As

filed with the Securities and Exchange Commission on January 30, 2025

Registration

Statement No. 333-284277

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 2

to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Enveric

Biosciences, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

95-4484725 |

| (State or other jurisdiction

of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification Number) |

4851

Tamiami Trail N, Suite 200

Naples,

FL 34103

(239)

302-1707

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Joseph

Tucker

Chief

Executive Officer

Enveric

Biosciences, Inc.

4851

Tamiami Trail N, Suite 200

Naples,

FL 34103

(239)

302-1707

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Bradley

J. Wyatt, Esq.

Rasika

A. Kulkarni, Esq.

Dickinson

Wright PLLC

1850

N. Central Avenue Suite 1400

Phoenix,

AZ 85004

(734)

623-1905 |

|

Robert

F. Charron

Ellenoff

Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

(212) 370-1300 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act. (Check

one):

| Large accelerated

filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company

|

☒ |

| |

|

Emerging growth company

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

The

sole purpose of this Amendment No. 2 to the Registration Statement on Form S-1 (File No. 333-284277) (the “Registration Statement”)

is to file Exhibits 1.1, 1.2, and 23.2 as indicated in Item 16(a) of Part II of this amendment. No change is made to the

preliminary prospectus constituting Part I of the Registration Statement or Items 13, 14, 15 or 17 of Part II of the Registration Statement.

Accordingly, this amendment consists only of the cover page, this explanatory note, Item 16(a) of the Registration Statement, the exhibit

index to the Registration Statement, the signature page to the Registration Statement, and the exhibits filed herewith.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

16. Exhibits and Financial Statement Schedules

(a)

Exhibits - Our audited financial statements are included in the preliminary prospectus.

| Exhibit

Number |

|

Description |

| 1.1* |

|

Engagement Letter between Enveric Biosciences, Inc. and H.C. Wainwright & Co., LLC dated December 8, 2024 (“Wainwright Engagement Letter”) |

| 1.2* |

|

Amendment to the Wainwright Engagement Letter, dated January 14, 2025 |

| 2.1 |

|

Share Purchase Agreement, dated January 10, 2020, by and between AMERI Holdings, Inc. and Ameri100, Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the Commission on January 13, 2020) |

| 2.2 |

|

Tender Offer Support Agreement and Termination of Amalgamation Agreement, dated August 12, 2020, by and among AMERI Holdings, Inc., Jay Pharma Merger Sub, Inc., Jay Pharma Inc., 1236567 B.C. Unlimited Liability Company and Barry Kostiner, as the Ameri representative (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on August 12, 2020) |

| 2.3 |

|

Amendment No. 1 To Tender Offer Support Agreement and Termination of Amalgamation Agreement, dated December 18, 2020, by and among Ameri, Jay Pharma Merger Sub, Inc., Jay Pharma Inc., 1236567 B.C. Unlimited Liability Company and Barry Kostiner, as the Ameri representative (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on December 18, 2020) |

| 2.4 |

|

Amalgamation Agreement, dated May 24, 2021, by and among Enveric Biosciences, Inc., 1306432 B.C. LTD., 1306436 B.C. LTD., and MagicMed Industries, Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the Commission on May 24, 2021) |

| 3.1 |

|

Amended and Restated Certificate of Incorporation of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 3.2 |

|

Certificate of Amendment to Amended and Restated Certificate of Incorporation of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 3.3 |

|

Certificate of Designations of Series B Preferred Stock of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 3.4 |

|

Amended and Restated Bylaws of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.4 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 3.5 |

|

Amendment to the Amended and Restated Bylaws of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on November 18, 2021) |

| 3.6 |

|

Certificate of Designation of the Series C Preferred Stock of the Company, dated May 4, 2022 (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form 8-A, filed with the Securities and Exchange Commission on May 4, 2022, File No. 000-26460) |

| 3.7 |

|

Certificate of Amendment of Certificate of Designation of the Series C Preferred Stock of the Company, dated May 17, 2022 (incorporated by reference to Exhibit 3.2 to the Company’s Registration Statement on Form 8-A/A, filed with the Securities and Exchange Commission on May 17, 2022, File No. 000 26460) |

| 3.8 |

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 14, 2022) |

| 3.9 |

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of Enveric Biosciences, Inc. (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the Commission on January 21, 2025) |

| 4.1 |

|

Description of Securities (incorporated by reference to Exhibit 4.1 of the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 31, 2023) |

| 4.2 |

|

Form of Pre-Funded Warrant (issued in connection with January 2021 Registered Direct Offering) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed with the Commission on January 12, 2021) |

| 4.3 |

|

Form of Warrant (issued in connection with January 2021 Registered Direct Offering) (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K, filed with the Commission on January 12, 2021) |

| 4.4 |

|

Form of Warrant (issued in connection with February 2021 Registered Direct Offering) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed with the Commission on February 11, 2021) |

| 4.5 |

|

Form of Series B Warrant (incorporated by reference to Exhibit 4.5 to the Company’s Annual Report on Form 10-K filed with the Commission on April 1, 2021) |

| 4.6 |

|

Form of MagicMed Warrant Certificate (incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021) |

| 4.7 |

|

Form of Common Stock Purchase Warrant (in connection with February 2022 Offering) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed with the Commission on February 15, 2022) |

| 4.8 |

|

Form of RD Pre-Funded Warrant (in connection with July 2022 Offering) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 4.9 |

|

Form of PIPE Pre-Funded Warrant (in connection with July 2022 Offering) (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 4.10 |

|

Form of RD Preferred Investment Option (in connection with July 2022 Offering) (incorporated by reference to Exhibit 4.3 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 4.11 |

|

Form of PIPE Preferred Investment Option (in connection with July 2022 Offering) (incorporated by reference to Exhibit 4.4 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 4.12 |

|

Form of Wainwright Warrant (in connection with July 2022 Offering) (incorporated by reference to Exhibit 4.5 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 4.13 |

|

Form of Inducement Warrant (in connection with December 2023 Offering) (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K, filed with the Commission on December 29, 2023) |

| 4.14** |

|

Form of Pre-Funded Warrant offered hereby |

| 4.15** |

|

Form of Series A Warrant offered hereby |

| 4.16** |

|

Form of Series B Warrant offered hereby |

| 4.17** |

|

Form of Placement Agent Warrant |

| 5.1** |

|

Opinion of Dickinson Wright PLLC |

| 10.1# |

|

Employment Agreement between Kevin Coveney and the Company, effective March 13, 2023 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on February 28, 2023) |

| 10.2 |

|

Form of Securities Purchase Agreement (entered into in connection with the May 5, 2022 Private Placement) (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on May 11, 2022) |

| 10.3 |

|

Certificate of the Designations, Preferences and Rights of Akos Series A Convertible Preferred Stock (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed with the Commission on May 11, 2022) |

| 10.4 |

|

Form of Registration Rights Agreement (entered into in connection with the May 5, 2022 Private Placement) (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K, filed with the Commission on May 11, 2022) |

| 10.5 |

|

Form of Warrant (entered into in connection with the May 5, 2022 Private Placement) (incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K, filed with the Commission on May 11, 2022) |

| 10.6 |

|

Form of Warrant Amendment (in connection with the July 2022 Offerings) (incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 10.7 |

|

First Amendment to the Enveric Biosciences, Inc. 2020 Long-Term Incentive Plan (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 14, 2022) |

| 10.8 |

|

Form of Warrant Amendment (in connection with July 2022 Offering) (incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 10.9 |

|

Form of Securities Purchase Agreement (in connection with July 2022 Offering) (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 10.10 |

|

Form of Securities Purchase Agreement (in connection with July 2022 Offering) (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 10.11 |

|

Form of Registration Rights Agreement (in connection with July 2022 Offering) (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K, filed with the Commission on July 26, 2022) |

| 10.12 |

|

Enveric Biosciences, Inc. 2020 Long-Term Equity Incentive Plan (incorporated by reference to Exhibit 10.5 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 10.13 |

|

Form of RSU Award Agreement (incorporated by reference to Exhibit 10.6 to the Company’s Current Report on Form 8-K, filed with the Commission on January 6, 2021) |

| 10.14 |

|

Form of Securities Purchase Agreement, dated January 11, 2021, by and among the Company and the purchasers thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on January 12, 2021) |

| 10.15 |

|

Form of Registration Rights Agreement, dated January 11, 2021, by and among the Company and the purchasers thereto (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed with the Commission on January 12, 2021) |

| 10.16 |

|

Letter Agreement, dated January 11, 2021, by and between the Company and Alpha Capital Anstalt (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K, filed with the Commission on January 12, 2021) |

| 10.17 |

|

Form of Securities Purchase Agreement, dated February 9, 2021, by and among the Company and the purchasers thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on February 11, 2021) |

| 10.18 |

|

Form of Registration Rights Agreement, dated February 9, 2021, by and among the Company and the purchasers thereto (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed with the Commission on February 11, 2021) |

| 10.19 |

|

Exclusive License Agreement, between the Company and Diverse Biotech, Inc., dated March 5, 2021 (incorporated by reference to Exhibit 10.6 the Company’s Quarterly Report on Form 10-Q, filed with the Commission on May 17, 2021) |

| 10.20 |

|

Form of Voting and Support Agreement, dated as of May 24, 2021, by and among Enveric Biosciences, Inc. and certain shareholders of MagicMed Industries Inc. named therein (incorporated by reference to Annex B-1 to the Company’s Proxy Statement/Prospectus, filed with the Commission on August 6, 2021) |

| 10.21 |

|

Form of Voting Agreement, dated as of May 24, 2021, by and among MagicMed Industries Inc. and certain shareholders of Enveric Biosciences, Inc. named therein (incorporated by reference to Annex B-2 to the Company’s Proxy Statement/Prospectus, filed with the Commission on August 6, 2021) |

| 10.22 |

|

Form of Lock-Up Agreement, dated as of May 24, 2021, by and among Enveric Biosciences, Inc. and certain shareholders of MagicMed Industries Inc. named therein (incorporated by reference to Annex C-1 to the Company’s Proxy Statement/Prospectus, filed with the Commission on August 6, 2021) |

| 10.23 |

|

Form of Lock-Up/Leak-Out Agreement, dated as of May 24, 2021, by and among Enveric Biosciences, Inc. and certain shareholders of MagicMed Industries Inc. named therein (incorporated by reference to Annex C-2 to the Company’s Proxy Statement/Prospectus, filed with the Commission on August 3, 2021) |

| 10.24# |

|

Employment Agreement between Joseph Tucker and Enveric Biosciences, Inc. (incorporated by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 24, 2021) |

| 10.25# |

|

Employment Agreement between Peter Facchini and Enveric Biosciences, Inc. (incorporated by reference to Exhibit 10.2 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 24, 2021) |

| 10.26# |

|

Employment Agreement between Jillian Hagel and Enveric Biosciences, Inc. (incorporated by reference to Exhibit 10.3 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 24, 2021) |

| 10.27 |

|

MagicMed Stock Option Plan, as amended September 10, 2021 (incorporated by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 17, 2021) |

| 10.28 |

|

Purchase Agreement, dated November 3, 2023, by and among the Company and Lincoln Park Capital Fund, LLC (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the Commission on November 6, 2023) |

| 10.29 |

|

Registration Rights Agreement, dated November 3, 2023, by and among the Company and Lincoln Park Capital Fund, LLC (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K, filed with the Commission on November 6, 2023) |

| 10.30^ |

|

Form of Inducement Warrant, dated December 28, 2023, by and among the investors thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on December 29, 2023) |

| 10.31 |

|

Form

of Common Stock Purchase Agreement, dated March 8, 2024, between Enveric Biosciences, Inc. and the investors set forth therein

(incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission

on March 11, 2024) |

| 10.32 |

|

Form of Common Stock Purchase Agreement, dated May 3, 2024, between Enveric Biosciences, Inc. and the investors set forth therein (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the Commission on May 3, 2024) |

| 10.33** |

|

Form of Securities Purchase Agreement |

| 21.1 |

|

Subsidiaries (incorporated by reference to Exhibit 21.1 of the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 31, 2023) |

| 23.1** |

|

Consent of Dickinson Wright PLLC (included in Exhibit 5.1) |

| 23.2* |

|

Consent of independent registered public accountant – Marcum LLP |

| 24.1** |

|

Power of Attorney (contained in the signature page of this registration statement) |

| 101 |

|

Interactive Data File |

| 104 |

|

Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101) |

| 107** |

|

Filing Fee Table |

| * |

Filed herewith. |

| ** |

Previously filed. |

| ^ |

Certain confidential portions of this Exhibit were omitted by means of marking such portions with brackets (“[***]”) because the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed. |

| # |

Management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, we have duly caused this Registration Statement on Form S-1 to be signed

on its behalf by the undersigned, thereunto duly authorized in the City of Naples, Florida, on January 30, 2025.

| |

Enveric Biosciences, Inc. |

| |

|

|

| |

By: |

/s/ Joseph

Tucker |

| |

|

Joseph Tucker, Ph. D |

| |

|

Chief Executive Officer |

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following persons

in the capacities and on the dates indicated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Joseph Tucker |

|

|

|

|

| Joseph Tucker, Ph.D. |

|

Chief Executive Officer and Director (Principal Executive

Officer) |

|

January 30, 2025 |

| |

|

|

|

|

| /s/

Kevin Coveney |

|

|

|

|

| Kevin Coveney |

|

Chief Financial Officer (Principal Financial Officer

and Principal Accounting Officer) |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| Peter Facchini, Ph.D. |

|

Chief Innovation Officer |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| George Kegler |

|

Director |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| Frank Pasqualone |

|

Director |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| Michael Webb |

|

Director (Chairman) |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| Marcus Schabacker, M.D.,

Ph.D. |

|

Director |

|

January 30, 2025 |

| |

|

|

|

|

| * |

|

|

|

|

| Sheila DeWitt, Ph.D. |

|

Director |

|

January 30, 2025 |

| *By: |

/s/ Joseph Tucker |

|

| |

Joseph Tucker, Ph.D |

|

| |

Attorney-in-fact |

|

Exhibit

1.1

Execution

Version

December

8, 2024

STRICTLY

CONFIDENTIAL

Enveric

Biosciences, Inc.

4851

Tamiami Trail N, Suite 200

Naples,

Florida 34103

Attn:

Joseph Tucker, Ph.D., Chief Executive Officer

Dear

Dr. Tucker:

This

letter agreement (this “Agreement”) constitutes the agreement between Enveric Biosciences, Inc. (the “Company”)

and H.C. Wainwright & Co., LLC (“Wainwright”), that Wainwright shall serve as the exclusive underwriter, agent

or advisor in any offering of securities of the Company (the “Securities”) during the Term (as hereinafter defined)

of this Agreement, including, but not limited to, a so-called at-the-market facility (“ATM”) (each, an “Offering”).

The terms of each Offering and the Securities issued in connection therewith shall be mutually agreed upon by the Company and Wainwright

and nothing herein implies that Wainwright would have the power or authority to bind the Company and nothing herein implies that the

Company shall have an obligation to issue any Securities. It is understood that Wainwright’s assistance in an Offering will be

subject to the satisfactory completion of such investigation and inquiry into the affairs of the Company as Wainwright deems appropriate

under the circumstances and to the receipt of all internal approvals of Wainwright in connection with an Offering. The Company expressly

acknowledges and agrees that Wainwright’s involvement in an Offering is strictly on a reasonable best efforts basis and that the

consummation of an Offering will be subject to, among other things, market conditions. The execution of this Agreement does not constitute

a commitment by Wainwright to purchase the Securities and does not ensure a successful Offering of the Securities or the success of Wainwright

with respect to securing any other financing on behalf of the Company. Wainwright may retain other underwriters, brokers, dealers or

agents on its behalf in connection with an Offering.

A. Compensation;

Reimbursement. The Company shall compensate Wainwright, as follows:

| 1. | Cash

Fee. The Company shall pay to Wainwright a cash fee, or as to an underwritten Offering

an underwriter discount, equal to 7.0% of the aggregate gross proceeds raised at each closing

of each Offering (each, a “Closing”); provided, however, that the cash

fee for an ATM shall equal 3.0% of the aggregate gross proceeds raised in each takedown pursuant

to an ATM. |

| 430 Park Avenue | New York, New York 10022 | 212.356.0500 | www.hcwco.com |

| Member: FINRA/SIPC |

| 2. | Warrant

Coverage. The Company shall issue to Wainwright or its designees at each Closing, warrants

(the “Wainwright Warrants”) to purchase that number of shares of common

stock of the Company equal to 7.0% of the aggregate number of shares of common stock (or

common stock equivalent, if applicable) placed in each Offering (and if an Offering includes

a “greenshoe” or “additional investment” component, such number of

shares of common stock underlying such “greenshoe” or “additional investment”

component, with the Wainwright Warrants issuable upon the exercise of such component); provided,

however, that no warrants will be issued to Wainwright in connection with an ATM. If the

Securities included in an Offering are convertible, the Wainwright Warrants shall be determined

by dividing the gross proceeds raised in such Offering by the Offering Price (as defined

hereunder). The Wainwright Warrants shall be in a customary form reasonably acceptable to

Wainwright, have a term of five (5) years and an exercise price equal to 125% of the offering

price per share (or unit, if applicable) in the applicable Offering and if such offering

price is not available, the market price of the common stock on the date an Offering is commenced

(such price, the “Offering Price”). If warrants are issued to investors

in an Offering, the Wainwright Warrants shall have the same terms as the warrants issued

to investors in the applicable Offering, except that such Wainwright Warrants shall have

an exercise price equal to 125% of the Offering Price. |

| 3. | Expense

Allowance. Out of the proceeds of each Closing, the Company also agrees to pay Wainwright

(a) a management fee equal to 1.0% of the gross proceeds raised in each Offering; (b) $35,000

for non-accountable expenses (to be increased to $50,000 in case a public Offering is contemplated

or consummated); (c) up to $50,000 for fees and expenses of legal counsel and other out-of-pocket

expenses (to be increased to $100,000 in case a public Offering is contemplated or consummated);

plus the additional amount payable by the Company pursuant to Paragraph D.4 hereunder and,

if applicable, the costs associated with the use of a third-party electronic road show service

(such as NetRoadshow); provided, however, that such amounts in no way limit or impair the

indemnification and contribution provisions of this Agreement. |

| | | |

| | | Notwithstanding

anything to the contrary included in the preceding paragraph, in connection with an ATM, the Company shall pay Wainwright up to $100,000

for fees and expenses of its legal counsel in addition to any other out-of-pocket expenses that will be incurred by the Company and Wainwright

in connection with the set-up, execution, performance and maintenance of the ATM. |

| 4. | Tail.

Wainwright shall be entitled to compensation under clauses (1) and (2) hereunder, calculated

in the manner set forth therein, with respect to any public or private offering or other

financing or capital-raising transaction of any kind (“Tail Financing”) to the

extent that such Tail Financing is provided to the Company directly or indirectly by investors

whom Wainwright (i) had brought over-the-wall during the Term, with respect to an Offering

other than a public Offering, or (ii) had contacted during the Term, with respect to a public

Offering, in each case if such Tail Financing is consummated at any time within the 12-month

period following the expiration or termination of this Agreement. |

| 5. | Right

of First Refusal. If, from the date hereof until the 12-month anniversary following consummation

of each Offering (subject to FINRA Rule 5110(g)(6)(A)), the Company decides to raise funds

by means of a public offering (including at-the-market facility) or a private placement or

any other capital-raising financing of equity, equity-linked or debt securities using an

underwriter or placement agent, Wainwright (or any affiliate designated by Wainwright) shall

have the right to act as sole book-running manager, sole underwriter or sole placement agent

for such financing. If Wainwright or one of its affiliates decides to accept any such engagement,

the agreement governing such engagement will contain, among other things, provisions for

customary fees for transactions of similar size and nature and the provisions of this Agreement,

including indemnification, which are appropriate to such a transaction. |

B. Term

and Termination of Engagement; Exclusivity. The term of Wainwright’s exclusive engagement will begin on the date hereof and

end ninety (90) days thereafter (the “Initial Term”); provided, however, that if an Offering is consummated within

the Initial Term, the term of this Agreement shall be extended by an additional ninety (90) day period (the “Extension Term,”

and together with the Initial Term, the “Term”). For clarity, the term “Term” shall mean the Initial Term

if there is no Extension Term. Notwithstanding anything to the contrary contained herein, the Company agrees that the provisions relating

to the payment of fees, reimbursement of expenses, right of first refusal, tail, indemnification and contribution, confidentiality, conflicts,

independent contractor and waiver of the right to trial by jury will survive any termination or expiration of this Agreement. Notwithstanding

anything to the contrary contained herein, the Company has the right to terminate the Agreement for cause in compliance with FINRA Rule

5110(g)(5)(B)(i). The exercise of such right of termination for cause eliminates the Company’s obligations with respect to the

provisions relating to the tail fees and right of first refusal. Notwithstanding anything to the contrary contained in this Agreement,

in the event that an Offering pursuant to this Agreement shall not be carried out for any reason whatsoever during the Term, the Company

shall be obligated to pay to Wainwright its actual and accountable out-of-pocket expenses related to an Offering (including the fees

and disbursements of Wainwright’s legal counsel) and, if applicable, for electronic road show service used in connection with an

Offering subject to the cap limitations in Section A.3 hereof. During Wainwright’s engagement hereunder: (i) the Company will not,

and will not permit its representatives to, other than in coordination with Wainwright, contact or solicit institutions, corporations

or other entities or individuals as potential purchasers of the Securities or investment banks in connection with an Offering and (ii)

the Company will not pursue any financing transaction which would be in lieu of an Offering. Furthermore, the Company agrees that during

Wainwright’s engagement hereunder, all inquiries from prospective investors will be referred to Wainwright. Additionally, except

as set forth hereunder, the Company represents, warrants and covenants that no brokerage or finder’s fees or commissions are or

will be payable by the Company or any subsidiary of the Company to any broker, financial advisor or consultant, finder, placement agent,

investment banker, bank or other third-party with respect to any Offering.

C. Information;

Reliance. The Company shall furnish, or cause to be furnished, to Wainwright all information requested by Wainwright for the purpose

of rendering services hereunder and conducting due diligence (all such information being the “Information”). In addition,

the Company agrees to make available to Wainwright upon request from time to time the officers, directors, accountants, counsel and other

advisors of the Company. The Company recognizes and confirms that Wainwright (a) will use and rely on the Information, including any

documents provided to investors in each Offering (the “Offering Documents”) which shall include any Purchase Agreement

(as defined hereunder), and on information available from generally recognized public sources in performing the services contemplated

by this Agreement without having independently verified the same; (b) does not assume responsibility for the accuracy or completeness

of the Offering Documents or the Information and such other information; and (c) will not make an appraisal of any of the assets or liabilities

of the Company. Upon reasonable request, the Company will meet with Wainwright or its representatives to discuss all information relevant

for disclosure in the Offering Documents and will cooperate in any investigation undertaken by Wainwright thereof, including any document

included or incorporated by reference therein. At each Offering, at the request of Wainwright, the Company shall deliver such legal letters

(including, without limitation, negative assurance letters), opinions, comfort letters, officers’ and secretary certificates and

good standing certificates, all in form and substance satisfactory to Wainwright and its counsel as is customary for such Offering. Wainwright

shall be a third party beneficiary of any representations, warranties, covenants, closing conditions and closing deliverables made by

the Company in any Offering Documents, including representations, warranties, covenants, closing conditions and closing deliverables

made to any investor in an Offering.

D. Related

Agreements. At each Offering, the Company shall enter into the following additional agreements, as applicable:

| 1. | Underwritten

Offering. If an Offering is an underwritten Offering, the Company and Wainwright shall

enter into a customary underwriting agreement in form and substance satisfactory to Wainwright

and its counsel. |

| 2. | Best

Efforts Offering. If an Offering is on a best efforts basis, the sale of Securities to

the investors in the Offering will be evidenced by a purchase agreement (“Purchase

Agreement”) between the Company and such investors in a form reasonably satisfactory

to the Company and Wainwright. Wainwright shall be a third party beneficiary with respect

to the representations, warranties, covenants, closing conditions and closing deliverables

included in the Purchase Agreement. Prior to the signing of any Purchase Agreement, officers

of the Company with responsibility for financial affairs will be available to answer inquiries

from prospective investors. |

| 3. | ATM

Offering. If an Offering is an ATM, the Company and Wainwright shall enter into a customary

at-the-market sales agreement in form and substance satisfactory to Wainwright and its counsel. |

| 4. | Escrow,

Settlement and Closing. If each Offering is not settled via delivery versus payment (“DVP”),

the Company and Wainwright shall enter into an escrow agreement with a third party escrow

agent pursuant to which Wainwright’s compensation and expenses shall be paid from the

gross proceeds of the Securities sold. If the Offering is settled in whole or in part via

DVP, Wainwright shall arrange for its clearing agent to provide the funds to facilitate such

settlement; provided, however, if the clearing firm provides the funds in a best efforts

offering and subsequent to such delivery an investor fails to provide the necessary funds

to the clearing agent for such purchase of Securities, Wainwright shall instruct the clearing

agent to promptly return any such Securities to the Company and the Company shall promptly

return such investor’s purchase price to the clearing agent. The Company shall pay

Wainwright closing costs, which shall also include the reimbursement of the out-of-pocket

cost of the escrow agent or clearing agent, as applicable, which closing costs shall not

exceed $15,950. |

| 5. | FINRA

Amendments. Notwithstanding anything herein to the contrary, in the event that Wainwright

determines that any of the terms provided for hereunder shall not comply with a FINRA rule,

including but not limited to FINRA Rule 5110, then the Company shall agree to amend this

Agreement (or include such revisions in the final underwriting agreement) in writing upon

the request of Wainwright to comply with any such rules; provided that any such amendments

shall not provide for terms that are less favorable to the Company than are reflected in

this Agreement. |

E. Confidentiality.

In the event of the consummation or public announcement of any Offering, Wainwright shall have the right to disclose its participation

in such Offering, including, without limitation, the Offering at its cost of “tombstone” advertisements in financial and

other newspapers and journals.

F. Indemnity.

| 1. | In

connection with the Company’s engagement of Wainwright hereunder, the Company hereby

agrees to indemnify and hold harmless Wainwright and its affiliates, and the respective controlling

persons, directors, officers, members, shareholders, agents and employees of any of the foregoing

(collectively the “Indemnified Persons”), from and against any and all

claims, actions, suits, proceedings (including those of shareholders), damages, liabilities

and expenses incurred by any of them (including the reasonable fees and expenses of counsel),

as incurred, whether or not the Company is a party thereto (collectively a “Claim”),

that are (A) related to or arise out of (i) any actions taken or omitted to be taken (including

any untrue statements made or any statements omitted to be made) by the Company, or (ii)

any actions taken or omitted to be taken by any Indemnified Person in connection with the

Company’s engagement of Wainwright, or (B) otherwise relate to or arise out of Wainwright’s

activities on the Company’s behalf under Wainwright’s engagement, and the Company

shall reimburse any Indemnified Person for all expenses (including the reasonable fees and

expenses of counsel) as incurred by such Indemnified Person in connection with investigating,

preparing or defending any such claim, action, suit or proceeding, whether or not in connection

with pending or threatened litigation in which any Indemnified Person is a party. The Company

will not, however, be responsible for any Claim that is finally judicially determined to

have resulted from the gross negligence or willful misconduct of any such Indemnified Person

for such Claim. The Company further agrees that no Indemnified Person shall have any liability

to the Company for or in connection with the Company’s engagement of Wainwright except

for any Claim incurred by the Company as a result of such Indemnified Person’s gross

negligence or willful misconduct. |

| 2. | The

Company further agrees that it will not, without the prior written consent of Wainwright,

settle, compromise or consent to the entry of any judgment in any pending or threatened Claim

in respect of which indemnification may be sought hereunder (whether or not any Indemnified

Person is an actual or potential party to such Claim), unless such settlement, compromise

or consent includes an unconditional, irrevocable release of each Indemnified Person from

any and all liability arising out of such Claim. |

| 3. | Promptly

upon receipt by an Indemnified Person of notice of any complaint or the assertion or institution

of any Claim with respect to which indemnification is being sought hereunder, such Indemnified

Person shall notify the Company in writing of such complaint or of such assertion or institution

but failure to so notify the Company shall not relieve the Company from any obligation it

may have hereunder, except and only to the extent such failure results in the forfeiture

by the Company of substantial rights and defenses. If the Company is requested by such Indemnified

Person, the Company will assume the defense of such Claim, including the employment of counsel

for such Indemnified Person and the payment of the fees and expenses of such counsel, provided,

however, that such counsel shall be satisfactory to the Indemnified Person and provided further

that if the legal counsel to such Indemnified Person reasonably determines that the use of

counsel chosen by the Company to represent such Indemnified Person would present such counsel

with a conflict of interest or if the defendant in, or target of, any such Claim, includes

an Indemnified Person and the Company, and legal counsel to such Indemnified Person reasonably

concludes that there may be legal defenses available to it or other Indemnified Persons different

from or in addition to those available to the Company, such Indemnified Person will employ

its own separate counsel (including local counsel, if necessary) to represent or defend him,

her or it in any such Claim and the Company shall pay the reasonable fees and expenses of

such counsel. If such Indemnified Person does not request that the Company assume the defense

of such Claim, such Indemnified Person will employ its own separate counsel (including local

counsel, if necessary) to represent or defend him, her or it in any such Claim and the Company

shall pay the reasonable fees and expenses of such counsel. Notwithstanding anything herein

to the contrary, if the Company fails timely or diligently to defend, contest, or otherwise

protect against any Claim, the relevant Indemnified Person shall have the right, but not

the obligation, to defend, contest, compromise, settle, assert crossclaims, or counterclaims

or otherwise protect against the same, and shall be fully indemnified by the Company therefor,

including without limitation, for the reasonable fees and expenses of its counsel and all

amounts paid as a result of such Claim or the compromise or settlement thereof. In addition,

with respect to any Claim in which the Company assumes the defense, the Indemnified Person

shall have the right to participate in such Claim and to retain his, her or its own counsel

therefor at his, her or its own expense. |

| 4. | The

Company agrees that if any indemnity sought by an Indemnified Person hereunder is held by

a court to be unavailable for any reason then (whether or not Wainwright is the Indemnified

Person), the Company and Wainwright shall contribute to the Claim for which such indemnity

is held unavailable in such proportion as is appropriate to reflect the relative benefits

to the Company, on the one hand, and Wainwright on the other, in connection with Wainwright’s

engagement referred to above, subject to the limitation that in no event shall the amount

of Wainwright’s contribution to such Claim exceed the amount of fees actually received

by Wainwright from the Company pursuant to Wainwright’s engagement. The Company hereby

agrees that the relative benefits to the Company, on the one hand, and Wainwright on the

other, with respect to Wainwright’s engagement shall be deemed to be in the same proportion

as (a) the total value paid or proposed to be paid or received by the Company pursuant to

the applicable Offering (whether or not consummated) for which Wainwright is engaged to render

services bears to (b) the fee paid or proposed to be paid to Wainwright in connection with

such engagement. |

| 5. | The

Company’s indemnity, reimbursement and contribution obligations under this Agreement

(a) shall be in addition to, and shall in no way limit or otherwise adversely affect any

rights that any Indemnified Person may have at law or at equity and (b) shall be effective

whether or not the Company is at fault in any way. |

G. Limitation

of Engagement to the Company. The Company acknowledges that Wainwright has been retained only by the Company, that Wainwright is

providing services hereunder as an independent contractor (and not in any fiduciary or agency capacity) and that the Company’s

engagement of Wainwright is not deemed to be on behalf of, and is not intended to confer rights upon, any shareholder, owner or partner

of the Company or any other person not a party hereto as against Wainwright or any of its affiliates, or any of its or their respective

officers, directors, controlling persons (within the meaning of Section 15 of the Securities Act of 1933, as amended (the “Securities

Act”) or Section 20 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), employees

or agents. Unless otherwise expressly agreed in writing by Wainwright, no one other than the Company is authorized to rely upon this

Agreement or any other statements or conduct of Wainwright, and no one other than the Company is intended to be a beneficiary of this

Agreement. The Company acknowledges that any recommendation or advice, written or oral, given by Wainwright to the Company in connection

with Wainwright’s engagement is intended solely for the benefit and use of the Company’s management and directors in considering

a possible Offering, and any such recommendation or advice is not on behalf of, and shall not confer any rights or remedies upon, any

other person or be used or relied upon for any other purpose. Wainwright shall not have the authority to make any commitment binding

on the Company. The Company, in its sole discretion, shall have the right to reject any investor introduced to it by Wainwright.

H. Limitation

of Wainwright’s Liability to the Company. Wainwright and the Company further agree that neither Wainwright nor any of its affiliates

or any of its or their respective officers, directors, controlling persons (within the meaning of Section 15 of the Securities Act or

Section 20 of the Exchange Act), employees or agents shall have any liability to the Company, its security holders or creditors, or any

person asserting claims on behalf of or in the right of the Company (whether direct or indirect, in contract, tort, for an act of negligence

or otherwise) for any losses, fees, damages, liabilities, costs, expenses or equitable relief arising out of or relating to this Agreement

or the services rendered hereunder, except for losses, fees, damages, liabilities, costs or expenses that arise out of or are based on

any action of or failure to act by Wainwright and that are finally judicially determined to have resulted solely from the gross negligence

or willful misconduct of Wainwright.

I. Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable to agreements

made and to be fully performed therein. Any disputes that arise under this Agreement, even after the termination of this Agreement, will

be heard only in the state or federal courts located in the City of New York, State of New York. The parties hereto expressly agree to

submit themselves to the jurisdiction of the foregoing courts in the City of New York, State of New York. The parties hereto expressly

waive any rights they may have to contest the jurisdiction, venue or authority of any court sitting in the City and State of New York.

In the event Wainwright or any Indemnified Person is successful in any action, or suit against the Company, arising out of or relating

to this Agreement, the final judgment or award entered shall be entitled to have and recover from the Company the costs and expenses

incurred in connection therewith, including its reasonable attorneys’ fees. Any rights to trial by jury with respect to any such

action, proceeding or suit are hereby waived by Wainwright and the Company.

J. Notices.

All notices hereunder will be in writing and sent by certified mail, hand delivery, overnight delivery or e-mail, if sent to Wainwright,

at the address set forth on the first page hereof, e-mail: notices@hcwco.com, Attention: Head of Investment Banking, and if sent to the

Company, to the address set forth on the first page hereof, e-mail: jtucker@enveric.com, Attention: Chief Executive Officer. Notices

sent by certified mail shall be deemed received five days thereafter, notices sent by hand delivery or overnight delivery shall be deemed

received on the date of the relevant written record of receipt, notices sent by e-mail shall be deemed received as of the date and time

they were sent.

K. Conflicts.

The Company acknowledges that Wainwright and its affiliates may have and may continue to have investment banking and other relationships

with parties other than the Company pursuant to which Wainwright may acquire information of interest to the Company. Wainwright shall

have no obligation to disclose such information to the Company or to use such information in connection with any contemplated transaction.

L. Anti-Money

Laundering. To help the United States government fight the funding of terrorism and money laundering, the federal laws of the United

States require all financial institutions to obtain, verify and record information that identifies each person with whom they do business.

This means Wainwright must ask the Company for certain identifying information, including a government-issued identification number (e.g.,

a U.S. taxpayer identification number) and such other information or documents that Wainwright considers appropriate to verify the Company’s

identity, such as certified articles of incorporation, a government-issued business license, a partnership agreement or a trust instrument.

M. Miscellaneous.

The Company represents and warrants that it has all requisite power and authority to enter into and carry out the terms and provisions

of this Agreement and the execution, delivery and performance of this Agreement does not breach or conflict with any agreement, document

or instrument to which it is a party or bound. Furthermore, the Company represents and warrants that no consent, permit, waiver, approval

or authorization of any third party in connection with the execution, delivery and performance by the Company of this Agreement or an

Offering, is required or has not been obtained. This Agreement shall not be modified or amended except in writing signed by Wainwright

and the Company. This Agreement shall be binding upon and inure to the benefit of both Wainwright and the Company and their respective

assigns, successors, and legal representatives. This Agreement constitutes the entire agreement of Wainwright and the Company with respect

to the subject matter hereof and supersedes any prior agreements with respect to the subject matter hereof; provided, however, that those

certain engagement letters, dated as of April 6, 2022 and July 11, 2022, by and between the Company and Wainwright shall govern the subject

matter thereof. If any provision of this Agreement is determined to be invalid or unenforceable in any respect, such determination will

not affect such provision in any other respect, and the remainder of the Agreement shall remain in full force and effect. This Agreement

may be executed in counterparts (including electronic counterparts), each of which shall be deemed an original but all of which together

shall constitute one and the same instrument. Signatures to this Agreement transmitted by electronic mail in “portable document

format” (.pdf) form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document,

will have the same effect as physical delivery of the paper document bearing the original signature. The undersigned hereby consents

to receipt of this Agreement in electronic form and understands and agrees that this Agreement may be signed electronically. In the event

that any signature is delivered by electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000,

Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or otherwise

by electronic transmission evidencing an intent to sign this Agreement, such electronic mail or other electronic transmission shall create

a valid and binding obligation of the undersigned with the same force and effect as if such signature were an original. Execution and

delivery of this Agreement by electronic mail or other electronic transmission is legal, valid and binding for all purposes.

*********************

In

acknowledgment that the foregoing correctly sets forth the understanding reached by Wainwright and the Company, please sign in the space

provided below, whereupon this letter shall constitute a binding Agreement as of the date indicated above.

| |

Very truly yours, |

| |

|

| |

H.C. WAINWRIGHT & CO., LLC |

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

Date: |

|

| Accepted and Agreed: |

|

| |

|

| Enveric Biosciences, Inc. |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Exhibit 1.2

Execution

Version

January

14, 2025

STRICTLY

CONFIDENTIAL

Enveric

Biosciences, Inc.

4851

Tamiami Trail N, Suite 200

Naples,

Florida 34103

Attn:

Joseph Tucker, Ph.D., Chief Executive Officer

Dear

Mr. Tucker:

Reference

is made to the engagement letter (the “Engagement Letter”), dated December 8, 2024, by and between Enveric Biosciences,

Inc. (the “Company”) and H.C. Wainwright & Co., LLC (“Wainwright”), pursuant to which Wainwright

shall serve as the exclusive agent, advisor or underwriter in any Offering of Securities of the Company during the “Term”

(as defined in the Engagement Letter). Defined terms used herein but not defined herein shall have the meanings given to such terms in

the Engagement Letter.

The

Company and Wainwright hereby agree, solely in connection with the Offering of the Company’s equity securities contemplated by

the Registration Statement on Form S-1 to be filed with the Securities and Exchange Commission on or about the date hereof, to amend

and restate clause (b) of Paragraph A.3 of the Engagement Letter as follows:

“(b)

$25,000 for non-accountable expenses;”

Except

as expressly set forth above, all of the terms and conditions of the Engagement Letter shall continue in full force and effect after

the execution of this amendment and shall not be in any way changed, modified or superseded except as set forth herein.

This

amendment shall be construed and enforced in accordance with the laws of the State of New York, without regards to conflicts of laws

principles. This amendment may be executed in two or more counterparts, each one of which shall be an original, with the same effect

as if the signatures thereto and hereto were upon the same instrument. Counterparts may be delivered via electronic mail (including any

electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and

Records Act or other applicable law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered shall be deemed

to have been duly and validly delivered and be valid and effective for all purposes.

*

* * * *

[Remainder

of page intentionally left blank]

In

acknowledgment that the foregoing correctly sets forth the understanding reached by Wainwright and the Company, please sign in the space

provided below, whereupon this amendment shall constitute a binding agreement as of the date indicated above.

| |

Very truly yours, |

| |

|

| |

H.C. WAINWRIGHT & CO., LLC |

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| Accepted and Agreed: |

|

| |

|

| Enveric Biosciences, Inc. |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Exhibit

23.2

Independent

Registered Public Accounting Firm’s Consent

We consent to the inclusion in this Registration Statement of Enveric Biosciences, Inc. on Amendment No. 1 to Form S-1 (File No. 333-284277)

of our report dated March 25, 2024, except for the matter added and described in Notes 1 and 12, as to which the date is January 30, 2025,

which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, with respect to our audits of

the consolidated financial statements of Enveric Biosciences, Inc. as of and for the years ended December 31, 2023 and 2022, which report

appears in the Prospectus, which is part of this Registration Statement. We also consent to the reference to our Firm under the heading

“Experts” in such Prospectus.

/s/

Marcum llp

Marcum

llp

Morristown,

New Jersey

January

30, 2025

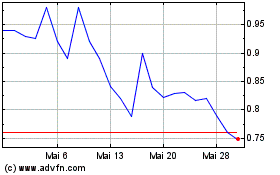

Enveric Biosciences (NASDAQ:ENVB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Enveric Biosciences (NASDAQ:ENVB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025