AGNC Declares Dividend Payout - Analyst Blog

12 Juni 2012 - 7:34PM

Zacks

American Capital Agency Corp. (AGNC), a real

estate investment trust (REIT), has recently declared a second

quarter 2012 dividend of $1.25 per share, which is payable in cash

on July 27, 2012 to shareholders of record as on June 21, 2012.

Earlier in first quarter 2012, American Capital Agency had also

paid a quarterly dividend of $1.25 per share, which equated to a

total of $1.5 billion in dividends or $20.11 per share since its

initial public offering in May 2008. Over the years, the company

has been paying a steady dividend to its shareholders and even

continued to pay it during recession when most companies had

suspended the same to avoid liquidity crunch.

A steady dividend payout facilitates the long-term strategy of

American Capital Agency to provide attractive risk-adjusted returns

to its stockholders. Investors looking for high dividend yields are

increasingly favoring REITs. Solid dividend payouts are arguably

the biggest enticement for REIT investors as the U.S. law requires

REITs to distribute 90% of their annual taxable income in the form

of dividends to shareholders.

American Capital Agency focuses on investments in mortgage

pass-through securities and collateralized mortgage obligations

(CMOs). The company purchases single-family residential

pass-through securities which are interests in pooled loans of

principal and interest including pre-paid principal that are made

to the holders of the notes. Collateralized mortgage obligations

consist of multiple classes with payments of principal and interest

being made to note holders based on the maturity date of the class

of security.

American Capital Agency invests only in fixed-rate agency

securities where payments are guaranteed by the U.S. government or

government-owned entities, such as Fannie Mae (FNMA), Freddie Mac

(FHLMC) and Ginnie Mae (GNMA). Specifically, American Capital

Agency invests in FHLMC Gold certificates, FNMA certificates, and

GNMA certificates.

With the government takeover of FNMA and FHLMC, American Capital

Agency’s securities have an explicit government guarantee, which

makes it a much more attractive prospect for investors.

Additionally, the company’s portfolio of government-backed assets

is relatively liquid and credit risk is limited.

American Capital Agency borrows against its investment portfolio

pursuant to a master repurchase agreement which provides short-term

financing, typically 30-90 days. The company makes a profit and

pays dividend from net interest income, which is the difference

between interest earned on investments and its cost of

borrowing.

American Capital Agency also purchases payer swaptions to

protect against lower interest rates that might lead to early

prepayment of the mortgages. This measure ultimately facilitates

the company to continue making money by collecting premium and

ensures a steady revenue stream, which in turn helps to maintain a

steady dividend payout.

We maintain our long-term Outperform recommendation for American

Capital Agency, which presently has a Zacks #1 Rank that translates

into a short-term Strong Buy rating. We have a Neutral

recommendation and a Zacks #3 Rank (short-term Hold rating) for

Anworth Mortgage Asset Corporation (ANH), one of

the competitors of American Capital Agency.

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ANWORTH MTGE (ANH): Free Stock Analysis Report

To read this article on Zacks.com click here.

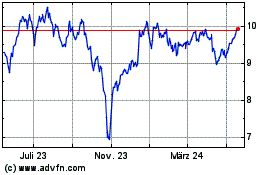

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024