UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

January

24, 2025

Commission

File Number 001-37974

VIVOPOWER

INTERNATIONAL PLC

(Translation

of registrant’s name into English)

The

Scalpel, 18th Floor, 52 Lime Street London EC3M 7AF

United

Kingdom

+44-203-667-5158

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F: Form 20- F ☒ Form 40-F

☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

In

compliance with the Nasdaq Listing Rule 5250(c)(2), VivoPower International PLC has filed its unaudited consolidated statement of financial

position as of December 31, 2024, and its unaudited consolidated statement of comprehensive income, unaudited consolidated statement

of changes in equity and unaudited consolidated cash flow statement for the six months ended December 31, 2024. The financial information

set forth in this report is unaudited and subject to adjustment in connection with the audit of the Company’s financial statements

for the year ending June 30, 2025.

This

Current Report on Form 6-K (“Form 6-K”) is being filed to include the Company’s Management’s Discussion

and Analysis of Financial Condition and Results of Operations for the six months ended December 31, 2024 and 2023 and to provide six-month

interim financial statements and incorporate such financial statements into the Company’s registration statements referenced below.

Highlights

for the half year ended December 31, 2024

| ● | On

July 2, 2024, as part of the Company’s previously announced strategic focus on its

fast-growing business units being Electric Vehicles and Sustainable Energy Solutions, the

Company announced the sale of its non-core business unit, Kenshaw Electrical, for gross consideration

of approximately AU$1.2 million. |

| ● | Revenue

from continuing operations increased to $0.06 million in the half year ended December 31,

2024, compared to nil in the same period of the prior year. This growth reflects the initial

build-up and scaling of revenue from Tembo’s operations. |

| ● | Net

after-tax loss from continuing operations decreased to $6.2 million in the half year ended

December 31, 2024, compared to $7.5 million in the same period of the prior year. The improvement

was driven by a combination of reduced headcount, technology-enabled efficiencies, outsourcing

savings, and lower non-recurring costs. |

| ● | EBITDA

for the half year ended December 31, 2024, improved compared to the same period in the prior

year, driven by a reduction in general and administrative expenses and minimal restructuring

and other non-recurring costs recorded during the period. |

| ● | Tembo

executed a definitive Business Combination Agreement with CCTS on August 29, 2024; the business

combination is expected to be completed by the first quarter of the calendar year 2025, with

Tembo being listed as a separate entity on the Nasdaq. |

| ● | On

September 17, 2024, VivoPower announced a heads of agreement to merge with Future Automotive

Solutions and Technologies Inc. (“FAST”), a Canadian hydrogen technology company,

at a combined equity valuation of US$1.13 billion. The all-stock merger, giving VivoPower

shareholders 49% ownership, is contingent on the Tembo-Cactus business combination, regulatory

approvals, and a third-party fairness opinion. |

| ● | On

September 17, 2024, the Company entered into a placement agency agreement with Chardan Capital

Markets LLC for an offering of up to 10,000,000 Ordinary Shares at $1.25 per share, under

the Company’s Registration Statement on Form F-1 (No. 333-281065), effective August

29, 2024. The offering closed early on September 27, 2024, resulting in the issuance of 3,200,000

Ordinary Shares to institutional investors, generating approximately $4 million in gross

proceeds. |

| ● | On

October 3, 2024, Tembo entered into a definitive partnership agreement with Sarao Motors,

the leading jeepney manufacturer in the Philippines which includes the delivery of Tembo’s

electric jeepney kits to Sarao’s facility in Metro Manila. |

| ● | On

November 14, 2024, the Company’s Board of Directors approved an execution plan for

Caret, to develop up to 55MW of its solar farm portfolio for Dogecoin and Litecoin mining. |

| ● | On

November 18, 2024, Tembo secured full on-road Vehicle Type Approval (VTA) in Australia for

its fully electric utility vehicle, the Tembo Tusker. |

| ● | On

November 23, 2024, AWN Holdings (AWN) agreed to a 9-month grace period for the repayment

of $11 million accrued interest, and a deferral of $8.9 million of principal for repayment

from April 1, 2025 to January 1, 2026. This renders all but $1 million of interest non-current

in nature, and $2 million of the principal loan as current as of December 2024. |

| ● | After

the balance sheet date, on January 13, 2025, Caret, secured a definitive and binding investment

commitment of CAD$140 million (approximately US$100 million) from GEM Global Yield LLC SCS

(“GGY”), a Luxembourg-based alternative investment group, subject to a separate

listing of Caret Digital on a Canadian stock exchange. The proceeds from this investment

will be used to advance Caret’s Power2X strategy, initially focusing on Dogecoin mining,

while also supporting working capital and general corporate purposes. |

Our

unaudited half-year results demonstrate significant progress in aligning with our strategic priorities, particularly in scaling our Electric

Vehicle (EV) and Sustainable Energy Solutions (SES) business units, while enhancing financial flexibility and streamlining operations.

During

the period, we divested Kenshaw Electrical, a non-core asset, allowing us to concentrate on high-growth opportunities within Tembo and

Caret. Revenue from continuing operations saw an initial uptick, reflecting the early stages of scaling Tembo’s revenue streams.

Meanwhile, cost-saving initiatives, including reduced headcount and outsourcing efficiencies, contributed to a narrower net after-tax

loss and improved EBITDA compared to the prior year.

Tembo

achieved several milestones, including the signing of a definitive Business Combination Agreement with CCTS, paving the way for its Nasdaq

listing in early 2025. Additionally, Tembo secured key partnerships, such as with Sarao Motors for electric jeepney kits in the Philippines

and obtained full on-road Vehicle Type Approval for the Tembo Tusker in Australia, solidifying its market position.

Caret

advanced its Power2X strategy with a Board-approved plan to develop solar farms for cryptocurrency mining and secured a substantial investment

commitment of CAD$140 million from GGY to fund this initiative and support its broader growth.

We

also strengthened our financial position through a successful equity offering amid rough market conditions and a restructuring of loan

terms with AWN significantly improving our liquidity and balance sheet flexibility. These achievements underscore our commitment to executing

our strategy, enhancing efficiency, and positioning the Company for sustainable growth.

A

reconciliation of IFRS (“International Financial Reporting Standards”) to non-IFRS financial measures has been provided in

the financial statement table included in this press release. An explanation of these measures is also included below, under the heading

“About Non-IFRS Financial Measures.”

About

Non-IFRS Financial Measures

Our

results include certain non-IFRS financial measures, including adjusted EBITDA, adjusted net after-tax loss and adjusted EPS. Management

believes that the use of these non-IFRS financial measures provides consistency and comparability with our past financial performance,

facilitates period-to-period comparisons of our results of operations, and also facilitates comparisons with peer companies, many of

which use similar non-IFRS or non-GAAP (“Generally Accepted Accounting Principles”) financial measures to supplement their

IFRS or GAAP results. Non-IFRS results are presented for supplemental informational purposes only to aid in understanding our results

of operations. The non-IFRS results should not be considered a substitute for financial information presented in accordance with IFRS

and may be different from non-IFRS or non-GAAP measures used by other companies.

The

tables included in this press release titled “Reconciliation of Adjusted (Underlying) EBITDA to IFRS Financial Measures”

and “Reconciliation of Adjusted (Underlying) Net After-Tax Loss and Adjusted (Underlying) EPS to IFRS Financial Measures”

provide reconciliations of non-IFRS financial measures to the most recent directly comparable financial measures calculated and presented

in accordance with IFRS.

Reconciliation

of IFRS Financial Measures to Adjusted (Underlying) EBITDA for Continuing Operations

| | |

Six months

ended December 31 |

| (US dollars in thousands

except per share amounts) | |

2024 | |

2023 |

| Net Profit / (loss) | |

| (4,476 | ) | |

| (7,828 | ) |

| Income/(loss) from discontinued

operations | |

| 1,688 | | |

| (296 | ) |

| Loss from continuing operations | |

| (6,164 | ) | |

| (7,532 | ) |

| Income Tax | |

| 381 | | |

| (196 | ) |

| Net finance expense / (income) | |

| 3,215 | | |

| 2,148 | |

| Share based compensation | |

| - | | |

| 208 | |

| Restructuring & other non-recurring costs | |

| 4 | | |

| (1,261 | ) |

| Depreciation and amortization | |

| 237 | | |

| 563 | |

| Adjusted EBITDA | |

| (2,327 | ) | |

| (6,070 | ) |

Notes:

| |

(1) |

Restructuring and other non-recurring

costs relate to one-off impairments on two Solar projects in FY24 following the non- renewal on lease extensions. |

Reconciliation

of IFRS Financial Measures to Adjusted (Underlying) Net After-Tax Loss for Continuing Operations and Adjusted (Underlying) EPS

| | |

Six months

ended December 31 | |

| (US dollars

in thousands except per share amounts) | |

2024 | | |

2023 | |

| Loss from continuing operations | |

| (6,164 | ) | |

| (7,532 | ) |

| Restructuring & other non-recurring costs | |

| (4 | ) | |

| 1,261 | |

| Non-recurring cost of

sales costs1 | |

| - | | |

| - | |

| Adjusted earnings for

EPS | |

| (6,168 | ) | |

| (6,271 | ) |

| | |

| | | |

| | |

| Profit/loss - per share | |

| (0.90 | ) | |

| (2.81 | ) |

| Reorg & other non-recurring - per share | |

| (0.00 | ) | |

| 0.47 | |

| Non-recurring cost of

sales costs1 | |

| - | | |

| - | |

| Adjusted

earnings for EPS - per share | |

| (0.90 | ) | |

| (2.34 | ) |

Note:

| (1) | Restructuring

and other non-recurring costs relate to one-off impairments on two Solar projects in FY24

following the non-renewal on lease extensions. |

About

VivoPower

Established

in 2014 and listed on Nasdaq since 2016, VivoPower is an award-winning global sustainable energy solutions B Corporation company focussed

on electric solutions for off-road and on-road customised and ruggedised fleet applications as well as ancillary financing, charging,

battery and microgrids solutions. VivoPower’s core purpose is to provide its customers with turnkey decarbonisation solutions that

enable them to move toward net-zero carbon status. VivoPower has operations and personnel covering Australia, Canada, the Netherlands,

the United Kingdom, the United States, the Philippines, and the United Arab Emirates.

Forward-Looking

Statements

This

communication includes certain statements that may constitute “forward-looking statements” for purposes of the U.S. federal

securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intends,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the benefits

of the events or transactions described in this communication and the expected returns therefrom. These statements are based on VivoPower’s

management’s current expectations or beliefs and are subject to risk, uncertainty and changes in circumstances. Actual results

may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or

regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s business. These risks, uncertainties

and contingencies include changes in business conditions, fluctuations in customer demand, changes in accounting interpretations, management

of rapid growth, intensity of competition from other providers of products and services, changes in general economic conditions, geopolitical

events and regulatory changes and other factors set forth in VivoPower’s filings with the United States Securities and Exchange

Commission. The information set forth herein should be read in light of such risks. VivoPower is under no obligation to, and expressly

disclaims any obligation to, update or alter its forward-looking statements whether as a result of new information, future events, changes

in assumptions or otherwise.

For

further guidance on risks, uncertainties and other factors that can have an impact on our outcomes, please refer to Item 3. Key Information

– D. Risk Factors, as reported in the Company’s Annual Report on Form 20-F, for the year ended June 30, 2024. Specifically,

the consolidated financial statements included therein were prepared on a going concern basis and do not include any adjustments that

result from uncertainty about our ability to continue as a going concern. However, if losses continue, and if we are unable to raise

additional financing on sufficiently attractive terms or generate cash through sales of solar projects or other material assets or other

means, then we may not have sufficient liquidity to sustain our operations and may not be able to continue as a going concern. Similarly,

the report of our independent registered public accounting firm on our consolidated financial statements as of and for the year ended

June 30, 2024, includes an explanatory paragraph indicating that a material uncertainty exists which may cast material doubt on the group’s

ability to continue as a going concern if it is unable to secure sufficient funding. Our consolidated financial statements do not include

any adjustments that might result from the outcome of this uncertainty.

Contact

Shareholder

Enquiries

shareholders@vivopower.com

Financial

Results for the Six Months Ended December 31, 2024

The

Company and its subsidiaries (the “Group”) generated from continuing operations revenue of $0.06 million, gross profit of

nil, operating loss of $2.6 million, and net loss of $6.2 million in the first half of its current fiscal year ending June 30, 2025.

This compares to the same period in the prior year when the Group generated revenue of nil, gross loss of $0.01 million, an operating

loss of $4.3 million, and a net loss of $7.5 million from its continuing operations.

Management

analyses the Company’s business in five reportable segments: Critical Power Services, Electric Vehicles, Sustainable Energy Solutions,

Solar Development and Corporate Office. Critical Power Services is represented by VivoPower’s wholly owned subsidiary Aevitas and

its wholly owned subsidiary Kenshaw Electrical Pty Limited (“Kenshaw”), which operated in Australia with a focus on the design,

supply, installation and maintenance of critical power, control and distribution systems, including for solar farms. Critical Power Services

is now a discontinued operations after the sale of Kenshaw. Electric Vehicles is represented by Tembo e-LV B.V. (“Tembo Netherlands”)

and Tembo EV Australia Pty Ltd (“Tembo Australia”), (in combination “Tembo”) a specialist battery-electric and

off-road vehicle company delivering electric vehicles (“EV”) for mining and other industrial customers globally. Sustainable

Energy Solutions (“SES”) is the design, evaluation, sale and implementation of renewable energy infrastructure to customers,

both on a standalone basis and in support of Tembo EVs. Solar Development is represented by Caret and comprises three active utility-scale

solar projects under development in the United States. Corporate Office is the Company’s corporate functions, including costs to

maintain the Nasdaq public company listing, comply with applicable SEC reporting requirements, and related investor relations and is

located in the U.K.

The

following are the results of continuing and discontinued operations by reportable segment:

(Unaudited)

| | |

Continuing

operations | | |

Discontinued

operations | | |

Total | |

Six

months ended December 31, 2024

(US dollars in thousands) | |

Critical

Power Services | | |

Electric

Vehicle | | |

Solar | | |

SES | | |

Corporate | | |

Total | | |

Critical

Power Services | | |

| |

| Revenue

from contracts with customers | |

| - | | |

| 63 | | |

| - | | |

| - | | |

| - | | |

| 63 | | |

| - | | |

| 63 | |

| Cost

of Sales | |

| - | | |

| (63 | ) | |

| - | | |

| - | | |

| - | | |

| (63 | ) | |

| - | | |

| (63 | ) |

| Gross

profit | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| General

and administrative expenses | |

| (8 | ) | |

| (720 | ) | |

| (11 | ) | |

| (54 | ) | |

| (1,558 | ) | |

| (2,351 | ) | |

| - | | |

| (2,351 | ) |

| Gain/(loss)

on solar development | |

| - | | |

| - | | |

| - | | |

| 16 | | |

| - | | |

| 16 | | |

| 1,688 | | |

| 1,704 | |

| Other

income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Depreciation

and amortization | |

| - | | |

| (235 | ) | |

| - | | |

| (1 | ) | |

| (1 | ) | |

| (237 | ) | |

| - | | |

| (237 | ) |

| Operating

loss | |

| (8 | ) | |

| (955 | ) | |

| (11 | ) | |

| (39 | ) | |

| (1,559 | ) | |

| (2,572 | ) | |

| 1,688 | | |

| (884 | ) |

| Restructuring

& other non-recurring costs | |

| - | | |

| - | | |

| 4 | | |

| - | | |

| - | | |

| 4 | | |

| - | | |

| 4 | |

| Finance

income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Finance

expense | |

| (187 | ) | |

| (532 | ) | |

| - | | |

| 2 | | |

| (2,498 | ) | |

| (3,215 | ) | |

| - | | |

| (3,215 | ) |

| Loss

before income tax | |

| (195 | ) | |

| (1,487 | ) | |

| (7 | ) | |

| (37 | ) | |

| (4,056 | ) | |

| (5,783 | ) | |

| 1,688 | | |

| (4,095 | ) |

| Income

tax | |

| - | | |

| (380 | ) | |

| - | | |

| - | | |

| (1 | ) | |

| (381 | ) | |

| - | | |

| (381 | ) |

| Loss

for the period | |

| (195 | ) | |

| (1,867 | ) | |

| (7 | ) | |

| (37 | ) | |

| (4,057 | ) | |

| (6,164 | ) | |

| 1,688 | | |

| (4,476 | ) |

(Unaudited)

| | |

Continuing

operations | | |

Discontinued | | |

Total | |

| Six

months ended December 31, 2023 | |

Critical

Power Services | | |

Electric

Vehicle | | |

Solar | | |

SES | | |

Corporate | | |

Total | | |

Critical

Power Services | | |

| |

| Revenue

from contracts with customers | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,910 | | |

| 5,910 | |

| Cost

of Sales | |

| (16 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (16 | ) | |

| (5,357 | ) | |

| (5,373 | ) |

| Gross

profit | |

| (16 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (16 | ) | |

| 553 | | |

| 537 | |

| General

and administrative expenses | |

| (49 | ) | |

| (748 | ) | |

| (30 | ) | |

| (172 | ) | |

| (2,739 | ) | |

| (3,738 | ) | |

| (612 | ) | |

| (4,350 | ) |

| Gain/(loss)

on solar development | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Other

income | |

| 47 | | |

| - | | |

| - | | |

| (49 | ) | |

| - | | |

| (2 | ) | |

| 48 | | |

| 46 | |

| Depreciation

and amortization | |

| (221 | ) | |

| (335 | ) | |

| - | | |

| (2 | ) | |

| (5 | ) | |

| (563 | ) | |

| (143 | ) | |

| (706 | ) |

| Operating

loss | |

| (239 | ) | |

| (1,083 | ) | |

| (30 | ) | |

| (223 | ) | |

| (2,744 | ) | |

| (4,319 | ) | |

| (154 | ) | |

| (4,473 | ) |

| Restructuring

& other non-recurring costs | |

| - | | |

| - | | |

| (1,261 | ) | |

| - | | |

| - | | |

| (1,261 | ) | |

| - | | |

| (1,261 | ) |

| Finance

income | |

| 7 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7 | | |

| - | | |

| 7 | |

| Finance

expense | |

| (1,752 | ) | |

| (137 | ) | |

| - | | |

| (27 | ) | |

| (239 | ) | |

| (2,155 | ) | |

| (142 | ) | |

| (2,297 | ) |

| Loss

before income tax | |

| (1,984 | ) | |

| (1,220 | ) | |

| (1,291 | ) | |

| (250 | ) | |

| (2,983 | ) | |

| (7,728 | ) | |

| (296 | ) | |

| (8,024 | ) |

| Income

tax | |

| - | | |

| 196 | | |

| - | | |

| - | | |

| - | | |

| 196 | | |

| - | | |

| 196 | |

| Loss

for the period | |

| (1,984 | ) | |

| (1,024 | ) | |

| (1,291 | ) | |

| (250 | ) | |

| (2,983 | ) | |

| (7,532 | ) | |

| (296 | ) | |

| (7,828 | ) |

Revenue

Revenue

from continuing operations in the first half of the current fiscal year ending June 30, 2025, was $0.06 million, up from nil in the first

half of the prior fiscal year.

Revenue

from continuing operations from the Critical Power Services businesses was nil for both periods, as this segment is now classified as

discontinued following the sale of Kenshaw.

Revenue

in the Electric Vehicle division was $0.06 million during the half year ended 31 December 2024. This growth reflects the initial build-up

and scaling of revenue from Tembo’s operations.

Cost

of sales

Cost

of sales from continuing operations in the first half of the current fiscal year ending June 30, 2025, was $0.1 million, compared to

$0.02 million in the first half of the prior fiscal year. The cost of sales in the first half of the current year was entirely related

to $0.1 million of material and labour for the Electric Vehicle division. In the first half of the prior fiscal year, cost of sales comprised

of material and labour costs related to the continuing operations of Critical Power Services business. The increase in cost of sales

reflects the Company’s focus on scaling up its Electric Vehicle business.

Gross

profit

Gross

profit from continuing operations is equal to revenue less cost of sales amounting to nil for the six months ended December 31, 2024,

compared to ($0.02) million in the first half of the prior fiscal year. Critical Power Services gross margins are no longer applicable

as this segment has been discontinued following the sale of Kenshaw.

General

and administrative expenses

General

and administrative expenses consist primarily of operational expenses, including employee salaries and benefits, director fees, professional

fees, insurance, travel, IT, office and other expenses. General and administrative expenses from continuing operations for the first

half of the current fiscal year ending June 30, 2025, were $2.4 million, compared to $3.7 million in the prior fiscal year.

Other

income

There

was nil other income from continuing operations in the first half of the current fiscal year ending June 30, 2025. Other income from

continuing operations of less than $0.01 million in the first half of the prior fiscal year ending June 30, 2024.

Depreciation

and amortization

Depreciation

and amortization charges from continuing operations were $0.05 million and $0.2 million, respectively, in the first half of the current

fiscal year ending June 30, 2025, compared to $0.2 million and $0.4 million in the first half of the prior fiscal year. Amortization

costs relate to the amortization of intangible assets generated on the acquisition of VivoPower Australia and Aevitas in 2016 and of

Tembo in November 2020.

Restructuring

and other non-recurring costs

Restructuring

and other non-recurring costs by nature are one-time incurrences, and therefore, do not represent normal trading activities of the business.

These costs are disclosed separately in order to draw them to the attention of the reader of the financial information and enable comparability

in future periods.

The

results of operations for the first half of the current fiscal year ending June 30, 2025, include a positive value of less than $0.01m

relating to the reversal of a portion of impairment of intangible assets in the Solar development division. The first half of the prior

fiscal year include $1.3 million relating to the impairment of intangible assets in the Solar development division.

Finance

expense

Finance

expenses were $3.2 million in the first half of the current fiscal year ending June 30, 2025, comprising $2.2 million of interest expense,

$0.6 million foreign currency losses, and $0.4 million worth of Fees and Charges. The finance expense for the first half of the prior

fiscal year of $2.2 million, comprising $2.2 million of interest on a loan with AWN. Other finance charges including audit

fees, and interest on other loans and borrowings were more than offset by foreign currency gains on the loan with AWN.

Income

tax credits / expense

The

Company is subject to income tax for the period ended December 31, 2024, at rates of 19% to 25%, 21%, 25%, and 15% to 25.8% in the U.K.,

the U.S., Australia, and the Netherlands respectively, and it uses estimates in determining its provision for income taxes.

Discontinued

operations

On

July 2, 2024, Kenshaw Electrical was sold for $0.8 million (AU$1.2 million) consideration .

Financial

Position

Property,

plant, and equipment decreased slightly to $0.4 million as of December 31, 2024, compared to $0.44 million as of June 30, 2024.

Intangible

assets increased by $0.56 million, from $15.2 million at June 30, 2024, to $15.8 million at December 31, 2024. This increase was driven

by capitalized intangible development costs in Tembo.

Deferred

tax assets decreased slightly by $0.3 million to $3.8 million as of December 31, 2024, mainly due to the decline in USD:EUR translations.

Trade

and other receivables of $10.0 million as of December 31, 2024, remained relatively consistent with the $10.0 million reported at June

30, 2024, reflecting normal collection cycles.

Inventory

of $1.5 million at December 31, 2024, primarily comprises raw materials within the Electric Vehicles segment, compared to $1.7 million

as of June 30, 2024.

Restricted

cash of $0.2 million is being held as security for bank guarantees provided to customers in support of performance obligations under

power services contracts.

Trade

and other payables decreased slightly to $35.2 million as of December 31, 2024, compared to $37.9 million at June 30, 2024. This decrease

reflects the timing of payments on supplier contracts and the settlement of certain liabilities.

As

of December 31, 2024, the Company had $29.0 million of loans and borrowings outstanding, compared to $29.1 million at June 30, 2024,

comprising the following:

| | |

December 31 | | |

June 30 | |

| (US dollars in thousands) | |

2024 | | |

2024 | |

| Current liabilities: | |

| | | |

| | |

| Other borrowings | |

| - | | |

| - | |

| Debtor invoice finance facility | |

| 67 | | |

| 67 | |

| Shareholder loans | |

| 2,191 | | |

| 8,104 | |

| | |

| 2,258 | | |

| 8,171 | |

| Non-current liabilities: | |

| | | |

| | |

| Related party loan | |

| 26,734 | | |

| 20,915 | |

| | |

| 26,734 | | |

| 20,915 | |

| Total | |

| 28,992 | | |

| 29,086 | |

As

at December 31, 2024, the Company had principal balance on outstanding loans with AWN, the Company’s most significant shareholder,

of $28.9 million. The slight decrease from $29.0 million at June 30, 2024, was mainly attributable to foreign exchange translations.

Cash

Flow

Cash

and cash equivalents have decreased by $0.17 million from $0.2 million at June 30, 2024, to $0.03 million at December 31, 2024. This

excludes restricted cash of $0.2 million to be released in the post balance sheet period.

The

cash reduction was driven by cash ouawtflows from operating activities of $5.7 million and investing activities of $0.8 million offset

by cash inflow from financing activity of $6.7 million. Cash used in investing activities includes $0.7 million capital expenditure on

electric vehicle product development costs in Tembo and $0.03 million investment in property, plant and equipment.

This

was partially offset by net cash inflow from financing activities of $6.7 million which includes $6.7 million inflow from the issuance

of share capital.

The

Company has a drawdown facility of $2 million from a related party, Arowana Global Impact.

Business

Overview

VivoPower

is an award-winning global sustainable energy solutions B Corporation company focused on electric solutions for customised and ruggedised

fleet applications, battery and microgrids, solar and critical power technology and services. The Company’s core purpose is to

provide its customers with turnkey decarbonisation solutions that enable them to move toward net-zero carbon status. VivoPower has operations

and personnel in Australia, Canada, the Netherlands, the United Kingdom, the United States, and the Philippines.

Critical

Power Services

VivoPower’s

Critical Power Services business was known as Aevitas. Aevitas was a key player in the manufacture, distribution, installation and servicing

of critical energy infrastructure solutions. Its portfolio spans the design, procurement, installation, and upkeep of power and control

systems, including those catering to utility and industrial scale solar farms. Under Aevitas, there were three operating companies, J.A.

Martin Electrical, NDT Services and Kenshaw Electrical. J.A. Martin and NDT Services were sold in July 2022 and Kenshaw Electrical was

sold in July 2024. VivoPower is completing a restructure of Aevitas given it is now a discontinued operation.

Electric

Vehicles

Tembo

e-LV B.V. (“Tembo”) is the electric vehicle business unit and brand of VivoPower. It has operating subsidiaries in the Netherlands,

Australia, and Asia. Founded in the Netherlands in 1969, Tembo’s genesis was as a specialist off-road vehicle ruggedisation and

modification company. This led to the design and development of electric battery conversion kits to replace internal combustion engines

(“ICE”) in light utility vehicle fleets, particularly for the mining sector. VivoPower first acquired a shareholding in Tembo

in October 2020 before securing full control in February 2021. Since then, the Tembo business has been transformed into a global business

and brand with partners and customers globally.

Today,

Tembo has three product lines being the Electric Utility Vehicle (“EUV”) conversion kits for mining and other off-road and

ruggedised or customised on-road applications, the Public Utility Vehicle (“PUV”) electric powertrain conversion kits for

the jeepneys in the Philippines and the recently established full Tembo OEM light utility pick up truck range called the Tembo Tuskers.

Tembo’s

customers and partners are located across the globe and span a broad spectrum of sectors including mining, infrastructure, construction,

government services, humanitarian aid, tourism and agriculture.

Tembo’s

EUV conversion architecture is designed to allow a ‘plug and play’ approach that allows our global partner community to install

and maintain thousands of kits, whether in left-hand drive or right-hand drive, 2 door or 4 door vehicles in the harshest of environments.

Tembo’s ‘plug and play’ architecture allows us to replace components as technologies change therefore ensuring that

the maximum benefit can be obtained from the customers investment.

In

April 2024, VivoPower signed a heads of agreement for a business combination between Tembo and Nasdaq-listed Cactus Acquisition Corp.

1 Limited (“CCTS”) at a pre-money equity value of US$838 million (such transaction, the “Tembo Business Combination”).

On

July 2 and 29, 2024, Tembo and CCTS agreed to a one-month extension of their exclusive heads of agreement to July 31, 2024 and August

31, 2024, respectively. These extensions provide additional time to finalize the definitive business combination agreement and the independent

fairness opinion related to the proposed transaction.

On

August 29, 2024, Tembo executed a definitive Business Combination Agreement at a combined enterprise value of US$904 million with CCTS.

An independent third-party fairness opinion was satisfactorily completed, and the BCA was signed after a four-month period of due diligence.

Should the Tembo Business Combination be consummated, it would result in Tembo becoming a separate listed company on the Nasdaq. However,

it is expected that VivoPower will continue to be the major shareholder in the post-Tembo Business Combination company, and on that basis,

Tembo would continue to be a controlled subsidiary of VivoPower and consolidated in its financial statements. The business combination

is targeted to be completed by the first quarter of calendar year 2025.

On

October 3, 2024, Tembo entered into a definitive partnership agreement with Sarao Motors, the leading jeepney manufacturer in the Philippines.

The partnership, targeting the electrification of public utility jeepneys in a market valued at approximately US$10 billion, includes

the delivery of Tembo’s electric jeepney kits to Sarao’s facility in Metro Manila. Tembo will also support the transformation

of Sarao’s 20,000-square-meter facility into a sustainable energy solutions hub with assembly facilities and charging stations.

On

November 18, 2024, Tembo secured full on-road Vehicle Type Approval (VTA) in Australia for its fully electric utility vehicle, the Tembo

Tusker. This milestone positions the Tusker as only the second fully electric utility truck to achieve full on-road VTA regulatory approval

in the country, a critical requirement for legal road use in the estimated US$10 billion Australasian pick-up truck market. The certification

underscores compliance with safety, environmental, and battery-specific EV standards. Tembo is also pursuing similar approvals in New

Zealand to expand its presence across the Australasian region.

Tembo

is currently focused on scaling its Electric Vehicle business, driving growth in both revenue and associated costs as it advances production

of EUV conversion kits. Additionally, the company is preparing for the anticipated sale of Tembo Tusker Electric Utility Trucks and electric

Jeepneys, addressing demand from its established partnerships. By transitioning to a capital-light business model and leveraging a strategic

supply chain network across Asia, Tembo has eliminated the need for significant investment in assembly and manufacturing facilities,

enhancing operational efficiency and scalability.

Sustainable

Energy Solutions (“SES”)

VivoPower’s

Sustainable Energy Solutions (“SES”) segment designs, evaluates, sells, and implements renewable energy infrastructure. This

segment complements our electric vehicle offerings, enabling clients to adopt comprehensive decarbonization measures through on-site

renewable generation, batteries and microgrids, EV charging stations, emergency backup power solutions and digital twin technology.

Augmenting

its Electric Vehicle business, which deploys EUV conversion products and services to fleet owners, VivoPower is also focused on an SES

strategy with its core mission being to help corporate customers achieve their decarbonization goals. The SES business delivers full-suite,

holistic SES to industrial customers and other large energy users and is comprised of four key elements:

| |

● |

Critical

power “electric-retrofit” of customer’s sites to enable optimised EV battery charging, encompassing charging stations,

renewables, battery storage and microgrids; |

| |

● |

Digital

twin technology; |

| |

● |

EV

and battery leasing; |

| |

● |

EV

battery reuse and recycling; and |

| |

● |

Change

management and training services |

Since

its establishment in FY21, the SES business has signed several key agreements to complete its offering.

In

December 2021, VivoPower executed a Memorandum of Understanding signed with Relectrify, a leading supplier of battery energy storage

systems utilizing second-life EV batteries, with the collaboration extended to explore future redeployment of Tembo batteries.

In

August 2022, the Company invested in Green Gravity Energy Pty Ltd, an Australian company specializing in energy storage solutions in

former mining locations.

In

May 2023, VivoPower signed a definitive partnership agreement for VivoPower to market and distribute Vital EV Solutions (“Vital

EV”) fleet charging solutions globally. Vital EV is a specialist U.K-headquartered company, offering a comprehensive range of electric

vehicle charging solutions for fleet owners and is the official re-seller of Kempower charging stations and service solutions in the

U.K and across Africa. Kempower, headquartered in Finland, has high-speed EV fleet charging solutions including for off-highway working

environment applications. Under the Agreement, VivoPower will be able to offer to its customers and partners a wide range of EV fleet

charging products and services from Vital EV and Kempower for an initial term of 3 years. These products include multi-voltage lightweight

movable rapid chargers, hub-and-spoke rapid and ultra-rapid charging systems, satellite dispensers as well as conventional station chargers.

In

October, 2023, VivoPower signed a definitive joint venture agreement with Geminum, a digital twin technology company. This partnership

aims to design, test, and implement digital twins for Tembo electric utility vehicles and VivoPower’s sustainable energy solutions.

The joint venture will enhance VivoPower’s capabilities in fleet electrification and decarbonization solutions, providing clients

with near real-time analytics and carbon abatement data. This technology will be relevant for the mining sector in particular, to assist

in optimizing the total cost of ownership and operational efficiency.

Solar

VivoPower’s

portfolio of U.S. solar projects is held in its wholly owned subsidiary, Caret, LLC (“Caret”) formed in July 2021.

This

segment has historically been characterised as the Solar Development segment and encompassed the Company’s solar development activities

in the U.S. and Australia. The Company no longer has solar development activities in Australia following the sale of its interests in

solar farm projects in FY21.

VivoPower’s

historic strategy in relation to solar development has been to minimise capital intensity and maximise return on invested capital by

pursuing a business model predicated on developing and selling projects prior to construction and continually recycling capital rather

than owning assets. The stages of solar development can be broadly characterized as: (i) early stage; (ii) mid-stage; (iii) advanced

stage; (iv) construction; and (v) operation. Our business model has been to work through the development process from early stage through

to advanced stage, and then sell those projects that have completed the advanced stage of development, also known as “shovel-ready”

projects, to investors who will finance construction and ultimately own and operate the project.

On

November 14, 2024, the Company’s Board of Directors approved an execution plan for Caret, to develop up to 55MW of its solar farm

portfolio for Dogecoin and Litecoin mining.

After

the balance sheet date, on January 13, 2025, Caret secured a definitive and binding investment commitment of CAD$140 million (approximately

US$100 million) from GGY, a Luxembourg-based alternative investment group subject to a separate listing of Caret Digital on a Canadian

stock exchange. The proceeds from this investment will be used to advance Caret’s Power2X strategy, initially focusing on Dogecoin

mining, while also supporting working capital and general corporate purposes. This investment represents a critical step in VivoPower’s

growth strategy.

FINANCIAL

TABLES FOLLOW

VivoPower

International PLC

Consolidated

Statement of Comprehensive Income1

For

the Six Months Ended December 31, 2024 (Unaudited)

| Six months

ended December 31 |

| (US dollars in thousands

except per share amounts) | |

2024 | | |

2023 | |

| Revenue

from contracts with customers | |

| 63 | | |

| - | |

| Cost of sales | |

| (63 | ) | |

| (16 | ) |

| Gross profit | |

| - | | |

| (16 | ) |

| General and administrative expenses | |

| (2,351 | ) | |

| (3,738 | ) |

| Gain/(loss) on sale of assets | |

| 16 | | |

| - | |

| Other income | |

| - | | |

| (2 | ) |

| Depreciation of property, plant and equipment | |

| (52 | ) | |

| (151 | ) |

| Amortization of intangible

assets | |

| (185 | ) | |

| (412 | ) |

| Operating loss | |

| (2,572 | ) | |

| (4,319 | ) |

| Restructuring & other non-recurring costs | |

| 4 | | |

| (1,261 | ) |

| Finance income | |

| - | | |

| 7 | |

| Finance expense | |

| (3,215 | ) | |

| (2,155 | ) |

| Loss before income tax | |

| (5,783 | ) | |

| (7,728 | ) |

| Income tax | |

| (381 | ) | |

| 196 | |

| Loss from continuing operations | |

| (6,164 | ) | |

| (7,532 | ) |

| Income/ (loss) from discontinued

operations | |

| 1,688 | | |

| (296 | ) |

| Loss for the period | |

| (4,476 | ) | |

| (7,828 | ) |

| | |

| | | |

| | |

| Other comprehensive income | |

| | | |

| | |

| Items that may be reclassified

subsequently to profit or loss: | |

| | | |

| | |

| Currency translation differences

recognized directly in equity | |

| - | | |

| - | |

| Total

comprehensive (loss)/income for the period | |

| (4,476 | ) | |

| (7,828 | ) |

| | |

| | | |

| | |

| Earnings per share | |

| USD | | |

| USD | |

| Basic | |

| (0.654 | ) | |

| (2.920 | ) |

| Diluted | |

| (0.654 | ) | |

| (2.920 | ) |

Note:

| (1) | Financials

for continuing operations for both six months ended December 31, 2024, and six months ended

December 31, 2023, up to the “Loss from continuing operations” line and for earnings

per share. |

VivoPower

International PLC

Consolidated

Statement of Financial Position

As

at December 31, 2024

| | |

December 31 | | |

June 30 | |

| | |

2024 | | |

2024 | |

| (US dollars in thousands) | |

| Unaudited | | |

| Audited | |

| ASSETS | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Property, plant and equipment | |

| 415 | | |

| 439 | |

| Intangible assets | |

| 15,795 | | |

| 15,235 | |

| Deferred tax assets | |

| 3,842 | | |

| 4,099 | |

| Total

non-current assets | |

| 20,052 | | |

| 19,773 | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 26 | | |

| 199 | |

| Restricted cash | |

| 210 | | |

| 292 | |

| Trade and other receivables | |

| 10,041 | | |

| 10,044 | |

| Inventory | |

| 1,540 | | |

| 1,646 | |

| Assets held for sale | |

| - | | |

| 5,479 | |

| Total

current assets | |

| 11,817 | | |

| 17,660 | |

| TOTAL ASSETS | |

| 31,869 | | |

| 37,433 | |

| | |

| | | |

| | |

| EQUITY AND LIABILITIES | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade and other payables | |

| 35,210 | | |

| 37,929 | |

| Income tax liability | |

| 271 | | |

| 280 | |

| Provisions | |

| 2,219 | | |

| 2,230 | |

| Loans and borrowings | |

| 2,258 | | |

| 8,171 | |

| Liabilities held for sale | |

| - | | |

| 5,515 | |

| Total

current liabilities | |

| 39,958 | | |

| 54,125 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Loans and borrowings | |

| 26,734 | | |

| 20,915 | |

| Provisions | |

| 57 | | |

| 57 | |

| Deferred tax liability | |

| 3,036 | | |

| 2,873 | |

| Total

non-current liabilities | |

| 29,827 | | |

| 23,845 | |

| Total

Liabilities | |

| 69,785 | | |

| 77,970 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Share capital | |

| 1,043 | | |

| 533 | |

| Share premium | |

| 114,660 | | |

| 108,220 | |

| Cumulative translation reserve | |

| 396 | | |

| 2 | |

| Other reserves | |

| (6,548 | ) | |

| (6,301 | ) |

| Accumulated deficit | |

| (147,467 | ) | |

| (142,991 | ) |

| Total

equity | |

| (37,916 | ) | |

| (40,537 | ) |

| | |

| | | |

| | |

| TOTAL

EQUITY AND LIABILITIES | |

| 31,869 | | |

| 37,433 | |

VivoPower

International

PLC

Consolidated Statement of Cash Flow

For

the Six Months Ended December 31, 2024

(Unaudited)

| | |

Six

months ended December 31 | |

| (US dollars in thousands) | |

2024 | | |

2023 | |

| Loss from continuing operations | |

| (6,164 | ) | |

| (7,728 | ) |

| Income from discontinued operations | |

| 1,688 | | |

| (296 | ) |

| Income tax | |

| 411 | | |

| (243 | ) |

| Finance expense | |

| 3,215 | | |

| 1,224 | |

| Depreciation of property, plant and equipment | |

| 52 | | |

| 292 | |

| Amortization/Impairment of intangibles assets | |

| 181 | | |

| 1,674 | |

| Share-based payments | |

| - | | |

| 208 | |

| Decrease in trade and other receivables | |

| 3 | | |

| 1,341 | |

| Decrease/(increase) in inventories | |

| 106 | | |

| (253 | ) |

| Increase/(decrease) in trade and other payables | |

| (5,568 | ) | |

| 3,833 | |

| Increase/(decrease) in

provisions | |

| (11 | ) | |

| 58 | |

| Net

cash used in operating activities | |

| (6,087 | ) | |

| 110 | |

| | |

| | | |

| | |

| Cash flows from investing

activities | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (28 | ) | |

| (336 | ) |

| Purchase of intangibles | |

| (736 | ) | |

| (1,788 | ) |

| Net

cash (used in) / from investing activities | |

| (764 | ) | |

| (2,124 | ) |

| | |

| | | |

| | |

| Cash flows from financing

activities | |

| | | |

| | |

| Issuance of share capital | |

| 6,703 | | |

| 598 | |

| Related party loan borrowings / (repayments) | |

| (94 | ) | |

| 1,128 | |

| Lease borrowings / (repayments) | |

| - | | |

| (173 | ) |

| Debtor finance borrowings / (repayments) | |

| - | | |

| (114 | ) |

| Other borrowings / (repayments) | |

| - | | |

| 19 | |

| Transfers from / (to) restricted cash | |

| 82 | | |

| 124 | |

| Finance expense | |

| - | | |

| - | |

| Net

cash from / (used in) financing activities | |

| 6,691 | | |

| 1,582 | |

| | |

| | | |

| | |

| Net increase / (decrease) in cash and cash

equivalents | |

| (160 | ) | |

| (433 | ) |

| Effects of exchange rate changes on cash held | |

| (13 | ) | |

| (5 | ) |

| Cash and cash equivalents

at the beginning of the period | |

| 199 | | |

| 553 | |

| Cash

and cash equivalents at the end of the period | |

| 26 | | |

| 115 | |

VivoPower

International PLC

Consolidated

Statement of Changes in Equity

For

the Six Months Ended December 31, 2024

(Unaudited)

| (US dollars in thousands) | |

Share

Capital | | |

Share

Premium | | |

Other

Reserves | | |

Cumulative

Translation Reserve | | |

Retained

Earnings | | |

Non-controlling

interest | | |

Total

Equity | |

| At July 1, 2023 | |

| 308 | | |

| 105,018 | | |

| (6,492 | ) | |

| 1,203 | | |

| (96,291 | ) | |

| - | | |

| 3,746 | |

| Total comprehensive loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,828 | ) | |

| - | | |

| (7,828 | ) |

| Other comprehensive income/(expense) | |

| - | | |

| - | | |

| 84 | | |

| (1,113 | ) | |

| - | | |

| - | | |

| (1,029 | ) |

| Equity instruments | |

| - | | |

| - | | |

| 266 | | |

| - | | |

| - | | |

| - | | |

| 266 | |

| Employee share awards | |

| 15 | | |

| - | | |

| 192 | | |

| - | | |

| - | | |

| - | | |

| 207 | |

| Capital raises | |

| 64 | | |

| 599 | | |

| (67 | ) | |

| - | | |

| - | | |

| - | | |

| 596 | |

| At December 31, 2023 | |

| 387 | | |

| 105,617 | | |

| (6,017 | ) | |

| 90 | | |

| (104,119 | ) | |

| - | | |

| (4,042 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| (38,872 | ) | |

| - | | |

| (38,872 | ) |

| FX on translation of foreign operations | |

| - | | |

| - | | |

| (77 | ) | |

| (88 | ) | |

| - | | |

| - | | |

| (165 | ) |

| Equity instruments | |

| - | | |

| - | | |

| (116 | ) | |

| - | | |

| - | | |

| - | | |

| (116 | ) |

| Employee share awards | |

| 4,000 | | |

| 340,000 | | |

| 49 | | |

| - | | |

| - | | |

| - | | |

| 393 | |

| Capital raises | |

| 142 | | |

| 2,263 | | |

| (140 | ) | |

| - | | |

| - | | |

| - | | |

| 2,265 | |

| At June 30, 2024 | |

| 533 | | |

| 108,220 | | |

| (6,301 | ) | |

| 2 | | |

| (142,991 | ) | |

| - | | |

| (40,537 | ) |

| Total comprehensive loss for the period | |

| | | |

| | | |

| | | |

| | | |

| (4,476 | ) | |

| | | |

| (4,476 | ) |

| Other comprehensive income/(expense) | |

| | | |

| | | |

| | | |

| 394 | | |

| | | |

| | | |

| 394 | |

| Employee share awards | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| Capital raises | |

| 510 | | |

| 6,440 | | |

| (247 | ) | |

| - | | |

| - | | |

| - | | |

| 6,703 | |

| At December 31, 2024 | |

| 1,043 | | |

| 114,660 | | |

| (6,548 | ) | |

| 396 | | |

| (147,467 | ) | |

| - | | |

| (37,916 | ) |

This

Form 6-K, including the exhibits hereto, is hereby incorporated by reference into the registration statements of the Company on Form

S-8 (Registration Numbers 333-227810, 333-251546,333-268720, and 333-273520), on Form F-3 (Registration Number 333-276509) and on Form

F-1 (Registration Number 333-281065) and to be a part thereof from the date on which this report on Form 6-K is filed, to the extent

not superseded by documents or reports subsequently filed by the Company under the Securities Act of 1933, as amended, or the Securities

Exchange Act of 1934, as amended.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

January 24, 2025 |

VivoPower

International PLC |

| |

|

| |

/s/

Kevin Chin |

| |

Kevin

Chin |

| |

Chin

Executive Chairman |

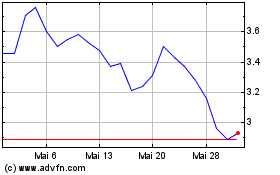

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025