UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Name of Registrant as Specified in its Charter)

Not applicable.

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a-6(i)(1) and 0-11. |

Executing Aimco’s Defined Value Add Strategy to Deliver Strong

Shareholder Returns 200 W. Broward Blvd. Fall 2022 Ft. Lauderdale, Florida

Forward Looking Statements This document contains forward-looking statements

within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to, the statements in

this document regarding future financing plans, including the Company’s expected leverage and capital structure; business strategies, prospects, and projected operating and financial results (including earnings), including facts related

thereto, such as expected costs; future share repurchases; expected investment opportunities; and our pipeline investments and projects. We caution investors not to place undue reliance on any such forward-looking statements. Words such as

“anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “plan(s),” “may,” “will,” “would,” “could,”

“should,” “seek(s),” “forecast(s),” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These statements are not guarantees of future performance,

condition or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, among others, that may affect actual results or outcomes include, but are not limited to: (i) the risk that the 2023

preliminary plans and goals may not be completed in a timely manner or at all, (ii) the inability to recognize the anticipated benefits of pipeline investments and projects, (iii) changes in general economic conditions, including as a result of the

COVID-19 pandemic. Although we believe that the assumptions underlying the forward-looking statements, which are based on management’s expectations and estimates, are reasonable, we can give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to differ materially from our expectations include, but are not limited to: the effects of the coronavirus pandemic on the Company’s business and on the global and U.S. economies

generally; real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which we operate and competition for residents in such markets; national and local economic conditions,

including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing and effects of acquisitions, dispositions, redevelopments and developments; changes in operating costs,

including energy costs; negative economic conditions in our geographies of operation; loss of key personnel; the Company’s ability to maintain current or meet projected occupancy, rental rate and property operating results; the Company’s

ability to meet budgeted costs and timelines, and, if applicable, achieve budgeted rental rates related to redevelopment and development investments; expectations regarding sales of apartment communities and the use of proceeds thereof; insurance

risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; financing risks, including the availability and cost of financing; the risk that cash flows from operations may be insufficient to meet required

payments of principal and interest; the risk that earnings may not be sufficient to maintain compliance with debt covenants, including financial coverage ratios; legal and regulatory risks, including costs associated with prosecuting or defending

claims and any adverse outcomes; the terms of laws and governmental regulations that affect us and interpretations of those laws and regulations; possible environmental liabilities, including costs, fines or penalties that may be incurred due to

necessary remediation of contamination of apartment communities presently or previously owned by the Company; activities by stockholder activists, including a proxy contest; the risk of the timing of our stockholder value enhancement review and the

risk that we will not identify any value enhancing options or that we will not successfully execute or achieve the potential benefits of any such options. In addition, the Company’s current and continuing qualification as a real estate

investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on the Company’s ability to meet the various requirements imposed by the Internal Revenue Code, through actual

operating results, distribution levels and diversity of stock ownership. Readers should carefully review the Company’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and in Item 1A of the Company’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2022, June 30, 2022, and September 30, 2022, and the other

documents the Company files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

These forward-looking statements reflect management’s judgment as of this date, and the Company assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances. We make no representations or

warranties as to the accuracy of any projections, estimates, targets, statements or information contained in this document. It is understood and agreed that any such projections, estimates, targets, statements and information are not to be viewed as

facts and are subject to significant business, financial, economic, operating, competitive and other risks, uncertainties and contingencies many of which are beyond our control, that no assurance can be given that any particular financial

projections or targets will be realized, that actual results may differ from projected results and that such differences may be material. While all financial projections, estimates and targets are necessarily speculative, we believe that the

preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected,

expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the

financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that we or our representatives, considered or consider the financial

projections, estimates and targets to be a reliable prediction of future events. Certain financial and operating measures found herein are used by management and are not defined under accounting principles generally accepted in the United States, or

GAAP. These measures are reconciled to the most comparable GAAP measures at the end of this presentation. 2

Executive Summary New Aimco has demonstrated a successful track record of

executing our strategic priorities since 1 the December 2020 spin-off Under the leadership of our reconstituted, majority-independent Board of Directors and all-new 2 executive leadership team, New Aimco has delivered superior shareholder returns,

materially (1) outperforming its developer peer group , real estate indices, and broader market indices Our nominees are highly qualified and key contributors to New Aimco’s accomplishments with 3 substantial institutional knowledge of the

Company. Election of any alternate candidate(s) would remove expertise from the Board that is critical to our success Land & Buildings is primarily focused on historical issues and decisions made prior to reconstitution 4 of the New Aimco Board

and appointment of the New Aimco leadership team – Not only are their governance and spin-related concerns largely baseless, they also are about a different company with an entirely different leadership team, and substantially different board

New Aimco’s qualified and experienced Director nominees are the best choice to continue overseeing New Aimco’s strategy, which is delivering clear results Vote “FOR” All of New Aimco’s Highly Qualified Director Nominees

on the “UNIVERSAL” WHITE Proxy Card Today (1) Developer Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K). 3

1. New Aimco: New Board, New Leadership, New Mission, and New Business

Plan

New Aimco: New Board, New Leadership, New Mission, and Business Plan

Discussion Backdrop: The 2020 Spin-Off The Aimco of Today (“New Aimco”) Was Formed Following the Spin-Off of Apartment Income REIT (“AIR”) and Has a New Majority-Independent Reconstituted Board, an All-New Executive

Leadership Team, a New Mission and a New Business Plan • The 2020 spin-off of AIR was completed in December 2020, with 88% of the market capitalization being Market Capitalization as of December 31, 2020 separated into the new entity known as

AIR and 12% (1) remaining in New Aimco $6.9Bn • The spin-off was designed, implemented, and $6.1Bn $0.8Bn executed by the Pre-Spin Board and Pre-Spin 88% 12% management and resulted in two significantly different companies: New Aimco and AIR

“New Aimco” (2) • The Aimco of Today includes among others : • 15MM square feet New Aimco-controlled Investment Pipeline Stabilized Apartment Opportunistic and (3) Communities Development Investments as well as Stabilized

Properties • $1Bn Alaska Permanent JV for Aimco-led projects Portfolio Approximate Current Portfolio Allocation Allocation 10% • And other high-quality development projects backed 10% by well-regarded institutional investors Stabilized

Assets 55% 100% 25% Source: Company information, Green Street The Aimco of Today is summarized (1) Based on market capitalization as of December 31, 2020, per Capital IQ. Includes OP Units. on the following pages (2) As of September 30, 2022. Core

& Core Plus Real Estate (3) This presentation includes non-GAAP financial measures. See the appendix hereto for a definition of the non-GAAP financial measures used herein. Value Add & Opportunistic Real Estate 5 Alternative Investments

Cash, Hedges, & Other Net Assets

New Aimco: New Board, New Leadership, New Mission, and Business Plan New,

Reconstituted Aimco Board of Directors 70% of New Aimco’s Board Was Not on the Board Pre-Spin; the Three Continuing Directors Have Critical Institutional Knowledge of the Company December 2020 Reconstitution • In 2020, the New Aimco

Board was reconstituted with six new independent directors appointed to replace resigning Director Resigned Newly Appointed members of the prior Board Thomas L. Keltner P • Ferguson Partners, a leading executive and board search Devin I.

Murphy P firm, led the candidate sourcing process Kathleen M. Nelson P • All new directors were previously unknown to Aimco, with the exception of Mr. Leupp, given his prior role as lead equity John D. Rayis P research analyst at Royal Bank of

Canada and at Robertson Ann Sperling P Stevens Nina A. Tran P • Chairman of the Board and CEO roles were separated and replaced Terry Considine Robert A. Miller• All five Committee Chairs were newly appointed Michael A. Stein Quincy L.

Allen P “Board members with longer tenure can provide important context to past strategic moves and provide leadership Patricia L. Gibson P regarding how the company dealt with crisis situations that may Jay P. Leupp P reoccur. Such experience

is valuable to the education and development of newer board members. Having a balance of Wes Powell P board members who can teach and younger board members Deborah Smith who want to learn would be optimum.” P R. Dary Stone P – Corporate

Board Member Magazine (4Q22) Kirk A. Sykes P 6

New Aimco: New Board, New Leadership, New Mission, and Business Plan New,

Reconstituted Aimco Board of Directors (Cont.) Newly Appointed, Majority Independent, and Diverse Board of Directors Including New Chairman and Separation of CEO / Chair Roles Legend: Independent Director A Audit Committee C Compensation & Human

Wes Powell Michael Stein Deborah Smith Kirk A. Sykes R. Dary Stone Resources Committee President, Former CFO Co-Founder and CEO, Co-Managing Partner, CEO, R.D. Stone ICOS Corporation, Chief Executive The CenterCap Group Accordia Partners, LLC

Interests Officer Nordstrom, Inc., Appointed 2020 Appointed 2021 Appointed 2020 & Marriott Appointed 2020 I International, Inc. Investment Committee Appointed 2004 A C I N A C I N A C I N A C I N T N Nominating, Environmental, Social, and

Governance Committee T Aimco-AIR Transactions Committee Committee Chair Patricia Gibson Robert A. Miller Terry Considine Jay Paul Leupp Quincy L. Allen Chairman of the Board Founding Principal and Co-Founder, Managing CEO, Apartment Income

Co-Founder and Appointed Since Spin CEO, Banner Oak (Since 2020) REIT Corp.; Chairman Partner and Senior Managing Partner, ARC Capital Partners and CEO, Aimco (1994- Portfolio Manager, Real Capital Partners President of RAMCO 2020) Estate

Securities, Terra Appointed 2020 Appointed 2020 Advisors Firma Asset Appointed 1994 Management Appointed 2007 Appointed 2020 A C I N A C I N T A C I N T I A C I N 7

New Aimco: New Board, New Leadership, New Mission, and Business Plan New

Executive Leadership Team Following the Spin-Off, the New Aimco Board Appointed an All-New Executive Leadership Team President & Chief Executive Officer EVP, Chief Administrative EVP & Officer, General Counsel Chief Financial Officer Wes

Powell Jennifer Johnson Lynn Stanfield (1) New Aimco’s leadership team is comprised of seasoned real estate executives with an average tenure of 19 years who offer relevant experience and fresh perspectives in addition to a deep understanding

of New Aimco’s business operations, geographic markets, existing assets, corporate structure, and workforce The team has generated significant momentum in the 23 months since assuming their current roles, significantly outperforming select

peers and benchmarks since the spin-off (1) Represents average tenure of executive leadership team including Wes Powell (18 years), Lynn Stanfield (21 years), and Jennifer Johnson (18 years). 8

New Aimco: New Board, New Leadership, New Mission, and Business Plan New

Mission Statement and New Business Plan New Aimco Board and New Executive Leadership Team Developed a New Mission Statement and New Business Plan as Clearly Outlined in our October 2021 Strategic Overview and Investor Presentation New Aimco’s

Mission Statement To make real estate investments, primarily focused on the multifamily sector within targeted U.S. markets where outcomes are enhanced through our human capital and substantial value is created for investors, teammates, and the

communities in which we operate New Aimco’s Business Plan New Aimco is focused on a total return strategy that includes value add, opportunistic, and alternative investments that offer the prospect of outsized returns on a risk-adjusted basis,

while maintaining an allocation to stabilized properties Value Add and Opportunistic Real Estate Alternative Investments Core and Core Plus Real Estate Re- / Developments Mezzanine Loan with 27 Stabilized Apartment Communities in Portfolio

Acquisitions Option to Participate in Development 10 Major U.S. Markets Operational Turnarounds Re-Entitlements Passive Equity Investments One Commercial Office Building 9

2. New Board and New Leadership Team’s Accomplishments Since

Spin-Off

New Board and New Leadership Team’s Accomplishments Since Spin-Off

New Aimco’s Successful Track Record Since Spin-Off New Leadership Team and Reconstituted Board Have Taken Decisive Actions to Drive Shareholder Value Milestones Commentary Status 1 New Aimco Has Tripled Its • Secured high-quality future

development projects in key target markets of South Florida, Washington, Development Pipeline D.C., and Denver Metro Regions, more than tripling Aimco's controlled pipeline to 15MM SF ✓ in 23 Months 2 • On-track execution, as measured

by budget, lease-up metrics, and current market valuations, for eight Successful Development development projects with $100MM of realized value creation from four of the projects almost 18 and Lease-Up ✓ (1) months earlier than anticipated 3

• Substantial momentum across operations as evidenced by 15.8% and 11.0% NOI and Revenue growth Strong Operating Performance (1) YTD, respectively, Avg. Daily Occupancy of 97.4% YTD, and Avg. Q3 2022 Revenue per Home of $2,173 ✓ 4

Significantly Fortified • Retired or refinanced more than $1Bn of near-term liabilities, eliminating substantially all of New the Balance Sheet Aimco’s floating rate exposure ✓ 5 Accretive • Unlocked almost $1Bn of asset

value through monetization of $669MM of leasehold development (2) Capital Allocation assets , $265MM of stabilized multifamily asset disposals at premium to NAV, and by selling a partial ✓ to Unlock Asset Value interest in New Aimco’s

minority investment in IQHQ generating >50% IRR 6 Accelerated Elimination of • Eliminated various legacy entanglements with AIR through the early repayment of a $534MM purchase Legacy Entanglements money note, the reduction of leasehold

liabilities from $475MM to $6MM, and the amendment of key ✓ with AIR provisions of the master leasing agreement with AIR • Favorable debt sourcing including $781MM of fixed rate non-recourse property debt locked in 7 significantly below

today’s potential refinancing levels Strong Capital Sourcing Momentum • Formed partnership providing equity capital for up to $1Bn of Aimco-led multifamily development ✓ projects with third-party management fees and potential for

incentive income (1) This presentation includes non-GAAP financial measures. See the appendix hereto for a definition of the non-GAAP financial measures used herein and reconciliations to the most directly comparable financial measures calculated in

accordance with GAAP. 11 (2) Gross transaction price includes $469MM relief of leasehold obligation and $200MM net cash proceeds.

New Board and New Leadership Team’s Accomplishments Since Spin-Off 1

New Aimco Has Tripled Its Development Pipeline In 23 Months Consistent with Its Newly-Defined Capital Allocation Strategy, New Aimco Has Secured High-Quality Future Developments in Key Target Markets of South Florida, Washington, D.C., and Denver

Metro Regions Controlled Development Pipeline Representative Pipeline Projects 15MM SF 15MM SF FLAGLER VILLAGE FORT LAUDERDALE, FL 10MM SF Strathmore BETHESDA, MD 5MM SF 5MM SF 3333 Biscayne MIAMI, FL At Spin-Off Today New Aimco’s development

pipeline now spans 15MM square feet across high-growth U.S. markets with tremendous value creation potential 12

New Board and New Leadership Team’s Accomplishments Since Spin-Off 2

Successful Development and Lease-Up On-Track Execution for Eight Development Projects Active Development Projects THE BENSON UPTON PLACE OAK SHORE THE HAMILTON AURORA, CO WASHINGTON, D.C. CORTE MADERA, CA MIAMI, FL Projects Completed and Stabilized

by New Aimco 707 LEAHY PRISM THE FREMONT REDWOOD CITY, CA CAMBRIDGE, MA AURORA, CO FLAMINGO POINT NORTH TOWER MIAMI BEACH, FL (1) Successfully completed and leased-up projects with a total investment of $570MM On track to complete and lease-up

another four projects at a total investment of $469MM (1) $469MM relief of leasehold obligation and $101MM of capital investment including direct capital, interest and lease payments, and other capital investments. 13

New Board and New Leadership Team’s Accomplishments Since Spin-Off 3

Strong Operating Performance Substantial Momentum Evidenced By Operating Results 17.5% 3Q2022 (1) YoY NOI Growth 96% Yacht Club 1045 on the Park 3Q2022 Occupancy $2,173 3Q2022 Avg. Monthly Revenue per Apartment Home 15.8% / 15.1% Elm Creek Royal

Crest Estates - Warwick 3Q2022 New Lease Rent Growth / Renewal Spreads (1) This presentation includes non-GAAP financial measures. See the appendix hereto for a definition of the non-GAAP financial measures used herein. 14

New Board and New Leadership Team’s Accomplishments Since Spin-Off 4

Significantly Fortified The Balance Sheet Creation of Fortress Balance Sheet Through $1Bn of Debt Retirement or Financings Weighted Average Maturity Has Been Leverage Fixed or Hedged Debt New Aimco’s Leverage… (1) Extended Maturing

Through 2024 (2) …has been reduced by 27% 7.2 Yrs $1.5Bn 100% of property-level, 4.3 Yrs $1.2Bn non-recourse debt is $1.1Bn fixed or protected with interest hedges valued at $61MM $0.2Bn At Spin-Off Today At Spin-Off Today At Spin-Off Today

Key Components of Aimco Leverage Leverage Weighted Average Interest Rate Weighted Average Maturity Fixed Rate Loans Payable $781MM 8.4 Yrs 4.86% Floating Rate Loans Payable $80MM 1.7 Yrs As of 3Q2022 Construction Loan Debt $85MM 1.9 Yrs Preferred

Equity Interests $158MM NA Leased Properties $6MM NA (1) Leverage includes property-level debt maturities. Lease liabilities for “at spin-off” as of 12/31/2020 and “Today” as of 9/30/2022. (2) Calculated by taking the sum of

property debt, construction loans, preferred equity strips, 15 and leasehold value on 11/1/2021 and 9/30/2022.

New Board and New Leadership Team’s Accomplishments Since Spin-Off 5

Accretive Capital Allocation to Unlock Asset Value Drives Enhanced Shareholder Value Accretive Capital Allocation $1,000MM $750MM The Fremont Aurora, CO September 2022 $500MM Prism Flamingo Point Cambridge, MA (North Tower) 707 Leahy September 2022

Miami Beach, FL Redwood City, CA September 2022 2900 on First September 2022 Seattle, WA Cedar Rim $250MM August 2022 Newcastle, WA July 2022 June 2022 Pathfinder Village Fremont, CA May 2022 (2) Unlocked almost $1Bn of asset value including the

monetization of $669MM of leasehold development assets , the sale of three stabilized multifamily assets for $265MM at a premium to New Aimco’s internal NAV estimate, and the sale of a partial interest in New Aimco’s minority investment

in IQHQ, generating >50% IRR (1) Based on the dispositions of Pathfinder ($127MM), Cedar Rim ($53MM), 2900 on First ($69MM), the 22% liquidation of AIV’s passive equity investment in IQHQ ($16.5MM) and the leasehold value of the four

monetized properties ($469MM) and $200MM received 16 from AIR. (2) Gross transaction price includes $469MM relief of leasehold obligation and $200MM net cash proceeds.

New Board and New Leadership Team’s Accomplishments Since Spin-Off 6

Accelerated Elimination of Legacy Entanglements with AIR New Aimco Has Removed The Majority of Entanglements 18 Months Sooner Than Anticipated Early Repayment of $534MM $534MM Purchase Money Note $- December 2020 Today 99% Reduction in $475MM

Leasehold Liabilities $6MM December 2020 Today • Eliminated the purchase option previously granted to AIR with respect to certain New Aimco assets post-stabilization Amendment of • Removed AIR’s right of first offer on certain New

Aimco 1031 designated assets and other exchange Key Provisions of transactions (1) Master Lease Agreement • Replaced purchase option with a right of first offer to AIR for certain assets that New Aimco desires to sell within 12 months

post-stabilization Elimination of Consulting and • Elimination of consulting agreement and expense reimbursement at the end of 2022 will result in Expense Reimbursement savings of $6MM annually Agreement “Aimco’s early payoff of

the AIR note reduces the vast majority of our near-term refunding risk and eliminates the single largest entanglement stemming from Aimco and AIR’s separation, furthering each company’s independence from the other.” (CEO Wes

Powell, 6/21/22) 1001 Brickell (1) On June 14, 2022, New Aimco entered into an amendment to the Master Leasing Agreement, dated as of December 15, 2020, to amend certain terms of the Master Leasing Agreement. 17

New Board and New Leadership Team’s Accomplishments Since Spin-Off 7

Strong Capital Sourcing Momentum Premier Strategic Capital Partnership And Favorable Debt Sourcing Support New Aimco $1Bn Programmatic JV With APFC Debt Financing • New Aimco has shown its ability to finance projects at attractive cost of

capital, further demonstrating New Aimco’s strong performance and proactive balance sheet management • Proactively sourced $781MM of fixed rate non-recourse property debt at a blended rate of 4.25%, well-below today’s potential

refinancing rate of (3) > 6.00% Programmatic Joint Venture Targeting up to $1Bn of Multifamily Development • New Aimco has hedged 100% of its floating rate exposure Background and Structure • Liquidity includes $211MM left undrawn on

New Aimco’s construction debt, with approximately $152MM expected in commitments for development and • In August 2022, New Aimco and Alaska Permanent Fund Corporation (“APFC”), (1) redevelopment projects the largest

state-level fund of its kind in the U.S. with a total fund value of (1) $70.6Bn , entered into a JV agreement to fund up to $1Bn of future New (2) Aimco-led multifamily developments • Target leverage of up to 60% LTC on the Alaska JV •

APFC will provide up to $360MM of limited partner equity into projects meeting • New Aimco plans to diversify its capital invested and limit the incremental specific criteria including return thresholds and minimum project size amount of New

Aimco capital needed, by using third-party equity sourced from • New Aimco will act as the general partner and developer, committed to a JV partners and construction debt to fund the build out of its investment minimum of $40MM through funding

or asset contribution, while earning pipeline when conditions are right customary fees and the potential for incentive economics Key Takeaways Other Strategic and Capital Relationships • Strong partnership potential given shared commitment to

investing in • In addition to the Alaska Permanent joint venture, New Aimco also has strategic development of dynamic multifamily properties in high-growth U.S. markets partnerships with the following groups: • Underscores New

Aimco’s ability to source high-quality strategic capital • Beitel partnerships – with an attractive core capital partner at a time when public • Donohoe equity capital is unattractive • Fivesquares Development •

Provides opportunity to unlock value embedded within New Aimco’s • Kushner development pipeline 1001 Brickell (1) As of September 30, 2022. (2) The agreement will remain in effect until the date on which APFC has given approval for

projects that are allocated 95% or more of APFC’s committed capital allocation, the tenth anniversary of the date of the agreement, or its earlier termination. 18 (3) Based on illustrative 200 bps spread over 10-year Treasury Rate for

potential proactive agency financing.

3. The Objective Results

The Objective Results New Aimco Has Delivered vs. Its Peers New

Aimco’s Total Shareholder Return (TSR) vs. Development-Focused REITs Showcases Best-in-Class Results Outperformed by Total Shareholder Return (“TSR”) Peer Set Rationale The “Right” Peers For New Aimco Aimco Since Spin?

• Pre-separation, Old Aimco was a large-cap multifamily REIT • New Aimco developed a post-spin peer set based and thus, its peer set, which was last disclosed on 10/28/2021 on industry grouping, business strategy, and size of to set

executive compensation for the pre-spin management total asset base team, was largely comprised of other sizable companies across (1) Peer Group (1) the REIT sector ✓ • Like New Aimco, the companies included in this group maintain

significant focus on development / • At the time of separation, 88% of the company was spun-off redevelopment activities into AIR, vastly changing the size and composition of New Aimco • With this in mind, the current board and

management team at • Designed to track the aggregate performance of FTSE Apartment REIT publicly-listed multi-family real estate, this index is New Aimco worked with an independent consultant to develop comprised of the 16 predominant and U.S.

based Index an accurate post-separation peer set that more closely ✓ Apartment REITs represents New Aimco. See “Peer Group” to the right (3) Land & Buildings’ Peer Set Is Stale • MSCI’s U.S. REIT Index is a

market cap weighted MSCI U.S. REIT listing of 132 constituents, which collectively (2) Index represent ~99% of the U.S. REIT universe✓ L&B references this irrelevant and stale peer set for both the wrong purpose and in the wrong context

û The purpose of this prior peer set was to set compensation at pre-spin Aimco, not to track shareholder return • Includes 2,000 of the smallest U.S. public equities based on market capitalization, providing a û Companies had a

median market capitalization of over $6.5Bn as of comprehensive barometer for small-cap 12/31/2020, more than 8x the market capitalization of New Aimco at that performance Russell 2000 Index time • With the Russell 2000’s average market

cap of ✓ ~$1.4Bn dwarfed by that of the S&P 500 (~$87Bn) û Only one pure-play multifamily REIT – a notable oversight considering and Dow Jones Industrial Average ($331Bn), the New Aimco’s primary focus is the multifamily

sector Russell 2000 is a “better fit” for Aimco û Just three companies with 10% or more of their asset base involved in development / re-development – an important consideration for a development-focused company like New Aimco

• Arguably the most-often cited barometer for U.S. û Two companies which were acquired after 12/31/2020 – both of which at S&P 500 Index equity market performance 30%+ premiums – skewing the total shareholder return of

Land & ✓ Buildings’ peer set to the upside (1) Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K). (2) Source: MSCI. (3) Land & Buildings’ peer set includes ACC

(de-listed), AMH, BRX, CPT, DEI, DRE (de- 20 listed), ELS, EXR, FRT, HPP, JBGS, KRC, KIM, LPT (de-listed), MAC, OHI, PK, REG, SUI, and TCO (de-listed).

The Objective Results New Aimco Has Delivered for Shareholders New Aimco

Has Shown Superior Total Returns Since Current Board and Management Have Been in Place (1) (1) Since Spin 2021 New Aimco’s Relative Outperformance New Aimco’s Relative Outperformance 45% (18%) 64% 3% 46% 10% 17% 43% 19% 36% 9% 31% 29%

11% 15% (1%) (1%) AIV Peer Group FTSE Apartment MSCI U.S. REIT Russell 2000 S&P 500 AIV Peer Group FTSE Apartment MSCI U.S. REIT Russell 2000 S&P 500 Equity Index Index Equity Index Index (1) (1) 2022 YTD Last Three Months New Aimco’s

Relative Outperformance New Aimco’s Relative Outperformance 33% 32% 28% 20% 21% 10% 13% 9% (2%) 2% 3% (2%) (4%) (6%) (17%) (18%) (25%) (13%) (14%) (29%) (30%) (17%) AIV Peer Group FTSE Apartment MSCI U.S. REIT Russell 2000 S&P 500 AIV Peer

Group FTSE Apartment MSCI U.S. REIT Russell 2000 S&P 500 Equity Index Index Equity Index Index (1) Returns measured from 12/14/2020, the date of when-issued trading for AIV post- separation from AIRC until 10/31/2022. Peer Group includes AHH,

CLPR, CSR, ELME, 21 FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K); represents simple average. 46% 26% 34% 46% 36%

The Objective Results New Aimco’s Strong Execution Has Been The

Primary Catalyst for the Stock in 2022 Aimco Outperformance Accelerated Following 6/21 Corporate Announcements and Has Sustained (1) 2022 YTD Total Shareholder Returns Avg. Daily Indexed to 100 Trading Volume st th th th th June 21 , 2022: New Aimco

Announces July 28 , 2022: August 9 , 2022: August 11 , 2022: September 7 , 2022: (MM) Significant Progress on Executing its New Aimco’s Westdale’s 13D AIV Announces AIV confirms (3) Business Plan existing share Filing Programmatic JV

with completion of lease repurchase Alaska Permanent Fund termination ✓ Realization of $100MM of Value 140 authorization is Targeting up to $1Bn of transaction, realizing 900 Creation From Development of Four Leased Properties from AIR

increased from Developments $100MM of value 10MM to 15MM creation ✓ Cancellation of $469MM Lease shares. A $0.02 Obligation 800 special dividend is ✓ Repayment of $534MM of AIR Notes also announced ✓ Amended Key Provisions of

Master th 120 Lease Agreement with AIR October 28 , 2022: 700 Land & Buildings Nearly 65% of L&B and Westdale long purchases occurred (3) Files Schedule 13D BEFORE the 6/21 Aimco Business Update Press Release - Aimco’s dramatic

outperformance vs. peers accelerated AFTER AIV: 600 6/21, a period of time after this L&B and Westdale purchasing +3% 2Q2022 Earnings Release (4) activity occurred 100 500 4Q2021 Earnings Release 400 RMZ: 80 1Q2022 Earnings (25%) Release th (2)

April 30 , 2022: Intentionally P30 eer0 Group : misleading date selected for th (30%) October 20 , 2022: Key Catalyst of AIV’s relative performance Land & Buildings Files (3) Stock Outperformance measurement by L&B (3) Definitive Proxy

200 60 100 New Aimco has sustained Nearly 65% of L&B and Westdale Purchases Occurred Prior to 6/21 Announcement the relative outperformance that accelerated after 6/21 40 0 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22

(2) AIV 30-Day Avg. Daily Trading Volume Aimco (NYSE: AIV) Peer Group MSCI US REIT Index (RMZ) AIV Strategic Accomplishments L&B and Westdale Proxy-Related Events Source: SNL Financial, Company Filings (1) Return figures shown are calculated as

of 12/31/2021 through 10/31/2022. (2) Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, 22 TRC, and VRE (per AIV 2021 10-K). (3) Publicly-filed proxy materials. (4) Includes long purchases only. L&B actively engaged

in short sales and swaps. throughout its disclosed transaction activity period.

The Objective Results New Aimco Relative Valuation vs. Peers While We Are

Not Satisfied With Our Valuation, New Aimco Trades Approximately In-Line With Or Better Than Its Peers on a Premium / (Discount) to NAV Basis (1) Premium / (Discount) to Consensus NAV • While AIV’s Peer Group 0% comprises a broad range

of companies, AIV is currently trading approximately in-line with (10%) its peers based on a Premium / (Discount) to NAV basis (20%) • Further, certain peers (particularly the FTSE NAREIT Equity Apartment Index) have a materially (30%) (29%)

larger share of their assets in stabilized real estate (34%) (36%) (38%) – NAV estimates tend to (40%) (3) FTSE NAREIT Equity (2) AIV Developer Peer Group Peer Group Members Most have less variability Apartment Index Similar to Aimco in (4)

around stabilized assets Development Exposure than development / non- Consists of multifamily REITs Consists of companies income producing assets with portfolios primarily with varying levels of Consists of real estate focused on stabilized

development exposure companies with more properties across the portfolios but significant exposure to Source: SNL Financial as of 10/31/2022 and company (where NAV estimates tend generally materially more developments which is information (1) AIV

NAV based on previous forecast of 2022 year-end to have less variability non-stabilized assets / highly similar to NAV per share published during 1Q2022 including compared to development / development (where there New Aimco’s asset development

at cost. non-income producing are inconsistent views of allocation today (2) FTSE NAREIT Equity Apartment Index includes AIRC, AIV, AVB, BRG, BRT, CPT, CSR, ELME, EQR, ESS, IRT, assets) private market value) MAA, NXRT, UDR, and VRE; reflects simple

average of constituents (AIV excluded from average, BRG excluded from average due to lack of consensus NAV estimates). (3) Developer Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K);

represents simple average 23 (FOR, FPH, JOE, STRS, and TRC excluded from average due to lack of consensus NAV estimates). (4) Includes AHH, HHC, KW, and VRE.

The Objective Results Commitment to Further Enhancing Stockholder Value

Evaluation of a Broad Range of Options to Enhance Stockholder Value • While Aimco’s reconstituted Board and new management team have outlined and implemented a clear strategy for the Company that has delivered strong results, the Board

is mindful that Aimco shares have continued to trade at a meaningful discount to the inherent value of the Company’s assets and growing platform • Therefore, the Aimco Board is overseeing the evaluation of a broad range of options to

enhance stockholder value, including, but not limited to, structural alternatives for the Company’s assets, new capitalization and financing strategies for Aimco’s development platform and pipeline, monetization of certain of the

Company’s assets and accelerated share repurchases • The evaluation and execution of a value enhancing plan will carefully consider the current market conditions and is being led by the Board’s Investment Committee, chaired by

Michael Stein, who has considerable experience with similar efforts to unlock stockholder value 24

4. Corporate Governance Highlights

Corporate Governance Highlights Recent Governance Enhancements New Aimco

Board Continues to Focus on Evolving Into Best-in-Class Governance 1 Declassify the Board in 2023 • Given the success of Aimco’s strategic plan, the Aimco Board will accelerate the Company’s previously planned transition to annual

elections for all directors for one-year terms beginning at the 2023 annual meeting 2 Opt Out of MUTA • The Aimco Board will opt out of the provisions of the Maryland Unsolicited Takeover Act, or MUTA, that allow it to re-classify the Board

without the approval of stockholders 3 Transition Timing of the Annual Meeting Date • The Board intends to move the date of the Company’s annual meeting so the 2024 annual meeting will be held by the end of the second quarter of 2024

26

Corporate Governance Highlights New Aimco Governance Highlights Consistent

Focus on Corporate Governance and Shareholder Engagement under the Reconstituted New Board of Directors Six of eight independent directors With mitigating circumstances having Pay is aligned with having been added in the last 23 kept New

Aimco’s Board staggered performance, 99% of months brings fresh perspectives since the 2020 spin, a plan is now in- shareholders supported to New Aimco’s Board of Directors place to declassify the Board in 2023 New Aimco's 2021 Say on

Pay ` Board reflects key expertise, In addition to moving the annual 40% Board diversity including significant industry meeting to before the end of the by gender and race / ethnicity experience and track records second quarter of 2024, New

Aimco’s of creating shareholder value Board and leadership team actively engage with shareholders and review opportunities to enhance value Demonstrated leadership in 6.6 year average Separate Chairman environmental conservation director

tenure compared and CEO Roles through building to LEED and to S&P 500 average director (1) Fitwel standards tenure of 7.8 years (1) According to SpencerStuart 2022 S&P 500 New Director Snapshot. 27

Corporate Governance Highlights New Aimco Has a Demonstrated Commitment to

ESG Environmental Stewardship: Commitment to Conservation & Sustainability Every development and redevelopment project is built with conservation, sustainability, resilience, and climate-related risks and opportunities in mind, Inaugural

Reporting In 2022, Aimco including respected environmental certifications. to Task Force on conducted climate-risk Further, we have implemented a number of measures Climate-Related assessments for each of Financial throughout our portfolio to reduce

our environmental its assets and land and Disclosures (TCFD) footprint, including innovative technologies. building acquisitions in 2022 Corporate Responsibility Report KEYLESS LED ENTRY LIGHTING RESIDENT SMART WATER & OFFICE THERMOSTATS SENSORS

RECYCLING 28

Corporate Governance Highlights New Aimco Has a Demonstrated Commitment to

ESG (Cont’d) Social Responsibility: Commitment to Our Teammates, Customers, and Communities A Workforce Rich With Diverse Backgrounds and Investments In Teammates …Showing Tangible Results Perspectives Leads To Improved Outcomes &

Company Culture… Highly Engaged Team Record 4.52 (out of 5 Aimco’s Human Capital Composition At A Glance • Workplace Flexibility stars) team engagement for 2022: • Parental Leave – 16 Weeks 92% employee response rate

Paid Leave • Healthy Work Environments Supporting Our Communities With 67% 43% 53% Partnerships and Opportunities For Women in Women and Women and Teammates To Volunteer executive racial / ethnic racial / ethnic management minorities in

minorities • Providing teammates with 15 hours of senior company-wide paid volunteer hours through leadership Aimco Cares positions (all officers) • Partnership with Camillus House in 2022, pledging $1MM over four years for expansion of

Camillus House’s workforce development programs 29

Corporate Governance Highlights Significant Investor Outreach Post Spin-Off

New Aimco Actively Engages with Its Shareholders and Prospective Shareholders, Reviewing Potential Opportunities To Enhance Value Active Shareholder Engagement Post-Spin New Aimco Shareholder Engagement Reported to Task Force on >66%

Climate-Related Financial New Aimco engaged with shareholders holding more than 2/3 of outstanding shares in 2021, Disclosures (TCFD) despite the significant shareholder turnover (2022) following the spin Enhanced Financial Disclosure Board

Refreshment 80% (2022) (2021) New Aimco has held more than 80 individual meetings with more than 35 current and prospective shareholders in the past 13 months, including shareholders that own in aggregate more than 80% of New Aimco’s

outstanding shares Disclosure of Enhanced Human Capital Diversity Environmental Disclosure (2021) (2021) 30

Corporate Governance Highlights Executive Compensation Compensation that

Incentivizes Relative Outperformance over the Long Term 99% “Say on Pay” Approved Voted for “Say On Pay” Every Year in 2021 Since First Introduced CEO Pay Components CEO 2021 Target Pay Mix Target Total Compensation at 80% of

peer group median 42% 29% Annual Cash Bonus LTI Equity Awards Salary 100% based on corporate goals Annual Long-term Incentive (LTI) Equity Awards 29% 100% at risk, based entirely on relative TSR over 71% Cash Bonus forward looking 3-Year period

Variable Incentive Pay Annual Cash Bonus Program Outcome Rigorous performance Maximum targets 2021 CEO Short-Term Bonus Incentive (STI) 63% Potential Annual Cash Bonus Program earned at 63% of maximum for 2021 31

5. Nominee Comparisons

Nominee Comparisons Our Class II Directors Are Key Contributors to New

Aimco’s Momentum Impressive Track Records and Public Company Board Experience Land & Buildings’ Nominees Michelle Applebaum ûBackground primarily focused on the steel industry Jay Paul Leupp ûNo real estate experience Audit

Committee Chairman ûNo U.S. REIT management experience ûPreviously nominated by Land & Buildings three times without success; highlights role operating ✓ Mr. Leupp is adding particular value to Aimco in the area of investor

relations essentially as an affiliate of Land & Buildings as a result of his deep experience managing investments in publicly traded ûGiven this track record, in the event that Ms. REITs Applebaum is elected to the Board, the Aimco Board

and management team believe that she ✓ Mr. Leupp, an independent director, has served on Aimco’s Board since would be incentivized to act as a Land & Buildings December 2020 and brings over 28 years of capital markets, investment

Proxy on the Board rather than a purely and finance, real estate, and development experience independent actor ✓ Currently a member of Aimco’s Compensation and Human Resources, James P. Sullivan Nominating, Environmental, Social, and

Governance, Investment, and ûNo prior public company board experience Aimco-AIR Transactions Committees in addition to serving as Chairman of ûNo track record of value creation at public the Audit Committee companies ✓ Currently

Managing Partner / Senior Portfolio Manager, Real Estate ûNo development experience Securities, Terra Firma Asset Management ûNo real estate company management experience ✓ Previously Managing Director & Portfolio Manager,

Global Real Estate Securities, at Lazard Asset Management, Founder, President and CEO for Real Estate Mutual Funds at Grubb & Ellis Alesco Global Advisors ✓ Currently serves on the board of directors of Healthcare Realty Trust and We

believe that Mr. Leupp is superior to Land & Buildings’ nominees and their appointment would Marathon Digital Holdings remove significant value from the Board that is critical to our success 33

Nominee Comparisons Our Class II Directors Are Key Contributors to New

Aimco’s Momentum (Cont’d) Impressive Track Records and Public Company Board Experience Land & Buildings’ Nominees Michelle Applebaum ûBackground primarily focused on the steel industry Michael A. Stein ûNo real estate

experience Investment Committee Chairman ûNo U.S. REIT management experience ûPreviously nominated by Land & Buildings three times without success; highlights role operating essentially as an affiliate of Land & Buildings ✓

Mr. Stein is a vital member of the Aimco board given his experience overseeing strategic corporate transactions which unlock shareholder value ûGiven this track record, in the event that Ms. as evidenced by his efforts as Marriott CFO during

the separation of Marriott Applebaum is elected to the Board, the Aimco International & Host Hotels and as ICOS CFO during the sale of ICOS to Eli Board and management team believe that she would be incentivized to act as a Land & Buildings

Lilly Proxy on the Board rather than a purely ✓ Mr. Stein, an independent director, brings real estate investment and independent actor finance, financial reporting, accounting and auditing, capital markets, and James P. Sullivan business

operations expertise, gained through service as a director of five ûNo prior public company board experience publicly traded companies and CFO of three publicly traded companies ûNo track record of value creation at public ✓

Currently a member of Aimco’s Audit, Compensation and Human companies Resources, and Nominating, Environmental, Social, and Governance ûNo development experience Committees, in addition to serving as Chairman of the Investment ûNo

real estate company management experience Committee ✓ Served as CFO of ICOS Corporation from January 2001 until its acquisition by Eli Lilly in January 2007; previously served as Executive VP and CFO of Nordstrom, Inc. and served in various

capacities with Marriott including We believe that Mr. Stein is superior to Land & Executive VP and CFO. Additionally, Mr. Stein was a Partner at Arthur Buildings’ nominees and their appointment would Andersen before joining Marriott in

1989 remove significant value from the Board that is critical to our success 34

Nominee Comparisons Our Class II Directors Are Key Contributors to New

Aimco’s Momentum (Cont’d) Impressive Track Records and Public Company Board Experience Land & Buildings’ Nominees Michelle Applebaum ûBackground primarily focused on R. Dary Stone the steel industry Nominating,

Environmental, Social, and ûNo real estate experience Governance Committee Chairman ûNo U.S. REIT management experience ûPreviously nominated by Land & Buildings three ✓ Mr. Stone provides the Board leadership on governance

practices and real times without success; highlights role operating estate development given his experience and track record at Cousin’s essentially as an affiliate of Land & Buildings Properties, Baylor University and the Texas Banking

Commission ûGiven this track record, in the event that Ms. ✓ Mr. Stone, an independent director, has served on Aimco’s Board since Applebaum is elected to the Board, the Aimco December 2020 and brings investment and finance, real

estate, Board and management team believe that she development, property / asset management and operations, and capital would be incentivized to act as a Land & Buildings markets experience from investing and developing a variety of projects and

Proxy on the Board rather than a purely independent actor joint ventures, including the management of one of the country’s largest master planned developments James P. Sullivan ✓ Currently a member of Aimco’s Audit, Compensation

and Human ûNo prior public company board experience Resources, and Investment Committees, in addition to serving as Chairman of the Nominating, Environmental, Social, and Governance Committee ûNo track record of value creation at public

companies ✓ Currently a member of the board of directors of Cousins Properties (received 98% of votes in most recent director election; chair of Cousins’ ûNo development experience Governance Committee) ûNo real estate company

management experience ✓ Twenty years of experience serving on the board and as Audit Committee Chair of Tolleson Wealth Management and Tolleson Private Bank, the largest Private Wealth Management Firm and Private Bank in Texas ✓ Former

member of the Real Estate Roundtable, a highly regarded real We believe that Mr. Stone is superior to Land & estate public advocacy committee comprising industry leaders, for five Buildings’ nominees and their appointment would years and

former President and COO at Cousins Properties remove significant value from the Board that is critical to our success ✓ Former Chairman of Baylor University Board of Regents 35

Nominee Comparisons Our Class II Directors Are Key Contributors to New

Aimco’s Momentum (Cont’d) Impressive Track Records and Public Company Board Experience New Aimco’s Nominees L&B’s Nominees Michelle Qualifications and Expertise Jay Paul Leupp Michael A. Stein R. Dary Stone James P.

Sullivan Applebaum Accounting & Auditing for Large PPP Businesses Business Operations PPPPP Capital Markets PPPPP Corporate Governance PPPPP ExecutiveP PPP Investment & FinancePP PPP Property / Asset Management & P PPP Operations Public

Company Board ExperienceP PPP Public Company C-Suite Executive PP Real Estate Development PP Real Estate Industry P PPP Jay Paul Leupp, Michael A. Stein and R. Dary Stone collectively bring extensive real estate and development experience, either as

operators, investors, and / or board members of private and public entities 36

Nominee Comparisons L&B’s Unusual Stake-Building Appears Designed

to Take Away Votes from Largest Institutional Shareholders Borrow In The Days Before The Record Date Removed ~2.8% of the Vote from Other Shareholders Beneficial Ownership (MM) • L&B’s trading shows a material DEF Proxy Filed At

Record Date 13D Filing increase in beneficial ownership in (1) (10/20/22) (10/26/22) (10/28/22) the days before the record date L&B Votes followed by a significant decrease 12.5 immediately following the record date: – Increased beneficial

ownership by 5.2MM shares between 10/20/22 L&B Owns 3 Days Later… and 10/26/22 8.8 – Facilitated primarily by borrowing 7.3 4.2MM shares and selling short while also purchasing – Decrease of approximately 3.7MM shares in the

days immediately following the record date (with shares used to close out of short positions) • It appears that the 4.2MM shares borrowed took a significant amount of votes away from long-term institutional investors (~2.8% of the register)

DEF Proxy Filed Record Date 13D Filing 10/20/22 10/26/22 10/28/22 (1) Per nomination supplement provided to the company on 11/1/22. 37

6. Concluding Remarks

Concluding Remarks New Aimco has demonstrated a successful track record of

executing our strategic priorities since 1 the December 2020 spin-off Under the leadership of our reconstituted, majority-independent Board of Directors and all-new 2 executive leadership team, New Aimco has delivered superior shareholder returns,

materially (1) outperforming its developer peer group , real estate indices, and broader market indices Our nominees are highly qualified and key contributors to New Aimco’s accomplishments with 3 substantial institutional knowledge of the

Company. Election of any alternate candidate(s) would remove expertise from the Board that is critical to our success Land & Buildings is primarily focused on historical issues and decisions made prior to reconstitution 4 of the New Aimco Board

and appointment of the New Aimco leadership team – Not only are their governance and spin-related concerns largely baseless, they also are about a different company with an entirely different leadership team, and substantially different board

New Aimco’s qualified and experienced Director nominees are the best choice to continue overseeing New Aimco’s strategy, which is delivering clear results Vote “FOR” All of New Aimco’s Highly Qualified Director Nominees

on the “UNIVERSAL” WHITE Proxy Card Today (1) Developer Peer Group includes AHH, CLPR, CSR, ELME, FOR, FPH, HHC, IRT, JBGS, JOE, STRS, TRC, and VRE (per AIV 2021 10-K). 39

Vote “FOR” All of New Aimco’s Highly Qualified Director

Nominees on the “UNIVERSAL” WHITE Proxy Card Today 40

Appendix

Glossary and Reconciliations of Non-GAAP Financial and Operating Measures

This document includes certain financial and operating measures used by Aimco management that are not calculated in accordance with accounting principles generally accepted in the United States, or GAAP. Aimco’s definitions and calculations of

these Non-GAAP financial and operating measures and other terms may differ from the definitions and methodologies used by other REITs and, accordingly, may not be comparable. These Non-GAAP financial and operating measures should not be considered

an alternative to GAAP net income or any other GAAP measurement of performance and should not be considered an alternative measure of liquidity. NET OPERATING INCOME (NOI) MARGIN: Represents an apartment community’s net operating income as a

percentage of the apartment community’s rental and other property revenues. PROPERTY NET OPERATING INCOME (NOI): NOI is defined by Aimco as total property rental and other property revenues less direct property operating expenses, including

real estate taxes. NOI does not include: property management revenues, primarily from affiliates; casualties; property management expenses; depreciation; or interest expense. NOI is helpful because it helps both investors and management to

understand the operating performance of real estate excluding costs associated with decisions about acquisition pricing, overhead allocations, and financing arrangements. NOI is also considered by many in the real estate industry to be a useful

measure for determining the value of real estate. Reconciliations of NOI as presented in this report to Aimco’s consolidated GAAP amounts are provided below. STABILIZED OPERATING PROPERTIES: Apartment communities that (a) are owned and asset

managed by Aimco, (b) had reached a stabilized level of operations as of January 1, 2021 and maintained it throughout the current and the comparable prior periods, and (c) are not expected to be sold within 12 months. VALUE CREATION, NET OF COSTS:

Value Creation, net of costs is defined by Aimco, in particular, as it relates to the termination of leases with AIR, as the lease termination payment less development and financing costs, net of operating revenues and expenses during the leasehold

period. Due to the diversity of its economic ownership interests in its apartment communities in the periods presented, Aimco evaluates the performance of the apartment communities in its segments using Property NOI, which represents the NOI for the

apartment communities that Aimco consolidates and excludes apartment communities that it does not consolidate. Property NOI is defined as rental and other property revenue less property operating expenses. In its evaluation of community results,

Aimco excludes utility cost reimbursement from rental and other property revenues and reflects such amount as a reduction of the related utility expense within property operating expenses. The following table presents the reconciliation of GAAP

rental and other property revenue to the revenues before utility reimbursements and GAAP property operating expenses to expenses, net of utility reimbursements as presented on Supplemental Schedule 6 of Aimco’s Third Quarter 2022 Earnings

Release and Supplemental Schedules Segment NOI Reconciliation Three Months Ended (in thousands) September 30, 2022 September 30, 2021 Revenues, Expenses, Revenues, Expenses, Before Utility Net of Utility Before Utility Net of Utility Total Real

Estate Operations Reimbursements [1] Reimbursements Reimbursements [1] Reimbursements Total (per consolidated statements of operations) $ 47,683 $ 17,455 $ 42,893 $ 18,155 Adjustment: Utilities reimbursement (1,318) (1,318) (1,246) (1,246)

Adjustment: Other Real Estate ( 4,263) $ 1 ,286 (3,472) 1 ,136 Adjustment: Non-stabilized and other amounts not allocated [2] (7,428) (7,213) (7,066) (7,759) Total Stabilized Operating (per Schedule 6) $ 3 4,674 $ 10,210 $ 3 1,110 $ 10,287 Segment

NOI Reconciliation Nine Months Ended (in thousands) September 30, 2022 September 30, 2021 Revenues, Expenses, Revenues, Expenses, Before Utility Net of Utility Before Utility Net of Utility Total Real Estate Operations Reimbursements [1]

Reimbursements Reimbursements [1] Reimbursements Total (per consolidated statements of operations) $ 148,375 $ 56,384 $ 1 23,115 $ 51,500 Adjustment: Utilities reimbursement (4,221) (4,221) (3,719) (3,719) Adjustment: Other Real Estate (13,619)

(4,085) (9,783) (3,251) Adjustment: Non-stabilized and other amounts not allocated [2] (30,533) (17,204) (19,486) (14,104) Total Stabilized Operating (per Schedule 6) $ 1 00,002 $ 30,874 $ 90,127 $ 3 0,426 (1) Approximately two-thirds of

Aimco’s utility costs are reimbursed by residents. These reimbursements are included in rental and other property revenues on Aimco’s consolidated statements of operations prepared in accordance with GAAP. This adjustment represents the

reclassification of utility reimbursements from revenues to property operating expenses for the purpose of evaluating segment results and as presented on 42 Supplemental Schedule 6. Aimco also excludes the reimbursement amounts from the calculation

of Average Revenue per Apartment Home throughout this presentation and Supplemental Schedules. (2) Properties not included in the Stabilized Operating Portfolio and other amounts not allocated includes operating results of properties not presented

in the Stabilized Operation Portfolio as presented on Supplemental Schedule 6 during the periods shown, as well as property management and casualty expense, which are not included in property operating expenses, net of utility reimbursements in the

Supplemental Schedule 6 presentation.

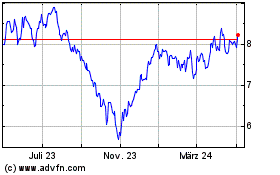

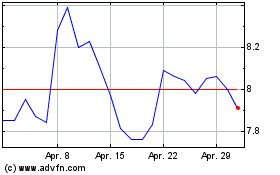

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mai 2023 bis Mai 2024