– Solid Growth in Construction and Transportation Businesses

More Than Offset Anticipated Second Quarter Mix Headwinds in

Utility Structures

– Disciplined Working Capital Management Led to 47% Increase in

Operating Cash Flow

– Raised Low End of Full Year 2023 Revenue and Adjusted EBITDA

Guidance Reflecting Strong First-Half Results and Increased

Confidence

Arcosa, Inc. (NYSE: ACA) (“Arcosa,” the “Company,” “We,” or

“Our”), a provider of infrastructure-related products and

solutions, today announced results for the second quarter ended

June 30, 2023.

On October 3, 2022, the Company completed the divestiture of its

storage tanks business. Financial results for the storage tanks

business were historically included in the Engineered Structures

segment as part of continuing operations until the date of sale.

The tables below include additional financial information to

facilitate the comparison to prior year's results.

Second Quarter Highlights

Three Months Ended June

30,

2023

2022

% Change

($ in millions, except per

share amounts)

Revenues

$

584.8

$

602.8

(3

)%

Revenues, excluding impact from divested

business(1)

$

584.8

$

540.9

8

%

Net income

$

40.9

$

39.0

5

%

Adjusted Net Income(2)

$

37.3

$

40.9

(9

)%

Diluted EPS

$

0.84

$

0.79

6

%

Adjusted Diluted EPS(2)

$

0.76

$

0.83

(8

)%

Adjusted EBITDA(2)

$

85.8

$

99.2

(14

)%

Adjusted EBITDA Margin(2)

14.7

%

16.5

%

(180 bps)

Adjusted EBITDA, excluding impact from

divested business(1)(2)

$

85.8

$

83.4

3

%

Adjusted EBITDA Margin, excluding impact

from divested business(1)(2)

14.7

%

15.4

%

(70 bps)

Net cash provided by operating

activities

$

127.6

$

86.7

47

%

Free Cash Flow(2)

$

75.6

$

68.3

11

%

bps - basis points

(1)

Excludes the impact of the storage tanks

business in the prior period.

(2)

Non-GAAP financial measure. See

reconciliation tables included in this release.

“I am pleased with Arcosa's second quarter performance, with

Adjusted EBITDA surpassing last year's record results, normalizing

for the divestiture of our storage tanks business,” said Antonio

Carrillo, President and Chief Executive Officer.

“In Construction Products, we continued to successfully advance

pricing, manage cost pressures, and drive solid unit profitability

in natural and recycled aggregates. However, overall Adjusted

Segment EBITDA margins were impacted by operating inefficiencies in

our specialty materials business that we are addressing.

“Within Engineered Structures, our wind towers business

performed well on a low level of volume, benefiting in part from

the recognition of tax credits associated with the Inflation

Reduction Act. Anticipated product mix headwinds in our utility

structures business resulted in lower overall segment profitability

in-line with our expectation. We expect a stronger second half and

remain optimistic about our future growth potential. The demand

environment across the segment continues to be very robust, and we

are in the early stages of a multi-year expansion in the wind

industry.

“Adjusted Segment EBITDA in Transportation Products more than

doubled and margins expanded 530 basis points year-over-year,

underscoring the operating leverage inherent in these businesses as

volumes improve. We were pleased to obtain sufficient second

quarter orders to maintain our barge backlog and extend our

production visibility further into 2024 with improved pricing.”

Carrillo concluded, “Our strong cash conversion was a highlight

for the quarter. Free Cash Flow increased 11% year-over-year,

despite a near doubling in planned capital expenditures as we

invest to capture an expanded range of organic growth initiatives.

Our pipeline of acquisition and organic opportunities remain

attractive, and our solid balance sheet and strong liquidity

position provide ample flexibility for strategic capital

allocation.”

2023 Outlook and Guidance

The Company made the following adjustments to its full year 2023

guidance:

- Increased the low end of its revenue guidance range to $2.25

billion from $2.20 billion, resulting in a full year range of $2.25

billion to $2.30 billion.

- Increased the low end of its Adjusted EBITDA guidance range to

$355 million from $345 million, resulting in a full year range of

$355 million to $370 million.

Commenting on the outlook, Carrillo concluded, “In light of

Arcosa's solid financial performance through the first half of the

year and improved visibility in our cyclical businesses, we have

increased confidence in our full-year outlook. As a result, we are

raising the low end of our 2023 revenue and Adjusted EBITDA

guidance range.

“As we look ahead, Arcosa is well-positioned for growth given

our broad exposure to infrastructure markets that we believe will

benefit from multi-year tailwinds. We remain committed to expanding

margin, generating strong cash flow and allocating capital to build

long-term shareholder value.”

Second Quarter 2023 Results and Commentary

Construction Products

Engineered Structures

- Comparability of segment results was impacted by the

divestiture of our storage tanks business. Second quarter 2022

revenues and Adjusted EBITDA for the storage tanks business were

$61.9 million and $15.8 million, respectively.

- Revenues for utility, wind, and related structures were flat as

higher volumes in our utility structures business were offset by

lower volumes in our wind tower business.

- Excluding the impact of the storage tanks business, Adjusted

Segment EBITDA decreased 17% to $28.1 million, and margins

decreased 270 basis points to 13.6%.

- Adjusted Segment EBITDA declined as anticipated due to lower

margins in our utility structures business driven by project mix

and a decrease in wind tower volumes, partially offset by the

recognition of $5.9 million in net benefit from Advanced

Manufacturing Production (“AMP”) tax credits in our wind towers

business.

- Order activity for utility and related structures was healthy

during the quarter with orders received keeping pace with

shipments. There were no new wind tower orders booked during the

quarter, however, customer inquiries continue to indicate strong

multi-year demand.

- At the end of the second quarter, the combined backlog for

utility, wind, and related structures was $1,507.4 million compared

to $410.1 million at the end of the second quarter of 2022.

Transportation Products

- Revenues were $113.0 million, up 28%. Barge revenues increased

35% and steel components revenues increased 17%, both driven by

higher volumes and pricing.

- Adjusted Segment EBITDA increased $8.1 million, or 108%, to

$15.6 million, representing a 13.8% margin compared to 8.5% in the

prior period. The increase was driven by operating leverage

associated with higher volumes and improved pricing.

- During the quarter, we received orders of approximately $81

million in our barge business, representing a book-to-bill of 1.1.

These orders are primarily for hopper barges for delivery in

2024.

- Barge backlog at the end of the quarter was $287.1 million

compared to $131.8 million at the end of the second quarter of

2022. We expect to deliver approximately 45% of our current backlog

in 2023.

Corporate and Other Financial Notes

- Excluding acquisition and divestiture-related costs, which have

been excluded from Adjusted EBITDA, corporate expenses increased to

$16.4 million in the second quarter compared to $13.4 million in

the prior year primarily driven by higher compensation-related

costs.

- Acquisition and divestiture-related costs were $0.3 million in

the second quarter compared to $2.5 million in the prior year.

- The effective tax rate for the second quarter was 12.0%

compared to 20.6% in the prior year. The decrease in the tax rate

was primarily due to AMP tax credits for our wind tower business,

which are excluded from taxable income, an increase in the excess

tax benefit related to equity compensation, and lower foreign

taxes.

Cash Flow and Liquidity

- Operating cash flow was $127.6 million during the second

quarter, an increase of $40.9 million year-over-year.

- A reduction in working capital resulted in a $41.0 million

source of cash for the quarter compared to the prior year's $7.7

million source of cash. The decrease in working capital was

primarily due to a reduction in receivables and an increase to

payables, offsetting higher inventory.

- Capital expenditures in the second quarter were $52.5 million,

up from $27.0 million in the prior year, as progress continued on

organic projects underway in Construction Products and Engineered

Structures.

- Free Cash Flow for the quarter was $75.6 million, up from $68.3

million in the prior year.

- We ended the quarter with total liquidity of $672.8 million,

including $197.9 million of cash, and Net Debt to Adjusted EBITDA

was 1.0X for the trailing twelve months.

Non-GAAP Financial Information

This earnings release contains financial measures that have not

been prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). Reconciliations of non-GAAP financial measures

to the closest GAAP measure are included in the accompanying tables

to this earnings release.

Conference Call Information

A conference call is scheduled for 8:30 a.m. Eastern Time on

August 4, 2023 to discuss second quarter 2023 results. To listen to

the conference call webcast, please visit the Investor Relations

section of Arcosa’s website at https://ir.arcosa.com. A slide

presentation for this conference call will be posted on the

Company’s website in advance of the call at https://ir.arcosa.com.

The audio conference call number is 800-343-1703 for domestic

callers and 785-424-1116 for international callers. The conference

ID is ARCOSA and the passcode is 90544. An audio playback will be

available through 11:59 p.m. Eastern Time on August 18, 2023, by

dialing 800-839-2457 for domestic callers and 402-220-7217 for

international callers. A replay of the webcast will be available

for one year on Arcosa’s website at

https://ir.arcosa.com/news-events/events-presentations.

About Arcosa

Arcosa, Inc. (NYSE:ACA), headquartered in Dallas, Texas, is a

provider of infrastructure-related products and solutions with

leading positions in construction, engineered structures, and

transportation markets. Arcosa reports its financial results in

three principal business segments: Construction Products,

Engineered Structures, and Transportation Products. For more

information, visit www.arcosa.com.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” “strategy,” “plans,” and similar

expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release, and Arcosa expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, except as required by

federal securities laws. Forward-looking statements are based on

management’s current views and assumptions and involve risks and

uncertainties that could cause actual results to differ materially

from historical experience or our present expectations, including

but not limited to assumptions, risks and uncertainties regarding

the impact of the COVID-19 pandemic, or other similar outbreaks, on

Arcosa’s business; assumptions, risks and uncertainties regarding

achievement of the expected benefits of Arcosa’s spin-off from

Trinity Industries, Inc.; tax treatment of the spin-off; failure to

successfully integrate acquisitions or divest any business, or

failure to achieve the expected benefits of acquisitions or

divestitures; market conditions and customer demand for Arcosa’s

business products and services; the cyclical nature of, and

seasonal or weather impact on, the industries in which Arcosa

competes; competition and other competitive factors; governmental

and regulatory factors; changing technologies; availability of

growth opportunities; market recovery; ability to improve margins;

the impact of inflation and costs of materials; assumptions

regarding achievements of the expected benefits from the Inflation

Reduction Act; and Arcosa’s ability to execute its long-term

strategy, and such forward-looking statements are not guarantees of

future performance. For further discussion of such risks and

uncertainties, see "Risk Factors" and the "Forward-Looking

Statements" section of "Management's Discussion and Analysis of

Financial Condition and Results of Operations" in Arcosa's Form

10-K for the year ended December 31, 2022 and as may be revised and

updated by Arcosa's Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

Arcosa, Inc.

Condensed Consolidated Statements of

Operations

(in millions, except per share

amounts)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenues

$

584.8

$

602.8

$

1,134.0

$

1,138.6

Operating costs:

Cost of revenues

463.7

482.9

904.3

922.6

Selling, general, and administrative

expenses

70.7

66.3

133.2

128.9

Gain on disposition of property, plant,

equipment, and other assets

(0.6

)

(3.6

)

(23.2

)

(4.8

)

Gain on sale of storage tanks business

—

—

(6.4

)

—

533.8

545.6

1,007.9

1,046.7

Operating profit

51.0

57.2

126.1

91.9

Interest expense

7.1

7.7

14.2

14.9

Other, net (income) expense

(2.6

)

0.4

(4.5

)

1.3

4.5

8.1

9.7

16.2

Income before income taxes

46.5

49.1

116.4

75.7

Provision for income taxes

5.6

10.1

19.8

16.5

Net income

$

40.9

$

39.0

$

96.6

$

59.2

Net income per common share:

Basic

$

0.84

$

0.80

$

1.99

$

1.22

Diluted

$

0.84

$

0.79

$

1.98

$

1.21

Weighted average number of shares

outstanding:

Basic

48.5

48.3

48.4

48.2

Diluted

48.7

48.6

48.6

48.6

Arcosa, Inc.

Condensed Segment Data

(in millions)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

Revenues:

2023

2022

2023

2022

Aggregates and specialty materials

$

227.1

$

216.2

$

438.1

$

404.1

Construction site support

37.7

29.7

62.8

53.3

Construction Products

264.8

245.9

500.9

457.4

Utility, wind, and related structures

207.0

206.7

414.7

397.3

Storage tanks(1)

—

61.9

—

121.8

Engineered Structures

207.0

268.6

414.7

519.1

Inland barges

72.5

53.8

140.6

100.8

Steel components

40.5

34.5

77.8

61.3

Transportation Products

113.0

88.3

218.4

162.1

Consolidated Total

$

584.8

$

602.8

$

1,134.0

$

1,138.6

Three Months Ended June

30,

Six Months Ended June

30,

Operating profit (loss):

2023

2022

2023

2022

Construction Products

$

34.4

$

28.1

$

83.9

$

44.8

Engineered Structures(1)

21.7

41.5

51.6

69.8

Transportation Products

11.6

3.5

21.7

6.2

Segment Totals before Corporate

Expenses

67.7

73.1

157.2

120.8

Corporate

(16.7

)

(15.9

)

(31.1

)

(28.9

)

Consolidated Total

$

51.0

$

57.2

$

126.1

$

91.9

Backlog:

June 30, 2023

June 30, 2022

Engineered Structures:

Utility, wind, and related structures

$

1,507.4

$

410.1

Transportation Products:

Inland barges

$

287.1

$

131.8

(1) On October 3, 2022, the Company sold

the storage tanks business. We have recognized a total gain on the

sale of $195.4 million, of which, $189.0 million was recognized in

the fourth quarter of 2022 and $6.4 million was recognized in the

first quarter of 2023. See Reconciliation of Historical Adjusted

EBITDA for the Storage Tanks Business table for the contribution of

the storage tanks business to operating profit, included above, for

the three and six months ended June 30, 2022.

Arcosa, Inc.

Condensed Consolidated Balance

Sheets

(in millions)

(unaudited)

June 30, 2023

December 31, 2022

Current assets:

Cash and cash equivalents

$

197.9

$

160.4

Receivables, net of allowance

386.5

334.2

Inventories

354.6

315.8

Other

36.1

46.4

Total current assets

975.1

856.8

Property, plant, and equipment, net

1,233.2

1,199.6

Goodwill

966.7

958.5

Intangibles, net

251.9

256.1

Deferred income taxes

9.7

9.6

Other assets

59.0

60.0

$

3,495.6

$

3,340.6

Current liabilities:

Accounts payable

$

238.7

$

190.7

Accrued liabilities

126.0

121.8

Advance billings

40.0

40.5

Current portion of long-term debt

16.1

14.7

Total current liabilities

420.8

367.7

Debt

530.5

535.9

Deferred income taxes

192.2

175.6

Other liabilities

74.8

77.0

1,218.3

1,156.2

Stockholders' equity:

Common stock

0.5

0.5

Capital in excess of par value

1,685.6

1,684.1

Retained earnings

607.3

515.5

Accumulated other comprehensive loss

(16.1

)

(15.7

)

2,277.3

2,184.4

$

3,495.6

$

3,340.6

Arcosa, Inc.

Consolidated Statements of Cash

Flows

(in millions)

(unaudited)

Six Months Ended June

30,

2023

2022

Operating activities:

Net income

$

96.6

$

59.2

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion, and

amortization

78.3

77.3

Stock-based compensation expense

12.6

10.1

Provision for deferred income taxes

12.9

12.3

Gains on disposition of property, plant,

equipment, and other assets

(23.2

)

(4.8

)

Gain on sale of storage tanks business

(6.4

)

—

(Increase) decrease in other assets

(0.3

)

2.9

Increase (decrease) in other

liabilities

(3.4

)

(16.4

)

Other

2.2

1.0

Changes in current assets and

liabilities:

(Increase) decrease in receivables

(30.7

)

(75.0

)

(Increase) decrease in inventories

(34.6

)

(17.4

)

(Increase) decrease in other current

assets

10.3

7.6

Increase (decrease) in accounts

payable

43.4

55.3

Increase (decrease) in advance

billings

4.0

(4.6

)

Increase (decrease) in accrued

liabilities

(6.8

)

3.7

Net cash provided by operating

activities

154.9

111.2

Investing activities:

Proceeds from disposition of property,

plant, equipment, and other assets

24.4

29.2

Proceeds from sale of storage tanks

business

2.0

—

Capital expenditures

(96.9

)

(52.9

)

Acquisitions, net of cash acquired

(15.6

)

(75.0

)

Net cash required by investing

activities

(86.1

)

(98.7

)

Financing activities:

Payments to retire debt

(5.4

)

(56.3

)

Proceeds from issuance of debt

—

80.0

Shares repurchased

—

(15.0

)

Dividends paid to common stockholders

(4.8

)

(5.0

)

Purchase of shares to satisfy employee tax

on vested stock

(11.1

)

(9.7

)

Holdback payment from acquisition

(10.0

)

—

Net cash required by financing

activities

(31.3

)

(6.0

)

Net increase (decrease) in cash and cash

equivalents

37.5

6.5

Cash and cash equivalents at beginning of

period

160.4

72.9

Cash and cash equivalents at end of

period

$

197.9

$

79.4

Arcosa, Inc.

Reconciliation of Adjusted Net Income

and Adjusted Diluted EPS

(unaudited)

GAAP does not define “Adjusted Net Income”

and it should not be considered as an alternative to earnings

measures defined by GAAP, including net income. We use this metric

to assess the operating performance of our consolidated business.

We adjust net income for certain items that are not reflective of

the normal operations of our business to provide investors with

what we believe is a more consistent comparison of earnings

performance from period to period.

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(in millions)

Net Income

$

40.9

$

39.0

$

96.6

$

59.2

Gain on sale of storage tanks business,

net of tax

—

—

(4.5

)

—

Impact of acquisition and

divestiture-related expenses, net of tax(1)

0.2

1.9

0.7

2.6

Benefit from reduction in holdback

obligation, net of tax

(3.8

)

—

(3.8

)

—

Adjusted Net Income

$

37.3

$

40.9

$

89.0

$

61.8

GAAP does not define “Adjusted Diluted

EPS” and it should not be considered as an alternative to earnings

measures defined by GAAP, including diluted EPS. We use this metric

to assess the operating performance of our consolidated business.

We adjust diluted EPS for certain items that are not reflective of

the normal operations of our business to provide investors with

what we believe is a more consistent comparison of earnings

performance from period to period.

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

(in dollars per share)

Diluted EPS

$

0.84

$

0.79

$

1.98

$

1.21

Gain on sale of storage tanks

business

—

—

(0.09

)

—

Impact of acquisition and

divestiture-related expenses(1)

—

0.04

0.01

0.05

Benefit from reduction in holdback

obligation

(0.08

)

—

(0.08

)

—

Adjusted Diluted EPS

$

0.76

$

0.83

$

1.82

$

1.26

(1) Expenses associated with acquisitions

and divestitures, including the cost impact of the fair value

markup of acquired inventory, advisory and professional fees,

integration, separation, and other transaction costs.

Arcosa, Inc.

Reconciliation of Adjusted

EBITDA

($ in millions)

(unaudited)

“EBITDA” is defined as net income plus

interest, taxes, depreciation, depletion, and amortization.

“Adjusted EBITDA” is defined as EBITDA adjusted for certain items

that are not reflective of the normal earnings of our business.

GAAP does not define EBITDA or Adjusted EBITDA and they should not

be considered as alternatives to earnings measures defined by GAAP,

including net income. We use Adjusted EBITDA to assess the

operating performance of our consolidated business, as a metric for

incentive-based compensation, as a measure within our lending

arrangements, and as a basis for strategic planning and forecasting

as we believe that it closely correlates to long-term shareholder

value. As a widely used metric by analysts, investors, and

competitors in our industry, we believe Adjusted EBITDA also

assists investors in comparing a company's performance on a

consistent basis without regard to depreciation, depletion,

amortization, and other items which can vary significantly

depending on many factors. “Adjusted EBITDA Margin” is defined as

Adjusted EBITDA divided by Revenues.

Three Months Ended June

30,

Six Months Ended June

30,

Full Year 2023

Guidance

2023

2022

2023

2022

Low

High

Revenues

$

584.8

$

602.8

$

1,134.0

$

1,138.6

$

2,250.0

$

2,300.0

Net income

40.9

39.0

96.6

59.2

152.9

158.0

Add:

Interest expense, net

5.7

7.7

11.6

14.8

22.0

23.0

Provision for income taxes

5.6

10.1

19.8

16.5

33.6

39.5

Depreciation, depletion, and amortization

expense(1)

39.5

39.5

78.3

77.3

157.0

160.0

EBITDA

91.7

96.3

206.3

167.8

365.5

380.5

Add (less):

Gain on sale of storage tanks business

—

—

(6.4

)

—

(6.4

)

(6.4

)

Impact of acquisition and

divestiture-related expenses(2)

0.3

2.5

0.9

3.4

0.9

0.9

Benefit from reduction in holdback

obligation

(5.0

)

—

(5.0

)

—

(5.0

)

(5.0

)

Other, net (income) expense

(1.2

)

0.4

(1.9

)

1.4

—

—

Adjusted EBITDA(3)

$

85.8

$

99.2

$

193.9

$

172.6

$

355.0

$

370.0

Adjusted EBITDA Margin

14.7

%

16.5

%

17.1

%

15.2

%

15.8

%

16.1

%

(1) Includes the impact of the fair value

markup of acquired long-lived assets, subject to final purchase

price adjustments.

(2) Expenses associated with acquisitions

and divestitures, including the cost impact of the fair value

markup of acquired inventory, advisory and professional fees,

integration, separation, and other transaction costs.

(3) See Reconciliation of Historical

Adjusted EBITDA for the Storage Tanks Business table for the

contribution of the storage tanks business to Adjusted EBITDA,

included above, for the three and six months ended June 30,

2022.

Arcosa, Inc.

Reconciliation of Adjusted Segment

EBITDA

($ in millions)

(unaudited)

“Segment EBITDA” is defined as segment

operating profit plus depreciation, depletion, and amortization.

“Adjusted Segment EBITDA” is defined as Segment EBITDA adjusted for

certain items that are not reflective of the normal earnings of our

business. GAAP does not define Segment EBITDA or Adjusted Segment

EBITDA and they should not be considered as alternatives to

earnings measures defined by GAAP, including segment operating

profit. We use Adjusted Segment EBITDA to assess the operating

performance of our businesses, as a metric for incentive-based

compensation, and as a basis for strategic planning and forecasting

as we believe that it closely correlates to long-term shareholder

value. As a widely used metric by analysts, investors, and

competitors in our industry we believe Adjusted Segment EBITDA also

assists investors in comparing a company's performance on a

consistent basis without regard to depreciation, depletion,

amortization, and other items, which can vary significantly

depending on many factors. “Adjusted Segment EBITDA Margin” is

defined as Adjusted Segment EBITDA divided by Revenues.

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Construction Products

Revenues

$

264.8

$

245.9

$

500.9

$

457.4

Operating Profit

34.4

28.1

83.9

44.8

Add: Depreciation, depletion, and

amortization expense(1)

27.8

26.3

54.7

50.9

Segment EBITDA

62.2

54.4

138.6

95.7

Less: Benefit from reduction in holdback

obligation

(5.0

)

—

(5.0

)

—

Adjusted Segment EBITDA

$

57.2

$

54.4

$

133.6

$

95.7

Adjusted Segment EBITDA Margin

21.6

%

22.1

%

26.7

%

20.9

%

Engineered Structures

Revenues

$

207.0

$

268.6

$

414.7

$

519.1

Operating Profit

21.7

41.5

51.6

69.8

Add: Depreciation and amortization

expense(1)

6.4

8.0

13.0

16.0

Segment EBITDA

28.1

49.5

64.6

85.8

Less: Gain on sale of storage tanks

business

—

—

(6.4

)

—

Adjusted Segment EBITDA(2)

$

28.1

$

49.5

$

58.2

$

85.8

Adjusted Segment EBITDA Margin

13.6

%

18.4

%

14.0

%

16.5

%

Transportation Products

Revenues

$

113.0

$

88.3

$

218.4

$

162.1

Operating Profit

11.6

3.5

21.7

6.2

Add: Depreciation and amortization

expense

4.0

4.0

8.0

7.9

Segment EBITDA

15.6

7.5

29.7

14.1

Adjusted Segment EBITDA

$

15.6

$

7.5

$

29.7

$

14.1

Adjusted Segment EBITDA Margin

13.8

%

8.5

%

13.6

%

8.7

%

Operating Loss - Corporate

$

(16.7

)

$

(15.9

)

$

(31.1

)

$

(28.9

)

Add: Impact of acquisition and

divestiture-related expenses - Corporate(3)

0.3

2.5

0.9

3.4

Add: Corporate depreciation expense

1.3

1.2

2.6

2.5

Adjusted EBITDA

$

85.8

$

99.2

$

193.9

$

172.6

(1) Includes the impact of the fair value

markup of acquired long-lived assets, subject to final purchase

price adjustments.

(2) See Reconciliation of Historical

Adjusted EBITDA for the Storage Tanks Business table for the

contribution of the storage tanks business to Adjusted Segment

EBITDA, included above, for the three and six months ended June 30,

2022.

(3) Expenses associated with acquisitions

and divestitures, including the cost impact of the fair value

markup of acquired inventory, advisory and professional fees,

integration, separation, and other transaction costs.

Arcosa, Inc.

Reconciliation of Freight-Adjusted

Revenues for Construction Products

($ in millions)

(unaudited)

“Freight-Adjusted Revenues” for

Construction Products is defined as segment revenues less freight

and delivery, which are pass-through activities. GAAP does not

define Freight-Adjusted Revenues and they should not be considered

as alternatives to earnings measures defined by GAAP, including

revenues. We use Freight-Adjusted Revenues in the review of our

operating results. We also believe that this presentation is

consistent with our competitors. As a widely used metric by

analysts and investors, this metric assists in comparing a

company's performance on a consistent basis. “Freight-Adjusted

Segment Margin” is defined as Freight-Adjusted Revenues divided by

Adjusted Segment EBITDA.

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Construction Products

Revenues

$

264.8

$

245.9

$

500.9

$

457.4

Less: Freight revenues

27.3

30.5

57.2

60.5

Freight-Adjusted Revenues

$

237.5

$

215.4

443.7

396.9

Adjusted Segment EBITDA(1)

$

57.2

$

54.4

$

133.6

$

95.7

Adjusted Segment EBITDA Margin(1)

21.6

%

22.1

%

26.7

%

20.9

%

Freight-Adjusted Segment EBITDA Margin

24.1

%

25.3

%

30.1

%

24.1

%

(1) See Reconciliation of Adjusted Segment

EBITDA table.

Arcosa, Inc.

Reconciliation of Free Cash Flow and

Net Debt to Adjusted EBITDA

($ in millions)

(unaudited)

GAAP does not define “Free Cash Flow” and

it should not be considered as an alternative to cash flow measures

defined by GAAP, including cash flow from operating activities. We

define Free Cash Flow as cash provided by operating activities less

capital expenditures net of the proceeds from the disposition of

property, plant, equipment, and other assets. The Company also uses

“Free Cash Flow Conversion”, which we define as Free Cash Flow

divided by net income. We use these metrics to assess the liquidity

of our consolidated business. We present these metrics for the

convenience of investors who use such metrics in their analysis and

for shareholders who need to understand the metrics we use to

assess performance and monitor our cash and liquidity

positions.

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Cash Provided by Operating Activities

$

127.6

$

86.7

$

154.9

$

111.2

Capital expenditures

(52.5

)

(27.0

)

(96.9

)

(52.9

)

Proceeds from disposition of property,

plant, equipment, and other assets

0.5

8.6

24.4

29.2

Free Cash Flow

$

75.6

$

68.3

$

82.4

$

87.5

Net income

$

40.9

$

39.0

$

96.6

$

59.2

Free Cash Flow Conversion

185

%

175

%

85

%

148

%

GAAP does not define “Net Debt” and it

should not be considered as an alternative to cash flow or

liquidity measures defined by GAAP. The Company uses Net Debt,

which it defines as total debt minus cash and cash equivalents to

determine the extent to which the Company’s outstanding debt

obligations would be satisfied by its cash and cash equivalents on

hand. The Company also uses “Net Debt to Adjusted EBITDA”, which it

defines as Net Debt divided by Adjusted EBITDA for the trailing

twelve months as a metric of its current leverage position. We

present this metric for the convenience of investors who use such

metrics in their analysis and for shareholders who need to

understand the metrics we use to assess performance and monitor our

cash and liquidity positions.

June 30, 2023

Total debt excluding debt issuance

costs

$

551.4

Cash and cash equivalents

197.9

Net Debt

$

353.5

Adjusted EBITDA (trailing twelve

months)

$

346.4

Net Debt to Adjusted EBITDA

1.0

Arcosa, Inc.

Reconciliation of Historical Adjusted EBITDA for the Storage

Tanks Business

(in millions)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2022

2022

Storage tanks business:

Operating Profit

$

13.9

$

24.2

Add: Depreciation and amortization

expense

1.9

3.6

Storage tanks EBITDA

15.8

27.8

Storage tanks Adjusted EBITDA

$

15.8

$

27.8

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803368466/en/

INVESTOR CONTACTS

Gail M. Peck Chief Financial Officer

Erin Drabek Director of Investor Relations

T 972.942.6500 InvestorResources@arcosa.com

David Gold ADVISIRY Partners T 212.661.2220

David.Gold@advisiry.com

MEDIA CONTACT Media@arcosa.com

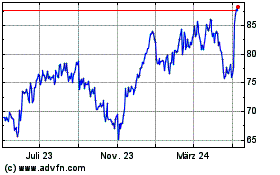

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

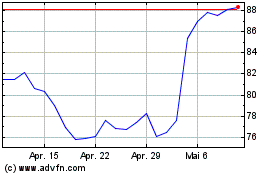

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Feb 2024 bis Feb 2025