U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a

registered investment advisory firm with longstanding experience in

global markets and specialized sectors from gold mining to

airlines, today reported net income of $315,000, or $0.02 per

share, for the quarter ended September 30, 2024, compared to a net

loss of $176,000 in the same quarter a year earlier.

Net income was bolstered by strong consolidated other income of

$995,000, a change of approximately $1.5 million from the quarter

ended September 30, 2023. The change in other income was primarily

due to net realized and unrealized gains in investment income,

compared to net realized and unrealized losses in investment income

in the three-month period a year ago. This helped offset lower

operating revenue during the quarter ended September 30, 2024.

Inverted Yield Curve and U.S. Presidential Election

Weighed on Investor Sentiment

Average assets under management (AUM) for the three-month period

ended September 30, 2024, were $1.5 billion, a decrease of $640

million, or 30%, from the same quarter a year earlier. At 60 basis

points, this represents about $3.8 million in annual revenue.

“The challenge to turn operating income from negative back to

positive, as it was last year, is simply fund flows into our

thematic, cyclical products,” says Company CEO and Chief Investment

Officer Frank Holmes.

The Company believes many potential investors limited their

exposure to risk due to a combination of factors, including global

conflicts, uncertainty surrounding the U.S. presidential election

and the inverted yield curve, which has been one of the most

reliable recession indicators over the last 50 years.

“An inverted yield curve, where short-term rates are higher than

long-term rates, has preceded every U.S. recession since the 1970s.

This occurs because market participants, anticipating future rate

cuts to combat a downturn, drive long-term rates lower,” says Mr.

Holmes. “Before turning positive again in early September, the

yield curve had been inverted for a staggering 783 consecutive

days, the longest such period in U.S. history.1 We believe

this kept a lot of investors on the sidelines. Despite these market

pressures, we have remained committed to our disciplined investment

approach. Post-election, we anticipate a renewed sense of investor

confidence, and we’re optimistic that industry inflows will

recover.

Enhanced Shareholder Value Through Continued GROW

Dividends and Share Repurchases

The Board of Directors (the "Board") authorized a monthly

dividend of $0.0075 per share through December 2024, at which time

it will be considered for continuation by the Board. The total

amount of cash dividends expected to be paid to class A and class C

shareholders from October to December 2024 is approximately

$309,000.

The Board also approved plans to buy back up to approximately

14% of the Company’s shares outstanding. During the three-month

period ended September 30, 2024, the Company purchased a total of

197,887 class A shares using cash of approximately $520,000. This

is similar to the number of shares that the Company bought back

during the same quarter in 2023. The repurchase program has been in

place since December 2012, and the Company buys back stock on flat

or down days.

“Similar to United Airlines, which just announced a $1.5 billion

share buyback program on growing confidence,2 we have bolstered our

own buyback program to enhance shareholder value,” says Mr. Holmes.

“In September, we announced an update to the program, allowing for

the repurchase of up to $5 million of GROW stock through December

31, 2024. Under the plan, we will continue purchasing shares

whenever the Class A shares are at or below the previous day's

closing price or fall below a specific price threshold. We may also

buy a block of up to 100,000 shares, generally at or below the bid

price, following Rule 10b-18 guidelines.”

Historically Strong Seasonality for Airline

Stocks

Despite an exceptionally robust summer travel season that posted

a record number of people—approximately 3 million3—board commercial

planes in the U.S. on a single day in July, the U.S. Global Jets

ETF (NYSE: JETS) saw increased bets against the airline industry by

short sellers.4 However, the Company believes inflows will return

on seasonality as we head further into the fall and winter

months.

“Historically, airline stocks have tended to outperform in the

fall,” Mr. Holmes continues. “According to Bank of America’s

analysis of the Dow Jones U.S. Airlines Index since 2000, the

second half of the year has typically been the stronger half for

airlines. The industry has outperformed the S&P 500 in three of

the last six months of the year—namely September, October and

November.”5

U.S. Global Investors Marketing Team Recognized by

IMEA

The Company is pleased to announce that its marketing team

received a STAR Award from the Investment Management Education

Alliance (IMEA) at its annual awards ceremony in October. The

recognition, in the category of Investor Content for a Product, was

awarded to the Company for its content on the U.S. Global Jets

ETF.

“We continue to leverage our strong branding strategy to raise

awareness of our investment products. In October, for instance, we

hosted a JETS webcast for registered investment advisors (RIAs)

that was well-attended,” says Mr. Holmes.

Healthy Liquidity and Capital Resources

As of September 30, 2024, the Company had net working capital of

approximately $38.2 million. With approximately $27.3 million in

cash and cash equivalents, the Company has adequate liquidity to

meet its current obligations, in addition to investments in our

funds and convertible notes.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time

on Friday, November 8, 2024, to discuss the Company’s key financial

results for the quarter. Frank Holmes will be accompanied on the

webcast by Lisa Callicotte, chief financial officer, and Holly

Schoenfeldt, marketing and public relations manager. Click here to

register for the earnings webcast or visit www.usfunds.com for more

information.

Selected Financial Data (unaudited): (dollars in

thousands, except per share data)

| |

Three months ended |

| |

9/30/2024 |

|

9/30/2023 |

|

|

Operating Revenues |

$ |

2,157 |

|

$ |

3,133 |

|

| Operating Expenses |

|

2,716 |

|

|

2,918 |

|

| Operating Income (Loss) |

|

(559 |

) |

|

215 |

|

| |

|

|

| Total Other Income (Loss) |

|

995 |

|

|

(456 |

) |

| Income (Loss) Before Income

Taxes |

|

436 |

|

|

(241 |

) |

| |

|

|

| Income Tax Expense (Benefit) |

|

121 |

|

|

(65 |

) |

| Net Income (Loss) |

$ |

315 |

|

$ |

(176 |

) |

| |

|

|

| Net Income (Loss) Per Share

(Basic and Diluted) |

$ |

0.02 |

|

$ |

(0.01 |

) |

| |

|

|

| Avg. Common Shares Outstanding

(Basic) |

|

13,714,517 |

|

|

14,465,510 |

|

| Avg. Common Shares Outstanding

(Diluted) |

|

13,714,517 |

|

|

14,465,701 |

|

| |

|

|

| Avg. Assets Under Management

(Billions) |

$ |

1.5 |

|

$ |

2.1 |

|

| |

|

|

|

|

|

|

About U.S. Global Investors,

Inc.

The story of U.S. Global Investors goes back more than 50 years

when it began as an investment club. Today, U.S. Global Investors,

Inc. (www.usfunds.com) is a registered investment adviser that

focuses on niche markets around the world. Headquartered in San

Antonio, Texas, the Company provides investment management and

other services to U.S. Global Investors Funds and U.S. Global

ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors

may include certain “forward-looking statements,” including

statements relating to revenues, expenses and expectations

regarding market conditions. You can identify these forward-looking

statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “opportunity,” “seeks,” “anticipates” or

other comparable words. Such statements involve certain risks and

uncertainties and should be read with corporate filings and other

important information on the Company’s website, www.usfunds.com, or

the Securities and Exchange Commission’s website at

www.sec.gov.

These filings, such as the Company’s annual report and Form

10-Q, should be read in conjunction with the other cautionary

statements that are included in this release. Future events could

differ materially from those anticipated in such statements and

there can be no assurance that such statements will prove accurate

and actual results may vary. The Company undertakes no obligation

to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Please consider carefully a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a fund prospectus by visiting www.usfunds.com. Read it

carefully before investing. U.S. Global mutual funds are

distributed by Foreside Fund Services, LLC, Distributor. U.S.

Global Investors is the investment adviser.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors

is the investment adviser. JETS is distributed by Quasar

Distributors, LLC. U.S. Global Investors is the investment adviser

to JETS. Foreside Fund Services, LLC and Quasar Distributors, LLC

are affiliated.

Shares of any ETF are bought and sold at market price (not NAV),

may trade at a discount or premium to NAV and are not individually

redeemed from the funds. Brokerage commissions will reduce returns.

Stock markets can be volatile and share prices can fluctuate in

response to sector-related and other risks as described in the fund

prospectus. Foreign and emerging market investing involves special

risks such as currency fluctuation and less public disclosure, as

well as economic and political risk. Companies in the consumer

discretionary sector are subject to risks associated with

fluctuations in the performance of domestic and international

economies, interest rate changes, increased competition and

consumer confidence.

All opinions expressed and data provided are subject to change

without notice. Some of these opinions may not be appropriate to

every investor.

Fund holdings and allocations are subject to change at any time.

Click to view fund holdings for JETS.

The Dow Jones US Total Market Airlines Index is constructed

and weighted using free-float market capitalization and the

index is quoted in USD.

Please carefully consider a fund’s investment objectives, risks,

charges and expenses. For this and other important information,

obtain a statutory and summary prospectus for JETS by clicking

here. Read it carefully before investing.

Distributed by Quasar Distributors, LLC. U.S. Global Investors

is the investment adviser to JETS.

It is not possible to invest in an index.

1 Bilello, C. (2024, September 4). The longest inversion in

history is over – Chart of the day.

https://bilello.blog/2024/the-longest-inversion-in-history-is-over-chart-of-the-day-9-4-242

Singh, R. K. (2024, October 15). United Airlines sees stronger

profit, unveils $1.5 billion share buyback program. Reuters.

https://www.reuters.com/business/aerospace-defense/united-airlines-forecasts-stronger-fourth-quarter-profit-2024-10-153

Shepardson, D. (2024, July 8). US agency screens record 3 million

airline passengers in single day. Reuters.

https://www.reuters.com/world/us/us-agency-screens-record-3-million-airline-passengers-single-day-2024-07-084

Forte, P. (2024, July 11). Wall Street bets against airlines

despite summer travel boom. Bloomberg.

https://www.bloomberg.com/news/articles/2024-07-11/bets-against-airline-stocks-hit-post-pandemic-high-amid-summer-travel-boom?sref=1pPyLRr75

Didora, A. G., & Clough, S. (2024, September 9). Time to

consider airlines: Pricing improves as fuel moves lower. Bank of

America.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/09a53b26-c713-4383-b9d9-3e6dd29d937b

https://www.globenewswire.com/NewsRoom/AttachmentNg/ac940fe0-bb28-47b9-ba97-3545bebc28f3

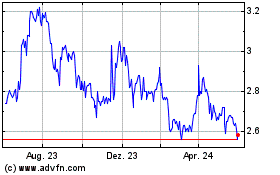

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

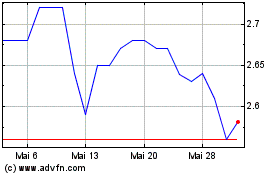

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

Von Nov 2023 bis Nov 2024