Current Report Filing (8-k)

06 Juli 2022 - 1:02PM

Edgar (US Regulatory)

0001759824false0001759824us-gaap:PreferredStockMember2022-07-062022-07-060001759824altg:CommonStocksClassUndefinedMember2022-07-062022-07-0600017598242022-07-062022-07-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 6, 2022

ALTA EQUIPMENT GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38864 |

|

83-2583782 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13211 Merriman Road

Livonia, Michigan 48150

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (248) 449-6700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

ALTG |

|

The New York Stock Exchange |

Depositary Shares representing a 1/1000th fractional interest in a share of 10% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value per share |

|

ALTG PRA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Amended and Restated Credit Arrangements

In connection with the acquisition of the stock of Yale Industrial Trucks Inc. ("YIT") discussed further below, Alta Equipment Group Inc. (“Alta” or the “Company”) will be amending its Sixth Amended and Restated ABL First Lien Credit Agreement along with its Sixth Amended and Restated Floor Plan First Lien Credit Agreement, both dated April 1, 2021, by and between the Company and other credit parties named therein, and the lender JP Morgan Chase Bank, N.A., as Administrative Agent. The amendment will, among other things, (i) exercise $80 million of the $150 million accordion function currently included in the Company’s asset-based revolving line of credit increasing borrowing capacity from $350 million to $430 million, which will include a $35 million Canadian-denominated sublimit facility; and (ii) increase the maximum borrowing capacity of its revolving floor plan facility by $10 million from $50 million to $60 million.

Item 8.01. Other Events. *

On July 6, 2022, the Company issued a press release announcing that it has entered into a definitive agreement to acquire the stock of YIT, a privately held Canadian equipment distributor with locations in Ontario and Quebec. YIT generated approximately $46.6 million in revenue and adjusted EBITDA of $9.4 million in the trailing twelve months through May 2022. The implied enterprise value of the acquisition is estimated to be approximately $33.5 million, subject to post-closing purchase price adjustments. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The information furnished under Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information included in Item 8.01.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALTA EQUIPMENT GROUP INC. |

|

|

Dated: July 6, 2022 |

By: |

|

/s/ Ryan Greenawalt |

|

|

|

Name: Ryan Greenawalt |

|

|

|

Title: Chief Executive Officer |

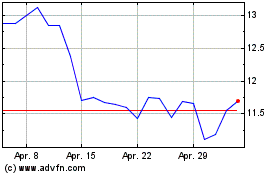

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

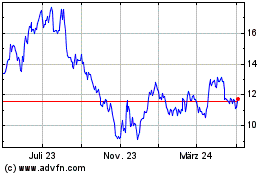

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024