Strong demand propels 2nd quarter revenue to

increase 278% over the same period in 2021

iSun, Inc. (NASDAQ: ISUN) (the “Company,” or “iSun”), a leading

solar energy and clean mobility infrastructure company with

50-years of experience accelerating the adoption of innovative

electrical technologies, today announced results for the second

quarter of 2022.

Highlights

- Revenue of $16.5 million in the second quarter, up 278% over

the second quarter in 2021

- YTD revenue of $31.6 million representing 172% growth over

the same period in 2021

- Backlog grew to $147.9 million adding approximately $35.7

million in new customer demand and contracts during the

quarter

- Gross profit of $3.8 million in the second quarter compared

to ($0.6) million for the same period in 2021.

- YTD gross profit of $6.9 million compared to ($0.5) million

for the same period in 2021

- Gross margins of 22.8% in the second quarter, marks fourth

consecutive quarter of margin improvement

- YTD gross margin of 21.9% compared to (4.4%) for the same

period in 2021

Management Commentary

“In the second quarter of 2022, we continued to execute on our

strategic plan initiated in 2021,” said Jeffrey Peck, Chief

Executive Officer of iSun. “iSun made several strategic investments

to transform the company and position it for the future. These

strategic investments were designed to diversify our revenue mix,

and secure project pipelines that iSun develops, constructs, and

holds a minority ownership in. We are just beginning to see the

benefits of these strategic initiatives and investments. In the

second quarter of 2022, we tripled our revenue over the same period

in 2021. Customer demand continued to accelerate, with new demand

of $35.7 million generated in the quarter, increasing our backlog

to $147.9 million. Additionally, iSun has approximately 1GW of

projects in development. The recent legislation to combat climate

change increases the value of our pipeline and provides an

operating environment that will further accelerate our growth. Our

preparation, pipeline, and this legislation has me more optimistic

about our prospects than ever.”

Second Quarter and Year-to-Date

Results

iSun reported second quarter 2022 revenue of $16.5 million

representing a $12.1 million or 278% increase over the same period

in 2021. YTD revenue was $31.6 million representing a $19.9 million

or 172% increase over the same period in 2022. Revenue growth was

driven by the continued fulfillment of residential consumer demand

and execution of our commercial and industrial backlog.

While we continued to execute against our existing backlog, we

also generated new demand by adding $35.7 million in new business

during the 2nd quarter. By division, our:

- Residential division generated revenue of $8.9 and $14.1

million in the second quarter and YTD, respectively. Customer

orders are approximately $30.7 million and expected to be completed

within three to six months.

- Commercial division generated revenue of $1.1 and $2.5 million

in the second quarter and YTD, respectively, and has a contracted

backlog of approximately $11.4 million expected to be completed

within six to eight months.

- Industrial division generated revenue of $6.0 and $12.9 million

in the second quarter and YTD, respectively, and has a contracted

backlog of approximately $105.8 million expected to be completed

within twelve to eighteen months.

- Utility division generated revenue of $0.5 and $2.1 million in

the second quarter and YTD, respectively. Our Utility division also

has 993 MW of projects currently under development with projects

achieving NTP in late 2022 and early 2023.

Gross profit in the second quarter was $3.8 million compared to

a ($0.6) million loss during the 2nd quarter 2021. Consolidated

gross margin for the quarter was 22.8%, compared to (14.6%) over

the same period in 2021. YTD gross profit was $6.9 compared to a

($0.5) million during the same period in 2021. YTD gross margin was

21.9% compared to (4.4%) during the same period in 2021. The margin

improvement represents the fourth consecutive quarter in which our

margin has improved. As we grow synergies among our segments, the

strengthening of our margin is expected to continue.

Operating income in the second quarter was a loss of ($5.6)

million compared to a loss of ($2.8) million over the same period

in 2021. YTD operating income was a loss of ($11.3) million

compared to a loss of ($5.4) million during the same period in

2021. Non-cash depreciation and amortization expenses were $1.8

million in the second quarter compared to $0.2 million in the same

period in 2022. YTD non-cash depreciation and amortization expenses

were $3.5 million compared to $0.3 million in the same period in

2021.

iSun reported a net loss of ($5.7) million, or ($0.40) per share

in the second quarter of 2022, compared to a net loss of ($1.3)

million, or ($0.15) per share over the same period in 2021. YTD was

a net loss of ($8.6) million or ($0.64) per share compared to a net

loss of ($4.4) million or ($0.53) per share in the same period in

2021.

EBITDA for the quarter was ($3.2) million or (0.23) per share

compared to ($2.4) million or ($0.26) per share in the same period

in 2021. YTD EBITDA was ($3.4) million or ($0.25) per share

compared to ($3.8) million or ($0.45) per share in the same period

in 2021.

We continue to focus our efforts on strengthening our balance

sheet to improve our cash position and liquidity ratios. Our

collections remain strong, and we have invested in inventory to

meet the needs of our growing customer backlog and mitigate supply

chain risks. We recognize the need to clean up our balance sheet

following the multiple acquisitions that were successfully closed

during 2021. We are in active conversations to secure a new debt

facility that will refinance our existing debt, properly

collateralize the assets from our investments and acquisitions, and

provide the capital necessary to continue our growth trajectory. We

anticipate closing prior to the end of the third quarter.

Outlook

iSun’s investments perfectly positions us to respond to the

increase in energy demand associated with automotive

electrification, and make iSun an indispensable partner to

consumers, businesses, industries, and utilities as they transition

to renewable energy sources. With the recent climate legislation,

we anticipate a more favorable environment for solar development

and EV infrastructure. Our breadth of capabilities and depth of

services position us to continue our growth trajectory. We now have

a platform that can deliver a full suite of services. We have

assembled a team that has the experience and expertise to execute

on our capabilities. We have tremendous demand, and a growing

customer base. We are confident that these conditions will continue

to accelerate our established year-over-year revenue growth.

Second Quarter 2022 Conference Call

Details

iSun will host a conference call on Tuesday, August 16th at 8:30

AM EDT to review the Company’s financial results, discuss recent

events, and conduct a question-and-answer session. Participants can

access the live conference call via telephone at 888-506-0062,

using Conference ID #840002. An archived audio replay will be

available through Tuesday, August 30, 2022, at 877-481-4010,

Conference ID# 46361.

Interested parties may also listen to the live audio of the

conference call by visiting the Investor Relations section of the

iSun website at investors.isunenergy.com. To listen to a live

broadcast, go to the site at least 15 minutes prior to the

scheduled start time to register, download, and install any

necessary audio software.

iSun, Inc.

Consolidated Balance Sheets

June 30, 2022 (Unaudited) and

December 31, 2021

(In thousands, except number of

shares)

June 30, 2022

December 31, 2021

Assets

Current Assets:

Cash

$

1,296

$

2,242

Accounts receivable, net of allowance

9,777

14,337

Costs and estimated earnings in excess of

billings

3,132

4,004

Inventory

5,458

2,480

Other current assets

1,312

1,071

Total current assets

20,975

24,134

Other Assets:

Property and equipment, net of accumulated

depreciation

9,084

11,042

Captive insurance investment

270

270

Goodwill

36,907

36,907

Intangible assets, net

16,447

18,907

Investments

12,220

12,420

Other assets

48

48

Total other assets

74,976

79,594

Total assets

$

95,951

$

103,728

Liabilities and Stockholders’

Equity

Current Liabilities:

Accounts payable

$

9,644

$

13,188

Accrued expenses

7,325

7,628

Billings in excess of costs and estimated

earnings on uncompleted contracts

3,464

2,389

Line of credit

4,754

4,468

Current portion of deferred

compensation

31

31

Current portion of long-term debt

571

6,694

Total current liabilities

25,789

34,398

Long-term liabilities:

Deferred compensation, net of current

portion

14

28

Deferred tax liability

-

772

Warrant liability

57

148

Other liabilities

2,303

3,375

Long-term debt, net of current portion

2,157

5,149

Total liabilities

30,320

43,870

Commitments and Contingencies (Note 8)

-

-

Stockholders’ equity:

Common stock – 0.0001 par value 49,000,000

shares authorized, 14,382,080 and 11,825,878 issued and outstanding

as of June 30, 2022 and December 31, 2021, respectively

1

1

Additional paid-in capital

75,222

60,863

Accumulated deficit

(9,592

)

(1,006

)

Total Stockholders’ equity

65,631

59,858

Total liabilities and stockholders’

equity

$

95,951

$

103,728

The accompanying notes are an

integral part of these unaudited consolidated financial

statements.

iSun, Inc.

Condensed Consolidated Statements

of Operations (Unaudited)

For the Three and Six Months

Ended June 30, 2022 and 2021

(In thousands, except number of

shares)

Three Months ended

Six Months ended

June 30,

June 30,

2022

2021

2022

2021

Earned revenue

$

16,476

$

4,353

$

31,563

$

11,614

Cost of earned revenue

12,723

4,988

24,640

12,130

Gross profit

3,753

(635

)

6,923

(516

)

Warehousing and other operating

expenses

1,017

80

1,367

127

General and administrative expenses

5,982

1,655

11,509

3,120

Stock based compensation – general and

administrative

591

265

1,835

1,336

Depreciation and amortization

1,778

169

3,530

305

Total operating expenses

9,368

2,169

18,241

4,888

Operating loss

(5,615

)

(2,804

)

(11,318

)

(5,404

)

Other income (expenses)

Gain on forgiveness of PPP Loan

-

-

2,592

-

Change in fair value of the warrant

liability

28

1,079

91

818

Interest expense, net

(87

)

(50

)

(716

)

(88

)

Loss before income taxes

(5,674

)

(1,775

)

(9,351

)

(4,674

)

(Benefit) provision for income taxes

7

(451

)

(765

)

(236

)

Net loss

(5,681

)

(1,324

)

(8,586

)

(4,438

)

Preferred shareholders’ dividend

-

-

-

(70

)

Net loss available to shares of common

stockholders

$

(5,681

)

$

(1,324

)

$

(8,586

)

$

(4,508

)

Net loss per share of Common Stock - Basic

and diluted

$

(0.40

)

$

(0.15

)

$

(0.64

)

$

(0.53

)

Weighted average shares of Common Stock -

Basic and diluted

14,070,117

9,058,483

13,364,352

8,382,930

The accompanying notes are an

integral part of these unaudited consolidated financial

statements.

Non-GAAP Financial

Measures

Included in this presentation are discussions and

reconciliations of earnings before interest, income tax and

depreciation and amortization (“EBITDA”) and EBITDA adjusted for

certain non-cash, non-recurring or non-core expenses (“Adjusted

EBITDA”) to net loss in accordance with GAAP. Adjusted EBITDA

excludes certain non-cash and other expenses, certain legal

services costs, professional and consulting fees and expenses, and

one-time Reverse Merger and Recapitalization expenses and certain

adjustments. We believe that these non-GAAP measures illustrate the

underlying financial and business trends relating to our results of

operations and comparability between current and prior periods. We

also use these non-GAAP measures to establish and monitor

operational goals.

These non-GAAP measures are not in accordance with, or an

alternative to, GAAP and should be considered in addition to, and

not as a substitute or superior to, the other measures of financial

performance prepared in accordance with GAAP. Using only the

non-GAAP financial measures, particularly Adjusted EBITDA, to

analyze our performance would have material limitations because

such calculations are based on a subjective determination regarding

the nature and classification of events and circumstances that

investors may find significant. We compensate for these limitations

by presenting both the GAAP and non-GAAP measures of our operating

results. Although other companies may report measures entitled

“Adjusted EBITDA” or similar in nature, numerous methods may exist

for calculating a company’s Adjusted EBITDA or similar measures. As

a result, the methods that we use to calculate Adjusted EBITDA may

differ from the methods used by other companies to calculate their

non-GAAP measures.

The reconciliations of EBITDA and Adjusted EBITDA to net loss,

the most directly comparable financial measure calculated and

presented in accordance with GAAP, are shown in the table

below:

Three Months Ended June 30,

Six Months Ended June 30,

2022

2021

2022

2021

Net income (loss)

$

(5,681

)

$

(1,324

)

$

(8,586

)

$

(4,437

)

Depreciation and amortization

1,778

169

3,530

305

Interest expense

87

50

716

88

Stock based compensation

591

(1,079

)

1,835

1,336

Change in fair value of warrant

liability

(28

)

265

(91

)

(818

)

Income tax (benefit)

7

(451

)

(765

)

(237

)

EBITDA

(3,246

)

(2,370

)

(3,361

)

(3,763

)

Other costs(1)

-

-

10

-

Adjusted EBITDA

(3,246

)

(2,370

)

(3,351

)

(3,763

)

Weighted Average shares outstanding

14,070,117

9,058,483

13,364,352

8,382,930

Adjusted EPS

(0.23

)

(0.26

)

(0.25

)

(0.45

)

(1)

Other costs consist of one-time expenses

related to the valuation of acquisitions of SolarCommunities,

Inc.

About iSun Inc.

Since 1972, iSun has accelerated the adoption of proven,

life-improving innovations in electrification technology. iSun has

been the trusted service provider to Fortune 500 companies for

decades and has installed clean rooms, fiber optic cables, flight

simulators, and over 600 megawatts of solar systems. The Company

currently provides a comprehensive suite of solar services across

residential, commercial, industrial & municipal, and utility

scale projects and provides solar electric vehicle charging

solutions for both grid-tied and battery backed solar EV charging

systems. iSun believes that the transition to clean, renewable

solar energy is the most important investment to make today and is

focused on profitable growth opportunities. Please visit

www.isunenergy.com for additional information.

Forward Looking

Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, as amended. Words or phrases such as

"may," "should," "expects," "could," "intends," "plans,"

"anticipates," "estimates," "believes," "forecasts," "predicts" or

other similar expressions are intended to identify forward-looking

statements, which include, without limitation, earnings forecasts,

effective tax rate, statements relating to our business strategy

and statements of expectations, beliefs, future plans and

strategies and anticipated developments concerning our industry,

business, operations and financial performance and condition.

The forward-looking statements included in this press release

are based on our current expectations, projections, estimates and

assumptions. These statements are only predictions, not guarantees.

Such forward-looking statements are subject to numerous risks and

uncertainties that are difficult to predict. These risks and

uncertainties may cause actual results to differ materially from

what is forecast in such forward-looking statements, and include,

without limitation, the risk factors described from time to time in

our filings with the Securities and Exchange Commission, including

our Annual Report on Form 10-K.

All forward-looking statements included in this press release

are based on information currently available to us, and we assume

no obligation to update any forward-looking statement except as may

be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220815005672/en/

IR Contact: Tyler Barnes IR@isunenergy.com 802-289-8141

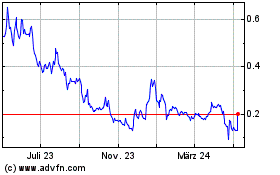

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

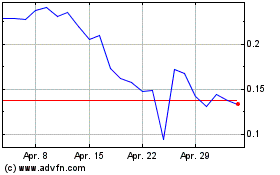

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024