TIDMIGP

RNS Number : 3659N

Intercede Group PLC

10 June 2010

INTERCEDE GROUP plc

('Intercede', 'the Company' or 'the Group')

Preliminary Results for the Year Ended 31 March 2010

Intercede, one of the world's leading developers and suppliers of identity

management software, today announces its preliminary results for the year ended

31 March 2010.

SUMMARY

- Sales revenues increased from GBP5.7m to GBP6.2m.

- Full year profitability reported for the second consecutive period:

* Operating profit before exceptional item of GBP2.0m (2009: GBP1.9m)

* Profit before tax of GBP0.5m (2009: GBP1.4m)

* Profit for the year of GBP0.5m (2009: GBP1.7m)

- Full and final settlement of US and UK patent litigation; GBP1.5m

exceptional item for legal costs.

- Cash balances of GBP4.7m at 31 March 2010 (2009: GBP3.7m).

- All external borrowings eliminated following the decision of the

convertible loan note holders to convert their loan notes into ordinary shares.

- Increased investment in international sales and technical capabilities to

support growing demand for and use of Intercede's proprietary MyID Identity and

Credential Management System.

- National ID schemes powered by MyID go live in two countries.

- Continued expansion of Intercede's customer base in the US.

- Winning new contracts to supply MyID to government ministries, banks and

business corporations around the world.

- Intercede overtakes competitors to be No1 in class as measured by the

number of contract wins announced during the period.

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"Intercede continues to prove that it is a world leader in identity and

credential management. This is a market that is growing each year and we are

right at its heart. In an increasingly virtual and highly mobile world,

security of identity affects many areas of peoples' lives in a very real way:

accessing facilities in the workplace, buying goods and services, proving

entitlement, defeating terrorism and preventing cyber warfare."

"Our performance this year demonstrates how we have capitalised on this

opportunity. We are becoming involved in increasingly long term projects across

the world, we are financially strong and the millstone of patent litigation has

been removed. We therefore remain optimistic about our future prospects."

About Intercede

Intercede is the producer of the MyID Identity and Credential Management System

(IDCMS). Intercede's MyID is the only IDCMS software product that enables

organisations to easily and securely manage the identities of people and

their

associated identity credentials within a single, integrated, workflow

driven platform. This includes enabling and managing: secure registration,

biometric capture, application vetting and approval through to smart card

personalisation,

issuance and management.

Intercede's MyID is being used around the world by large corporations,

governments and banks to manage millions of identities for employees, citizens

and customers. Notable deployments in the US include 10 Federal Agencies,

a

program with Lockheed Martin and two major US financial institutions. In

Europe and the Middle East, Intercede's MyID is being deployed in support of

government identity, health and corporate employee ID security projects.

For more information visit http://www.intercede.com

ENQUIRIES

+-----------------------------------+-------------------------------+

| Intercede Group plc | Tel. +44 (0)1455 558111 |

+-----------------------------------+-------------------------------+

| Richard Parris, Chairman & Chief | |

| Executive | |

+-----------------------------------+-------------------------------+

| Andrew Walker, Finance Director | |

+-----------------------------------+-------------------------------+

| | |

+-----------------------------------+-------------------------------+

| FinnCap | Tel. + 44 (0)20 7600 |

| | 1658 |

+-----------------------------------+-------------------------------+

| Clive Carver | |

+-----------------------------------+-------------------------------+

| Sarah Wharry | |

+-----------------------------------+-------------------------------+

| | |

+-----------------------------------+-------------------------------+

| Pelham Bell Pottinger | Tel. +44 (0)20 7861 3112 |

+-----------------------------------+-------------------------------+

| Archie Berens | |

+-----------------------------------+-------------------------------+

| Francesca Tuckett | |

+-----------------------------------+-------------------------------+

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2010

Chairman's Statement

Intercede is one of the world's leading developers and suppliers of software for

identity and credential management. This software is branded as the Intercede

MyID Identity and Credential Management System. MyID is used by governments,

public authorities and companies around the world to improve the level of

identity assurance of their citizens and employees.

Financial and Operational Highlights

During the year significant progress has been made both financially and

operationally across many areas. Highlights include:

1. Sales revenues increased from GBP5.7m to GBP6.2m.

2. Full year profitability reported for the second consecutive period:

o Operating profit before exceptional item of GBP2.0m (2009: GBP1.9m)

o Profit before tax of GBP0.5m (2009: GBP1.4m)

o Profit for the year of GBP0.5m (2009: GBP1.7m)

3. Full and final settlement of US and UK patent litigation; GBP1.5m

exceptional item for legal costs.

4. GBP1.0m of cash generated during the period (2009: GBP2.6m), after payment

of legal costs relating to patent litigation.

5. National ID schemes powered by MyID go live in two countries.

6. Lockheed Martin purchased additional MyID licenses for provisioning all

permanent staff with PIV-Interoperable smart cards.

7. US Transportation Worker Identity Credential (TWIC) programme has issued

more than 1.5 million smart cards to date to US port workers and mariners using

MyID.

8. US Federal Aviation Authority significantly increased its investment in

MyID infrastructure at airports across the US.

9. The US Social Security Administration has used MyID to issue smartcards to

more than 80,000 staff.

10. A new multi year contract has been won with a US partner to supply MyID to

a large US based, global management consultancy group for internal security and

regulatory compliance.

11. The NHS has purchased a further 200,000 MyID licenses to deliver smart

cards to medical professionals in the UK bringing the total purchased to date up

to 800,000.

Results

+--------------------------+--------------+-------------+-------------+

| | Year ended 31 March |

+--------------------------+------------------------------------------+

| GBP'000 | 2010 | 2009 | 2008 |

+--------------------------+--------------+-------------+-------------+

| Revenue | 6,194 | 5,701 | 2,805 |

+--------------------------+--------------+-------------+-------------+

| Gross profit | 6,128 | 5,660 | 2,775 |

+--------------------------+--------------+-------------+-------------+

| Pre-exceptional | 2,026 | 1,858 | (102) |

| operating profit/(loss) | | | |

+--------------------------+--------------+-------------+-------------+

| Exceptional item | (1,517) | (371) | - |

+--------------------------+--------------+-------------+-------------+

| Profit/(loss) before tax | 510 | 1,408 | (177) |

+--------------------------+--------------+-------------+-------------+

In the year ended 31 March 2010, revenue increased by 9% from GBP5,701,000 to

GBP6,194,000 at a gross margin of 99%. While the level of growth is lower than

that achieved in the previous period, it belies an underlying strengthening of

the business, with no single project representing more than 15% of total revenue

(2009: 25%). As a result of the growth delivered from multiple projects, we have

a stronger and more diverse customer base from which to generate recurring

revenues.

Good progress has been made growing our international sales and technical

capabilities through a targeted programme of investment, which has been

accelerated to take advantage of the growing market opportunity. This includes

the incorporation of Intercede MyID Inc. in the United States and recruiting two

additional business development and sales resources in the region. Furthermore,

we have also recruited a senior business head in France to spearhead our further

growth in continental Europe. In parallel with this investment, though, we have

continued to maintain tight control of our cost base.

The pre-exceptional operating profit for the period was GBP2,026,000 which

compares to GBP1,858,000 in the previous year, the margin on sales remaining at

33% year on year. As a consequence at 31 March 2010, the Group had cash balances

of GBP4,664,000, an increase of GBP953,000 from 2009. This includes the payment

during the year of GBP1,085,000 of legal costs associated with the conduct and

eventual settlement of the patent litigation, described below. With a balance of

GBP747,000 of legal costs remaining to be paid as at 31 March 2010, the Group

has effectively entered the new financial year with a net cash balance of

GBP3,917,000.

The US and UK patent litigations involving ActivIdentity were settled on 23

March 2010. The exceptional charge to the current financial year for all of the

legal fees and associated costs relating to this case is GBP1,517,000. There are

no other additional costs associated with this suit in the reported period and

no further legal costs or exposures are expected to arise in the foreseeable

future. Furthermore, the patent licence agreement included within the settlement

will have no material impact on Intercede's future earnings. We believe that

this was an appropriate use of funds, which removed a major uncertainty from the

business and was necessary for the successful protection of long term

shareholder value. We also believe it sends a clear message to others in the

industry that Intercede is prepared to invest with the world's strongest law

firms in order to robustly defend itself in any legal action.

After these exceptional charges are taken into account, Intercede delivered a

profit before tax of GBP510,000. This is the second consecutive full year of

profitability and is a tremendous achievement under the circumstances.

Key Revenue Statistics

* 83% of revenue generated by recurring customers.

* 15% of revenue generated by the largest single customer.

* 45% of revenue generated in the US.

* 62% of revenue generated by government customers.

* 33% of revenue generated by software licence sales.

* 43% of revenue generated by professional services and custom MyID software

development.

* 24% of revenue generated by support and maintenance.

Product Development

This year has been marked by the continuing adaptation of MyID to service a

growing number of major commercial organisations, governments and managed

service providers. These funded adaptations significantly enhance the MyID

platform and will be made available to all customers in the next major product

release, MyID 9 scheduled in Q4 2010.

MyID 9 will enable customers to maximise their return on investment in

credential management by:

* Providing a comprehensive infrastructure that reduces the number of 'moving

parts' in a credential management system. This reduces both initial deployment

and subsequent ongoing operating costs;

* Delivering enhanced levels of business process improvement through Intercede's

generic objects technology;

* Allowing Systems Integrators to add value faster by utilising MyID's rich

productivity toolkit; and

* Leveraging MyID's vendor independence to protect customers from technology

obsolescence.In the US, the PIV-Interoperable market is proving to be of

particular interest. Customers include those organisations that wish to

interoperate or emulate the best practice of the US Government's HSPD-12/PIV

initiative. Intercede has already delivered a number of customer deployments

outside of Federal Government, thereby achieving significant first mover

advantage. These include a large aerospace company,a leading strategy and

technology consulting firm, the Transportation Workers Identity Credential

programme and a US state.

A major European telecommunications provider has also adopted MyID to support a

new managed service for the issuance of secure credentials in support of online

data services. This is complemented by MyID's service management capability

which has been developed over the last year for a UK government customer. This

extends the scope of usage of MyID from credential issuance to the larger

credential usage market. It enables MyID to be used to provision subscriber

access to on-card data services and to support 'Security in the Cloud' managed

service deployments.

MyID's identity management capabilities continue to be extended to increase our

product reach, both through MyID's own capabilities and through enhanced

integration with 3rd party identity provisioning systems. For example, we have

enhanced our integration with SUN Identity Manager for our Lockheed Martin and

BT customers. We have also enabled integration with Novell Identity Manager for

our Middle East Oil Company customer and, in the case of a large government

contract, we have integrated with the Thales TAMIS biometric system.

Finally, Intercede continues to invest in its integrators' toolkit; a tool that

accelerates Intercede's own project specific customisation activities and

provides integrators with a platform for rapid application development.

Strategy

In last year's Chairman's statement, I highlighted that the Group's 2009/10

business plan was to:

* Continue to successfully deliver existing large projects that cross the

financial year end;

* Secure new large scale public sector projects from governments worldwide;

* Further expand our market penetration in the US by incorporating a US subsidiary

company and appointing a local general manager;

* Capitalise on our new business in the Middle East and Australia to win

additional contracts in these regions; and

* Refocus Intercede's supply chain development efforts onto those partners who are

prepared to invest in product training and marketing. It is also critical that

they have the technical expertise to excel in project delivery and customer

care.

After 12 months of further progress, Intercede's success in executing this

strategy can be summarised as follows:

* 80% of Intercede's revenues were derived from 16 major projects that span across

financial years;

* A new subcontract with Thales UK for a major UK government contract was

announced on 1 March 2010. This is in addition to ongoing large and small public

sector contracts in Australia, Greece, Hungary, Ireland, Israel, Kuwait,

Netherlands, Portugal, Romania, Slovakia and the US;

* Intercede MyID Inc, was incorporated in September 2009 in the State of Delaware

and a senior industry professional has been appointed to grow the business;

* Intercede's footprint in the Middle East and Australia has been expanded by the

addition of a middle eastern oil company and an Australian bank as new

customers; and

* A new sales structure has been put in place lead by Jurek Sikorski, a

Non-Executive Director of Intercede. Jurek is a member of the London Business

School and is a highly experienced sales professional. Under Jurek's expert

leadership, Intercede is investing in supporting and leveraging a selected group

of sales partners who are judged to be most likely to maximise our commercial

performance in the short to medium term.

The Group's business plan in the coming year is to build on this year's success

by executing the following strategy:

* Launch MyID 9 as a major product release, designed to deliver new levels of

business productivity and cost improvements to customers;

* Expand the number of large customers who generate long term recurring revenues;

* Further develop an ecosystem of global partners and integrators to deliver

complete solutions to customers around the world;

* Increase the service revenues from Intercede expert professional services team

at a time when one of the major barriers to market growth is a lack of skilled

implementers;

* Drive product innovation in the support of managed service partners including

the delivery of 'security in the cloud' and the use of mobile devices as a

secure credential; and

* Accelerate growth and compensate for any loss of revenue that may result from

cuts in UK public sector spending by investing to drive new sales in

international markets, particularly in the US.

Outlook

Intercede's activities are highly relevant to world events; but its products are

also helping to build a safer world, as illustrated by a selection of media

headlines from earlier this year:

March 3, New York - FAA puts two air traffic control employees on admin leave

after teen directs aircraft over JFK.

March 25, Leeds - NHS Choose and Book programme [a national electronic referral

service] announces that it has reached a key milestone of 20 million patient

referrals having been booked using the system.

April 13, Washington - In full accord on a global threat, world leaders endorse

President Barack Obama's call for securing all nuclear materials around the

globe within four years to keep them out of the grasp of terrorists.

April 15, Washington - 1,421,756 TWIC cards issued to port workers at 159 TWIC

Enrollment Centers across the US, American Samoa and Guam.

Behind each of these headlines is a story about how Intercede's people and

technology are enabling these and similar programmes to enhance security and

deliver trust. For example, the FAA is using MyID to provision strong identity

cards to air traffic controllers across the US to enable better access security

to sensitive facilities and the NHS has issued nearly 800,000 smart cards using

MyID to medical professionals across the UK to enable secure access to the NHS

Choose and Book system. In the US, MyID is being used in a programme to control

the movement of radioactive materials and all of the TWIC cards for US port

workers are produced using MyID. These are just a few topical examples of the

ongoing growth of identity projects and there is clear evidence of an

acceleration in the number of similar opportunities that are emerging around the

world.

We believe the importance of being able to establish trust between individuals

and organisations in an increasingly virtual and highly mobile world will be

critical to many areas of day to day business and personal life, such as

accessing facilities in the workplace, buying goods and services, proving

entitlement, defeating terrorism and preventing cyber warfare. This need is a

subset of the wider Identity and Access Management market which is forecast to

grow globally from $3.15bn in 2007 to $5.3bn in 2012. 75% of this total market

is driven by compliance and regulatory demand, notably in the US which accounts

for around 40% of the whole (Source:IDC).

Intercede's MyID technology and our expert team of engineers are ideally placed

to deliver world-class solutions to these difficult and complex requirements.

For a company with modest current revenues, the potential upside from our

continuing success is very high and we remain optimistic about our future

prospects.

We look forward with confidence to reporting on our progress during the current

year and beyond.

Richard Parris

Chairman & Chief Executive

Business and Finance Review

Introduction

Intercede has delivered an improved trading performance in the current financial

year despite difficult economic conditions. This further growth reflects the

continued momentum from the Group's involvement in an increasing number of

projects around the world with a consequential increase in revenues from

software licence sales, associated support & maintenance and the delivery of

ongoing professional services assistance.

Business Development

In last year's Business and Finance Review, I stated that the momentum is

clearly building, which has been further demonstrated by these results.

Existing projects have gone to plan and new projects have continued to be won.

Moreover, the Directors are increasingly confident that this will be reflected

in the Group's future financial performance as more and more projects move

beyond the initial proof of concept and pilot phases.

It is also worthy of note that the nature of these projects, which are

infrastructure related, means that they can realistically be expected to deliver

revenues over many years offering increasing levels of visibility. Intercede's

MyID software manages the secure enrolment, verification, issuance and lifecycle

of digital identities for a wide range of uses. This requires the integration of

multiple technologies and products from many different vendors, including smart

cards, biometrics, digital certificates, Open Platform applets and physical

access control systems. Requests for professional services assistance are an

ongoing feature of major projects, in addition to revenues from further licence

sales and support & maintenance renewals.

Following the successful launch of MyID 8 in June 2008, which repositioned MyID

from being a smart card management system to a fully featured Identity and

Credential Management System, MyID 8 SR1 was released on 26 October 2009. This

updated version includes support for a wide range of third party systems and

devices and enables partners and systems integrators to add value faster using

Intercede's revolutionary Project Designer suite of Application Programming

Interfaces (APIs) and customisation tools.

The combined effect of project wins and product strengthening continues to be

reflected in a growing level of interest in MyID from existing and potential new

industry partners. The nature and extent of project wins over the past 2-3 years

has established MyID as a market leader in its own right and an increasing

proportion of Intercede's industry partners are marketing and selling the

Group's technology under the MyID name. The consequential benefit from Intercede

receiving a greater share of the contract value has also contributed to the

Group's improved financial performance.

The Group enters 2010/11 with a larger pipeline than ever before, both in terms

of the number and value of individual opportunities. The current pipeline

contains a high level of forecast revenue from projects we have already won

(i.e. additional revenues from existing projects), quite apart from other

projects that we are still bidding for.

Whilst experience tells us that project delays can and will happen for a variety

of reasons, we remain focused on the action we can take to ensure that we are

best placed to deal with any changes to project timings.

Financial Results

The financial results outlined below reflect the continued momentum from the

Group's involvement in an increasing number of projects around the world.

+--------------------------+-----------------+----------------+----------+

| | Year ended | Year ended | |

| | 31 March 2010 | 31 March 2009 | Change |

| | GBP000 | GBP000 | % |

+--------------------------+-----------------+----------------+----------+

| Revenue | 6,194 | 5,701 | 8.6 |

+--------------------------+-----------------+----------------+----------+

| Gross profit (%) | 6,128 (99%) | 5,660 (99%) | 8.3 |

+--------------------------+-----------------+----------------+----------+

| Pre-exceptional | (4,102) | (3,802) | (7.9) |

| operating costs | | | |

+--------------------------+-----------------+----------------+----------+

| Pre-exceptional | 2,026 (33%) | 1,858 (33%) | 9.0 |

| operating profit (%) | | | |

+--------------------------+-----------------+----------------+----------+

| Exceptional item | (1,517) | (371) | |

+--------------------------+-----------------+----------------+----------+

| Profit before tax | 510 | 1,408 | (63.8) |

+--------------------------+-----------------+----------------+----------+

| Basic earnings per share | 1.1p | 4.7p | (76.6) |

+--------------------------+-----------------+----------------+----------+

| Adjusted earnings per | 4.2p | 3.7p | 13.5 |

| share | | | |

+--------------------------+-----------------+----------------+----------+

Sales revenues have grown by a further 9% following last year's doubling, with

no one project representing more than 15% of total revenue (2009: 25%). With

gross profit margins remaining constant at 99%, and the increase in costs being

restricted to 8%, the Group has delivered a 33% pre-exceptional operating margin

for the second year in succession.

Staff costs continue to represent the main area of expense representing 84% of

the total pre-exceptional operating costs (2009: 84%). The average number of

employees increased from 47 to 54 year on year.

The exceptional item represents the costs associated with defending a patent

infringement lawsuit which was filed by ActivIdentity in the United States

District Court for the Northern District of California on 1 October 2008. No

further legal costs are expected to arise following the settlement of this claim

on 23 March 2010.

The net finance income for the year was GBP1,000 (2009: GBP79,000 net finance

cost) which reflects the benefit of the May 2009 convertible loan note

conversion. Having regard for the enhanced tax relief available in respect of

research and development expenditure, GBP3,574,000 of prior year tax losses

remain available for utilisation against future year's profits (2009:

GBP3,506,000). Given the increase in tax losses carried forward, no change has

been made to the deferred tax asset recognised in respect of prior year losses

(2009: GBP280,000 credit).

A profit for the year of GBP496,000 (2009: GBP1,749,000) resulted in a basic

earnings per share of 1.1p (2009: 4.7p) and a fully diluted earnings per share

of 1.0p (2009: 3.6p). The adjusted fully diluted earnings per share, based upon

profit prior to tax and exceptional item of GBP2,027,000 (2009: GBP1,779,000),

is 4.2p (2009: 3.7p).

Funding

As at 31 March 2010, the Group had cash balances totaling GBP4,664,000 (2009:

GBP3,711,000). The increase in cash balances principally reflects a GBP2,085,000

inflow from pre-exceptional operating activities (2009: GBP2,445,000 inflow) and

GBP1,085,000 of exceptional payments relating to the ActivIdentity patent

litigation (2009: GBP56,000). Following the settlement of this litigation on 23

March 2010, all outstanding legal costs have now been paid. This resulted in a

further GBP747,000 being paid out during April and May 2010 to the Group's legal

advisers, as a result of which the Group has effectively entered the new

financial year with a net cash balance of GBP3,917,000.

The Group has no debt (2009: GBP1,936,000). As outlined in note 7, all of the

convertible loan note holders elected to convert their loan notes into ordinary

shares during the period. The conversion significantly strengthens the Company's

Balance Sheet and leaves the Group with a substantial cash balance to meet its

future needs.

The Board proposes to reduce the Company's share capital by cancelling the Share

Premium Account and cancelling and extinguishing the Deferred Shares. A circular

will be sent to shareholders seeking approval for the Proposals at a General

Meeting of the Company which is scheduled to follow this year's AGM on 24

September 2010. The effect of the Capital Reduction would be to eliminate the

deficit showing as profit and loss account reserves, thereby facilitating the

payment of a dividend as and when the Board considers this to be appropriate.

Summary

The Group has delivered another strong trading and financial performance. It is

pleasing to enter the new financial year with a much stronger Balance Sheet and

having resolved the patent litigation.

Andrew Walker

Finance Director

INTERCEDE GROUP plc

Consolidated Income Statement for the year ended 31 March 2010

+---------------------------------------------+--------+------------+------------+

| | Notes | 2010 | 2009 |

+---------------------------------------------+--------+------------+------------+

| | | GBP000 | GBP000 |

+---------------------------------------------+--------+------------+------------+

| Continuing operations | | | |

+---------------------------------------------+--------+------------+------------+

| Revenue | 2 | 6,194 | 5,701 |

+---------------------------------------------+--------+------------+------------+

| Cost of sales | | (66) | (41) |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Gross profit | | 6,128 | 5,660 |

+---------------------------------------------+--------+------------+------------+

| Administrative expenses | | (5,619) | (4,173) |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Operating profit | | 509 | 1,487 |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Operating profit before exceptional item | | 2,026 | 1,858 |

+---------------------------------------------+--------+------------+------------+

| Exceptional item | 3 | (1,517) | (371) |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Operating profit | | 509 | 1,487 |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Finance income | | 27 | 68 |

+---------------------------------------------+--------+------------+------------+

| Finance costs | | (26) | (147) |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Profit before tax | | 510 | 1,408 |

+---------------------------------------------+--------+------------+------------+

| Taxation | 4 | (14) | 341 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Profit for the year | | 496 | 1,749 |

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

| | | | |

+---------------------------------------------+--------+------------+------------+

| Total comprehensive income attributable to | | 496 | 1,749 |

| owners of the company | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

| | | | |

+---------------------------------------------+--------+------------+------------+

| Earnings per share (pence) | 5 | | |

+---------------------------------------------+--------+------------+------------+

| - basic | | 1.1p | 4.7p |

+---------------------------------------------+--------+------------+------------+

| - diluted | | 1.0p | 3.6p |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

There are no recognised gains or losses in either year other than the profit for

the year.

The accompanying notes are an integral part of these financial statements.

INTERCEDE GROUP plc

Consolidated Balance Sheet at 31 March 2010

+--------------------------------------------+--------+------------+------------+

| | Notes | 2010 | 2009 |

+--------------------------------------------+--------+------------+------------+

| | | GBP'000 | GBP'000 |

+--------------------------------------------+--------+------------+------------+

| Non-current assets | | | |

+--------------------------------------------+--------+------------+------------+

| Property, plant and equipment | | 84 | 67 |

+--------------------------------------------+--------+------------+------------+

| Deferred tax | | 280 | 280 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | 364 | 347 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | | |

+--------------------------------------------+--------+------------+------------+

| Current assets | | | |

+--------------------------------------------+--------+------------+------------+

| Trade and other receivables | | 954 | 902 |

+--------------------------------------------+--------+------------+------------+

| Cash and cash equivalents | 8 | 4,664 | 3,711 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | 5,618 | 4,613 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | | |

+--------------------------------------------+--------+------------+------------+

| Total assets | | 5,982 | 4,960 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | | |

+--------------------------------------------+--------+------------+------------+

| Equity | | | |

+--------------------------------------------+--------+------------+------------+

| Called up share capital | 7 | 4,413 | 4,305 |

+--------------------------------------------+--------+------------+------------+

| Share premium account | | 4,718 | 2,875 |

+--------------------------------------------+--------+------------+------------+

| Other reserves | | 1,508 | 1,508 |

+--------------------------------------------+--------+------------+------------+

| Equity reserve | | - | 109 |

+--------------------------------------------+--------+------------+------------+

| Retained earnings | | (7,497) | (8,102) |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| Total equity | | 3,142 | 695 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | | |

+--------------------------------------------+--------+------------+------------+

| Current liabilities | | | |

+--------------------------------------------+--------+------------+------------+

| Trade and other payables | | 1,385 | 1,156 |

+--------------------------------------------+--------+------------+------------+

| Deferred revenue | | 1,455 | 1,173 |

+--------------------------------------------+--------+------------+------------+

| Convertible loan notes | 8 | - | 1,936 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | 2,840 | 4,265 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

| | | | |

+--------------------------------------------+--------+------------+------------+

| Total equity and liabilities | | 5,982 | 4,960 |

+--------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+--------------------------------------------+--------+------------+------------+

The accompanying notes are an integral part of these financial statements.

INTERCEDE GROUP plc

Consolidated Statement of Changes in Equity for the year ended 31 March 2010

+----------------------------+----------+----------+----------+----------+----------+----------+

| | Share | Share | Other | Equity | Retained | Total |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | capital | premium |reserves | reserve | earnings | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | | account | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | | | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| At 31 March 2008 | 4,292 | 2,764 | 1,508 | 109 | (9,851) | (1,178) |

+----------------------------+----------+----------+----------+----------+----------+----------+

| Issue of shares, net of | 13 | 111 | - | - | - | 124 |

| costs | | | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| Total comprehensive income | - | - | - | - | 1,749 | 1, 749 |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | ________ | ________ | ________ | _______ | ________ | _______ |

+----------------------------+----------+----------+----------+----------+----------+----------+

| At 31 March 2009 | 4,305 | 2,875 | 1,508 | 109 | (8,102) | 695 |

+----------------------------+----------+----------+----------+----------+----------+----------+

| Issue of shares, net of | 108 | 1,843 | - | (109) | 109 | 1,951 |

| costs (see note 7) | | | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| Total comprehensive income | - | - | - | - | 496 | 496 |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | ________ | ________ | ________ | _______ | _______ | ________ |

+----------------------------+----------+----------+----------+----------+----------+----------+

| At 31 March 2010 | 4,413 | 4,718 | 1,508 | - | (7,497) | 3,142 |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | _ | ________ | ________ | _______ | ________ | ________ |

| | ______ | | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

| | | | | | | |

| | | | | | | |

+----------------------------+----------+----------+----------+----------+----------+----------+

The accompanying notes are an integral part of these financial statements.

INTERCEDE GROUP plc

Consolidated Cash Flow Statement for the year ended 31 March 2010

+---------------------------------------------+--------+------------+------------+

| | Notes | 2010 | 2009 |

+---------------------------------------------+--------+------------+------------+

| | | GBP'000 | GBP'000 |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Cash flows from operating activities | | | |

+---------------------------------------------+--------+------------+------------+

| Operating profit | | 509 | 1,487 |

+---------------------------------------------+--------+------------+------------+

| Exceptional item | | 1,517 | 371 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Operating profit before exceptional item | | 2,026 | 1,858 |

+---------------------------------------------+--------+------------+------------+

| Depreciation | | 31 | 25 |

+---------------------------------------------+--------+------------+------------+

| Increase in trade and other receivables | | (60) | (473) |

+---------------------------------------------+--------+------------+------------+

| Increase in trade and other payables | | 88 | 1,035 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Cash generated from operations before | | 2,085 | 2,445 |

| exceptional item | | | |

+---------------------------------------------+--------+------------+------------+

| Exceptional item | | (1,085) | (56) |

+---------------------------------------------+--------+------------+------------+

| Taxation (paid)/received | | (14) | 61 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Net cash generated from operating | | 986 | 2,450 |

| activities | | | |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Investing activities | | | |

+---------------------------------------------+--------+------------+------------+

| Interest received | | 25 | 68 |

+---------------------------------------------+--------+------------+------------+

| Purchases of property, plant and equipment | | (48) | (40) |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Net cash from investing activities | | (23) | 28 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Financing activities | | | |

+---------------------------------------------+--------+------------+------------+

| (Costs)/proceeds on issue of shares | | (10) | 80 |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| | | | |

+---------------------------------------------+--------+------------+------------+

| Net increase in cash and cash equivalents | 8 | 953 | 2,558 |

+---------------------------------------------+--------+------------+------------+

| Cash and cash equivalents at the beginning | 8 | 3,711 | 1,153 |

| of the year | | | |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

| Cash and cash equivalents at the end of the | 8 | 4,664 | 3,711 |

| year | | | |

+---------------------------------------------+--------+------------+------------+

| | | __________ | __________ |

+---------------------------------------------+--------+------------+------------+

The accompanying notes are an integral part of these financial statements.

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2010

NOTES

1. The financial information set out in this announcement does not

constitute the Group's Statutory Accounts for the years ended 31 March 2009 or

2010, but is derived from those accounts. Statutory Accounts for 2009 have been

delivered to the Registrar of Companies and those for 2010, which have been

approved by the Board of Directors, will be delivered following the Group's

Annual General Meeting. The Company's auditors have reported on those accounts;

their reports were unqualified and did not contain statements under Section 498

of the Companies Act 2006.

The Annual General Meeting of the Company will be held at 11.00 am on Friday 24

September 2010 at Lutterworth Hall. Copies of the full Statutory Accounts will

be despatched to shareholders in due course. Copies will also be available on

the website (www.intercede.com) and from the registered office of the Company:

Lutterworth Hall, St. Mary's Road, Lutterworth, Leicestershire, LE17 4PS.

2. SEGMENTAL REPORTING

All of the Group's revenue, operating profits and net assets originate from

operations in the United Kingdom. The Directors consider that the activities of

the Group constitute a single business segment.

The split of revenue by geographical destination of the end customer can be

analysed as follows:

+-------------------------------------------+------+------------+----------+----------+

| | 2010 | 2009 |

+--------------------------------------------------+------------+---------------------+

| | GBP'000 | GBP'000 |

+--------------------------------------------------+------------+---------------------+

| United Kingdom | 1,601 | 2,488 |

+--------------------------------------------------+------------+---------------------+

| Rest of Europe | 1,389 | 846 |

+--------------------------------------------------+------------+---------------------+

| USA | 2,795 | 2,104 |

+--------------------------------------------------+------------+---------------------+

| Rest of World | 409 | 263 |

+--------------------------------------------------+------------+---------------------+

| | __________ | _________ |

+--------------------------------------------------+------------+---------------------+

| | 6,194 | 5,701 |

+--------------------------------------------------+------------+---------------------+

| | __________ | _________ |

+--------------------------------------------------+------------+---------------------+

| | | |

+-------------------------------------------+------------------------------+----------+

| | | | | |

+-------------------------------------------+------+------------+----------+----------+

3. EXCEPTIONAL ITEM

The exceptional item represents the costs associated with defending a patent

infringement lawsuit which was filed by ActivIdentity in the United States

District Court for the Northern District of California on 1 October 2008. No

further legal costs are expected to arise following the settlement of this claim

on 23 March 2010.

4. TAXATION

The tax (charge)/credit comprises:

+------------------------------------------------+----------+----------+-----------+

| | 2010 | 2009 |

+-----------------------------------------------------------+----------+-----------+

| | GBP'000 | GBP'000 |

+-----------------------------------------------------------+----------+-----------+

| | | |

+-----------------------------------------------------------+----------+-----------+

| Current year - UK corporation tax | - | - |

+-----------------------------------------------------------+----------+-----------+

| Prior year - UK corporation tax | (14) | - |

+-----------------------------------------------------------+----------+-----------+

| Research and development tax credits relating to prior | - | 61 |

| periods | | |

+-----------------------------------------------------------+----------+-----------+

| Recognition of deferred tax asset arising from prior | - | 280 |

| period losses | | |

+-----------------------------------------------------------+----------+-----------+

| | __________ | _________ |

+------------------------------------------------+---------------------+-----------+

| | (14) | 341 |

+-----------------------------------------------------------+----------+-----------+

| | __________ | _________ |

+------------------------------------------------+---------------------+-----------+

| | | | |

+------------------------------------------------+----------+----------+-----------+

The Group has unrecognised deferred tax assets of GBP721,000 (2009: GBP702,000)

and unused tax losses of GBP3,574,000 (2009: GBP3,506,000).

5. EARNINGS PER ORDINARY SHARE

The calculations of earnings per ordinary share are based on the profit for the

financial year and the weighted average number of ordinary shares in issue

during each year.

+----------+----------------------------------------------+----------+------------+------------+----------+

| | | 2010 | 2009 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | GBP'000 | GBP'000 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | Profit for the year | 496 | 1,749 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | Adjusted profit before tax and exceptional | 2,027 | 1,779 | |

| | item | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | __________ | __________ |

+--------------------------------------------------------------------+------------+-----------------------+

| | | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | Number | Number | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | Weighted average number of shares - basic | 46,304,420 | 37,011,460 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | 48,735,005 | 48,735,009 | |

| | - diluted | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | __________ | __________ |

+--------------------------------------------------------------------+------------+-----------------------+

| | | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | Pence | Pence | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | Earnings per share - basic | 1.1 | 4.7 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | - diluted | 1.0 | 3.6 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | - adjusted* | 4.2 | 3.7 | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | __________ | __________ |

+--------------------------------------------------------------------+------------+-----------------------+

| | * Adjusted fully diluted earnings per share | | | |

| | based on profit before tax and exceptional | | | |

| | item | | | |

+----------+----------------------------------------------+-----------------------+------------+----------+

| | | | | | |

+----------+----------------------------------------------+----------+------------+------------+----------+

6.DIVIDEND

The Directors do not recommend the payment of a dividend.

7. CALLED UP SHARE CAPITAL

+----------------------------------------------+------------+------------+

| | 2010 | 2009 |

+----------------------------------------------+------------+------------+

| | GBP'000 | GBP'000 |

+----------------------------------------------+------------+------------+

| Authorised | | |

+----------------------------------------------+------------+------------+

| 481,861,616 (2009: 481,861,616) ordinary | 4,819 | 4,819 |

| shares of 1p each | | |

+----------------------------------------------+------------+------------+

| 393,138,384 (2009: 393,138,384) deferred | 3,931 | 3,931 |

| shares of 1p each | | |

+----------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------+------------+------------+

| | 8,750 | 8,750 |

+----------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------+------------+------------+

| Issued and fully paid | | |

+----------------------------------------------+------------+------------+

| 48,178,005 (2009: 37,403,756) ordinary | 482 | 374 |

| shares of 1p each | | |

+----------------------------------------------+------------+------------+

| 393,138,384 (2009: 393,138,384) deferred | 3,931 | 3,931 |

| shares of 1p each | | |

+----------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------+------------+------------+

| | 4,413 | 4,305 |

+----------------------------------------------+------------+------------+

| | __________ | __________ |

+----------------------------------------------+------------+------------+

The increase in issued and fully paid ordinary shares of 1p each reflects the

exercise of warrants and convertible loan stock during the year.

On 13 May 2008, Credo Corporate Finance exercised the warrants which were

granted in connection with the July 2003 placing. This resulted in the issue of

1,017,100 ordinary shares at the July 2003 placing price of 7.8p per ordinary

share.

On 10 March 2009, 292,915 ordinary shares were issued at a price of 15p per

ordinary share following notification from Champel Inc. that they had agreed to

convert their loan note together with associated interest for the period to 31

May 2009.

On 29 May 2009, notification was received from the remaining holders of the

convertible loan notes issued by the Company on 31 March 2000 and 6 December

2001 that they had elected to convert their loan notes together with associated

interest for the period to 31 May 2009 into ordinary shares of 1p each in the

Company. This resulted in the issue of 3,877,166 ordinary shares at a price of

15p per share and 6,897,083 ordinary shares at a price of 20p per share.

The deferred shares which were created as a result of the July 2003 placing have

minimal rights attaching to them and are effectively worthless.

8. ANALYSIS OF NET CASH

+------------------+--------------------+------------+------------+-----------+

| | 2009 | Cash flow | Non-cash | 2010 |

| | | | movement | |

+------------------+--------------------+------------+------------+-----------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+------------------+--------------------+------------+------------+-----------+

| Cash at bank and | 3,711 | 953 | - | 4,664 |

| in hand | | | | |

+------------------+--------------------+------------+------------+-----------+

| Debt due within | (1,936) | - | 1,936 | - |

| one year | | | | |

+------------------+--------------------+------------+------------+-----------+

| | ________ | __________ | __________ | _________ |

+------------------+--------------------+------------+------------+-----------+

| Net cash | 1,775 | 953 | 1,936 | 4,664 |

+------------------+--------------------+------------+------------+-----------+

| | ________ | __________ | __________ | _________ |

+------------------+--------------------+------------+------------+-----------+

On 29 May 2009, as outlined in note 7, the debt due within one year disappeared

since the remaining convertible loan note holders elected to convert their loan

notes into ordinary shares rather than to request repayment.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KKCDPOBKDBAK

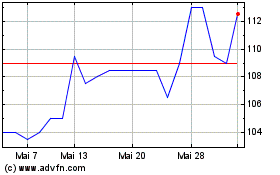

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024