RNS Number:6557M

Intercede Group PLC

24 May 2005

INTERCEDE GROUP plc

("Intercede", "the Company" or "the Group")

Preliminary Results for the Year Ended 31 March 2005

Intercede, a leading developer of electronic identity management software, today

announces its preliminary results for the year ended 31 March 2005.

SUMMARY

- Sales increased from #1.6m to #1.8m

- Pre-tax losses reduced from #0.7m to #0.4m

- Strong second half performance resulting in the first half year's profit

since the Group was admitted to AIM

- Full year cash outflow reduced from #0.5m to #0.4m and cash generative in

the second half

- Second patent granted and issued in February 2005

- New orders received from DoT Ireland, Gemplus, RSA Security, European

Notaries, The British Library, a major Russian Telecoms Company and a major

Israeli Corporate

- Successful year securing new channels to market and consolidating

activities with existing partners, notably Athena Smart Card Systems, Atos

Origin, Axalto, Giesecke & Devrient, Gemplus, Siemens and Thales e-Security

- Good progress continues to be made in the development of strategic

relationships with a number of other product companies and channel partners

- The Group is well placed to take advantage of a major new market that is

opening up rapidly in the US as a result of Homeland Security Presidential

Directive 12

- The Group's technology is increasingly being bid by major industry players

on smart card related projects in all parts of the world

Richard Parris, Chairman & Chief Executive of Intercede, said today:

"The Group has taken a major stride forward with significant new contracts in

Europe and the US delivering year on year revenue growth and profitability in

the second half of the year."

23 May 2005

ENQUIRIES:

Intercede Group plc Tel. 01455 558111

Richard Parris, Chairman & Chief Executive

Andrew Walker, Finance Director

CHAIRMAN'S STATEMENT

The Group has taken a major stride forward with significant new contracts in

Europe and the US delivering year on year revenue growth and profitability in

the second half of the year.

Introduction

Intercede is a leading developer of software to issue and manage smart cards and

digital identities.

In my report last year I indicated that the use of smart cards for

identification purposes, and hence the need for Intercede's MyID(TM) software,

would accelerate through the period. I am pleased to confirm gathering momentum

in this early stage market as evidenced by rapidly increasing demand from

partners and potential customers. Sales revenues in the second half of the year

increased substantially compared to the first six months and the Group traded

profitably during the second half period.

The major drivers fuelling this growth in the use of smart cards and devices,

requiring the use of MyID software, include:

1. Identity management and security is now one of the highest IT spending

priorities in many large organisations.

2. Homeland Security Presidential Directive (HSPD) 12 requires smart card

identity badges to be issued to all US Federal government employees by

October 2006.

3. Fears of identity theft and "phishing" for retail and corporate banking

customers is creating new demand within the financial services industry.

4. The use of smart cards, national identity cards and passports is becoming a

global inevitability in the fight against terrorism, crime and illegal

immigration.

5. The issuance of digital tachograph cards to all new trucks drivers

throughout the EU.

6. New service delivery mechanisms and legislation requiring the enhanced

protection of electronic medical records in the US and EU health care

industries.

7. Personal identity and loyalty cards that deliver financial benefits,

cashless vending and access control to campus communities,

e.g. universities, hospitals, major employers.

Intercede has been engaged in projects propelled by all of these drivers within

the last 12 months. MyID has now been successfully deployed in a wide range of

customer environments, including; a European aerospace contractor,

telecommunications companies in Russia and Israel, a major US Defence

contractor, a US Federal Financial Institution, two major UK clearing banks, a

world famous police force, a national association of Notary Publics, the Irish

Department of Transport, one of the world's largest health care providers, a

Dutch hospital and an African university.

In many cases, the number of licences sold to these customers in the last twelve

months is only a small proportion of the licences still to be purchased over the

coming year and beyond. Along with recurring support and maintenance revenues,

Intercede is building an annuity stream from additional licence sales and now

has its largest ever forward looking sales pipeline of new customers.

To ensure the scalability of our business model, we continue to grow an

international network of business partners who are working with Intercede to

establish the MyID product line as a de facto standard for a wide range of

identification applications around the world. MyID is the only technology of its

class that can now be purchased through:

* Each of the five largest smart card companies in the world, i.e. Axalto,

Gemplus, Giesecke & Devrient, Oberthur, Siemens.

* Specialist security companies, e.g. Athena Smart Card Systems, Thales

e-Security and RSA.

* Major systems integrators, e.g. Atos Origin, Fujitsu Services, Northrop

Grumman.

* Managed services providers, e.g. PinkRoccade and RBS Trust Assured

Services.

This list of partners continues to grow as the Group targets new market sectors

and geographical territories.

It is testimony to the vision of the management team and the quality of our

technical and sales staff that the Group has forged a position of global

leadership in a highly specialised niche. This is an enviable platform for

growth as smart cards move from a niche market to the technology mainstream and

the need for effective lifecycle management of those cards is increasingly being

recognised.

I will now describe our results and achievements in more detail.

Results

In the year ended 31 March 2005, turnover of #1.8m was achieved at a gross

margin of 94% (compared to #1.6m at a gross margin of 83% in the previous

period).

Over the past four years, Intercede has significantly reduced operating losses

from #2.2m to #0.4m and the cash outflow before financing has been reduced

during that time from #1.2m to #0.4m. As at 31 March 2005, the Group had a cash

balance of #0.7m.

Our strategy of concentrating on continuing to develop and promote our own

products, while maintaining tight control over costs, is succeeding and has

brought the Group much closer to breakeven for the whole year. I am particularly

pleased to report that the second half of the year was both profitable and cash

generative.

Strategy and Outlook

In my statement last year, I highlighted that in the 2004/05 year the Group

would be focused on executing its strategy to:

* Increase our software licence revenues from Europe and the US and to

establish distribution channels in the Asia Pacific region.

* Progress OEM partners from initial OEM licence fees through to recurring

licence revenues.

* Continue product development focused on the packaging of the MyID range

of solutions to meet a wider range of vertical markets.

* Expand the Company's turnover much faster than the associated cost base

by exploiting Intercede's product maturity, scalability, ease of use and

global distribution channels.

I also remarked in the 2004 Interim Report that "Intercede has the contracts and

the channels to market, to deliver a strong finish to the financial year and to

continue the trend towards profitability and rapid revenue growth."

After 12 months of continued progress, we have succeeded in executing this

strategy as demonstrated by the following new orders:

1) DoT Ireland

Intercede has been selected by the Irish Department of Transport to provide its

MyID smart card and identity management software for the secure enrolment,

processing and management of digital tachograph cards.

2) Gemplus

An order in excess of #0.5m has been received from Gemplus, a leading provider

of smart card solutions, for a major European customer.

3) RSA Security

Partnered with RSA Security to win an initial order with a prestigious European

aerospace contractor.

4) European Notaries

Secured a strategically important win with an Association of European Notaries

to issue smart cards to all of the notaries in that country.

5) The British Library

Following a public tender, Intercede was awarded a contract to issue smart cards

to all of the British Library's employees.

6) Major Russian Telecoms Company

After a successful test installation, the rollout of production licences has

commenced to a major Russian Telecoms Company via Athena Smart Card Systems, an

OEM partner.

7) Major Israeli Corporate Customer

Delivered a combined physical and logical security smart card management

solution in partnership with Athena Smart Card Systems and EDS.

Within the last few weeks, we have also been advised that we have been

successful in bids for a major US aerospace contractor, a major UK clearing

bank, and a major European insurance group. Further details will be provided as

appropriate as contracts are finalised.

Intercede has had a successful year securing new channels to markets and

consolidating activities with existing partners. In particular:

* Athena Smart Card Systems

Intercede's sales channels have been extended into Asia with Athena Smart

Card Systems, Japan, signing an OEM contract to adopt MyID as the Athena

Smart Card Manager. Two major customers have already been secured under

this contract.

* Atos Origin

Atos Origin, a leading global systems integrator, signed a European-wide

reselling contract for MyID in May 2004. Bids are outstanding on a number

of potential contracts across Europe.

* Axalto

In November 2004, Axalto (formerly part of Schlumberger and a world

leading smart card manufacturer) announced that it would adopt MyID as

its strategic smart card management system for major corporate customers.

Intercede is working closely with Axalto to implement a product

integration plan and strategy for those corporations already using

Axalto's previous card management offering.

* Giesecke & Devrient (G&D)

Following a recent major joint win in the US defence industry, G&D are

continuing to propose MyID to a number of major North American customers.

* Gemplus

In February 2005, Gemplus launched Gemplus SafesITe Corporate,

incorporating MyID, at the RSA Show in San Francisco. The Gemplus channel

has already generated revenues in excess of #0.5m and additional revenues

are expected from a number of prospective customers in the United States.

* Siemens

In March 2005, Intercede joined forces with Siemens in the UK to deliver

MyID to a number of Siemens customers in the UK. The first award under

this arrangement is anticipated during the first half of the 2006

financial year.

* Thales e-Security

Thales e-Security have now completed the integration of MyID into the

Thales SafeSign product range. Following a European launch in November

2004 and an Asian launch in February 2005, Thales have already submitted

a number of commercial proposals incorporating MyID licences and we are

awaiting contract award decisions.

Our strategy in the forthcoming year is to achieve full year profitability and

to consolidate our industry leadership credentials by:

* Exploiting our existing channel network to generate MyID licence sales

in Europe, the US and Asia.

* Establishing a significant revenue stream from the US Federal Government

HSPD 12 initiative.

* Increase our sales and support bandwidth by making our partners more

self-sufficient through the delivery of enhanced training, configuration

and integration capability.

The effectiveness of this strategy is dependent on the ongoing high calibre of

our products, the dedication and professionalism of our staff, the quality of

our partners and the ongoing support of our shareholders. In all of these

respects, Intercede has an impressive track record. Furthermore, a programme of

continuous product innovation and improvement continues to ensure that Intercede

remains a leader amongst a small number of global competitors.

The outlook for the next 12 months is one of accelerating growth in the number

of software licences sold to an increasing number of customers around the world.

Intercede is well positioned to take advantage of this emerging growth. The

management team is committed to maintaining the Group on its focused course and

I look forward to reporting further progress.

Richard Parris

Chairman & Chief Executive

23 May 2005

OPERATING AND FINANCIAL REVIEW

It is good to be able to report the Group's first profitable half year period of

trading. As we enter a new financial year, the focus is on sustaining this

performance against a backdrop of the largest ever forward order book and sales

pipeline.

Introduction

As outlined in the Chairman's Statement, excellent progress has been made during

the past financial year. The momentum for the Group's technology, and the

markets it serves, has continued to grow and there are clear signs of

acceleration, notably in areas such as the US Federal Government as a result of

Homeland Security Presidential Directive 12.

Business Development

Technical development efforts continue to be focused on further increases in the

level of interoperability of the MyID technology and additional areas of

functionality as driven by the various market sector requirements. Following the

grant of the "Secure Multipart Authorization" patent on 18 February 2004, a

further patent ("Web File Server") was granted and issued by the UK Patent

Office on 23 February 2005.

Business activity has been building rapidly with customers and partners over the

past year and the number of invitations to tender for prospects throughout the

world has exceeded expectations. Intercede has welcomed major new channel

partners in the US, France, Japan, Switzerland and Austria and additional key

contracts have been secured with customers in the UK, Ireland, Continental

Europe, Israel, Russia and Austria. Good progress continues to be made in the

development of strategic relationships with a number of other product companies

and channel partners.

Financial Results

Good progress has been made towards profitability over the past financial year

with a strong second half performance resulting in the first half year's profit

since the Group was admitted to AIM. An analysis of the last two year's trading

is provided below:

Year ended Year ended

31 March 2005 31 March 2004 Change

#000 % #000 % %

Sales 1,806 1,605 12.5

Gross margin (%) 1,693 (94%) 1,339 (83%) 26.4

Operating costs (2,079) (1,960) 6.1

Operating loss (386) (621) (37.8)

Loss per share (0.7)p (2.9)p (75.9)

Sales have increased by 13% year on year with an underlying 81% increase in MyID

license sales. Gross profit margins have increased from 83% to 94% as the

proportion of own technology related sales has increased from 67% to 87%.

Costs have continued to be tightly controlled with #36,000 of the #119,000 year

on year increase reflecting the cost of engaging Ernst & Young to assist with

the Group's outstanding Research & Development tax claims. This was successful

as it resulted in the receipt of payments from the Inland Revenue totalling

#182,000 for the 2002/03 and 2003/04 financial years. The underlying increase in

costs all related to the second half with the Group re-commencing recruitment of

personnel in key areas in order to be able to respond to customer and partner

demands.

The combined effect of higher sales and margins coupled with continued control

over costs has resulted in a further reduction in full year losses and, more

significantly, second half profits totalling #152,000 and #132,000k at the

operating and pre tax levels respectively.

Funding

As at 31 March 2005, the Group had cash balances totalling #672,000 (2004:

#1,068,000). Whilst the full year cash outflow before financing was #394,000

(2004: #503,000), it is worthy of note that cash balances have increased by

#57,000 since the half year stage. The Group has therefore been both profitable

and cash generative in the second half of the current financial year.

Summary

It is good to be able to report the Group's first profitable half year period of

trading. As we enter a new financial year, the focus is on sustaining this

performance against a backdrop of the largest ever forward order book and sales

pipeline.

Given the Group's current size, the timing of contract commitments and

deliveries will continue to be very important in the short to medium term.

However, with momentum continuing to build in this early stage and exciting

market, the Board believes that the Group is increasingly well placed to meet

its longer term objectives.

Andrew Walker

Finance Director

23 May 2005

Consolidated Profit and Loss Account for the year ended 31 March 2005

Notes 2005 2004

#'000 #'000

Turnover 1,806 1,605

Cost of sales (113) (266)

Gross profit 1,693 1,339

Other operating expenses (2,079) (1,960)

Operating loss (386) (621)

Interest receivable and similar income 32 34

Interest payable and similar charges (72) (74)

Loss on ordinary activities before taxation (426) (661)

Taxation 2 182 (202)

Retained loss on ordinary activities after taxation and

for the year (244) (863)

Basic and diluted loss per ordinary share 3 (0.7)p (2.9)p

All operations of the Group continued throughout both years and no operations

were acquired or discontinued.

There are no recognised gains or losses in either year other than the loss for

the year.

Consolidated Balance Sheet at 31 March 2005

2005 2004

#'000 #'000

Fixed assets

Tangible assets 25 42

Current assets

Debtors 379 119

Cash at bank and in hand 672 1,068

1,051 1,187

Creditors: Amounts falling due within one year (869) (778)

Net current assets 182 409

Total assets less current liabilities 207 451

Creditors: Amounts falling due after more than one year

Convertible debt (1,432) (1,432)

Net liabilities (1,225) (981)

Capital and reserves

Called-up share capital 4,271 4,271

Share premium account 2,107 2,107

Other reserves 1,508 1,508

Profit and loss account (9,111) (8,867)

Shareholders' deficit - all equity (1,225) (981)

Consolidated Cash Flow Statement for the year ended 31 March 2005

Notes 2005 2004

#'000 #'000

Net cash outflow from operating activities 5 (604) (525)

Returns on investments and servicing of finance

Interest received 35 31

Interest paid - (1)

Interest element of finance lease rentals - (2)

Net cash inflow from returns on investments and servicing of

finance 35 28

Taxation received 182 -

Capital expenditure

Purchase of tangible fixed assets (7) (6)

Cash outflow before financing (394) (503)

Financing

Issue of ordinary share capital - 1,270

Repayment of secured loan (2) (10)

Capital element of finance lease rentals - (6)

Net cash (outflow)/inflow from financing (2) 1,254

(Decrease)/increase in cash in the year 6 (396) 751

NOTES

1. The financial information set out in this announcement does not constitute

the Group's Statutory Accounts for the years ended 31 March 2004 or 2005, but

is derived from those accounts. Statutory Accounts for 2004 have been

delivered to the Registrar of Companies and those for 2005, which have been

approved by the Board of Directors, will be delivered following the Group's

Annual General Meeting. Accounting policies have been consistently applied

throughout both accounting periods. The Company's auditors have reported on

those accounts; their reports were unqualified and did not contain statements

under Section 237 (2) or (3) of the Companies Act 1985.

2. TAX ON LOSS ON ORDINARY ACTIVITIES

The tax credit/(charge) comprises:

Year ended 31 March

2005 2004

#'000 #'000

Current year - UK corporation tax - -

Adjustment in respect of prior periods 182 (202)

182 (202)

There is no charge in respect of corporation tax in either year due to the

availability of losses. An adjustment has been made in respect of research

and development claims which have been agreed by the Inland Revenue.

3. BASIC AND DILUTED LOSS PER ORDINARY SHARE

The calculations of loss per ordinary share are based on the loss for the

financial year and the weighted average number of ordinary shares in issue

during each year.

2005 2004

#'000 #'000

Loss for the year (244) (863)

Number Number

Weighted average number of shares 33,963,438 29,672,863

Pence Pence

Basic and diluted loss per ordinary share (0.7) (2.9)

4. DIVIDEND

The Directors do not recommend the payment of a dividend.

5. RECONCILIATION OF OPERATING LOSS TO OPERATING CASH FLOW

2005 2004

#'000 #'000

Operating loss (386) (621)

Depreciation charge 24 34

Decrease in stock - 2

(Increase)/decrease in debtors (263) 226

Increase/(decrease) in creditors 21 (166)

Net cash outflow from operating activities (604) (525)

6. ANALYSIS AND RECONCILIATION OF NET DEBT

2004 Cash flow 2005

#'000 #'000 #'000

Cash at bank and in hand 1068 (396) 672

Debt due within one year (2) 2 -

Debt due after one year (1,432) - (1,432)

(1,434) 2 (1,434)

Net debt (366) (394) (760)

The reconciliation of net cash flow to the movement in net debt is as

follows:

2005 2004

#'000 #'000

(Decrease)/increase in cash in the year (396) 751

Cash inflow from decrease in debt and lease financing 2 16

Movement in net cash in the year (394) 767

Net debt at beginning of year (366) (1,133)

Net debt at end of year (760) (366)

7. ANNUAL GENERAL MEETING

The Annual General Meeting of the Company will be held at 9.00am on Wednesday

13 July 2005 at Lutterworth Hall.

8. ANNUAL REPORT AND ACCOUNTS

Copies of the full Statutory Accounts will be despatched to shareholders in

due course. Copies will also be available on the website (www.intercede.com)

and from the registered office of the Company: Lutterworth Hall, St. Mary's

Road, Lutterworth, Leicestershire, LE17 4PS.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKNKBOBKDFPB

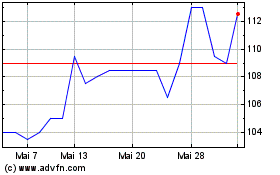

Intercede (LSE:IGP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Intercede (LSE:IGP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024