Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL), a biopharmaceutical

company focused on delivering novel therapeutics for nonalcoholic

steatohepatitis (NASH)/metabolic dysfunction-associated

steatohepatitis (MASH), today reports second-quarter 2024 financial

results and provides corporate updates.

Bill Sibold, Chief Executive Officer of Madrigal, stated, “We’re

off to a strong start with our U.S. launch of Rezdiffra and are

encouraged by the high enthusiasm and early demand from physicians

and patients, as well as the favorable coverage from payers. Our

efforts to help healthcare practices build patient care pathways

are progressing well, setting the stage for future growth. Given

the strong start in the U.S., we aim to extend Madrigal’s global

leadership in NASH by directly commercializing Rezdiffra in Europe

next year upon regulatory approval.”

Mr. Sibold continued, “The urgent unmet need in NASH, which is

the leading cause of liver transplant among women in the U.S., is

driving the strong reception to Rezdiffra as the first and only

approved therapy for NASH. Data presented at the EASL Congress

demonstrating 91% efficacy in halting or improving liver stiffness,

a key noninvasive measure of fibrosis, at three years reinforce the

Rezdiffra efficacy profile; and the new EASL guidelines position

Rezdiffra as the foundational NASH therapy.”

Second Quarter and Recent Corporate Updates

- Rezdiffra U.S. launch update

- On April 9, 2024, the Company announced U.S. availability of

Rezdiffra, a once-daily, oral, liver-directed, THR-β agonist

designed to target the underlying causes of NASH, which is the

number-one cause of liver transplants for women in the U.S.

- Madrigal is continuing to execute the U.S. launch of Rezdiffra,

which is focused on building the foundation for future growth by

educating the community on the clinical benefits of Rezdiffra,

supporting the creation of care pathways for patients at physician

offices, driving breadth and depth of Rezdiffra prescribers, and

engaging with payers to increase Rezdiffra coverage.

- As of June 30, 2024, coverage for Rezdiffra is in place for

more than 50 percent of commercial lives covered by health

insurance in the U.S., tracking well towards the Company’s goal of

80 percent of commercial lives covered by year-end 2024. Less than

5 percent of Rezdiffra-covered lives require biopsy for diagnosis

and instead accept noninvasive tests, or NITs, in line with current

standard of care.

- Driving future growth through European

expansion

- Rezdiffra is currently under evaluation with the European

Medicines Agency’s (EMA) Committee for Medicinal Products for Human

Use (CHMP) and has the potential to become the first therapy for

patients with NASH/MASH with liver fibrosis to receive approval in

Europe.

- The Company plans to directly commercialize resmetirom in

Europe following a decision from the EMA on the Marketing

Authorization Application (MAA), which is expected mid-year

2025.

- Expert guidelines recommend Rezdiffra as first-line

therapy for NASH/MASH

- In July, updated clinical practice guidelines co-authored by

the European Association for the Study of the Liver (EASL), the

European Association for the Study of Diabetes (EASD), and the

European Association for the Study of Obesity (EASO) for MASH were

published in the Journal of Hepatology and recommend Rezdiffra as

first-line therapy for patients with F2/F3 NASH/MASH where the

medicine is available. The guidelines noted that Rezdiffra is the

only disease-specific agent in MASH with positive results from a

registrational Phase 3 clinical trial.

- In July, “Expert Panel Recommendations: Practical Clinical

Applications for Initiating and Monitoring Resmetirom in Patients

with MASH/NASH and Moderate to noncirrhotic Advanced Fibrosis” were

published in the Journal of Clinical Gastroenterology and

Hepatology. These recommendations were written by well-recognized

experts in NASH/MASH and provide practical guidance for the

appropriate use of Rezdiffra, including patient identification,

assessment of response and general monitoring.

- Multiple abstracts presented at the EASL Congress in

June

- A late breaking oral presentation that leveraged innovative AI

technology provided deeper insight from the Phase 3 MAESTRO-NASH

study of the antifibrotic effect of Rezdiffra and the role of THR-β

as a suppressor of disease progression.

- New analyses from noninvasive test data pointed to a durable

Rezdiffra treatment response through three years including a 91%

improvement or stabilization of liver stiffness (a surrogate for

fibrosis), and a positive quality-of-life analysis showing the

benefit of Rezdiffra treatment on patient worry, health distress

and stigma.

- The Company also presented for the first time an analysis of

Rezdiffra treatment in patients with probable metabolic dysfunction

and alcohol-associated liver disease, known as MetALD, which

demonstrated that patients achieved similar rates of fibrosis

improvement and steatohepatitis resolution compared to the NASH

population.

- Two health economics outcomes research studies in Medicare

patients concluded that NASH patients are at a higher risk of

progression, which is associated with higher costs, particularly at

advanced stages. These studies concluded that interventions that

can delay or prevent progression may reduce morbidity and mortality

and deliver cost benefits.

Second-Quarter 2024 Financial Results

- Total revenues: The Company shipped Rezdiffra

beginning in April and generated second-quarter 2024 net revenues

of $14.6 million. No product sales were recognized during the

comparable prior year period.

- Cost of sales: Second-quarter 2024 cost of

sales were $0.6 million. Cost of sales were not recognized during

the comparable prior year period given that no product sales were

recorded.

- Operating Expenses: Second-quarter 2024

operating expenses were $177.2 million, compared to $86.5 million

in the comparable prior year period.

- R&D Expense: Second-quarter 2024 R&D

expense was $71.1 million, compared to $68.6 million in the

comparable prior year period. The increase is primarily

attributable to an increase related to timing of manufacturing,

headcount and stock compensation expense.

- SG&A Expense: Second-quarter 2024 SG&A

expense was $105.4 million, compared to $17.8 million in the

comparable prior year period. The increase is primarily

attributable to increases in prelaunch and launch activities for

Rezdiffra, including significant commercial headcount expansion and

stock compensation expense.

- Interest Income: Second-quarter 2024 interest

income was $14.2 million, compared to $3.6 million in the

comparable prior year period. The increase in interest income is

due primarily to higher principal balances and interest rates in

2024.

- Interest Expense: Second-quarter 2024 interest

expense was $3.7 million, compared to $2.9 million in the

comparable prior year period. The increase in interest expense was

a result of a higher outstanding principal balance during the

period under the Company’s loan facility.

- Cash, Cash Equivalents, Restricted Cash and Marketable

Securities: As of June 30, 2024, Madrigal had cash, cash

equivalents, restricted cash and marketable securities of $1.1

billion, compared to $634.1 million at Dec. 31, 2023. The increase

in cash and marketable securities was primarily attributable to

$574 million of net proceeds from the Company’s March 2024 public

offering partially offset by funding of operations.

Conference Call and WebcastAt 8 a.m. EDT today,

August 7, 2024, the Company will host a webcast to review its

financial and operating results and provide a general business

update. To access the webcast, please visit the investor relations

section of the Madrigal website or click here to register. An

archived webcast will be available on the Madrigal website

following the event.

About NASH Nonalcoholic steatohepatitis (NASH)

is a more advanced form of nonalcoholic fatty liver disease

(NAFLD). NASH is a leading cause of liver-related

mortality and an increasing burden on healthcare systems globally.

Additionally, patients with NASH, especially those with more

advanced metabolic risk factors (hypertension, concomitant type 2

diabetes), are at increased risk for adverse cardiovascular events

and increased morbidity and mortality.

Once patients progress to NASH with moderate to

advanced liver fibrosis (consistent with stages F2 to F3 fibrosis),

the risk of adverse liver outcomes increases dramatically. NASH is

rapidly becoming the leading cause of liver transplantation in

the U.S.

Madrigal estimates that approximately 1.5 million patients have

been diagnosed with NASH in the U.S., of which

approximately 525,000 have NASH with moderate to advanced

liver fibrosis. Madrigal plans to focus on approximately 315,000

diagnosed patients with NASH with moderate to advanced

liver fibrosis under the care of the liver specialist physicians

during the launch of Rezdiffra.

NASH is also known as metabolic dysfunction associated

steatohepatitis (MASH). In 2023, global liver disease medical

societies and patient groups came together to rename the disease,

with the goal of establishing an affirmative, non-stigmatizing name

and diagnosis. Nonalcoholic fatty liver disease (NAFLD) was renamed

metabolic dysfunction-associated steatotic liver disease

(MASLD); NASH was renamed MASH; and an overarching term,

steatotic liver disease (SLD), was established to capture multiple

types of liver diseases associated with fat buildup in the liver.

In addition to liver disease, patients with MASH have at least one

related comorbid condition (e.g., obesity, hypertension,

dyslipidemia, or type 2 diabetes).

About Madrigal PharmaceuticalsMadrigal

Pharmaceuticals, Inc. (Nasdaq: MDGL) is a biopharmaceutical

company pursuing novel therapeutics for nonalcoholic

steatohepatitis (NASH), a liver disease with high unmet medical

need. Madrigal’s medication, Rezdiffra (resmetirom), is a

once-daily, oral, liver-directed THR-β agonist designed to target

key underlying causes of NASH. For more information,

visit www.madrigalpharma.com.

Forward Looking StatementsThis press release

includes “forward-looking statements” made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995, that are based on Madrigal’s beliefs and assumptions and

on information currently available to it but are subject to factors

beyond its control. Forward-looking statements reflect management’s

current knowledge, assumptions, judgment and expectations regarding

future performance or events. Forward-looking statements include

all statements that are not historical facts; statements referenced

by forward-looking statement identifiers; and statements regarding:

Rezdiffra (resmetirom) and its expected use for

treating NASH with moderate to advanced fibrosis; future

growth of Rezdiffra sales; projections or objectives for obtaining

approval from EMA for Rezdiffra (resmetirom) and expected

commercialization of Rezdiffra (resmetirom) in Europe; the final

number of patients who randomize in the MAESTRO-NASH trial, the

estimated study duration for such trial and the anticipated

timeframe for topline data from such trial; the U.S. opportunity

for Rezdiffra in patients with stage 4 fibrosis (F4)/compensated

cirrhosis; estimates of patients diagnosed with NASH and

market opportunities; and strategies, objectives and commercial

opportunities, including potential prospects or results.

Forward-looking statements can be identified by terms such as

“accelerate,” “achieve,” “allow,” “anticipates,” “appear,” “be,”

“believes,” “can,” “confidence,” “continue,” “could,”

“demonstrates,” ”design,” “estimates,” “expectation,” “expects,”

“forecasts,” “future,” “goal,” “help,” “hopeful,” “inform,”

inform,” “intended,” “intends,” “may,” “might,” “on track,”

“planned,” “planning,” “plans,” “positions,” “potential,” “powers,”

“predicts,” ”predictive,” “projects,” “seeks,” “should,” “will,”

“will achieve,” “will be,” “would”, “future” or similar expressions

and the negatives of those terms.

Forward-looking statements are subject to a number of risks and

uncertainties including, but not limited to: the assumptions

underlying the forward-looking statements; risks of obtaining and

maintaining regulatory approvals, including, but not limited to,

potential regulatory delays or rejections; the challenges with the

commercial launch of a new product, particularly for a company that

does not have commercial experience; risks associated with meeting

the objectives of Madrigal’s clinical studies, including, but not

limited to Madrigal’s ability to achieve enrollment objectives

concerning patient numbers (including an adequate safety database),

outcomes objectives and/or timing objectives for Madrigal’s

studies; any delays or failures in enrollment, and the occurrence

of adverse safety events; risks related to the effects of

Rezdiffra’s (resmetirom’s) mechanism of action; enrollment and

trial conclusion uncertainties; market demand for and acceptance of

our product; the potential inability to raise sufficient capital to

fund ongoing operations as currently planned or to obtain

financings on terms similar to those arranged in the past; the

ability to service indebtedness and otherwise comply with debt

covenants; outcomes or trends from competitive studies; future

topline data timing or results; our ability to prevent and/or

mitigate cyber-attacks; the timing and outcomes of clinical studies

of Rezdiffra (resmetirom); the uncertainties inherent in clinical

testing; and uncertainties concerning analyses or assessments

outside of a controlled clinical trial. Undue reliance should not

be placed on forward looking statements, which speak only as of the

date they are made. Madrigal undertakes no obligation to update any

forward-looking statements to reflect new information, events, or

circumstances after the date they are made, or to reflect the

occurrence of unanticipated events. Please refer to Madrigal’s

submissions filed with the U.S. Securities and Exchange

Commission, or SEC, for more detailed information regarding

these risks and uncertainties and other factors that may cause

actual results to differ materially from those expressed or

implied. Madrigal specifically discusses these risks and

uncertainties in greater detail in the sections appearing in Part

I, Item 1A of its Annual Report on Form 10-K for the year

ended December 31, 2023, filed with

the SEC on February 28, 2024, , and Part II, Item 1A

of its Quarterly Report on Form 10-Q for the quarter ended March

31, 2024, filed with the SEC on May 7, 2024, and as updated from

time to time by Madrigal’s other filings with the SEC.

Investor Contact Tina Ventura,

IR@madrigalpharma.com

Media ContactChristopher Frates,

media@madrigalpharma.com

(tables follow)

| |

|

Madrigal Pharmaceuticals, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(in thousands, except share and per share

amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

Product revenue, net |

$ |

14,638 |

|

$ |

- |

|

|

$ |

14,638 |

|

$ |

- |

|

|

Operating expenses: |

|

|

|

|

|

|

Cost of sales |

|

636 |

|

|

- |

|

|

|

636 |

|

|

- |

|

|

Research and development |

|

71,091 |

|

|

68,605 |

|

|

|

142,328 |

|

|

130,759 |

|

|

Selling, general and administrative |

|

105,448 |

|

|

17,845 |

|

|

|

186,249 |

|

|

34,027 |

|

|

Total operating expenses |

|

177,175 |

|

|

86,450 |

|

|

|

329,213 |

|

|

164,786 |

|

|

Loss from operations |

|

(162,537 |

) |

|

(86,450 |

) |

|

|

(314,575 |

) |

|

(164,786 |

) |

|

Interest income, net |

|

14,222 |

|

|

3,551 |

|

|

|

22,556 |

|

|

7,327 |

|

|

Interest expense |

|

(3,656 |

) |

|

(2,901 |

) |

|

|

(7,493 |

) |

|

(5,237 |

) |

|

Net loss |

$ |

(151,971 |

) |

$ |

(85,800 |

) |

|

$ |

(299,512 |

) |

$ |

(162,696 |

) |

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share |

$ |

(7.10 |

) |

$ |

(4.69 |

) |

|

$ |

(14.47 |

) |

$ |

(8.91 |

) |

|

Basic and diluted weighted average number of common shares

outstanding |

|

21,402,646 |

|

|

18,310,952 |

|

|

|

20,702,041 |

|

|

18,249,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Madrigal Pharmaceuticals, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

June 30, |

December 31, |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents, restricted cash, and marketable

securities |

$ |

1,062,794 |

|

$ |

634,131 |

|

|

|

|

|

Other current assets |

|

28,934 |

|

|

3,150 |

|

|

|

|

|

Other non-current assets |

|

8,061 |

|

|

3,266 |

|

|

|

|

|

Total assets |

$ |

1,099,789 |

|

$ |

640,547 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

Current liabilities |

$ |

125,162 |

|

$ |

118,548 |

|

|

|

|

|

Long-term liabilities |

|

117,507 |

|

|

116,666 |

|

|

|

|

|

Stockholders’ equity |

|

857,120 |

|

|

405,333 |

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

1,099,789 |

|

$ |

640,547 |

|

|

|

|

|

|

|

|

|

|

|

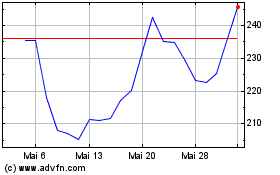

Madrigal Pharmaceuticals (NASDAQ:MDGL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Madrigal Pharmaceuticals (NASDAQ:MDGL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024