UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act

of 1934

Date of Report (Date of

earliest event reported) March 8, 2024

AmeriServ Financial, Inc.

(exact name of registrant

as specified in its charter)

| Pennsylvania |

|

0-11204 |

|

25-1424278 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| Main and Franklin Streets, Johnstown, PA |

15901 |

| (address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: 814-533-5300

N/A

(Former name or former address,

if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

Of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange On Which Registered |

| Common Stock |

|

ASRV |

|

The NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging

growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On March 8, 2024, AmeriServ Financial, Inc.

(the “Company”) began mailing a letter to shareholders of the Company, a copy of which is attached to this Current Report

on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

Important Additional Information

The Company intends to file a proxy statement

and GOLD proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with Company’s

2024 annual meeting of shareholders (the “Annual Meeting”) and, in connection therewith, the Company, its directors and certain

of its executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with

such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING GOLD PROXY CARD AND

ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE ANNUAL MEETING. The Company’s definitive proxy statement for the 2023 annual meeting of shareholders contains

information in the section entitled “Security Ownership of Directors and Management” regarding the direct and indirect

interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities.

Supplemental information regarding their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and

5, which are available through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 (when it becomes available). Updated information regarding the identity

of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive

proxy statement and other materials to be filed with the SEC in connection with the Annual Meeting. Shareholders will be able to obtain

the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the

SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website

at http://investors.ameriserv.com/sec-filings/documents.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AMERISERV FINANCIAL, INC. |

| |

|

|

| Date: March 8, 2024 |

By |

/s/ Michael D. Lynch |

| |

|

Michael D. Lynch |

| |

|

EVP & CFO |

Exhibit 99.1

March 8, 2024

Dear Fellow Shareholder:

With 2024 well underway, we wanted

to take this opportunity to update you on our financial performance and business highlights from last year, as well as provide an overview

of what’s next. We remain excited about AmeriServ Financial, Inc.’s (“AmeriServ” or the “Company”)

opportunities and are focused on creating long-term value for you and all our stakeholders.

On the business front, during the

fourth quarter of 2023, we continued to see several encouraging results, including a $36 million, or 3.6%, increase in total loans and

our fourth consecutive quarter of growth in wealth management revenues. The loyalty of our deposit customers has also shown excellent

resilience this year, with an increase of approximately $50 million, or 4.5%, in total deposits on an end-of-period basis since December

31, 2022. This positive momentum in our key business lines—combined with the previously announced $1.5 million benefit expected

from our Earnings Improvement Program—places the Company on track for earnings growth in 2024.

Additionally, we paid a $0.03

per share quarterly common stock cash dividend on February 20, 2024. The Company’s Board of Directors (the “Board”)

maintained the common dividend at its current level given the Company’s strong capital position and expected earnings improvement

in 2024.

Looking at the financials, we

reported a fourth quarter 2023 net loss of approximately $5.3 million, which caused a net loss of approximately $3.3 million or $0.20

earnings per diluted common share (“EPS”) for the full year of 2023. This compares to record-high net income of approximately

$7.4 million or $0.43 EPS for the full year of 2022. The fourth quarter 2023 net loss was caused by an increased provision for credit

losses related to commercial real estate loans and our decision to execute an investment portfolio repositioning strategy. Specifically,

Rite Aid—a national tenant in several commercial real estate properties financed by the bank that had been long-term well-performing

credits—declared bankruptcy, resulting in increased credit costs and charge-offs related to these loans.

We continue to execute

our strategy to create long-term value. Our three-pronged strategy includes (i) maintaining a strong balance sheet with diversified revenue

streams; (ii) appropriately managing risk; and (iii) striving to improve shareholder returns.

Our highly qualified Board is fully engaged

in overseeing and driving our strategy. We have taken concrete steps in recent years to ensure that the composition of the Board aligns

with the needs and goals of the business.

Over the past few years, the Company

has continued to benefit from fresh perspectives and expertise in the Boardroom. In fact, four of our nine directors have joined the

Board during the past four years. At the 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”), shareholders elected

two individuals with highly relevant skill sets to the Board: Richard “Rick” Bloomingdale, former president of the Pennsylvania

AFL-CIO, and David J. Hickton, a former U.S. Attorney and cybersecurity expert. This follows the Board’s May 2020 appointment of

Daniel A. Onorato and the Board’s May 2022 appointment of Amy Bradley to the Board. We believe this Board refreshment speaks to

our commitment to good governance.

We

also wanted to explain the change to the timing of the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”). The

2024 Annual Meeting is scheduled to be held on August 20, 2024—later than usual. You might recall that back in August 2023, shareholder

J. Abbott R. Cooper, the founder and managing member of activist hedge fund Driver Management Company LLC (collectively with its affiliates,

“Driver”), demanded that the Board sue its own members (as well as two recently retired directors) for what the fund alleged

to be a “breach of [those directors’] fiduciary duty.” Driver’s history includes suing and “green-mailing”

other community banks, seemingly for its own self-enrichment. Given Driver’s questionable track record of attacking community banks,

its actions are unsurprising.

In response, the Company acted

according to the Pennsylvania Business Corporation Law and formed a Special Litigation Committee (“SLC”) comprised of independent,

outside individuals who hired their own independent counsel to fully and fairly evaluate Mr. Cooper’s demand. The timing of the

2024 Annual Meeting will allow the SLC to complete its work, and we look forward to its conclusions.

However,

let us be clear: Driver’s actions and frequent shareholder communications criticizing the Company and its leadership will not distract

us from focusing on running our day-to-day business. It is business as usual at the Company, and the Board and management will not be

distracted by Driver’s missives. What’s more, we believe that the courts having ruled in the Company’s favor in the

litigation brought by Driver speaks for itself.1

The latest update is that Driver

has submitted a notice to nominate three individuals for election at the 2024 Annual Meeting. Consistent with its fiduciary duties, the

Board has evaluated Driver’s notice. The Board’s recommended slate of director candidates for election at the 2024 Annual

Meeting will be in the Company’s proxy statement that will be filed with the U.S. Securities and Exchange Commission (the “SEC”).

You, as shareholders, do not have to take any action at this time. We would, however, caution you to be wary of Driver’s communications,

which we believe are frequently misleading and irresponsible.

As always, we continue to diligently

focus on maintaining a safe bank with sound asset quality, strong capital and good liquidity. Our Board and management team believe this

focus is critical to maintaining long-term value for all of our key stakeholders—including you, our shareholders—as well

as our customers, employees and the communities in which we operate.

We deeply appreciate your support and

thank you for your investment in AmeriServ!

|

|

| J.

Michael Adams, Jr. |

Jeffrey

A. Stopko |

| Chairman |

President

& CEO |

1

See, e.g., Driver Opportunity Partners I, LP v. Adams, Civil Action 3:23-56 (W.D. Pa. Dec. 20, 2023) (Driver must

take responsibility for its “own failure to meet the requirements of the [Company’s Amended and Restated Bylaws as] the cause

for the rejection [of its nominees at the 2023 Annual Meeting,] not any alleged illegal motives or actions” by the Board.).

Important Additional

Information

The Company intends to

file a proxy statement and GOLD proxy card with the SEC in connection with the 2024 Annual Meeting and, in connection therewith,

the Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from the Company’s

shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING

GOLD PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE 2024 ANNUAL MEETING. The Company’s

definitive proxy statement for the 2023 Annual Meeting contains information in the section entitled “Security Ownership of Directors

and Management” regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors

and executive officers in the Company’s securities. Supplemental information regarding their holdings of the Company’s securities

can be found in the SEC filings on Forms 3, 4, and 5, which are available through the SEC’s website at www.sec.gov. Information

can also be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (when it becomes available).

Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or

otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the 2024

Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement

and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also

be available at no charge at the Company’s website at http://investors.ameriserv.com/sec-filings/documents.

Forward-Looking Statements

This letter contains forward-looking

statements as defined in the Securities Exchange Act of 1934 and is subject to the safe harbors created therein. Such statements are

not historical facts and include expressions about management’s confidence and strategies and management’s current views

and expectations about new and existing programs and products, relationships, opportunities, technology, market conditions, dividend

program, and future payment obligations. These statements may be identified by such forward-looking terminology as “continuing,”

“expect,” “look,” “believe,” “anticipate,” “may,” “will,” “should,”

“projects,” “strategy,” or similar statements. Actual results may differ materially from such forward- looking

statements, and no reliance should be placed on any forward-looking statement. Factors that may cause results to differ materially from

such forward-looking statements include, but are not limited to, unanticipated changes in the financial markets, the level of inflation,

and the direction of interest rates; volatility in earnings due to certain financial assets and liabilities held at fair value; competition

levels; loan and investment prepayments differing from our assumptions; insufficient allowance for credit losses; a higher level of loan

charge-offs and delinquencies than anticipated; material adverse changes in our operations or earnings; a decline in the economy in our

market areas; changes in relationships with major customers; changes in effective income tax rates; higher or lower cash flow levels

than anticipated; inability to hire or retain qualified employees; a decline in the levels of deposits or loss of alternate funding sources;

a decrease in loan origination volume or an inability to close loans currently in the pipeline; changes in laws and regulations; adoption,

interpretation and implementation of accounting pronouncements; ability to successfully execute the Earnings Improvement Program and

achieve the anticipated benefits in the amounts and at times estimated; operational risks, including the risk of fraud by employees,

customers or outsiders; unanticipated effects to our banking platform; expense and reputational impact on the Company as a result of

litigation and other expenses related to the continuing activities of an activist shareholder; and the inability to successfully implement

or expand new lines of business or new products and services. These forward-looking statements involve risks and uncertainties that could

cause AmeriServ’s results to differ materially from management’s current expectations. Such risks and uncertainties are detailed

in AmeriServ’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2022. Forward-looking

statements are based on the beliefs and assumptions of AmeriServ’s management and on currently available information. The statements

in this press release are made as of the date of this press release, even if subsequently made available by AmeriServ on its website

or otherwise. AmeriServ undertakes no responsibility to publicly update or revise any forward-looking statement.

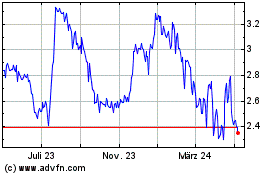

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

Von Dez 2024 bis Dez 2024

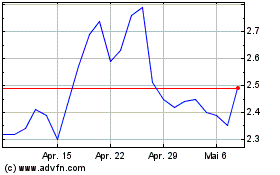

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

Von Dez 2023 bis Dez 2024