Report of Independent Registered Public

Accounting Firm

To the Shareholders and Board of Directors of AllianceBernstein

National Municipal Income Fund, Inc.:

In planning and performing our audit of the financial

statements of AllianceBernstein National Municipal Income Fund, Inc. (the

“Fund”) as of and for the year ended October 31, 2023 in accordance with the

standards of the Public Company Accounting Oversight Board (United States)

(PCAOB), we considered the Fund’s internal control over financial reporting,

including controls over safeguarding securities, as a basis for designing our

auditing procedures for the purpose of expressing our opinion on the financial

statements and to comply with the requirements of Form N-CEN, but not for the

purpose of expressing an opinion on the effectiveness of the Fund’s internal

control over financial reporting. Accordingly, we express no such opinion.

The management of the Fund is responsible for

establishing and maintaining effective internal control over financial

reporting. In fulfilling this responsibility, estimates and judgments by

management are required to assess the expected benefits and related costs of

controls. A fund’s internal control over financial reporting is a process

designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in

accordance with U.S. generally accepted accounting principles. A fund’s internal

control over financial reporting includes those policies and procedures that

(1) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of the assets

of the fund; (2) provide reasonable assurance that transactions are recorded as

necessary to permit preparation of financial statements in accordance with U.S.

generally accepted accounting principles, and that receipts and expenditures of

the fund are being made only in accordance with authorizations of management

and directors of the fund; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use or disposition

of a fund’s assets that could have a material effect on the financial

statements.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also,

projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may

deteriorate.

A deficiency in internal control over financial

reporting exists when the design or operation of a control does not allow management

or employees, in the normal course of performing their assigned functions, to

prevent or detect misstatements on a timely basis. A material weakness is a

deficiency, or a combination of deficiencies, in internal control over

financial reporting, such that there is a reasonable possibility that a

material misstatement of the fund’s annual or interim financial statements will

not be prevented or detected on a timely basis.

Our consideration of the Fund’s internal control over

financial reporting was for the limited purpose described in the first

paragraph and would not necessarily disclose all deficiencies in internal

control that might be material weaknesses under standards established by the PCAOB.

However, we noted no deficiencies in the Fund’s internal control over financial

reporting and its operation, including controls over safeguarding

securities that we consider to be a material weakness as defined above as of October 31, 2023.

This report is intended solely for the information and

use of management and the Board of Directors of AllianceBernstein National

Municipal Income Fund, Inc. and the Securities and Exchange Commission and is not

intended to be and should not be used by anyone other than these specified

parties.

/s/ Ernst & Young LLP

New York, New York

December 28, 2023

ALLIANCEBERNSTEIN

NATIONAL MUNICIPAL INCOME FUND, INC.

ARTICLES OF

AMENDMENT

THIS IS TO CERTIFY THAT:

FIRST: The charter of AllianceBernstein

National Municipal Income Fund, Inc., a Maryland corporation (the “Corporation”),

is hereby amended in the manner set forth on Schedule I hereto.

SECOND: The amendments to the

charter of the Corporation (the “Charter”) as set forth above have been duly

advised by the Board of Directors and approved by the holders of the 2018

Variable Rate MuniFund Term Preferred Shares in the

manner and by the vote required by law and the Charter.

THIRD: These Articles of Amendment shall become effective on September

14, 2023 (the “Effective Time”).

FOURTH: The amendments

to the Charter as set forth above do not increase the authorized stock of the

Corporation.

FIFTH: The

undersigned officer acknowledges these Articles of Amendment to be the

corporate act of the Corporation and, as to all matters or facts required to be

verified under oath, the undersigned officer acknowledges that, to the best of

his knowledge, information and belief, these matters and facts are true in all

material respects and that this statement is made under the penalties for

perjury.

[Signature Page Follows]

IN WITNESS

WHEREOF, the Corporation has caused these Articles of Amendment to be executed

in its name and on its behalf by its Chief Financial Officer and attested to by

its Assistant Secretary on this 14th day of September, 2023.

ATTEST: ALLIANCEBERNSTEIN

NATIONAL MUNICIPAL INCOME FUND, INC.

/s/ Stephen J. Laffey____________ /s/

Joseph J. Mantineo________(SEAL)

Name: Stephen J. Laffey Name:

Joseph J. Mantineo

Title: Assistant Secretary Title:

Treasurer and Chief Financial Officer

Schedule

I

The charter of the Corporation (the “Charter”) is amended as set forth

herein in connection with the 2023 Special Terms Period, which shall commence

on the Terms Period Commencement Date and end on the Terms Period Termination

Date (subject to early redemption of the 2018 VMTP Shares (as defined below) in

accordance with the terms of the Articles (as defined below)) and such period

to be referred to herein as the “2023 Special Terms Period,” the terms

of which are contained in and established by the Notice for the 2018 Variable

Rate MuniFund Term Preferred Shares (the “2018 VMTP Shares”)

issued by AllianceBernstein National Municipal Income Fund, Inc. (the “Fund”)

for the 2023 Special Terms Period, all in accordance with the terms of the 2018

VMTP Shares as set forth in the Charter (the “Articles”).

ARTICLE 1

DEFINITIONS

Definitions. During the 2023 Special

Terms Period, unless the context or use indicates another or different meaning

or intent, each of the following terms when used herein shall have the meaning

ascribed to it below, whether such term is used in the singular or plural and

regardless of tense; capitalized terms used herein but not defined herein have

the respective meanings therefor set forth in the Articles:“2023 Special

Terms Period” means the Special Terms Period commencing on and including

the Terms Period Commencement Date and ending on and including the Terms Period

Termination Date (subject to early redemption of the 2018 VMTP Shares in

accordance with the terms of the Articles).

“Applicable Spread” means, with respect to any Rate Period for the

2018 VMTP Shares, the percentage per annum set forth opposite the highest

applicable credit rating most recently assigned to the 2018 VMTP Shares by any

Rating Agency in the table set forth directly below on the Rate Determination

Date for such Rate Period:

|

Long-Term Ratings*

|

Applicable Percentage**

|

|

S&P Rating

|

|

|

|

|

|

AAA to AA-

|

0.55%

|

|

A+ to A-

|

1.55%

|

|

BBB+ to BBB-

|

2.55%

|

|

BB+ or lower***

|

3.55%

|

|

*And/or the equivalent ratings of an Other Rating Agency

then rating the 2018 VMTP Shares utilizing the highest of the ratings of the

Rating Agencies then rating the 2018 VMTP Shares.

**Unless an

Increased Rate Period is in effect and is continuing, in which case the

Applicable Spread shall be 6.05% for such period.

*** Includes unrated.

|

|

“Articles” has the meaning set forth in the preamble above.

“Benchmark” means, initially, One-Month Term SOFR; provided,

however, that if a Benchmark Transition Event or an Early Opt-In Election, as

applicable, has occurred with respect to One-Month Term SOFR or the

then-current Benchmark, then “Benchmark” means the applicable Benchmark

Replacement to the extent that such Benchmark Replacement has become effective

pursuant to Section 2.2(i) of the Articles.

“Benchmark Replacement” means the sum of: (a) the alternate

benchmark rate that has been selected by the Fund, giving due consideration to

(i) any selection or recommendation of a replacement rate or the mechanism for

determining such a rate by the Relevant Governmental Body, (ii) any evolving or

then-prevailing market convention for determining a rate of dividends as a

replacement to the then-current Benchmark for U.S. registered closed-end

investment companies that invest primarily in municipal bonds, or (iii) any

evolving or then-prevailing market convention for determining a rate of

interest as a replacement to the then-current Benchmark for U.S.

dollar-denominated syndicated or bilateral credit facilities and (b) the

Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means, with respect to any

replacement of the then-current Benchmark with an Unadjusted Benchmark

Replacement for each applicable Dividend Period, the spread adjustment, or

method for calculating or determining such spread adjustment (which may be a

positive or negative value or zero), that has been selected by the Fund with

the consent of the the Holders of at least a majority of the 2018 VMTP Shares

Outstanding, giving due consideration to (i) any selection or recommendation of

a spread adjustment, or method for calculating or determining such spread

adjustment, for the replacement of the then-current Benchmark with the

applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body,

(ii) any evolving or then-prevailing market convention for determining a spread

adjustment, or method for calculating or determining such spread adjustment,

for the replacement of the then-current Benchmark with the applicable

Unadjusted Benchmark Replacement for either (A) U.S. registered closed-end

investment companies that invest primarily in municipal bonds at such time or

(B) U.S. dollar-denominated syndicated or bilateral credit facilities at such

time, and (iii) any adjustment to the current Benchmark that may have been

included in the transaction at the time the Benchmark Replacement is to become

effective.

“Benchmark Replacement Conforming Changes”

means, with respect to any Benchmark Replacement, any technical, administrative

or operational changes (including, without limitation, changes to the

definitions of “Dividend Rate,” “Dividend Period,” “Dividend Date,”

“Applicable Spread,” “Rate Determination Date,” “Reference Time” and “Index

Rate,” the timing and frequency of determining rates and declaring and making

payments of dividends, optional redemption provisions, and other administrative

matters) that the Fund decides (in a commercially reasonable manner) may be

appropriate to reflect the adoption and implementation of such Benchmark

Replacement and to permit the administration thereof by the Fund in a manner

substantially consistent with market practice (or, if the Fund decides that

adoption of any portion of such market practice is not administratively

feasible or if the Fund determines that no market practice for the

administration of the Benchmark Replacement exists, in such other manner of

administration as the Fund decides is reasonably necessary in connection with

the administration of these Articles).

“Benchmark Termination Date” means the earliest to occur of the

following events with respect to the then-current Benchmark:

(1) in the case of clause (1) or (2) of the definition of “Benchmark

Transition Event,” the later of (a) the date of the public statement or

publication of information referenced therein and (b) the date on which the

administrator of the Benchmark permanently or indefinitely ceases to provide

the Benchmark; or

(2) in the case of clause (3) of the definition of “Benchmark Transition

Event,” the date of the public statement or publication of information

referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark

Termination Date occurs on the same day as, but earlier than, the Reference

Time in respect of any determination, the Benchmark Termination Date will be

deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more

of the following events with respect to the then-current Benchmark:

(1) a public statement or publication of information by or on

behalf of the administrator of the Benchmark announcing that such administrator

has ceased or will cease to provide the Benchmark, permanently or indefinitely,

provided that at the time of such statement or publication, there is no

successor administrator that will continue to provide the Benchmark;

(2) a public statement or publication of information by the

regulatory supervisor for the administrator of the Benchmark, the U.S. Federal

Reserve System, an insolvency official with jurisdiction over the administrator

for the Benchmark, a resolution authority with jurisdiction over the

administrator for the Benchmark or a court or an entity with similar insolvency

or resolution authority over the administrator for the Benchmark, which states

that the administrator of the Benchmark has ceased or will cease to provide the

Benchmark permanently or indefinitely, provided that at the time of such

statement or publication, there is no successor administrator that will

continue to provide the Benchmark; or

(3) a public statement or publication of

information by the regulatory supervisor for the administrator of the Benchmark

announcing that the Benchmark is no longer representative.

“Benchmark Unavailability Period” means, if a Benchmark Transition

Event has occurred with respect to the then-current Benchmark and solely to the

extent that the Benchmark has not been replaced with a Benchmark Replacement,

the period:

(x) beginning with the first Reference Time occurring on or after the

Benchmark Termination Date; and

(y) ending at the time that a Benchmark Replacement has replaced the

Benchmark for all purposes hereunder pursuant to the provisions hereof.

“Corresponding Tenor” means, with respect to an Index Rate

determined in accordance with Section 2.2(d)(i), a tenor having approximately

the same length (disregarding business day adjustment) as the applicable tenor

for the applicable Dividend Period with respect to the then-current Benchmark.

“Early Opt-In Election” means the delivery of a notice to the

Holders by the Fund or to the Fund by the Holders of at least a majority of the

2018 VMTP Shares Outstanding indicating the occurrence of:

(1) a determination by the party providing such notice, acting in a

commercially reasonable manner, that preferred securities issued by registered

closed-end investment companies that invest primarily in municipal bonds are

being executed or amended to incorporate or adopt a new benchmark to replace

the current Benchmark (due to a determination that such new benchmark is

necessary or appropriate in anticipation of the cessation of publication of the

Benchmark or the Benchmark becoming no longer representative); and

(2) the election by the party providing such notice to declare an

Early Opt-In Election for the purpose of replacing the current Benchmark.

“Early Term Redemption Date” means September 16, 2026.

“Early Term Redemption Price” means the price per share equal to

the Liquidation Preference per share plus an amount equal to all unpaid

dividends and other distributions on the 2018 VMTP Shares accumulated from and

including the Terms Period Commencement Date to (but excluding) the Early Term

Redemption Date (whether or not earned or declared by the Fund, but excluding

interest thereon).

“Federal Reserve Bank of New York’s Website” means the website of

the Federal Reserve Bank of New York at http://www.newyorkfed.org, or any

successor source.

“Index Rate” means, with respect to any Rate Period (or portion

thereof) for the 2018 VMTP Shares, 80% of the Benchmark made available on the

Rate Determination Date for such Rate Period.

“Increased Rate” means, with respect to

any Increased Rate Period for the 2018 VMTP Shares, the Index Rate for such

Rate Period (or portion thereof) plus an Applicable Spread of 6.05%.

"Initial Rate Period" means, with respect to the 2018

VMTP Shares, (i) prior to the Terms Period Commencement Date, the period

commencing on and including April 22, 2021 and ending on, and

including, April 30, 2021 and (ii) from and including the Terms Period

Commencement Date, the period commencing on and including the Terms

Period Commencement Date and ending on, and including, the last day of the

month in which the Terms Period Commencement Date occurred (or if such day is

not a Business Day, the next succeeding Business Day).

“ISDA Definitions” means the 2006 ISDA Definitions published by

the International Swaps and Derivatives Association, Inc. or any successor

thereto, as amended or supplemented from time to time, or any successor

definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment, (which may

be a positive or negative value or zero) that would apply for derivatives

transactions referencing the ISDA Definitions to be determined upon the

occurrence of an index cessation event with respect to the Benchmark for the

Corresponding Tenor.

“ISDA Fallback Rate” means the rate that would apply for

derivatives transactions referencing the ISDA Definitions to be effective upon

the occurrence of an index cessation date with respect to the Benchmark for the

Corresponding Tenor excluding the applicable ISDA Fallback Adjustment.

“Optional Redemption Premium” means, with

respect to each 2018 VMTP Share to be redeemed at the option of the Fund, as

set forth in Section 2.6(c)(i) of the Articles, on any Optional Redemption Date

for a period of three years from the Terms Period Commencement Date, an amount

equal to:

(A) if such Optional Redemption Date is less than

one year following the Terms Period Commencement Date, 1.0% of the Liquidation

Preference of the 2018 VMTP Shares subject to redemption or

(B) if the Optional Redemption Date for such 2018 VMTP Shares occurs on

the date that is one year or more from the Terms Period Commencement Date,

zero.

“One-Month Term SOFR” means, commencing September 14, 2023, with

respect to any Dividend Period, the Term SOFR Reference Rate as published by

the Term SOFR Administrator prior to 5:00 p.m., New York City time, on the Rate

Determination Date for such Dividend Period; provided, however, that (i) if as

of 5:00 p.m., New York City time, on any Rate Determination Date, the Term SOFR

Reference Rate has not been published by the Term SOFR Administrator, and

One-Month Term SOFR has not been replaced pursuant to the terms of these

Articles, then One-Month Term SOFR will be the Term SOFR Reference Rate as

published by the Term SOFR Administrator on the first U.S. Government

Securities Business Day preceding the Rate Determination Date for which the

Term SOFR Reference Rate was published by the Term SOFR

Administrator, so long as such first preceding U.S. Government Securities

Business Day is not more than three (3) U.S. Government Securities Business

Days prior to such Rate Determination Date or (ii) if such Term SOFR Reference

Rate is not so published on any of such U.S. Government Securities Business

Days, then One-Month Term SOFR will be the Term SOFR Reference Rate as in

effect on the previous Rate Period.

“Purchase Agreement” means the VMTP Purchase Agreement dated as of

September 14, 2023 between the Fund and the Purchaser.

“Purchaser” means Wells Fargo Municipal Capital

Strategies, LLC, as purchaser of 2018 VMTP Shares pursuant to the Purchase

Agreement.

“Rate Period Commencement Date” means September 13, 2023.

"Rate Determination Date" means, from and including the

Rate Period Commencement Date, with respect to the Initial Rate Period for the

2018 VMTP Shares, the date that is two U.S. Government Securities Business Days

preceding the last day of the immediately preceding Rate Period for such Subsequent

Dividend Period, provided however, that the next succeeding Rate Determination

Date will be determined without regard to any prior extension of a Rate

Determination U.S. Government Securities Business Day.

“Reference Time” means (i) with respect to any determination of

the Benchmark, (a) if the Benchmark is One-Month Term SOFR, 5:00 p.m., New York

City time, on the day that is two U.S. Government Securities Business Days

preceding the Dividend Reset Date, and (b) if the Benchmark is not One-Month

Term SOFR, the time and day determined by the Fund in accordance with the

Benchmark Replacement Conforming Changes and (ii) with respect to any

determination of the Benchmark Unavailability Period Index Rate, the time and

day determined by the Fund in accordance with Section 2.2(i)(d) of these

Articles.

“Registration Rights

Agreement” means the registration rights

agreement entered into between the Fund and the Purchaser dated as of September

14, 2023, as amended from time to time.

“Relevant Governmental Body” means the Federal Reserve Board

and/or the Federal Reserve Bank of New York, or a committee officially endorsed

or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New

York or any successor thereto.

“Retroactive Benchmark Adjustment” means, with respect to a

Benchmark Holdover Period, the difference, if a positive number, of (1) the

hypothetical aggregate accumulated dividend amount calculated using the Index

Rate described in Section 2.2(d)(i)(A) or (B) of these Articles, as applicable,

minus (2) the aggregate accumulated dividend amount calculated pursuant to the

Index Rate in effect during the Benchmark Holdover Period.

“SOFR” means the Secured Overnight Financing Rate administered by

the Federal Reserve Bank of New York (or any successor administrator).

“Subsequent Rate Period” means, with respect to the 2018 VMTP

Shares, the period consisting of one calendar month, but adjusted in each case

to reflect any changes when the regular day that is a

Rate Determination Date is not a Business Day, from, and including, the first

day following the Initial Rate Period to, and including, the next Rate

Determination Date and any period thereafter from, and including, the first day

following a Rate Determination Date to, and including, the next succeeding

Rate Determination Date.

“Terms Period Commencement Date” means September 14, 2023.

“Terms Period Termination Date” means the earliest of (i) any

Redemption Date with respect to any 2018 VMTP Shares to be redeemed on such

date, (ii) the date on which a succeeding Special Terms Period is declared and

effective with respect to the 2018 VMTP Shares, and (iii) provided that all

Holders of the 2018 VMTP Shares have made an affirmative election to retain,

the Mandatory Tender Date associated with the Early Term Redemption Date.

“Term SOFR Administrator” means CME Group Benchmark Administration

Limited (or any successor administrator).

“Term SOFR Reference Rate” means the forward-looking term rate for

a tenor of one month administered by the Term SOFR Administrator based on SOFR.

“U.S. Government Securities Business Day” means any day except for

(a) a Saturday, (b) a Sunday or (c) a day on which the Securities Industry and

Financial Markets Association recommends that the fixed income departments of

its members be closed for the entire day for purposes of trading in United

States government securities.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement

excluding the Benchmark Replacement Adjustment.

Interpretation. (a) The headings preceding

the text of Sections included herein are for convenience only and shall not be

deemed part hereof or be given any effect in interpreting this document. The

use of the masculine, feminine or neuter gender or the singular or plural form

of words herein shall not limit any provision hereof. The use of the terms

“including” or “include” shall in all cases herein mean “including, without

limitation” or “include, without limitation,” respectively. Reference to any

Person includes such Person’s successors and assigns to the extent such

successors and assigns are permitted by the terms of any applicable agreement,

and reference to a Person in a particular capacity excludes such Person in any

other capacity or individually. Reference to any agreement (including this

document), document or instrument means such agreement, document or instrument

as amended or modified and in effect from time to time in accordance with the

terms thereof and, if applicable, the terms hereof. Except as otherwise

expressly set forth herein, reference to any law means such law as amended,

modified, codified, replaced or re-enacted, in whole or in part, including

rules, regulations, enforcement procedures and any interpretations promulgated

thereunder. References to Sections shall refer to those portions hereof,

unless otherwise provided. The use of the terms “hereunder,” “hereof,”

“hereto” and words of similar import shall refer to this document as a whole

and not to any particular Article, Section or clause hereof.(b) The Special Terms Period provisions set forth

herein shall, during the Special Terms Period designated herein, supersede the

terms of the Articles to the extent inconsistent therewith. Upon the Terms

Period Termination Date, the Special Terms Period

provisions set forth herein shall no longer apply and the terms of the Articles

shall be in effect.

ARTICLE 2

TERMS

APPLICABLE TO THE

2018 VARIABLE RATE MUNIFUND TERM

PREFERRED SHARES

THE 2023 SPECIAL TERMS PERIOD

The 2018 VMTP Shares shall have the following

terms for the 2023 Special Terms Period:

Applicable Spread,

Increased Rate, and Optional Redemption Premium.During the term of the 2023 Special Terms Period,

the defined terms “Applicable Spread”, “Early Term Redemption Price”, “Increased

Rate”, “Initial Rate Period”, “Optional Redemption Premium”, and “Purchaser”

shall have the meanings ascribed to such terms herein and as defined, shall

supersede the definitions provided for in the Articles.

2.1

Designation of Special Terms

Period.

During the term of the 2023 Special Terms Period, the language of

Section 2.2(h)(ii)(3) of the Articles is removed and replaced by the following:

“such

designation of a Special Terms Period shall not become effective prior to 12

months subsequent to the Terms Period Commencement Date,”

2.2

Index Benchmark Replacement

Provisions.

During the term of the 2023 Special Terms Period, Section 2.2(i) of the

Articles is added as follows:

“(i) Index Benchmark Replacement Provisions.

Notwithstanding anything to the contrary contained in these Articles or in any

other related documents, the following provisions shall apply with respect to

changes to or replacement of the Benchmark and related terms in connection with

a Benchmark Transition Event or Early Opt-In Election:

(a) Benchmark Replacement. As further provided in this Section

2.2(i), it shall be the obligation of the Fund to propose the Benchmark

Replacement, the Benchmark Replacement Adjustment and any Benchmark Replacement

Conforming Changes (collectively, the “Benchmark Replacement Provisions”). Also

as further provided in this Section 2.2(i), prior to the Benchmark Transition

Event, either the Fund or the Holders of at least a majority of the 2018 VMTP

Shares Outstanding may make an Early Opt-In Election. Upon the occurrence of a

Benchmark Transition Event or an Early Opt-In Election, as applicable, subject

to agreement by the Fund and the Holders of at least a majority of the 2018

VMTP Shares Outstanding to the Benchmark Replacement Provisions, the Fund

shall, with the consent of the Holders of at least a majority of the 2018 VMTP

Shares Outstanding, amend the Articles such that the then current Benchmark

shall be replaced by the Benchmark Replacement with such replacement becoming

effective commencing with the first Subsequent Rate Period starting after the

latest to occur of (i) 5:00 p.m. on the fifth (5th) Business Day after the

occurrence of the Benchmark Transition Event or Early

Opt-In Election and (ii) the effective date of the amendment to the Articles

with respect to such replacement as approved by the written consent of the

Holders of at least a majority of the 2018 VMTP Shares Outstanding (the

applicable effective date of replacement, the “Effective Date”). If the

Effective Date has not occurred prior to the first Reference Time on or after

the Benchmark Termination Date, then a Benchmark Unavailability Period shall

commence and the Index Rate shall be determined in accordance with Section

2.2(i)(d) below (such Index Rate, the “Benchmark Unavailability Period Index

Rate”).

(b) Benchmark Replacement Conforming Changes. In

connection with a Benchmark Replacement, the Fund will have the right to make

Benchmark Replacement Conforming Changes from time to time and, notwithstanding

anything to the contrary in these Articles or in any other related documents,

any amendments implementing such Benchmark Replacement Conforming Changes will

become effective only with the consent of the Holders of at least a majority of

the 2018 VMTP Shares Outstanding.

(c) Notices; Standards for Decisions and Determinations.

The Fund, upon becoming aware of any of the following events, as applicable,

will promptly notify the Holders of (i) any occurrence of a Benchmark

Transition Event or an Early Opt-In Election by the Fund or by the Holders of

at least a majority of the 2018 VMTP Shares Outstanding, if not then the

Holders of 100% of the 2018 VMTP Shares, as applicable, (ii) the implementation

of any Benchmark Replacement, (iii) the effectiveness of any Benchmark

Replacement Conforming Changes and (iv) the commencement or conclusion of any

Benchmark Unavailability Period and the Benchmark Unavailability Period Index

Rate being used. Any determination, decision or election that may be made

pursuant to this Section 2.2, including any determination with respect to a

tenor, rate or adjustment or of the occurrence or non-occurrence of an event,

circumstance or date and any decision to take or refrain from taking any

action, will be made in the Fund’s good faith discretion and in a commercially

reasonable manner.

(d) Benchmark Unavailability Period Index Rate. For any

determination of dividend payments hereunder for any Dividend Period during a

Benchmark Unavailability Period, commencing with the first Subsequent Dividend

Period starting after the Benchmark Termination Date through and including the

last Subsequent Dividend Period starting prior to the end of the Benchmark

Unavailability Period, the Index Rate shall be the Benchmark Unavailability

Period Index Rate and equal to:

(i) Subject to the terms of clause (ii) below, first (A) 80% of

the sum of the ISDA Fallback Rate plus the ISDA Fallback Adjustment, each

determined for the Corresponding Tenor as of the Reference Time for such

Dividend Period, provided that, if the Fund cannot determine the ISDA Fallback

Rate or the ISDA Fallback Adjustment as of any relevant date during the

Benchmark Unavailability Period, then (B) 80% of the sum of the simple average

SOFR, determined for the Corresponding Tenor as of the Reference Time for such

Dividend Period, plus 0.15%, computed as otherwise provided herein, provided

further that if the Fund is not reasonably able to calculate the Index Rate

pursuant to clause (A) or (B) above for the period of the Corresponding Tenor

to, but excluding, the date that is two Business Days preceding the end of the

related Dividend Period due to the unavailability of timely data, the Fund,

acting in a commercially reasonable manner, may perform the calculation in

clause (B) using data for a period of the

Corresponding Tenor as of the most recent date practicable for which data are

available.

(ii) Notwithstanding the foregoing, if the Fund, acting in a

commercially reasonable manner, determines that, as of the first day of the

Benchmark Unavailability Period, the Fund is not able to calculate the Index

Rate pursuant to clause (i)(A) or (i)(B) above, then the Fund may elect (by

written notice to the Holders) that the Index Rate will be calculated using the

Benchmark as was calculated for the last Dividend Period commencing prior to

the Benchmark Unavailability Period. Such election shall become effective

commencing with the first Subsequent Dividend Period starting after the date of

such election and ending on the earliest to occur of (A) the date that is 45

calendar days from such date, (B) the date on which the Fund (acting a

commercially reasonable manner) determines that it is able to calculate the

Index Rate pursuant to clause (i)(A) or (i)(B) above, or (C) the date on which

a Benchmark Replacement becomes effective (the period during which such election

is effective, the “Benchmark Holdover Period”).

Following a Benchmark Holdover Period, the Holders of the 2018 VMTP

Shares shall be entitled to receive a special dividend on the 2018 VMTP Shares

equal to the Retroactive Benchmark Adjustment when authorized by the Board of

Directors and declared by the Fund.

For purposes of determining the Benchmark Unavailability Period Index

Rate as provided in this Section 2.2(i)(d) and calculating and declaring

dividends in arrears, if necessary as determined by the Fund in a commercially

reasonable manner, the Fund shall amend the definitions of “Rate Determination

Date” and “Reference Time,” and make such other technical, administrative or

operational changes, if any, that are reasonably necessary as determined in a

commercially reasonable manner that is substantially consistent with market

practice for the calculation of the relevant fallback rate as provided in

Section 2.2(i)(d)(i) and calculating and declaring dividends in arrears, or, if

the Fund determines that such market practice is not administratively feasible

or that no market practice for such changes for determining the applicable

Index Rate and calculating and declaring dividends in arrears exists, the Fund

shall adopt such amendment to the definition of Rate Determination Date, and

make such other technical, administrative or operational changes, if any, as

the Fund determines, acting in a commercially reasonable manner, are reasonably

necessary in order to determine the Index Rate as provided above and calculate

and declare dividends in arrears. Notwithstanding any provision to the contrary

in the Articles, except as expressly set forth in this Section 2.2(i), the Fund

may, to the extent permitted by applicable law, without a shareholder vote or consent,

implement the foregoing amendments, provided that such amendments do not

adversely affect the Holders of the 2018 VMTP Shares or cause the Fund to

violate any applicable law, rule or regulation.”

2.3

Early Term Redemption Date

and Mandatory Tender Event.

(a)

The Early Term Redemption

Date as defined in the Articles will not apply during the term of the 2023

Special Terms Period and the Early Term Redemption Date will instead be set as

September 16, 2026 as provided for in Article 1 hereof. All terms in the Articles calculated in relation to the Early Term

Redemption Date will be calculated with respect to the Early Term Redemption

Date herein.

(b)

During the term of the 2023

Special Terms Period, the language of Section 2.5(a)(i)(A) of the Articles is

removed and replaced by the following:

“any date that is 20

Business Days prior to the Early Term Redemption Date,”.

2.4

Optional Redemption Price.

(a)

During the term of the 2023 Special Terms Period, the language of

Section 2.6(c)(i) of the Articles is removed and replaced by the following:

“Subject

to the provisions of Section 2.6(c)(ii) hereof, the Fund may at its option at

any time on any Business Day (an “Optional Redemption Date”)

redeem in whole or from time to time in part the Outstanding 2018 VMTP Shares,

at a redemption price per 2018 VMTP Share (the “Optional Redemption

Price”) equal to (x) the Liquidation Preference per 2018 VMTP Share plus

(y) an amount equal to all unpaid dividends and other distributions on such

2018 VMTP Share accumulated from and including the Terms Period Commencement

Date to (but excluding) the Optional Redemption Date (whether or not earned or

declared by the Fund, but excluding interest thereon) plus (z) the Optional

Redemption Premium per share (if any) that is applicable to an optional

redemption of 2018 VMTP Shares that is effected on such Optional Redemption

Date.”

SK 00250 0209 10680199 v3

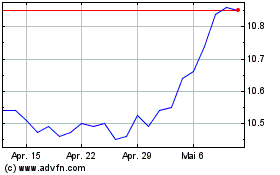

AllianceBernstein Nation... (NYSE:AFB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

AllianceBernstein Nation... (NYSE:AFB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024