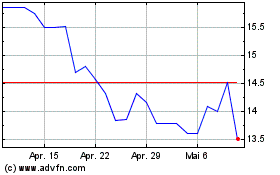

American Realty Investors (NYSE:ARL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

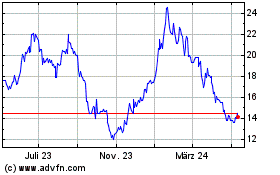

American Realty Investors (NYSE:ARL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024