– Total net product revenues of $693 million in Q1'23 (+14%

Y/Y)

– Jakafi® (ruxolitinib) net product revenues of $580 million

(+7% Y/Y) in Q1'23; raising the bottom end of full year guidance to

new range of $2.55 - $2.63 billion for FY 2023

– Opzelura® (ruxolitinib) cream approved as the first and only

treatment for repigmentation of nonsegmental vitiligo in Europe;

continued strong U.S. launch in atopic dermatitis and vitiligo

– Multiple positive data readouts from dermatology portfolio at

AAD and EHSF 2023

– Conference Call and Webcast Scheduled

Today at 8:00 a.m. ET

Incyte (Nasdaq:INCY) today reports 2023 first quarter financial

results, and provides a status update on the Company’s clinical

development portfolio.

"Our first quarter results demonstrate continued year-over-year

double-digit revenue growth driven by Jakafi, which grew across all

indications, and Opzelura, which is on track to become one of the

most successful dermatology launches in recent years. In addition,

we further expanded our commercial portfolio with several

regulatory approvals including Opzelura for vitiligo in Europe.”

said Hervé Hoppenot, Chief Executive Officer, Incyte. "Furthermore,

in Q1 we made a decision to focus our development efforts on eight

programs that have high potential value for us and discontinued six

other programs. This allows us to optimize our allocation of

resources on programs that can have a high impact for patients and

for Incyte."

Key Product Sales Performance

Jakafi:

Net product revenues of $580 million:

- Net product revenues grew 7% compared with the first quarter of

2022, driven by strong underlying patient demand growth (+7% Y/Y)

including an 8% growth in new patients. Total patients grew across

myelofibrosis (MF), polycythemia vera (PV) and graft-versus-host

disease (GVHD).

- Net product revenues were unfavorably impacted by:

- Higher gross-to-net deductions, compared to fourth quarter of

2022, as a result of the Medicare coverage gap and higher

commercial patient deductibles at the beginning of the plan year,

as well as an increase in 340B orders.

- Lower than normal levels of channel inventory at the end of Q1,

representing an $11 million impact.

Opzelura:

Net product revenues of $57 million:

- Net product revenues grew 343% compared with the first quarter

of 2022, driven by growth in patient demand and expansion in payer

coverage as the launch in atopic dermatitis (AD) and vitiligo

continues.

- Compared to the fourth quarter of 2022, net product revenues

were unfavorably impacted by:

- Increase in co-pay assistance due to higher commercial patient

deductibles at the beginning of the plan year, consistent with

first quarter dynamics and higher Medicaid utilization volume.

- Acceleration of refills in December 2022 driven by patient

demand in advance of annual deductible reset or health plan changes

that negatively impacted refills during the months of January and

February this year.

Pipeline Updates

MPNs and GVHD – key highlights

LIMBER (Leadership In MPNs and GVHD BEyond Ruxolitinib):

Our LIMBER development program encompasses multiple monotherapy and

combination strategies, with the goal of improving upon the

standard of care in MF, PV, GVHD and now, essential thrombocythemia

(ET).

- Combination trials of ruxolitinib BID with zilurgisertib

(ALK2) and INCB57643 (BET) are ongoing and progressing

well.

- In early development, INCA33989 (mCALR) is on track for

initiating first-in-human study in MF and ET in 2023. Additionally,

a Phase 1 study evaluating ruxolitinib BID in combination with

Cellenkos' CK0804 in MF is continuing to recruit

patients.

- AGAVE-201, a global pivotal Phase 2 trial of axatilimab

in patients with cGVHD is ongoing and results are on track for

mid-2023. A Phase 1/2 combination trial of axatilimab in

combination with ruxolitinib is being planned.

- The Phase 3 LIMBER-304 trial, evaluating parsaclisib in

combination with ruxolitinib BID in suboptimal responders in MF

and the Phase 3 LIMBER-313 trial, evaluating parsaclisib in

combination with ruxolitinib BID in first-line MF, were

discontinued following results of interim analyses that indicated

that the studies were unlikely to meet their primary endpoints in

the intent-to-treat patient population. The studies were not

stopped due to safety.

- The U.S. Food and Drug Administration (FDA) issued a complete

response letter for ruxolitinib extended-release (XR)

tablets for once-daily (QD) use in the treatment of certain

types of MF, PV and GVHD. Incyte will work with the FDA to

determine appropriate next steps.

Indication and status

Ruxolitinib XR (QD)

(JAK1/JAK2)

Myelofibrosis, polycythemia vera and

GVHD

Ruxolitinib + zilurgisertib

(JAK1/JAK2 + ALK2)

Myelofibrosis: Phase 2

Ruxolitinib + INCB57643

(JAK1/JAK2 + BET)

Myelofibrosis: Phase 2

Ruxolitinib + CK08041

(JAK1/JAK2 + CB-Tregs)

Myelofibrosis: Phase 1

(LIMBER-TREG108)

Axatilimab (anti-CSF-1R)2

Chronic GVHD: Pivotal Phase 2 (third-line

plus therapy) (AGAVE-201)

Ruxolitinib + axatilimab2

(JAK1/JAK2 + anti-CSF-1R)

Chronic GVHD: Phase 1/2 in preparation

INCA33989

(mCALR)

Myelofibrosis, essential thrombocythemia:

Entering clinic in 2023

1 Development collaboration with

Cellenkos, Inc.

2 Clinical development of axatilimab in

GVHD conducted in collaboration with Syndax Pharmaceuticals.

Other Hematology/Oncology – key highlights

Zynyz™ (retifanlimab-dlwr) approved for Merkel cell carcinoma

in the U.S.: Zynyz, a humanized monoclonal antibody targeting

programmed death receptor-1 (PD-1), received accelerated approval

for the treatment of adults with metastatic or recurrent locally

advanced Merkel cell carcinoma (MCC) in the U.S. This represents

the first regulatory approval for Incyte's PD-1 inhibitor, which is

also being evaluated in pivotal trials in non-small cell lung

cancer (NSCLC) and squamous cell carcinoma of the anal canal

(SCAC).

Monjuvi® (tafasitamab-cxix)/Minjuvi® (tafasitamab):

Minjuvi continues to launch in new ex-US markets, having gained

reimbursement in two additional countries this quarter, bringing

the total of launch markets to six. At the American Association for

Cancer Research (AACR), final five-year follow-up data from the

Phase 2 L-MIND study were presented, which showed that Monjuvi plus

lenalidomide followed by Monjuvi monotherapy provided prolonged,

durable responses in adult patients with relapsed or refractory

diffuse large B-cell lymphoma (DLBCL).

Pemazyre® (pemigatinib) continues to expand in ex-U.S.

markets in cholangiocarcinoma and myeloproliferative neoplasms

(MLNs): Pemazyre was approved in Japan by the Japanese Ministry

of Health, Labour and Welfare (MHLW) for the treatment of MLNs with

FGFR1 fusion. MLNs are a rare, aggressive group of cancers

characterized by an over-production of myeloid cells, or bone

tissue, with the tendency to rapidly progress to an acute myeloid

leukemia (AML). The launch of Pemazyre in cholangiocarcinoma (CCA)

is ongoing in 10 key markets in Europe. In clinical development,

FIGHT-210, evaluating pemigatinib in NSCLC, was discontinued.

Parsaclisib in warm autoimmune hemolytic anemia (wAIHA):

Based on the challenging regulatory landscape associated with the

PI3K class, development of parsaclisib in wAIHA has been

discontinued.

Indication and status

Pemigatinib (Pemazyre®)

(FGFR1/2/3)

Myeloid/lymphoid neoplasms (MLN): approved

in the U.S. and Japan

Cholangiocarcinoma (CCA): Phase 3

(FIGHT-302)

Glioblastoma: Phase 2 (FIGHT-209)

Tafasitamab

(Monjuvi®/Minjuvi®)1

(CD19)

Relapsed or refractory diffuse large

B-cell lymphoma (DLBCL): Phase 3 (B-MIND)

First-line DLBCL: Phase 3 (frontMIND)

Relapsed or refractory follicular lymphoma

(FL) and relapsed or refractory marginal zone lymphoma (MZL): Phase

3 (inMIND)

Retifanlimab (Zynyz™)2

(PD-1)

Merkel cell carcinoma: approved in the

U.S.

Squamous cell anal cancer (SCAC): Phase 3

(POD1UM-303)

Non-small cell lung cancer (NSCLC): Phase

3 (POD1UM-304)

MSI-high endometrial cancer: Phase 2

(POD1UM-101, POD1UM-204)

INCB99280

(Oral PD-L1)

Solid tumors: Phase 1

KRASG12C-mutated solid tumors: Phase 1/1b

in combination with adagrasib3, in preparation

INCB99318

(Oral PD-L1)

Solid tumors: Phase 1

1 Development of tafasitamab in

collaboration with MorphoSys.

2 Retifanlimab licensed from

MacroGenics.

3 Clinical trial collaboration and supply

agreement with Mirati Therapeutics.

Inflammation and Autoimmunity (IAI) – key highlights

Dermatology

Opzelura

- Opzelura approved for vitiligo in Europe: Opzelura was

approved by the European Commission for the treatment of

non-segmental vitiligo with facial involvement in adults and

adolescents 12 years of age and older. The EC decision is based on

data from two pivotal Phase 3 clinical trials (TRuE-V1 and -V2),

which showed treatment with Opzelura resulted in significant

improvements in facial and total body repigmentation versus vehicle

at Week 24 and among completers of an open-label extension at Week

52. Opzelura was well-tolerated with no serious treatment-related

adverse events related to ruxolitinib cream.

- Opzelura 104-week safety and efficacy data in vitiligo

provide insights into the value of long-term treatment:

104-week results from the long-term extension of the Phase 3 TRuE-V

study were presented at the American Academy of Dermatology (AAD)

Annual Meeting. The data demonstrated that many patients who

achieved a high level of facial repigmentation (≥F-VASI90) at Week

52 were able to maintain durable response one year following

withdrawal of treatment. In patients who did not achieve ≥F-VASI90

at Week 52 and continued treatment with Opzelura, improvements in

facial and total body repigmentation, as shown by greater

proportions of patients reaching F-VASI75 and T-VASI50, were

observed through Week 104.

- Ruxolitinib cream in pediatric atopic dermatitis (AD): A

Phase 3 trial of ruxolitinib cream in pediatric AD has completed

enrollment with results expected by end of year. There are an

estimated 2-3 million pediatric AD patients (ages 2-11) in the

United States.

- Ruxolitinib cream in other indications: Incyte continues

to expand the development of ruxolitinib cream into new indications

as we seek to maximize the potential opportunity with the

franchise. Phase 2 trials evaluating ruxolitinib cream in mild to

moderate hidradenitis suppurativa (HS), lichen planus (LP) and

lichen sclerosus (LS) are ongoing. Additionally, two Phase 3 trials

evaluating ruxolitinib cream in prurigo nodularis (PN) were

initiated.

Povorcitinib

- Phase 2 results in hidradenitis suppurativa: 52-week

results from the Phase 2 study evaluating povorcitinib (15mg QD,

45mg QD, 75mg QD) in HS were presented as an oral presentation at

the European Hidradenitis Suppurativa Foundation (EHSF) Annual

Meeting. The data demonstrated that continuation of treatment with

povorcitinib 75 mg resulted in sustained and durable efficacy

across all treatment arms, and importantly, 22-29% of patients

treated for 52-weeks achieved HiSCR100, which is defined as a 100%

reduction from baseline in total abscess and nodule (AN) count with

no increase from baseline in abscess or draining tunnel count.

Povorcitinib is currently in two Phase 3 studies in moderate to

severe HS.

- Phase 2 results in vitiligo: 36-week results from the

Phase 2b study evaluating povorcitinib in patients with extensive

vitiligo were presented as an oral late-breaking presentation at

the American Academy of Dermatology (AAD) Annual Meeting. The data

demonstrated that treatment with oral povorcitinib was associated

with substantial total body repigmentation in patients with

extensive nonsegmental vitiligo, as measured by total Vitiligo Area

Scoring Index (T-VASI) scores. Specifically, the study met its

primary endpoint, and patients receiving povorcitinib experienced

statistically superior improvements in T-VASI at Week 24 compared

to placebo (povorcitinib 15 mg, –19.1%; 45 mg, –17.8%; 75 mg,

–15.7% vs. placebo, +2.3%; least squares mean [LSM] difference,

P<0.01). Incyte plans to move into Phase 3 development for

povorcitinib in vitiligo, pending FDA regulatory discussions.

- Studies planned for asthma and chronic spontaneous

urticaria: Incyte announced the expansion of povorcitinib

development into other inflammatory and autoimmune diseases,

including planning for two Phase 2 trials in asthma and chronic

spontaneous urticaria.

Indication and status

Ruxolitinib cream (Opzelura®)1

(JAK1/JAK2)

AD: Phase 3 pediatric study (TRuE-AD3)

Vitiligo: Phase 3 (TRuE-V1, TRuE-V2);

approved in the U.S. and Europe

Lichen planus: Phase 2

Lichen sclerosus: Phase 2

Hidradenitis suppurativa: Phase 2

Prurigo nodularis: Phase 3 initiated

(TRuE-PN1, TRuE-PN2)

Ruxolitinib cream + UVB

(JAK1/JAK2 + phototherapy)

Vitiligo: Phase 2

Povorcitinib

(JAK1)

Hidradenitis suppurativa: Phase 2b; Phase

3 (STOP-HS1, STOP-HS2)

Vitiligo: Phase 2; Phase 3 planned

Prurigo nodularis: Phase 2

Asthma: PoC planned

Chronic spontaneous urticaria: PoC

planned

Auremolimab

(anti-IL-15Rβ)

Vitiligo: Phase 1 in preparation

1 Novartis’ rights to ruxolitinib outside

of the United States under our Collaboration and License Agreement

with Novartis do not include topical administration.

Discovery and other early development – key

highlights

INCB123667 (CDK2) oral presentation at the American

Association for Cancer Research (AACR) 2023: INCB123667 is a

selective and potent CDK2 kinase inhibitor, which has been shown to

suppress tumor growth as monotherapy and in combination with

standard of care, in Cyclin E amplified tumor models, in vivo. At

AACR, Incyte presented data demonstrating INCB123667 exhibited

significant single-agent activity in vivo in CCNE1high breast

cancer xenograft and patient-derived xenograft models. INCB123667

is currently being evaluated in a Phase 1 clinical trial in

patients with advanced malignancies including CCNE1high TNBC and

HR+HER2- tumors post-CDK4/6 inhibitors.

INCA33890 (TGFβR2xPD-1) in clinical development:

INCA33890 is a TGFβR2xPD1 bispecific antibody which has been

engineered to avoid the known toxicity of broad TGFβ pathway

blockade. INCA33890 has higher affinity for PD1 than TGFβR2, and

blocks TGFβ-signaling specifically in cells co-expressing PD-1,

thus potentially sparing tissues where TGFb-signaling is important

for normal function. Preclinical in vivo data presented at AACR

show that INCA33890 has a greater anti-tumor effect than either

individual benchmark antibodies or a simple combination of

these.

Development of the adenosine program (including INCB106385 and

INCA00186), INCAGN1876 (GITR) and INCB81776 (AXL/MER) has been

discontinued based on early efficacy data.

Modality

Candidates

Small molecules

INCB123667 (CDK2)

Monoclonal antibodies

INCAGN2385 (LAG-3)1, INCAGN2390

(TIM-3)1

Bi-specific antibodies

INCA32459 (LAG-3xPD-1)2, INCA33890

(TGFβR2xPD-1)2

1 Discovery collaboration with Agenus.

2 Development in collaboration with

Merus

Partnered – key highlights

Indication and status

Ruxolitinib1

(JAK1/JAK2)

Acute and chronic GVHD: approved in

Europe; J-NDA under review

Baricitinib2

(JAK1/JAK2)

AD: approved in Europe and Japan

Severe AA: approved in the U.S., Europe

and Japan

Capmatinib3

(MET)

NSCLC (with MET exon 14 skipping

mutations): approved in the U.S., Europe and Japan

1 Ruxolitinib (Jakavi®) licensed to

Novartis ex-U.S. for use in hematology and oncology excluding

topical administration.

2 Baricitinib (Olumiant®) licensed to

Lilly: approved as Olumiant in multiple territories globally for

certain patients with moderate-to-severe rheumatoid arthritis;

approved as Olumiant in EU and Japan for certain patients with

atopic dermatitis.

3 Capmatinib (Tabrecta®) licensed to

Novartis.

2023 First Quarter Financial Results

The financial measures presented in this press release for the

three months ended March 31, 2023 and 2022 have been prepared by

the Company in accordance with U.S. Generally Accepted Accounting

Principles (“GAAP”), unless otherwise identified as a Non-GAAP

financial measure. Management believes that Non-GAAP information is

useful for investors, when considered in conjunction with Incyte’s

GAAP disclosures. Management uses such information internally and

externally for establishing budgets, operating goals and financial

planning purposes. These metrics are also used to manage the

Company’s business and monitor performance. The Company adjusts,

where appropriate, for expenses in order to reflect the Company’s

core operations. The Company believes these adjustments are useful

to investors by providing an enhanced understanding of the

financial performance of the Company’s core operations. The metrics

have been adopted to align the Company with disclosures provided by

industry peers.

Non-GAAP information is not prepared under a comprehensive set

of accounting rules and should only be used in conjunction with and

to supplement Incyte’s operating results as reported under GAAP.

Non-GAAP measures may be defined and calculated differently by

other companies in our industry.

As changes in exchange rates are an important factor in

understanding period-to-period comparisons, Management believes the

presentation of certain revenue results on a constant currency

basis in addition to reported results helps improve investors’

ability to understand its operating results and evaluate its

performance in comparison to prior periods. Constant currency

information compares results between periods as if exchange rates

had remained constant period over period. The Company calculates

constant currency by calculating current year results using prior

year foreign currency exchange rates and generally refers to such

amounts calculated on a constant currency basis as excluding the

impact of foreign exchange or being on a constant currency basis.

These results should be considered in addition to, not as a

substitute for, results reported in accordance with GAAP. Results

on a constant currency basis, as the Company presents them, may not

be comparable to similarly titled measures used by other companies

and are not measures of performance presented in accordance with

GAAP.

Financial Highlights

Financial Highlights

(unaudited, in thousands,

except per share amounts)

Three Months Ended

March 31,

2023

2022

Total GAAP revenues

$

808,673

$

733,235

Total GAAP operating income

24,770

116,540

Total Non-GAAP operating income

89,729

172,147

GAAP net income

21,703

37,992

Non-GAAP net income

84,577

122,867

GAAP basic EPS

$

0.10

$

0.17

Non-GAAP basic EPS

$

0.38

$

0.56

GAAP diluted EPS

$

0.10

$

0.17

Non-GAAP diluted EPS

$

0.37

$

0.55

Revenue Details

Revenue Details

(unaudited, in

thousands)

Three Months Ended

March 31,

% Change (as

reported)

% Change

(constant currency)1

2023

2022

Net product revenues:

Jakafi

$

579,969

$

544,464

7

%

7

%

Iclusig

27,685

26,069

6

%

12

%

Pemazyre

22,475

18,032

25

%

29

%

Minjuvi

6,556

4,502

46

%

51

%

Opzelura

56,552

12,754

343

%

343

%

Total net product revenues

693,237

605,821

14

%

15

%

Royalty revenues:

Jakavi

76,692

70,867

8

%

16

%

Olumiant

34,155

48,064

(29

%)

(16

%)

Tabrecta

4,177

3,483

20

%

NA

Pemazyre

412

—

NM

NM

Total royalty revenues

115,436

122,414

(6

%)

Total net product and royalty revenues

808,673

728,235

11

%

Milestone and contract revenues

—

5,000

(100

%)

(100

%)

Total GAAP revenues

$

808,673

$

733,235

10

%

NM = not meaningful

NA = not available

1.Percentage change in constant currency

is calculated using 2022 foreign exchange rates to recalculate 2023

results.

Product and Royalty Revenues Product and royalty revenues

for the three months ended March 31, 2023 increased 11% over the

prior year comparative period as a result of net product revenues

increasing 14% year-over-year, primarily driven by increases in

Jakafi and Opzelura net product revenues. The increase in Jakafi

net product revenues was primarily driven by growth in patient

demand across all indications and was partially offset by higher

gross-to-net deductions for Medicare and commercial co-pay

assistance consistent with historical prior years' first quarters,

as well as an increase in 340B volumes. The quarter was also

impacted by lower weeks on hand channel inventory than normal due

to timing of certain customer purchases. Opzelura net product

revenues for the quarter were $57 million, representing a 343%

increase year-over-year driven by increased patient demand and

expanded coverage. The quarter was negatively impacted by an

increase in co-pay assistance due to higher commercial patient

deductibles at the beginning of the plan year and higher Medicaid

utilization volume. In addition, volume was negatively impacted by

an acceleration of refills in December 2022 driven by patient

demand in advance of annual deductible reset or health plan

changes. Jakavi and Olumiant royalties for the quarter were

impacted by unfavorable changes in foreign currency exchange rates,

while Olumiant royalties were also impacted by a decrease in net

product sales of Olumiant for use as a treatment for COVID-19.

Operating Expenses

Operating Expense

Summary

(unaudited, in

thousands)

Three Months Ended

March 31,

% Change

2023

2022

GAAP cost of product revenues

$

56,822

$

42,614

33

%

Non-GAAP cost of product revenues1

50,669

36,619

38

%

GAAP research and development

406,641

353,373

15

%

Non-GAAP research and development2

375,620

327,045

15

%

GAAP selling, general and

administrative

315,606

209,584

51

%

Non-GAAP selling, general and

administrative3

294,017

192,682

53

%

GAAP loss on change in fair value of

acquisition-related contingent consideration

6,196

6,382

(3

%)

Non-GAAP loss on change in fair value of

acquisition-related contingent consideration4

—

—

—

%

GAAP (profit) and loss sharing under

collaboration agreements

(1,362

)

4,742

(129

%)

1 Non-GAAP cost of product revenues

excludes the amortization of licensed intellectual property for

Iclusig relating to the acquisition of the European business of

ARIAD Pharmaceuticals, Inc. and the cost of stock-based

compensation.

2 Non-GAAP research and development

expenses exclude the cost of stock-based compensation.

3 Non-GAAP selling, general and

administrative expenses exclude the cost of stock-based

compensation.

4 Non-GAAP loss on change in fair value of

acquisition-related contingent consideration is null.

Cost of product revenues GAAP and Non-GAAP cost of

product revenues for three months ended March 31, 2023 increased

33% and 38%, respectively, compared to the same period in 2022

primarily due to product related costs for our commercial products

including Opzelura.

Research and development expenses GAAP and Non-GAAP

research and development expense for three months ended March 31,

2023 increased 15%, compared to the same period in 2022 primarily

due to continued investment in our late stage development assets

and timing of certain expenses.

Selling, general and administrative expenses GAAP and

Non-GAAP selling, general and administrative expenses for the three

months ended March 31, 2023 increased 51% and 53%, respectively,

compared to the same period in 2022, primarily due to expenses

related to promotional activities to support the launch of Opzelura

for the treatments of atopic dermatitis and vitiligo and timing of

certain expenses.

Other Financial

Information

Operating income GAAP and Non-GAAP operating income for

the three months ended March 31, 2023 decreased 79% and 48%,

respectively, compared to the same period in 2022, primarily due to

expenses related to promotional activities to support the launch of

Opzelura for the treatments of atopic dermatitis and vitiligo and

timing of certain expenses.

Cash, cash equivalents and marketable securities position

As of March 31, 2023 and December 31, 2022, cash, cash equivalents

and marketable securities totaled $3.1 billion and $3.2 billion,

respectively. The decrease from December 31, 2022 is due a

reduction of our accounts payable balance at March 31, 2023.

2023 Financial Guidance

Incyte is tightening its full year 2023 guidance for Jakafi net

product revenues as a result of its strong first quarter

performance. Guidance does not include revenue from any potential

new product launches or the impact of any potential future

strategic transactions. Incyte’s guidance is summarized below.

Current

Previous

Jakafi net product revenues

$2.55 - $2.63 billion

$2.53 - $2.63 billion

Other Hematology/Oncology net product

revenues(1)

$215 - $225 million

Unchanged

GAAP Cost of product revenues

7 – 8% of net product revenues

Unchanged

Non-GAAP Cost of product revenues(2)

6 – 7% of net product revenues

Unchanged

GAAP Research and development expenses

$1,610 - $1,650 million

Unchanged

Non-GAAP Research and development

expenses(3)

$1,485 - $1,520 million

Unchanged

GAAP Selling, general and administrative

expenses

$1,050 - $1,150 million

Unchanged

Non-GAAP Selling, general and

administrative expenses(3)

$965 - $1,060 million

Unchanged

1 Pemazyre in the U.S., EU and Japan and

Iclusig and Minjuvi in the EU.

2 Adjusted to exclude the amortization of

licensed intellectual property for Iclusig relating to the

acquisition of the European business of ARIAD Pharmaceuticals, Inc.

and the estimated cost of stock-based compensation.

3 Adjusted to exclude the estimated cost

of stock-based compensation.

Conference Call and Webcast Information

Incyte will hold a conference call and webcast this morning at

8:00 a.m. ET. To access the conference call, please dial

877-407-3042 for domestic callers or 201-389-0864 for international

callers. When prompted, provide the conference identification

number, 13737924.

If you are unable to participate, a replay of the conference

call will be available for 90 days. The replay dial-in number for

the United States is 877-660-6853 and the dial-in number for

international callers is 201-612-7415. To access the replay you

will need the conference identification number, 13737924.

The conference call will also be webcast live and can be

accessed at investor.incyte.com.

About Incyte

Incyte is a Wilmington, Delaware-based, global biopharmaceutical

company focused on finding solutions for serious unmet medical

needs through the discovery, development and commercialization of

proprietary therapeutics. For additional information on Incyte,

please visit Incyte.com and follow @Incyte.

About Jakafi® (ruxolitinib)

Jakafi® (ruxolitinib) is a JAK1/JAK2 inhibitor approved by the

U.S. FDA for treatment of polycythemia vera (PV) in adults who have

had an inadequate response to or are intolerant of hydroxyurea;

intermediate or high-risk myelofibrosis (MF), including primary MF,

post-polycythemia vera MF and post-essential thrombocythemia MF in

adults; steroid-refractory acute GVHD in adult and pediatric

patients 12 years and older; and chronic GVHD after failure of one

or two lines of systemic therapy in adult and pediatric patients 12

years and older.

Jakafi is a registered trademark of Incyte.

About Opzelura® (ruxolitinib) Cream 1.5%

Opzelura, a novel cream formulation of Incyte’s selective

JAK1/JAK2 inhibitor ruxolitinib, approved by the U.S. Food &

Drug Administration for the topical treatment of nonsegmental

vitiligo in patients 12 years of age and older, is the first and

only treatment for repigmentation approved for use in the United

States. Opzelura is also approved in the U.S. for the topical

short-term and non-continuous chronic treatment of mild to moderate

atopic dermatitis (AD) in non-immunocompromised patients 12 years

of age and older whose disease is not adequately controlled with

topical prescription therapies, or when those therapies are not

advisable. Use of Opzelura in combination with therapeutic

biologics, other JAK inhibitors, or potent immunosuppressants, such

as azathioprine or cyclosporine, is not recommended.

In Europe, Opzelura (ruxolitinib) cream 15mg/g is approved for

the treatment of non-segmental vitiligo with facial involvement in

adults and adolescents from 12 years of age.

Incyte has worldwide rights for the development and

commercialization of ruxolitinib cream, marketed in the United

States as Opzelura.

Opzelura and the Opzelura logo are registered trademarks of

Incyte.

About Monjuvi®/Minjuvi® (tafasitamab)

Tafasitamab is a humanized Fc-modified CD19 targeting

immunotherapy. In 2010, MorphoSys licensed exclusive worldwide

rights to develop and commercialize tafasitamab from Xencor, Inc.

Tafasitamab incorporates an XmAb® engineered Fc domain, which

mediates B-cell lysis through apoptosis and immune effector

mechanism including Antibody-Dependent Cell-Mediated Cytotoxicity

(ADCC) and Antibody-Dependent Cellular Phagocytosis (ADCP).

In the United States, Monjuvi® (tafasitamab-cxix) is

approved by the U.S. Food and Drug Administration in combination

with lenalidomide for the treatment of adult patients with relapsed

or refractory DLBCL not otherwise specified, including DLBCL

arising from low grade lymphoma, and who are not eligible for

autologous stem cell transplant (ASCT). This indication is approved

under accelerated approval based on overall response rate.

Continued approval for this indication may be contingent upon

verification and description of clinical benefit in a confirmatory

trial(s).

In Europe, Minjuvi® (tafasitamab) received conditional marketing

authorization in combination with lenalidomide, followed by

Minjuvi® monotherapy, for the treatment of adult patients with

relapsed or refractory diffuse large B-cell lymphoma (DLBCL) who

are not eligible for autologous stem cell transplant (ASCT).

Tafasitamab is being clinically investigated as a therapeutic

option in B-cell malignancies in several ongoing combination

trials.

Minjuvi® and Monjuvi® are registered trademarks of MorphoSys AG.

Tafasitamab is co-marketed by Incyte and MorphoSys under the brand

name Monjuvi® in the U.S., and marketed by Incyte under the brand

name Minjuvi® in Europe and Canada.

XmAb® is a registered trademark of Xencor, Inc.

About Pemazyre® (pemigatinib)

Pemazyre is a kinase inhibitor indicated in the United States

for the treatment of adults with previously treated, unresectable

locally advanced or metastatic cholangiocarcinoma with a fibroblast

growth factor receptor 2 (FGFR2) fusion or other rearrangement as

detected by an FDA-approved test*. This indication is approved

under accelerated approval based on overall response rate and

duration of response. Continued approval for this indication may be

contingent upon verification and description of clinical benefit in

a confirmatory trial(s).

Pemazyre is also the first targeted treatment approved for use

in the United States for treatment of adults with relapsed or

refractory myeloid/lymphoid neoplasms (MLNs) with FGFR1

rearrangement.

In Japan, Pemazyre is approved for the treatment of patients

with unresectable biliary tract cancer (BTC) with a fibroblast

growth factor receptor 2 (FGFR2) fusion gene, worsening after

cancer chemotherapy.

In Europe, Pemazyre is approved for the treatment of adults with

locally advanced or metastatic cholangiocarcinoma with a fibroblast

growth factor receptor 2 (FGFR2) fusion or rearrangement that have

progressed after at least one prior line of systemic therapy.

Pemazyre is a potent, selective, oral inhibitor of FGFR isoforms

1, 2 and 3 which, in preclinical studies, has demonstrated

selective pharmacologic activity against cancer cells with FGFR

alterations.

Pemazyre is marketed by Incyte in the United States, Europe and

Japan.

Pemazyre is a trademark of Incyte.

* Pemazyre® (pemigatinib) [Package Insert]. Wilmington, DE:

Incyte; 2020.

About Iclusig® (ponatinib) tablets

Ponatinib (Iclusig®) targets not only native BCR-ABL but also

its isoforms that carry mutations that confer resistance to

treatment, including the T315I mutation, which has been associated

with resistance to other approved TKIs.

In the EU, Iclusig is approved for the treatment of adult

patients with chronic phase, accelerated phase or blast phase

chronic myeloid leukemia (CML) who are resistant to dasatinib or

nilotinib; who are intolerant to dasatinib or nilotinib and for

whom subsequent treatment with imatinib is not clinically

appropriate; or who have the T315I mutation, or the treatment of

adult patients with Philadelphia-chromosome positive acute

lymphoblastic leukemia (Ph+ ALL) who are resistant to dasatinib;

who are intolerant to dasatinib and for whom subsequent treatment

with imatinib is not clinically appropriate; or who have the T315I

mutation.

Click here to view the Iclusig EU Summary of Medicinal

Product Characteristics.

Incyte has an exclusive license from Takeda Pharmaceuticals

International AG to commercialize ponatinib in the European Union

and 29 other countries, including Switzerland, UK, Norway, Turkey,

Israel and Russia. Iclusig is marketed in the U.S. by Millennium

Pharmaceuticals, Inc., a wholly owned subsidiary of Takeda

Pharmaceutical Company Limited.

About Zynyz™ (retifanlimab-dlwr)

Zynyz (retifanlimab-dlwr), is an intravenous PD-1 inhibitor

indicated in the U.S. for the treatment of adult patients with

metastatic or recurrent locally advanced Merkel cell carcinoma

(MCC). This indication is approved under accelerated approval based

on tumor response rate and duration of response. Continued approval

for this indication may be contingent upon verification and

description of clinical benefit in confirmatory trials.

Zynyz is marketed by Incyte in the U.S. In 2017, Incyte entered

into an exclusive collaboration and license agreement with

MacroGenics, Inc. for global rights to retifanlimab.

Zynyz is a trademark of Incyte.

Forward-Looking Statements

Except for the historical information set forth herein, the

matters set forth in this release contain predictions, estimates

and other forward-looking statements, including any discussion of

the following: Incyte’s potential for continued performance and

growth; Incyte’s financial guidance for 2023, including its

expectations regarding sales of Jakafi; expectations with respect

to demand for and uptake of Opzelura; the potential for ruxolitinib

cream to expand into other indications; expectations regarding the

potential and progress of programs in our pipeline and the delivery

of same; expectations regarding ongoing clinical trials and

clinical trials to be initiated, including the LIMBER program,

INCA33989 (mCALR) in MF and ET, a Phase 1 study evaluating

ruxolitinib BID in combination with Cellenkos' CK0804 in MF,

axatilimab in cGVHD (alone and in combination with ruxolitinib),

Incyte’s oral PD-L1 program, a phase 3 trial of ruxolitinib cream

in pediatric AD, phase 2 and 3 trials of povorcitinib in multiple

indications and a phase 1 trial of auremolimab in vitiligo; our and

our collaborators’ potential for receiving additional regulatory

approvals within the next 1-2 years and the corresponding potential

for launches of new products and/or indications; Incyte’s plan to

work with the FDA to determine next steps for ruxolitinib

extended-release (XR) tablets for once-daily (QD) use; expectations

regarding ongoing launches by us and our collaborators; and our

expectations regarding 2023 newsflow items.

These forward-looking statements are based on Incyte’s current

expectations and subject to risks and uncertainties that may cause

actual results to differ materially, including unanticipated

developments in and risks related to: further research and

development and the results of clinical trials possibly being

unsuccessful or insufficient to meet applicable regulatory

standards or warrant continued development; the ability to enroll

sufficient numbers of subjects in clinical trials and the ability

to enroll subjects in accordance with planned schedules; the

effects of the COVID 19 pandemic and measures to address the

pandemic on Incyte’s clinical trials, supply chain and other

third-party providers, sales and marketing efforts and business,

development and discovery operations; determinations made by the

FDA, EMA, and other regulatory agencies; Incyte’s dependence on its

relationships with and changes in the plans of its collaboration

partners; the efficacy or safety of Incyte’s products and the

products of Incyte’s collaboration partners; the acceptance of

Incyte’s products and the products of Incyte’s collaboration

partners in the marketplace; market competition; unexpected

variations in the demand for Incyte’s products and the products of

Incyte’s collaboration partners; the effects of announced or

unexpected price regulation or limitations on reimbursement or

coverage for Incyte’s products and the products of Incyte’s

collaboration partners; sales, marketing, manufacturing and

distribution requirements, including Incyte’s and its collaboration

partners’ ability to successfully commercialize and build

commercial infrastructure for newly approved products and any

additional products that become approved; greater than expected

expenses, including expenses relating to litigation or strategic

activities; variations in foreign currency exchange rates; and

other risks detailed in Incyte’s reports filed with the Securities

and Exchange Commission, including its annual report for the year

ended December 31, 2022. Incyte disclaims any intent or obligation

to update these forward-looking statements.

INCYTE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except per share amounts)

Three Months Ended

March 31,

2023

2022

GAAP

Revenues:

Product revenues, net

$

693,237

$

605,821

Product royalty revenues

115,436

122,414

Milestone and contract revenues

—

5,000

Total revenues

808,673

733,235

Costs and expenses:

Cost of product revenues (including

definite-lived intangible amortization)

56,822

42,614

Research and development

406,641

353,373

Selling, general and administrative

315,606

209,584

Loss on change in fair value of

acquisition-related contingent consideration

6,196

6,382

(Profit) and loss sharing under

collaboration agreements

(1,362

)

4,742

Total costs and expenses

783,903

616,695

Income from operations

24,770

116,540

Interest income and other, net

32,873

1,260

Interest expense

(469

)

(680

)

Unrealized loss on long term

investments

(5,318

)

(46,585

)

Income before provision for income

taxes

51,856

70,535

Provision for income taxes

30,153

32,543

Net income

$

21,703

$

37,992

Net income per share:

Basic

$

0.10

$

0.17

Diluted

$

0.10

$

0.17

Shares used in computing net income per

share:

Basic

222,960

221,326

Diluted

225,589

222,950

INCYTE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in

thousands)

March 31, 2023

December 31,

2022

ASSETS

Cash, cash equivalents and marketable

securities

$

3,112,712

$

3,238,965

Accounts receivable

623,788

644,879

Property and equipment, net

741,701

739,310

Finance lease right-of-use assets, net

25,849

26,298

Inventory

157,564

120,959

Prepaid expenses and other assets

216,694

194,144

Long term investments

128,313

133,676

Other intangible assets, net

140,658

129,219

Goodwill

155,593

155,593

Deferred income tax asset

494,751

457,941

Total assets

$

5,797,623

$

5,840,984

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable, accrued expenses and

other liabilities

$

1,084,207

$

1,216,603

Finance lease liabilities

32,848

33,262

Acquisition-related contingent

consideration

218,000

221,000

Stockholders’ equity

4,462,568

4,370,119

Total liabilities and stockholders’

equity

$

5,797,623

$

5,840,984

INCYTE CORPORATION

RECONCILIATION OF GAAP NET

(LOSS) INCOME TO SELECTED NON-GAAP ADJUSTED INFORMATION

(unaudited, in thousands,

except per share amounts)

Three Months Ended

March 31,

2023

2022

GAAP Net Income

$

21,703

$

37,992

Adjustments1:

Non-cash stock compensation from equity

awards (R&D)2

31,021

26,328

Non-cash stock compensation from equity

awards (SG&A)2

21,589

16,902

Non-cash stock compensation from equity

awards (COGS)2

769

611

Non-cash interest3

108

108

Changes in fair value of equity

investments4

5,318

46,585

Amortization of acquired product

rights5

5,384

5,384

Loss on change in fair value of contingent

consideration6

6,196

6,382

Tax effect of Non-GAAP pre-tax

adjustments7

(7,511

)

(17,425

)

Non-GAAP Net Income

$

84,577

$

122,867

Non-GAAP net income per share:

Basic

$

0.38

$

0.56

Diluted

$

0.37

$

0.55

Shares used in computing Non-GAAP net

income per share:

Basic

222,960

221,326

Diluted

225,589

222,950

1 Included within the Milestone and

contract revenues line item in the Condensed Consolidated

Statements of Operations (in thousands) for the three months ended

March 31, 2023 and 2022 are milestones of $0 and $5,000,

respectively, earned from our collaborative partners. Included

within the Research and development expenses line item in the

Condensed Consolidated Statements of Operations (in thousands) for

the three months ended March 31, 2023 and 2022 are upfront

consideration and milestones of $2,700 and $20,000, respectively,

related to our collaborative partners.

2 As included within the Cost of product

revenues (including definite-lived intangible amortization) line

item; the Research and development expenses line item; and the

Selling, general and administrative expenses line item in the

Condensed Consolidated Statements of Operations.

3 As included within the Interest expense

line item in the Condensed Consolidated Statements of

Operations.

4 As included within the Unrealized loss

on long term investments line item in the Condensed Consolidated

Statements of Operations.

5 As included within the Cost of product

revenues (including definite-lived intangible amortization) line

item in the Condensed Consolidated Statements of Operations.

Acquired product rights of licensed intellectual property for

Iclusig is amortized utilizing a straight-line method over the

estimated useful life of 12.5 years.

6 As included within the Loss on change in

fair value of acquisition-related contingent consideration line

item in the Condensed Consolidated Statements of Operations.

7 Income tax effects of Non-GAAP pre-tax

adjustments are calculated using an estimated annual effective tax

rate, taking into consideration any permanent items and valuation

allowances against related deferred tax assets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230502005266/en/

Media Catalina Loveman +1 302 498 6171

cloveman@incyte.com

Investors Christine Chiou +1 302 274 4773

cchiou@incyte.com

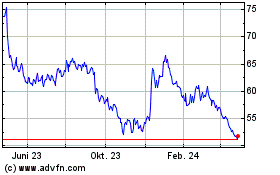

Incyte (NASDAQ:INCY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Incyte (NASDAQ:INCY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024