0001487712false00014877122024-08-012024-08-010001487712us-gaap:CommonClassAMember2024-08-012024-08-010001487712us-gaap:SeriesAPreferredStockMember2024-08-012024-08-010001487712al:SeriesAMediumTermNotesMember2024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 | | |

| August 1, 2024 |

Date of Report (Date of earliest event reported) |

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Delaware | 001-35121 | 27-1840403 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 2000 Avenue of the Stars, | Suite 1000N | | |

| Los Angeles, | California | | 90067 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 553-0555 | | |

Not Applicable (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | AL | New York Stock Exchange |

| 6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A | AL PRA | New York Stock Exchange |

| 3.700% Medium-Term Notes, Series A, due April 15, 2030 | AL30 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure

On August 1, 2024, the Company held a conference call to discuss its financial results for the three and six months ended June 30, 2024. A copy of the conference call transcript is furnished herewith and attached hereto as Exhibit 99.1.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 104 The cover page from this Current Report on 8-K formatted in Inline XBRL

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| AIR LEASE CORPORATION | |

| | | | |

| Date: August 2, 2024 | /s/ Gregory B. Willis | |

| Gregory B. Willis | |

| Executive Vice President and Chief Financial Officer

| |

08 - 01 - 2024

Air Lease Corporation

Q2 2024 Earnings Conference Call

TOTAL PAGES: 16

Air Lease Corporation

Q2 2024 Earnings Conference Call

CORPORATE SPEAKERS:

Jason Arnold

Air Lease Corporation; Head of Investor Relations

John Plueger

Air Lease Corporation; President and Chief Executive Officer

Steven Udvar-Hazy

Air Lease Corporation; Executive Chairman

Gregory Willis

Air Lease Corporation; Executive Vice President and Chief Financial Officer

PARTICIPANTS:

Hillary Cacanando

Deutsche Bank; Analyst

Terry Ma

Barclays; Analyst

Jamie Baker

JPMorgan; Analyst

Moshe Orenbuch

TD Cowen; Analyst

Stephen Trent

Citi; Analyst

PRESENTATION:

Operator: Good afternoon. (Operator Instructions) At this time I would like to welcome everyone to the Air Lease Corporation Q2 Earnings Conference Call. (Operator Instructions)

I will now turn the call over to Mr. Jason Arnold, Head of Investor Relations.

Mr. Arnold, you may begin your conference.

Jason Arnold: Thanks, Audra. And good afternoon, everyone. And welcome to Air Lease Corporation's second quarter 2024 earnings call.

This is Jason Arnold. And I'm joined today by Steve Hazy, our Executive Chairman; John Plueger, our Chief Executive Officer and President; and Greg Willis, our Executive Vice President and Chief Financial Officer.

Earlier today, we published our second quarter 2024 results.

A copy of our management release is available on the Investors section of our website at www.airleasecorp.com.

This conference call is being webcast and recorded today, Thursday, August 1, 2024, and the webcast will be available for replay on our website.

At this time, all participants to this call are in listen-only mode.

Before we begin, please note that certain statements in this conference call including certain answers to your questions are forward-looking statements within the meaning of the Private Securities Litigation Reform Act.

This includes without limitation statements regarding the state of the airline industry, the impact of aircraft and engine delivery delays in manufacturing flaws, our aircraft sales pipeline and our future operations and performance.

These statements and any projections as to our future performance represent management's current estimates and speak only as of today's date.

These estimates involve risks and uncertainties that could cause actual results to differ materially from expectations.

Please refer to our filings with the SEC for a more detailed description of risk factors that may affect our results.

Air Lease Corporation assumes no obligation to update any forward-looking statements or information in light of new information or future events.

In addition, we may discuss certain financial measures such as adjusted net income before income taxes, adjusted diluted earnings per share before income taxes and adjusted pretax return on equity, which are non-GAAP measures.

A description of our reasons for utilizing these non-GAAP measures as well as our definition of them and the reconciliation to corresponding GAAP measures can be found in the earnings release and 10-Q that we issued today.

This release can be found in both the Investors and press section of our website at airleasecorp.com.

As a reminder, unauthorized recording of this conference call is not permitted.

I'll now turn the call over to our Chief Executive Officer and President, John Plueger.

John?

John Plueger: Well thanks, Jason. Good afternoon, everyone. And thank you for joining us on our call today.

During the second quarter, ALC generated revenues of $667 million and $0.81 in diluted earnings per share. Results this quarter were impacted by further OEM delivery delays, lower end of lease revenues compared to prior years as airlines continue extending the majority of their leases, a reduction in aircraft sales gains due to the timing of individual aircraft sales closings in various packages, and new aircraft deliveries that reflect lease deals concluded on average two years ago when aircraft demand was not as strong and interest rates were lower.

We purchased 13 new aircraft from our orderbook in the second quarter, adding $940 million in flight equipment to our balance sheet, and we sold 11 aircraft for approximately $530 million in sales proceeds. Deliveries came in $600 million below our expectations, which I'll comment on more in a moment, while sales were approximately inline. Weighted average fleet age remains young at 4.7 years, while weighted average lease term remaining was 6.9 years at quarter end. The utilization rate on our fleet remains exceptionally strong at 100%.

Currently, we are 100% placed on our forward orderbook through 2025 and 96% placed through 2026, with 64% of our entire orderbook placed. Our $20 billion orderbook remains a key source of strength given Boeing and Airbus have very few delivery positions available until the 2030s, while the vast majority of our positions are set to deliver through 2028. As such, demand for our delivery slots continues to rise, supporting lease rates on our new aircraft placements delivering well inside of the timeline a buyer today could receive a new aircraft from the OEMs. We continue to see strong lease rates on new lease placements relative to those witnessed prior to the global pandemic.

As you are all likely now well aware, more delays have been announced by the OEMs, an outcome, which we've highlighted as probable for some time now. We told you last quarter, we were expecting about $1.5 billion in new aircraft deliveries in Q2. Our actual total was $940 million. Our estimate last quarter included several widebodies that have now subsequently delivered. Boeing MAX delays are ongoing, with a slowdown of production to improve process and quality control and FAA constraints on production rates. On the widebody side for Boeing, slow 787 production ramp-up is also persisting as a product of supply chain constraints.

Supply chain challenges, of course, are also impacting Airbus, resulting in them recently pulling back delivery expectations for 2024 and further pushing out some of their production ramp-up aspirations as well. Airbus cited issues with receiving engines from both Pratt & Whitney and CFM, among other key components as a source of delays. While some have wanted to point fingers at one party or another for being a primary source of delivery delays, the fact of the matter is that the majority of the aerospace industry is experiencing ongoing supply chain challenges. We expect these challenges to persist to a greater or lesser degree for the next three to four years, and we're not holding our breath for a major breakthrough or shortening of this timeframe, given the complicated moving parts faced by the industry.

Accordingly, demand for commercial aircraft remains high. Given these added OEM delivery delays and production rate goals have not been achieved, airlines continue to scramble for lift wherever they can find it, with the narrowbody segment, of course still the hottest, though increasingly, widebody demand is accelerating as well. So we continue to believe that supply chain dynamic points towards aircraft shortages for quite some time ahead.

Despite the recent delivery delays impacting our second quarter, we are maintaining our view that aircraft deliveries for us will fall in the $4.5 billion to $5.5 billion range for the full year 2024, and we're expecting aircraft deliveries for the third quarter to be approximately $2 billion. However, there are several variables, the biggest of which is a potential labor strike at the Boeing Company, which could result in changes to our third quarter delivery expectations. Based on current delayed notifications from the OEMs and our internal projections, we anticipate deliveries to be about $5 billion total for the year, which is at the midpoint of our range. It's important to note that even at the lower end of our expected range, our deliveries will offer meaningful growth to our $27 billion owned fleet.

As a plus, the commercial aircraft market shortage is offering us the benefit of robust secondary market demand for our aircraft and sales volume for the second quarter came in line with what we told you to expect at around $500 million. Our sales pipeline remains robust at $1.5 billion including roughly $600 million of flight equipment held for sale and $900 million of aircraft subject to letters of intent with a great variety of buyers. Given the time required to close sales transactions, some of these aircraft are expected to close in the first half of '25, though based on sales completed thus far in '24, we continue to expect to close $1.5 billion in total sales for this year. Let me remind you that we use aircraft sales to optimize our fleet in terms of aircraft age, type, yield, customer concentration and geographic concentration. So risk balancing and optimization is always part of the calculus, and therefore, there is a mix in our sales package of levels of gains on individual aircraft. As for the third quarter, we believe around $350 million in sales should close, though we continue to highlight the fact that sales timing can be impacted by factors outside of our control. Overall gains on aircraft sales packages remain healthy and continue to enhance the returns generated by our business. Keep in mind that there will be occasional fluctuations on the gains, as we saw this quarter, due to timing of closings of individual aircraft sales in various packages.

I do want to add a brief comment on lease extension activity in our fleet. Lease extensions remain elevated and continue to benefit our business more broadly at present, particularly given reduced time off lease, along with the attractive lease rates, we are currently realizing on extensions that we believe create meaningful long-term value. That said, we only have a handful of lease expirations for the remainder of 2024, which is reducing end-of-lease revenue this quarter and likely for the rest of the year, particularly as compared to the prior year. But let me be clear, we prefer lease extensions with the current operator at healthy rates as there are no reconfiguration or transition costs or downtime associated with configuration changes for a new operator.

As we look forward, funding costs for our business appear likely to benefit from anticipated Fed rate cuts. Clearly, the timing and magnitude of these cuts are outside of our control, but our business is a significant beneficiary of the normalization of the shape of the yield curve following the longest period of the curve inversion on record, even longer than witnessed in the late 1970s. Adding in the continued strong demand environment for commercial aircraft and industry supply chain dynamics that are not likely to resolve for some time, this overall backdrop should support strength for new aircraft lease rates and values, benefiting aircraft gains on sales and bolstering lease rates and lease placements for our forward orderbook.

Finally, I'd like to remind everyone that we are 100% placed on our widebody passenger orderbook. The only widebodies we have remaining are our launch order for seven new A350 freighters, with deliveries now looking to commence in 2027. The air freight and cargo markets have strengthened

meaningfully over the past six months as the tax in the Middle East on commercial cargo ships have continued, and the capacity for ships transiting the Panama Canal remains significantly reduced due to low water levels feeding the canal. We believe these factors will continue, and as such, we are getting robust inquiries from a variety of airlines on our A350 freighter positions.

So similar to last quarter, I’d like to close by saying that we manage Air Lease Corporation with a mindset of long-term benefit of shareholders. The factors I've outlined in my remarks give us confidence in our financial performance in the years ahead.

So now I'd like to turn the call over to Steve Hazy, who will offer you some additional commentary.

Steve?

Steven Hazy: Thank you very much, John. We've just returned from the Farnborough International Show last week in the United Kingdom, where we met with a large number of our existing airline customers as well as new potential customers. All the airlines that John, myself and our entire marketing team met with continue to request more new aircraft. New order activity continues to push out the sold-out status of many different aircraft types, which has six plus years for several of the higher-demand aircraft types is already at historically exceptional levels. These circumstances are expected to further bolster lease rates and the values of new aircraft that are the focal point of Air Lease's strategy.

Airline traffic volumes remain robust globally, rising 9% year-over-year based on the latest IATA report that came out yesterday. Total international volume was up a strong 12%, with all major markets continuing to rise at double-digit or high single-digit percentage rates. Asia Pacific traffic remains the strongest market this year, expanding at 23% versus last year. We continue to expect Asia Pacific growth to remain one of the strongest globally as travel momentum continues to build. Asia is Air Lease's second largest marketplace at 37% of our fleet with a very diversified exposure throughout the region instead of relying more heavily on China and just a few percentage points behind Europe as our largest geographic concentration. International traffic in Latin America, Africa and Europe also remain among the strongest markets for the period. Domestic traffic also rose at a still healthy 4% year-over-year, with Brazil, China, India and the U.S. leading strength in IATA's domestic market segments. Passenger load factors also continue to expand with many markets achieving new record levels, and we expect overall load factors to continue to climb from the mid-80% range which also constrains commercial aircraft supply likely pushing beyond record levels on a global basis. Rising load factors typically benefit airline yields and profitability, though do eventually begin to challenge airline operations as aircraft become more completely full, further bolstering the need for new aircraft such as those from our forward orderbook.

With delivery delays persisting, there's not much good news from the OEMs. We are pleased, however, to report that the Airbus A321 XLR finally received the EASA type certification in mid-July with the FAA to follow very soon. It is possible that this is an important step for the entry into service for this aircraft type. As most of you know Air Lease is a launch customer of the A321 XLR, which is the extended range version. And we look forward to a huge potential for this aircraft type in the coming years. A number of potential new city pairs that this aircraft can serve with its range and payload capability is extremely significant and can add to network flexibility particularly on the transatlantic routes between North America and Europe, but also from North to South America and

in a number of other international markets as well. We believe new city pairs will likely siphon some traffic away from larger hubs, but will also stimulate new demand as well. For example, travelers are very likely to think differently about taking a flight from south of France, say, Bordeaux or Nice, to various U.S. East Coast cities if they no longer have to take a long trip by train or a car from the airports to the larger hubs or make connections which can be very frustrating. With a 4,700 nautical mile range, the possibilities are very exciting for the A321 XLR and is likely to invigorate travel demand in many markets. Airline profitability on these routes should also benefit given reduced fuel burn and more easily manageable amount of capacity and network flexibility for these aircraft. Lower fuel burn, of course, also equates to reduced emissions, which Airbus cites at 30% below prior generation alternatives. For example, the 757-200. Our customers are very eagerly looking forward to receiving these new aircraft and putting them to work. We expect to receive our first A321 XLR in the late second quarter of 2025, assuming all else remains equal on Airbus' production capabilities. As a reminder, Air Lease is one of Airbus' top A321 XLR customers with 49 aircraft on order. We're one of the largest orders as compared to those of major airlines and we're, by far, the largest XLR customer among the lessor community.

Returning to ALC's second quarter results. We delivered two more A220 aircraft to ITA Airways, the national carrier of Italy. As you know ITA's growth and expansion has been further strengthened by the recent EU approval of a major investment in the airline by Lufthansa. We also delivered five A321200neos in the quarter, including two to Transavia Airlines based in Amsterdam, Netherlands, one to ITA as part of a nine aircraft deal with the airline, one to a Danish operator Sunclass Airlines and one toLATAM Airlines, which is the largest airline in Latin America based in Santiago, Chile.

We also delivered two 737-8 aircraft during the quarter, including one to Malaysia Airlines as part of our 25 aircraft 737-8 placement with the airline, and one to LOT Polish Airlines, making it the 12th 737-8 we have on lease to the national carrier of Poland. We also delivered a 737-9 to Corendon Dutch Airlines based in Amsterdam, replacing a 737-800. On the widebodyside, we delivered one new Airbus A330-900neo to Virgin Atlantic, joining four other A330neos and six, A350-1000s we have on lease with that airline. This specific A330-900, which I just mentioned, was delivered to us and Virgin in June and was featured and displayed very successfully at the Farnborough Airshow. We also delivered one A350-900 to Air France, another one of our key European airline customers. Lastly, we delivered one new Boeing 787-9 to Aeromexico the national flag carrier, further enhancing the airline’s international capacity expansion, particularly across the North Atlantic.

We are continuing to pursue avenues of recovery for aircraft that were retained in Russia. As you recall we have multiple lawsuits pending against our insurers including a case in California, which is set for trial in the spring of 2025. Given the lawsuits, we won't be able to speak further on the topic other than to say that we still feel very strongly about the validity of our claims and we're pursuing our insurers vigorously.

In closing, I'd just like to add that we see very strong support and tailwinds building long-term momentum for our business. Aircraft supply/demand remains strongly in our favor. And given the production constraints and challenges, that's unlikely to shift direction for multiple years ahead, and potentially benefiting lease rates and also gains on sale of aircraft for many years to come. Additionally, the financing environment now appears set for improvement after a long extended

period of abnormally high yield curve inversion. We feel good about these trends and remain overall positive in our outlook for the future.

I will now turn the call over to our CFO, Greg Willis, for his more detailed comments on our second quarter financial results.

Gregory Willis: Thank you, Steve. And good afternoon, everyone.

During the second quarter, Air Lease generated total revenues of $667 million, which was comprised of approximately $610 million of rental revenues and $57 million from aircraft sales, trading and other activities.

Total revenues declined by approximately 1%, as compared to the prior year. This was driven by a few items including the sale of older higher-yielding aircraft, the addition of new aircraft at lower initial lease yields, lower end of lease revenue and OEM delays. As a reminder, when we purchase new aircraft, they come on our books at the lowest yield point in the aircraft’s earnings cycle. And over time, with our fixed-rate leases, the yield accretes up as a function of depreciation. Strategically, we remain focused on minimizing residual value risk while maximizing returns viathe purchase of the highest in demand, most fuel-efficient new aircraft. We continue to believe that this will generate a substantial amount of shareholder value for years to come.

During the quarter, we recognized $2 million in end of lease revenue as compared to $15 million in the prior period. This was driven by fewer lease expirations during the quarter, and us continuing to experience a very robust market for lease extensions, given the strong aircraft demand environment. These lease extensions are supportive of our overall portfolio yield and add to our contracted cash flows, further enhancing the value of these aircraft. Excluding the effects of end of lease income, our portfolio yield remained flat as compared to what we recorded in the first quarter of '24.

OEM delays also slowed our revenue growth during the quarter, due to $600 million of aircraft that were penciled for the second quarter, which ultimately slipped to the first few weeks of the third quarter.

Sales proceeds for the second quarter totaled approximately $530 million from the sale of 11 aircraft. These sales generated $40 million in gains, representing a roughly 8% gain on sale margin. As we have said in the past, gain on sale margins will vary from quarter-to-quarter based on the mix of aircraft sold and market conditions. However, looking at our aircraft sales pipeline of $1.5 billion, we expect to see healthy margins towards the upper end of our historical 8% to 10% range. I would like to remind everyone that in addition to enhancing returns for our business, attractive gains also highlight the embedded value of our $27 billion fleet.

Moving on to expenses, interest expense rose by roughly $18 million year-over-year, driven by a 50 basis point increase in our composite cost of funds to 3.99%. This was a primary contributor to the uptick in operating expenses relative to last year. Our funding costs did decline slightly quarter-to-quarter as we completed attractive fixed rate financings in June. We continue to significantly benefit from our largely fixed rate capital structure, which has helped us to moderate the impact of the interest rate environment witnessed over the last couple of years, with now over 88% of our financing at fixed interest rates at quarter end.

Depreciation expense continues to track the growth of our fleet. SG&A meanwhile, declined slightly relative to the prior year's quarter and was flat relative to that period as a percentage of revenue, while down as a percentage of revenue as compared to the first quarter.

Moving on to our financing activities for the quarter. In June, we completed a successful dual tranche senior unsecured notes offering, totaling $1.2 billion. This transaction was several times oversubscribed and was comprised of a $600 million notes offering at a fixed rate of 5.3% maturing in 2026 and another $600 million in notes at a fixed rate of 5.2% maturing in 2031. This offering further bolstered our strong liquidity position of $8.2 billion as of quarter end. In addition, let me remind you that our $29 billion unencumbered assets and our $30 billion of contracted rentals remain a key source of strength for our business.

Our debt equity ratio at the end of the second quarter was 2.69x on a GAAP basis, which net of cash on the balance sheet, is approximately 2.63x, both roughly flat as compared to the prior quarter. We will continue to utilize proceeds from aircraft sales to pay down our debt with the goal of reaching our long-term debt-to-equity target over the medium term.

To conclude, we remain confident in the demand for aircraft in our fleet and orderbook, given the shortage of aircraft supply in a market driven by the persisting OEM production challenges, as well as, the long-term secular trends that are driving passenger traffic, both of which we believe will ultimately benefit our business.

With that, I'll turn the call back over to Jason for the question and answer portion of the call.

Jason Arnold: Thanks, Greg. This concludes our prepared commentary and remarks.

For the Q&A session, we ask that each participant limit their time to one question and one follow-up. [Audra], please open the lines for the Q&A session.

QUESTION & ANSWER:

Operator: (Operator Instructions) We'll take our first question from Hillary Cacanando with Deutsche Bank.

Hillary Cacanando: I'm just trying to understand for gains -- gain on sale, I guess it was 8% this quarter, which was at the lower end of the historical range. Was it because maybe you sold? I just wanted to understand why, I guess, it was because of the product mix? Was it because you sold maybe younger aircraft with higher book value? Or was this the type that -- yes.

John Plueger: Yes. This is John.

As I said in my prepared remarks. The timing of individual sales and packages vary. The packages themselves as a package are nice healthy gains in the double-digit area.

But we do use aircraft sales to moderate and look at our risk portfolio geographically by customer yield by aircraft type and age.

So we do have individual aircraft within these packages, some are at different levels of gain, higher and lower. And so really, you're just looking at simply the timing of closings as they happened this quarter.

Hillary Cacanando: Okay. Got it. That's helpful. And then the other question is, one of your competitors has said that they have actually shown in their presentation a couple of months ago that next year, they expect maybe -- I think it was like 85% of leases coming under book to be -- to have been executed during 2023 and beyond. And then in 2025, that number goes up to 95%.

So I was wondering if (inaudible) in the past also talked about a lag in interest in revenue, about a three year lag.

Could we think about it the same way for your revenue as well with the leases coming online next year maybe around the same percentage like 85% or so, and then maybe higher the following year?

Gregory Willis: I don't think we can give you specific percentages right now.

But we do -- I mean as you would expect, we typically sign our leases 18 to 24 months in advance of the actual delivery date.

So as we move further and further away from the Covid-era lows and the low interest rate environment period, you should expect to see higher lease rates on our delivered aircraft continuing to help support our overall portfolio yields.

John Plueger: Continued with lease extensions at higher rates.

So overall, as airlines come to the end of their lease period, they're all extending, as I said in my in my prepared remarks.

Steven Hazy: As incremental borrowing cost hopefully will decline as we go into 2025.

It means there are spreads between the cost of financing and lease yield will improve.

Hillary Cacanando: Okay. Great. Helpful. That's very helpful. And looking forward to seeing you guys in September at our conference.

Steven Hazy: Absolutely.

We will look forward to it.

Operator: We'll move next to Terry Ma at Barclays.

Terry Ma: So last quarter, you kind of guided to a flattish profit margin for the rest of the year.

Looked like it was kind of modestly down this quarter.

I guess, are you -- do you still feel pretty good about that guide? And then as we kind of look forward to 2025, maybe can you just help outline the major drivers that maybe helped you kind of get back to a normalized profit margin?

Gregory Willis: Right.

I think going forward, that guide still holds around the same sort of levels. This quarter was a little lower due to the fact that we had lower end of lease revenue coming through, but that was due to the timing of extensions and the like.

I think looking forward to '25, it's a little unclear because of what happens with, as Steve mentioned, with the rate environment as rates come down, I think that should help the business as well. And also the taking on of higher initial lease yield on some of those orderbook lines as they come through.

Steven Hazy: And also remember that we had a large number of aircraft that should have delivered before June 30, that slid into July and August.

So that's really an OEM issue. And it means we lost revenue on those aircraft that we expected to receive back in April and May.

Terry Ma: Got it.

Okay. That's helpful. And then maybe just on the funding. You guys issued in the unsecured market this past quarter, termed out a portion of the revolver.

I guess, are you comfortable with rates and spreads today to maybe tap that market again? Or will you just carry some excess on your revolver going forward? Just trying to figure out the right funding mix in the near term.

Gregory Willis: We maintain a high level of liquidity.

We have $8.2 billion.

So we tend to be very opportunistic as we look to the market.

Spreads have been very low, very, very attractive right now. And today, with the recent drop in base rates, it sets up a very nice environment.

But again, we're going to be very selective as to the market windows that we tap into.

There is, of course, a benefit of terming out our unsecured revolver because those floating rates are probably in the area of 6.7%, 6.75% all in. And then you compare that to fixed rate funding costs in the high 4s, low 5s.

I think that also creates a lot of value as well.

Operator: We'll take our next question from Jamie Baker at JPMorgan.

Jamie Baker: Steve and John. Let me start with a question that I asked AerCap this morning.

So Mark and I are just trying to reconcile the global aircraft shortage with the growing phenomenon of airlines citing overcapacity.

On one hand, we've got this really positive narrative on tight supply. And Steve just spoke to his experience at Farnborough.

But then you've got just about every U.S. airline citing overcapacity.

We've seen discouraging prints from several European airlines.

Singapore took it on the chin yesterday, Wizz a few hours ago.

I mean how do you square these two seemingly competitive narratives with one another.

John Plueger: Right. Jamie, let me start. Really two overall comments. Yes, of course, the industry responded to strong traffic demand and continues to by adding capacity in the marketplace. No doubt about that.

But overriding all of that is still a grave concern about getting aircraft for the future and their deliveries sliding out, being able to replace older aircraft.

So by far, the overriding demand, despite some of these commentaries, is that there is a need for aircraft, and we're still getting all these requests.

And the second comment I would make is just remember that historically, as airlines start to experience any financial squeeze, historically, that has always favored leasing.

Jamie Baker: Yes, fair points John. And then as a follow-up, we saw AerCap step into Spirit's orderbook today. And obviously Spirit being a somewhat weak credit at the moment.

Should we think about this strategy possibly being an avenue for Air Lease's incremental growth or are placing new orders still your preferred avenue.

John Plueger: Steve?

Steven Hazy: Yes.

Well Jamie, we already have a long, long relationship with Spirit.

It even goes back to ILFC days when we replaced their MD80 fleet with A319s and A321ceo aircraft.

So we currently have eight new A321neos delivering to Spirit in the next six to nine months.

We recently delivered two new A321neos from our orderbook.

So very soon, we'll have 10, A321neos there.

We previously delivered to them five, A320neos and all of those aircraft we have sold to third parties over the last 24 months.

So we looked at that transaction and we felt that the overall package due to our existing relationship with Spirit and the other backlog aircraft we have coming from Airbus being really the largest A321neo lessor, we felt that, that was more of a transaction for AerCap than for Air Lease.

Jamie Baker: Okay.

I appreciate the color, Steve. Take care.

Operator: We'll move next to Moshe Orenbuch at TD Cowen.

Moshe Orenbuch: Great. Maybe to kind of piggyback on Jamie's question. Are there, putting one particular airline aside, are there any other kind of strategies that you're thinking about in this current environment of low deliveries where you could either increase aircraft purchases or, in fact, kind of reduce your capital given that it's been a somewhat lower growth environment.

John Plueger: Yes.

Well the answer is yes.

I mean although you -- the prior question was around Spirit Airlines, there are a number of competitive campaigns over the world that we're looking at both with Airbus and Boeing, whereby we could incrementally add aircraft pursuant to the OEM's strategies and competitive environment in those campaigns. And that's not really anything new from us -- for us.

We continue to take advantage of that just as we did in prior years, but we do see potential future there as well as alignment along our managed business using that as a platform to add additional aircraft as well.

Gregory Willis: I do think there's going to be a large opportunity, though. The airlines have definitely over ordered and a lot of them don't have quite the access to capital as we do here as an investment-grade public company.

So I think there's going to be a search for financing on behalf of the airlines and there'll be a lot of airlines that will need help.

I think that's one avenue that we could look at in the future.

Steven Hazy: Yes.

For example, if an airline who ordered 20 aircraft and they might wind up buying 15 of them they will probably approach us and say, Air Lease, can you take five of those 20 and either do say, leaseback transaction or even divert some of those aircraft to another airline.

So we're always opportunistic.

We're always looking for transactions that are accretive, but we don't want to overpay for aircraft.

We don't want to pay a premium above what we can buy those same aircraft for from Boeing and Airbus.

Moshe Orenbuch: Great. And maybe just as a follow-up. The total lease revenue obviously had been affected by a number of things, slow deliveries, late deliveries and the lack of end of lease revenue, but the lack of end of lease revenue is probably going to be with you for the balance of the year.

So as you kind of look forward for the next couple of quarters, I mean have you sold planes that had been renegotiated during COVID with lower yields? I mean is that something that's gone on?

And as I think about the $2 billion number that you talked about, I don't recall quarters of late where you had $2 billion in deliveries.

So I think, Steve, you had mentioned that, that $600 million that fell in, that some of that had already been received.

I mean is it -- how confident are you in that in the level of deliveries for Q3?

John Plueger: Well let me just say.

Gregory Willis: Go ahead, John.

John Plueger: Yes.

I'm just going to say, as I said in my prepared remarks, there is a huge big contingency out there, Moshe, and that is a potential Boeing strike.

So while we put a $2 billion estimate, frankly, that's a huge contingency. And so yes, we had a $600 million shortfall in deliveries compared to what we told you all last quarter as a result of these ongoing delays.

But there are so many factors that it's really hard to put a pin on it.

And I think the first part of your question is, yes, we have sold some aircraft that we renegotiated or restructured during the pandemic.

So I think overall, it's a very difficult challenge for us.

Our whole business model is taking delivery of brand new aircraft and putting them out on lease. And when these are contingent events.

It's really hard to put a pin on CapEx expectations.

So just by way of summary, we did say we still expect about $5 billion for the whole year. That's mid-range of our 4.5% to 5.5%. And we based upon our best judgment, we're looking about $2 billion, but that's going to be dependent somewhat about whether Boeing continues its deliveries and whether they go on strike.

Steven Hazy: And part of that $2 billion was the spillover from the first quarter.

John Plueger: Yes.

Steven Hazy: So to illustrate a couple of examples, we had an A350-900 that should’ve delivered in the quarter, and it didn't. And that's a $150 million airplane. Then we had a 787-10, the largest 787, again, was supposed to deliver in May, and we just delivered on Monday this week.

So right there, there's two aircraft, they're about $310 million.

That should have been delivered in the prior quarter.

Operator: And next, we'll move to Stephen Trent at Citi.

Stephen Trent: I guess good afternoon. can you hear me, by the way?

John Plueger: Yes.

Gregory Willis: Yes.

Stephen Trent: Great.

I'm sorry.

I'm having some trouble with my phone. Two for you.

I appreciate the geographic color and you mentioned Southeast Asia and what have you as a growth area.

What do you happen to refresh my memory as to what percentage of your book is in China these days?

John Plueger: Under 5%.

Stephen Trent: Perfect. And just as my follow-up question, when we think about Air Lease's aircraft sales, any high-level color regarding what proportion of your equipment you're selling to airlines versus maybe making sales to other aircraft lessors.

Gregory Willis: Yes, most of our aircraft sales are to other aircraft lessors at the current moment. Very few of them have been to the airlines. You typically see end-of-life aircraft being sold back to the airline at the very last part of their life to take advantage of the maintenance reserves that are there.

But given that we have a very young fleet, we're selling airplanes that are about eight years old. Most of them being sold to other lessors.

Operator: There are no further questions at this time.

Mr. Arnold, I'll turn the call back over to you.

Jason Arnold: Thank you, everyone, for participating in our second quarter call.

We look forward to speaking with you again next quarter.

Audra, thanks for your assistance and please disconnect us.

Operator: You're welcome. This does conclude today's conference call. Thank you for your participation.

You may now disconnect.

v3.24.2.u1

Cover Page Cover Page

|

Aug. 01, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

AIR LEASE CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35121

|

| Entity Tax Identification Number |

27-1840403

|

| Entity Address, Address Line One |

2000 Avenue of the Stars,

|

| Entity Address, Address Line Two |

Suite 1000N

|

| Entity Address, City or Town |

Los Angeles,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90067

|

| City Area Code |

310

|

| Local Phone Number |

553-0555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001487712

|

| Amendment Flag |

false

|

| Class A Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

AL

|

| Security Exchange Name |

NYSE

|

| 6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

6.150% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

AL PRA

|

| Security Exchange Name |

NYSE

|

| Series A Medium-Term Notes |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.700% Medium-Term Notes, Series A, due April 15, 2030

|

| Trading Symbol |

AL30

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=al_SeriesAMediumTermNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

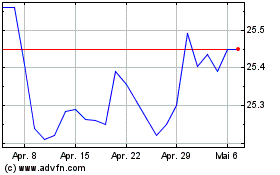

Air Lease (NYSE:AL-A)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Air Lease (NYSE:AL-A)

Historical Stock Chart

Von Nov 2023 bis Nov 2024