0001294133falseInogen Inc00012941332023-09-142023-09-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 14, 2023 |

INOGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36309 |

33-0989359 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

859 Ward Drive |

|

Goleta, California |

|

93111 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (805) 562-0500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

INGN |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

On September 14, 2023, Inogen, Inc., a Delaware corporation (“Inogen”), completed the acquisition of Physio-Assist SAS, a société par actions simplifiée organized under the laws of France, pursuant to the previously announced Share Purchase Agreement (the “Share Purchase Agreement”) entered into on July 10, 2023 with Mr. Adrien Mithalal, Mr. Jean-Sébastien Lantz, Mrs. Anne Reiser, CAAP Creation, Societe De Capital Risque Provencale Et Corse, Region Sud Investissement, Mérieux Participations 2, Relyens Innovation Santé and certain holders of exercisable securities identified therein (collectively, the “Sellers”). Pursuant to the Share Purchase Agreement, Inogen acquired all of the issued and outstanding capital stock of Physio-Assist SAS. Physio-Assist SAS, directly and through its wholly owned subsidiary, PhysioAssist GmbH, is in the business of the design, production and marketing of medical devices for bronchial decongestion (airway clearance technique) for patients suffering from obstructive respiratory diseases.

Pursuant to the terms of the Share Purchase Agreement, Inogen paid the Sellers approximately $32,000,000 cash at closing subject to adjustment for the estimated net debt amount of Physio-Assist SAS (subject to potential adjustment after closing following confirmation of the actual net debt amount and target working capital amount) and may pay up to either an additional $13,000,000 in cash or $11,000,000 in cash (minus related development costs) depending upon the achievement of one of two alternative milestones related to the Simeox Airway Clearance System’s receipt of FDA de novo authorization or 510(k) clearance within four years of the date of the closing of the transaction.

The foregoing description of the Share Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Share Purchase Agreement. The Share Purchase Agreement was filed as Exhibit 2.1 to Inogen’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 13, 2023 and is incorporated by reference herein. It is not intended to provide any other factual information about Inogen or Physio-Assist SAS. In particular, the assertions embodied in the representations and warranties contained in the Share Purchase Agreement are qualified by information in confidential disclosure schedules provided by the Sellers to Inogen in connection with the signing of the Share Purchase Agreement. These confidential disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Share Purchase Agreement. Moreover, certain representations and warranties in the Share Purchase Agreement were used for the purpose of allocating risk between Inogen and Sellers rather than establishing matters as facts. Accordingly, you should not rely on the representations and warranties in the Share Purchase Agreement as characterizations of the actual state of facts about Inogen or Physio-Assist SAS.

Item 7.01. Regulation FD Disclosure.

On September 18, 2023, Inogen issued a press release announcing the completion of the acquisition of Physio-Assist SAS pursuant to the previously announced Share Purchase Agreement. A copy of the press release is furnished herewith as Exhibit 99.1.

The information set forth under this Current Report under Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

Exhibit |

|

Description |

2.1 |

|

Share Purchase Agreement dated July 10, 2023, by and among Inogen, Inc. and Mr. Adrien Mithalal, Mr. Jean-Sébastien Lantz, Mrs. Anne Reiser, CAAP Creation, Societe De Capital Risque Provencale Et Corse, Region Sud Investissement, Mérieux Participations 2, Relyens Innovation Santé and certain individual sellers identified therein (incorporated by reference to Exhibit 2.1 to Inogen, Inc.’s Current Report on Form 8-K filed on July 13, 2023) |

99.1 |

|

Press Release dated September 18, 2023 |

104 |

|

The cover page of this Current Report on Form 8-K, formatted in inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

INOGEN, INC. |

|

|

|

|

Date: |

September 18, 2023 |

By: |

/s/ Nabil Shabshab |

|

|

|

Nabil Shabshab

Chief Executive Officer and President

(Principal Executive Officer) |

Exhibit 99.1

Inogen Completes Acquisition of Physio-Assist

Acquisition Expands Inogen’s Global Respiratory Care Presence by Addressing the Sizeable, Growing and Underserved Airway Clearance Market Opportunity

GOLETA, Calif., September 18, 2023 – Inogen, Inc. (Nasdaq: INGN), a medical technology company offering innovative respiratory products for use in the homecare setting, today announced it has completed the acquisition of Physio-Assist SAS, expanding the company’s innovative respiratory portfolio.

Simeox, from Physio-Assist, is a technology-enabled airway clearance and mucus management device predominantly aimed at treating bronchiectasis which is a condition that presents as the lung’s bronchi are damaged and widened, in patients with cystic fibrosis or chronic obstructive pulmonary disease. Simeox is used in pulmonary rehabilitation centers, as well as at home.

As a result of the close of the transaction, originally announced on July 13, 2023, Inogen owns Physio-Assist and will now market the Simeox device outside of the United States and continue with ongoing preparations for FDA submission.

“Physio-Assist's Simeox product provides a differentiated and clinically proven innovative airway clearance technology which will add a sizable, growing, and underserved airway clearance market opportunity in support of our strategy to become a multi-portfolio global respiratory care company. Welcoming Physio-Assist to Inogen will add the Simeox airway clearance and mucus management solution to our portfolio and allow us to positively impact patients earlier in their disease journey,” said Nabil Shabshab, President and Chief Executive Officer of Inogen. “I am pleased that Inogen can now deliver a broader set of effective solutions, empowering patients to better manage their respiratory conditions in the comfort of their homes while allowing the benefits of ambulation. We are also excited about Simeox’s revenue model whereby recurring revenue will be generated by the sale of disposables in addition to the capital sales per device.”

Simeox has been cleared under CE mark in the EU and is currently being sold in Europe, Asia, and the Middle East. Inogen will leverage its commercial infrastructure and capabilities to continue marketing the device in these geographies while pursuing US regulatory approvals. The acquisition may provide access to a large and growing market opportunity with 400,000 to 490,000 patients suffering from bronchiectasis in the US eventually.

1

As previously communicated, the acquisition is expected to be immaterial to Inogen’s 2023 revenue and immediately accretive to gross margin. Given the clinical and commercial investment required to obtain FDA clearance and launch Simeox in the US, the transaction is expected to be accretive to adjusted earnings beginning in 2027.

About Inogen

Inogen, Inc. (Nasdaq: INGN) is a leading global medical technology company offering innovative respiratory products for use in the homecare setting. Inogen supports patient respiratory care by developing, manufacturing, and marketing innovative best-in-class portable oxygen concentrators used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. Inogen partners with patients, prescribers, home medical equipment providers, and distributors to make its oxygen therapy products widely available allowing patients the chance to remain ambulatory while managing the impact of their disease.

For more information, please visit www.inogen.com.

Inogen has used, and intends to continue to use, its Investor Relations website, http://investor.inogen.com/, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. For more information, visit http://investor.inogen.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, Inogen’s expectations for patient care with the Simeox device, and forecasted impact to revenue and earnings. Any statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “believes,” “anticipates,” “plans,” “expects,” “will,” “intends,” “potential,” “possible,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that Inogen will not realize anticipated revenue or expenses will not decrease; risks related to cost inflation; the risks our innovation pipeline will not produce meaningful results; risks related to our pending acquisition of Physio Assist including on expenses; the impact of changes in reimbursement rates and reimbursement and regulatory policies; and the possible loss of key employees, customers, or suppliers; the risk that expenses and costs will exceed Inogen’s expectations. Information on these and additional risks, uncertainties, and other information affecting Inogen’s business operating results are contained in its Annual Report on Form 10-K for the year ended December 31, 2022, its Quarterly Report on Form 10-Q for the calendar quarter ended June 30, 2023, and in its other filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. Inogen disclaims any obligation to update these forward-looking statements except as may be required by law.

Contact:

ir@inogen.net

2

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

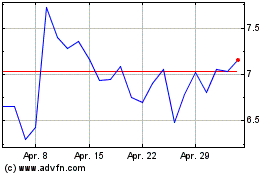

Inogen (NASDAQ:INGN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Inogen (NASDAQ:INGN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024