Ares Acquisition Corp. Announces the Separate Trading of its Class A Ordinary Shares & Warrants Commencing March 25, 2021

25 März 2021 - 11:00AM

Business Wire

Ares Acquisition Corporation (NYSE: AAC.U) (the “Company”)

announced today that, commencing March 25, 2021, holders of the

units sold in the Company’s initial public offering of 100,000,000

units, completed on February 4, 2021, may elect to separately trade

the Class A ordinary shares and warrants included in the units.

Those units not separated will continue to trade on the New York

Stock Exchange (“NYSE”) under the symbol “AAC.U,” and the Class A

ordinary shares and warrants that are separated will trade on the

NYSE under the symbols “AAC” and “AAC WS,” respectively. Holders of

units will need to have their brokers contact Continental Stock

Transfer & Trust Company, the Company’s transfer agent, in

order to separate the units into Class A ordinary shares and

warrants.

The units were initially offered by the Company in an

underwritten offering. UBS Investment Bank and Citigroup acted as

book-runners and representatives of the underwriters for this

offering. Morgan Stanley and Barclays acted as book-runners, and

CastleOak acted as co-manager. A registration statement relating to

the units and the underlying securities was declared effective by

the Securities and Exchange Commission (the “SEC”) on February 1,

2021.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities of the Company, nor

shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. The offering was

made only by means of a prospectus. Copies of the final prospectus

related to the offering may be obtained from: UBS Securities LLC,

Attention: Prospectus Department, 1285 Avenue of the Americas, New

York, New York 10019, Telephone: (888) 827-7275 or email:

ol-prospectusrequest@ubs.com; and Citigroup Global Markets Inc.,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, Telephone: (800) 831-9146.

About Ares Acquisition Corporation

Ares Acquisition Corporation (“AAC”) is a special purpose

acquisition company sponsored by a subsidiary of Ares Management

Corporation (NYSE: ARES) (“Ares”), a leading global alternative

investment manager. Having completed a $1 billion initial public

offering in February 2021, AAC seeks to effect a merger, share

exchange, asset acquisition, share purchase, reorganization or

similar business combination and is expected to benefit from its

affiliation with Ares through access to corporate relationships,

industry sector expertise and value creation capabilities. For more

information, please visit: www.AresAcquisitionCorporation.com.

Cautionary Note Concerning Forward-Looking Statements

This press release contains statements that constitute

“forward-looking statements,” including with respect to the

anticipated use of the net proceeds. No assurance can be given that

the net proceeds of the offering will be used as indicated.

Forward-looking statements are subject to numerous conditions, many

of which are beyond the control of the Company, including those set

forth in the Risk Factors section of the Company’s registration

statement and prospectus for the Company’s offering filed with the

Securities and Exchange Commission (“SEC”). Copies are available on

the SEC’s website, www.sec.gov. The Company undertakes no

obligation to update these statements for revisions or changes

after the date of this release, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210325005295/en/

Mendel Communications Bill Mendel, 212-397-1030

bill@mendelcommunications.com

Ares Management Corporation

Carl Drake, 888-818-5298 cdrake@aresmgmt.com or Priscila Roney,

212-808-1185 proney@aresmgmt.com

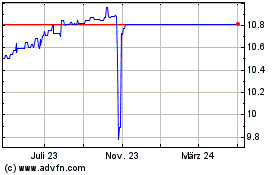

Ares Acquisition (NYSE:AAC.U)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Ares Acquisition (NYSE:AAC.U)

Historical Stock Chart

Von Dez 2023 bis Dez 2024