00000959532024FYfalse2774,175—864267653iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesacnt:segmentxbrli:pureutr:acre00000959532024-01-012024-12-3100000959532024-06-3000000959532025-02-2800000959532024-12-3100000959532023-12-3100000959532023-01-012023-12-310000095953us-gaap:RetainedEarningsMember2024-01-012024-12-3100000959532022-12-310000095953us-gaap:CommonStockMember2022-12-310000095953us-gaap:AdditionalPaidInCapitalMember2022-12-310000095953us-gaap:RetainedEarningsMember2022-12-310000095953us-gaap:TreasuryStockCommonMember2022-12-310000095953us-gaap:RetainedEarningsMember2023-01-012023-12-310000095953us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000095953us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000095953us-gaap:CommonStockMember2023-12-310000095953us-gaap:AdditionalPaidInCapitalMember2023-12-310000095953us-gaap:RetainedEarningsMember2023-12-310000095953us-gaap:TreasuryStockCommonMember2023-12-310000095953us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000095953us-gaap:TreasuryStockCommonMember2024-01-012024-12-310000095953us-gaap:CommonStockMember2024-12-310000095953us-gaap:AdditionalPaidInCapitalMember2024-12-310000095953us-gaap:RetainedEarningsMember2024-12-310000095953us-gaap:TreasuryStockCommonMember2024-12-310000095953srt:MinimumMember2024-01-012024-12-310000095953srt:MaximumMember2024-01-012024-12-310000095953acnt:SpecialtyChemicalsSegmentMember2024-01-012024-12-310000095953acnt:SpecialtyChemicalsSegmentMember2023-01-012023-12-310000095953acnt:TubularProductsMember2024-01-012024-12-310000095953acnt:TubularProductsMember2023-01-012023-12-310000095953acnt:ObsolescenceReserveMember2024-12-310000095953acnt:ObsolescenceReserveMember2023-12-310000095953acnt:PhysicalInventoryShrinkReserveMember2024-12-310000095953acnt:PhysicalInventoryShrinkReserveMember2023-12-310000095953srt:MinimumMemberus-gaap:LandBuildingsAndImprovementsMember2024-12-310000095953srt:MaximumMemberus-gaap:LandBuildingsAndImprovementsMember2024-12-310000095953srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000095953srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000095953us-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310000095953acnt:SpecialtyChemicalsSegmentMember2022-12-310000095953acnt:SpecialtyChemicalsSegmentMember2023-12-3100000959532023-07-012023-09-300000095953us-gaap:CustomerRelatedIntangibleAssetsMember2024-12-310000095953us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310000095953us-gaap:TrademarksAndTradeNamesMember2024-12-310000095953us-gaap:TrademarksAndTradeNamesMember2023-12-310000095953us-gaap:OtherIntangibleAssetsMember2024-12-310000095953us-gaap:OtherIntangibleAssetsMember2023-12-310000095953acnt:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberacnt:SpecialtyChemicalsSegmentMember2024-01-012024-12-310000095953acnt:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberacnt:SpecialtyChemicalsSegmentMember2023-01-012023-12-310000095953acnt:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberacnt:TubularProductsMember2024-01-012024-12-310000095953acnt:OneCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberacnt:TubularProductsMember2023-01-012023-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2023-04-012023-06-300000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2023-07-012023-09-300000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2024-01-012024-03-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2024-07-012024-09-3000000959532023-05-012023-05-3100000959532023-08-012023-08-310000095953acnt:SpecialtyPipeAndTubeInc.Member2023-12-222023-12-220000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2024-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2023-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012024-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2023-10-012023-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2024-01-012024-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMember2023-01-012023-12-310000095953acnt:FiberglassAndSteelLiquidStorageTanksAndSeparationEquipmentMember2024-01-012024-12-310000095953acnt:FiberglassAndSteelLiquidStorageTanksAndSeparationEquipmentMember2023-01-012023-12-310000095953acnt:StainlessSteelPipeMember2024-01-012024-12-310000095953acnt:StainlessSteelPipeMember2023-01-012023-12-310000095953acnt:SpecialtyChemicalsMember2024-01-012024-12-310000095953acnt:SpecialtyChemicalsMember2023-01-012023-12-310000095953us-gaap:TransferredAtPointInTimeMember2024-01-012024-12-310000095953us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000095953us-gaap:TransferredOverTimeMember2024-01-012024-12-310000095953us-gaap:TransferredOverTimeMember2023-01-012023-12-310000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2023-06-300000095953us-gaap:DiscontinuedOperationsHeldforsaleMemberacnt:MunhallFacilityMember2023-09-300000095953us-gaap:FairValueInputsLevel2Memberacnt:MunhallFacilityMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-12-310000095953us-gaap:FairValueInputsLevel2Memberacnt:MunhallFacilityMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-12-310000095953us-gaap:LandMember2024-12-310000095953us-gaap:LandMember2023-12-310000095953us-gaap:LandImprovementsMember2024-12-310000095953us-gaap:LandImprovementsMember2023-12-310000095953us-gaap:BuildingMember2024-12-310000095953us-gaap:BuildingMember2023-12-310000095953us-gaap:MachineryAndEquipmentMember2024-12-310000095953us-gaap:MachineryAndEquipmentMember2023-12-310000095953us-gaap:ConstructionInProgressMember2024-12-310000095953us-gaap:ConstructionInProgressMember2023-12-310000095953us-gaap:CostOfSalesMember2024-01-012024-12-310000095953us-gaap:CostOfSalesMember2023-01-012023-12-310000095953us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310000095953us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000095953us-gaap:NotesPayableToBanksMember2023-06-130000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-11-062024-11-060000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMember2024-11-062024-11-060000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMember2024-01-012024-12-310000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2024-01-012024-12-310000095953acnt:TheFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-12-310000095953acnt:ABLLineOfCreditDueJanuary152025Memberus-gaap:LineOfCreditMember2024-12-310000095953acnt:ABLLineOfCreditDueJanuary152025Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310000095953acnt:ABLLineOfCreditDueJanuary152025Memberacnt:MachineryAndEquipmentSubLimitMemberus-gaap:LineOfCreditMember2024-12-310000095953acnt:ABLLineOfCreditDueJanuary152025Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310000095953us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310000095953us-gaap:RevolvingCreditFacilityMember2024-01-012024-12-310000095953us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-3100000959532024-07-012024-09-300000095953acnt:FourthAmendedAndRestatedMasterLeaseAgreementMember2024-01-012024-12-3100000959532024-04-012024-06-300000095953acnt:AmendedShareRepurchaseProgramMember2021-02-170000095953us-gaap:SubsequentEventMember2025-02-170000095953us-gaap:SubsequentEventMember2025-02-172025-02-170000095953acnt:AmendedShareRepurchaseProgramMember2024-12-310000095953us-gaap:EmployeeStockOptionMemberacnt:A2011PlanMember2024-01-012024-12-310000095953acnt:A2011PlanMemberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2011PlanMemberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-12-310000095953us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberacnt:ShareBasedPaymentArrangementTrancheFiveMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberacnt:ShareBasedPaymentArrangementTrancheFourMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembersrt:MinimumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:MaximumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:MaximumMember2024-01-012024-12-310000095953acnt:A2015StockAwardsPlanMemberacnt:StockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembersrt:MaximumMember2024-01-012024-12-310000095953acnt:StockAwardsMemberacnt:A2015StockAwardsPlanMember2024-01-012024-12-310000095953acnt:StockAwardsMember2024-01-012024-12-310000095953acnt:StockAwardsMember2023-12-310000095953acnt:StockAwardsMember2024-12-310000095953us-gaap:PerformanceSharesMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberacnt:ShareBasedPaymentArrangementTrancheFourMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberacnt:ShareBasedPaymentArrangementTrancheFiveMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberacnt:ShareBasedPaymentArrangementTrancheSixMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMemberacnt:ShareBasedPaymentArrangementTrancheSevenMember2024-01-012024-12-310000095953us-gaap:PerformanceSharesMember2023-01-012023-12-310000095953us-gaap:PerformanceSharesMember2023-12-310000095953us-gaap:PerformanceSharesMember2024-12-310000095953acnt:InducementAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310000095953acnt:InducementAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310000095953acnt:InducementAwardsMember2023-12-310000095953acnt:InducementAwardsMember2024-01-012024-12-310000095953acnt:InducementAwardsMember2024-12-310000095953acnt:NonEmployeeDirectorMemberus-gaap:RestrictedStockMember2024-01-012024-12-310000095953us-gaap:RestrictedStockMemberacnt:AuditCommitteeMemberacnt:NonEmployeeDirectorMember2024-01-012024-12-310000095953us-gaap:RestrictedStockMemberacnt:CompensationCommitteeMemberacnt:NonEmployeeDirectorMember2024-01-012024-12-310000095953us-gaap:RestrictedStockMemberacnt:NominatingAndCorporateGovernanceCommitteeMemberacnt:NonEmployeeDirectorMember2024-01-012024-12-310000095953acnt:NonEmployeeDirectorMemberus-gaap:RestrictedStockMember2024-12-310000095953us-gaap:RestrictedStockMemberacnt:NonEmployeeDirectorMembersrt:MaximumMember2024-01-012024-12-310000095953us-gaap:StateAndLocalJurisdictionMember2024-12-310000095953us-gaap:StateAndLocalJurisdictionMember2023-12-310000095953us-gaap:DomesticCountryMember2024-12-310000095953us-gaap:DomesticCountryMember2023-12-310000095953us-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2024-01-012024-12-310000095953us-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2024-01-012024-12-310000095953us-gaap:CorporateNonSegmentMember2024-01-012024-12-310000095953country:USus-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2024-01-012024-12-310000095953country:USus-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2024-01-012024-12-310000095953country:USus-gaap:CorporateNonSegmentMember2024-01-012024-12-310000095953country:US2024-01-012024-12-310000095953us-gaap:NonUsMemberus-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2024-01-012024-12-310000095953us-gaap:NonUsMemberus-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2024-01-012024-12-310000095953us-gaap:NonUsMemberus-gaap:CorporateNonSegmentMember2024-01-012024-12-310000095953us-gaap:NonUsMember2024-01-012024-12-310000095953us-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2023-01-012023-12-310000095953us-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2023-01-012023-12-310000095953us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000095953country:USus-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2023-01-012023-12-310000095953country:USus-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2023-01-012023-12-310000095953country:USus-gaap:CorporateNonSegmentMember2023-01-012023-12-310000095953country:US2023-01-012023-12-310000095953us-gaap:NonUsMemberus-gaap:OperatingSegmentsMemberacnt:SpecialtyChemicalsMember2023-01-012023-12-310000095953us-gaap:NonUsMemberus-gaap:OperatingSegmentsMemberacnt:TubularProductsMember2023-01-012023-12-310000095953us-gaap:NonUsMemberus-gaap:CorporateNonSegmentMember2023-01-012023-12-310000095953us-gaap:NonUsMember2023-01-012023-12-310000095953acnt:A401kEmployeeStockOwnershipPlanMember2024-01-012024-12-310000095953acnt:A401kEmployeeStockOwnershipPlanMember2023-01-012023-12-310000095953acnt:A401kandProfitSharingPlanMember2024-01-012024-12-310000095953acnt:A401kandProfitSharingPlanMember2023-01-012023-12-310000095953acnt:DanChemPlanMember2024-01-012024-12-310000095953acnt:DanChemPlanMember2023-01-012023-12-3100000959532024-10-012024-12-310000095953us-gaap:InventoryValuationReserveMember2023-12-310000095953us-gaap:InventoryValuationReserveMember2024-01-012024-12-310000095953us-gaap:InventoryValuationReserveMember2024-12-310000095953us-gaap:InventoryValuationReserveMember2022-12-310000095953us-gaap:InventoryValuationReserveMember2023-01-012023-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 0-19687

Ascent Industries Co.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | 57-0426694 |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| | | | |

| 20 N. Martingale Rd, | Suite 430 | | | |

| Schaumburg, | Illinois | | | 60173 |

| (Address of principal executive offices) | | | (Zip Code) |

| | (630) | 884-9181 | |

| | (Registrant's telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, par value $1.00 per share | ACNT | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

Based on the closing price as of June 30, 2024, which was the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the common stock held by non-affiliates of the registrant was $71.7 million.

The number of shares outstanding of the registrant's common stock as of February 28, 2025 was 10,078,533.

Documents Incorporated By Reference

Portions of the Proxy Statement for the 2025 annual shareholders' meeting are incorporated by reference into Part III of this Form 10-K.

Ascent Industries Co.

Form 10-K

For Period Ended December 31, 2024

Disclosure Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable federal securities laws. All statements that are not historical facts are forward-looking statements. Forward looking statements can be identified through the use of words such as "estimate," "project," "intend," "expect," "believe," "should," "anticipate," "hope," "optimistic," "plan," "outlook," "should," "could," "may" and similar expressions. The forward-looking statements are subject to certain risks and uncertainties, including without limitation those identified below, which could cause actual results to differ materially from historical results or those anticipated. Readers are cautioned not to place undue reliance on these forward-looking statements. The following factors could cause actual results to differ materially from historical results or those anticipated: adverse economic conditions, including risks relating to the impact and spread of and the government’s response to pandemics; inability to weather an economic downturn; the impact of competitive products and pricing; product demand and acceptance risks; raw material and other increased costs; raw material availability; financial stability of the Company’s customers; customer delays or difficulties in the production of products; loss of consumer or investor confidence; employee relations; ability to maintain workforce by hiring trained employees; labor efficiencies; risks associated with acquisitions; environmental issues; negative or unexpected results from tax law changes; inability to comply with covenants and ratios required by the Company’s debt financing arrangements; and other risks detailed in Item 1A, Risk Factors, in this Annual Report on Form 10-K and from time-to-time in Ascent Industries Co.'s Securities and Exchange Commission filings. Ascent Industries Co. assumes no obligation to update any forward-looking information included in this Annual Report on Form 10-K.

PART I

Item 1. Business

Ascent Industries Co. is a diverse industrials company focused on the production of specialty chemicals and stainless steel pipe and tube. Ascent Industries Co. was incorporated in 1958 as the successor to a chemical manufacturing business founded in 1945 known as Blackman Uhler Industries Inc. The Company's executive office is located at 20 N. Martingale Rd, Suite 430, Schaumburg, Illinois 60173. Unless indicated otherwise, the terms "Ascent", "Company," "we" "us," and "our" refer to Ascent Industries Co. and its consolidated subsidiaries.

The Company's business is divided into two reportable operating segments, Specialty Chemicals and Tubular Products. The Specialty Chemicals segment produces critical ingredients and process aids for the oil & gas, household, industrial and institutional ("HII"), personal care, coatings, adhesives, sealants and elastomers (CASE), pulp and paper, textile, automotive, agricultural, water treatment, construction and other industries.

The Tubular Products segment serves markets through pipe and tube production and customers in the appliance, architectural, automotive and commercial transportation, brewery, chemical, petrochemical, pulp and paper, mining, power generation (including nuclear), water and waste-water treatment, liquid natural gas ("LNG"), food processing, pharmaceutical, oil and gas and other industries.

General

Specialty Chemicals – Specialty Chemicals consists of the Company's three production facilities located in Cleveland, Tennessee, Fountain Inn, South Carolina and Danville, Virginia.

The segment produces specialty formulations and intermediates for use in a wide variety of applications and industries with primary product lines focusing on the production of surfactants, defoamers, lubricating agents, flame retardants and chemical intermediates. End users include companies that use our products as raw materials or process aids in the manufacturing of products such as cleaners, coatings, water treatment chemicals, metal working fluids, textiles, oilfield production chemicals, agrochemical formulations and other applications. The segment offers products that are petroleum derived, as well as bio-based alternatives.

Beyond its multi-functional product portfolio, the segment also provides an array of custom manufacturing services ranging from product development to commercial scale production. The segment operates both customer-specific, dedicated plants as well as multi-purpose plants with broad capabilities ranging from blending to complex, multi-step chemical reactions. The segment has long-term relationships with a number of leading chemical companies that outsource their requirements to our production facilities allowing those customers to accelerate new product commercialization efforts while avoiding the CAPEX requirement to modify and/or build manufacturing plants to support their growth.

The majority of raw materials used by the segment are available from numerous independent suppliers and approximately 34% of total raw material purchases are from its top 5 suppliers. While some raw material needs are met by an individual supplier or only a few suppliers, the Company anticipates no difficulties in fulfilling its raw material requirements.

Tubular Products – Tubular Products is comprised of BRISMET, located in Bristol, Tennessee and ASTI, located in Troutman and Statesville, North Carolina.

BRISMET manufactures welded pipe and tube, primarily from stainless steel, duplex, and nickel alloys. Pipe is produced in sizes from 1/2 inch nominal outside diameter to 144 inches outside diameter and wall thickness from 1/16 inch up to 1 and 3/8 inches. Pipe smaller than 18 inches in outside diameter is made on equipment that forms and welds the pipe in a continuous process. Pipe larger than 18 inches in outside diameter is formed on presses or rolls and welded using a batch welding technique. Pipe is normally produced in standard 20-foot lengths, although BRISMET also has capabilities in the production of pipe without circumferential welds in lengths up to 60 feet. BRISMET is one of the few domestic producers capable of making pipe in 48-foot lengths up to 36 inches in diameter.

ASTI is a leading manufacturer of high-end ornamental stainless steel tube, supplying the automotive, commercial transportation, marine, food services, construction, furniture, healthcare, and other industries. ASTI's facilities are located in Troutman and Statesville, North Carolina. ASTI incorporates proprietary finishing capabilities and the highest levels of customer service and technical support to provide the customer with the highest quality ornamental products available in the market. ASTI's product range includes a variety of shapes, including rounds, squares, rectangles and ellipticals up to 5 inches in outside diameter.

The majority of raw materials used by the segment are available from numerous independent suppliers and approximately 92% of total raw material purchases are from its top 5 suppliers. The Company does not anticipate that the loss of a supplier would have a materially adverse effect on the Company as raw materials are readily available from a number of different sources, and the Company anticipates no difficulties in fulfilling its requirements.

See Note 13 to the consolidated financial statements, which are included in Item 8 of this Form 10-K, for financial information about the Company's segments. Sales

Specialty Chemicals – Specialty chemicals are sold directly into various market by inside sales, outside sales and distribution partners. The Specialty Chemicals segment has one customer that accounted for approximately 12% of the segment's revenues for 2024 and 24% of the segment's revenues for 2023.

Tubular Products – The Tubular Products segment utilizes a sales force comprised of inside sales employees, outside sales employees and independent manufacturers' representatives. The segment's products are sold to various distributors, OEM and end use customers. The Tubular Products segment has one customer that accounted for approximately 18% and 17% of the segment's revenues for 2024 and 2023.

Mergers, Acquisitions and Dispositions

The Company is committed to a long-term strategy of reinvesting capital in our current business segments to foster organic growth and completing acquisitions that expand our manufacturing capabilities, product offerings and geographic footprint. The Company may, from time-to-time, divest or close businesses in an effort to better align capital investment within its core operations, increase operational efficiencies and improve profitability.

During the second quarter of 2023, the Company's Board of Directors made the decision to cease operations at BRISMET's Munhall facility. The Company ceased operations at this facility effective August 31, 2023. The Munhall facility has been classified as a discontinued operation for all periods presented and was formerly a component within the Tubular Products segment.

On December 22, 2023, the Company and its wholly-owned subsidiary Specialty Pipe & Tube, Inc. (“SPT”) entered into an Asset Purchase Agreement pursuant to which Ascent and SPT sold substantially all of the assets primarily related to SPT to Specialty Pipe & Tube Operations, LLC, a Delaware limited liability company. The consideration for the transaction was approximately $55 million of cash proceeds subject to certain closing adjustments. The transaction closed on December 22, 2023. SPT has been classified as a discontinued operation for all periods presented and was formerly a reporting unit within the Tubular Products segment.

Environmental

Environmental expenditures that relate to an existing condition caused by past operations and do not contribute to future revenue generation are expensed. Liabilities are recorded when environmental assessments and/or cleanups are probable and the costs of these assessments and/or cleanups can be reasonably estimated. Changes to laws and environmental issues, including climate change, are made or proposed with some frequency and some of the proposals, if adopted, might directly or indirectly result in a material reduction in the operating results of one or more of our operating units. We are presently unable to quantify this risk.

Seasonality

The Company's businesses and products are generally not subject to seasonal impacts that result in significant variations in revenues from one quarter to another.

Backlogs

The backlog of open orders for the Specialty Chemicals segment were $4.6 million and $5.0 million at the end of 2024 and 2023, respectively. The backlog of open orders for the Tubular Products segment were $26.7 million and $22.5 million at the end of 2024 and 2023, respectively. Our backlog may not be indicative of actual sales and, therefore, should not be used as a direct measure of future revenue.

Human Capital

Our workforce is critical to our success. As of December 31, 2024, the Company had 452 employees, 451 of which were full-time employees. The Company considers relations with employees to be strong. The number of employees of the Company represented by unions is 181, or 40% of the Company's employees. They are represented by locals affiliated with the United Steelworkers (the "USW") and the United Food and Commercial Workers (the "UFCW"). Collective bargaining agreements with the USW was ratified in October and with the UFCW in December. Collective bargaining agreements for the USW and UFCW locals expire at various dates in 2027.

Our voluntary turnover rate in 2024 was approximately 22%. We monitor employee turnover rates by plant and the Company as a whole. The average employee tenure is approximately 11 years.

People and Culture

We have a shared commitment within our organization to foster an inclusive and respectful culture that encourages innovation, teamwork, and collaboration to eliminate barriers to progress, and continuously drive improvements across the enterprise. Our business results depend on our ability to identify, attract, recruit, develop and retain talent. Factors that may affect our ability to attract and retain employees include competition from other employers, availability of qualified individuals and opportunities for employee growth.

Safety and Compliance

Our safety, compliance, and operational reliability mandates are not at odds with our objectives to maintain the lowest cost and most efficient operations. We demand functional excellence across the entire organization, and our goal is to eliminate all injuries and incidents by providing comprehensive initial and ongoing safety training, and clear communication of safety policies and procedures.

Employees make a daily commitment to and take an active role in owning health and safety, ensuring safe working conditions for everyone. To support this, we provide employees with the necessary personal protective equipment to perform their job responsibilities safely and confidently.

Total Rewards

We invest in our workforce by offering a total rewards package including competitive compensation and health, wellness, retirement, and educational benefits.

The Employee Assistance Program (EAP) is a valuable resource for employees, providing access to confidential mental health support, as well as legal and financial assistance from qualified professionals. These services are designed to help address personal and work-related challenges that could impact their well-being or job performance.

Diversity, Equity and Inclusion

From the boardroom to the frontline, we are dedicated to building incredible teams with diverse backgrounds, perspectives, and experiences to drive innovation, outperform the competition, and strengthen our ability to attract and retain top talent.

Available information

The Company electronically files with the Securities and Exchange Commission ("SEC") its annual reports on Form 10-K, its quarterly reports on Form 10-Q, its periodic reports on Form 8-K, amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 (the "1934 Act"), and proxy materials pursuant to Section 14 of the 1934 Act. The SEC maintains a site on the internet at www.sec.gov which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Company also makes its filings available, free of charge, through its website at www.ascentco.com as soon as reasonably practical after the electronic filing of such material with the SEC. The information on the Company's website is not incorporated into this Annual Report on Form 10-K or any other filing the Company makes with the SEC.

Item 1A. Risk Factors

There are inherent risks and uncertainties associated with our business that could adversely affect our operating performance and financial condition. Set forth below are descriptions of those risks and uncertainties that we believe to be material, but the risks and uncertainties described are not the only risks and uncertainties that could affect our business. Reference should be made to "Forward-Looking Statements" above, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 and our consolidated financial statements and related notes in Item 8 below. Industry and Segment Risks

The demand for our products may be cyclical, creating uncertainty regarding future profitability.

Various changes in general economic conditions affect (or disproportionately affect) the industries in which our customers operate. These changes include decreases in the rate of consumption or use of our customers’ products due to economic downturns. Other factors causing fluctuation in our customers’ positions are changes in market demand, capital spending, tariff induced price changes, lower overall pricing due to domestic and international overcapacity, lower priced imports, currency fluctuations, and increases in use or decreases in prices of substitute materials. As a result of these factors, our profitability has been and may in the future be subject to significant fluctuation.

Domestic competition and excess manufacturing capacity could force lower product pricing and may have an adverse effect on our revenues and profitability.

From time-to-time, intense competition and excess manufacturing capacity in the commodity stainless steel industry have resulted in reduced selling prices, excluding raw material surcharges, for many of our stainless steel products sold by the Tubular Products segment. In such situations, in order to maintain market share, we would have to lower our prices to match the competition. These factors have had and may in the future have a material adverse impact on our revenues, operating results and financial condition.

Overcapacity and overproduction by foreign producers in our industry could result in lower domestic prices, which would adversely affect our sales, margins and profitability.

Our business is susceptible to the import of products from other countries, particularly in our Tubular Products segment. Import levels of various products are affected by, among other things, overall world-wide demand, lower cost of production in other countries, the trade practices of foreign governments, government subsidies to foreign producers, the strengthening of the U.S. dollar, and government-imposed trade restrictions in the United States, such as imposed in 2018 under Section 232 of the Trade Expansion Act of 1962 (section 232 tariffs). Although imports from certain countries have been curtailed by anti-dumping duties, imported products from other countries could significantly reduce prices. Increased imports of certain products, whether illegal dumping or legal imports, could reduce demand for our products or cause us to lower our prices to maintain demand for our products, which could adversely affect our business, financial position, or results of operations.

A substantial portion of our sales in the Specialty Chemicals segment is dependent upon a limited number of customers. The top 15 customers in the Specialty Chemicals segment accounted for approximately 53% of revenues for the year ended December 31, 2024 and 72% for the year ended December 31, 2023 with the top customer accounting for approximately 12% of revenues for 2024 and 24% of revenues for 2023. An adverse change in, or termination of, the relationship with one or more of our top customers could materially and adversely affect our results of operations.

Operations and Supply Chain Risks

Any interruption in our ability to procure raw materials, or significant volatility in the price of raw materials, could adversely affect our business and results of operations.

While the Company believes that raw materials for both segments are (in general) readily available from numerous sources, some of our raw material needs are met by a sole supplier or only a few suppliers and many such relationships are terminable by either party. If any key supplier that we rely on for raw materials ceases or limits production, we may incur significant additional costs, including capital costs, in order to find alternate, reliable raw material suppliers. We may also experience significant production delays while locating new supply sources, which could result in our failure to timely deliver products to our customers.

In addition, purchase prices and availability of these critical raw materials are subject to volatility which may negatively impact financial performance due to decreased sales volume and /or decreased profitability. At any given time, we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, at acceptable prices and other terms, or at all. If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. As well, though we attempt to pass changes in the prices of raw materials along to our customers, we cannot always do so due to market

competition, among other reasons, or price increases to customers may occur on a delayed basis. In addition, although raw materials may remain available, volatility in raw material pricing may negatively impact customer ordering patterns.

The loss of or reduced supply from one or more key suppliers in either segment, or any other material change in our current supply channels, could materially affect the Company’s ability to meet the demand for its products and adversely affect the Company’s business and results of operations. In addition, any limitations (or delay) on our ability to pass through any price increases in raw materials could have an adverse effect on our profitability.

Loss of a key supplier or lack of product availability from suppliers could adversely affect our sales and earnings.

Our Specialty Chemicals segment depends on maintaining an immediately available supply of various products to meet customer demand. Many of our relationships with key product suppliers are longstanding but are terminable by either party. The loss of key supplier authorizations, or a substantial decrease in the availability of their products, could put us at a competitive disadvantage and have a material adverse effect on our business or results of operations. Supply interruptions could arise from raw material shortages, inadequate manufacturing capacity or utilization to meet demand, financial difficulties, tariffs and other regulations affecting trade between the U.S. and other countries, labor disputes, weather conditions affecting suppliers' production, transportation disruptions or other reasons beyond our control.

Our operating results are sensitive to the availability and cost of energy and freight, which are important in the manufacture and transport of our products.

Our operating costs increase when energy or freight costs rise. During periods of increasing energy and freight costs, we might not be able to fully recover our operating cost increases through price increases without reducing demand for our products. In addition, we are dependent on third party freight carriers to transport many of our products, all of which are dependent on fuel to transport our products. The prices for and availability of electricity, natural gas, oil, diesel fuel and other energy resources are subject to volatile market conditions. These market conditions often are affected by political and economic factors beyond our control. Disruptions in the supply of energy resources could temporarily impair our ability to manufacture products for customers and may result in the decline of freight carrier capacity in our geographic markets, or make freight carriers unavailable or more expensive. Further, increases in energy or freight costs that cannot be passed on to customers, or adverse changes in our costs relative to energy and freight costs paid by competitors, has adversely affected, and may continue to adversely affect, our profitability.

We are dependent upon the continued operation of our production facilities, which are subject to a number of hazards.

Our manufacturing processes are dependent upon critical pieces of equipment. This equipment may, on occasion, be out of service as a result of unanticipated failures. We have experienced, and may in the future experience, material plant shutdowns or periods of reduced production as a result of such equipment failures. In addition, our production facilities are subject to hazards associated with the manufacture, handling, storage and transportation of materials and products, including leaks and ruptures, explosions, fires, inclement weather and natural disasters, unscheduled downtime and environmental hazards. As well, some of our production capabilities are highly specialized, which limits our ability to shift production to another facility. The occurrence of incidents in the future may result in production delays, failure to timely fulfill customer orders or otherwise have a material adverse effect on our business, financial condition or results of operations.

Our operations present significant risk of injury and other liabilities.

The industrial activities conducted at our facilities present significant risk of serious injury or even death to our employees or other visitors to our operations, notwithstanding our safety precautions, including our material compliance with federal, state and local employee health and safety regulations, and we may be unable to avoid material liabilities for any such incidents. We maintain various forms of insurance, including insurance covering claims related to our properties and risks associated with our operations, but there can be no assurance that the insurance coverage will be applicable and adequate, or will continue to be available on terms acceptable to us, or at all, which could result in material liability to us for any injuries or deaths.

We may not be able to make the operational and product changes necessary to continue to be an effective competitor.

We must continue to enhance our existing products, develop and manufacture new products with improved capabilities, and accurately predict future customer needs and preferences in order to continue to be an effective competitor in our business markets. In addition, we must anticipate and respond to changes in industry standards, including government regulations, that affect our products and the needs of our customers. The success of any new or enhanced products will depend on a number of factors, such as technological innovations, increased manufacturing and material costs, customer acceptance, and the performance and quality of the new or enhanced products. We cannot predict the level of market acceptance or the amount of market share these new or enhanced products may achieve, and we may experience delays or problems in the introduction of new or enhanced products. Any failure in our ability to effectively and efficiently launch new or enhanced products could materially and adversely affect our business, financial condition or results of operation.

Government Regulation Risks

Our operations expose us to the risk of environmental, health and safety liabilities and obligations, which could have a material adverse effect on our financial condition or results of operations.

We are subject to numerous federal, state and local environmental protection and health and safety laws governing, among other things:

•the generation, use, storage, treatment, transportation, disposal and management of hazardous substances and wastes;

•emissions or discharges of pollutants or other substances into the environment;

•investigation and remediation of, and damages resulting from, releases of hazardous substances; and

•the health and safety of our employees.

Under certain environmental laws, we can be held strictly liable for hazardous substance contamination of any real property we have ever owned, operated or used as a disposal site. We are also required to maintain various environmental permits and licenses, many of which require periodic modification and renewal. Our operations entail the risk of violations of those laws and regulations, and we may not have been in the past or will be at all times in the future, in compliance with all of these requirements. In addition, these requirements and their enforcement may become more stringent in the future.

We have incurred, and expect to continue to incur, additional capital expenditures (in addition to ordinary or other costs and capital expenditures) to comply with applicable environmental laws. Our failure to comply with applicable environmental laws and permit requirements could result in civil and/or criminal fines or penalties, enforcement actions, and regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, such as the installation of pollution control equipment, which could have a material adverse effect on our financial condition, results of operations or cash flows.

We are currently, and may in the future be, required to investigate, remediate or otherwise address contamination at our current or former facilities. Many of our current and former facilities have a history of industrial usage for which additional investigation, remediation or other obligations could arise in the future and that could materially adversely affect our business, financial condition, results of operations or cash flows. In addition, we are currently, and could in the future be, responsible for costs to address contamination identified at any real property we used as a disposal site.

Although we cannot predict the ultimate cost of compliance with any of the requirements described above, the costs could be material. Non-compliance could subject us to material liabilities, such as government fines, third-party lawsuits or the suspension of non-compliant operations. We also may be required to make significant site or operational modifications at substantial cost. Future developments also could restrict or eliminate the use of or require us to make modifications to our products, which could have a significant negative impact on our results of operations. At any given time, we are (or may be) involved in claims, litigation, administrative proceedings and investigations of various types involving potential environmental liabilities, including cleanup costs associated with hazardous waste disposal sites at our facilities. We cannot assure you that the resolution of these environmental matters will not have a material adverse effect on our results of operations. The occurrence and ultimate costs and timing of environmental liabilities are difficult to predict. Liability under environmental laws relating to contaminated sites can be imposed retroactively and on a joint and several basis. We could incur significant costs, including cleanup costs, civil or criminal fines and sanctions and third-party claims, as a result of past or future violations of, or liabilities under, environmental laws.

We could be subject to third party claims for property damage, personal injury, nuisance or otherwise as a result of violations of, or liabilities under, environmental, health or safety laws in connection with releases of hazardous or other materials at any current or former facility. We could also be subject to environmental indemnification claims in connection with assets and businesses that we have acquired or divested.

There can be no assurance that any future capital and operating expenditures to maintain compliance with environmental laws, as well as costs incurred to address contamination or environmental claims, will not exceed any current estimates or adversely affect our financial condition and results of operations. In addition, any unanticipated liabilities or obligations arising, for example, out of discovery of previously unknown conditions or changes in laws or regulations, could have an adverse effect on our business, financial condition or results of operations.

Federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing, as well as governmental reviews of such activities could result in delays or eliminate new wells from being started, thus reducing the demand for our pressure vessels and heavy walled pipe and tube.

Hydraulic fracturing (“fracking”) is currently an essential and common practice to extract oil from dense subsurface rock formations, and this lower cost extraction method is a significant driving force behind the surge of oil exploration and drilling in several locations in the United States. However, the Environmental Protection Agency, U.S. Congress and state legislatures have considered adopting legislation to provide additional regulations and disclosures surrounding this process. In the event that new legal restrictions surrounding the fracking process are adopted in the areas in which our customers operate, we may experience a decrease in revenue, which could have an adverse impact on our results of operations, including profitability.

Regulations related to “conflict minerals” may force us to incur additional expenses, may make our supply chain more complex and may result in damage to our reputation with customers.

On August 22, 2012, under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), the SEC adopted new requirements for companies that use certain minerals and metals, known as conflict minerals, in their products, whether or not these products are manufactured by third parties. These regulations require companies to conduct annual due diligence and disclose whether or not such minerals originate from the Democratic Republic of Congo and adjoining countries. Tungsten and tantalum are designated as conflict minerals under the Dodd-Frank Act. These metals are used to varying degrees in our welding materials and are also present in specialty alloy products. These new requirements could adversely affect the sourcing, availability and pricing of minerals used in our products. In addition, we could incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products. Since our supply chain is complex, we may not be able to sufficiently verify the origins for these minerals and metals used in our products through the due diligence procedures that we implement, which may harm our reputation. In such event, we may also face difficulties in satisfying customers who could require that all of the components of our products are conflict mineral-free.

Human Capital Risks

Certain of our employees are covered by collective bargaining agreements, and the failure to renew these agreements could result in labor disruptions and increased labor costs.

As of December 31, 2024, we had 181 employees represented by unions which is approximately 40% of the aggregate number of Company employees. These employees are represented by local unions affiliated with the USW and the UFCW. Collective bargaining contracts for the USW and UFCW locals expire at various dates in 2027. Although we believe that our present labor relations are strong, our failure to renew these agreements on reasonable terms as the current agreements expire could result in labor disruptions and increased labor costs, which could adversely affect our financial performance.

Failure to attract and retain key personnel may adversely impact our strategy and execution and financial results.

Our ability to successfully operate, grow our business and implement our business strategies is largely dependent on the efforts, abilities and services of our employees. The loss of employees or our inability to attract, train and retain additional personnel could reduce the competitiveness of our business or otherwise impair our operations. Our future success will also depend, in part, on our ability to attract and retain qualified personnel who have experience in the application of our products and are knowledgeable about our business, markets and products.

We also face risks associated with the actions taken in response to COVID-19, including those associated with workforce reductions, and may experience difficulties with hiring additional employees or replacing employees following the pandemic, which may be exacerbated by the tight labor market. In addition, COVID-19 has, and may again result in quarantines of our personnel or an inability to access facilities, which could adversely affect our operations.

Financial and Strategic Risks

There are risks associated with our outstanding and future indebtedness.

As of December 31, 2024, we had no outstanding indebtedness, however, we may incur additional indebtedness in the future. We have customary restrictive covenants in our current debt agreements, which may limit our flexibility to operate our business. Failure to comply with this covenant could result in an event of default that, if not cured or waived, could have a material adverse effect on our business, results of operations and financial condition. Additionally, our ability to pay interest and repay the principal for our indebtedness is dependent upon our ability to manage our business operations, generate sufficient cash flows to service such debt and the other factors discussed in this section. There can be no assurance that we will be able to manage any of these risks successfully.

We may need new or additional financing in the future to expand our business, and our inability to obtain capital on satisfactory terms or at all may have an adverse impact on our operations and our financial results.

If we are unable to access capital on satisfactory terms and conditions, we may not be able to expand our business or meet our payment requirements under the Credit Agreement. Our ability to obtain new or additional financing will depend on a variety of factors, many of which are beyond our control. We may not be able to obtain new or additional financing because we may have substantial debt, our current receivable and inventory balances do not support additional debt availability or because we may not have sufficient cash flows to service or repay our existing or future debt. In addition, depending on market conditions and our financial performance, equity financing may not be available on satisfactory terms or at all. If we are unable to access capital on satisfactory terms and conditions, this could have an adverse impact on our operations and our financial results.

Impairment in the carrying value of our fixed assets or intangible assets could adversely affect our financial condition and consolidated results of operations.

We evaluate the useful lives of our fixed assets and intangible assets to determine if they are definite or indefinite-lived. Reaching a determination on useful life requires significant judgments and assumptions regarding the lease term, future effects of obsolescence, demand, competition, other economic factors (such as the stability of the industry, legislative action that results in an uncertain or changing regulatory environment, and expected changes in distribution channels), the level of required maintenance expenditures and the expected lives of other related groups of assets. We cannot accurately predict the amount and timing of any impairment of assets. Should the value of goodwill, fixed assets or intangible assets become impaired, there could be an adverse effect on our financial condition and consolidated results of operations.

From time to time, we engage in acquisitions and divestitures and may encounter difficulties in integrating and separating these businesses and therefore we may not realize the anticipated benefits.

We may seek growth opportunities through strategic acquisitions as well as evaluate our portfolio for potential divestitures to optimize our business footprint and portfolio. The success of these transactions will depend on our ability to integrate or separate, as applicable, assets and personnel in these transactions and to cooperate with our strategic partners. We may encounter difficulties in integrating acquisitions with our operations as well as separating divested businesses, and in managing strategic investments. Additionally, we may seek opportunities to monetize non-core and excess assets. These opportunities may not materialize or generate the financial benefits expected. Furthermore, we may not realize the degree, or timing, of benefits we anticipate when we first enter into a transaction.

Intellectual Property Risks

Our inability to sufficiently or completely protect our intellectual property rights could adversely affect our business, prospects, financial condition and results of operations.

Our ability to compete effectively in both of our business segments will depend on our ability to maintain the proprietary nature of the intellectual property used in our businesses. These intellectual property rights consist largely of trade-secrets and know-how. We rely on a combination of trade secrets and non-disclosure and other contractual agreements and technical measures to protect our rights in our intellectual property. We also depend upon confidentiality agreements with our officers, employees, consultants and subcontractors, as well as collaborative partners, to maintain the proprietary nature of our intellectual property. These measures may not afford us sufficient or complete protection, and others may independently develop intellectual property similar to ours, otherwise avoid our confidentiality agreements or produce technology that would adversely affect our business, financial condition or results of operations.

General Risk Factors

We encounter significant competition in all areas of our businesses and may be unable to compete effectively, which could result in reduced profitability and loss of market share.

We actively compete with companies producing the same or similar products and, in some instances, with companies producing different products designed for the same uses. We encounter competition from both domestic and foreign sources in price, delivery, service, performance, product innovation, and product recognition and quality, depending on the product involved. For some of our products, our competitors are larger and have greater financial resources than we do. As a result, these competitors may be better able to withstand a change in conditions within the industries in which we operate, a change in the prices of raw materials or a change in the economy as a whole. Our competitors can be expected to continue to develop and introduce new and enhanced products and more efficient production capabilities, which could cause a decline in market acceptance of our products. Current and future consolidation among our competitors and customers also may cause a loss of market share as well as put downward pressure on pricing. Our competitors could cause a reduction in the prices for some of

our products as a result of intensified price competition. Competitive pressures can also result in the loss of major customers. If we cannot compete successfully, our business, financial condition and results of operation could be adversely affected.

We have identified and may continue to discover material weaknesses in our internal controls over financial reporting, which may adversely affect investor confidence in the accuracy and completeness of our financial reports and consequently the market price of our securities.

We have identified and may continue to discover material weaknesses in our internal controls over financial reporting, which may adversely affect investor confidence in the accuracy and completeness of our financial reports and consequently the market price of our securities. As a public company, we are required to design and maintain proper and effective internal controls over financial reporting and to report any material weaknesses in such internal controls. Section 404 of the Sarbanes-Oxley Act of 2002 requires that we evaluate and determine the effectiveness of our internal controls over financial reporting and provide a management report on the internal controls over financial reporting, which must be attested to by our independent registered public accounting firm. We have identified material weaknesses in our internal controls over financial reporting, and may not detect errors on a timely basis and our financial statements may be materially misstated.

The process of compiling the system and processing documentation necessary to perform the evaluation needed to comply with Section 404 is challenging and costly. In the future, we may not be able to complete our evaluation, testing, and any required remediation in a timely fashion. If we continue to identify material weaknesses in our internal controls over financial reporting, if we are unable to comply with the requirements of Section 404 in a timely manner, if we continue to be unable to assert that our internal controls over financial reporting are effective, or if our independent registered public accounting firm is unable to express an unqualified opinion as to the effectiveness of our internal controls over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our securities could be negatively affected, and we could become subject to investigations by the Financial Industry Regulatory Authority, the SEC, or other regulatory authorities, which could require additional financial and management resources.

Cybersecurity risks and cyber incidents could adversely affect our business and disrupt operations.

Cyber incidents can result from deliberate attacks or unintentional events. These incidents can include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. The result of these incidents could include, but are not limited to, disrupted operations, misstated financial data, liability for stolen assets or information, increased cyber security protection costs, litigation and reputational damage adversely affecting customer or investor confidence. We have taken steps to address these concerns and have implemented internal control and security measures to protect our systems and networks from security breaches; however, there can be no assurance that a system or network failure, or security breach, will not impact our business, results of operations and financial condition.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cybersecurity

Cybersecurity Governance

The Company's Board of Directors (the "Board") recognizes the critical nature of managing risks associated with cybersecurity threats and is responsible for oversight of the Company's information security programs, including risk of cybersecurity threats. The Audit Committee, which supports the Board of Directors in the oversight of the Company's information security program, oversees managements design, implementation and enforcement of our cybersecurity risk management program. The Audit Committee is composed of Board members with diverse expertise, including technology, financial and risk management experience.

The Audit Committee and full Board receive periodic briefings from management on our cyber risk management programs. The Company also has an internal disclosure committee made up of members of management to assist in fulfilling its obligations to maintain disclosure controls and procedures and to coordinate and oversee the process of preparing our periodic securities filings with the SEC. The disclosure committee meets on a quarterly basis to ensure they are appropriately informed of any matters that should be considered in advance of applicable public filings, including cybersecurity and data privacy matters, and to address the proper handling and escalation of information to the Board and Audit Committee as needed.

Cybersecurity Risk Management and Strategy

We have developed and implemented a cybersecurity risk management program intended to protect the confidentiality, integrity and availability of our critical systems and infrastructure. This program includes the implementation of a set of system, network and application level controls to protect our data and systems. These controls are monitored for cybersecurity risks and incidents by internal staff and our third-party service provider and are updated as necessary to protect the Company.

Our overall cybersecurity program includes: security tools, technologies and processes and control reviews; cybersecurity awareness training exercises for our employees, including phishing simulations to raise internal awareness of manipulated electronic communications; and an annual review of System and Organization reports for critical third-party service providers.

We have not identified known risks, including as a result of prior cybersecurity incidents, that have materially affected us, including our operations, business strategy, results of operations or financial condition. We face certain ongoing risks from cybersecurity threats that, if realized, are reasonably likely to materially affect us, including our operations, business strategy, results of operations or financial condition. See Item 1A Risk Factors - Cybersecurity risks and cyber incidents could adversely affect our business and disrupt operations.

Item 2. Properties

The Company operates the major plants and facilities listed below, all of which are in adequate condition for their current usage and are able to accommodate our capacity needs for the immediate future. Substantially all of the value of the Company's leased plants and facilities relate to the Master Lease with Store Master Funding XII, LLC (“Store”), an affiliate of Store Capital Corporation ("Store Capital"), that was entered into in 2016 and since amended, with the latest amendment occurring in 2024; see Note 7 to the consolidated financial statements included in Item 8 of this Form 10-K for additional information on the Company's leases. The following table sets forth certain information concerning our principal properties including which segment's products are supported out of each location:

| | | | | | | | | | | | | | | | | | | | |

| | | | | Segment |

| Location | Principal Operations |

Square

Feet | Land

Acres | Leased or Owned | Tubular

Products | Specialty Chemicals |

| Bristol, TN | Manufacturing stainless steel pipe | 275,000 | 73.1 | Leased | ✔ | |

| Fountain Inn, SC | Chemical manufacturing and warehousing | 136,834 | 16.9 | Leased | | ✔ |

| Danville, VA | Chemical manufacturing and warehousing | 135,811 | 55.3 | Owned | | ✔ |

| Cleveland, TN | Chemical manufacturing and warehousing | 122,800 | 18.8 | Leased | | ✔ |

| Troutman, NC | Manufacturing ornamental stainless steel tube | 106,657 | 26.5 | Leased | ✔ | |

| Statesville, NC | Manufacturing ornamental stainless steel tube | 83,000 | 26.8 | Leased | ✔ | |

The following table sets forth certain information concerning other properties under the Master Lease in which the Company is the responsible party:

| | | | | | | | | | | | | | |

| Location | Principal Operations |

Square

Feet | Land

Acres | Leased or Owned |

Munhall, PA1 | Manufacturing stainless steel pipe | 284,000 | 20.0 | Leased |

Andrews, TX2 | Liquid storage solutions and separation equipment | 122,662 | 19.6 | Leased |

Houston, TX3 | Cutting facility and storage yard for heavy walled pipe | 29,821 | 10.0 | Leased |

Mineral Ridge, OH3 | Cutting facility and storage yard for heavy walled pipe | 12,000 | 12.0 | Leased |

1Company ceased operations as of August 31, 2023

2Company currently subleases facility to a third party

3Company sold substantially all assets of SPT as of December 22, 2023 and currently subleases facility to a third party

In addition to the facilities listed above, the Company leases from a third party the Company's executive office located in Schaumburg, Illinois.

Item 3. Legal Proceedings

For a discussion of legal proceedings, see Note 15 to the Consolidated Financial Statements included in Item 8 of this Form 10-K. Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

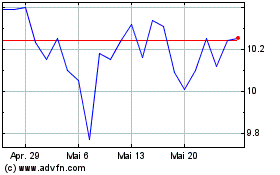

The Company had 312 common shareholders of record at February 28, 2025. The Company's common stock trades on the NASDAQ Global Market under the trading symbol ACNT. The Company's credit agreement restricts the payment of dividends indirectly through a minimum fixed charge coverage covenant. No dividends were declared or paid in 2024 or 2023.

Stock Performance Graph

The Company is a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and is not required to provide this information.

Issuer Purchases of Equity Securities

The following table sets forth information with respect to purchase of the Company's common stock made during the fourth quarter of 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| Period | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Programs1 | | Number of Shares that May Yet Be Purchased under the Program1 |

| | | | | | | |

| October 1, 2024 - October 31, 2024 | — | | | $ | — | | | — | | | 462,685 | |

| November 1, 2024 - November 30, 2024 | 4,088 | | | 10.17 | | | 4,088 | | | 458,597 | |

| December 1, 2024 - December 31, 2024 | 22,989 | | | 11.16 | | | 22,989 | | | 435,608 | |

| As of December 31, 2024 | 27,077 | | | $ | 11.01 | | | 27,077 | | | 435,608 | |

1Pursuant to the 790,383 share stock repurchase program re-authorized by the Board of Directors in December 2022. On February 17, 2025, the Board of Directors authorized a new share repurchase program allowing for repurchase of up to 1.0 million shares of the Company's outstanding common stock over 24 months. See Note 9 for additional information. Item 6. Reserved

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

This discussion and analysis summarizes the significant factors affecting our consolidated operating results, financial condition, liquidity, and capital resources during the fiscal years ended December 31, 2024 and 2023. Unless otherwise noted, all references herein for the years 2024 and 2023 represent the fiscal years ended December 31, 2024 and 2023, respectively. We intend for this discussion to provide the reader with information that will assist in understanding our financial statements, the changes in certain key items in those financial statements from year to year, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our financial statements. This discussion should be read in conjunction with our consolidated financial statements and notes to the consolidated financial statements included in this Annual Report that have been prepared in accordance with accounting principles generally accepted in the United States of America. This discussion and analysis is presented in five sections:

•Executive Overview

•Results of Operations and Non-GAAP Financial Measures

•Liquidity and Capital Resources

•Material Cash Requirements from Contractual and Other Obligations

•Critical Accounting Policies and Estimates

Executive Overview

Ascent Industries Co. is a diverse industrials company focused on the production of specialty chemicals and stainless steel pipe and tube. Ascent Industries Co. was incorporated in 1958 as the successor to a chemical manufacturing business founded in 1945 known as Blackman Uhler Industries Inc.

The Specialty Chemicals segment produces critical ingredients and process aids for the oil & gas, household, industrial and institutional ("HII"), personal care, coatings, adhesives, sealants and elastomers (CASE), pulp and paper, textile, automotive, agricultural, water treatment, construction and other industries. The Tubular Products segment serves markets through pipe and tube production and customers in the appliance, architectural, automotive and commercial transportation, brewery, chemical, petrochemical, pulp and paper, mining, power generation (including nuclear), water and waste-water treatment, liquid natural gas ("LNG"), food processing, pharmaceutical, oil and gas and other industries.

Fiscal 2024 was a year of stabilization, recapitalization of talent and aggressive self-help to establish a foundation for organic and inorganic growth. The team rallied to overcome soft market conditions across both segments, delivering positive bottom line improvements while establishing a more predictable, reliable and profitable operating model. We ended the year with no outstanding debt, $16.1 million of cash and cash equivalents as well as $47.4 million of remaining available capacity on our revolving line of credit, allowing flexibility to continue to execute our strategy and future growth opportunities.

Munhall Closure

During the second quarter of 2023, the Board of Directors of the Company made the decision to permanently cease operations at Munhall effective on or around August 31, 2023. This strategic decision is part of the Company’s ongoing efforts to consolidate manufacturing to drive an increased focus on its core operations and to improve profitability while driving operational efficiencies. Munhall results are included within discontinued operations in all periods presented.

Divestiture of Specialty Pipe & Tube, Inc.

On December 22, 2023, the Company and its wholly-owned subsidiary Specialty Pipe & Tube, Inc. (“SPT”) entered into an Asset Purchase Agreement pursuant to which Ascent and SPT sold substantially all of the assets primarily related to SPT to Specialty Pipe & Tube Operations, LLC, a Delaware limited liability company. The consideration for the transaction was approximately $55 million of cash proceeds subject to certain closing adjustments. The transaction closed on December 22, 2023. As result of the sale, SPT results of operations are classified under discontinued operations for all periods presented. Prior to the divestiture, SPT was reported under the Company's Tubular Products segment. The discussion and analysis of our results of operations refers to continuing operations unless noted.

Results of Operations

Comparison of 2024 to 2023 – Continuing Operations

Net sales from continuing operations for the full-year 2024 decreased $15.3 million, or 7.9%, over the full-year 2023 to $177.9 million. The decrease in net sales was primarily driven by an 8.8% decrease in average selling prices coupled with a 0.9% decrease in pounds shipped.

Full-year 2024 gross profit from continuing operations increased 1349.1% to $22.1 million, or 12.4% of sales, compared to $1.5 million, or 0.8% of sales, in the full-year 2023. The increase in dollars and percentage of sales for the full-year 2024 were primarily driven by improved strategic sourcing initiatives and product line management resulting in lower raw material costs.

Selling, general and administrative expense (SG&A) from continuing operations for the full-year 2024 decreased $0.1 million to $26.6 million compared to $26.7 million for the full-year 2023. SG&A as a percentage of sales was 14.9% of sales for 2024 and 13.8% of sales for 2023. The changes in SG&A expense were primarily driven by:

•decreases in salaries, wages and benefits driven by lower headcount in the current year;

•decreases in taxes and licenses; and,

•decreases in other expenses primarily driven by decreases in share-based compensation expense

The full-year decreases were partially offset by:

•increases in incentive bonus driven by higher attainment of performance goals in the current year over the prior year;

•increases in professional fees driven by increased IT and legal expenses in the current year