U.S. Global Investors, Inc. (NASDAQ: GROW), a registered

investment advisory firm[1] with expertise in gold mining stocks

and the airline industry, is pleased to announce that it will

continue its payment of monthly dividends.

The Company’s Board of Directors (the “Board”) approved payment

of the $0.0075 per share per month dividend beginning in January

2025 and continuing through March 2025. The record dates are

January 13, February 10 and March 17, and the payment dates will be

January 27, February 24 and March 31.

At the December 13, closing price of $2.44, the $0.0075 monthly

dividend equals a 3.69% yield on an annualized basis. In addition,

the Company’s shareholder yield was 9.34% as of September 30,

2024.[2] This strong yield reflects the Board’s commitment to

delivering value to shareholders through a combination of monthly

dividends and share repurchases.

Airline Stocks Soar on Record-Breaking Holiday

Travel

Airline stocks have shown strong momentum over the past three

months, fueled by the holiday travel surge. On Sunday, December 1,

the Transportation Security Administration (TSA) reported a record

3.08 million passengers—the highest single-day total ever.[3]

United Airlines, one of the top holdings in our airlines ETF, has

rallied approximately 130% year-to-date through December 13, making

it the best performing airline stock of 2024.

In addition, the domestic airlines group has emerged as the

top-performing sector in the Industrials category for the

three-month period. This surge comes as carriers report robust

passenger demand and provide optimistic guidance.

“The media has been notably negative on the airline industry,

especially since Spirit Airlines filed for bankruptcy in November,”

says Frank Holmes, Company CEO and Chief Investment Officer.

“Sadly, many who followed these reports may have overlooked

opportunities with high-flying carriers like United. It’s always

important for investors to conduct their own due diligence.”

2025 Airlines Industry Outlook

Looking ahead to 2025, U.S. Global Investors sees a promising

year for the global airline industry. The International Air

Transport Association (IATA) projects total industry revenues to

surpass $1 trillion for the first time, reaching $1.007 trillion, a

4.4% increase from 2024. Passenger numbers are forecast to soar to

5.2 billion, marking another milestone in the industry’s

post-pandemic recovery.[4]

Morgan Stanley anticipates a “perfect storm of tailwinds” for

U.S. airline stocks in 2025, driven by strong demand, disciplined

capacity management and favorable fuel costs. This combination is

expected to support margin expansion, with revenue per available

seat mile (RASM) outpacing costs.[5]

Adding to the sector’s momentum, Alaska Air Group has announced

robust earnings guidance for 2025 and a $1 billion share repurchase

program, signaling confidence in its long-term growth.[6]

Meanwhile, major carriers like American Airlines[7] and Southwest

Airlines[8] have revised their profit expectations upward, citing

strong holiday demand, record passenger numbers and lower jet fuel

prices.

“The airline industry has shown remarkable resilience, and we

believe 2025 is shaping up to be a milestone year. With revenues

expected to hit $1 trillion and passenger numbers soaring past 5

billion, we’re witnessing a powerful recovery driven by disciplined

management and historic travel demand. This creates what we see as

an attractive opportunity for investors seeking exposure to the

sector’s growth,” says Mr. Holmes.

Gold Achieves New All-Time High, Driven by the Fear and Love

Trade

Gold recently achieved a new record high price, surpassing

$2,800 an ounce at the end of October. The Company believes this

rally has been supported by mounting global government debt and

expectations of falling interest rates. With U.S. interest payments

on public debt now topping $1 trillion a year,[9] the Company

believes owning gold remains a prudent strategy for investors

seeking an alternative asset—especially gold mining stocks with

strong free cash flow yields.

“The ongoing surge in global debt has amplified gold’s Fear

Trade, which I define as a hedge against monetary instability and

government overspending,” comments Mr. Holmes. “Gold is also driven

by what I call the ‘Love Trade,’ particularly in India—the world’s

most populous country, where gold has deep cultural significance as

gifts.”[10]

To sign up for news and research on a variety of asset

classes, from gold to airlines to digital assets, please

click here.

About U.S. Global Investors, Inc.The story of

U.S. Global Investors goes back more than 50 years when it began as

an investment club. Today, U.S. Global Investors, Inc.

(www.usfunds.com) is a registered investment adviser that focuses

on niche markets around the world. Headquartered in San Antonio,

Texas, the Company provides investment advisory and other services

to U.S. Global Investors Funds and U.S. Global ETFs.

# # #

Past performance does not guarantee future results.

This news release may include certain “forward-looking

statements” including statements relating to revenues, expenses,

and expectations regarding market conditions. These statements

involve certain risks and uncertainties. There can be no assurance

that such statements will prove accurate and actual results and

future events could differ materially from those anticipated in

such statements.

The continuation of future cash dividends will be determined by

U.S. Global Investors’s Board of Directors, at its sole discretion,

after review of the Company’s financial performance and other

factors, and is dependent on earnings, operations, capital

requirements, general financial condition of the Company and

general business conditions.

Shareholder yield is a financial metric that measures the total

return a company provides to its shareholders through dividends,

share repurchases (buybacks), and debt reduction. It reflects how

much cash a company is returning to investors relative to its

market value. Revenue per Available Seat Mile (RASM) is a key

financial metric used in the airline industry to measure an

airline's operating revenue efficiency. It represents the amount of

revenue generated per seat offered for every mile flown.

The S&P 500 Passenger Airlines Index, S&P 500

Construction & Engineering Index, S&P 500 Electrical

Equipment Index, S&P 500 Trading Companies & Distributors

Index, S&P 500 Machinery Index and S&P 500 Industrials

Index are all capitalization-weighted indices.

Holdings may change daily. Holdings are reported as of the most

recent quarter-end. The following securities mentioned in the

article were held by one or more accounts managed by U.S. Global

Investors as of 9/30/2024: Alaska Air Group Inc., American

Airlines Group Inc., Southwest Airlines Co., United Airlines

Holdings Inc.

[1] Registration does not imply a certain level of skill or

training.[2] The Company calculates shareholder yield by adding the

percentage of change in shares outstanding to the dividend yield

for the 12 months ending September 30, 2024. The Company did not

have debt; therefore, no debt reduction was included.

[3]Shepardson, D. (2024, December 2). US screened record 3.08

million airline passengers on Sunday, agency says. Reuters.

https://www.reuters.com/world/us/us-screened-record-308-million-airline-passengers-sunday-agency-says-2024-12-02/

[4] International Air Transport Association. (2024, December

10). Strengthened profitability expected in 2025 even as supply

chain issues persist. International Air Transport Association.

https://www.iata.org/en/pressroom/2024-releases/2024-12-10-01/[5]

Thakur, P. (2024, December 11). Morgan Stanley sees airline stocks

propelled by demand, favourable fuel cost. Investing.com.

https://www.investing.com/news/stock-market-news/morgan-stanley-sees-airline-stocks-propelled-by-demand-favourable-fuel-cost-3766443[6]

Tatananni, M. (2024, December 10). Alaska Air stock flies high on

strong guidance and $1 billion share buyback program. Barron’s.

https://www.barrons.com/amp/articles/alaska-air-stock-earnings-guidance-buybacks-927afce1[7]

Schlangenstein, M. (2024, December 5). American Air jumps on

stronger profit, holiday demand view. Bloomberg.

https://www.bloomberg.com/news/articles/2024-12-05/american-airlines-boosts-profit-outlook-heading-into-holidays?sref=1pPyLRr7[8]

Seal, D. (2024, December 5). Southwest Airlines lifts revenue

outlook on resilient travel demand. The Wall Street Journal.

https://www.wsj.com/business/earnings/southwest-airlines-lifts-revenue-outlook-on-resilient-travel-demand-75ac8b67[9]

Cox, J. (2024, September 12). Interest payments on the national

debt top $1 trillion as deficit swells. CNBC.

https://www.cnbc.com/2024/09/12/interest-payments-on-the-national-debt-top-1-trillion-as-deficit-swells.html[10]

Somani, D. (2023, July 30). India’s enduring affair with gold

jewellery: A timeless love story. The Times of India.

https://timesofindia.indiatimes.com/blogs/voices/indias-enduring-affair-with-gold-jewellery-a-timeless-love-story/

- United Airlines Is the Best Performing Airline Stock of

2024

- Airlines Are the Best Performing Industrials Sector for the

Three-Month Period

Holly Schoenfeldt

U.S. Global Investors, Inc.

210.308.1268

hschoenfeldt@usfunds.com

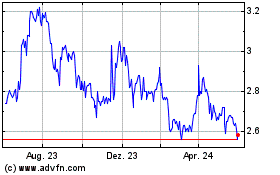

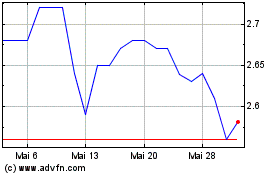

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025