- INBRIJA® (levodopa inhalation powder) Q3 2022 U.S.

net revenue of $7.8 million; 1% increase over Q3 2021

- AMPYRA® (dalfampridine) Q3 2022 net revenue of $21.1 million;

5% increase over Q3 2021

- $16.5M award and royalty/supply relief in AMPYRA arbitration

case

- Special Meeting of Stockholders scheduled for November 4,

2022

- Company will not use shares for December 2022 interest payment

on secured debt

- 2022 guidance reaffirmed, 2023 through 2027 guidance

provided

Acorda Therapeutics, Inc. (Nasdaq: ACOR) today provided a

business update and reported its financial results for the third

quarter ended September 30, 2022.

“The AMPYRA arbitration ruling was a major milestone for Acorda,

providing a significant cash infusion and, even more importantly,

the ability for us to obtain AMPYRA supply at far more competitive

rates. We expect this to significantly enhance the value of this

product to the company,” said Ron Cohen, M.D., Acorda’s President

and Chief Executive Officer. “We are also pleased that INBRIJA

continued to recover from the impact of the pandemic surge in the

first quarter of this year. Independent sources show that INBRIJA

is the market leader for on-demand treatments in Parkinson’s

disease, with a 67% share. Our highest priority now is to increase

the size of the overall on-demand market by educating health care

professionals and people with Parkinson’s about how important it is

to address OFF periods.”

Regarding the Special Meeting of Stockholders, Dr. Cohen added,

“The board of directors and I urge all shareholders to vote FOR

Proposal 2, to authorize the reverse stock split, in advance of the

meeting on November 4. This is critical to ensure that we are not

de-listed from Nasdaq, which could hamper our ability to execute on

our business plan and could result in our being in default to our

debtholders.”

Third Quarter 2022 Financial Results For the quarter

ended September 30, 2022, the Company reported INBRIJA worldwide

net revenue of $8.8 million, of which $7.8 million was derived from

sales in the U.S., a 1% increase compared to the same quarter in

2021. The Company also reported Ex-U.S. INBRIJA net revenue of $1.0

million in the third quarter related to the Esteve launch in

Germany.

For the quarter ended September 30, 2022, the Company reported

AMPYRA net revenue of $21.1 million, compared to $20.0 million for

the same quarter in 2021. As previously disclosed, AMPYRA lost its

exclusivity and generics entered the market in 2018, and the

Company expects AMPYRA revenue to continue to decline.

Research and development (R&D) expenses for the quarter

ended September 30, 2022 were $1.4 million, including negligible

share-based compensation expenses, compared to $1.9 million,

including $0.2 million of share-based compensation for the same

quarter in 2021.

Sales, general and administrative (SG&A) expenses for the

quarter ended September 30, 2022 were $23.0 million, including $0.4

million of share-based compensation, compared to $29.6 million,

including $0.6 million of share-based compensation for the same

quarter in 2021.

Change in fair value of derivative liability for the quarter

ended September 30, 2022 was negligible, compared to $(0.3) million

for the same quarter in 2021.

Provision for income taxes for the quarter ended September 30,

2022 was $1.4 million, compared to a benefit from income taxes of

$3.1 million for the same quarter in 2021.

The Company reported a GAAP net loss of $13.9 million for the

quarter ended September 30, 2022, or $0.57 per diluted share. GAAP

net loss in the same quarter of 2021 was $27.1 million, or $2.43

per diluted share.

Non-GAAP net loss for the quarter ended September 30, 2022 was

$13.3 million, or $0.55 per diluted share. Non-GAAP net loss in the

same quarter of 2021 was $15.9 million, or $1.43 per diluted share.

This quarterly non-GAAP net loss measure, more fully described

below under “Non-GAAP Financial Measures,” excludes share-based

compensation charges, non-cash interest charges on our debt,

changes in the fair value of acquired contingent consideration,

changes in the fair value of derivative liability related to our

2024 convertible senior secured notes, and expenses that pertain to

non-routine corporate restructurings. A reconciliation of the GAAP

financial results to non-GAAP financial results is included with

the attached financial statements.

At September 30, 2022, the Company had cash, cash equivalents,

and restricted cash of $34.2 million, compared to $65.2 million at

year end 2021. Restricted cash includes $12.4 million in escrow

related to the semi-annual interest payment to the holders of its

6.00% convertible senior secured notes (Convertible Notes). Cash at

September 30, 2022 does not include the $16.5 million arbitration

award, which amount was received in October 2022.

Special Meeting of Stockholders November 4, 2022 Acorda

will hold a Special Meeting of Stockholders on Friday, November 4

(the Special Meeting). Acorda’s CEO, board, and the three leading

proxy advisory firms recommend that shareholders vote FOR both of

the following proposals to be addressed at the meeting:

- Reverse Stock Split Proposal: To authorize Acorda’s Board of

Directors to implement a reverse stock split of its common stock at

a ratio of any whole number in the range of 1-for-2 to 1-for-20

within one year of the Special Meeting. This proposal is critical

to get Acorda’s stock price above $1.00 per share in order to avoid

being delisted from Nasdaq. Delisting could put the company in

default to the holders of its Convertible Notes, potentially

requiring Acorda to liquidate or file for bankruptcy. In a reverse

stock split, shareholders would hold the exact same percentage of

Acorda stock, with the same value as they did prior to the

split.

- Adjournment Proposal: To approve one or more adjournments of

the Special Meeting to a later date or dates, if necessary or

appropriate, to solicit additional proxies if there are

insufficient votes to approve the Reverse Stock Split Proposal at

the time of the Special Meeting, or in the absence of a

quorum.

AMPYRA Arbitration On October 16, 2022 we announced that

an arbitration panel issued a final decision in a dispute with

Alkermes PLC (Nasdaq: ALKS) regarding licensing royalties relating

to AMPYRA (dalfampridine). Acorda was awarded $15 million plus

prejudgment interest of $1.5 million from Alkermes. In addition, as

a result of the panel’s ruling, Acorda will no longer have to pay

Alkermes any royalties on net sales for license and supply of

AMPYRA, and Acorda is now free to use alternative sources for

supply of AMPYRA, which it has already secured.

2022 – 2027 Financial Guidance For the full year 2022,

Acorda continues to expect AMPYRA net revenue to be $68 – $78

million, and adjusted operating expenses to be $110 – $120 million.

The financial guidance provided below includes non-GAAP projections

of adjusted operating expenses (adjusted OPEX) and adjusted

earnings before income taxes depreciation and amortization

(adjusted EBITDA), as described below under “Non-GAAP Financial

Measures.”

Guidance Ranges in U.S.$M

2022

2023

2024

2025

2026

2027

(unaudited)

NET REVENUE

Inbrija U.S.

$27.8 - $28.7

$37.1 - $41.1

$50.1 - $55.3

$59.7 - $65.9

$64.1 - $70.9

$71.4 - $78.9

Inbrija OUS

$2.8 - $2.9

$7.3 - $8.1

$12.0 - $13.2

$22.7 - $25.1

$33.1 - $36.6

$45.0 - $49.7

Inbrija Sales

$30.6 - $31.6

$44.4 - $49.2

$62.1 - $68.5

$82.4 - $91.0

$97.2 - $107.5

$116.4 - $128.6

Ampyra U.S.

$71.4 - $73.6

$64.6 - $71.4

$61.5 - $68.0

$59.5 - $65.8

$57.6 - $63.7

$55.8 - $61.7

Fampyra Royalty

$12.0 - $12.4

$9.5 - $10.5

$8.6 - $9.5

$7.6 - $8.4

$7.6 - $8.4

$6.7 - $7.4

Ampyra Sales

$83.4 - $86.0

$74.1 - $81.9

$70.1 - $77.5

$67.1 - $74.2

$65.2 - $72.1

$62.5 - $69.1

ARCUS Development

$0.0 - $0.0

$1.1 - $1.3

$1.5 - $1.6

$1.5 - $1.6

$1.5 - $1.6

$1.5 - $1.6

Neurelis Royalty

$2.0 - $2.1

$1.7 - $1.9

$0.4 - $0.5

$0.0 - $0.0

$0.0 - $0.0

$0.0 - $0.0

Net Revenue

$116.0 - $119.7

$121.3 - $134.3

$134.1 - $148.1

$151.0 - $166.8

$163.9 - $181.2

$180.4 - $199.3

Adjusted OPEX

$113.7 - $117.1

$90.0 - $99.4

$90.6 - $100.2

$93.5 - $103.3

$96.3 - $106.4

$99.2 - $109.6

Adjusted EBITDA

$(13.5) - $(13.9)

$29.0 - $32.1

$40.8 - $45.1

$58.3 - $64.5

$72.1 - $79.7

$89.3 - $98.7

Ending Cash Balance

$43.2 - $44.5

$51.6 - $57.0

$72.8 - $80.4

$102.2 - $113.0

$138.5 - $153.1

$183.5 - $202.8

Cash Flow

$(21.0) - $(21.7)

$9.9 - $11.0

$21.2 - $23.4

$29.4 - $32.5

$36.3 - $40.1

$45.0 - $49.7

Webcast and Conference Call The Company will host a

webcast in conjunction with its third quarter update and financial

results today at 4:30 p.m. ET.

To participate in the Webcast, please use the following

registration link:

-

https://event.on24.com/wcc/r/4001897/47AF8C7CC150301C8AFD48F0F7E389AF

If you register for the Webcast, you will have the opportunity

to submit a written question for the Q&A portion of the

presentation. After you have registered, you will receive a

confirmation email with the Webcast details. On the day of the

Webcast, you will receive an email 2 hours prior to the start of

the Webcast with the link to join. The presentation will be

available on the Investors section of www.acorda.com.

A replay of the call will be available from 7:30 p.m. ET on

November 1, 2022 until 11:59 p.m. ET on December 1, 2022. To access

the replay, please dial 1 866 813 9403 (domestic) or +44 204 525

0658 (international); reference code 945092. The archived webcast

will be available in the Investor Relations section of the Acorda

website at www.acorda.com.

Non-GAAP Financial Measures This press release includes

financial results prepared in accordance with accounting principles

generally accepted in the United States (GAAP) and also certain

historical and forward-looking non-GAAP financial measures. In

particular, Acorda has provided non-GAAP net income (loss),

adjusted to exclude the items below, and has provided 2022-2027

adjusted operating expense and adjusted EBITDA guidance on a

non-GAAP basis. Non-GAAP financial measures are not an alternative

for financial measures prepared in accordance with GAAP. However,

the Company believes that the presentation of non-GAAP net income

(loss), when viewed in conjunction with actual GAAP results,

provides investors with a more meaningful understanding of our

ongoing and projected operating performance because this measure

excludes (i) non-cash compensation charges and benefits that are

substantially dependent on changes in the market price of our

common stock, (ii) non-cash interest charges related to the

accounting for our convertible debt which are in excess of the

actual interest expense owing on such convertible debt, as well as

non-cash interest related to the Fampyra royalty monetization and

acquired Biotie debt, (iii) changes in the fair value of acquired

contingent consideration which do not correlate to our actual cash

payment obligations in the relevant periods, (iv) expenses that

pertain to corporate restructurings which are not routine to the

operation of the business, and (v) changes in the fair value of

derivative liability relating to the 2024 convertible senior

secured notes, which is a non-cash charge and not related to the

operation of the business. The Company believes its non-GAAP net

income (loss) measure helps indicate underlying trends in the

Company's business and is important in comparing current results

with prior period results and understanding the Company’s projected

operating performance. In addition, management uses this non-GAAP

financial measure to establish budgets and operational goals, to

manage the Company's business, and to evaluate its performance.

In addition to non-GAAP net income (loss), we have provided

non-GAAP projections of adjusted OPEX and adjusted EBITDA. Adjusted

OPEX includes (i) research and development expenses and (ii)

selling, general, and administrative expenses and excludes (i)

costs of goods sold, (ii) amortization of intangible assets, (iii)

change in fair value of derivative liability, and (iv) change in

fair value of acquired contingent liability. Adjusted EBITDA is

GAAP net income (loss) before income taxes excluding (i) non-cash

compensation charges and benefits that are substantially dependent

on changes in the market price of our common stock, (ii) interest

due on our convertible debt, (iii) non-cash interest charges

related to the accounting for our convertible debt which are in

excess of the actual interest expense owing on such convertible

debt, as well as non-cash interest related to the Fampyra royalty

monetization and acquired Biotie debt, (iv) changes in the fair

value of acquired contingent consideration which do not correlate

to our actual cash payment obligations in the relevant periods, (v)

expenses that pertain to corporate restructurings which are not

routine to the operation of the business, and (vi) changes in the

fair value of derivative liability relating to the 2024 convertible

senior secured notes, which is a non-cash charge and not related to

the operation of the business. We are unable to reconcile these

forward-looking non-GAAP measures to GAAP due to the

forward-looking nature of the adjustments that are needed to

determine this information, which includes information regarding

future compensation charges, future changes in the market price of

our common stock, and changes in the fair value of derivative and

contingent liabilities, none of which are available at this

time.

Non-GAAP financial measures are not an alternative for financial

measures prepared in accordance with GAAP, and the calculation of

the non-GAAP financial measures included herein may differ from

similarly titled measures used by other companies. The Company

believes that the presentation of these non-GAAP financial

measures, when viewed in conjunction with actual GAAP results,

provides investors with a more meaningful understanding of our

ongoing and projected operating performance because it excludes (i)

expenses that pertain to corporate restructurings not routine to

the operation of our business, (ii) non-cash charges that are

substantially dependent on changes in the market price of our

common stock, and (iii) other items as set forth above that are not

ascertainable at the present time. We believe these non-GAAP

financial measures help indicate underlying trends in the Company’s

business and are important in comparing current results with prior

period results and understanding expected operating performance.

Also, management uses these non-GAAP financial measures to

establish budgets and operational goals, and to manage the

Company's business and evaluate its performance.

About Acorda Therapeutics Acorda Therapeutics develops

therapies to restore function and improve the lives of people with

neurological disorders. INBRIJA is approved for intermittent

treatment of OFF episodes in adults with Parkinson’s disease

treated with carbidopa/levodopa. INBRIJA is not to be used by

patients who take or have taken a nonselective monoamine oxidase

inhibitor such as phenelzine or tranylcypromine within the last two

weeks. INBRIJA utilizes Acorda’s innovative ARCUS® pulmonary

delivery system, a technology platform designed to deliver

medication through inhalation. Acorda also markets the branded

AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg.

Forward-Looking Statements This press release includes

forward-looking statements. All statements, other than statements

of historical facts, regarding management's expectations, beliefs,

goals, plans or prospects should be considered forward-looking.

These statements are subject to risks and uncertainties that could

cause actual results to differ materially, including: we may not be

able to successfully market AMPYRA, INBRIJA or any other products

under development; the COVID-19 pandemic, including related

restrictions on in-person interactions and travel, and the

potential for illness, quarantines and vaccine mandates affecting

our management, employees or consultants or those that work for

other companies we rely upon, could have a material adverse effect

on our business operations or product sales; our ability to attract

and retain key management and other personnel, or maintain access

to expert advisors; our ability to raise additional funds to

finance our operations, repay outstanding indebtedness or satisfy

other obligations, and our ability to control our costs or reduce

planned expenditures; risks associated with the trading of our

common stock and our credit agreements, including the potential

delisting of our common stock from the Nasdaq Global Select Market

which could result in a default under the indenture dated as of

December 23, 2019 for Acorda’s 6.00% convertible senior secured

notes, and could prevent the implementation of our business plan,

and the success of actions that we may take, such as a reverse

stock split, in order to attempt to maintain such listing and avoid

a default; risks related to the successful implementation of our

business plan, including the accuracy of its key assumptions; risks

related to our corporate restructurings, including our ability to

outsource certain operations, realize expected cost savings and

maintain the workforce needed for continued operations; risks

associated with complex, regulated manufacturing processes for

pharmaceuticals, which could affect whether we have sufficient

commercial supply of INBRIJA or AMPYRA to meet market demand; our

reliance on third-party manufacturers for the timely production of

commercial supplies of INBRIJA and AMPYRA; third-party payers

(including governmental agencies) may not reimburse for the use of

INBRIJA or AMPYRA at acceptable rates or at all and may impose

restrictive prior authorization requirements that limit or block

prescriptions; reliance on collaborators and distributors to

commercialize INBRIJA and AMPYRA outside the U.S.; our ability to

satisfy our obligations to distributors and collaboration partners

outside the U.S. relating to commercialization and supply of

INBRIJA and AMPYRA; competition for INBRIJA and AMPYRA, including

increasing competition and accompanying loss of revenues in the

U.S. from generic versions of AMPYRA (dalfampridine) following our

loss of patent exclusivity; the ability to realize the benefits

anticipated from acquisitions because, among other reasons,

acquired development programs are generally subject to all the

risks inherent in the drug development process and our knowledge of

the risks specifically relevant to acquired programs generally

improves over time; the risk of unfavorable results from future

studies of INBRIJA (levodopa inhalation powder) or from other

research and development programs, or any other acquired or

in-licensed programs; the occurrence of adverse safety events with

our products; the outcome (by judgment or settlement) and costs of

legal, administrative or regulatory proceedings, investigations or

inspections, including, without limitation, collective,

representative or class-action litigation; failure to protect our

intellectual property, to defend against the intellectual property

claims of others or to obtain third-party intellectual property

licenses needed for the commercialization of our products; and

failure to comply with regulatory requirements could result in

adverse action by regulatory agencies.

These and other risks are described in greater detail in our

filings with the Securities and Exchange Commission. We may not

actually achieve the goals or plans described in our

forward-looking statements, and investors should not place undue

reliance on these statements. Forward-looking statements made in

this press release are made only as of the date hereof, and we

disclaim any intent or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this press release, except as may be required by law.

The Proxy Statement On September 22, 2022, the Company

filed the Notice of Special Meeting and Proxy Statement (the

“Proxy Statement”) and definitive form

of proxy card with the United States Securities and Exchange

Commission (the “SEC”) in connection

with its solicitation of proxies from the Company’s stockholders.

On October 7, 2022, the Company filed a Supplement to the Proxy

Statement (the “Supplement”).

Investors and stockholders are strongly encouraged to read the

Proxy Statement and Supplement, the accompanying proxy card, and

other documents filed by the Company in their entirety, as they

contain important information.

We urge Stockholders to review the Proxy Statement. Stockholders

can obtain copies of the Proxy Statement, Supplement, any other

amendments or supplements to the Proxy Statement, and other

documents filed by the Company with the SEC for no charge at the

SEC’s website at www.sec.gov. Copies are also available at no

charge on the Investors section of our website at www.acorda.com.

You may also obtain additional copies of the Proxy Statement and

other proxy solicitation materials by contacting our proxy

solicitor, D.F. King & Co., Inc., as directed above.

Financial Statements

Acorda Therapeutics,

Inc.

Condensed Consolidated Balance

Sheet Data

(in thousands)

September 30,

December 31,

2022

2021

(unaudited)

Assets

Cash and cash equivalents

$

20,696

$

45,634

Restricted cash - short term

13,232

13,400

Trade receivable, net

14,690

17,002

Other current assets

7,822

7,573

Inventories, net

15,252

18,548

Property and equipment, net

2,825

4,382

Intangible assets, net

312,779

335,980

Restricted cash - long term

255

6,189

Right of use assets, net

5,541

6,751

Other assets

247

11

Total assets

$

393,339

$

455,470

Liabilities and stockholders'

equity

Accounts payable, accrued expenses and

other current liabilities

$

38,210

$

39,450

Current portion of lease liability

1,454

8,186

Current portion of royalty liability

—

4,460

Current portion of contingent

consideration

2,359

1,929

Convertible senior notes

162,760

151,025

Derivative liability related to conversion

option

—

37

Non-current portion of acquired contingent

consideration

35,241

47,671

Non-current portion of lease liability

4,612

4,086

Non-current portion of loans payable

24,929

27,645

Deferred tax liability

42,228

13,930

Other long-term liabilities

5,780

5,914

Total stockholder's equity

75,766

151,137

Total liabilities and stockholders'

equity

$

393,339

$

455,470

Acorda Therapeutics,

Inc.

Consolidated Statements of

Operations

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Revenues:

Net product revenues

$

29,964

$

27,851

$

76,023

$

81,297

Royalty revenues

$

3,047

$

3,605

$

10,573

$

10,807

License revenue

$

500

$

-

$

500

$

-

Total revenues

33,511

31,456

87,096

92,104

Costs and expenses:

Cost of sales

11,005

13,303

25,772

36,589

Research and development

1,383

1,931

4,602

9,054

Selling, general and administrative

22,997

29,623

80,002

95,959

Amortization of intangible assets

7,691

7,691

23,073

23,073

Change in fair value of derivative

liability

—

(288

)

(37

)

(868

)

Change in fair value of acquired

contingent consideration

(4,576

)

2,205

(10,709

)

(4,224

)

Total operating expenses

38,500

54,465

122,703

159,583

Operating loss

$

(4,989

)

$

(23,009

)

$

(35,607

)

$

(67,479

)

Other expense, (net)

(7,449

)

(7,167

)

(21,214

)

(22,696

)

Loss before income taxes

(12,438

)

(30,176

)

(56,821

)

(90,175

)

(Provision for) benefit from income

taxes

(1,416

)

3,105

(28,237

)

6,788

Net loss

$

(13,854

)

$

(27,071

)

$

(85,058

)

$

(83,387

)

Net loss per common share - basic and

diluted

$

(0.57

)

$

(2.43

)

$

(4.69

)

$

(8.17

)

Weighted average common shares - basic and

diluted

24,290

11,131

18,148

10,204

Acorda Therapeutics,

Inc.

Non-GAAP Net Loss and Net Loss

per Common Share Reconciliation

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

GAAP net loss

$

(13,854

)

$

(27,071

)

$

(85,058

)

$

(83,387

)

Pro forma adjustments:

Non-cash interest expense (1)

4,077

4,097

12,356

12,672

Change in fair value of acquired

contingent consideration (2)

(4,576

)

2,205

(10,709

)

(4,224

)

Restructuring costs (3)

—

2,432

251

4,582

Change in fair value of derivative

liability (4)

—

(288

)

(37

)

(868

)

Share-based compensation expenses included

in Cost of Sales

—

2

1

18

Share-based compensation expenses included

in R&D

13

225

65

599

Share-based compensation expenses included

in SG&A

351

627

1,253

1,898

Total share-based compensation

expenses

364

854

1,319

2,515

Total pro forma adjustments

(135

)

9,300

3,180

14,677

Income tax effect of reconciling items

above (5)

(673

)

(1,827

)

5,201

(10,727

)

Non-GAAP net loss

$

(13,316

)

$

(15,944

)

$

(87,079

)

$

(57,983

)

Non-GAAP net loss per common share - basic

and diluted

$

(0.55

)

$

(1.43

)

$

(4.80

)

$

(5.68

)

Weighted average common shares - basic and

diluted

24,290

11,131

18,148

10,204

(1) Non-cash interest expense related to

convertible senior notes, Biotie non-convertible and R&D loans

and Fampyra royalty monetization.

(2) Change in fair value of acquired

contingent consideration related to the Civitas acquisition.

(3) Costs associated with corporate

restructurings which are not routine to the operation of the

business.

(4) Change in the fair value of the

derivative liability related to the 2024 convertible senior secured

notes.

(5) Represents the tax effect of the

non-GAAP adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101006228/en/

Tierney Saccavino (914) 326-5104 tsaccavino@acorda.com

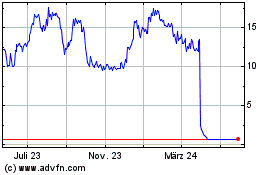

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025