RNS Number:2892W

Intercede Group PLC

23 May 2002

INTERCEDE GROUP plc

("Intercede", "the Company" or "the Group")

Preliminary Results for the Year Ended 31 March 2002

Intercede, a leading developer of electronic identity management software, which

obtained a listing on the Alternative Investment Market in January 2001, today

announces its preliminary results for the year ended 31 March 2002.

SUMMARY

* Turnover of £1.2 million (2001: £2.0 million) and pre-tax loss of £2.2

million (2001: £1.1 million)

* Concentration of resources on development of key electronic identity

management software, edeficeTM: Version 6.3 launched in April 2002

* Agreements signed with Oberthur, ActivCard and Datakey: total advance

licence commitments of almost US$2 million, of which US$0.8 million has

already been received

* Balance sheet structured for growth: additional funding secured during the

year and short term borrowings substantially reduced

* Tight control over costs and cash continues to be maintained

* Increased scope to grow international sales channel and secure wide market

penetration

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"It has been a year of significant change. In challenging market conditions, we

have successfully developed our business model to concentrate on one of the

fastest growing sectors of the IT security marketplace. The short term effect

has been an inevitable reduction in revenues. However, we are confident that we

can grow from the platform we have built for ourselves, as evidenced by the

recent contracts signed with several important international partners."

23 May 2002

ENQUIRIES:

Intercede Group plc Tel. 01455 558111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

College Hill Tel. 020 7457 2020

Archie Berens

Clare Warren

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2002

CHAIRMAN'S STATEMENT

The year has concluded with a number of very positive events that endorse the

Group's focused strategy. Principal amongst these were significant contracts

from ActivCard, Datakey and Oberthur, who have licensed the Group's edefice

product for incorporation into their product lines.

Introduction

Intercede produces software to enable organizations to securely create, issue

and subsequently manage electronic identities and associated credentials for

corporate, governmental and personal use.

These identities are typically stored on smart cards and may also involve the

use of fingerprints, facial recognition, digital certificates, passwords or

other security devices.

It is anticipated that within the next three to five years the majority of

people will carry at least one form of electronic identity which will probably

be embedded in a smart card, e.g. a corporate ID card in New York, health

records in France, a National Citizen's ID in Malaysia, a driving licence in

India or a bank debit card in the UK. This is an emerging and potentially very

large market, which currently has few technical standards and no established

market leaders.

It is this market opportunity which Intercede has identified and is looking to

exploit.

Results

In the year ended 31 March 2002, turnover of £1.2 million was achieved at a

gross margin of 62% (compared to £2.0 million at a gross margin of 53% in the

previous period). Both the increase in gross margin and the decrease in turnover

are a direct result of the Group's decision to redeploy its software development

resources from project related work to the development of our proprietary

edefice product.

Importantly, this strategy has resulted in a significant increase in the Group's

intangible intellectual property as represented by its edefice software.

The validity of this approach was demonstrated when the Group won US$2 million

of advance orders for its edefice software in the second half of the year,

US$0.8 million of which had been already paid into the Group's bank account by

31 March 2002.

In a very difficult year for the IT sector, Intercede's operating losses have

widened to £2.2m as a result of continued product development. Nevertheless,

through rigorous financial control, the Group has consistently out-performed its

cash forecasts and maintained its cash outflow before financing at the same

level as the previous year.

Finance

At 31 March 2002, the Group had cash reserves of £1.8 million compared to £2.0

million as at 31 March 2001. This includes £982,000 of new funding which was

raised as a convertible five year loan in December 2001. An existing convertible

loan totaling £450,000 was also extended for a further five years during the

period. The overall effect is to secure long term funding for the Group, while

substantially reducing its short term borrowings.

Strategy and Outlook

The year started with an optimistic outlook for Internet security business.

However, the worsening economic climate in the early part of the period reduced

the demand from many organizations for security related purchases. The

unfortunate events of 11 September 2001, while highlighting the importance and

ultimately increasing the size of the security products industry, only served to

result in further short term deferrals of expenditure.

The downturn in end user spending in 2001 resulted in the Group's potential

partners and competitors retrenching to focus on their core competencies: for

example, a number of the smart card manufacturers reduced their in-house

software development activities. This happened just as the need for electronic

identity management systems started to emerge. As a result, many smart card

industry participants are urgently undertaking 'buy or build' decisions for new

software systems at a time when they have already downscaled their own

development capabilities. This has created the opportunity for Intercede to

become a preferred software provider to the major smart card manufacturers as

they start to 'tool up' for future growth.

According to a number of industry forecasters, the use of smart cards for access

and security purposes will grow rapidly over the next three to five years at

estimated annual growth rates ranging from 30% to more than 50%. The electronic

identity management market to support this sector is estimated to exceed $1bn

over the same period. With no clear standard or market leader in this sector,

the Group believes that edefice has an excellent prospect of winning significant

market share. For example, the Group's existing partners would claim more than

50% market penetration of the access and security market for smart cards.

The current period has seen the Group placing increased emphasis on signing

licensing contracts and building a robust software platform, with a high degree

of success.

Looking ahead to the next year, the Group will continue to focus on this

strategy to ensure that:

• Existing partners successfully sell edefice enabled products to their

end-user customers.

• Product development remains world-class and competitive.

• New partners are signed.

• Gross margins are increased.

A critical measure of success in the next 12 months will be the Group's ability

to secure wide market penetration through channel partners while managing cash

reserves. However, once this has been achieved, the Group needs only modest

market growth in order to secure early profitability. In the longer term, the

Group continues to believe that exceptional returns are possible.

Richard Parris

Chairman & Chief Executive

23 May 2002

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2002

REVIEW OF OPERATIONS

During the past year the Group has emerged as one of the very few companies in

the world that has developed 'package' software to manage the deployment and

life cycle of electronic identities.

Product Design

The Group's software is called edefice. The edefice product provides a

general-purpose identification management platform across a wide range of

existing and potential applications.

Version 6.3 of edefice was launched at the CardTech/SecurTech Exhibition in New

Orleans in April 2002. It is a world-class product for managing the issuance and

life cycle of smart cards and associated credentials, including picture ID's,

Public Key Infrastructure certificates and biometrics (e.g. fingerprints and

facial recognition), for corporates, national ID schemes and some consumer

applications

Originally conceived to be a management platform for corporate IT security in

general, edefice has been developed over the course of the last 12 months into a

highly focused electronic identity management system. This has enabled the Group

to concentrate on one of the fastest growing sectors of the IT security

marketplace.

The edefice platform is powerful because it enables any PC with a browser and an

Internet connection to become a distributed yet secure and centrally controlled

identification management station. Edefice is a sophisticated product that makes

very complicated security products, processes and technologies from multiple

manufacturers simple to deploy and easy to use. This makes edefice attractive to

all participants in the industry sector.

The strength of the Group is the intellectual property embedded in edefice and

the high quality of the Group's workforce, both of which the Group works

rigorously to nurture and protect. Edefice represents more than 40 man years of

development by the Group's in-house technical team.

Business Development

The Group's preferred route to market is to license edefice to global product

and service companies who embed the edefice technology within their own branded

product lines.

The quality and efficacy of edefice and the Group's channel approach was

demonstrated when:

• Oberthur Card Systems, the third largest producer of smart cards in the

world, signed a contract to license edefice as their own brand smart card

provisioning and management system in September 2001.

• ActivCard, a leading digital identity software company with offices in

Silicon Valley, Paris and Singapore and a long term partner of Intercede,

signed a contract to license edefice for incorporation into the ActivCard

product range in December 2001.

• Datakey, a Minneapolis company specialising in secure smart card systems,

signed a contract to license edefice as the Datakey smart card management

system in April 2002.

The above contracts involve advance licence commitments of nearly US$2 million,

of which US$0.8 million has already been received. Additional licensing

negotiations and partnership discussions with other companies are in progress.

In addition, a major UK Government Department has agreed to deploy edefice to

provide enhanced security for employees accessing its networks. This agreement

came about through the combined marketing efforts of Intercede and its long

standing partner, Fujitsu Services. It is further vindication of our strategy of

entering into partnerships with key industry players with a view to securing a

wide distribution of the edefice product.

These relationships will enable Intercede to sell its edefice product throughout

the world without the need to establish a costly international infrastructure.

It is anticipated that it will take approximately 9 to 12 months after signing

for each licensing partner to produce additional revenues, beyond their initial

commitments, from end users. Thereafter, the Group expects strong growth in

recurring revenue via these partners.

In the UK domestic market, the Group continues with the direct sale of edefice

and third party products to UK banks, Government departments and the NHS. These

activities make an important contribution to earnings. However, as a proportion

of total revenue, these earnings will reduce as the Group continues to move to

an indirect international distribution model.

While other companies involved in smart card management are focusing on

mass-market consumer applications, such as multi-application banking cards,

Intercede is initially targeting access control and security applications,

typically in a corporate environment. Nevertheless, the edefice architecture is

easily portable to other application areas and Intercede intends to pursue

consumer deployments in partnership with the application providers who already

service this market.

International Expansion

Last year, the Group stated its aim of expanding internationally through a

number of strategic partners, both manufacturers of smart card and security

systems, and integration partners world-wide. Partnership agreements with

ActivCard, Datakey and Oberthur are evidence of success to date in executing

this strategy. Individually and collectively, they provide world-wide sales

channels for the edefice technology. The Group believes that this maximises the

potential for rapid growth by leveraging its core UK based technical skills in a

highly scalable manner.

Jayne Murphy

Operations Director

23 May 2002

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2002

FINANCIAL REVIEW

The Group continues to make significant progress with limited funds. The

challenge is to continue to take the necessary action to maximise the market

opportunity, whilst maintaining tight control over costs and cash.

Financial Results

Revenues for the year were £1.2 million compared with £2.0 million for the prior

period. This includes £277,000 (US$0.4 million) relating to the advance licence

commitment paid by ActivCard in the second half of the period. The balance of

£278,000 (US$0.4 million) will be included in the revenues for the six months

ending 30 September 2002.

Excluding ActivCard, the revenues for the year were £0.9 million. As reported at

the interim stage, the overriding need to develop and release further versions

of edefice and to link up with key industry players in the smart card management

market has resulted in Intercede focusing its technical resources almost

entirely to this end. The Group has neither sought nor undertaken new project

work during the period. Revenues therefore related primarily to the servicing of

existing customers through the resale of additional software licenses and

associated third party hardware and maintenance services.

Additional staff were recruited during the period to increase and strengthen the

Group's technical and sales capability. This resulted in a 50% increase in the

average number of employees from 24 to 36. The consequent increase in overheads

from £2.2 million to £2.9 million, when combined with the impact of

discontinuing project work, served to increase the loss before tax for the

period to £2.2 million (2001: £1.1 million). The loss after tax was £1.9 million

(2001: £1.1 million), due to the Group being able to take advantage of the tax

relief for research and development expenditure introduced by the Finance Act

2000. This resulted in a loss per ordinary share of 11.7p (2001: 8.8p).

Funding

The Group's first external funding, which came from venture capital sources, was

provided in February 1999 and subsequent injections, up to and including the

£982,000 which was raised in December 2001, have resulted in £5.1 million of

external funding being raised to date. With £1.8 million of funds remaining as

at 31 March 2002, this means that £3.3 million (net) has been invested to date

(£1.2 million over the past 12 months). It is also worth noting that the gross

level of investment during this period is approaching £6.0 million, with

projects completed for early adopters in the UK Finance and Government Sectors

plus the advance licence commitment received from ActivCard, effectively

providing additional funding along the way.

These funds have been invested to create:

• A world class software development team, as evidenced by the agreements

already concluded with a number of major global industry players.

• The edefice product which is already demonstrating the potential to become

an industry standard for smart card management.

• Delivery channels with global reach.

• An experienced management team and company framework which is capable of

supporting substantial growth in the Group's activities over the coming

years.

Summary

The Group has continued to make significant progress with the achievement of the

objectives outlined at the time of its flotation onto the Alternative Investment

Market. Indeed, with difficult market conditions only serving to increase the

Group's focus on those objectives, the transition from being a distributor and

integrator of third party security products to becoming a global business able

to earn long term revenues from its proprietary products has accelerated.

As discussed above, and in the Chairman's Statement and Review of Operations,

the Board is confident that the Group will be successful in securing significant

new business in 2002/03. However, the Board recognises that strong cost control

and cash management will continue to be particularly critical for the Group as

it moves ahead to a position of profitability.

Andrew Walker

Finance Director

23 May 2002

INTERCEDE GROUP plc

Consolidated Profit and Loss Account for the year ended 31 March 2002

Notes 2002 2001

£'000 £'000

Turnover 1,193 2,014

Cost of sales (450) (945)

743 1,069

Gross profit

Other operating expenses (2,939) (2,188)

Operating loss (2,196) (1,119)

Interest receivable and similar income 66 48

Interest payable and similar charges (58) (54)

(2,188) (1,125)

Loss on ordinary activities before taxation

Taxation 2 272 -

Loss on ordinary activities after taxation and retained loss for the

year (1,916) (1,125)

Basic and diluted loss per ordinary share 3 (11.7)p (8.8)p

All operations of the Group continued throughout both years and no operations

were acquired or discontinued.

There are no recognised gains or losses in either year other than the loss for

the year.

INTERCEDE GROUP plc

Consolidated Balance Sheet at 31 March 2002

2002 2001

£'000 £'000

Fixed assets

Tangible assets 110 119

Current assets

Stocks 8 8

Debtors 404 663

Cash at bank and in hand 1,772 2,042

2,184 2,713

Creditors: Amounts falling due within one year (1,328) (1,341)

Net current assets 856 1,372

Total assets less current liabilities 966 1,491

Creditors: Amounts falling due after more than one year

Convertible debt (1,432) -

Other creditors (18) (59)

(1,450) (59)

Net (liabilities)/assets (484) 1,432

Capital and reserves

Called-up share capital 4,090 4,090

Share premium account 1,011 1,011

Other reserves 1,508 1,508

Profit and loss account (7,093) (5,177)

Shareholders' (deficit)/funds - all equity (484) 1,432

INTERCEDE GROUP plc

Consolidated Cash Flow Statement for the year ended 31 March 2002

Notes 2002 2001

£'000 £'000

Net cash outflow from operating activities 5 (1,293) (1,093)

Returns on investments and servicing of finance

Interest received 71 42

Interest paid (34) (27)

Interest element of finance lease rentals (9) (12)

Net cash inflow from returns on investments and servicing of finance

28 3

Taxation received 93 -

Capital expenditure

Purchase of tangible fixed assets (39) (80)

Sale of tangible fixed assets - 1

Net cash outflow on capital expenditure (39) (79)

Cash outflow before financing (1,211) (1,169)

Financing

Issue of ordinary share capital - 3,175

Issue of convertible debt 982 -

Repayment of secured loan (10) (10)

Repayment of directors' loans - (8)

Capital element of finance lease rentals (31) (24)

Receipts from sale and lease back of assets - 26

Net cash inflow from financing 941 3,159

(Decrease)/increase in cash in the year 6 (270) 1,990

INTERCEDE GROUP plc

Preliminary Results for the Year Ended 31 March 2002

NOTES

1. The financial information set out in this announcement does not

constitute the Group's Statutory Accounts for the years ended 31 March 2001 or

2002, but is derived from those accounts. Statutory Accounts for 2001 have been

delivered to the Registrar of Companies and those for 2002, which have been

approved by the Board of Directors, will be delivered following the Group's

Annual General Meeting. Accounting policies have been consistently applied

throughout both accounting periods. The Company's auditors have reported on

those accounts; their reports were unqualified and did not contain statements

under Section 237(2) or (3) of the Companies Act 1985.

2. TAX ON LOSS ON ORDINARY ACTIVITIES

The tax credit comprises:

Year ended 31 March

2002 2001

£'000 £'000

UK corporation tax

Current year 179 -

Adjustment in respect of prior periods 93 -

272 -

The tax credit relates to tax relief for research and development expenditure.

3. BASIC AND DILUTED LOSS PER ORDINARY SHARE

The calculations of loss per ordinary share are based on the loss for the

financial year and the weighted average number of ordinary shares in issue

during each year.

Year ended 31 March

2002 2001

£'000 £'000

Loss for the year (1,916) (1,125)

Number Number

Weighted average number of shares 16,360,485 12,771,716

Pence Pence

Basic and diluted loss per ordinary share (11.7) (8.8)

4. DIVIDEND

The Directors do not recommend the payment of a dividend.

5. RECONCILIATION OF OPERATING LOSS TO OPERATING CASH FLOW

2002 2001

£'000 £'000

Operating loss (2,196) (1,119)

Depreciation charge 48 34

Decrease/(increase) in debtors 433 (549)

Increase in creditors 422 541

Net cash outflow from operating activities (1,293) (1,093)

6. ANALYSIS AND RECONCILIATION OF NET DEBT

2001 Cash Flow 2002

£'000 £'000 £'000

Cash at bank and in hand 2,042 (270) 1,772

Debt due within one year (460) 450 (10)

Debt due after one year (22) (1,422) (1,444)

Finance leases (68) 31 (37)

(550) (941) (1,491)

Net cash 1,492 (1,211) 281

The reconciliation of net cash flow to the movement in net debt is as follows:

2002 2001

£'000 £'000

(Decrease)/increase in cash in the year (270) 1,990

Cash inflow from decrease in debt and lease financing 41 17

Change in net debt resulting from cash flows (229) 2,007

New finance leases - (14)

New convertible debt (982) -

Movement in net cash in the year (1,211) 1,993

Net cash/(debt) at beginning of year 1,492 (501)

Net cash at end of year 281 1,492

7. ANNUAL GENERAL MEETING

The Annual General Meeting of the Company will be held at 10.00am on Wednesday

10 July 2002 at Lutterworth Hall.

8. ANNUAL REPORT AND ACCOUNTS

Copies of the full Statutory Accounts will be despatched to shareholders in due

course. Copies will also be available on the website (www.intercedegroup.com)

and from the registered office of the Company: Lutterworth Hall, St. Mary's

Road, Lutterworth, Leicestershire, LE17 4PS.

This information is provided by RNS

The company news service from the London Stock Exchange

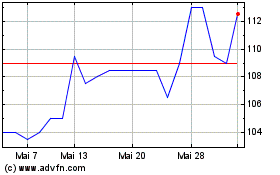

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024