Alcoa enters into Scheme Implementation Deed

with Alumina Limited on terms consistent with previously agreed and

announced Process Deed

Both Alcoa and Alumina Limited Boards of

Directors recommend that its shareholders vote in favor of the

transaction

Expected to result in long-term value creation

for both companies’ shareholders

Alcoa (NYSE: AA or “Alcoa”) today announced that it has entered

into a binding Scheme Implementation Deed (the “Agreement”) with

Alumina Limited (ASX: AWC), under which Alcoa will acquire Alumina

Limited in an all-scrip, or all-stock, transaction. The Agreement

terms are consistent with the previously agreed and announced

transaction process deed (“Process Deed”).

Consistent with the Process Deed, the Alumina Limited Board of

Directors has recommended that Alumina Limited shareholders vote in

favor of the Agreement in the absence of a superior proposal and

subject to an independent expert concluding (and continuing to

conclude) that the transaction is in the best interests of Alumina

Limited shareholders. The Independent Directors of Alumina Limited,

and its Managing Director and Chief Executive Officer intend to

vote all shares of Alumina Limited held or controlled by them in

favor of the Agreement.

“Entering into the Scheme Implementation Deed to acquire Alumina

Limited is a milestone on our path to deliver value for both Alcoa

and Alumina shareholders,” said William F. Oplinger, Alcoa’s

President and CEO. “This transaction provides enhanced

opportunities for value creation, including strengthening Alcoa’s

position as one of the world’s largest bauxite and alumina

producers and providing Alumina Limited shareholders the

opportunity to participate in a stronger, better-capitalized

combined company with upside potential. We look forward to building

on Alcoa’s success and continuing to execute our long-term

strategy.”

Agreement Details

The terms of the Agreement are consistent with the Process Deed.

Accordingly, under the Agreement, Alumina Limited shareholders

would receive consideration of 0.02854 Alcoa shares for each

Alumina Limited share (the “Agreed Ratio”). Upon completion of the

transaction, Alumina Limited shareholders would own 31.25 percent,

and Alcoa shareholders would own 68.75 percent of the combined

company.1 Based on Alcoa’s closing share price as of February 23,

2024, the last trading day prior to the announcement of the Process

Deed, the Agreed Ratio implies a value of A$1.15 per Alumina

Limited share and an equity value of approximately $2.2 billion for

Alumina Limited. 2

As part of the Agreement, interests in Alcoa shares would be

delivered in the form of CHESS Depositary Interests (“CDIs”) that

represent a unit of beneficial ownership in a share of Alcoa common

stock 3, which would allow Alumina Limited shareholders to trade

Alcoa common stock via CDIs on the Australian Stock Exchange

(“ASX”). In order to allow the trading of Alcoa CDIs, Alcoa will

apply to establish a secondary listing on the Australian Securities

Exchange. Alcoa has committed to maintain the CDI listing for at

least 10 years.

In addition, two new mutually agreed upon Australian directors

from Alumina Limited’s Board would be appointed to Alcoa’s Board of

Directors upon closing of the transaction.

Under the terms of the Agreement and at Alumina's request, Alcoa

has agreed to provide short-term liquidity support to Alumina

Limited to fund equity calls made by the AWAC joint venture if

Alumina Limited’s net debt position exceeds $420 million. Based on

AWAC's current 2024 cashflow forecast, Alcoa does not expect any

support to be required in the 2024 calendar year. Subject to

certain accelerated repayment triggers, Alumina Limited would be

required to pay its equity calls (plus accrued interest) not later

than September 1, 2025 in the event the transaction is not

completed.

Allan Gray Australia, currently the largest substantial holder

in Alumina Limited, has confirmed it continues to be supportive of

the proposed transaction.

Transaction Timing &

Conditions

The transaction is expected to be completed in the third quarter

2024, subject to the satisfaction of customary conditions as well

as approval by both companies’ shareholders and receipt of required

regulatory approvals. The required regulatory approvals include

approvals from Australia’s Foreign Investment Review Board and from

the antitrust regulators in Australia and Brazil. The transaction

is not conditional on due diligence or financing.

Transaction Website

Associated materials regarding the transaction will be available

on the investor relations section of Alcoa’s website at

www.alcoa.com as well as a transaction website at

www.strongawacfuture.com.

Advisors

J.P. Morgan Securities LLC and UBS Investment Bank are acting as

financial advisors to Alcoa, and Ashurst and Davis Polk &

Wardwell LLP are acting as its legal counsel.

About Alcoa Corporation

Alcoa (NYSE: AA) is a global industry leader in bauxite, alumina

and aluminum products with a vision to reinvent the aluminum

industry for a sustainable future. With a values-based approach

that encompasses integrity, operating excellence, care for people

and courageous leadership, our purpose is to Turn Raw Potential

into Real Progress. Since developing the process that made aluminum

an affordable and vital part of modern life, our talented Alcoans

have developed breakthrough innovations and best practices that

have led to greater efficiency, safety, sustainability and stronger

communities wherever we operate.

Dissemination of Company Information

Alcoa intends to make future announcements regarding company

developments and financial performance through its website,

www.alcoa.com, as well as through press releases, filings with the

Securities and Exchange Commission, conference calls and webcasts.

The Company does not incorporate the information contained on, or

accessible through, its corporate website into this press

release.

Forward-Looking Statements

This communication contains statements that relate to future

events and expectations and as such constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,”

“expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,”

“potential,” “plans,” “projects,” “reach,” “seeks,” “sees,”

“should,” “strive,” “targets,” “will,” “working,” “would,” or other

words of similar meaning. All statements by Alcoa Corporation

(“Alcoa”) that reflect expectations, assumptions or projections

about the future, other than statements of historical fact, are

forward-looking statements, including, without limitation,

statements regarding the proposed transaction; the ability of the

parties to complete the proposed transaction; the expected benefits

of the proposed transaction; the competitive ability and position

following completion of the proposed transaction; forecasts

concerning global demand growth for bauxite, alumina, and aluminum,

and supply/demand balances; statements, projections or forecasts of

future or targeted financial results, or operating performance

(including our ability to execute on strategies related to

environmental, social and governance matters); statements about

strategies, outlook, and business and financial prospects; and

statements about capital allocation and return of capital. These

statements reflect beliefs and assumptions that are based on

Alcoa’s perception of historical trends, current conditions, and

expected future developments, as well as other factors that

management believes are appropriate in the circumstances.

Forward-looking statements are not guarantees of future performance

and are subject to known and unknown risks, uncertainties, and

changes in circumstances that are difficult to predict. Although

Alcoa believes that the expectations reflected in any

forward-looking statements are based on reasonable assumptions, it

can give no assurance that these expectations will be attained and

it is possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks and uncertainties. Such risks and uncertainties include, but

are not limited to: (1) the non-satisfaction or non-waiver, on a

timely basis or otherwise, of one or more closing conditions to the

proposed transaction; (2) the prohibition or delay of the

consummation of the proposed transaction by a governmental entity;

(3) the risk that the proposed transaction may not be completed in

the expected time frame or at all; (4) unexpected costs, charges or

expenses resulting from the proposed transaction; (5) uncertainty

of the expected financial performance following completion of the

proposed transaction; (6) failure to realize the anticipated

benefits of the proposed transaction; (7) the occurrence of any

event that could give rise to termination of the proposed

transaction; (8) potential litigation in connection with the

proposed transaction or other settlements or investigations that

may affect the timing or occurrence of the contemplated transaction

or result in significant costs of defense, indemnification and

liability; (9) the impact of global economic conditions on the

aluminum industry and aluminum end-use markets; (10) volatility and

declines in aluminum and alumina demand and pricing, including

global, regional, and product-specific prices, or significant

changes in production costs which are linked to LME or other

commodities; (11) the disruption of market-driven balancing of

global aluminum supply and demand by non-market forces; (12)

competitive and complex conditions in global markets; (13) our

ability to obtain, maintain, or renew permits or approvals

necessary for our mining operations; (14) rising energy costs and

interruptions or uncertainty in energy supplies; (15) unfavorable

changes in the cost, quality, or availability of raw materials or

other key inputs, or by disruptions in the supply chain; (16) our

ability to execute on our strategy to be a lower cost, competitive,

and integrated aluminum production business and to realize the

anticipated benefits from announced plans, programs, initiatives

relating to our portfolio, capital investments, and developing

technologies; (17) our ability to integrate and achieve intended

results from joint ventures, other strategic alliances, and

strategic business transactions; (18) economic, political, and

social conditions, including the impact of trade policies and

adverse industry publicity; (19) fluctuations in foreign currency

exchange rates and interest rates, inflation and other economic

factors in the countries in which we operate; (20) changes in tax

laws or exposure to additional tax liabilities; (21) global

competition within and beyond the aluminum industry; (22) our

ability to obtain or maintain adequate insurance coverage; (23)

disruptions in the global economy caused by ongoing regional

conflicts; (24) legal proceedings, investigations, or changes in

foreign and/or U.S. federal, state, or local laws, regulations, or

policies; (25) climate change, climate change legislation or

regulations, and efforts to reduce emissions and build operational

resilience to extreme weather conditions; (26) our ability to

achieve our strategies or expectations relating to environmental,

social, and governance considerations; (27) claims, costs and

liabilities related to health, safety, and environmental laws,

regulations, and other requirements, in the jurisdictions in which

we operate; (28) liabilities resulting from impoundment structures,

which could impact the environment or cause exposure to hazardous

substances or other damage; (29) our ability to fund capital

expenditures; (30) deterioration in our credit profile or increases

in interest rates; (31) restrictions on our current and future

operations due to our indebtedness; (32) our ability to continue to

return capital to our stockholders through the payment of cash

dividends and/or the repurchase of our common stock; (33) cyber

attacks, security breaches, system failures, software or

application vulnerabilities, or other cyber incidents; (34) labor

market conditions, union disputes and other employee relations

issues; (35) a decline in the liability discount rate or

lower-than-expected investment returns on pension assets; and (36)

the other risk factors discussed in Part I Item 1A of Alcoa’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and other reports filed by Alcoa with the SEC. These risks, as

well as other risks associated with the proposed transaction, will

be more fully discussed in the proxy statement. Alcoa cautions

readers not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. Alcoa

disclaims any obligation to update publicly any forward-looking

statements, whether in response to new information, future events

or otherwise, except as required by applicable law. Market

projections are subject to the risks described above and other

risks in the market. Neither Alcoa nor any other person assumes

responsibility for the accuracy and completeness of any of these

forward-looking statements and none of the information contained

herein should be regarded as a representation that the

forward-looking statements contained herein will be achieved.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell

or the solicitation of an offer to buy or sell any securities. This

communication relates to the proposed transaction. In connection

with the proposed transaction, Alcoa plans to file with the SEC a

proxy statement on Schedule 14A (the “Proxy Statement”). This

communication is not a substitute for the Proxy Statement or any

other document that Alcoa may file with the SEC and send to its

stockholders in connection with the proposed transaction. The

issuance of the stock consideration in the proposed transaction

will be submitted to Alcoa’s stockholders for their consideration.

The Proxy Statement will contain important information about Alcoa,

the proposed transaction and related matters. Before making any

voting decision, Alcoa’s stockholders should read all relevant

documents filed or to be filed with the SEC completely and in their

entirety, including the Proxy Statement, as well as any amendments

or supplements to those documents, when they become available,

because they will contain important information about Alcoa and the

proposed transaction. Alcoa’s stockholders will be able to obtain a

free copy of the Proxy Statement, as well as other filings

containing information about Alcoa, free of charge, at the SEC’s

website (www.sec.gov). Copies of the Proxy Statement and other

documents filed by Alcoa with the SEC may be obtained, without

charge, by contacting Alcoa through its website at

https://investors.alcoa.com/.

Participants in the Solicitation

Alcoa, its directors, executive officers and other persons

related to Alcoa may be deemed to be participants in the

solicitation of proxies from Alcoa’s stockholders in connection

with the proposed transaction. Information about the directors and

executive officers of Alcoa and their ownership of common stock of

Alcoa is set forth in the section entitled “Information about our

Executive Officers” included in Alcoa’s annual report on Form 10-K

for the fiscal year ended December 31, 2023, which was filed with

the SEC on February 21, 2024 (and which is available at

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1675149/000095017024018069/aa-20231231.htm),

and in the sections entitled “Director Nominees” and “Stock

Ownership of Directors and Executive Officers” included in its

proxy statement for its 2023 annual meeting of stockholders, which

was filed with the SEC on March 16, 2023 (and which is available at

https://www.sec.gov/Archives/edgar/data/1675149/000119312523072587/d427643ddef14a.htm).

Additional information regarding the persons who may, under the

rules of the SEC, be deemed participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, will be included in the Proxy

Statement and other relevant materials to be filed with the SEC in

connection with the proposed transaction when they become

available. Free copies of these documents may be obtained as

described in the preceding paragraph.

1 Based on fully diluted shares outstanding for Alcoa and

Alumina Limited as of February 23, 2024. 2 Based on the prevailing

AUD / USD exchange rate of 0.656 as of February 23, 2024. 3 Each

Clearing House Electronic Sub-register System Depositary Interest

represents a unit of beneficial ownership in a share of Alcoa

common stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240311270242/en/

Investor Contact: James Dwyer James.Dwyer@alcoa.com

Media Contact: Jim Beck James.Beck@alcoa.com Additional

Media Contacts Australia Citadel MAGNUS Paul Ryan +61

409 296 511 pryan@citadelmagnus.com United States Joele

Frank, Wilkinson Brimmer Katcher Sharon Stern / Kaitlin Kikalo /

Lyle Weston Alcoa-jf@joelefrank.com

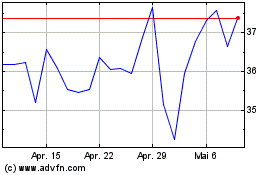

Alcoa (NYSE:AA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

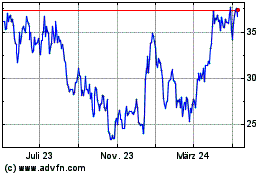

Alcoa (NYSE:AA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024