TIDMTMT

RNS Number : 1093W

TMT Investments PLC

16 August 2022

16 August 2022

TMT INVESTMENTS PLC

("TMT" or the "Company")

Half-year report for the six months to 30 June 2022

TMT Investments Plc (AIM: TMT), the venture capital company

investing in high-growth technology companies, is pleased to

announce its unaudited interim results for the half-year ended 30

June 2022.

The interim report will shortly be available on the Company's

website, www.tmtinvestments.com .

Highlights :

-- NAV per share of US$6.68 (down 25.8% from US$9.00 as of 31 December 2021)

-- Total NAV of US$210.1 million (down from US$283.1 million as of 31 December 2021)

-- 5-year IRR of 26.6% per annum

-- US$7.3 million of investments across 6 new and existing companies in the first half of 2022

-- Diversified global portfolio of over 55 companies focused

mainly around SaaS (software-as-a-service), marketplaces, big

data/cloud, EdTech, FinTech, e-commerce, and FoodTech solutions

-- US$13 million in cash reserves as of 15 August 2022

Alexander Selegenev, Executive Director of TMT, commented:

"The first half of 2022 saw continued investor interest in

high-growth, high-quality digital technology companies, resulting

in positive revaluations of several of TMT's portfolio companies

that have demonstrated ongoing growth throughout the period and

received further validation for their business models by raising

fresh equity capital at higher valuations, namely Accern, Outfund,

FemTech, Spin Technology and Feel. In tandem, most other portfolio

companies have continued to either grow their businesses quietly in

the background or diligently react to the evolving market

situation, adapting and repositioning their businesses as

required.

We were reasonably pleased with our portfolio companies'

performance in the first half of 2022, especially against the

backdrop of the recent market volatility and the worsening economic

outlook for the global economy. While the recent period of

uncertainty has not been long enough to have a broad and sustained

negative effect on the underlying businesses of technology

companies, the recent larger-cap public market sell-off has led to

reduced valuations of privately held start-ups, although with a

significantly lower negative effect on the valuations of

earlier-stage start-ups, the stage at which TMT is most closely

focused.

The significantly reduced share prices of publicly traded

technology companies negatively affected the value of TMT's equity

stake in NASDAQ-traded cloud storage company Backblaze (

www.backblaze.com ), resulting in a US$43.6 million reduction in

the value of TMT's investment in Backblaze as at 30 June 2022.

Despite such financial market volatility, Backblaze's business has

been developing well, recording 28% revenue growth in the second

quarter of 2022 compared to the same period of 2021 and the recent

announcement of many new partnerships and integrations. Backblaze

remains well capitalised with a reported net cash position of

approximately US$51 million at 30 June 2022.

Consistent with TMT's prudent valuation policy, the Company has

also decided to reduce the fair value of its equity stake in Bolt (

www.bolt.eu ) by 28%, despite the fact that the previous valuation

level was established on the back of Bolt's successful EUR628

million equity raise, which completed only recently in January 2022

- after the market correction had started. This decision reflects

the significant reduction in the values of Bolt's publicly traded

peers, namely Uber and Lyft, as of 30 June 2022.

Business-wise, both Bolt and Backblaze, as well as most of TMT's

other portfolio companies, have continued to perform reasonably

well, with very few investees experiencing clear difficulties at

this juncture.

Substantial recent cash exits from Wrike ($23m in 2018),

Pipedrive (US$41m in 2020) and Depositphotos (initial cash exit

consideration of US$12.9m in 2021), together with other cash exits

and the proceeds of the Company's fund raise conducted in October

2021 (which raised US$19.3 million before expenses), have been

reinvested into earlier and mid-stage companies as part of planning

the next generation of the portfolio's potential winners. In the

first half of 2022, TMT made US$7.3m of investments into 6 existing

and new portfolio companies. As of 30 June 2022, early and

mid-stage companies represented 45.1% of TMT's total portfolio

value and 95% of the total number of portfolio companies.

TMT is continuing to source and identify investment

opportunities very selectively and at appropriate valuation levels,

whilst employing an extremely cautious general investment approach

for the time being. With no financial debt and cash reserves of

approximately US$13 million at 15 August 2022), TMT is well

positioned to ride out the current market volatility and make

selective investments when the right opportunities present

themselves. The Company expects a number of positive revaluations

across its portfolio by the end of 2022 and will update

shareholders on relevant developments as appropriate."

For further information contact:

TMT Investments Plc +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited

(Nominated Adviser)

James Bellman / James Dance +44 (0)20 7409 3494

Cenkos Securities plc

(Joint Broker)

Ben Jeynes +44 (0)20 7397 8900

Hybridan LLP

(Joint Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European (Withdrawal)

Act 2018 (as amended).

About TMT Investments Plc

TMT Investments Plc invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has a current investment portfolio of over 55 companies

and net assets of US$210 million as of 30 June 2022. The Company's

objective is to generate an attractive rate of return for

shareholders, predominantly through capital appreciation. The

Company is traded on the AIM market of the London Stock Exchange.

www.tmtinvestments.com .

Twitter

LinkedIn

Facebook

EXECUTIVE DIRECTOR'S STATEMENT

The first half of 2022 saw substantially increased market and

economic volatility. The effect of this volatility has had a mixed

effect on privately held technology companies.

While the recent period of uncertainty has not been long enough

to have a broad and sustained negative effect on the underlying

businesses of technology companies, the recent larger-cap public

market sell-off has led to reduced valuations of privately held

start-ups, although with a significantly lower negative effect on

the valuations of earlier-stage start-ups, the stage at which TMT

Investments Plc ("TMT" or the "Company") is most closely focused.

Indeed, the period saw continued investor interest in high-growth,

high-quality digital technology companies, resulting in positive

revaluations of several of TMT's portfolio companies which have

demonstrated ongoing growth throughout the period and received

further validation for their business models by raising fresh

equity capital at higher valuations during the period.

As can be seen from the BVP Cloud Index (

https://cloudindex.bvp.com/ ), median valuation multiples for

larger-cap publicly traded technology companies have fallen

sharply, in effect returning to the more sustainable levels seen in

2013-2017. With regard to privately held start-ups, it is mainly

the valuations of later-stage companies (i.e. Series B and later)

that have been negatively affected (

https://stack.angellist.com/valuations ).

The significantly reduced share prices of publicly traded

technology companies negatively affected the value of TMT's equity

stake in NASDAQ-traded cloud storage company Backblaze (

www.backblaze.com ), resulting in a US$43.6 million reduction in

the value of TMT's investment in Backblaze as at 30 June 2022.

Consistent with TMT's prudent valuation policy, the Company has

also decided to reduce the fair value of its equity stake in Bolt (

www.bolt.eu ) by 28%, despite the fact that the previous valuation

level was established on the back of Bolt's successful EUR628

million equity raise, which completed only recently in January 2022

- after the market correction had started. This decision reflects

the significant reduction in the values of Bolt's publicly traded

peers, namely Uber and Lyft, as of 30 June 2022.

Business-wise however, both Bolt and Backblaze, as well as most

of TMT's other portfolio companies, have continued to perform

reasonably well, with very few investees experiencing clear

difficulties at this juncture.

The main negative effect of increased market and economic

volatility on earlier-stage start-ups is not a reduction in

valuation levels per se, but the generally lower availability of

funding. We are seeing that founders are having to go the extra

mile to prove the quality and potential of their businesses, as

investors become more discerning. High-quality fast-growing

earlier-stage start-ups, however, can still currently demand

broadly similar valuation levels as they did prior to 2022.

In that sense, the current composition of TMT's portfolio has

turned out to be quite auspicious. Following a number of successful

exits from later-stage portfolio companies (such as Wrike,

Pipedrive, and Depositphotos) in recent years, TMT redeployed the

cash proceeds into mainly late-Seed / pre Series-A opportunities,

whose valuations have proven to be much more defensive in the

current environment. TMT's approach to investing in earlier-stage

stage companies is to avoid overpaying and to remain highly

diligent when investing in follow-on rounds, which provides extra

buffer in the event of future down rounds. In addition, the fact

that many of the investments TMT made at those stages were

structured in the form of convertible notes currently provides

further defence against potential down rounds.

NAV per share

The Company's NAV per share decreased by 25.8% in the first half

of 2022 to US$6.68 as at 30 June 2022 (31 December 2021: US$9.00),

mainly as a result of the significant downward revaluation of

Backblaze and Bolt during H1 2022.

Operating expenses

In the first half of 2022, the Company's administrative expenses

of US$772,317 were slightly below corresponding 2021 levels (H1

2021: US$802,919), reflecting the Company's reduced level of

investment and business development activities during the

period.

Financial position

As of 30 June 2022, the Company had no financial debt and cash

reserves of approximately US$14 million (31 December 2021: US$26

million). As of 15 August 2022, the Company had cash reserves of

approximately US$13 million.

Outlook

TMT has a diversified investment portfolio of over 55 companies,

focused primarily on big data/cloud, SaaS (software-as-a-service),

marketplaces, e-commerce, FinTech, EdTech and FoodTech, most of

which continue to benefit from the ongoing shift to online consumer

habits and remote working.

The recent military conflict in Ukraine, followed by the broad

sanctions against Russia, have undoubtedly added significantly to

global market uncertainty. TMT invests globally and its portfolio

is highly diversified in terms of revenue origin from its

underlying companies. Given the international nature of

online/digital businesses, a small number of the Company's

earlier-stage portfolio companies have varying degrees of revenue

exposure to Russia and Ukraine. At the time of TMT's 2021 Annual

Report published in March 2022, the Company said it had identified

a total of approximately US$4.6 million of potential write-downs

across eight of its portfolio companies that were most likely to be

negatively affected by the military conflict in Ukraine. The actual

negative effect from the relevant events estimated in this report

has turned out to be smaller than initially anticipated, with only

four portfolio companies' valuations negatively affected (see the

Portfolio Developments section below). This has resulted in a

corresponding US$2.25 million negative effect on the Company's

NAV.

A number of negative trends and factors continue to affect the

prospects of the wider global economy, and the ultimate effect on

the technology sector and its participants will depend on how

global dynamics unfold in the coming months.

Despite the ongoing volatility, investors continue to be

interested in high-quality technology businesses, and TMT is

continuing to source and identify such opportunities very

selectively and at appropriate valuation levels, whilst employing

an extremely cautious general investment approach for the time

being. With no financial debt and cash reserves of approximately

US$13 million at 15 August 2022), TMT is well positioned to ride

out the current market volatility and make selective investments

when the right opportunities present themselves. The Company

expects a number of positive revaluations across its portfolio by

the end of 2022 and will update shareholders on relevant

developments as appropriate.

Alexander Selegenev

Executive Director

15 August 2022

PORTFOLIO DEVELOPMENTS

We were reasonably pleased with our portfolio companies'

performance in the first half of 2022, especially against the

backdrop of the recent market volatility and worsening economic

outlook for the global economy. A number of portfolio companies

received further validation for their business models by raising

fresh equity capital at higher valuations. In tandem, most other

portfolio companies have continued to either grow their businesses

quietly in the background or diligently react to the evolving

market situation, adapting and repositioning their businesses as

required. In addition, the Company continues its policy of seeking

to reduce the value of underperforming investees as soon as there

is enough evidence to support such decisions.

While the selling pressure on publicly-traded technology

companies in the first half of 2022 has directly negatively

affected the valuation of NASDAQ-traded Backblaze (TMT's second

largest portfolio holding), Backblaze's business has been

developing well - with 28% revenue growth in the second quarter of

2022 compared to the same period of 2021 and the recent

announcement of many new partnerships and integrations. Backblaze

remains well capitalised with a reported net cash position of

approximately US$51 million at 30 June 2022, and at its share price

as of 11 August 2022 was valued at approximately 2.2 times its

announced expected 2022 revenue.

Despite the prudent reduction in the estimated value of Bolt

based on comparable multiples, Bolt remains well-capitalised and

continues to grow successfully across its multiple business lines

and geographic markets.

As for the rest of the portfolio, many of the Company's

investees entered the current period of volatility with freshly

raised funds and continue to grow and optimize their

businesses.

Portfolio performance:

The following developments have had an impact on, and are

reflected in, the Company's NAV and/or financial statements as of

30 June 2022 in accordance with applicable accounting

standards.

Full and partial cash exits, and positive revaluations:

-- Accern, a no-code AI platform for the financial service

industry ( www.accern.com ), completed a new equity funding round.

The transaction represented a revaluation uplift of US$1.6 million

(or 124%) in the fair value of TMT's investment, compared to the

previous reported amount as of 31 December 2021.

-- MTL Financial, trading as Outfund, a revenue-based financing

provider ( www.out.fund ), completed a new equity funding round.

The transaction represented a revaluation uplift of US$1.5 million

(or 112%) in the fair value of TMT's investment, compared to the

previous reported amount as of 31 December 2021.

-- FemTech, a London-based technology accelerator focused on

female founders ( www.femtechlab.com ), completed a new equity

funding round. The transaction represented a revaluation uplift of

US$0.9 million (or 318%) in the fair value of TMT's investment,

compared to the previous reported amount as of 31 December

2021.

-- Spin Technology, an all-in-one SaaS data protection platform

for mission-critical SaaS apps ( www.spin.ai ), completed a new

equity funding round. The transaction represented a revaluation

uplift of US$0.7 million (or 221%) in the fair value of TMT's

investment, compared to the previous reported amount as of 31

December 2021.

-- Feel, a subscription-based multivitamin and supplement

producer ( www.wearefeel.com ), completed a new equity funding

round. The transaction represented a revaluation uplift of US$0.1

million (or 3%) in the fair value of TMT's investment, compared to

the previous reported amount as of 31 December 2021 (adjusted for

the value of TMT's additional investment made in Feel in 2022).

Negative revaluations:

The following of the Company's portfolio investments were

negatively revalued in the first half of 2022:

Portfolio Write-down Reduction as Reasons for write-down

Company amount (US$) % of fair value

reported as

of 31 Dec 2021

Insufficient progress in

Academy the last year; revenue exposure

of Change 670,000 67% to Russia

-------------- ----------------- ----------------------------------

Lack of progress in the last

Anews 330,000 100% year

-------------- ----------------- ----------------------------------

Based on the closing mid-market

price of US$5.23 per share

Backblaze 43,593,102 69% on 30 June 2022

-------------- ----------------- ----------------------------------

Based on comparable company

multiple analysis (reduction

from the previous valuation

based on Bolt's independent

equity financing round completed

Bolt 29,054,520 28% in January 2022)

-------------- ----------------- ----------------------------------

Insufficient progress in

the last year; revenue exposure

EdVibe 750,001 50% to Russia

-------------- ----------------- ----------------------------------

Acquisition by Delivery Hero

announced in Oct 2021 has

not completed; valuation

returned to the previous

Hugo 1,976,290 53% level

-------------- ----------------- ----------------------------------

Lack of progress in the last

StudyFree 500,000 50% 1.5 years

-------------- ----------------- ----------------------------------

Total 76,873,913

-------------- ----------------- ----------------------------------

Key developments for the five largest portfolio holdings in the

first half of 2022 (source: TMT's portfolio companies):

Bolt (ride-hailing and food delivery service):

-- Active in over 450 cities globally (up from over 400 cities as of 31 December 2021)

-- Triple-digit annualised revenue growth

Backblaze (cloud storage provider):

-- Double-digit annualised revenue growth continued

-- Multiple new integrations and partnerships building basis for future growth

PandaDoc (proposal automation and contract management

software):

-- Double-digit annualised revenue growth

-- Over 35,000 paying clients (from over 30,000 as of 31 December 2021)

-- Acquisition of LiveNotary to launch a remote online notarisation service

3S Money Club (provider of corporate multi-currency bank

accounts):

-- Triple-digit annualised revenue growth

-- Profitable and cash flow positive

Scentbird (Perfume, wellness and beauty product subscription

service):

-- Stable revenue

-- Near break-even

-- Over 600 scents in the product range

New investments:

Given the high level of market uncertainty and volatility, TMT

was even more selective in the first half of 2022, investing

approximately US$7.3 million across the following companies:

-- Initial EUR825,000 in Bairrissimo, LDA, trading as Bairro, an

instant food and grocery delivery company in Portugal (

www.bairro.io );

-- Initial US$4,000,000 in SOAX Ltd, a SaaS-enabled marketplace

of tools to collect publicly available data on a scale (

https://soax.com );

-- Additional EUR400,000 in Postoplan OÜ, a social network

marketing platform, which helps create, schedule, and promote

content ( www.postoplan.app );

-- Initial GBP999, 918 in Laundryheap Limited, a marketplace for

on-demand laundry and dry-cleaning services ( www.laundryheap.com

);

-- Additional US$250,000 in Legionfarm, Inc., an online game

coaching platform ( www.legionfarm.com ); and

-- Additional GBP250,000 in Feel Holdings Limited, a

subscription-based multivitamin and supplement producer (

www.wearefeel.com ).

ESG POLICY

Introduction

As with most business sectors, technology has the capacity to

make the world a better place. Given the high pace of technology

innovation we are witnessing, TMT believes this capacity is

intensified in the case of technology. However, technological

innovation for its own sake is meaningless unless it results in

tangible benefits in terms of productivity, improved user

experience, higher efficiency, positive impact in its chosen

sectors, improved profitability or other desired objectives.

ESG evaluation can be carried out in a number of different ways.

Among other factors, its effectiveness will depend on the questions

being addressed, the principles being applied and the quality of

data available. Indeed, at times the prioritising of some

principles can have a negative impact on others, given the

asymmetric nature of benefits that can sometimes arise. An example

is when alleviation of poverty in the short term comes at a higher

environmental cost.

The social and economic fallout from the COVID-19 pandemic has

served to put the ESG agenda into sharper relief and has

accelerated the intensity of focus. TMT started to formalise its

approach to ESG in its initial ESG Policy announced in the 2021

Annual Report, which is being confirmed in this 2022 Interim Report

and will be subsequently updated as required.

As an investment company, TMT has been monitoring ESG issues and

taking them into account before they began to enter the mainstream

investment agenda. As such, the Company has made a number of

investments in ESG-focused companies that also meet TMT's

investment criteria. These include Timbeter, a SaaS solution for

quick and accurate timber measurement and data management, which is

making the forestry industry more sustainable, profitable and

efficient (www.timbeter.com); eAgronom, which provides a unique

combination of services to grain farmers: carbon programmes, an

AI-powered consulting service and farm management software enabling

farmers to build sustainable businesses and preserve nature

(www.eagronom.com); Mobilo, an eco-friendly solution allowing users

to digitally share contact details instead of using paper/plastic

business cards and turn meetings into leads (www.mobilocard.com);

and FemTechLab, Europe's first tech accelerator focused on female

founders ( www.femtechlab.com );

TMT holds minority positions in its portfolio companies and

therefore can exert influence on ESG matters in two main ways:

first, by screening investments for exclusion from investment and

second, by engaging in constructive dialogue with portfolio

companies and monitoring progress. The Company's ESG policy

reflects this approach.

TMT itself, as an investment company with limited internal

resources, has little impact on the environment. The Company's team

is mindful of reducing its travel, paper consumption, energy costs

and other environmental impact wherever possible. TMT has adopted

the Quoted Companies Alliance (QCA) Corporate Governance Code for

Small & Mid-Sized Companies, which already covers a number of

well-established ESG items.

TMT's ESG policy is outlined below.

TMT's 3 guiding ESG principles for portfolio companies:

relevant, realistic and accountable

TMT's three ESG principles guide and inform potential portfolio

companies of the Company's approach to ESG and are at the core of

what good ESG looks like. They are specific and challenging, whilst

allowing portfolio companies to engage with them both at an earlier

stage of development and as they grow in size.

Relevant

-- Is the investee addressing ESG where it can make the greatest

impact in terms of its business model?

-- Has the investee undertaken an ESG materiality assessment

and, if so, how has this informed its ESG framework?

-- Have ESG risks, as well as opportunities, been identified?

Realistic

-- Is the investee developing an ESG roadmap as part of its business plan?

-- Are the investee's ESG objectives achievable in view of its current resources?

-- What resources does the investee need to consider in order to progress on its ESG roadmap?

Accountable

-- How is the investee evaluating its ESG activities and engagement?

-- Is the investee conducting ESG benchmarking against its peers?

-- Does the investee review its ESG metrics and reporting

process in view of latest ESG, scientific and technological

developments?

TMT's approach

TMT's ESG policy is based on a 3-step approach:

Step 1: Filter out by Exclusion list

TMT's exclusion list sets out the sectors, businesses and

activities in which the Company will not invest due to having as

their objective, or direct impact on, any of the following:

1. Slavery, human trafficking, forced or compulsory labour, or unlawful / harmful child labour.

2. Production or sale of illegal or banned products, or involvement in illegal activities.

3. Activities that compromise endangered or protected wildlife.

4. Production or sale of hazardous chemicals, pesticides and waste.

5. Manufacture, distribution or sale of arms or ammunitions.

6. Manufacture of, or trade in, tobacco or drugs.

7. Manufacture or sale of pornography.

8. Trade in human body parts or organs.

9. Animal testing other than for the satisfaction of medical regulatory requirements.

10. Production or other trade related to unbonded asbestos

fibres.

Step 2: Assess level of ESG Engagement

Step 2 focuses on assessing how the proposed portfolio company

incorporates ESG in its business model and company culture.

In its investment selection process, TMT examines how each

potential investee company is addressing and incorporating ESG

issues based on TMT's principles of being relevant, realistic and

accountable, feeding the results into an evaluation sheet for

presentation to TMT's Initial Investment Committee and the Formal

Investment Committee. If necessary, remedial actions or areas for

improvement are agreed with the investee company. For follow-on

investments, TMT requires a formal update from the investee

highlighting any divergence from TMT's initial assessment.

Step 3: Engagement with portfolio companies on ESG

ESG by its very nature is a journey, which needs to adapt to

changing environmental, social and governance dynamics, in view of

latest developments. Two-way dialogue and engagement with portfolio

companies is an essential part of this journey, in which both

parties are sharing and learning. TMT therefore includes ESG topics

as part of its continuous engagement with portfolio companies.

FINANCIAL STATEMENTS

Statement of Comprehensive Income (unaudited)

For the For the

six months six months

ended 30/06/2022 ended 30/06/20

2 1

Notes USD USD

(72, 148

(Losses)/Gains on investments 3 , 629 ) 41,971,813

Dividend income 105,700 -

------------------------------------ ------ ------------------ ----------------

( 72 ,

042 , 929

Total investment (loss)/income ) 41,971,813

------------------------------------ ------ ------------------ ----------------

Expenses

Bonus scheme payment charge 6 - (372,556)

(772, 317

Administrative expenses 5 ) (802,919)

(72, 815

Operating (loss)/ gain , 246 ) 40,796,338

Currency exchange loss (185,967) (81,059)

------------------------------------ ------ ------------------ ----------------

(73, 001

(Loss)/Gain before taxation ,213) 40,715,279

Taxation 7 - -

------------------------------------ ------ ------------------ ----------------

(Loss)/Gain attributable to equity (73, 001

shareholders ,213) 40,715,279

Total comprehensive (loss)/income (73, 001

for the year ,213) 40,715,279

------------------------------------ ------ ------------------ ----------------

(Loss)/Gain per share

Basic and diluted (loss)/gain per

share (cents per share) 8 (232.11) 139.50

------------------------------------ ------ ------------------ ----------------

Statement of Financial Position

At 30 June At 31 December

2022 2021

USD USD

Unaudited Audited

Notes

Non-current assets

Financial assets at FVPL 9 200,560,955 265,454,136

Total non-current assets 200,560,955 265,454,136

Current assets

Trade and other receivables 1 0 1,745,642 2,050,649

Cash and cash equivalents 1 1 13,957,990 25,527,801

Total current assets 15,703,632 27,578,450

Total assets 216,264,587 293,032,586

Current liabilities

Trade and other payables 1 2 6,138,037 9,904,823

Total current liabilities 6,138,037 9,904,823

Total liabilities 6,138,037 9,904,823

Net assets 210,126,550 283,127,763

----------------------------- ------ -------------------- ---------- ------------------------

Equity

Share capital 1 3 53,283,415 53,283,415

Retained profit 156,843,135 229,844,348

Total equity 210,126,550 283,127,763

----------------------------- ------ -------------------- ---------- ------------------------

Statement of Cash Flows (unaudited)

For the six For the six

months ended months ended

30/06/2022 30/06/2021

Notes USD USD

Operating activities

Operating (loss)/gain (72,815,246) 40,796,338

------------------------------------------- ----- ------------- -------------

Adjustments for non-cash items

Changes in fair value of financial

assets at FVPL 3 72,176,280 (41,852,901)

Currency exchange loss (185,966) (81,059)

(824,932) (1,137,622)

------------------------------------------- ----- ------------- -------------

Changes in working capital

Decrease/(Increase) in trade and

other receivables 1 0 305,007 (291,387)

Decrease in trade and other payables 1 2 (3,766,786) (2,252,526)

Net cash used in operating activities (4,286,711) (3,681,535)

------------------------------------------- ----- ------------- -------------

Investing activities

Interest received - -

Purchase of financial assets at FVPL 9 (7,283,100) (14,081,056)

Proceeds from sale of financial assets

at FVPL 9 - 1,628,923

------------------------------------------- ----- ------------- -------------

Net cash used in investing activities (7,283,100) (12,452,133)

------------------------------------------- ----- ------------- -------------

Financing activities

------------------------------------------- ----- ------------- -------------

Net cash from financing activities - -

------------------------------------------- ----- ------------- -------------

Decrease in cash and cash equivalents (11,569,811) (16,133,668)

------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the beginning

of the period 1 1 25,527,801 39,004,288

------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the end

of the period 1 1 13,957,990 22,870,620

------------------------------------------- ----- ------------- -------------

Statement of Changes in Equity (unaudited)

Share capital Retained profit Total

USD USD USD

Balance at 01 January 2021 34,790,174 143,132,533 177,922,707

-------------------------------------------------------- -------------- ---------------- -------------

Gain for the year - 86,711,815 86,711,815

Total comprehensive income for the year - 86,711,815 86,711,815

-------------------------------------------------------- -------------- ---------------- -------------

Transactions with owners in their capacity as owners:

------------------------------------------------------- -------------- ---------------- -------------

Issue of shares 18,493,241 - 18,493,241

Balance at 31 December 2021 53,283,415 229,844,348 283,127,763

-------------------------------------------------------- -------------- ---------------- -------------

Loss for the period - (73,001,213) (73,001,213)

Total comprehensive (loss)/ income for the period - (73,001,213) (73,001,213)

-------------------------------------------------------- -------------- ---------------- -------------

Balance at 30 June 2022 53,283,415 156,843,135 210,126,550

-------------------------------------------------------- -------------- ---------------- -------------

NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHSED 30 JUNE

2022

1. Company information

TMT Investments Plc ("TMT" or the "Company") is a company

incorporated in Jersey with its registered office at 13 Castle

Street, St Helier, JE1 1ES, Channel Islands.

The Company was incorporated and registered on 30 September 2010

in Jersey under the Companies (Jersey) Law 1991 (as amended) with

registration number 106628 under the name TMT Investments Limited.

The Company obtained consent from the Jersey Financial Services

Commission pursuant to the Control of Borrowing (Jersey) Order 1985

on 30 September 2010. On 1 December 2010 the Company re-registered

as a public company and changed its name to TMT Investments Plc.

The Company's ordinary shares were admitted to trading on the AIM

market of the London Stock Exchange on 10 December 2010.

The memorandum and articles of association of the Company do not

restrict its activities and therefore it has unlimited legal

capacity. The Company's ability to implement its Investing Policy

and achieve its desired returns will be limited by its ability to

identify and acquire suitable investments. Suitable investment

opportunities may not always be readily available.

The Company will seek to make investments in any region of the

world.

Financial statements of the Company are prepared by and approved

by the Directors in accordance with International Financial

Reporting Standards, International Accounting Standards and their

interpretations issued or adopted by the International Accounting

Standards Board as adopted by the European Union ("IFRSs"). The

Company's accounting reference date is 31 December.

2. Summary of significant accounting policies

2.1 Basis of presentation

Interim financial statements for the six months ended 30 June

2022 and 2021 are unaudited and were approved by the Directors on

15 August 2022. They do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The financial

statements for the year ended 31 December 2021 were prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The report of the auditor on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis of matter.

The principal accounting policies applied by the Company in the

preparation of these unaudited financial statements are set out

below and have been applied consistently.

The financial statements have been prepared on a going concern

basis, under the historical cost basis as modified by the fair

value of financial assets at ("FVTPL"), as explained in the

accounting policies below, and in accordance with IFRS. Historical

cost is generally based on the fair value of the consideration

given in exchange for assets.

2.2 Foreign currency translation

(a) Functional and presentation currency

Items included in the financial statements of the Company are

measured in United States Dollars ('US dollars', 'USD' or 'US$'),

which is the Company's functional and presentation currency.

(b) Transactions and balances

Foreign currency transactions are translated into US$ using the

exchange rates prevailing at the dates of the transactions.

Exchange differences arising from the translation at the year-end

exchange rates of monetary assets and liabilities denominated in

foreign currencies are recognised in the statement of comprehensive

income.

Conversation rates, USD

-----------------------------------------------------------

Currency Average

rate, for

six months

At 30/06/2022 ended 30/06/2022

----------------- -------------- ------------------

British pounds,

GBP 1.2143 1.2987

Euro, EUR 1.0452 1.0933

--------------------- -------------- ------------------

2.3 New IFRSs and interpretations

The following standards and amendments became effective from 1

January 2022, but did not have any material impact on the

Company:

-- Amendments to IAS 16 "Property, Plant and Equipment"

-- Amendments to IAS 37 "Provisions, Contingent Liabilities and

Contingent Asserts"

-- Amendments to IFRS 3 "Business Combination"

3 (Loss)/Gain on investments

For six months ended 30/06/2022 For six months

ended 30/06/2021

USD USD

Gross interest income from convertible notes receivable 19,780 18,844

Net interest income from convertible notes receivable 19,780 18,844

(Losses)/Gains on changes in fair value of financial assets at

FVPL (72,176,280) 41,852,901

Other gains on investment (revaluation of receivables) 7,871 100,068

Total (loss)/gain on investments (72,148,629) 41,971,813

---------------------------------------------------------------- -------------------------------- ------------------

4 Segmental analysis

Geographic information

The Company has investments in six principal geographical areas

- USA, Estonia, the United Kingdom, British Virgin Islands ('BVI'),

Cyprus, and The Cayman Islands.

Non-current financial assets

As at 30/06/2022

United The Cayman

USA Other BVI Cyprus Estonia Kingdom Islands Total

USD USD USD USD USD USD USD USD

-------------- ----------- ---------- ---------- ---------- ----------- ----------- ----------- ------------

Equity

investments 66,399,723 500,000 1,780,250 330,000 77,382,608 25,656,362 - 172,048,943

Convertible

notes &

SAFEs 17,349,132 942,233 - 3,600,000 1,784,185 3,806,462 1,030,000 28,512,012

-------------- ----------- ---------- ---------- ---------- ----------- ----------- ----------- ------------

Total 83,748,855 1,442,233 1,780,250 3,930,000 79,166,793 29,462,824 1,030,000 200,560,955

-------------- ----------- ---------- ---------- ---------- ----------- ----------- ----------- ------------

As at 31/12/2021

United Cayman

USA Other BVI Cyprus Estonia Kingdom Islands Total

USD USD USD USD USD USD USD USD

-------------- ------------ ------ ---------- ---------- ------------ ----------- ---------- ------------

Equity

investments 112,296,648 - 3,756,540 1,000,000 106,437,128 20,017,105 - 243,507,421

Convertible

notes

& SAFEs 14,620,030 - - 3,600,000 1,332,985 1,363,700 1,030,000 21,946,715

-------------- ------------ ------ ---------- ---------- ------------ ----------- ---------- ------------

Total 126,916,678 - 3,756,540 4,600,000 107,770,113 21,380,805 1,030,000 265,454,136

-------------- ------------ ------ ---------- ---------- ------------ ----------- ---------- ------------

5 Administrative expenses

Administrative expenses include the following amounts:

For six months ended 30/06/2022 For six months ended

30/06/2021

USD USD

--------------------------- -------------------------------- ---------------------

Staff expenses (note 6) 414,602 395,818

Professional fees 188,923 228,715

Legal fees 60,092 83,048

Bank and LSE charges 6,746 8,034

Audit and accounting fees 25,522 17,851

Other expenses 76,432 69,453

772,317 802,919

--------------------------- -------------------------------- ---------------------

6 Staff expenses

For six months ended 30/06/2022 For six months ended 30/06/2021

USD USD

-------------------- -------------------------------- --------------------------------

Directors' fees 108,002 103,218

Wages and salaries 306,600 292,600

414,602 395,818

-------------------- -------------------------------- --------------------------------

Wages and salaries shown above include fees and salaries

relating to the six months ended 30 June. Bonus Plan costs are not

included in administrative expenses and are shown separately.

The Directors' fees for the six months ended 30 June 2022 and

2021 were as follows:

For six months ended 30/06/2022 For six months ended

30/06/2021

USD USD

---------------------- -------------------------------- ---------------------

Alexander Selegenev 55,000 55,000

Yuri Mostovoy 27,500 27,500

James Joseph Mullins 14,171 15,218

Andrea Nastaj 1,984 -

Petr Lanin 9,347 5,500

---------------------- -------------------------------- ---------------------

108,002 103,218

---------------------- -------------------------------- ---------------------

The Directors' fees shown above are all classified as 'short

term employment benefits' under International Accounting Standard

24. The Directors do not receive any pension contributions or other

benefits. The average number of staff employed (excluding

Directors) by the Company during the six months ended 30 June 2022

was 7 (six months ended 30 June 2021: 7).

Key management personnel of the Company are defined as those

persons having authority and responsibility for the planning,

directing and controlling the activities of the Company, directly

or indirectly. Key management of the Company are therefore

considered to be the Directors of the Company. There were no

transactions with the key management, other than their Directors

fees, bonuses and reimbursement of business expenses.

For six months ended 30/06/2022 For six months ended 30/06/2021

USD USD

------------------------------------------------- --------------------------------- --------------------------------

Bonus scheme payment charge related to previous

periods - 372,556

- 372,556

----------------------------------------------------------------------------------- --------------------------------

Under the Company's Bonus Plan, subject to achieving a minimum

hurdle NAV and high watermark conditions, the team receives an

annual cash bonus equal to 10% of the net increases in the

Company's NAV, adjusted for any changes in the Company's equity

capital resulting from issuance of new shares, dividends, share

buy-backs and similar corporate transactions. The Company`s bonus

year runs from 1 January to 31 December. If, pursuant to the

Company's Bonus Plan, the bonus attributable to the NAV increase

from 1 January 2022 to 30 June 2022 had been accrued during the

period, it would have resulted in a bonus charge of US$nil (2021:

US$4,108,784).

7 Income tax expense

The Company is incorporated in Jersey. No tax reconciliation

note has been presented as the income tax rate for Jersey companies

is 0%.

8 (Loss)/Gain per share

The calculation of basic loss per share is based upon the net

loss for the six months ended 30 June 2022 attributable to the

ordinary shareholders of US$ 73,001,213 (for the six months ended

30 June 2021: net gain of US$ 40,715,279 ) and the weighted average

number of ordinary shares outstanding calculated as follows:

(Loss)/Gain per share For the six months ended 30/06/2022 For six months ended 30/06/2021

---------------------------------------------- ------------------------------------ --------------------------------

Basic (loss)/gain per share (cents per share) (232.11) 139.50

(Loss)/Gain attributable to equity holders of

the entity (73,001,213) 40,715,279

---------------------------------------------- ------------------------------------ --------------------------------

The weighted average number of ordinary shares outstanding was

calculated as follows:

For the six months ended 30/06/2022 For the six months ended 30/06/2021

------------------------------------------ ------------------------------------ ------------------------------------

Weighted average number of shares in

issue

Ordinary shares 31,451,538 29,185,831

31,451,538 29,185,831

------------------------------------------ ------------------------------------ ------------------------------------

During the six months ended 30 June 2022 and 30 June 2021 there

were no dilutive instruments in issue.

9 Non-current financial assets

Reconciliation of fair value measurements of non-current

financial assets:

At 30 June 2022 At 31 December 2021

USD USD

Investments held at fair value through profit and loss

- unlisted shares (i) 178,170,405 241,461,421

- promissory notes (ii) 3,354,215 4,266,715

- SAFEs (iii) 19,036,335 17,680,000

- Shares to be issued (iv) - 2,046,000

-------------------------------------------------------- ---------------- --------------------

200,560,955 265,454,136

-------------------------------------------------------- ---------------- --------------------

At 30 June 2022 At 31 December 2021

USD USD

Opening valuation 265,454,136 144,803,154

Purchased at cost 7,283,100 40,540,924

Disposal proceeds - (18,489,994)

Disposal due to full impairment (330,000) -

Realised gain - 6,294,635

Unrealised (losses)/gains (71,846,281) 92,305,417

Closing valuation 200,560,955 265,454,136

--------------------------------- ---------------- --------------------

Movement in unrealised gains

Opening accumulated unrealised gains 195,706,888 111,980,464

Movement in unrealised (losses)/gains (71,846,281) 92,305,417

Transfer of previously unrealised losses/(gains) to realised reserve on disposal of

Investments 670,000 (8,578,993)

Closing accumulated unrealised gains 124,530,607 195,706,888

----------------------------------------------------------------------------------------- ------------- ------------

Reconciliation of investments, if held under the cost (less impairment) model:

Historic cost basis

Opening book cost 69,747,248 32,822,690

Purchases (including consulting and legal fees) 7,283,100 40,540,924

Disposal on sale of investment - (3,616,366)

Disposal due to impairment (1,000,000) -

Closing book cost 76,030,348 69,747,248

-------------------------------------------------------------------------------- ------------ ------------

Valuation methodology

Mid-market price 19,553,338 63,146,440

Revenue multiple 80,912,234 6,590,954

Cost or price of recent equity funding round (reviewed for impairment and fair value

adjustment) 100,095,383 195,716,742

200,560,955 265,454,136

------------------------------------------------------------------------------------------ ------------ ------------

Financial assets at fair value through profit or loss are

measured at fair value, and changes therein are recognised in

profit or loss.

When measuring the fair value of a financial instrument, the

Company uses relevant transactions during the year or shortly after

the year end, which gives an indication of fair value and considers

other valuation methods to provide evidence of value. The "price of

recent investment" methodology is used mainly for venture capital

investments, and the fair value is derived by reference to the most

recent equity financing round or sizeable partial disposal. Fair

value change is only recognised if that round involved a new

external investor. From time to time, the Company may assess the

fair value in the absence of a relevant independent equity

transaction by relying on other market observable data and

valuation techniques, such as the analysis of revenue multiples of

comparable companies and/or comparable transactions. The nature of

such valuation techniques is highly judgmental and dependent on the

market sentiment at the time of the analysis.

(i) Equity investments as at 30 June 2022:

Investee Date Value Additions Conversions Gain/(loss) Disposals, Value Equity

company of initial at to equity from from changes USD at 30 stake

investment 1 Jan investments loan in fair Jun 2022, owned

2022, during the notes, value of USD

USD period, USD USD equity

investments,

USD

------------------- ------------ ------------ ------------ ------------ ------------- ----------- ------------ -------

Wanelo 21.11.2011 602,447 - - - - 602,447 4.69%

1 1

.8 2

Backblaze 24.07.2012 63,146,440 - - (43,593,102) - 19,553,338 %

Remote.it 13.06.2014 1,512,642 - - - 1,512,642 1.64%

Anews 25.08.2014 330,000 - - (330,000) - - 9.41%

Bolt 15.09.2014 103,375,800 - - (29,054,520) - 74,321,280 1.26%

PandaDoc 11.07.2014 16,185,773 - - - - 16,185,773 1.18%

FullContact 11.01.2018 244,506 - - - - 244,506 0.19%

ScentBird 13.04.2015 6,590,954 - - - - 6,590,954 4.18%

Workiz 16.05.2016 3,971,659 - - - - 3,971,659 1.89%

Usual (Vinebox) 06.05.2016 450,015 - - - - 450,015 1.91%

MEL Science 25.02.2019 2,663,696 - - - - 2,663,696 3.40%

Hugo 19.01.2019 3,756,540 - - (1,976,290) - 1,780,250 3.55%

Qumata (Healthy

Health) 06.06.2019 1,818,822 - - - - 1,818,822 2.52%

eAgronom 31.08.2018 447,087 - - - - 447,087 1.41%

Rocket

Games(Legionfarm) 16.09.2019 200,000 - - - - 200,000 1.26%

Timbeter 05.12.2019 221,688 - - - - 221,688 4.64%

Classtag 03.02.2020 200,000 - - - - 200,000 1.70%

3S Money Club 07.04.2020 8,253,630 - 2,046,000 - - 10,299,630 11.38%

Hinterview 21.09.2020 891,107 - - - - 891,107 4.97%

Virtual Mentor

(Allright) 12.11.2020 772,500 - - - - 772,500 2.95%

NovaKid 13.11.2020 2,949,855 - - - - 2,949,855 1.55%

MTL Financial

(OutFund) 17.11.2020 1,322,100 - - 1,478,052 - 2,800,152 3.66%

Scalarr 15.08.2019 1,378,282 - - - - 1,378,282 7.66%

Accern 21.08.2019 1,282,705 - - 1,591,179 - 2,873,884 3.21%

Feel 13.08.2020 2,035,512 314,275 1,363,700 92,975 - 3,806,462 11.30%

Affise 18.09.2019 3,470,870 - - - - 3,470,870 8.71%

3D Look 03.03.2021 1,000,000 - - - - 1,000,000 3.77%

FemTech 30.03.2021 274,220 - - 871,325 - 1,145,545 9.36%

Muncher 23.04.2021 2,059,999 - - - - 2,059,999 4.77%

Cyberwrite 20.05.2021 500,000 - - - - 500,000 3.71%

VertoFX 16.07.2021 1,132,999 - - - - 1,132,999 3.24%

Academy of

Change 02.08.2021 1,000,000 - - (670,000) - 330,000 7.69%

EstateGuru 06.09.2021 1,780,200 - - - - 1,780,200 2.73%

Prodly 06.09.2021 1,800,000 - - - - 1,800,000 4.39%

Sonic Jobs 08.09.2021 712,018 - - - - 712,018 2.77%

EdVibe (Study

Space, Inc) 02.11.2021 1,500,001 - - (750,001) - 750,000 7.36%

1Fit (Alippe,

Inc) 24.12.2021 500,000 - - - - 500,000 4.70%

Laundry Heap 01.01.2022 - 1,325,392 - - - 1,325,392 2.44%

SOAX 21.01.2022 - 4,000,000 - - - 4,000,000 9.41%

Agendapro 15.04.2021 515,000 - - - - 515,000 2.00%

Outvio 22.06.2021 612,353 - - - - 612,353 4.00%

------------------- ------------ ------------ ------------ ------------ ------------- ----------- ------------ -------

Total 241,461,421 5,639,667 - (72,340,382) - 178,170,405

--------------------------------- ------------ ------------ ------------ ------------- ----------- ------------ -------

(ii) Convertible loan notes as at 30 June 2022:

Investee Date of Value at Additions Conversions Gain/(loss) Disposals/ Value at Term, Interest

company initial 1 Jan to from loan from conversions, 30 Jun years rate, %

investment 2022, convertible notes, USD changes in USD 2022, USD

USD note fair value

investments of

during the convertible

period, USD notes, USD

------------- ------------ ---------- ------------ ------------ ------------ ------------- ---------- ------ ---------

ShareThis 26.03.2013 570,030 - - - - 570,030 5.0 1.09%

Metrospeedy 16.07.2021 1,000,000 - - - - 1,000,000 - 0.00%

Feel 08.10.2021 1,363,700 - - - (1,363,700) - - -

Postoplan 18.12.2020 1,332,985 451,200 - - - 1,784,185 1.0 5.00%

----------

Total 4,266,715 451,200 - - - 3,354,215

--------------------------- ---------- ------------ ------------ ------------ ------------- ---------- ------ ---------

(iii) SAFEs as at 30 June 2022:

Investee company Date of Value at 1 Additions to Gain/(loss) Disposals, USD Value at 30

initial Jan 2022, SAFE from changes Jun 2022, USD

investment USD investments in fair value

during the of SAFE

period, USD investments,

USD

Adwisely (Retarget) 24.09.2019 1,600,000 - - - 1,600,000

Spin Technology 17.12.2018 300,000 - 664,102 - 964,102

Cheetah (Go-X) 29.07.2019 350,000 - - - 350,000

Rocket Games

(Legionfarm) 17.09.2019 1,200,000 250,000 - - 1,450,000

Classtag 03.02.2020 200,000 - - - 200,000

Moeco 08.07.2020 500,000 - - - 500,000

Collectly 13.07.2021 2,060,000 - - - 2,060,000

StudyFree 08.12.2020 1,000,000 - (500,000) - 500,000

Aurabeat 03.05.2021 1,030,000 - - - 1,030,000

OneNotary (Adorum) 01.10.2021 500,000 - - - 500,000

BaFood 05.11.2021 2,000,000 - - - 2,000,000

Educate online 16.11.2021 1,000,000 - - - 1,000,000

My Device Inc 30.11.2021 850,000 - - - 850,000

Mobilo (Lulu

Systems, Inc) 09.12.2021 1,030,000 - - - 1,030,000

Muncher 13.12.2021 2,000,000 - - - 2,000,000

Bairro

(BAIRRÍSSIMO,

LDA) 12.01.2022 - 942,233 - - 942,233

Synder

(CloudBusiness

Inc) 26.05.2021 2 060,000 - - - 2,060,000

-------------------- --------------- -------------- --------------

Total 17,680,000 1,192,233 164,102 - 19,036,335

------------------------------------- -------------- -------------- -------------- --------------- --------------

(iv) Shares to be issued as at 30 June 2022:

Investee Date of Value at 1 Additions Conversions Gain/loss Disposals/ Value at 30

company initial Jan 2022, to equity from loan from changes conversions, Jun 2022,

investment USD investments notes, USD in fair USD USD

during value of

the period, equity

USD investments,

USD

-------------- ------------- ------------ ------------ ------------ ------------- ------------- ------------

3S Money Club 07.04.2020 2,046,000 - - - (2,046,000) -

Total 2,046,000 - - - - -

----------------------------- ------------ ------------ ------------ ------------- ------------- --------------

1 0 Trade and other receivables

At 30 June 2022 At 31 December 2021

USD USD

----------------------------------------- ---------------- --------------------

Prepayments 36,248 53,412

Other receivables 1,610,220 1,917,843

Interest receivable on promissory notes 99,174 79,394

1,745,642 2,050,649

----------------------------------------- ---------------- --------------------

The fair values of trade and other receivables approximate to

their carrying amounts as presented above. During the six months

ended 30 June 2022 and 2021 no balances were past due or impaired,

and no credit losses had been expected.

Other receivables include the amounts receivable from the

disposal of TMT's investments in DepositPhotos (US$1,262,484),

Klear (US$227,658), and KitApps (US$5,521), as well as the value

(US$114,557 as of 30 June 2022) of the publicly traded shares in 3D

Systems Inc., received by TMT as partial consideration for the

disposal of its investment in Volumetric.

11 Cash and cash equivalents

The cash and cash equivalents as at 30 June 2022 include cash in

banks. Cash and cash equivalents comprise the following:

At 30 June 2022 At 31 December 2021

USD USD

--------------- ---------------- --------------------

Bank balances 13,957,990 25,527,801

--------------- ---------------- --------------------

13,957,990 25,527,801

--------------- ---------------- --------------------

The following table represents an analysis of cash and

equivalents by rating agency designation based on Moody`s Investors

Service and Standards & Poor`s credit rating or their

equivalent:

At 30 June 2022 At 31 December 2021

USD USD

--------------- ---------------- --------------------

Bank balances

A3 rating 13,939,893 25,512,940

Baa3 rating 2,709 3,296

Not rated 15,388 11,565

--------------- ---------------- --------------------

13,957,990 25,527,801

--------------- ---------------- --------------------

1 2 Trade and other payables

At 30 June 2022 At 31 December 2021

USD USD

--------------------------- ---------------- --------------------

Salaries payable 140 ,752 82,500

Directors' fees payable - 40 , 534

Bonus payable 5,977,983 9 , 676 , 043

Trade payables 7,785 73 ,042

Other current liabilities 3,513 -

Other accrued expenses 8,004 32,704

6,138,037 9,904,823

--------------------------- ---------------- --------------------

The fair values of trade and other payables approximate to their

carrying amounts as presented above. The bonus payable amount as of

30 June 2022 relates to the bonuses earned in year 2021.

13 Share capital

On 30 June 2022 the Company had an authorised share capital of

unlimited ordinary shares of no par value and had issued ordinary

share capital of:

At 30 June 2022 At 31 December 2021

USD USD

----------------------------- ----------------- --------------------

Share capital 53,283,415 53,283,415

Issued capital comprises: Number Number

Fully paid ordinary shares 31,451,538 31,451,538

----------------------------- ----------------- --------------------

Number of shares Share capital, USD

----------------------------- ----------------- --------------------

Balance at 31 December 2021 31,451,538 53,283,415

Balance at 30 June 2022 31,451,538 53,283,415

----------------------------- ----------------- --------------------

There have been no changes to the Company's ordinary share

capital between 30 June 2022 and the date of approval of these

financial statements.

14 Related party transactions

The Company's Directors receive fees and bonuses from the

Company, details of which can be found in Note 6.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UVSORURUWAUR

(END) Dow Jones Newswires

August 16, 2022 02:00 ET (06:00 GMT)

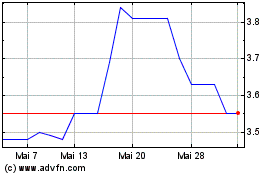

Tmt Investments (LSE:TMT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Tmt Investments (LSE:TMT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024