Board Authorizes US$50 Million Share Buyback Program TAINAN,

Taiwan, Nov. 6 /PRNewswire-FirstCall/ -- Himax Technologies, Inc.

("Himax" or "Company")(NASDAQ:HIMX) today reported financial

results for the third quarter ended September 30, 2006. Net revenue

for the third quarter of 2006 was $177.1 million, compared to

$154.8 million for the third quarter of 2005, and $171.7 million in

the second quarter of 2006. Net income for the third quarter of

2006 was $4.6 million, or $0.02 per diluted share, compared to net

income of $21.4 million, or $0.12 per diluted share in the third

quarter of 2005, and $19.5 million, or $0.10 per diluted share in

the second quarter of 2006. Share-based compensation was $11.5

million, $1.4 million and $1.1 million in the third quarter of

2006, the third quarter of 2005 and the second quarter of 2006,

respectively. Gross margin in the third quarter of 2006 was 17.4%,

as compared to 23.5% in the third quarter of 2005, and 19.2% in the

second quarter of 2006. Operating margin was 1.6% in the third

quarter of 2006, as compared to 15.1% in the third quarter of 2005,

and 11.0% in the second quarter of 2006. Excluding share-based

compensation, gross margin was 17.5% in the third quarter of 2006,

23.5% in the third quarter of 2005, and 19.2% in the second quarter

of 2006, with an operating margin of 8.0%, 16.1%, and 11.6%,

respectively. A reconciliation of our gross margin and operating

margin excluding share- based compensation, a non-GAAP financial

measure, to GAAP gross margin and GAAP operating margin, our most

comparable GAAP figure, is set out in the attached reconciliation

schedule. Jordan Wu, President and Chief Executive Officer of

Himax, commented, "The third quarter proved to be another difficult

quarter. We continued to experience pricing pressure. Our third

quarter results did not benefit from the rebound of market momentum

in the TFT-LCD industry, as the increase in demand was offset by

the reduction of customers' inventory levels. Separately, on August

29th, we announced the Board's approval to acquire Wisepal

Technologies, Inc. ("Wisepal") by way of a share exchange at the

exchange ratio of five Wisepal shares for one ordinary share of

Himax. The transaction is designed to bolster Himax's position in

the small- and medium-sized display driver market. We expect the

transaction to close in January of 2007." Max Chan, Chief Financial

Officer of Himax, said, "Our gross margin and operating margin both

declined on a sequential basis. In addition to the continued

pricing pressure, our gross margin was negatively impacted by a

change of product mix, where small- and medium-sized display

drivers, which typically enjoy higher gross margin, accounted for a

lower percentage of our total revenue. We continued to add

headcount and invest in R&D. Intensive design-in activities

have also contributed to higher R&D expenses in the quarter.

Finally, we made our annual restricted share units grant of

approximately 3.8 million shares to our employees at the end of

September, representing a 1.9% dilution to our total outstanding

shares. Around 47% of the grant vested immediately, with the

remainder vesting in three equal installments over three years. The

front-end loaded vesting schedule reflected our attempt to attract

and retain talent. In the third quarter, our net cash used in

operating activities was $3.1 million, primarily as a result of

higher net working capital requirement, partially in anticipation

of growing demand in the fourth quarter." Looking forward, Mr. Wu

added, "We expect the business environment in the fourth quarter of

2006 will be much improved compared to the third quarter. Overall,

we expect net revenue in the fourth quarter of 2006 to grow more

than 20% sequentially, and gross margin to maintain flat or

increase slightly. We expect diluted GAAP EPS to return to the

level in the first half of 2006. Reflecting our confidence in the

Company's near and long-term prospects, on November 2nd, our Board

of Directors authorized a share buyback program. The program allows

Himax to repurchase up to $50 million of the Company's American

Depositary Receipts in the open market or through privately

negotiated transactions depending on prevailing market conditions

and other factors." A reconciliation of our diluted EPS excluding

share-based compensation, a non-GAAP financial measure, to diluted

GAAP EPS, our most comparable GAAP figure, is set out in the

attached reconciliation schedule. Investor Conference Call /

Webcast Details The Company's management will review detailed third

quarter 2006 results on Monday, November 6, 2006 at 6:00 PM EST

(7:00 AM, November 7, Taiwan time). The conference call-in number

is +1-201-689-8560 (international) and +1-877-407-0784 (U.S.

domestic). A live webcast of the conference call will be available

on the Company's website at http://www.himax.com.tw/. The playback

will be available beginning two hours after the conclusion of the

conference call and will be accessible by dialing +1-201-612-7415

(international) and 1-877-660-6853 (U.S. domestic). The account

number to access the replay is 3055 and the confirmation ID number

is 217204. About Himax Technologies, Inc. Himax Technologies, Inc.

designs, develops and markets semiconductors that are critical

components of flat panel displays. The Company's principal products

are display drivers for large-sized TFT-LCD panels, which are used

in desktop monitors, notebook computers and televisions, and

display drivers for small- and medium-sized TFT-LCD panels, which

are used in mobile handsets and consumer electronics products such

as digital cameras, mobile gaming devices and car navigation

displays. In addition, the Company is expanding its product

offering to include LCD TV chipset solutions and LCOS

microdisplays. Based in Tainan, Taiwan, the Company has regional

offices in Hsinchu and Taipei, Taiwan; Suzhou and Shenzhen, China;

Yokohama, Japan and Anyangsi Kyungkido, South Korea. Contacts: Max

Chan Chief Financial Officer Himax Technologies, Inc.

+886-2-3393-0877 Ext. 22300 Jackson Ko Investor Relations Himax

Technologies, Inc. +886-2-3393-0877 Ext. 22240 In the U.S. David

Pasquale The Ruth Group 646-536-7006 Forward-Looking Statements:

Certain statements in this press release, including statements

regarding expected future financial results and industry growth,

are forward-looking statements that involve a number of risks and

uncertainties that could cause actual events or results to differ

materially from those described in this press release. Factors that

could cause actual results to differ include general business and

economic conditions and the state of the semiconductor industry;

level of competition; demand for end-use applications products;

reliance on a small group of principal customers; continued success

in technological innovations; development of alternative flat panel

display technologies; ability to develop and protect our

intellectual property; pricing pressures including declines in

average selling prices; changes in customer order patterns;

shortages in supply of key components; changes in environmental

laws and regulations; exchange rate fluctuations; regulatory

approvals for further investments in our subsidiaries; and other

risks described from time to time in the Company's SEC filings,

including its Form F-1 dated March 13, 2006, as amended. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise. Himax Technologies, Inc. Unaudited

Condensed Consolidated Statements of Income (These interim

financials do not fully comply with US GAAP because they omit all

interim disclosure required by US GAAP.) (Figures in Thousands of

U.S. Dollars, Except Per Share Data) Three Months Three Months

Ended Ended September 30, June 30, 2006 2005 2006 Revenues Revenues

from third parties, net $89,044 $65,683 $84,634 Revenues from

related parties, net 88,061 89,137 87,041 177,105 154,820 171,675

Costs and expenses: Cost of revenues 146,287 118,475 138,766

Research and development 22,685 10,234 11,603 General and

administrative 3,027 1,649 1,334 Sales and marketing 2,364 1,053

1,097 Total costs and expenses 174,363 131,411 152,800 Operating

income 2,742 23,409 18,875 Non operating income (loss): Interest

income 2,000 207 1,843 Impairment loss on an investment --- ---

(1,500) Foreign exchange gains (losses), net (1,298) 1,189 1,398

Interest expense --- (4) (27) Other income, net 59 85 58 761 1,477

1,772 Income before income taxes and minority interest 3,503 24,886

20,647 Income tax (benefit) expense (1,246) 3,602 1,246 Income

before minority interest 4,749 21,284 19,401 Minority interest, net

of tax (157) 92 124 Net income $4,592 $21,376 $19,525 Basic

earnings per ordinary share and ADS $0.02 $0.12 $0.10 Diluted

earnings per ordinary share and ADS $0.02 $0.12 $0.10 Basic

Weighted Average Outstanding Shares 197,110 176,231 195,535 Diluted

Weighted Average Outstanding Shares 199,729 180,606 198,512 Himax

Technologies, Inc. Unaudited Supplemental Financial Information

(Figures in Thousands of U.S. Dollars) Three Months Three Months

Ended September 30, Ended June 30, The amount of share-based

compensation included in applicable costs and expenses categories

is summarized as follows: 2006 2005 2006 Share-based compensation

Cost of revenues $208 $29 $18 Research and development 8,963 1,060

818 General and administrative 1,090 138 98 Sales and marketing

1,195 205 129 Total $11,456 $1,432 $1,063 Himax Technologies, Inc.

Unaudited Condensed Consolidated Statements of Income (Figures in

Thousands of U.S. Dollars, Except Per Share Data) Nine Months Ended

September 30, 2006 2005 Revenues Revenues from third parties, net

$239,105 $138,724 Revenues from related parties, net 284,534

224,146 523,639 362,870 Costs and expenses: Cost of revenues

422,351 279,716 Research and development 45,190 27,321 General and

administrative 6,419 4,228 Sales and marketing 4,468 2,744 Total

costs and expenses 478,428 314,009 Operating income 45,211 48,861

Non operating income (loss): Interest income 4,048 257 Impairment

loss on an investment (1,500) --- Foreign exchange gains (losses),

net (132) 1,673 Interest expense (311) (11) Other income, net 172

216 2,277 2,135 Income before income taxes and minority interest

47,488 50,996 Income tax expense 1,491 6,610 Income before minority

interest 45,997 44,386 Minority interest, net of tax 59 192 Net

income $46,056 $44,578 Basic earnings per ordinary share and ADS

$0.24 $0.25 Diluted earnings per ordinary share and ADS $0.24 $0.25

Himax Technologies, Inc. Unaudited Condensed Consolidated Balance

Sheets (Figures in Thousands of U.S. Dollars) Sep 30, Jun 30, Dec

31, 2006 2006 2005 Assets Current assets: Cash and cash equivalents

$155,594 $166,884 $7,086 Marketable securities available-for-sale

4,072 1,930 3,989 Restricted cash equivalents and marketable

securities 31 395 14,053 Accounts receivable, less allowance for

sales returns and discounts 101,660 86,907 80,158 Accounts

receivable from related parties 71,530 66,434 69,688 Inventories

106,977 99,605 105,004 Deferred income taxes 11,202 11,331 8,965

Prepaid expenses and other current assets 20,622 16,142 11,113

Total current assets $471,688 $449,628 $300,056 Property and

equipment, net 34,946 29,128 24,426 Deferred income taxes 134 135

151 Intangible assets, net 61 68 81 Investments in non-marketable

securities 1,723 313 1,813 Refundable deposits 603 511 712 37,467

30,155 27,183 Total assets $509,155 $479,783 $327,239 Liabilities,

minority interest and stockholders' equity Current liabilities:

Short-term debt $--- $--- $27,274 Current portion of long-term debt

--- --- 89 Accounts payable 106,829 98,015 105,801 Income tax

payable 11,783 12,858 13,625 Other accrued expenses and other

current liabilities 16,029 11,985 13,995 Total current liabilities

$134,641 $122,858 $160,784 Minority interest $1,054 $449 $624

Stockholders' equity: Ordinary share, US$0.0001 par value,

500,000,000 shares authorized 19 19 18 Additional paid-in capital

260,031 247,653 98,450 Accumulated other comprehensive income 27 13

36 Unappropriated earnings 113,383 108,791 67,327 Total

stockholders' equity $373,460 $356,476 $165,831 Total liabilities,

minority interest and stockholders' equity $509,155 $479,783

$327,239 Himax Technologies, Inc. Unaudited Condensed Consolidated

Statements of Cash Flows (Figures in Thousands of U.S. Dollars)

Three Months Three Months Ended September 30, Ended June 30, 2006

2005 2006 Cash flows from operating activities: Net income $4,592

$21,376 $19,525 Adjustments to reconcile net income to net cash

provided (used in) by operating activities: Depreciation and

amortization 1,119 921 1,204 Share-based compensation expenses

11,456 1,432 1,063 Minority interest, net of tax 157 (92) (124)

Loss on disposal of property and equipment --- --- 5 Gain on sale

of marketable securities, net (23) (90) (55) Impairment loss on an

investment --- --- 1,500 Deferred income taxes 132 (276) (1,677)

Changes in operating assets and liabilities: Accounts receivable

(14,772) (15,942) (13,672) Accounts receivable from related parties

(5,096) (13,704) 5,076 Inventories (7,369) (32,135) (4,009) Prepaid

expenses and other current assets (4,497) 1,482 (2,838) Accounts

payable 8,815 54,467 12,525 Income tax payable (1,075) 3,445

(3,056) Other accrued expenses and other current liabilities 3,477

295 (195) Net cash provided by (used in) operating activities

(3,084) 21,179 15,272 Cash flows from investing activities:

Purchase of land, property and equipment (5,691) (11,182) (4,065)

Purchase of available-for-sales marketable securities (10,608)

(3,859) (8,625) Sales and maturities of available-for-sale

marketable securities 8,480 9,912 9,830 Proceeds from sale of

subsidiary shares by Himax Technologies Limited 27 --- 55 Purchase

of investments in non-marketable securities (1,410) --- ---

Purchase of subsidiary shares from minority interest (64) (5) (84)

Return of (increase in) refundable deposits (92) 310 (23) Release

of restricted cash equivalents and marketable securities 424 52

14,101 Net cash provided by (used in) investing activities (8,934)

(4,772) 11,189 Himax Technologies, Inc. Unaudited Condensed

Consolidated Statements of Cash Flows (Figures in Thousands of U.S.

Dollars) Three Months Three Months Ended September 30, Ended June

30, 2006 2005 2006 Cash flows from financing activities: Proceeds

from issuance of ordinary shares 929 147,813 Proceeds from issuance

of new shares by subsidiaries 655 --- --- Repayment of short-term

debt --- --- (38,577) Repayment of long-term debt --- (47) --- Net

cash provided by financing activities 655 882 109,236 Effect of

exchange rate changes on cash and cash equivalents 73 --- (60) Net

increase (decrease) in cash and cash equivalents (11,290) 17,289

135,637 Cash and cash equivalents at beginning of period 166,884

28,162 31,247 Cash and cash equivalents at end of period $155,594

$45,451 $166,884 Supplemental disclosures of cash flow information:

Cash paid during the period for: Interest $--- $11 $28 Income taxes

$21 $27 $5,549 Supplemental disclosures of non-cash investing and

financing activities: Decrease in payable for purchase of equipment

and construction in progress $(1,750) $(1,366) $(18) Himax

Technologies, Inc. Unaudited Supplemental Data - Reconciliation

Schedule (Figures in Thousands of U.S. Dollars, Except Per Share

Data) Gross Margin and Operating Margin Excluding Share-based

Compensation: Three Months Three Months Ended September 30, Ended

June 30, 2006 2005 2006 Revenues $177,105 $154,820 $171,675 Gross

profit 30,818 36,345 32,909 Add: Share-based compensation - Cost of

revenues 208 29 18 Gross profit excluding share-based compensation

31,026 36,374 32,927 Gross margin excluding share-based

compensation 17.5% 23.5% 19.2% Operating income 2,742 23,409 18,875

Add: Share-based compensation 11,456 1,432 1,063 Operating income

excluding share-based compensation 14,198 24,841 19,938 Operating

margin excluding share-based compensation 8.0% 16.1% 11.6% * Gross

margin excluding share-based compensation equals gross profit

excluding share-based compensation divided by revenues * Operating

margin excluding share-based compensation equals operating income

excluding share-based compensation divided by revenues Diluted

Earnings Per Share Excluding Share-based Compensation: Three Months

Ended September 30, 2006 Diluted GAAP EPS $0.02 Add: Estimated

share-based compensation per diluted share $0.06 Diluted non GAAP

EPS excluding share-based compensation $0.08 Numbers do not add up

due to rounding DATASOURCE: Himax Technologies, Inc. CONTACT: Max

Chan, Chief Financial Officer, +886-2-3393-0877, Ext. 22300, , or

Investor Relations, Jackson Ko, +886-2-3393-0877, Ext. 22240, ,

both of Himax Technologies, Inc.; or In the U.S., David Pasquale of

The Ruth Group, +1-646-536-7006, Web site: http://himax.com.tw/

Copyright

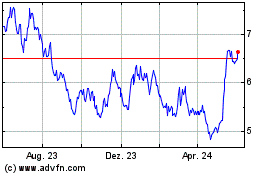

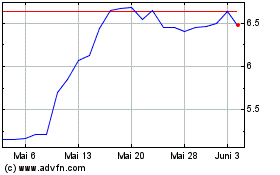

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024