SoFi Technologies to Adopt Galileo’s Cyberbank Core for New Commercial Payment Services Sponsor Banking Program

16 Oktober 2024 - 2:00PM

Business Wire

SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric,

one-stop shop for digital financial services that empowers members

to borrow, save, spend, invest, and protect their money, today

announced its adoption of Galileo’s modern, cloud-based Cyberbank

Core to power a range of payment services to commercial clients,

including debit, prepaid, ACH and wire transactions, and associated

banking services. Cyberbank Core became an integral part of

Galileo’s offering after SoFi’s acquisition of Technisys in 2022.

Galileo is a subsidiary of SoFi.

“We are thrilled that our new commercial payment services

sponsor bank program is built on Galileo’s powerful tech platform,”

said Anthony Noto, CEO of SoFi. “Galileo’s modern, cloud-based

banking core offering is cutting edge, enabling banks, fintech, and

financial services companies like SoFi to quickly launch new

products, effortlessly scale financial services products, and stay

ahead of the evolving needs of customers. Importantly, Galileo is

uniquely positioned to understand and meet the regulatory

expectations of customers since it operates under federal banking

regulations as a subsidiary of SoFi, a federal bank holding

company.”

Galileo delivers a wide range of benefits for clients like SoFi

that are modernizing their core infrastructure in order to improve

customers’ experience, including:

- Cloud-Based Architecture: Easily and affordably scale

computing power and storage as needs grow, without losing

performance or investing in expensive data centers and

hardware.

- Real-Time Processing: Faster and more efficient

transactions, giving clients immediate access to their funds and

financial information.

- Scalability and Resilience: The ability to support rapid

growth while maintaining a seamless, reliable client

experience.

- Agility: Enhanced flexibility to develop and launch

innovative financial products and services tailored to specific

customer needs.

- Robust Security: Industry-leading security features and

compliance support to ensure that customers' data and finances are

protected.

- Federal Regulation: A framework to ensure safety and

soundness within the banking system.

"We are excited to support SoFi on its journey to revolutionize

financial services," said Derek White, CEO of Galileo. "Our modern

core infrastructure is designed to provide forward-thinking banks

with the foundation they need to thrive in today’s dynamic

financial services landscape. We look forward to seeing SoFi unlock

new possibilities with our platform."

SoFi’s commercial payment services program implementation of

Cyberbank Core is expected to be complete in November 2024. This

collaboration is the latest step in SoFi’s partnership with

Galileo, which currently powers an array of Banking, Payments,

Lending, and Risk products for SoFi Bank’s consumer business,

including:

- Cyberbank Konecta: An AI-driven customer experience

platform with digital assistants for 24/7 support.

- Payments and Card Issuing: A secure platform for digital

payments, virtual cards, and accounts, with easy API

integration.

- Lending: Solutions for consumer and business lending,

including BNPL options, via flexible APIs.

- Risk Management: Advanced fraud detection using machine

learning, reducing fraud by 35% on average for Galileo

clients.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company’s

full suite of financial products and services helps its nearly 8.8

million SoFi members borrow, save, spend, invest, and protect their

money better by giving them fast access to the tools they need to

get their money right, all in one app. SoFi also equips members

with the resources they need to get ahead – like credentialed

financial planners, exclusive experiences and events, and a

thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and

Technology Platform, which offers the only end-to-end vertically

integrated financial technology stack. SoFi Bank, N.A., an

affiliate of SoFi, is a nationally chartered bank, regulated by the

OCC and FDIC and SoFi is a bank holding company regulated by the

Federal Reserve. The company is also the naming rights partner of

SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles

Rams. For more information, visit https://www.sofi.com or download

our iOS and Android apps

©2024 SoFi Technologies, Inc. All rights reserved.

About Galileo Financial Technologies

Galileo Financial Technologies, LLC and certain of its

affiliates collectively comprise a financial technology company

owned and operated independently by SoFi Technologies, Inc.

(NASDAQ: SOFI) that enables fintechs, financial institutions, and

emerging and established brands to build differentiated financial

solutions that deliver exceptional, customer-centric experiences.

Through modern, open APIs, Galileo’s flexible, secure, scalable and

fully integrated platform drives innovation across payments and

financial services. Trusted by digital banking heavyweights,

early-stage innovators and enterprise clients alike, Galileo

supports issuing physical and virtual payment cards, mobile push

provisioning, tailored and differentiated financial products and

more, across industries and geographies.

©2024 Galileo Financial Technologies, LLC. All rights

reserved.

Galileo Financial Technologies, LLC is a technology company, not

a bank. Galileo partners with many issuing banks to provide banking

services in North and Latin America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016349186/en/

MEDIA CONTACT: Solomon Joseph (905)

510-1400 solomon@fletchergroupllc.com

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

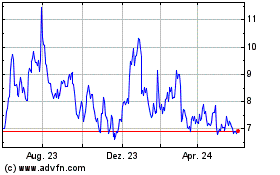

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024