0001157647

false

0001157647

2023-10-24

2023-10-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 24, 2023

WESTERN NEW ENGLAND BANCORP, INC.

(Exact name of registrant as specified in its charter)

| |

Massachusetts |

|

001-16767 |

|

73-1627673 |

|

| |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

| |

|

|

|

|

|

|

| 141 Elm Street |

|

| Westfield, Massachusetts |

01085 |

| (Address of principal executive offices) |

(zip code) |

| |

|

|

|

|

|

|

|

Registrant's telephone number, including area code:

(413) 568-1911

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

WNEB |

NASDAQ |

Indicate by check mark whether the Registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On October

24, 2023, Western New England Bancorp, Inc. (the “Company”) issued a press release announcing its financial results for the

quarter and nine months ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby

incorporated by reference into this Item 2.02.

| Item 7.01. | Regulation FD Disclosure. |

On October 24, 2023, the Company

made available an investor presentation to be used during investor meetings. The slide show for the investor presentation is attached

to this report as Exhibit 99.2.

The information

contained in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor will such information or exhibits be deemed incorporated by reference into any filing made by the

Company under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof and regardless

of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

The furnishing of the information included in Item 7.01 of this Current Report on Form 8-K shall

not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation

FD.

| Item 9.01. | Financial Statements and Exhibits. |

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

The exhibits required by this item are set forth on the Exhibit Index

attached hereto.

|

Exhibit

Number |

|

Description |

| |

|

|

| 99.1 |

|

Press Release of Western New England Bancorp, Inc. dated October 24, 2023. |

| 99.2 |

|

Investor Presentation dated October 24, 2023 for Western New England Bancorp, Inc. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WESTERN NEW ENGLAND BANCORP, INC. |

| |

|

| |

|

| |

By: |

/s/ Guida R. Sajdak |

| |

|

Guida R. Sajdak |

| |

|

Chief Financial Officer |

Dated: October 24, 2023

Western New England Bancorp, Inc. 8-K

Exhibit 99.1

For further information contact:

James C. Hagan, President and CEO

Guida R. Sajdak, Executive Vice President and CFO

Meghan Hibner, Vice President and Investor Relations

Officer

413-568-1911

WESTERN NEW ENGLAND BANCORP, INC. REPORTS RESULTS

FOR

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND DECLARES QUARTERLY CASH DIVIDEND

Westfield, Massachusetts, October 24,

2023: Western New England Bancorp, Inc. (the “Company” or “WNEB”) (NasdaqGS: WNEB), the holding company for

Westfield Bank (the “Bank”), announced today the unaudited results of operations for the three and nine months ended September

30, 2023. For the three months ended September 30, 2023, the Company reported net income of $4.5 million, or $0.21 per diluted share,

compared to net income of $6.0 million, or $0.28 per diluted share, for the three months ended September 30, 2022. On a linked quarter

basis, net income was $4.5 million, or $0.21 per diluted share, as compared to net income of $2.8 million, or $0.13 per diluted share,

for the three months ended June 30, 2023. For the nine months ended September 30, 2023, net income was $12.6 million, or $0.58 per diluted

share, compared to net income of $16.9 million, or $0.77 per diluted share, for the nine months ended September 30, 2022.

The Company also announced that the Board

of Directors declared a quarterly cash dividend of $0.07 per share on the Company’s common stock. The dividend will be payable on

or about November 22, 2023 to shareholders of record on November 8, 2023.

James C. Hagan, President and Chief Executive

Officer, commented, “We are pleased overall with our third quarter results and the success of our deposit growth, as well as our

continued expense management initiatives. We were able to successfully grow deposits by $18.3 million in the third quarter, and at September

30, 2023, 72% of total deposits were insured. The Company also maintains a strong liquidity position, which covers approximately 137%

of uninsured deposits as of September 30, 2023. We remain focused on expense management initiatives, and were able to decrease expenses

by $778,000, or 5.2%, from the first quarter of 2023 to the third quarter of 2023. Total loans increased $23.4 million, or 1.2%, since

December 31, 2022, and our asset quality continues to remain strong, with nonperforming loans to total loans at 0.31% as of September

30, 2023, and classified assets decreasing 28.7% from December 31, 2022.”

Hagan concluded, “In order to continue

to increase shareholder value, during the nine months ended September 30, 2023, we repurchased 404,905 shares of our common stock at an

average price per share of $7.27. We believe that share repurchases represents a prudent use of capital, especially when they are accretive

to book value. Our team remains committed to our community and to our existing and new customers in our local market area with our competitive

products and services that are based on true relationship banking, while providing continued access to local decision makers. We believe

our various growth, customer and expense initiatives are creating positive impacts to our performance and are positioning the Company

for future growth and increased profitability.”

Key Highlights:

Loans and Deposits

At September 30, 2023, total loans of $2.0

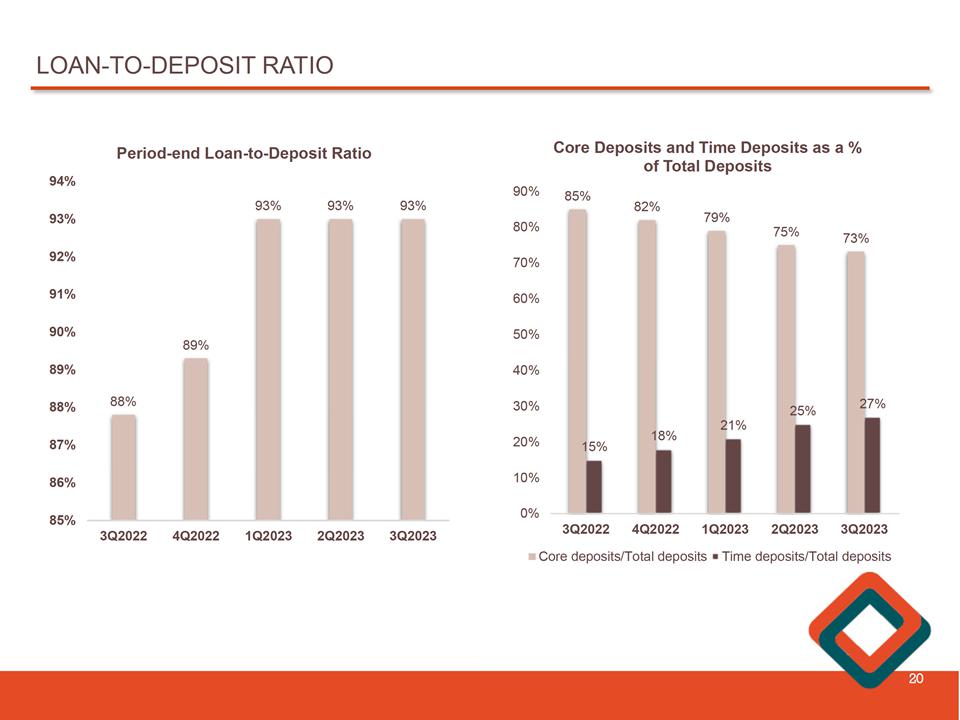

billion increased $23.4 million, or 1.2%, from December 31, 2022. During the same period, total deposits decreased $53.1 million, or 2.4%,

to $2.2 billion at September 30, 2023, but increased $18.3 million, or 0.9%, from June 30, 2023. Core deposits, which are defined by the

Company as all deposits except for time deposits, decreased $224.0 million, or 12.3%, from $1.8 billion, or 81.5% of total deposits, at

December 31, 2022, to $1.6 billion, or 73.2% of total deposits, at September 30, 2023. The decrease in core deposits was partially offset

by a $170.9 million, or 41.5%, increase in time deposits from $411.7 million at December 31, 2022 to $582.6 million at September 30, 2023.

The loan-to-deposit ratio increased from 89.3% at December 31, 2022 to 92.6% at September 30, 2023.

Liquidity

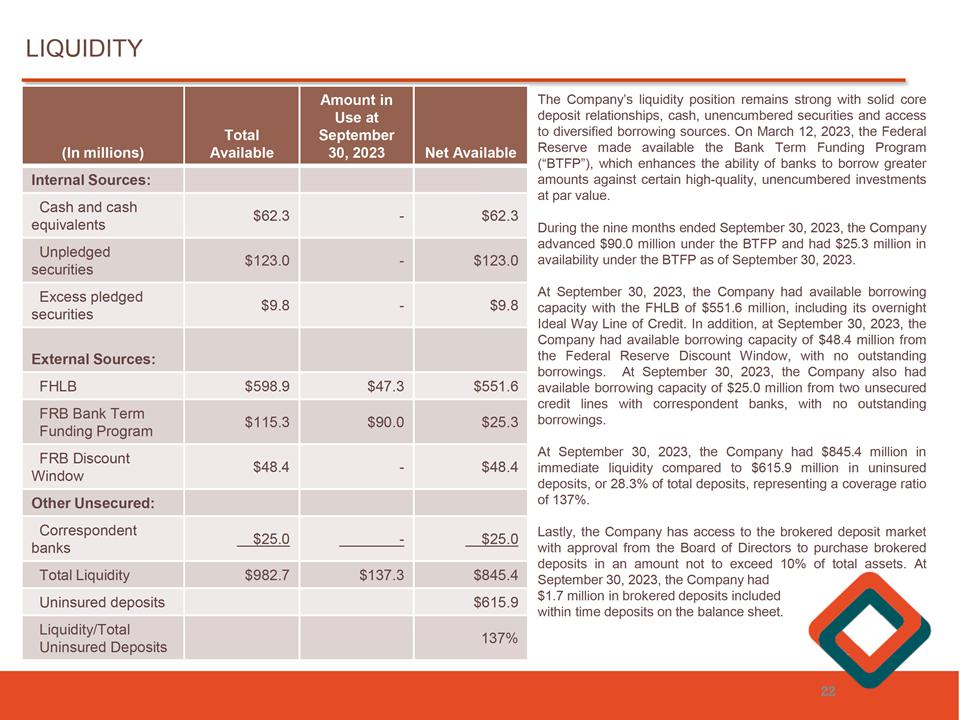

The Company’s liquidity position remains

strong with solid core deposit relationships, cash, unencumbered securities, a diversified deposit base and access to diversified borrowing

sources. At September 30, 2023, the Company had $845.4 million in immediate liquidity compared to $615.9 million in uninsured deposits,

or 28.3% of total deposits, representing a coverage ratio of 137%. Uninsured deposits of the bank’s customers are eligible for FDIC

pass-through insurance if the customer opens an IntraFi Insured Cash Sweep (ICS) account or a reciprocal time deposit through the Certificate

of Deposit Account Registry System (CDARS). IntraFi allows for up to $250.0 million per customer of pass-through FDIC insurance which

would more than cover each of the Bank’s deposit customers if such customer desired to have such pass-through insurance.

Allowance for Loan Losses and Credit Quality

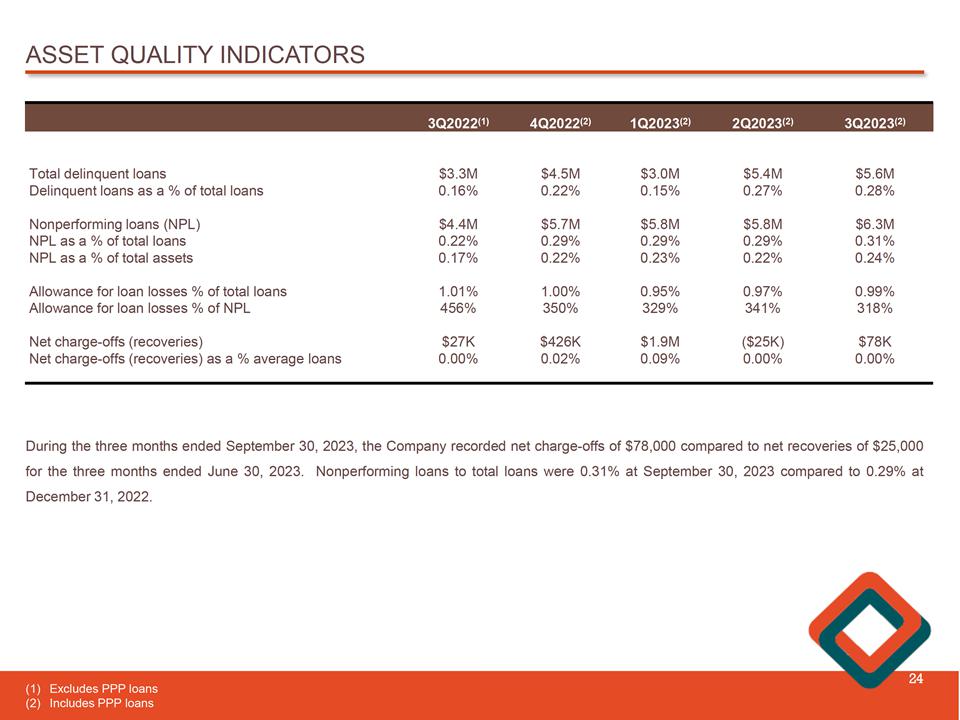

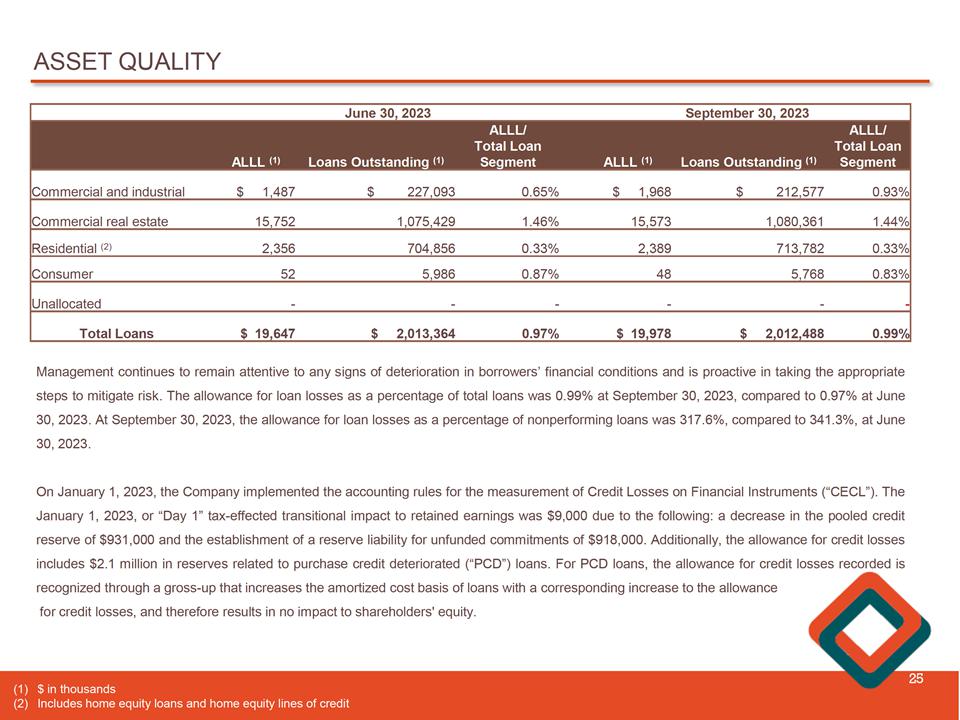

At September 30, 2023, the allowance for

credit losses was $20.0 million, or 0.99% of total loans and 317.6% of nonperforming loans, compared to $19.9 million, or 1.00% of total

loans and 350.0% of nonperforming loans, at December 31, 2022. At September 30, 2023, nonperforming loans totaled $6.3 million, or 0.31%

of total loans, compared to $5.7 million, or 0.29% of total loans, at December 31, 2022. Total delinquent loans increased $1.1 million,

or 25.8%, from $4.5 million, or 0.22% of total loans, at December 31, 2022, to $5.6 million, or 0.28% of total loans, at September 30,

2023.

Current Expected Credit Loss

On January 1, 2023, the Company implemented

the accounting rules for the measurement of Credit Losses on Financial Instruments (“CECL”). The January 1, 2023, or “Day

1” tax-effected transitional impact to retained earnings was $9,000 due to the following: a decrease in the pooled credit reserve

of $931,000 and the establishment of a reserve liability for unfunded commitments of $918,000. Additionally, the allowance for credit

losses includes $2.1 million in reserves related to purchase credit deteriorated (“PCD”) loans. For PCD loans, the allowance

for credit losses recorded is recognized through a gross-up that increases the amortized cost basis of loans with a corresponding increase

to the allowance for credit losses, and therefore results in no impact to shareholders’ equity.

Net Interest Margin

The net interest margin was 2.70% for the

three months ended September 30, 2023 compared to 2.81% for the three months ended June 30, 2023. The net interest margin, on a tax-equivalent

basis, was 2.72% for the three months ended September 30, 2023, compared to 2.83% for the three months ended June 30, 2023.

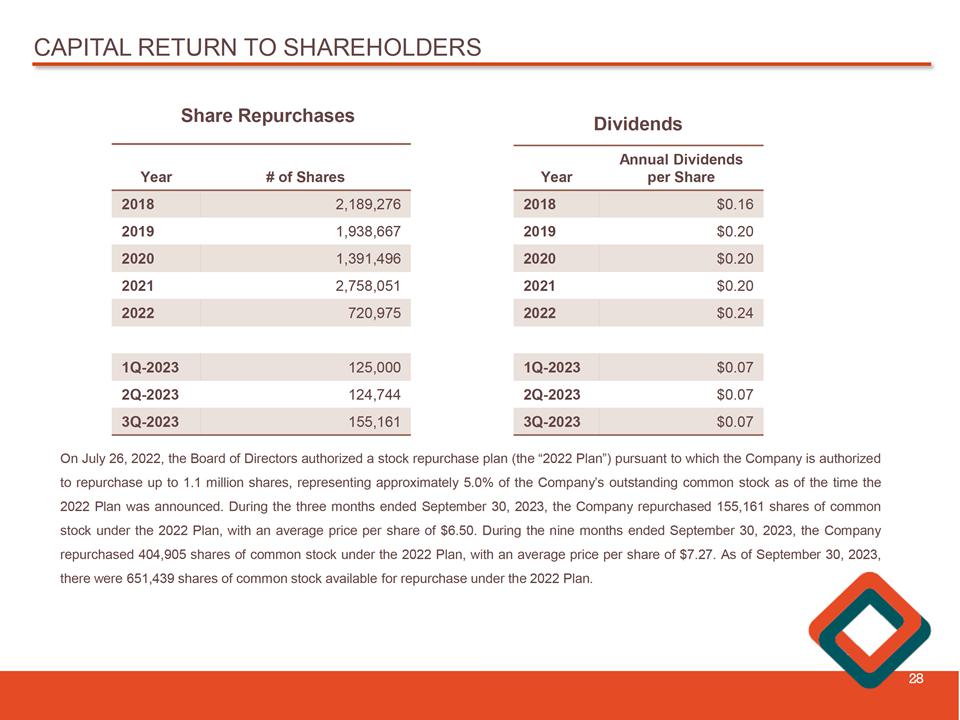

Stock Repurchase Program

On July 26, 2022, the Board of Directors

authorized a stock repurchase plan (the “2022 Plan”), pursuant to which the Company is authorized to repurchase up to 1.1

million shares, representing approximately 5.0% of the Company’s outstanding common stock as of the time the 2022 Plan was announced.

During the three months ended September 30, 2023, the Company repurchased 155,161 shares of common stock under the 2022 Plan, with an

average price per share of $6.50. During the nine months ended September 30, 2023, the Company repurchased 404,905 shares of common stock

under the 2022 Plan, with an average price per share of $7.27. As of September 30, 2023, there were 651,439 shares of common stock available

for repurchase under the 2022 Plan.

The repurchase of shares under the stock

repurchase program is administered through an independent broker. The shares of common stock repurchased under the 2022 Plan will be purchased

from time to time at prevailing market prices, through open market or privately negotiated transactions, or otherwise, depending upon

market conditions. There is no guarantee as to the exact number, or value, of shares that will be repurchased by the Company, and the

Company may discontinue repurchases at any time that the Company’s management (“Management”) determines additional repurchases

are not warranted. The timing and amount of additional share repurchases under the 2022 Plan will depend on a number of factors, including

the Company’s stock price performance, ongoing capital planning considerations, general market conditions, and applicable legal

requirements.

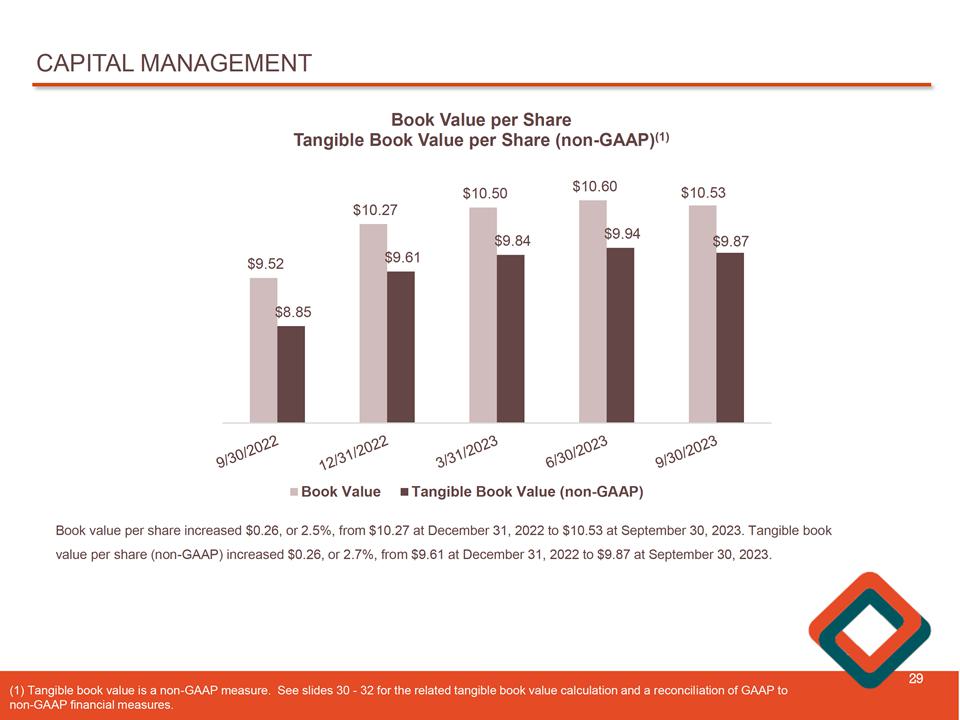

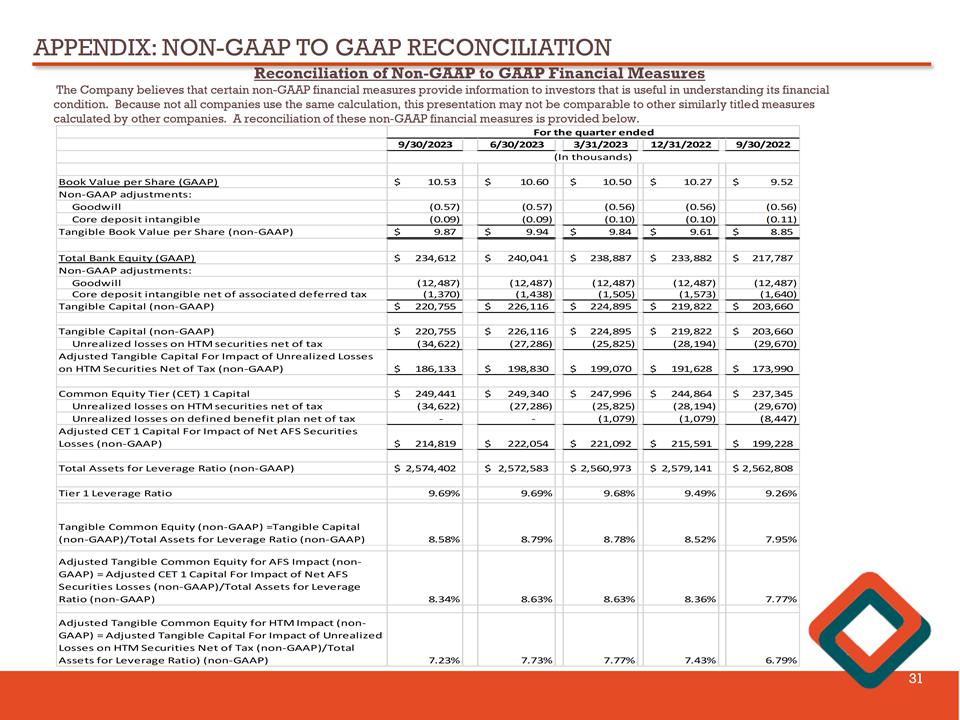

Book Value and Tangible Book Value

Book value per share was $10.53 at September

30, 2023, compared to $10.27 at December 31, 2022, while tangible book value per share, a non-GAAP financial measure, increased $0.26,

or 2.7%, from $9.61 at December 31, 2022 to $9.87 at September 30, 2023. As of September 30, 2023, the Company’s and the Bank’s

regulatory capital ratios continued to exceed the levels required to be considered “well-capitalized” under federal banking

regulations. See pages 19-22 for the related tangible book value calculation and a reconciliation of GAAP to non-GAAP financial measures.

Westfield Bank Defined Benefit Pension

Plan

The Board of Directors previously announced

the termination of the Westfield Bank Defined Benefit Plan (the “DB Plan”) on October 31, 2022, subject to required regulatory

approval. At December 31, 2022, the Company reversed $7.3 million in net unrealized losses recorded in accumulated other comprehensive

income attributed to both the DB Plan curtailment resulting from the termination of the DB Plan as well as changes in discount rates.

In addition, during the three months ended December 31, 2022, the Company recorded a gain on curtailment of $2.8 million through non-interest

income. During the nine months ended September 30, 2023, the Company made an additional cash contribution of $1.3 million in order to

fully fund the DB Plan on a plan termination basis. In addition, for those participants who did not opt for a one-time lump sum payment,

the Company funded $6.3 million to purchase a group annuity contract to transfer its remaining liabilities under the DB Plan. In addition,

during the nine months ended September 30, 2023, the Company recognized the final termination expense of $1.1 million related to the DB

Plan termination, which was recorded through non-interest income.

Net Income for the Three Months Ended

September 30, 2023 Compared to the Three Months Ended June 30, 2023

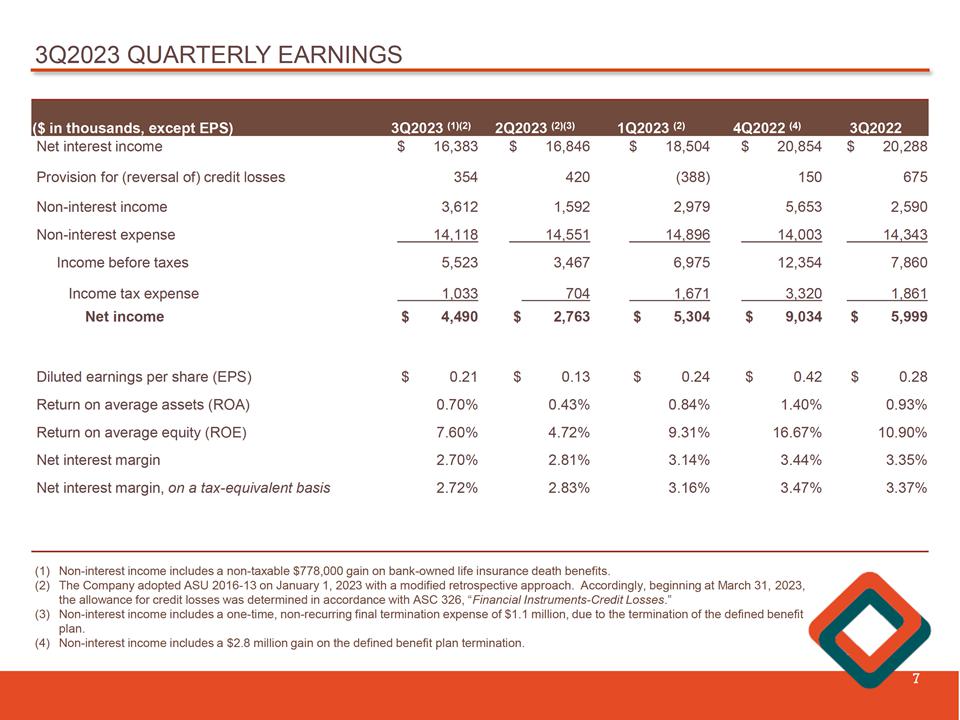

The Company reported net income of $4.5 million,

or $0.21 per diluted share, for the three months ended September 30, 2023, compared to net income of $2.8 million, or $0.13 per diluted

share, for the three months ended June 30, 2023. Net interest income decreased $463,000, or 2.7%, non-interest income increased $2.0 million

or 126.9%, non-interest expense decreased $433,000, or 3.0%, and provision for credit losses decreased $66,000, or 15.7%, during the same

period. For the three months ended September 30, 2023, non-interest income included a non-taxable gain of $778,000 on bank-owned life

insurance (“BOLI”) death benefits. For the three months ended June 30, 2023, non-interest income included a one-time, non-recurring

final termination expense of $1.1 million, due to the termination of the Company’s DB Plan.

Return on average assets and return on average

equity were 0.70% and 7.60%, respectively, for the three months ended September 30, 2023, compared to 0.43% and 4.72%, respectively, for

the three months ended June 30, 2023.

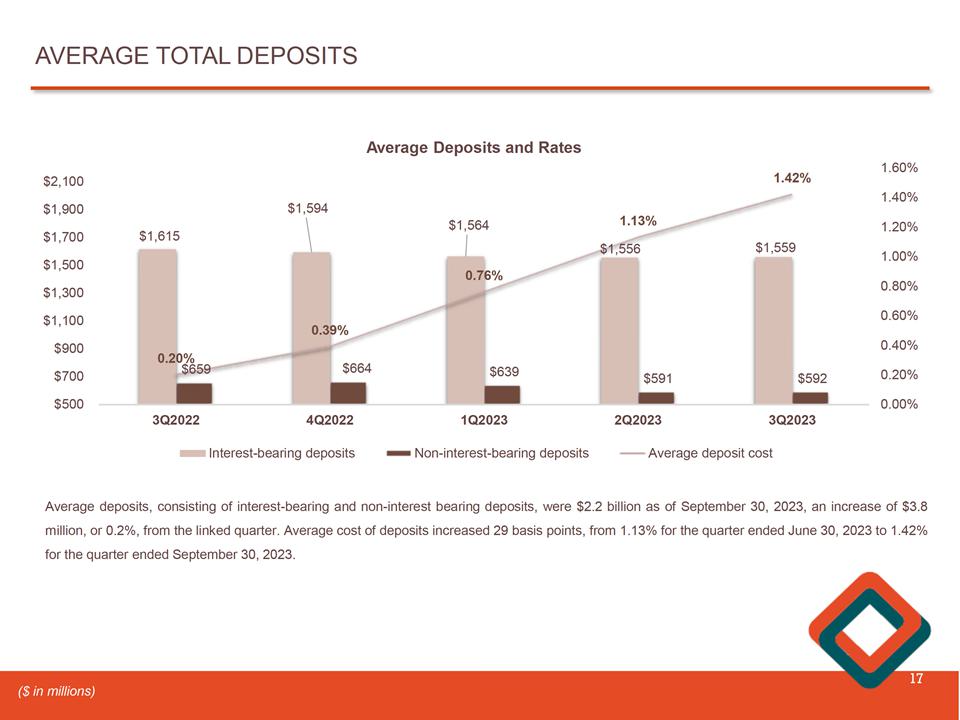

Net Interest Income and Net Interest Margin

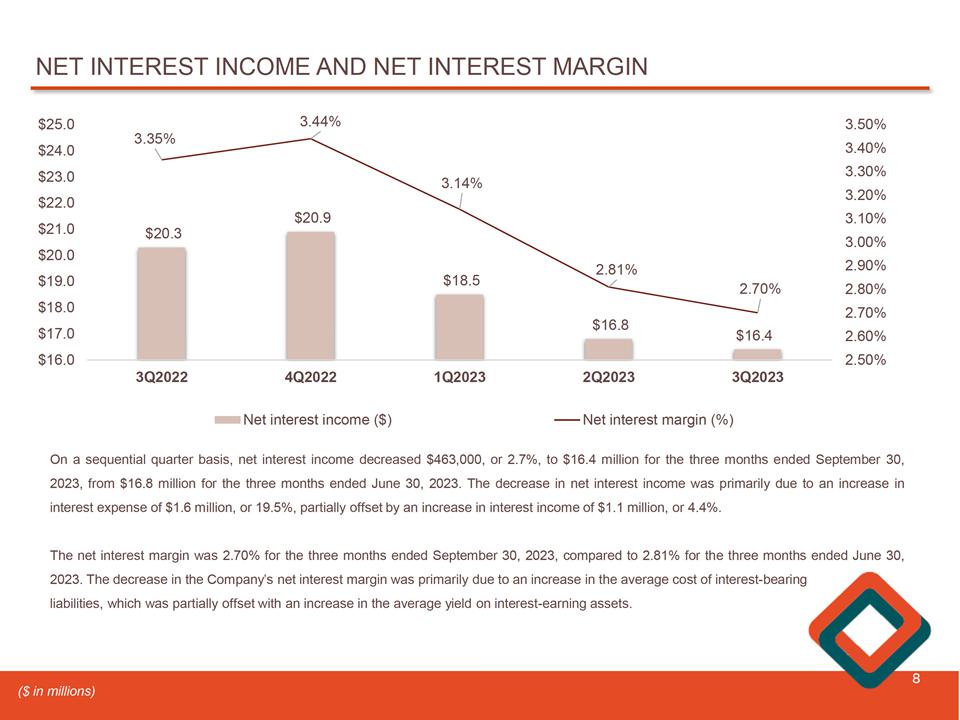

On a sequential quarter basis, net interest

income, our primary source of revenues, decreased $463,000, or 2.7%, to $16.4 million for the three months ended September 30, 2023, from

$16.8 million for the three months ended June 30, 2023. The decrease in net interest income was primarily due to an increase in interest

expense of $1.6 million, or 19.5%, partially offset by an increase in interest income of $1.1 million, or 4.4%. The increase in interest

expense was a result of competitive pricing on deposits due to the continued high interest rate environment and the unfavorable shift

in the deposit mix from low cost core deposits to high cost time deposits.

The net interest margin decreased 11 basis

points to 2.70%, for the three months ended September 30, 2023, from 2.81% for the three months ended June 30, 2023. The net interest

margin, on a tax-equivalent basis, was 2.72% for the three months ended September 30, 2023, compared to 2.83% for the three months ended

June 30, 2023. The decrease in the net interest margin was primarily due to an increase in the average cost of interest-bearing liabilities,

which was partially offset with an increase in the average yield on interest-earning assets.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.28% for the three months ended September 30, 2023, compared to 4.14% for the three

months ended June 30, 2023. The average loan yield, without the impact of tax-equivalent adjustments, was 4.64% for the three months ended

September 30, 2023, compared to 4.49% for the three months ended June 30, 2023. During the three months ended September 30, 2023, average

interest-earning assets decreased $2.1 million, or 0.1% to $2.4 billion, primarily due to an decrease in average securities of $13.3 million,

or 3.6%, and a decrease in average other investments of $1.2 million, or 8.8%, partially offset by an increase in average short-term investments,

consisting of cash and cash equivalents, of $12.0 million, or 116.4%.

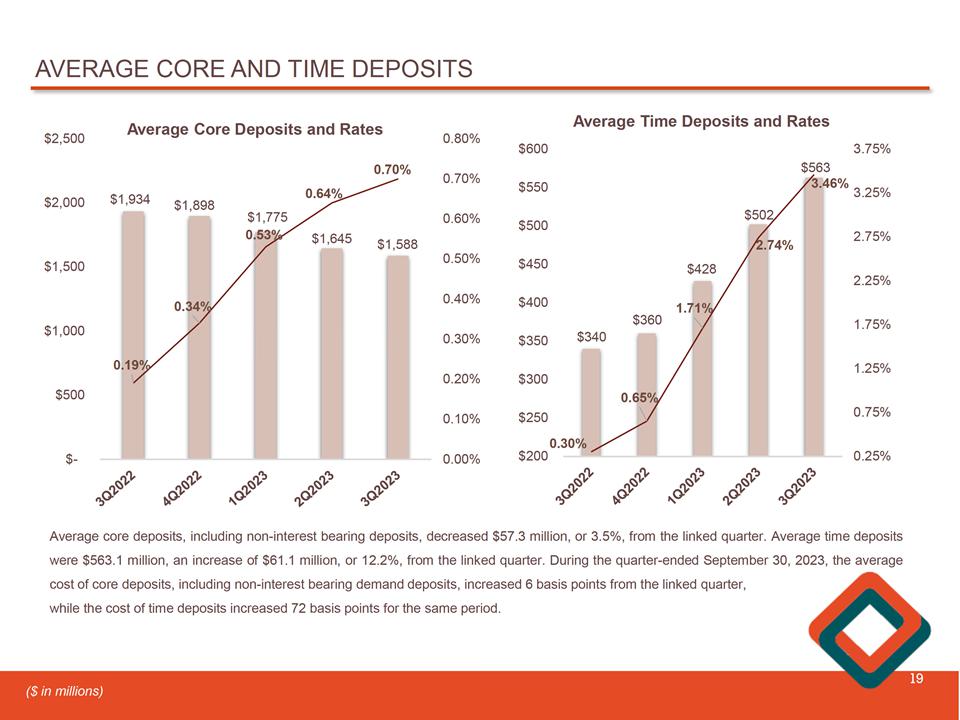

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased 25 basis points from 1.39% for the three months ended June 30, 2023 to 1.64%

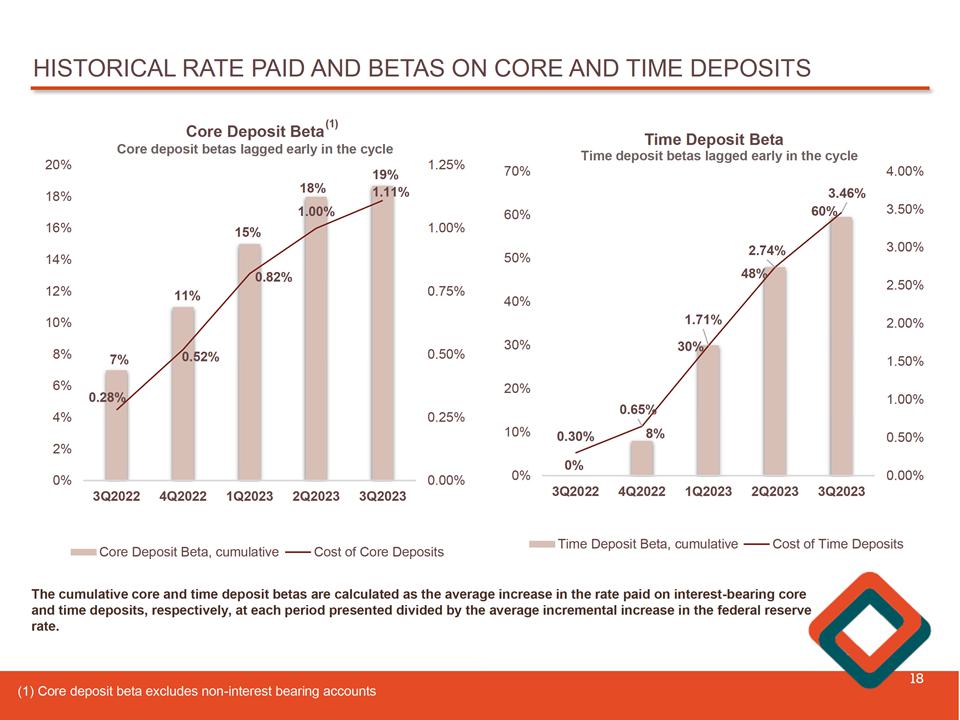

for the three months ended September 30, 2023. The average cost of core deposits, which the Company defines as all deposits except time

deposits, increased 6 basis points to 0.70% for the three months ended September 30, 2023, from 0.64% for the three months ended June

30, 2023. The average cost of time deposits increased 72 basis points from 2.74% for the three months ended June 30, 2023 to 3.46% for

the three months ended September 30, 2023. The average cost of borrowings, including subordinated debt, decreased 7 basis points from

4.88% for the three months ended June 30, 2023 to 4.81% for the three months ended September, 2023. During the same period, average demand

deposits, an interest-free source of funds, remained virtually unchanged at $591.9 million, or 27.5% of total average deposits, for the

three months ended September 30, 2023.

Provision for (Reversal of) Credit Losses

During the three months ended September 30,

2023, the Company recorded a provision for credit losses of $354,000, compared to a provision for credit losses of $420,000 during the

three months ended June 30, 2023. The provision for credit losses includes a $55,000 negative provision for unfunded commitments primarily

due to the impact of decreased unfunded loan commitments. Total unfunded loan commitments decreased $6.7 million, or 3.7%, to $172.9 million

at September 30, 2023 from $179.6 million at June 30, 2023. The provision for credit losses was determined by a number of factors:

the continued strong credit performance of the Company’s loan portfolio, changes in the loan portfolio mix and Management’s

consideration of existing economic conditions and the economic outlook from the Federal Reserve’s actions to control inflation.

The Company also increased the qualitative reserve to consider the potential losses resulting from future recessionary pressures. Management

continues to monitor macroeconomic variables related to increasing interest rates, inflation and the concerns of an economic downturn,

and believes it is appropriately reserved for the current economic environment and supportable forecast period.

During the three months ended September 30,

2023, the Company recorded net charge-offs of $78,000, compared to net recoveries of $25,000 for the three months ended June 30, 2023.

Non-Interest Income

On a sequential quarter basis, non-interest

income increased $2.0 million, or 126.9%, to $3.6 million for the three months ended September 30, 2023, from $1.6 million for the three

months ended June 30, 2023. During the three months ended September 30, 2023, non-interest income included a non-taxable gain of $778,000

on BOLI death benefits. During the three months ended June 30, 2023, the Company recorded a $1.1 million final termination expense related

to the DB Plan termination.

Service charges and fees on deposits decreased

$96,000, or 4.3%, from the three months ended June 30, 2023 to $2.1 million for the three months ended September 30, 2023. Income from

BOLI decreased $40,000, or 8.1%, from the three months ended June 30, 2023, to $454,000 for the three months ended September 30, 2023.

During the three months ended September 30, 2023, the Company reported a gain on non-marketable equity investments of $238,000. At June

30, 2023, the Company did not have comparable non-interest income from non-marketable equity investments. During the three months ended

September 30, 2023, the Company reported a loss on the disposal of premises and equipment of $3,000. The Company did not have a comparable

loss during the three months ended June 30, 2023.

Non-Interest Expense

For the three months ended September 30,

2023, non-interest expense decreased $433,000, or 3.0%, to $14.1 million from $14.6 million for the three months ended June 30, 2023.

Salaries and employee benefits decreased

$134,000, or 1.7%, to $8.0 million. Other non-interest expense decreased $191,000, or 7.5%, professional fees decreased $160,000, or 19.9%,

occupancy expense decreased $44,000, or 3.7%, and furniture and equipment expense decreased $10,000, or 2.0%. These decreases were partially

offset by an increase in advertising expense of $23,000, or 6.8%, an increase in FDIC insurance expense of $51,000, or 17.6%, and an increase

in data processing expense of $32,000, or 4.0%.

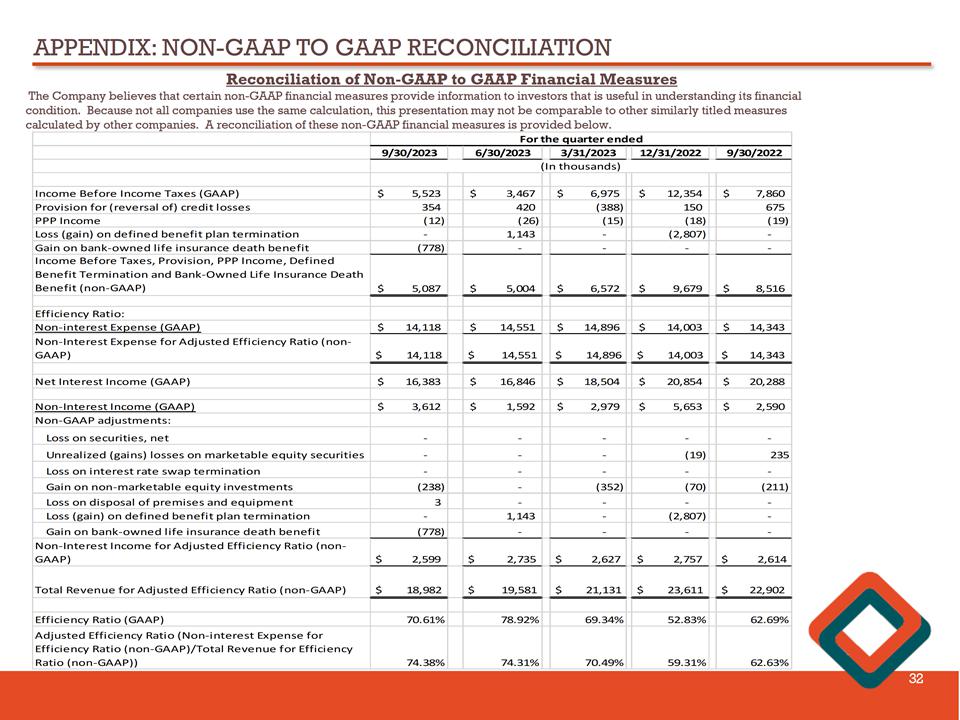

For the three months ended September 30,

2023, the efficiency ratio was 70.6% compared to 78.9% for the three months ended June 30, 2023. For the three months ended September

30, 2023, the adjusted efficiency ratio, a non-GAAP financial measure, was 74.4% compared to 74.3% for the three months ended June 30,

2023. See pages 19-22 for the related ratio calculation and a reconciliation of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the three months ended

September 30, 2023 was $1.0 million, or an effective tax rate of 18.7%, compared to $704,000, or an effective tax rate of 20.3%, for the

three months ended June 30, 2023. The decrease in the Company’s effective tax rate

was primarily due to BOLI death benefits recognized during the three months ended September 30, 2023.

Net Income for the Three Months Ended

September 30, 2023 Compared to the Three Months Ended September 30, 2022.

The Company reported net income of $4.5 million,

or $0.21 per diluted share, for the three months ended September 30, 2023, compared to net income of $6.0 million, or $0.28 per diluted

share, for the three months ended September 30, 2022. Net interest income decreased $3.9 million, or 19.2%, non-interest income increased

$1.0 million or 39.5%, non-interest expense decreased $225,000, or 1.6%, and provision for credit losses decreased $321,000, or 47.6%,

during the same period. During the three months ended September 30, 2023, non-interest income included a non-taxable gain of $778,000

in BOLI death benefits. Return on average assets and return on average equity were 0.70% and 7.60%, respectively, for the three months

ended September 30, 2023, compared to 0.93% and 10.90%, respectively, for the three months ended September 30, 2022.

Net Interest Income and Net Interest Margin

Net interest income decreased $3.9 million,

or 19.2%, to $16.4 million, for the three months ended September 30, 2023, from $20.3 million for the three months ended September 30,

2022. The decrease in net interest income was due to an increase in interest expense of $8.1 million, or 549.2%, partially offset by an

increase in interest and dividend income of $4.1 million, or 19.1%. Interest expense on deposits increased $6.5 million and interest expense

on borrowings increased $1.5 million. The increase in interest expense was a result of competitive pricing on deposits due to the continued

higher interest rate environment and the unfavorable shift in the deposit mix from low cost core deposits to high cost time deposits.

The net interest margin was 2.70% for the

three months ended September 30, 2023, compared to 3.35% for the three months ended September 30, 2022. The net interest margin, on a

tax-equivalent basis, was 2.72% for the three months ended September 30, 2023, compared to 3.37% for the three months ended September

30, 2022. The decrease in the net interest margin was primarily due to an increase in the average cost of interest-bearing liabilities

and the unfavorable shift in the deposit mix from low cost core deposits to high cost time deposits, which was partially offset with an

increase in the average yield on interest-earning assets.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.28% for the three months ended September 30, 2023, compared to 3.59% for the three

months ended September 30, 2022. The average loan yield, without the impact of tax-equivalent adjustments, was 4.64% for the three months

ended September 30, 2023, compared to 3.93% for the three months ended September 30, 2022. During the three months ended September 30,

2023, average interest-earning assets increased $1.5 million, or 0.1%, to $2.4 billion primarily due to an increase in average loans of

$33.7 million, or 1.7%, an increase in average other investments of $2.1 million, or 21.1%, and an increase in average short-term investments,

consisting of cash and cash equivalents, of $8.4 million, or 60.7%, partially offset by a decrease in average securities of $42.8 million,

or 10.6%.

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased 139 basis points from 0.25% for the three months ended September 30, 2022 to 1.64%

for the three months ended September 30, 2023. The average cost of core deposits, which the Company defines as all deposits except time

deposits, increased 51 basis points to 0.70% for the three months ended September 30, 2023, from 0.19% for the three months ended September

30, 2022. The average cost of time deposits increased 316 basis points from 0.30% for the three months ended September 30, 2022 to 3.46%

for the three months ended September 30, 2023. The average cost of borrowings, including subordinated debt, increased 69 basis points

from 4.12% for the three months ended September 30, 2022 to 4.81% for the three months ended September 30, 2023. Average demand deposits,

an interest-free source of funds, decreased $67.0 million, or 10.2%, from $658.9 million, or 29.0% of total average deposits, for the

three months ended September 30, 2022, to $591.9 million, or 27.5% of total average deposits, for the three months ended September 30,

2023.

Provision for Credit Losses

During the three months ended September, 30,

2023, the Company recorded a provision for credit losses of $354,000, under the CECL model, compared to a provision for credit losses

of $675,000 during the three months ended September 30, 2022, under the incurred loss model. The decrease was primarily due to changes

in the economic environment and related adjustments to the quantitative components of the CECL methodology. The provision for credit

losses was determined by a number of factors: the continued strong credit performance of the Company’s loan portfolio, changes

in the loan portfolio mix and Management’s consideration of existing economic conditions and the economic outlook from the Federal

Reserve’s actions to control inflation. Management continues to monitor macroeconomic variables related to increasing interest

rates, inflation and the concerns of an economic downturn, and believes it is appropriately provisioned for the current economic environment

and supportable forecast period.

The Company recorded net charge-offs of $78,000

for the three months ended September 30, 2023, as compared to net charge-offs of $27,000 for the three months ended September 30, 2022.

Non-Interest Income

Non-interest income increased $1.0 million,

or 39.5%, to $3.6 million for the three months ended September 30, 2023, from $2.6 million for the three months ended September 30, 2022.

During the three months ended September 30, 2023, the Company recorded a non-taxable gain of $778,000 in BOLI death benefits. Service

charges and fees decreased $78,000, or 3.5%, from the three months ended September 30, 2022 to $2.1 million for the three months ended

September 30, 2023, primarily due to changes in the Company’s overdraft program that were implemented in the first quarter of 2023.

Income from BOLI increased $63,000, or 16.1%, for the three months ended September 30, 2022 to $454,000 for the three months ended September

30, 2023. During the three months ended September 30, 2023, the Company reported a gain of $238,000 on non-marketable equity investments

compared to a gain of $211,000 during the three months ended September 30, 2022. During the three months ended September 30, 2022, the

Company reported unrealized losses on marketable equity securities of $235,000. During the three months ended September 30, 2023, the

Company did not have comparable gains or losses. During the three months ended September 30, 2023, the Company reported a loss on the

disposal of premises and equipment of $3,000. The Company did not have a comparable gain or loss during the same period in 2022.

Non-Interest Expense

For the three months ended September 30,

2023, non-interest expense decreased $225,000, or 1.6%, to $14.1 million from $14.3 million for the three months ended September 30, 2022.

The decrease in non-interest expense was due to a decrease in professional fees of $160,000, or 19.9%, a decrease in salaries and benefits

of $70,000, or 0.9%, a decrease in occupancy expense of $67,000, or 5.5%, a decrease in advertising expense of $57,000, or 13.6%, and

a decrease in other non-interest expense of $73,000, or 3.0%. These decreases were partially offset by an increase in data processing

of $117,000, or 16.5%, an increase in FDIC insurance expense of $68,000, or 24.9%, and an increase in furniture and equipment of $17,000,

or 3.7%.

For the three months ended September 30,

2023, the efficiency ratio was 70.6%, compared to 62.7% for the three months ended September 30, 2022. For the three months ended September

30, 2023, the adjusted efficiency ratio, a non-GAAP financial measure, was 74.4% compared to 62.6% for the three months ended September

30, 2022. The efficiency ratio increase was driven by decreased revenues, defined as net interest income and non-interest income, during

the three months ended September 30, 2023 compared to the three months ended September 30, 2022. See pages 19-22 for the related ratio

calculation and a reconciliation of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the three months ended

September 30, 2023 was $1.0 million, representing an effective tax rate of 18.7%, compared to $1.9 million, representing an effective

tax rate of 23.7%, for three months ended September 30, 2022. The decrease in the Company’s effective tax rate was primarily due

to BOLI death benefits recognized during the three months ended September 30, 2023.

Net Income for the Nine Months Ended September

30, 2023 Compared to the Nine Months Ended September 30, 2022

For the nine months ended September 30, 2023,

the Company reported net income of $12.6 million, or $0.58 per diluted share, compared to $16.9 million, or $0.77 per diluted share, for

the nine months ended September 30, 2022. Return on average assets and return on average equity were 0.66% and 7.19% for the nine months

ended September 30, 2023, respectively, compared to 0.88% and 10.26% for the nine months ended September 30, 2022, respectively.

Net Interest Income and Net Interest Margin

During the nine months ended September 30,

2023, net interest income decreased $6.7 million, or 11.4%, to $51.7 million, compared to $58.4 million for the nine months ended September

30, 2022. The decrease in net interest income was due to an increase in interest expense of $18.7 million, or 470.4%, partially offset

by an increase in interest and dividend income of $12.0 million, or 19.3%. The increase in interest expense was due to an increase in

interest expense on deposits of $14.7 million, or 468.2%, and an increase in interest expense on borrowings of $3.9 million, or 478.6%.

For the nine months ended September 30, 2023, interest and dividend income included $52,000 in Paycheck Protection Program (“PPP

Income”), compared to $710,000 during the nine months ended September 30, 2022.

The net interest margin for the nine months

ended September 30, 2023 was 2.88% compared to 3.26% during the nine months ended September 30, 2022. The net interest margin, on a tax-equivalent

basis, was 2.90% for the nine months ended September 30, 2023, compared to 3.28% for the nine months ended September 30, 2022. The decrease

in the net interest margin was primarily due to an increase in the average cost of interest-bearing liabilities and the unfavorable shift

in the deposit mix from low cost core to high cost time deposits, which was partially offset with an increase in the average yield on

interest-earning assets.

The average yield on interest-earning assets,

without the impact of tax-equivalent adjustments, was 4.14% for the nine months ended September 30, 2023, compared to 3.48% for the nine

months ended September 30, 2022. The average loan yield, without the impact of tax-equivalent adjustments, was 4.49% for the nine months

ended September 30, 2023, compared to 3.86% for the nine months ended September 30, 2022. During the nine months ended September 30, 2023,

average interest-earning assets increased $5.2 million, or 0.2% to $2.4 billion, primarily due to an increase in average loans of $62.9

million, or 3.2%, and an increase in average other investments of $2.4 million, or 23.2%, partially offset by a decrease in average securities

of $41.2 million, or 10.0%, and a decrease in average short-term investments, consisting of cash and cash equivalents, of $18.9 million,

or 59.4%.

The average cost of total funds, including

non-interest bearing accounts and borrowings, increased 109 basis points from 0.23% for the nine months ended September 30, 2022 to 1.32%

for the nine months ended September 30, 2023. The average cost of core deposits, which the Company defines as all deposits except time

deposits, increased 46 basis points to 0.62% for the nine months ended September 30, 2023, from 0.16% for the nine months ended September

30, 2022. The average cost of time deposits increased 239 basis points from 0.33% for the nine months ended September 30, 2022 to 2.72%

for the nine months ended September 30, 2023. The average cost of borrowings, including subordinated debt, increased 60 basis points from

4.24% for the nine months ended September 30, 2022 to 4.84% for the nine months ended September 30, 2023. Average demand deposits, an

interest-free source of funds, decreased $35.3 million, or 5.5%, from $642.6 million, or 28.4% of total average deposits, for the nine

months ended September 30, 2022, to $607.3 million, or 28.0% of total average deposits, for the nine months ended September 30, 2023.

Provision for Credit Losses

During the nine months ended September 30,

2023, the Company recorded a provision for credit losses of $386,000, under the CECL model, compared to a provision for credit losses

of $550,000 during the nine months ended September 30, 2022 under the incurred loss model. The increase in reserves was primarily due

to changes in the economic environment and related adjustments to the quantitative components of the CECL methodology. The Company recorded

net charge-offs of $1.9 million for the nine months ended September 30, 2023, as compared to net charge-offs of $129,000 for the nine

months ended September 30, 2022.

Non-Interest Income

For the nine months ended September 30, 2023,

non-interest income increased $504,000, or 6.6%, from $7.7 million during the nine months ended September 30, 2022 to $8.2 million. During

the nine months ended September 30, 2023, the Company recorded a $1.1 million final termination expense related to the DB Plan termination

and also recorded a non-taxable gain of $778,000 on BOLI death benefits. During the same period, service charges and fees decreased $170,000,

or 2.5%, primarily due to changes in the Company’s overdraft program that were implemented in 2023 and income from BOLI increased

$91,000, or 7.0%. Other income from loan-level swap fees on commercial loans decreased $25,000 for the nine months ended September 30,

2023 compared to the nine months ended September 30, 2022. During the nine months ended September 30, 2023, the Company reported a gain

of $590,000 on non-marketable equity investments compared to a gain of $352,000 during the nine months ended September 30, 2022. During

the nine months ended September 30, 2022, the Company reported unrealized losses on marketable equity securities of $736,000 and realized

losses on the sale of securities of $4,000. The Company did not have comparable investment activity in 2023. During the nine months ended

September 30, 2023, the Company reported a loss on the disposal of premises and equipment of $3,000. The Company did not have a comparable

gain or loss during the same period in 2022.

Non-Interest Expense

For the nine months ended September 30, 2023,

non-interest expense increased $333,000, or 0.8%, to $43.6 million, compared to $43.2 million for the nine months ended September 30,

2022. The increase in non-interest expense was primarily due to an increase in data processing of $208,000, or 9.6%, and increase in FDIC

insurance expense of $190,000, or 24.0%, an increase in professional fees of $104,000, or 5.0%, and an increase in other non-interest

expense of $111,000, or 1.6%. These increases were partially offset by a decrease in advertising expense of $112,000, or 9.1%, a decrease

in furniture and equipment expense of $87,000, or 5.6%, a decrease in occupancy expense of $56,000, or 1.5%, and decrease in salaries

and employee benefits of $25,000, or 0.1%. During the nine months ended September 30, 2023, other non-interest expense included $154,000

in expense related to the DB Plan termination.

For the nine months ended September 30, 2023,

the efficiency ratio was 72.7%, compared to 65.5% for the nine months ended September 30, 2022. For the nine months ended September 30,

2023, the adjusted efficiency ratio, a non-GAAP financial measure, was 73.0%, compared to 65.1% for the nine months ended September 30,

2022. The adjusted efficiency ratio is a non-GAAP measure. See pages 19-22 for the related efficiency ratio calculation and a reconciliation

of GAAP to non-GAAP financial measures.

Income Tax Provision

Income tax expense for the nine months ended

September 30, 2023 was $3.4 million, representing an effective tax rate of 21.3%, compared to $5.4 million, representing an effective

tax rate of 24.3%, for nine months ended September 30, 2022. The decrease in the Company’s effective tax rate was primarily due

to lower pre-tax income for the nine months ended September 30, 2023 compared to the same period in 2022 as well as BOLI death benefits

recognized during the three months ended September 30, 2023.

Balance Sheet

At September 30, 2023, total assets were

$2.6 billion and increased $31.8 million, or 1.3%, from December 31, 2022. The increase in total assets was mainly related to an increase

in total loans of $23.4 million, or 1.2%, an increase in cash and cash equivalents of $31.9 million, or 105.2%, to $62.3 million, partially

offset by a decrease in investment securities of $27.7 million, or 7.2%, to $355.7 million.

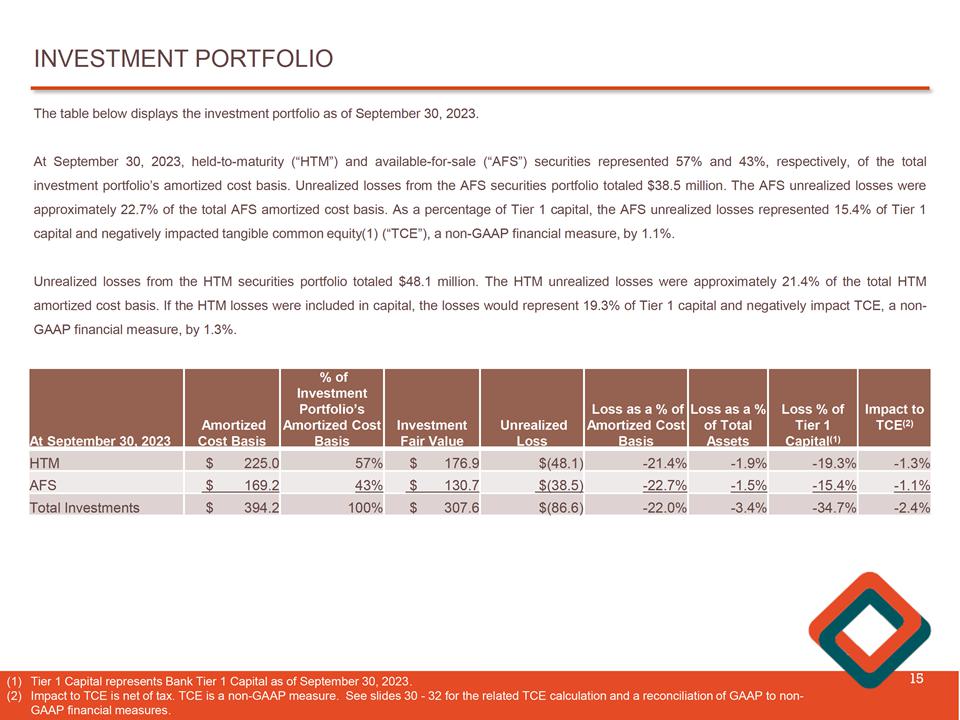

Investments

At September 30, 2023, the available-for-sale

(“AFS”) and held-to-maturity (“HTM”) securities portfolio represented 13.8% of total assets compared to 14.8%

at December 31, 2022. At September 30, 2023, the Company’s AFS securities portfolio, recorded at fair market value, decreased $16.3

million, or 11.1%, from $147.0 million at December 31, 2022 to $130.7 million. The HTM securities portfolio, recorded at amortized cost,

decreased $5.2 million, or 2.2%, from $230.2 million at December 31, 2022 to $225.0 million at September 30, 2023. The marketable equity

securities portfolio decreased $6.2 million, or 100.0%, from $6.2 million at December 31, 2022 due to the redemption of marketable equity

securities during the nine months ended September 30, 2023. The decrease in the AFS and HTM securities portfolios was primarily due to

amortization and payoffs recorded during the nine months ended September 30, 2023.

At September 30, 2023, the Company reported

unrealized losses on the AFS securities portfolio of $38.5 million, or 22.7% of the amortized cost basis of the AFS securities portfolio,

compared to unrealized losses of $32.2 million, or 18.0% of the amortized cost basis of the AFS securities at December 31, 2022. At September

30, 2023, the Company reported unrealized losses on the HTM securities portfolio of $48.2 million, or 21.4%, of the amortized cost basis

of the HTM securities portfolio, compared to $39.2 million, or 17.0% of the amortized cost basis of the HTM securities portfolio at December

31, 2022.

The securities in which the Company may invest

are limited by regulation. Federally chartered savings banks have authority to invest in various types of assets, including U.S. Treasury

obligations, securities of various government-sponsored enterprises, mortgage-backed securities, certain certificates of deposit of insured

financial institutions, repurchase agreements, overnight and short-term loans to other banks, corporate debt instruments and marketable

equity securities. The securities, with the exception of $6.8 million in corporate bonds, are issued by the United States government

or government-sponsored enterprises and are therefore either explicitly or implicitly guaranteed as to the timely payment of contractual

principal and interest. These positions are deemed to have no credit impairment, therefore, the disclosed unrealized losses with the

securities portfolio relate primarily to changes in prevailing interest rates. In all cases, price improvement in future periods will

be realized as the issuances approach maturity.

Management regularly reviews the portfolio

for securities in an unrealized loss position. At September 30, 2023 and December 31, 2022, the Company did not record any impairment

charges on its securities portfolio and attributed the unrealized losses primarily due to fluctuations in general interest rates or changes

in expected prepayments and not due to credit quality. The primary objective of the Company’s investment portfolio is to provide

liquidity and to secure municipal deposit accounts while preserving the safety of principal. The Company expects to strategically redeploy

available cash flows from the securities portfolio to fund loan growth and deposit outflows.

Total Loans

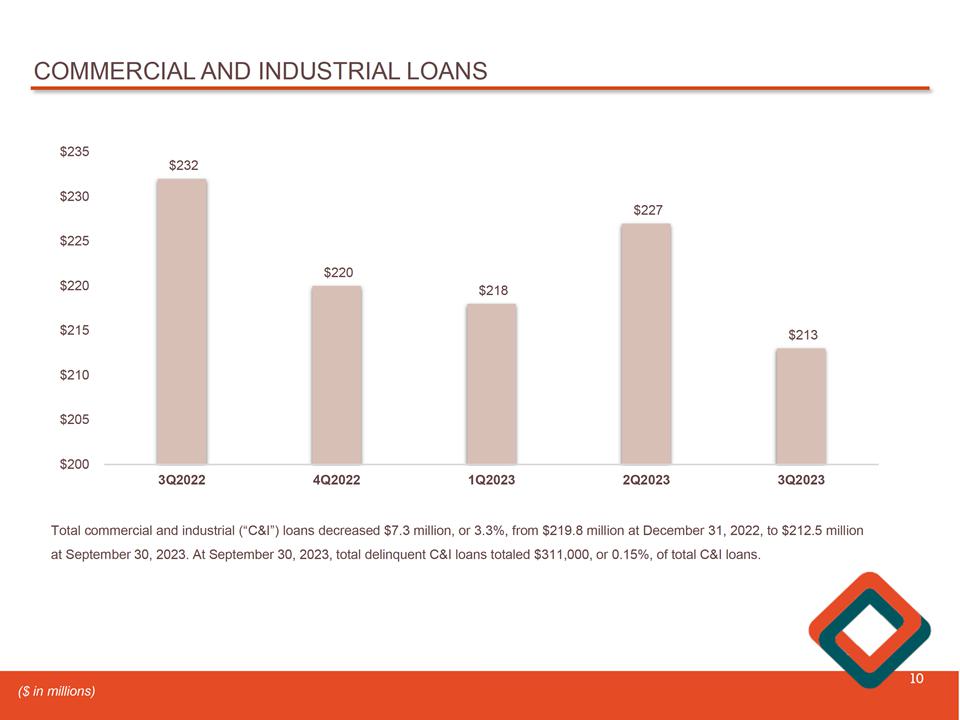

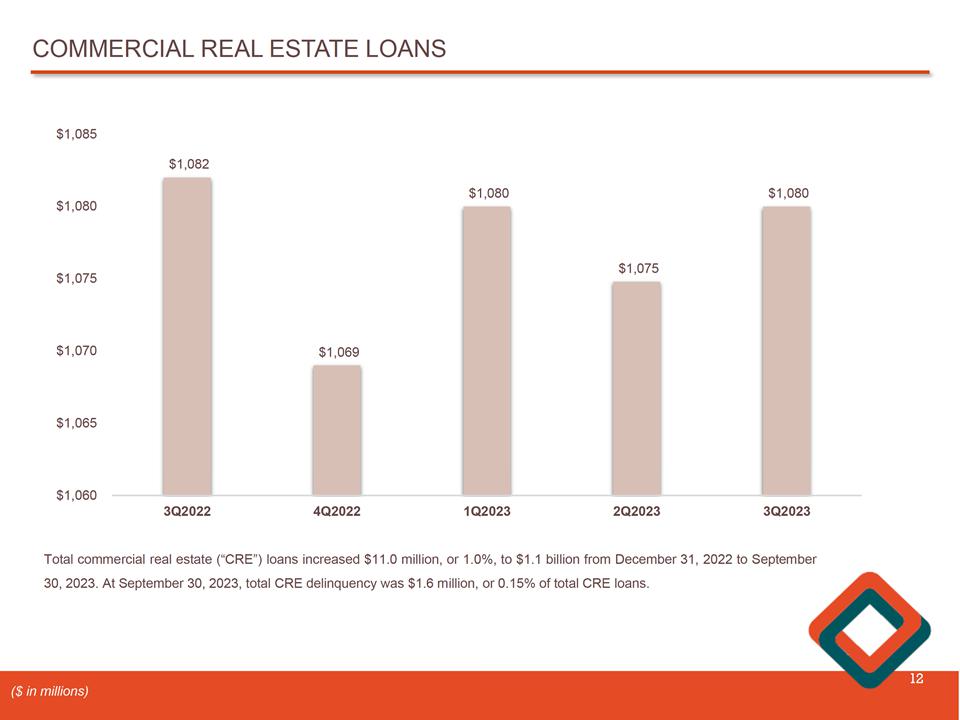

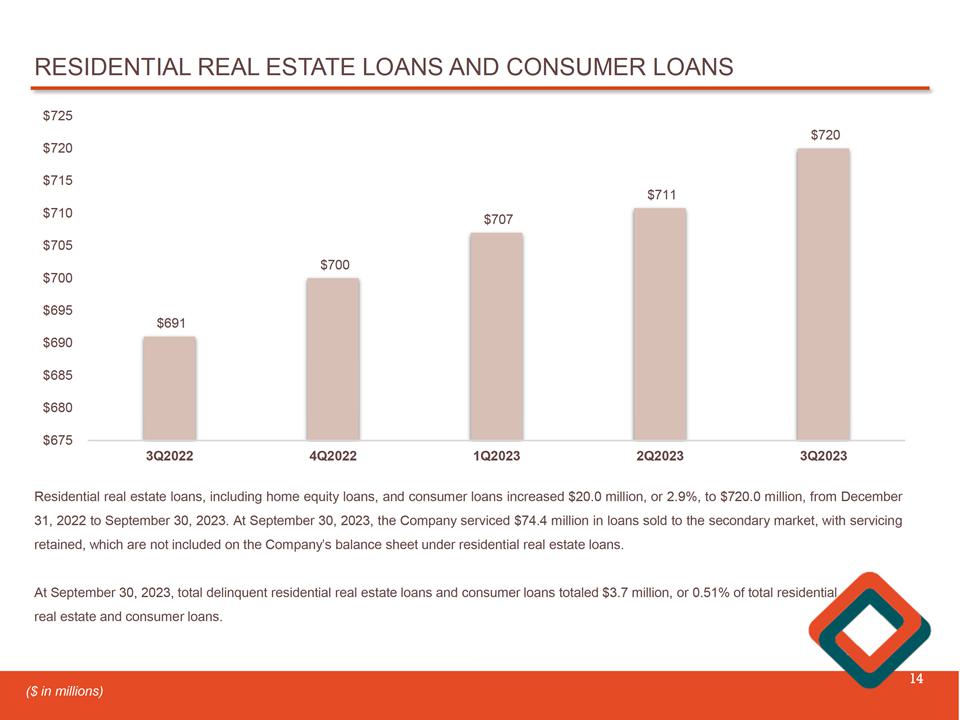

At September 30, 2023, total loans increased

$23.4 million, or 1.2%, to $2.0 billion from December 31, 2022. Residential real estate loans, including home equity loans, increased

$18.7 million, or 2.7%, commercial real estate loans increased $11.0 million, or 1.0%, and commercial and industrial loans decreased $7.3

million, or 3.3%.

The following table is a summary of our outstanding

loan balances for the periods indicated:

| | |

September 30, 2023 | |

June 30, 2023 | |

March 31, 2023 | |

December 31, 2022 |

| | |

(Dollars in thousands) |

| Commercial real estate loans | |

$ | 1,080,361 | | |

$ | 1,075,429 | | |

$ | 1,079,664 | | |

$ | 1,069,323 | |

| | |

| | | |

| | | |

| | | |

| | |

| Residential real estate loans: | |

| | | |

| | | |

| | | |

| | |

| Residential | |

| 606,221 | | |

| 597,812 | | |

| 595,097 | | |

| 589,503 | |

| Home equity | |

| 107,561 | | |

| 107,004 | | |

| 105,801 | | |

| 105,557 | |

| Total residential real estate loans | |

| 713,782 | | |

| 704,856 | | |

| 700,898 | | |

| 695,060 | |

| | |

| | | |

| | | |

| | | |

| | |

| Commercial and industrial loans: | |

| | | |

| | | |

| | | |

| | |

| PPP loans | |

| 1,415 | | |

| 1,864 | | |

| 2,129 | | |

| 2,274 | |

| Commercial and industrial loans | |

| 211,162 | | |

| 225,229 | | |

| 215,971 | | |

| 217,574 | |

| Total commercial and industrial loans | |

| 212,577 | | |

| 227,093 | | |

| 218,100 | | |

| 219,848 | |

| Consumer loans | |

| 5,768 | | |

| 5,986 | | |

| 5,667 | | |

| 5,045 | |

| Total gross loans | |

| 2,012,488 | | |

| 2,013,364 | | |

| 2,004,329 | | |

| 1,989,276 | |

| Unamortized PPP loan fees | |

| (70 | ) | |

| (78 | ) | |

| (99 | ) | |

| (109 | ) |

| Unamortized premiums and net deferred loans fees and costs | |

| 2,402 | | |

| 2,307 | | |

| 2,269 | | |

| 2,233 | |

| Total loans | |

$ | 2,014,820 | | |

$ | 2,015,593 | | |

$ | 2,006,499 | | |

$ | 1,991,400 | |

Credit Quality

Credit quality remains sound and our loan

portfolio continues to perform well. Total delinquency was 0.28% of total loans at September 30, 2023, compared to 0.22% of total loans

at December 31, 2022. At September 30, 2023, nonperforming loans totaled $6.3 million, or 0.31% of total loans, compared to $5.7 million,

or 0.29% of total loans, at December 31, 2022. At September 30, 2023, there were no loans 90 or more days past due and still accruing

interest. Nonperforming assets to total assets was 0.24% at September 30, 2023 and 0.22% at December 31, 2022. At September 30, 2023 and

at December 31, 2022, the Company did not have any other real estate owned. The allowance for credit losses as a percentage of total loans

was 0.99% at September 30, 2023, compared to 1.00% at December 31, 2022. At September 30, 2023, the allowance for credit losses as a percentage

of nonperforming loans was 317.6%, compared to 350.0% at December 31, 2022. Total classified loans, defined as special mention and substandard

loans, decreased $18.4 million, or 28.7%, from $64.0 million, or 3.2% of total loans, at December 31, 2022 to $45.6 million, or 2.3%,

of total loans at September 30, 2023.

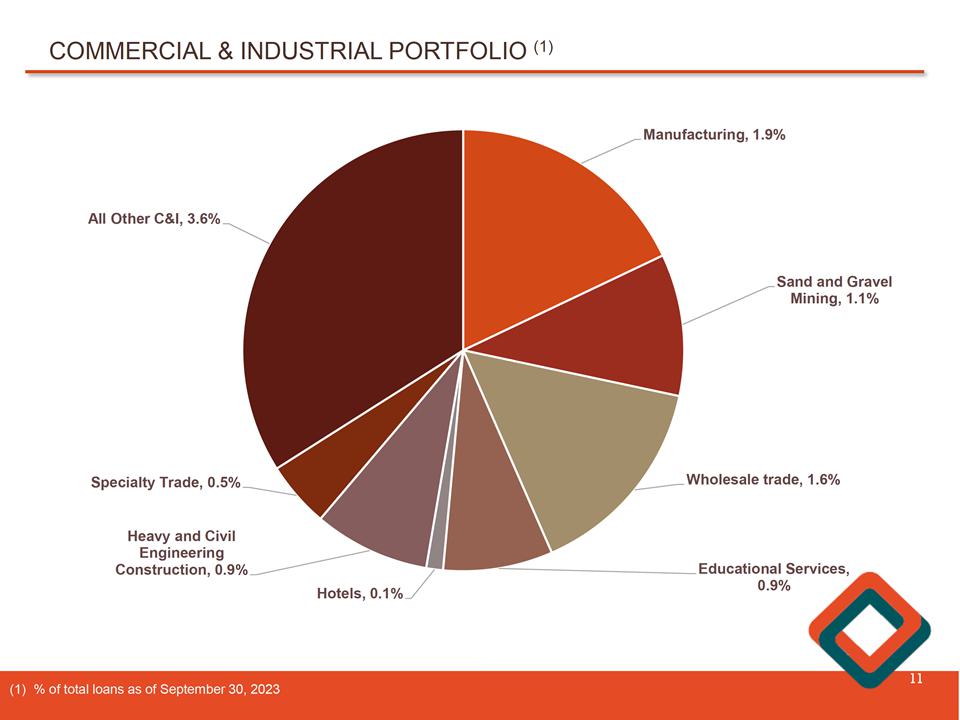

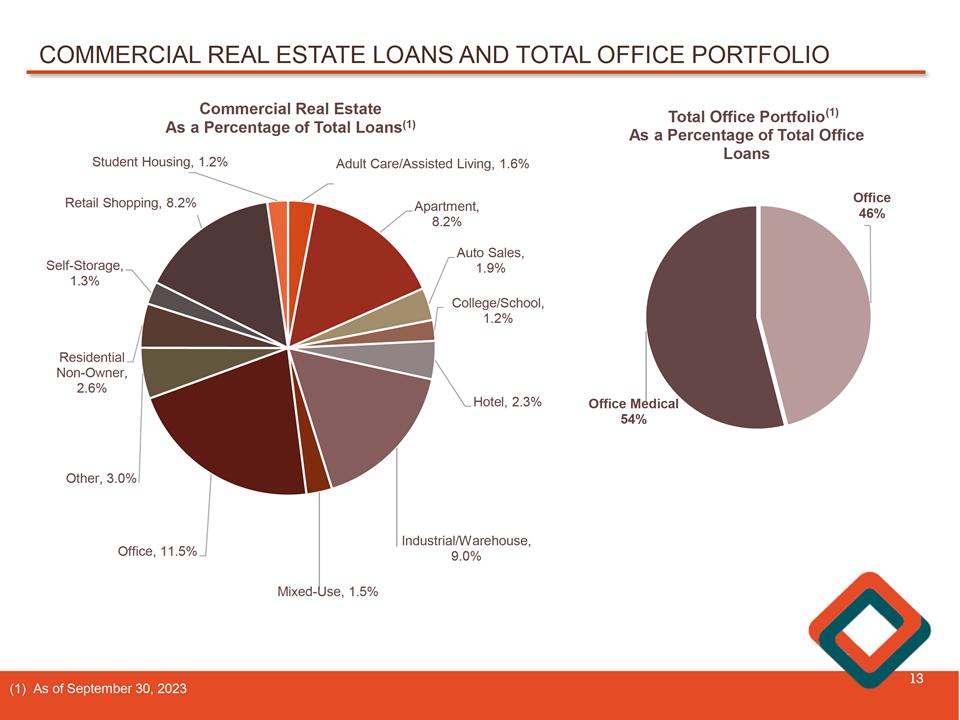

We continue to maintain diversity among property

types and within our geographic footprint. More details on the diversification of the loan portfolio are available in the supplementary

earnings presentation. Management will continue to remain attentive to any signs of deterioration in borrowers’ financial conditions

and is proactive in taking the appropriate steps to mitigate risk.

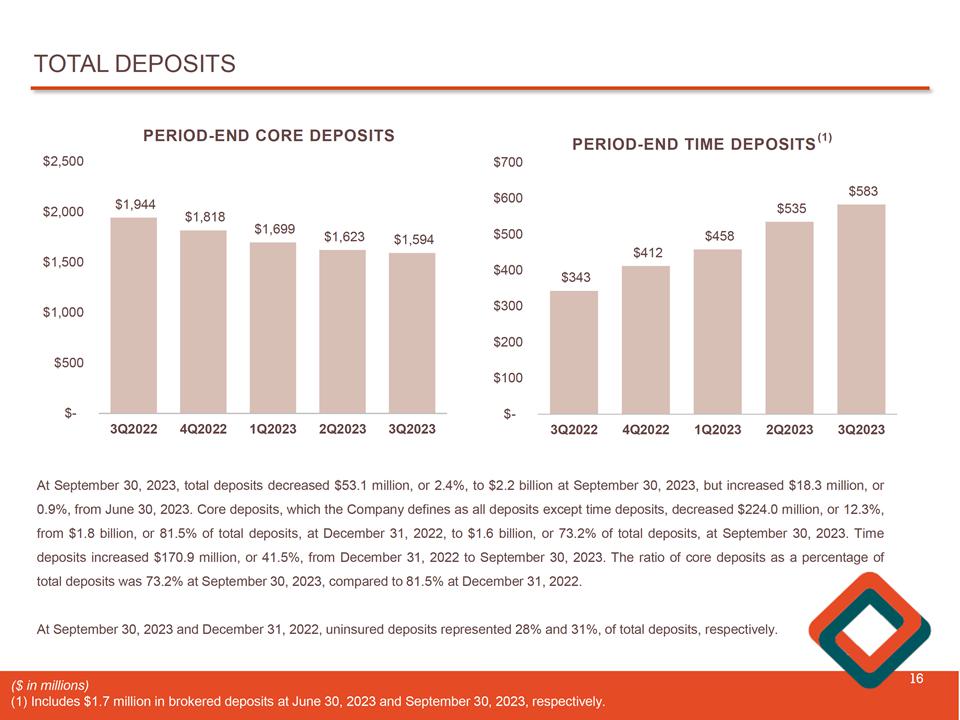

Deposits

Total deposits decreased $53.1 million, or

2.4%, from December 31, 2022, to $2.2 billion at September 30, 2023, due to industry-wide pressures and a competitive market for deposits

but increased $18.3 million, or 0.9%, from June 30, 2023. Core deposits, which the Company defines as all deposits except time deposits,

decreased $224.0 million, or 12.3%, from $1.8 billion, or 81.5% of total deposits, at December 31, 2022, to $1.6 billion, or 73.2% of

total deposits, at September 30, 2023. Money market accounts decreased $146.2 million, or 18.2%, to $654.9 million, non-interest-bearing

deposits decreased $51.9 million, or 8.0%, to $593.6 million, savings accounts decreased $30.1 million, or 13.5%, to $192.3 million and

interest-bearing checking accounts increased $4.2 million, or 2.8%, to $152.9 million. Time deposits increased $170.9 million, or 41.5%,

from $411.7 million at December 31, 2022 to $582.6 million at September 30, 2023. Brokered time deposits, which are included in time deposits,

totaled $1.7 million at September 30, 2023. The Company did not have any brokered deposits at December 31, 2022.

The table below is a summary of our deposit

balances for the periods noted:

| | |

September 30, 2023 | |

June 30, 2023 | |

March 31, 2023 | |

December 31, 2022 |

| | |

(Dollars in thousands) |

| Core Deposits: | |

| |

| |

| |

|

| Demand accounts | |

$ | 593,601 | | |

$ | 584,511 | | |

$ | 625,656 | | |

$ | 645,571 | |

| Interest bearing accounts | |

| 152,886 | | |

| 162,823 | | |

| 133,727 | | |

| 148,670 | |

| Savings accounts | |

| 192,321 | | |

| 203,376 | | |

| 218,800 | | |

| 222,436 | |

| Money market accounts | |

| 654,909 | | |

| 672,483 | | |

| 721,219 | | |

| 801,076 | |

| Total Core Deposits | |

$ | 1,593,717 | | |

$ | 1,623,193 | | |

$ | 1,699,402 | | |

$ | 1,817,753 | |

| | |

| | | |

| | | |

| | | |

| | |

| Time Deposits: | |

| | | |

| | | |

| | | |

| | |

| Time deposits less than $250,000 | |

$ | 384,472 | | |

$ | 338,667 | | |

$ | 300,907 | | |

$ | 279,953 | |

| Time deposits of $250,000 or more | |

| 198,114 | | |

| 196,114 | | |

| 156,819 | | |

| 131,737 | |

| Total Time Deposits: | |

| 582,586 | | |

| 534,781 | | |

| 457,726 | | |

| 411,690 | |

| Total Deposits: | |

$ | 2,176,303 | | |

$ | 2,157,974 | | |

$ | 2,157,128 | | |

$ | 2,229,443 | |

During the nine months ended September 30,

2023, the Company experienced a higher level of competition not only from local competitors but also from money market funds and Treasury

notes that were offering higher returns. In addition, the Company also saw an unfavorable shift in deposit mix from low cost core deposits

to high cost time deposits as customers migrated to higher yields.

The Company continues to focus on the maintenance,

development, and expansion of its core deposit base to meet funding requirements and liquidity needs, with an emphasis to retain a long-term

customer relationship base and to efficiently compete for and retain deposits in our local market. At September 30, 2023, the Bank’s

uninsured deposits represented 28.3% of total deposits, compared to 30.8% at December 31, 2022.

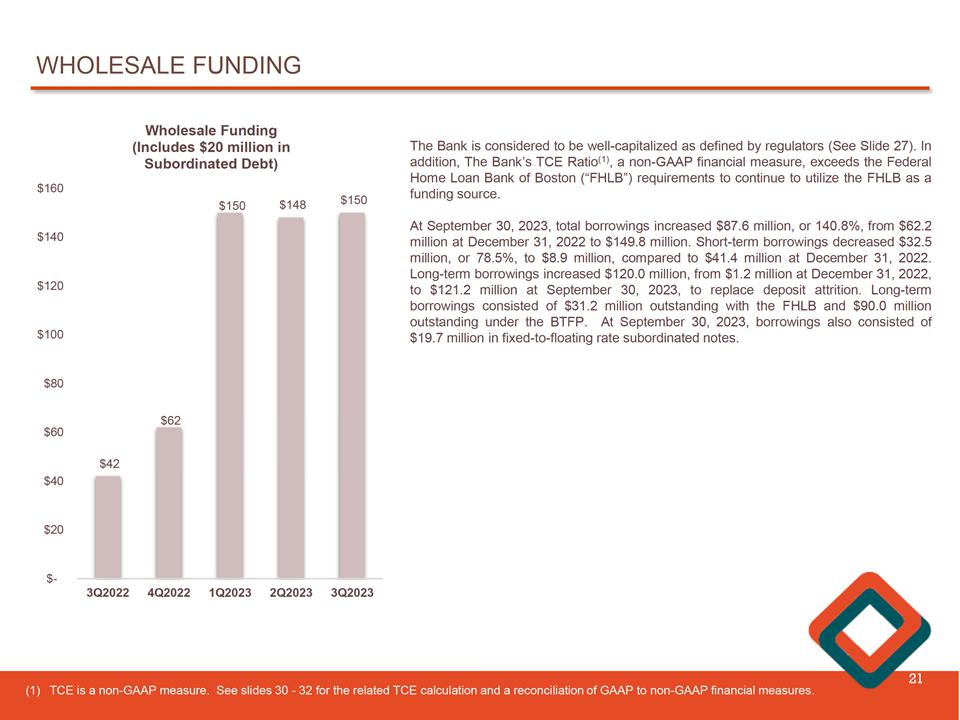

Borrowings

At September 30, 2023, total borrowings increased

$87.6 million, or 140.8%, from $62.2 million at December 31, 2022 to $149.8 million. Short-term borrowings decreased $32.5 million, or

78.5%, to $8.9 million, compared to $41.4 million at December 31, 2022. Long-term borrowings increased $120.0 million, from $1.2 million

at December 31, 2022, to $121.2 million at September 30, 2023, to replace deposit attrition. Long-term borrowings consisted of $31.2 million

outstanding with the Federal Home Loan Bank (“FHLB”) and $90.0 million outstanding under the Bank Term Funding Program (“BTFP”).

At September 30, 2023, borrowings also consisted of $19.7 million in fixed-to-floating rate subordinated notes.

Liquidity

The Company’s liquidity position remains

strong with solid core deposit relationships, cash, unencumbered securities, a diversified deposit base and access to diversified borrowing

sources. On March 12, 2023, the Federal Reserve made available the BTFP, which enhances the ability of banks to borrow greater amounts

against certain high-quality, unencumbered investments at par value.

During the nine months ended September 30,

2023, the Company participated in the BTFP, which enabled the Company to pay off higher rate FHLB advances. With the BTFP, the Company

has the ability to pay off the BTFP advance prior to maturity without incurring a penalty or termination fee. The Company advanced $90.0

million under the BTFP during the nine months ended September 30, 2023 and had $25.3 million in availability under the BTFP as of September

30, 2023.

At September 30, 2023, the Company had available

borrowing capacity with the FHLB of $551.6 million, including its overnight Ideal Way Line of Credit. In addition, at September 30,

2023, the Company had available borrowing capacity of $48.4 million from the Federal Reserve Discount Window, with no outstanding borrowings.

At September 30, 2023, the Company also had available borrowing capacity of $25.0 million from two unsecured credit lines with correspondent

banks, with no outstanding borrowings. At September 30, 2023, the Company has $650.3 million in total available borrowing capacity.

Hedging Program

During the nine months ended September 30,

2023, the Company executed a $200 million fair value hedge on fixed-rate assets with maturities up to 18 months, where the Company exchanged,

or swapped, fixed rate payments for floating rate payments. The Company’s hedging program aims to reduce the Company’s sensitivity

to interest rates by locking in a spread.

Capital

At September 30, 2023, shareholders’

equity was $230.9 million, or 8.9% of total assets, compared to $228.1 million, or 8.9% of total assets, at December 31, 2022. The increase

was primarily attributable to net income of $12.6 million, partially offset by an increase in accumulated other comprehensive loss of

$3.6 million, $3.1 million for the repurchase of common stock and cash dividends paid of $4.6 million. At September 30, 2023, total shares

outstanding were 21,927,242.

The Company’s regulatory capital ratios

continue to be strong and in excess of regulatory minimum requirements to be considered well-capitalized as defined by regulators and

internal Company targets. Total Risk-Based Capital Ratio at September 30, 2023 was 14.4%, compared to 14.2% at December 31, 2022.

The Bank’s Tier 1 Leverage Ratio to adjusted average assets was 9.69% at September 30, 2023 and 9.49% at December 31, 2022. The

Bank’s tangible common equity (“TCE”) to tangible assets ratio, a non-GAAP financial measure, was 8.58% at September

30, 2023, compared to 8.52% at December 31, 2022. Fluctuations in the TCE ratio were driven by the changes in the unrealized

loss on available-for-sale securities. TCE is a non-GAAP measure. See pages 19-22 for the related ratio calculation and a reconciliation

of GAAP to non-GAAP financial measures.

Dividends

Although the Company has historically paid

quarterly dividends on its common stock and currently intends to continue to pay such dividends, the Company’s ability to pay such

dividends depends on a number of factors, including restrictions under federal laws and regulations on the Company’s ability to

pay dividends, and as a result, there can be no assurance that dividends will continue to be paid in the future.

About Western New England Bancorp, Inc.

Western New England Bancorp, Inc. is a Massachusetts-chartered

stock holding company and the parent company of Westfield Bank, CSB Colts, Inc., Elm Street Securities Corporation, WFD Securities, Inc.

and WB Real Estate Holdings, LLC. Western New England Bancorp, Inc. and its subsidiaries are headquartered in Westfield, Massachusetts

and operate 25 banking offices throughout western Massachusetts and northern Connecticut. To learn more, visit our website at www.westfieldbank.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, with respect to the Company’s financial condition, liquidity, results of operations, future performance,

and business. Forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,”

“should,” “planned,” “estimated,” and “potential.” Examples of forward-looking

statements include, but are not limited to, estimates with respect to our financial condition, results of operations and business that

are subject to various factors which could cause actual results to differ materially from these estimates. These factors include,

but are not limited to:

| • | unpredictable

changes in general economic conditions, financial markets, fiscal, monetary and regulatory policies, including actual or potential stress

in the banking industry; |

| • | the

duration and scope of potential pandemics, including the emergence of new variants and the response thereto; |

| • | changes

in economic conditions which could materially impact credit quality trends and the ability to generate loans and gather deposits; |

| • | inflation

and governmental responses to inflation, including recent and potential future increases in interest rates that reduce margins; |

| • | the

effect on our operations of governmental legislation and regulation, including changes in accounting regulation or standards, the nature

and timing of the adoption and effectiveness of new requirements under the Dodd-Frank Act Wall Street Reform and Consumer Protection

Act of 2010, Basel guidelines, capital requirements and other applicable laws and regulations; |

| • | significant

changes in accounting, tax or regulatory practices or requirements; |

| • | new

legal obligations or liabilities or unfavorable resolutions of litigation; |

| • | disruptive

technologies in payment systems and other services traditionally provided by banks; |

| • | the

highly competitive industry and market area in which we operate; |

| • | changes

in business conditions and inflation; |

| • | operational

risks or risk management failures by us or critical third parties, including without limitation with respect to data processing, information

systems, cybersecurity, technological changes, vendor issues, business interruption, and fraud risks; |

| • | failure

or circumvention of our internal controls or procedures; |

| • | changes

in the securities markets which affect investment management revenues; |

| • | increases

in Federal Deposit Insurance Corporation deposit insurance premiums and assessments; |

| • | the

soundness of other financial services institutions which may adversely affect our credit risk; |

| • | certain

of our intangible assets may become impaired in the future; |

| • | new

lines of business or new products and services, which may subject us to additional risks; |

| • | changes

in key management personnel which may adversely impact our operations; |

| • | severe

weather, natural disasters, acts of war or terrorism and other external events which could significantly impact our business; and |

| • | other

risk factors detailed from time to time in our SEC filings. |

Although we believe that the expectations reflected

in such forward-looking statements are reasonable, actual results may differ materially from the results discussed in these forward-looking

statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

We do not undertake any obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof

or to reflect the occurrence of unanticipated events, except to the extent required by law.

WESTERN NEW ENGLAND BANCORP, INC. AND SUBSIDIARIES

Consolidated Statements of Net Income and Other

Data

(Dollars in thousands, except per share data)

(Unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

June 30, | |

March 31, | |

December 31, | |

September 30, | |

September 30, |

| | |

2023 | |

2023 | |

2023 | |

2022 | |

2022 | |

2023 | |

2022 |

| INTEREST AND DIVIDEND INCOME: | |

| |

| |

| |

| |

| |

| |

|

| Loans | |

$ | 23,451 | | |

$ | 22,450 | | |

$ | 21,329 | | |

$ | 21,274 | | |

$ | 19,543 | | |

$ | 67,230 | | |

$ | 55,990 | |

| Securities | |

| 2,033 | | |

| 2,094 | | |

| 2,149 | | |

| 2,174 | | |

| 2,104 | | |

| 6,276 | | |

| 6,122 | |

| Other investments | |

| 166 | | |

| 146 | | |

| 106 | | |

| 75 | | |

| 47 | | |

| 418 | | |

| 102 | |

| Short-term investments | |

| 251 | | |

| 119 | | |

| 54 | | |

| 62 | | |

| 60 | | |

| 424 | | |

| 129 | |

| Total interest and dividend income | |

| 25,901 | | |

| 24,809 | | |

| 23,638 | | |

| 23,585 | | |

| 21,754 | | |

| 74,348 | | |

| 62,343 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 7,704 | | |

| 6,069 | | |

| 4,103 | | |

| 2,206 | | |

| 1,164 | | |

| 17,876 | | |

| 3,146 | |

| Short-term borrowings | |

| 117 | | |

| 646 | | |

| 703 | | |

| 272 | | |

| 48 | | |

| 1,466 | | |

| 58 | |

| Long-term debt | |

| 1,444 | | |

| 995 | | |

| 74 | | |

| — | | |

| — | | |

| 2,513 | | |

| — | |

| Subordinated debt | |

| 253 | | |

| 253 | | |

| 254 | | |

| 253 | | |

| 254 | | |

| 760 | | |

| 761 | |

| Total interest expense | |

| 9,518 | | |

| 7,963 | | |

| 5,134 | | |

| 2,731 | | |

| 1,466 | | |

| 22,615 | | |

| 3,965 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income | |

| 16,383 | | |

| 16,846 | | |

| 18,504 | | |

| 20,854 | | |

| 20,288 | | |

| 51,733 | | |

| 58,378 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR (REVERSAL OF) CREDIT LOSSES | |

| 354 | | |

| 420 | | |

| (388 | ) | |

| 150 | | |

| 675 | | |

| 386 | | |

| 550 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income after provision for (reversal of) credit losses | |

| 16,029 | | |

| 16,426 | | |

| 18,892 | | |

| 20,704 | | |

| 19,613 | | |

| 51,347 | | |

| 57,828 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST INCOME: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service charges and fees | |

| 2,145 | | |

| 2,241 | | |

| 2,187 | | |

| 2,329 | | |

| 2,223 | | |

| 6,573 | | |

| 6,743 | |

| Income from bank-owned life insurance | |

| 454 | | |

| 494 | | |

| 440 | | |

| 428 | | |

| 391 | | |

| 1,388 | | |

| 1,297 | |

| Loss on sales of securities, net | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4 | ) |

| Unrealized gain (loss) on marketable equity securities | |

| — | | |

| — | | |

| — | | |

| 19 | | |

| (235 | ) | |

| — | | |

| (736 | ) |

| Loss on disposal of premises and equipment | |

| (3 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (3 | ) | |

| — | |

| Gain on sale of mortgages | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2 | |

| Gain on non-marketable equity investments | |

| 238 | | |

| — | | |

| 352 | | |

| 70 | | |

| 211 | | |

| 590 | | |

| 352 | |

| (Loss) gain on defined benefit plan termination | |

| — | | |

| (1,143 | ) | |

| — | | |

| 2,807 | | |

| — | | |

| (1,143 | ) | |

| — | |

| Gain on bank-owned life insurance death benefit | |

| 778 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 778 | | |

| — | |

| Other income | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 25 | |

| Total non-interest income | |

| 3,612 | | |

| 1,592 | | |

| 2,979 | | |

| 5,653 | | |

| 2,590 | | |

| 8,183 | | |

| 7,679 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salaries and employees benefits | |

| 7,955 | | |

| 8,089 | | |

| 8,431 | | |

| 8,197 | | |

| 8,025 | | |

| 24,475 | | |

| 24,500 | |

| Occupancy | |

| 1,159 | | |

| 1,203 | | |

| 1,348 | | |

| 1,218 | | |

| 1,226 | | |

| 3,710 | | |

| 3,766 | |

| Furniture and equipment | |

| 482 | | |

| 492 | | |

| 486 | | |

| 479 | | |

| 465 | | |

| 1,460 | | |

| 1,547 | |

| Data processing | |

| 824 | | |

| 792 | | |

| 753 | | |

| 724 | | |

| 707 | | |

| 2,369 | | |

| 2,161 | |

| Professional fees | |

| 643 | | |

| 803 | | |

| 757 | | |

| 617 | | |

| 803 | | |

| 2,203 | | |

| 2,099 | |

| FDIC insurance | |

| 341 | | |

| 290 | | |

| 352 | | |

| 255 | | |

| 273 | | |

| 983 | | |

| 793 | |

| Advertising | |

| 362 | | |

| 339 | | |

| 417 | | |

| 178 | | |

| 419 | | |

| 1,118 | | |

| 1,230 | |

| Other | |

| 2,352 | | |

| 2,543 | | |

| 2,352 | | |

| 2,335 | | |

| 2,425 | | |

| 7,247 | | |

| 7,136 | |

| Total non-interest expense | |

| 14,118 | | |

| 14,551 | | |

| 14,896 | | |

| 14,003 | | |

| 14,343 | | |

| 43,565 | | |

| 43,232 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAXES | |

| 5,523 | | |

| 3,467 | | |

| 6,975 | | |

| 12,354 | | |

| 7,860 | | |

| 15,965 | | |

| 22,275 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX PROVISION | |

| 1,033 | | |

| 704 | | |

| 1,671 | | |

| 3,320 | | |

| 1,861 | | |

| 3,408 | | |

| 5,422 | |

| NET INCOME | |

$ | 4,490 | | |

$ | 2,763 | | |

$ | 5,304 | | |

$ | 9,034 | | |

$ | 5,999 | | |

$ | 12,557 | | |

$ | 16,853 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

$ | 0.21 | | |

$ | 0.13 | | |

$ | 0.24 | | |

$ | 0.42 | | |

$ | 0.28 | | |

$ | 0.58 | | |

$ | 0.77 | |

| Weighted average shares outstanding | |

| 21,560,940 | | |

| 21,634,683 | | |

| 21,699,042 | | |

| 21,676,892 | | |

| 21,757,027 | | |

| 21,631,067 | | |

| 21,947,989 | |

| Diluted earnings per share | |

$ | 0.21 | | |

$ | 0.13 | | |

$ | 0.24 | | |

$ | 0.42 | | |

$ | 0.28 | | |

$ | 0.58 | | |

$ | 0.77 | |

| Weighted average diluted shares outstanding | |

| 21,680,113 | | |

| 21,648,235 | | |

| 21,716,869 | | |

| 21,751,409 | | |

| 21,810,036 | | |

| 21,681,251 | | |

| 22,001,371 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets (1) | |

| 0.70 | % | |

| 0.43 | % | |

| 0.84 | % | |

| 1.40 | % | |

| 0.93 | % | |

| 0.66 | % | |

| 0.88 | % |

| Return on average equity (1) | |

| 7.60 | % | |

| 4.72 | % | |

| 9.31 | % | |

| 16.67 | % | |

| 10.90 | % | |

| 7.19 | % | |

| 10.26 | % |

| Efficiency ratio | |

| 70.61 | % | |

| 78.92 | % | |

| 69.34 | % | |

| 52.83 | % | |

| 62.69 | % | |

| 72.71 | % | |

| 65.45 | % |

| Adjusted efficiency ratio (2) | |

| 74.38 | % | |

| 74.31 | % | |

| 70.49 | % | |

| 59.31 | % | |

| 62.63 | % | |

| 72.98 | % | |

| 65.06 | % |

| Net interest margin | |

| 2.70 | % | |

| 2.81 | % | |

| 3.14 | % | |

| 3.44 | % | |

| 3.35 | % | |

| 2.88 | % | |

| 3.26 | % |

| Net interest margin, on a fully tax-equivalent basis | |

| 2.72 | % | |

| 2.83 | % | |

| 3.16 | % | |

| 3.47 | % | |

| 3.37 | % | |

| 2.90 | % | |

| 3.28 | % |

| (2) | The adjusted efficiency ratio (non-GAAP) represents the ratio of

operating expenses divided by the sum of net interest and dividend income and non-interest income, excluding realized and unrealized

gains and losses on securities, loss on disposal of premises and equipment, gain on non-marketable equity investments, gains and losses

on defined benefit plan termination and gain on bank-owned life insurance death benefit. |

WESTERN NEW ENGLAND BANCORP, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Dollars in thousands)

(Unaudited)

| | |

September 30, | |

June 30, | |

March 31, | |

December 31, | |

September 30, |

| | |

2023 | |

2023 | |

2023 | |

2022 | |

2022 |

| Cash and cash equivalents | |

$ | 62,267 | | |

$ | 31,689 | | |

$ | 23,230 | | |

$ | 30,342 | | |

$ | 27,113 | |

| Available-for-sale securities, at fair value | |

| 130,709 | | |

| 141,481 | | |

| 146,373 | | |

| 146,997 | | |

| 148,716 | |

| Held-to-maturity securities, at amortized cost | |

| 225,020 | | |

| 222,900 | | |

| 226,996 | | |

| 230,168 | | |

| 234,387 | |

| Marketable equity securities, at fair value | |

| — | | |

| — | | |

| 6,309 | | |

| 6,237 | | |

| 11,280 | |

| Federal Home Loan Bank of Boston and other restricted stock - at cost | |

| 3,063 | | |

| 3,226 | | |

| 7,173 | | |

| 3,352 | | |

| 2,234 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

| 2,014,820 | | |

| 2,015,593 | | |

| 2,006,499 | | |

| 1,991,400 | | |

| 2,007,672 | |

| Allowance for credit losses (1) | |

| (19,978 | ) | |

| (19,647 | ) | |

| (19,031 | ) | |

| (19,931 | ) | |

| (20,208 | ) |

| Net loans | |

| 1,994,842 | | |

| 1,995,946 | | |

| 1,987,468 | | |

| 1,971,469 | | |

| 1,987,464 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Bank-owned life insurance | |

| 74,713 | | |

| 75,554 | | |

| 75,060 | | |

| 74,620 | | |

| 74,192 | |

| Goodwill | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | |

| Core deposit intangible | |

| 1,906 | | |

| 2,000 | | |

| 2,094 | | |

| 2,188 | | |

| 2,281 | |

| Other assets | |

| 79,998 | | |

| 77,001 | | |

| 74,825 | | |

| 75,290 | | |

| 78,671 | |

| TOTAL ASSETS | |

$ | 2,585,005 | | |

$ | 2,562,284 | | |

$ | 2,562,015 | | |

$ | 2,553,150 | | |

$ | 2,578,825 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total deposits | |

$ | 2,176,303 | | |

$ | 2,157,974 | | |

$ | 2,157,128 | | |

$ | 2,229,443 | | |

$ | 2,287,754 | |

| Short-term borrowings | |

| 8,890 | | |

| 7,190 | | |

| 98,990 | | |

| 41,350 | | |

| 21,500 | |

| Long-term debt | |

| 121,178 | | |

| 121,178 | | |

| 31,178 | | |

| 1,178 | | |

| 1,178 | |

| Subordinated debt | |

| 19,702 | | |

| 19,692 | | |

| 19,682 | | |

| 19,673 | | |

| 19,663 | |

| Securities pending settlement | |

| 2,253 | | |

| — | | |

| — | | |

| 133 | | |

| 9 | |

| Other liabilities | |

| 25,765 | | |

| 22,252 | | |

| 21,815 | | |

| 33,230 | | |

| 37,021 | |

| TOTAL LIABILITIES | |

| 2,354,091 | | |

| 2,328,286 | | |

| 2,328,793 | | |

| 2,325,007 | | |

| 2,367,125 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL SHAREHOLDERS' EQUITY | |

| 230,914 | | |

| 233,998 | | |

| 233,222 | | |

| 228,143 | | |

| 211,700 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

$ | 2,585,005 | | |

$ | 2,562,284 | | |

$ | 2,562,015 | | |

$ | 2,553,150 | | |

$ | 2,578,825 | |

| (1) | The Company adopted ASU 2016-13 on January 1, 2023 with a modified retrospective

approach. Accordingly, beginning with March 31, 2023, the allowance for credit losses was determined in accordance with ASC 326, “Financial

Instruments-Credit Losses.” |

WESTERN NEW ENGLAND BANCORP, INC. AND SUBSIDIARIES

Other Data

(Dollars in thousands, except per share data)

(Unaudited)

| | |

Three Months Ended |

| | |

September 30, | |

June 30, | |

March 31, | |

December 31, | |

September 30, |

| | |

2023 | |