Newbond Holdings and Funds Managed by Apollo Global Management Acquire Hotel Tampa Riverwalk

03 November 2022 - 10:16PM

Business Wire

The joint venture, the team’s second Tampa,

Fla. hotel investment, focuses on repositioning an irreplaceable

waterfront asset in dynamic downtown Tampa.

Newbond Holdings, a vertically integrated real estate investment

and operating platform, founded by Neil Luthra and Vann Avedisian,

is proud to announce the acquisition of the Hotel Tampa Riverwalk,

formerly known as the Sheraton Tampa Riverwalk Hotel, in

partnership with investment funds managed by an affiliate of Apollo

(NYSE: APO). The ownership team has selected Schulte Hospitality

Group to run the day-to-day operations and management of the

hotel.

The 277-room property, located on top of the Hillsborough River

Riverwalk in downtown Tampa, Fla. was delivered unencumbered of the

Sheraton flag and management, and will undergo an operational and

namesake rebrand as Hotel Tampa Riverwalk. Ownership plans to

implement a comprehensive renovation to guestrooms and public

areas, as well as introduce a re-conceptualized waterfront

restaurant, positioning the hotel to become downtown Tampa’s first

premier urban waterfront resort.

The Hotel Tampa Riverwalk stretches across 200 feet of

riverfront frontage and features an expansive outdoor pool,

waterfront dining, and 12,000 square feet of meeting space. It is

the only hotel with direct access to the Riverwalk Boulevard, a

3-mile pedestrian boardwalk that connects riverfront parks,

restaurants, bars, museums, and businesses. Additionally, the hotel

is located walking distance from 10 million square feet of CBD

office space, the Tampa Convention Center, Amalie Arena, and Water

Street Tampa, a transformational $3 billion, 53-acre redevelopment

that has delivered 3,500 new residential units, an iconic cultural

arts pavilion, 1 million square feet of retail and cultural spaces,

and 2 million square feet of office space.

About Newbond Holdings

Newbond Holdings is a real estate investment and operating

platform focused on debt and equity positions across multiple real

estate product types with a hospitality focus as well as

investments in related operating businesses and technology

platforms. As a vertically integrated operating and investment

platform, Newbond is uniquely positioned to create significant

value beyond the typical investment process through creative

structuring, operations and the development of single and multiple

asset brands.

About Apollo

Founded in 1990, Apollo is one of the largest global alternative

investment managers. As of March 2022, Apollo has $513 billion in

AUM and over 2,000 employees, primarily based in New York, Los

Angeles, Houston, London, Hong Kong, Singapore, and Mumbai.

Apollo’s Real Estate platform is comprised of three strategies:

equity, hybrid and yield. The firm’s global real estate business

has doubled in AUM during the past five years and featured $55

billion in AUM in March 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221103006268/en/

Firecracker Marketing info@firecrackermktg.com

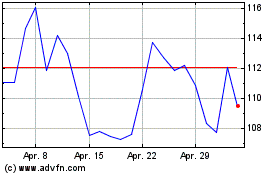

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024