0001090872false00010908722024-01-052024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 5, 2024

AGILENT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | | | 001-15405 | | | | 77-0518772 | |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

5301 Stevens Creek Boulevard, Santa Clara, CA 95051

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code (800) 227-9770

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TITLE OF EACH CLASS | | | TRADING SYMBOL(S) | | NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| COMMON STOCK, $0.01 PAR VALUE | | | | A | | | | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On December 20, 2023, we issued a press release announcing that we had moved our Cell Analysis Division into the Diagnostics and Genomics Group (DGG) business segment from the Life Sciences and Applied Markets Group (LSAG) business segment to further strengthen growth opportunities for both organizations. Following this reorganization, we will continue to have three business segments (LSAG, DGG and Agilent CrossLab), each of which will continue to comprise a reportable segment.

We are furnishing this Current Report on Form 8-K to present selected segment information that reflect changes in our reportable segments related to the changes in our organizational structure. Beginning with the quarter ending January 31, 2024, our financial statements will reflect the new reporting structure with prior periods recast accordingly.

The information contained in this report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Section 18. Furthermore, the information contained in this report shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended:

| | | | | | | | | | | | | | | | | |

| Exhibit No. | | Description | | | |

| | Selected segment information for the fiscal quarters ended January 31, 2021, 2022 and 2023, April 30, 2021, 2022 and 2023, July 31, 2021, 2022 and 2023 and October 31, 2021, 2022 and 2023 and fiscal years ended October 31, 2021, 2022 and 2023.

|

| 104 | | | Cover page interactive data file (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AGILENT TECHNOLOGIES, INC. |

| | |

| | |

| | By: | /s/ P. Diana Chiu |

| | Name: | P. Diana Chiu |

| | Title: | Vice President, Interim General Counsel

and Secretary |

| | | |

| | |

| | |

| Date: January 5, 2024 | |

| | | | | | | | | | | | | | | | | | | | |

| AGILENT TECHNOLOGIES, INC. |

| LIFE SCIENCES AND APPLIED MARKETS SEGMENT |

| (Unaudited) |

|

| All periods below were recast to reflect the movement of the Cell Analysis division to our Diagnostics and Genomics business segment from our Life Sciences and Applied Markets business segment. |

| | | | | | |

| (In millions, except margins data) | FY23 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 943 | | $ | 874 | | $ | 854 | | $ | 839 | | $ | 3,510 | |

| Gross margin % | 61.5 | % | 59.8 | % | 60.1 | % | 59.5 | % | 60.3 | % |

| Research and development expenses | $ | 67 | | $ | 69 | | $ | 62 | | $ | 64 | | $ | 262 | |

| Selling, general and administrative expenses | $ | 213 | | $ | 210 | | $ | 186 | | $ | 196 | | $ | 805 | |

| Income from operations | $ | 300 | | $ | 244 | | $ | 265 | | $ | 240 | | $ | 1,049 | |

| Operating margin % | 31.8 | % | 27.9 | % | 31.0 | % | 28.6 | % | 29.9 | % |

| | | | | | |

| | | | | | |

| | FY22 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 900 | | $ | 799 | | $ | 921 | | $ | 1,010 | | $ | 3,630 | |

| Gross margin % | 60.5 | % | 58.9 | % | 60.4 | % | 60.6 | % | 60.1 | % |

| Research and development expenses | $ | 66 | | $ | 63 | | $ | 64 | | $ | 64 | | $ | 257 | |

| Selling, general and administrative expenses | $ | 207 | | $ | 204 | | $ | 207 | | $ | 211 | | $ | 829 | |

| Income from operations | $ | 271 | | $ | 204 | | $ | 285 | | $ | 337 | | $ | 1,097 | |

| Operating margin % | 30.1 | % | 25.5 | % | 31.0 | % | 33.3 | % | 30.2 | % |

| | | | | | |

| | | | | | |

| | FY21 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 835 | | $ | 797 | | $ | 811 | | $ | 861 | | $ | 3,304 | |

| Gross margin % | 60.0 | % | 59.5 | % | 60.1 | % | 59.3 | % | 59.7 | % |

| Research and development expenses | $ | 59 | | $ | 62 | | $ | 60 | | $ | 63 | | $ | 244 | |

| Selling, general and administrative expenses | $ | 202 | | $ | 209 | | $ | 203 | | $ | 206 | | $ | 820 | |

| Income from operations | $ | 240 | | $ | 203 | | $ | 224 | | $ | 242 | | $ | 909 | |

| Operating margin % | 28.7 | % | 25.5 | % | 27.7 | % | 28.1 | % | 27.5 | % |

| | | | | | |

Income from operations reflect the results of our reportable segments under Agilent's management reporting system which are not necessarily in conformity with GAAP financial measures. Income from operations of our reporting segments exclude, among other things, charges related to restructuring and other related costs, asset impairments, amortization of intangibles, transformational initiatives, acquisition and integration costs, business exit and divestiture costs, special compliance costs and change in fair value of contingent consideration.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

| | | | | | | | | | | | | | | | | | | | |

| AGILENT TECHNOLOGIES, INC. |

| DIAGNOSTICS AND GENOMICS SEGMENT |

| (Unaudited) |

|

| All periods below were recast to reflect the movement of the Cell Analysis division to our Diagnostics and Genomics business segment from our Life Sciences and Applied Markets business segment. |

| | | | | | |

| (In millions, except margins data) | FY23 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 432 | | $ | 456 | | $ | 422 | | $ | 445 | | $ | 1,755 | |

| Gross margin % | 52.6 | % | 53.7 | % | 53.5 | % | 53.7 | % | 53.4 | % |

| Research and development expenses | $ | 47 | | $ | 48 | | $ | 38 | | $ | 44 | | $ | 177 | |

| Selling, general and administrative expenses | $ | 107 | | $ | 104 | | $ | 92 | | $ | 94 | | $ | 397 | |

| Income from operations | $ | 73 | | $ | 93 | | $ | 96 | | $ | 101 | | $ | 363 | |

| Operating margin % | 16.9 | % | 20.5 | % | 22.7 | % | 22.7 | % | 20.7 | % |

| | | | | | |

| | | | | | |

| | FY22 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 415 | | $ | 455 | | $ | 438 | | $ | 458 | | $ | 1,766 | |

| Gross margin % | 54.2 | % | 56.7 | % | 55.8 | % | 53.1 | % | 55.0 | % |

| Research and development expenses | $ | 42 | | $ | 44 | | $ | 43 | | $ | 45 | | $ | 174 | |

| Selling, general and administrative expenses | $ | 104 | | $ | 99 | | $ | 103 | | $ | 101 | | $ | 407 | |

| Income from operations | $ | 79 | | $ | 115 | | $ | 99 | | $ | 97 | | $ | 390 | |

| Operating margin % | 19.0 | % | 25.4 | % | 22.6 | % | 21.2 | % | 22.1 | % |

| | | | | | |

| | | | | | |

| | FY21 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 382 | | $ | 399 | | $ | 432 | | $ | 442 | | $ | 1,655 | |

| Gross margin % | 54.4 | % | 55.7 | % | 55.5 | % | 55.4 | % | 55.3 | % |

| Research and development expenses | $ | 35 | | $ | 37 | | $ | 40 | | $ | 44 | | $ | 156 | |

| Selling, general and administrative expenses | $ | 93 | | $ | 93 | | $ | 96 | | $ | 96 | | $ | 378 | |

| Income from operations | $ | 80 | | $ | 92 | | $ | 104 | | $ | 105 | | $ | 381 | |

| Operating margin % | 20.8 | % | 23.1 | % | 24.1 | % | 23.8 | % | 23.0 | % |

| | | | | | |

Income from operations reflect the results of our reportable segments under Agilent's management reporting system which are not necessarily in conformity with GAAP financial measures. Income from operations of our reporting segments exclude, among other things, charges related to restructuring and other related costs, asset impairments, amortization of intangibles, transformational initiatives, acquisition and integration costs, business exit and divestiture costs, special compliance costs and change in fair value of contingent consideration.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

| | | | | | | | | | | | | | | | | | | | |

| AGILENT TECHNOLOGIES, INC. |

| AGILENT CROSSLAB SEGMENT |

| (Unaudited) |

|

| No change. Included to show our business segments structure in its entirety. |

| | | | | | |

| (In millions, except margins data) | FY23 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 381 | | $ | 387 | | $ | 396 | | $ | 404 | | $ | 1,568 | |

| Gross margin % | 48.5 | % | 47.0 | % | 50.9 | % | 50.4 | % | 49.3 | % |

| Research and development expenses | $ | 9 | | $ | 8 | | $ | 8 | | $ | 8 | | $ | 33 | |

| Selling, general and administrative expenses | $ | 73 | | $ | 71 | | $ | 65 | | $ | 67 | | $ | 276 | |

| Income from operations | $ | 103 | | $ | 103 | | $ | 129 | | $ | 128 | | $ | 463 | |

| Operating margin % | 27.0 | % | 26.6 | % | 32.7 | % | 31.7 | % | 29.5 | % |

| | | | | | |

| | | | | | |

| | FY22 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 359 | | $ | 353 | | $ | 359 | | $ | 381 | | $ | 1,452 | |

| Gross margin % | 47.5 | % | 47.1 | % | 47.0 | % | 48.6 | % | 47.6 | % |

| Research and development expenses | $ | 8 | | $ | 7 | | $ | 8 | | $ | 9 | | $ | 32 | |

| Selling, general and administrative expenses | $ | 72 | | $ | 72 | | $ | 72 | | $ | 72 | | $ | 288 | |

| Income from operations | $ | 91 | | $ | 87 | | $ | 88 | | $ | 104 | | $ | 370 | |

| Operating margin % | 25.2 | % | 24.6 | % | 24.6 | % | 27.4 | % | 25.5 | % |

| | | | | | |

| | | | | | |

| | FY21 |

| | Q1 | Q2 | Q3 | Q4 | Total |

| | | | | | |

| Revenue | $ | 331 | | $ | 329 | | $ | 343 | | $ | 357 | | $ | 1,360 | |

| Gross margin % | 46.8 | % | 45.3 | % | 46.6 | % | 48.3 | % | 46.8 | % |

| Research and development expenses | $ | 9 | | $ | 8 | | $ | 9 | | $ | 8 | | $ | 34 | |

| Selling, general and administrative expenses | $ | 70 | | $ | 72 | | $ | 67 | | $ | 70 | | $ | 279 | |

| Income from operations | $ | 76 | | $ | 69 | | $ | 84 | | $ | 94 | | $ | 323 | |

| Operating margin % | 23.1 | % | 21.0 | % | 24.4 | % | 26.3 | % | 23.8 | % |

| | | | | | |

Income from operations reflect the results of our reportable segments under Agilent's management reporting system which are not necessarily in conformity with GAAP financial measures. Income from operations of our reporting segments exclude, among other things, charges related to restructuring and other related costs, asset impairments, amortization of intangibles, transformational initiatives, acquisition and integration costs, business exit and divestiture costs, special compliance costs and change in fair value of contingent consideration.

Readers are reminded that non-GAAP numbers are merely a supplement to, and not a replacement for, GAAP financial measures. They should be read in conjunction with the GAAP financial measures. It should be noted as well that our non-GAAP information may be different from the non-GAAP information provided by other companies.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

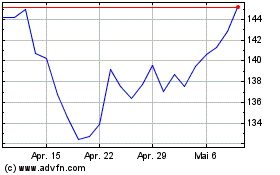

Agilent Technologies (NYSE:A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Agilent Technologies (NYSE:A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024