false

0000944809

0000944809

2024-09-16

2024-09-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 16, 2024

OPKO Health, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-33528

|

|

75-2402409

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

4400 Biscayne Blvd.

|

Miami,

|

Florida

|

|

33137

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (305) 575-4100

|

Not Applicable

|

|

Former name or former address, if changed since last report

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

OPK

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.02.

|

Termination of a Material Definitive Agreement.

|

Effective September 16, 2024, BioReference Health, LLC, a Delaware limited liability company (“BioReference”), a subsidiary of OPKO Health, Inc. (“OPKO” or the “Company”), repaid in full all of its obligations under and terminated that certain Amended and Restated Credit Agreement, dated as of August 30, 2021, by and among BioReference, certain of its subsidiaries, as borrowers or guarantors, the lenders party thereto, and JP Morgan Chase Bank, N.A., as administrative agent for the lenders (as amended, the “Credit Agreement”). BioReference paid approximately $9,721,000 to repay all its obligations under the Credit Agreement and did not incur any prepayment premium or penalty.

The Credit Agreement was terminated in connection with the consummation of the Transaction described in Item 2.01 of this Current Report on Form 8-K. A description of the material terms of the Credit Agreement is set forth under the heading “Liquidity and Capital Resources” contained in Part I, Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed on August 7, 2024, and such description is incorporated by reference in this Item 1.02 of this Current Report on Form 8-K.

The administrative agent under the Credit Agreement has, from time to time, provided investment banking, commercial banking, and advisory services to the Company, for which it has received customary fees.

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

As previously reported, on March 27, 2024, the Company, BioReference and Laboratory Corporation of America Holdings, a Delaware corporation (“Buyer”), entered into an Asset Purchase Agreement (the “Purchase Agreement”), pursuant to which BioReference and the Company agreed to sell and assign to Buyer, and Buyer agreed to purchase and assume from BioReference and the Company, certain assets and liabilities of BioReference’s laboratory testing businesses focused on clinical diagnostics and reproductive and women’s health across the United States, excluding New York and New Jersey, in exchange for approximately $237,500,000 in cash (the “Transaction”).

Other than the Transaction, there is no material relationship between Buyer, the Company, any of the Company’s affiliates, or any director or officer of the Company or any associate of any such director or officer.

On September 16, 2024, the parties to the Purchase Agreement consummated the Transaction, and the Company received approximately $237,500,000 in cash, including escrow, subject to certain adjustments as set forth in the Purchase Agreement.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On September 16, 2024, the Company issued a press release announcing the completion of the Transaction. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act except to the extent expressly stated in such filing.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

| |

(b) |

Pro Forma Financial Information

|

The unaudited pro forma consolidated balance sheet of the Registrant, as of June 30, 2024, and the unaudited pro forma consolidated statements of operations for the six months ended June 30, 2024, and for the year ended December 31, 2023 are filed as Exhibit 99.2 to the Current Report on Form 8-K and are incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

OPKO Health, Inc.

|

| |

|

|

|

| |

|

By:

|

/s/ Adam Logal

|

|

Date: September 16, 2024

|

|

Name:

|

Adam Logal

|

| |

|

Title:

|

Senior Vice President, Chief Financial Officer

|

| |

|

|

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

Labcorp Contacts:

Christin O’Donnell (investors) – 336-436-5076

Investor@Labcorp.com

Kimbrel Arculeo (media) – 336-436-8263

Media@Labcorp.com

OPKO Health Contacts:

Yvonne Briggs, LHA Investor Relations (investors) - 310-691-7100

ybriggs@lhai.com

Bruce Voss, LHA Investor Relations (investors) - 310-691-7100

bvoss@lhai.com

Labcorp Completes Acquisition of Select Assets of BioReference Health's Diagnostics Business

from OPKO Health

Enhances Labcorp’s laboratory services network and expands access to its clinical services

BURLINGTON, N.C. and MIAMI, September 16, 2024 – Labcorp (NYSE: LH), a global leader of innovative and comprehensive laboratory services, and OPKO Health, Inc. (Nasdaq: OPK), a multinational biopharmaceutical and diagnostics company, announced today the completion of Labcorp’s acquisition of select assets of BioReference Health, a wholly owned subsidiary of OPKO Health. The transaction is expected to provide patients, physicians and customers with greater access to Labcorp's comprehensive, high-quality laboratory services, scientific expertise and expanded testing capabilities in key regions across the country.

The acquisition includes BioReference Health's laboratory testing businesses focused on clinical diagnostics and reproductive and women's health in the United States outside of New York and New Jersey, including certain patient service centers (PSCs), customer contracts and operating assets, which currently generate approximately $100 million in annual revenue. The purchase price for the transaction is $237.5 million.

"This transaction demonstrates our commitment to increase patient access to quality laboratory services, and we are thrilled to close an acquisition that will expand our clinical diagnostics footprint with assets that will immediately benefit from Labcorp’s scale and expertise,” said Mark Schroeder, Executive Vice President and President of Diagnostics Laboratories and Chief Operations Officer of Labcorp. "With the transaction complete, we are focused on integrating these assets as we drive better health outcomes for patients and advance our mission to improve health and improve lives.”

“We believe the sale of these diagnostic assets is an important step in our efforts to improve efficiencies and enhance productivity of BioReference Health’s operations and accelerate our progress to profitability,” stated Phillip Frost, M.D., Chairman and Chief Executive Officer of OPKO. “Furthermore, it enables us to focus on our core clinical diagnostics in New York and New Jersey and higher value testing segments, including our national oncology and urology franchises, which comprise approximately $400 million in annual revenue. We look forward to continuing to build our best-in-class portfolio to better serve our clients and patients.”

Lazard served as Labcorp's financial advisor, and Hogan Lovells, Kilpatrick Townsend and Parker Poe served as legal counsel.

Piper Sandler & Co. served as OPKO's financial advisor, and Greenberg Traurig served as legal counsel.

About Labcorp

Labcorp (NYSE: LH) is a global leader of innovative and comprehensive laboratory services that helps doctors, hospitals, pharmaceutical companies, researchers and patients make clear and confident decisions. We provide insights and advance science to improve health and improve lives through our unparalleled diagnostics and drug development laboratory capabilities. The company's more than 67,000 employees serve clients in approximately 100 countries, provided support for 84% of the new drugs and therapeutic products approved in 2023 by the FDA and performed more than 600 million tests for patients around the world. Learn more about us at www.Labcorp.com.

About OPKO

OPKO Health, Inc. (Nasdaq: OPK) is a multinational biopharmaceutical and diagnostics company that seeks to establish industry-leading positions in large, rapidly growing markets by leveraging its discovery, development, and commercialization expertise and novel and proprietary technologies. For more information, visit www.opko.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements, including but not limited to statements with respect to the (a) the anticipated impact of the transaction including expanding patient access to laboratory services, scientific expertise and testing capabilities, (b) integration plans and (c) the anticipated benefits of the transaction for Labcorp and OPKO. Each of the forward-looking statements is subject to change based on various important factors, many of which are beyond each party's control, including without limitation (i) the successful integration of the transaction, (ii) potential difficulties with employee retention; (iii) the trading price of each of Labcorp and OPKO's stock, competitive actions and other unforeseen changes and general uncertainties in the marketplace; (iv) changes in government regulations; (v) customer purchasing decisions, including changes in payer regulations or policies; (vi) other adverse actions of governmental and third-party payers; (vii) changes in testing guidelines or recommendations; (viii) federal, state, and local government responses to the COVID-19 pandemic and the volume of COVID-19 Testing performed; (ix) the impact of global geopolitical events; (x) the effect of public opinion on each party's reputation; (xi) adverse results in material litigation matters, if applicable; (xii) the impact of changes in tax laws and regulations; (xiii) failure to maintain or develop customer relationships; (xiv) failure in information technology, systems or data security; (xv) personnel costs; (xvi) inflation, and (xvii) increased competition.. These factors, in some cases, have affected and in the future (together with other factors) could affect each of Labcorp’s and OPKO's ability to implement their respective business strategies, and actual results could differ materially from those suggested by these forward-looking statements. As a result, readers are cautioned not to place undue reliance on any of the forward-looking statements.

Each of Labcorp and OPKO has no obligation to provide any updates to these forward-looking statements even if its expectations change. All forward-looking statements are expressly qualified in their entirety by this cautionary statement. Further information on potential factors, risks and uncertainties that could affect operating and financial results is included in the most recent Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q, including in each case under the heading RISK FACTORS, and in other filings with the SEC by each of Labcorp and OPKO. The information in this press release should be read in conjunction with a review of each of Labcorp’s and OPKO’s filings with the SEC, including the information in each of Labcorp’s and OPKO's most recent Annual Report on Form 10-K, and subsequent quarterly reports on Form 10-Q, under the heading "MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS".

# # #

Exhibit 99.2

OPKO HEALTH, INC.AND SUBSIDIARIES

SUMMARY OF UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

On March 27, 2024, OPKO Health Inc. (the “Company”), the Company’s indirect wholly owned subsidiary, BioReference Health, LLC (“BioReference”), and Laboratory Corporation of America Holdings, a Delaware corporation (“Labcorp”), entered into an Asset Purchase Agreement (the “Purchase Agreement”), pursuant to which BioReference and the Company agreed to sell and assign to Labcorp, and Labcorp agreed to purchase and assume from BioReference and the Company, certain assets and liabilities of BioReference’s laboratory testing businesses focused on clinical diagnostics and reproductive and women’s health across the United States, excluding New York and New Jersey, in exchange for approximately $237,500,000 in cash (the “BioReference Transaction”). On September 16, 2024, the parties to the Purchase Agreement consummated the BioReference Transaction, and the Company received approximately $237,500,000 in cash, subject to certain adjustments as set forth in the Purchase Agreement.

The following unaudited pro forma condensed consolidated statements of operations for the six months ended June 30, 2024 and unaudited pro forma condensed consolidated statement of operations for the year ended December 31, 2023 are presented as if the BioReference Transaction and related events had occurred on January 1, 2023. The following unaudited pro forma condensed consolidated balance sheet as of June 30, 2024 is presented as if the BioReference Transaction and related events had occurred on June 30, 2024.

The unaudited consolidated pro forma financial statements have been derived from the Company’s historical financial statements prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) and are presented based on information currently available and certain assumptions that the Company’s management believes are reasonable. The accompanying pro forma financial statements reflect the impact of events directly attributable to the BioReference Transaction that are factually supportable and, for the purposes of the unaudited pro forma condensed consolidated statements of operations, expected to have a continuing impact on the Company. They are intended for informational purposes only and are not intended to represent the Company’s financial position or results of operations had the BioReference Transaction and related events occurred on the dates indicated or to project the Company’s financial performance for any future period. The unaudited pro forma consolidated financial statements and the accompanying notes should be read in conjunction with (i) the Company’s audited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 1, 2024, and (ii) the Company’s unaudited consolidated financial statements and accompany notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, as filed with the SEC on August 7, 2024.

OPKO HEALTH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AS OF JUNE 30, 2024

| |

|

|

|

|

|

Pro-forma

|

|

|

|

|

|

|

| |

|

|

|

|

|

Adjustments for

|

|

|

|

Unaudited

|

|

|

(in thousands, except share and per share data)

|

|

Historical (a)

|

|

|

disposition

|

|

Notes

|

|

Pro-forma

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

40,576 |

|

|

|

232,670 |

|

(e)

|

|

$ |

273,246 |

|

|

Accounts receivable, net

|

|

|

105,313 |

|

|

|

- |

|

|

|

|

105,313 |

|

|

Inventories, net

|

|

|

60,153 |

|

|

|

- |

|

|

|

|

60,153 |

|

|

Prepaid expenses and other current assets

|

|

|

32,288 |

|

|

|

- |

|

|

|

|

32,288 |

|

|

Assets held for sale

|

|

|

119,651 |

|

|

|

(119,651 |

) |

(f)

|

|

|

- |

|

|

Total current assets

|

|

|

357,981 |

|

|

|

113,019 |

|

|

|

|

471,000 |

|

|

Property, plant and equipment, and investment properties, net

|

|

|

66,766 |

|

|

|

- |

|

|

|

|

66,766 |

|

|

Intangible assets, net

|

|

|

659,111 |

|

|

|

(16 |

) |

(f) |

|

|

659,095 |

|

|

In-process research and development

|

|

|

195,000 |

|

|

|

- |

|

|

|

|

195,000 |

|

|

Goodwill

|

|

|

530,106 |

|

|

|

1,975 |

|

(f) |

|

|

532,081 |

|

|

Investments, net

|

|

|

101,489 |

|

|

|

- |

|

|

|

|

101,489 |

|

|

Operating lease right-of-use assets

|

|

|

61,622 |

|

|

|

- |

|

|

|

|

61,622 |

|

|

Other assets

|

|

|

7,796 |

|

|

|

- |

|

|

|

|

7,796 |

|

|

Total assets

|

|

$ |

1,979,871 |

|

|

$ |

114,978 |

|

|

|

$ |

2,094,849 |

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

82,242 |

|

|

$ |

- |

|

|

|

$ |

82,242 |

|

|

Accrued expenses

|

|

|

94,516 |

|

|

|

8 |

|

(g)

|

|

|

94,524 |

|

|

Current maturities of operating leases

|

|

|

11,624 |

|

|

|

- |

|

|

|

|

11,624 |

|

|

Liabilities associated with assets held for sale

|

|

|

8,872 |

|

|

|

(8,872 |

) |

(f)

|

|

|

- |

|

|

Current portion of convertible notes

|

|

|

170 |

|

|

|

- |

|

|

|

|

170 |

|

|

Current portion of lines of credit and notes payable

|

|

|

22,129 |

|

|

|

- |

|

|

|

|

22,129 |

|

|

Total current liabilities

|

|

|

219,553 |

|

|

|

(8,864 |

) |

|

|

|

210,689 |

|

|

Operating lease liabilities

|

|

|

49,624 |

|

|

|

- |

|

|

|

|

49,624 |

|

|

Long term portion of convertible notes

|

|

|

175,942 |

|

|

|

- |

|

|

|

|

175,942 |

|

|

Deferred tax liabilities

|

|

|

119,120 |

|

|

|

1,270 |

|

(g)

|

|

|

120,390 |

|

|

Other long-term liabilities, principally contract liabilities,

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

contingent consideration and lines of credit

|

|

|

20,315 |

|

|

|

- |

|

|

|

|

20,315 |

|

|

Total long-term liabilities

|

|

|

365,001 |

|

|

|

1,270 |

|

|

|

|

366,271 |

|

|

Total liabilities

|

|

|

584,554 |

|

|

|

(7,594 |

) |

|

|

|

576,960 |

|

|

Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock - $0.01 par value, 1,250,000,000 shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

authorized; 727,176,232 shares issued at June 30, 2024

|

|

|

7,273 |

|

|

|

- |

|

|

|

|

7,273 |

|

|

Treasury Stock - 29,800,177 shares at June 30, 2024

|

|

|

(1,791 |

) |

|

|

- |

|

|

|

|

(1,791 |

) |

|

Additional paid-in capital

|

|

|

3,540,414 |

|

|

|

- |

|

|

|

|

3,540,414 |

|

|

Accumulated other comprehensive income (loss)

|

|

|

(46,652 |

) |

|

|

- |

|

|

|

|

(46,652 |

) |

|

Accumulated deficit

|

|

|

(2,103,927 |

) |

|

|

122,571 |

|

(h)

|

|

|

(1,981,356 |

) |

|

Total shareholders' equity

|

|

|

1,395,317 |

|

|

|

122,571 |

|

|

|

|

1,517,888 |

|

|

Total liabilities and equity

|

|

$ |

1,979,871 |

|

|

$ |

114,978 |

|

|

|

$ |

2,094,849 |

|

OPKO HEALTH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2024

| |

|

Six months ended June 30, 2024

|

|

|

(in thousands, except share and per share data)

|

|

Historical (a)

|

|

|

Pro-forma Adjustments for disposition

|

|

Notes

|

|

Unaudited Pro-forma

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services

|

|

$ |

256,286 |

|

|

$ |

(52,438 |

) |

(b)

|

|

$ |

203,848 |

|

|

Revenue from products

|

|

|

78,532 |

|

|

|

- |

|

|

|

|

78,532 |

|

|

Revenue from transfer of intellectual property and other

|

|

|

21,054 |

|

|

|

- |

|

|

|

|

21,054 |

|

|

Total revenues

|

|

|

355,872 |

|

|

|

(52,438 |

) |

|

|

|

303,434 |

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service revenue

|

|

|

216,952 |

|

|

|

(47,929 |

) |

(b)

|

|

|

169,023 |

|

|

Cost of product revenue

|

|

|

45,199 |

|

|

|

- |

|

|

|

|

45,199 |

|

|

Selling, general and administrative

|

|

|

138,988 |

|

|

|

(19,098 |

) |

(b)

|

|

|

119,890 |

|

|

Research and development

|

|

|

46,020 |

|

|

|

- |

|

|

|

|

46,020 |

|

|

Amortization of intangible assets

|

|

|

41,856 |

|

|

|

(2,055 |

) |

(b)

|

|

|

39,801 |

|

|

Total costs and expenses

|

|

|

489,015 |

|

|

|

(69,082 |

) |

|

|

|

419,933 |

|

|

Operating loss (income)

|

|

|

(133,143 |

) |

|

|

16,644 |

|

|

|

|

(116,499 |

) |

|

Other income and (expense), net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

1,204 |

|

|

|

- |

|

|

|

|

1,204 |

|

|

Interest expense

|

|

|

(15,865 |

) |

|

|

- |

|

|

|

|

(15,865 |

) |

|

Fair value changes of derivative instruments, net

|

|

|

(26,160 |

) |

|

|

- |

|

|

|

|

(26,160 |

) |

|

Other income, net

|

|

|

80,197 |

|

|

|

- |

|

|

|

|

80,197 |

|

|

Other income, net

|

|

|

39,376 |

|

|

|

- |

|

|

|

|

39,376 |

|

|

Loss (income) before income taxes and investment losses

|

|

|

(93,767 |

) |

|

|

16,644 |

|

|

|

|

(77,123 |

) |

|

Income tax benefit (provision)

|

|

|

1,629 |

|

|

|

(801 |

) |

(d)

|

|

|

828 |

|

|

Loss (income) before investment losses

|

|

|

(92,138 |

) |

|

|

15,843 |

|

|

|

|

(76,295 |

) |

|

Loss from investments in investees

|

|

|

(3 |

) |

|

|

- |

|

|

|

|

(3 |

) |

|

Net loss (income)

|

|

$ |

(92,141 |

) |

|

$ |

15,843 |

|

|

|

$ |

(76,298 |

) |

|

Loss per share, basic and diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share

|

|

$ |

(0.13 |

) |

|

|

|

|

|

|

$ |

(0.11 |

) |

|

Weighted average number of common shares outstanding,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

basic and diluted

|

|

|

702,036,148 |

|

|

|

|

|

|

|

|

702,036,148 |

|

OPKO HEALTH, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2023

| |

|

Year ended December 31, 2023

|

|

|

(in thousands, except share and per share data)

|

|

Historical (a)

|

|

|

Pro-forma Adjustments for disposition

|

|

Notes

|

|

Unaudited Pro-forma

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services

|

|

$ |

515,275 |

|

|

$ |

(119,275 |

) |

(b)

|

|

$ |

396,000 |

|

|

Revenue from products

|

|

|

167,557 |

|

|

|

- |

|

|

|

|

167,557 |

|

|

Revenue from transfer of intellectual property

|

|

|

180,663 |

|

|

|

- |

|

|

|

|

180,663 |

|

|

Total revenues

|

|

|

863,495 |

|

|

|

(119,275 |

) |

|

|

|

744,220 |

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service revenue

|

|

|

445,830 |

|

|

|

(112,611 |

) |

(b)

|

|

|

333,219 |

|

|

Cost of product revenue

|

|

|

99,538 |

|

|

|

- |

|

|

|

|

99,538 |

|

|

Selling, general and administrative

|

|

|

300,559 |

|

|

|

(47,444 |

) |

(b)

|

|

|

253,115 |

|

|

Research and development

|

|

|

89,593 |

|

|

|

- |

|

|

|

|

89,593 |

|

|

Contingent consideration

|

|

|

(1,036 |

) |

|

|

- |

|

|

|

|

(1,036 |

) |

|

Amortization of intangible assets

|

|

|

86,032 |

|

|

|

(4,110 |

) |

(b)

|

|

|

81,924 |

|

|

Gain on sale of assets

|

|

|

- |

|

|

|

(105,655 |

) |

(c)

|

|

|

(105,655 |

) |

|

Total costs and expenses

|

|

|

1,020,516 |

|

|

|

(267,820 |

) |

|

|

|

750,696 |

|

|

Operating (loss) income

|

|

|

(157,021 |

) |

|

|

150,545 |

|

|

|

|

(6,476 |

) |

|

Other income and (expense), net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

3,983 |

|

|

|

- |

|

|

|

|

3,983 |

|

|

Interest expense

|

|

|

(13,506 |

) |

|

|

- |

|

|

|

|

(13,506 |

) |

|

Fair value changes of derivative instruments, net

|

|

|

(781 |

) |

|

|

- |

|

|

|

|

(781 |

) |

|

Other expense, net

|

|

|

(16,994 |

) |

|

|

- |

|

|

|

|

(16,994 |

) |

|

Other expense, net

|

|

|

(27,298 |

) |

|

|

- |

|

|

|

|

(27,298 |

) |

|

(Loss) income before income taxes and investment losses

|

|

|

(184,319 |

) |

|

|

150,545 |

|

|

|

|

(33,774 |

) |

|

Income tax (loss) benefit

|

|

|

(4,437 |

) |

|

|

8,190 |

|

(d)

|

|

|

3,753 |

|

|

Loss (income) before investment losses

|

|

|

(188,756 |

) |

|

|

158,735 |

|

|

|

|

(30,021 |

) |

|

Loss from investments in investees

|

|

|

(107 |

) |

|

|

- |

|

|

|

|

(107 |

) |

|

Net (loss) income

|

|

$ |

(188,863 |

) |

|

$ |

158,735 |

|

|

|

$ |

(30,128 |

) |

|

Loss per share, basic and diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share

|

|

$ |

(0.25 |

) |

|

|

|

|

|

|

$ |

(0.04 |

) |

|

Weighted average number of common shares outstanding,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

basic and diluted

|

|

|

751,765,915 |

|

|

|

|

|

|

|

|

751,765,915 |

|

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

NOTE 1. Basis of Presentation

The Company’s historical consolidated financial statements have been adjusted in the unaudited pro forma condensed consolidated financial statements to present events that are (i) directly attributable to the BioReference Transaction of assets, and (ii) are factually supportable. The unaudited pro forma condensed consolidated statements of operations do not reflect the estimated gain on the BioReference Transaction.

NOTE 2. Pro Forma Adjustments

The following adjustments have been reflected in the unaudited pro forma condensed consolidated financial statement:

| |

(a)

|

Reflects the Company’s historical US GAAP consolidated financial statements, as reported, before pro forma adjustments related to the BioReference Transaction. As of and for the six months ended June 30, 2024 and the year ended December 31, 2023, Bio Reference’s operating results were reported as part of the Company’s Diagnostic Segment. |

| |

|

|

| |

(b)

|

Reflects the elimination of revenues, cost of goods sold, expenses and amortization of intangible assets from the BioReference Transaction. |

| |

|

|

| |

(c)

|

Reflects the estimated gain on sale of assets of $105.7 million arising from the BioReference Transaction as if the BioReference Transaction and related events had occurred on January 1, 2023, the first day of fiscal year 2023. |

| |

|

|

| |

(d)

|

Reflects the estimated income tax effect of the BioReference Transaction. The tax effect of the BioReference Transaction was calculated using the historical statutory rates in effect for the periods presented. |

| |

|

|

| |

(e)

|

Reflects estimated net cash proceeds from the BioReference Transaction of $232.7 million, representing the gross sale price of $237.5 million minus certain purchase price adjustments and estimated transaction costs. |

| |

|

|

| |

(f)

|

Represents the assets and liabilities conveyed to Labcorp in the BioReference Transaction. |

| |

|

|

| |

(g)

|

Reflects tax impacts of the BioReference Transaction. |

| |

|

|

| |

(h)

|

Reflects the effect on accumulated deficit related to the estimated gain on sale and related tax impacts attributable to the BioReference Transaction as if the BioReference Transaction and related events had occurred on June 30, 2024. The actual amount of the gain on sale will be based on the balances as of the closing date of the BioReference Transaction and may differ materially from the pro forma gain on sale amount presented herein. |

|

Estimated proceeds, net of transaction costs.

|

|

$ |

232,670 |

|

| |

|

|

|

|

|

Assets held for sale

|

|

|

(117,692 |

) |

|

Liabilities of associated with assets held for sale

|

|

|

8,872 |

|

|

Tax impacts

|

|

|

(1,278 |

) |

|

Gain on sale

|

|

$ |

122,571 |

|

v3.24.3

Document And Entity Information

|

Sep. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OPKO Health, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 16, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33528

|

| Entity, Tax Identification Number |

75-2402409

|

| Entity, Address, Address Line One |

4400 Biscayne Blvd.

|

| Entity, Address, City or Town |

Miami

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33137

|

| City Area Code |

305

|

| Local Phone Number |

575-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

OPK

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000944809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

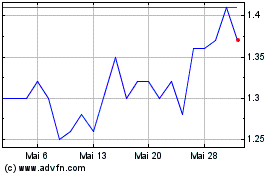

Opko Health (NASDAQ:OPK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Opko Health (NASDAQ:OPK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024