Adial Pharmaceuticals, Inc. (NASDAQ: ADIL; ADILW)

(“Adial” or the “Company”), a clinical-stage biopharmaceutical

company focused on developing therapies for the treatment and

prevention of addiction and related disorders, today provided a

business update and reported its financial results for the 2022

fiscal year ended December 31, 2022.

Cary Claiborne, President and Chief Executive

Officer of Adial, stated, “We made significant advancements

throughout 2022. Specifically, we announced topline data from our

pivotal ONWARD™ phase 3 clinical trial evaluating the efficacy,

safety, and tolerability of AD04 in patients with Alcohol Use

Disorder (AUD) and selected polymorphisms in the serotonin

transporter and receptor genes. ONWARD results showed that AD04

achieved a statistically significant reduction of heavy drinking

days in the “heavy drinkers” subgroup of patients. We recently

conducted a detailed analysis of our prior Phase 2 and our ONWARD

results and identified two specific genotypes that outperformed the

others, which provides us a high level of confidence in our ability

to pursue and obtain regulatory approval in the United States and

Europe. As a result, we requested meetings with the appropriate

regulatory agencies. We held a meeting with the Swedish Medical

Product Agency in March and have secured meeting dates in the

second quarter of 2023 with the Federal Institute for Drugs and

Medical Devices (BfArM) in Germany and the U.S. Food and Drug

Administration (FDA). Meeting dates for France, Finland, and the

United Kingdom are still pending. These meetings are intended to

provide us with a clearer understanding of a path forward to

approval. As we effectively cut down on costs associated with

Purnovate and reduce expenses related to research and

administration, we have positioned ourselves in a much stronger

financial position, while focusing on strategic partnership

opportunities to further the clinical development and

commercialization of AD04. Overall, we are encouraged by our

progress, and look forward to providing further updates.”

Other Recent Developments

Partnering

The Company recently engaged The Keswick Group, LLC, a biotech

strategic commercial and business development advisory firm, to

support advancement of the Company’s partnering activities. The

Keswick Group is led by Tony Goodman, a current member of Adial’s

Board of Directors. Mr. Goodman’s career spans over 23 years in the

pharmaceutical and biotech industries. Having held senior

leadership and business development positions at a variety of

pharmaceutical companies, Mr. Goodman brings significant expertise

and experience in strategically important partnering transactions

and extensive relationships in the healthcare market.

Financing

The Company closed an at-the-market registered

direct offering of 1,829,269 shares of common stock at a purchase

price of $0.41 per share of common stock with a single

institutional investor for gross proceeds of $0.75 million before

deducting the placement agent’s fees and other estimated offering

expenses payable by the Company.

Purnovate

The Company entered into an option agreement for

the sale of the assets of Purnovate, Inc. (“Purnovate”), a wholly

owned subsidiary of Adial, to Adovate, LLC (formerly known as

Adenomed, LLC) (“Adovate”), a new company formed by Purnovate Chief

Executive Officer William Stilley, founder and former Chief

Executive Officer of Adial. Under the terms of the agreement,

Adovate has 120 days to exercise the option with the right to

purchase two 30-day extensions. Adial would receive $450,000 upon

exercise of the option, and then be reimbursed for any Purnovate

expenditures incurred and paid after December 1, 2022. Under the

acquisition agreement, the Company would also be eligible to

receive up to approximately $11 million in development and approval

milestones for each compound (up to $33 million in total

development and approval milestones for the first three compounds

alone), as well as a total of $50 million in additional commercial

milestones, for a total consideration of up to $83 million with

potential milestone payments on additional compounds. Additionally,

the Company would receive a low, single-digit royalty and acquire a

19.9% equity stake in Adovate. Through this transaction, Adovate

would assume all current Adial obligations related to

Purnovate.

The proposed transaction was independently

evaluated and unanimously approved, first by the Adial Audit

Committee of the Board of Directors, and then by Adial’s Board of

Directors, with Mr. Stilley, a current board member, abstaining

from the vote.

Fiscal Year 2022 Financial Results

- Cash Position:

As of December 31, 2022, cash and cash equivalents were $4.0

million as compared to $6.1 million as of December 31, 2021. The

Company believes that its existing cash and cash equivalents will

fund its operating expenses into the third quarter of 2023 if the

option to sell Purnovate is not exercised by Adovate. If Adovate

exercises the option as expected, the Company would receive

non-dilutive funding and the sale would significantly reduce its

current cash burn rate, which would extend the Company's cash into

the first quarter of 2024.

- Research and Development expenses

decreased by $4.2 million (50%) to $4.2 million for the year ended

December 31, 2022, compared to $8.4 million for the year ended

December 31, 2021. The decrease was driven by lower costs related

to the ONWARD Phase 3 trial as clinical activities were

substantially complete in midyear 2022.

- General and

Administration expenses decreased by $0.2 million (2%) to $9.3

million for the year ended December 31, 2022, compared to $9.5

million for the year ended December 31, 2021.

- Net Loss was

$12.7 million for the year ended December 31, 2022, compared to a

net loss of $19.4 million for the year ended December 31,

2021.

About Adial Pharmaceuticals, Inc.

Adial Pharmaceuticals is a clinical-stage

biopharmaceutical company focused on the development of therapies

for the treatment and prevention of addiction and related

disorders. The Company’s lead investigational new drug product,

AD04, is a genetically targeted, serotonin-3 receptor antagonist,

therapeutic agent for the treatment of Alcohol Use Disorder (AUD)

in heavy drinking patients and was recently investigated in the

Company’s ONWARD™ pivotal Phase 3 clinical trial for the potential

treatment of AUD in subjects with certain target genotypes

(estimated to be approximately one-third of the AUD population)

identified using the Company’s proprietary companion diagnostic

genetic test. ONWARD showed promising results in reducing heavy

drinking in heavy drinking patients, and no overt safety or

tolerability concerns. AD04 is also believed to have the potential

to treat other addictive disorders such as Opioid Use Disorder,

gambling, and obesity. The Company is also developing adenosine

analogs for the treatment of pain and other disorders. Additional

information is available at www.adial.com.

Forward Looking Statements

This communication contains certain

"forward-looking statements" within the meaning of the U.S. federal

securities laws. Such statements are based upon various facts and

derived utilizing numerous important assumptions and are subject to

known and unknown risks, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Statements

preceded by, followed by or that otherwise include the words

"believes," "expects," "anticipates," "intends," "projects,"

"estimates," "plans" and similar expressions or future or

conditional verbs such as "will," "should," "would," "may" and

"could" are generally forward-looking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. The forward-looking statements include statements

regarding pursuing and obtaining regulatory approval for AD04 in

the United States and Europe, focusing on strategic partnership

opportunities to further the clinical development and

commercialization of AD04, providing further updates regarding the

clinical development and commercialization of AD04, entering into a

definitive agreement for the sale of the assets of Purnovate, Inc.

to Adovate, LLC pursuant to which the Company will receive

$450,000, be reimbursed for Purnovate expenditures incurred and

paid after December 1, 2022 and be eligible to receive up to

approximately $11 million in development and approval milestones

for each compound (up to $33 million in total development and

approval milestones for the first three compounds alone), as well

as a total of $50 million in additional commercial milestones, for

a total consideration of up to $83 million with potential milestone

payments on additional compounds, together with a single-digit

royalty and a 19.9% equity stake in Adovate, and the potential of

AD04 to treat other addictive disorders such as opioid use

disorder, gambling, and obesity. Any forward-looking statements

included herein reflect our current views, and they involve certain

risks and uncertainties, including, among others, our ability to

obtain regulatory approvals for commercialization of product

candidates or to comply with ongoing regulatory requirements, our

ability to develop strategic partnership opportunities and maintain

collaborations, our ability to obtain or maintain the capital or

grants necessary to fund our research and development activities,

our ability to retain our key employees or maintain our Nasdaq

listing, our ability to complete clinical trials on time and

achieve desired results and benefits as expected, regulatory

limitations relating to our ability to promote or commercialize our

product candidates for specific indications, acceptance of our

product candidates in the marketplace and the successful

development, marketing or sale of our products, our ability to

maintain our license agreements, the continued maintenance and

growth of our patent estate, our ability to retain our key

employees or maintain our Nasdaq listing, our ability to consummate

the Company’s proposed sale of Purnovate to Adovate, maximizing the

value of the early-stage assets in Purnovate, significantly

reducing the Company’s current burn rate and extending its cash

runway, providing an update with regards the Company’s detailed

strategic plan for AD04, continuing discussions with potential

pharmaceutical partners both in the U.S. and in Europe, our ability

to reduce our current burn rate and extend our cash runway, and our

ability to implement our strategic plan for AD04 and continue

discussions with potential pharmaceutical partners. These risks

should not be construed as exhaustive and should be read together

with the other cautionary statement included in our Annual Report

on Form 10-K for the year ended December 31, 2021, subsequent

Quarterly Reports on Form 10-Q and current reports on Form 8-K

filed with the Securities and Exchange Commission. Any

forward-looking statement speaks only as of the date on which it

was initially made. We undertake no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events, changed circumstances or otherwise,

unless required by law.

Contact:Crescendo

Communications, LLCDavid Waldman / Alexandra SchiltTel:

212-671-1020Email: ADIL@crescendo-ir.com

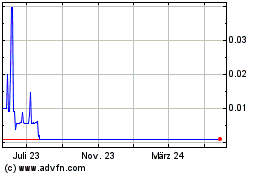

Adial Pharmaceuticals (NASDAQ:ADILW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

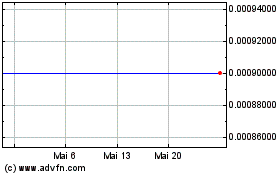

Adial Pharmaceuticals (NASDAQ:ADILW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025