TIDMFRES

RNS Number : 8117A

Fresnillo PLC

24 January 2024

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

24 January 2024

The following amendment has been made to the Fourth Quarter

Production Report announcement released on 24 January 2024 at 07:00

under RNS No 6893A

The FRESNILLO MINE PRODUCTION section has been updated. Figures

for 4Q23 and FY23, along with their respective % changes have been

corrected, as shown below. The changes are minor and do not affect

the explanations below the table or the messaging of the report

overall.

All other details remain unchanged, including the consolidated

figures at a Group level.

New version

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed

(t) 609,135 673,233 (9.5) 624,105 (2.4) 2,618,509 2,462,409 6.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,781 3,201 (13.1) 3,605 (22.9) 12,772 13,609 (6.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 8,149 9,013 (9.6) 8,314 (2.0) 36,909 34,432 7.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 5,226 5,175 1.0 5,609 (6.8) 21,373 21,756 (1.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,592 12,003 (11.8) 11,097 (4.5) 45,386 43,342 4.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 160 166 (3.6) 197 (18.9) 170 189 (9.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.59 0.59 (1.1) 0.58 1.3 0.62 0.61 0.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.03 0.90 14.5 1.05 (2.2) 0.96 1.05 (8.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.42 2.33 4.0 2.37 1.9 2.32 2.38 (2.6)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 13.1% when compared to

3Q23, mainly due to a decreased volume of ore processed as

development ore was not processed as a measure to increase head

grades to the mill along with a higher proportion of volumes

extracted from the western areas of the mine with lower ore grades.

We are increasing development in eastern areas with higher grades

albeit with narrower widths.

Quarterly silver production decreased 22.9% vs. 4Q22, mainly due

to the lower ore grade as explained above.

Full year silver production decreased 6.2% vs. FY22 driven by

the lower ore grade, partially mitigated by the increase in volume

of ore processed from the Candelaria, San Carlos, San Alberto and

Santa Elena areas.

Mine development rates increased quarter on quarter to an

average of 3,038m per month in 4Q23 (3Q23: 2,987m per month) as

productivity from unionised personnel increased after taking over

from contractors in 3Q23.

Quarterly by-product gold production decreased 9.6% vs. 3Q23

mainly driven by the decreased volume of ore processed and lower

ore grade.

Full year by-product gold production increased 7.2% vs. FY22

primarily as a result of the higher volume of ore processed.

Silver ore grade in 2024 is expected to be in the range of 180

to 200 g/t, while the gold ore grade is estimated to be

between 0.60 to 0.70 g/t.

Old version

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed

(t) 621,344 673,233 (7.7) 624,105 (0.4) 2,630,719 2,462,409 6.8

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,838 3,201 (11.3) 3,605 (21.3) 12,829 13,609 (5.7)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 8,248 9,013 (8.5) 8,314 (0.8) 37,008 34,432 7.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 5,289 5,175 2.2 5,609 (5.7) 21,436 21,756 (1.5)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,791 12,003 (10.1) 11,097 (2.8) 45,585 43,342 5.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 160 166 (3.6) 197 (18.8) 170 189 (9.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.58 0.59 (1.7) 0.58 0.6 0.61 0.61 0.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.02 0.90 13.6 1.05 (2.9) 0.96 1.05 (8.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.41 2.33 3.7 2.37 1.6 2.32 2.38 (2.7)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 11.3% when compared to

3Q23, mainly due to a decreased volume of ore processed as

development ore was not processed as a measure to increase head

grades to the mill along with a higher proportion of volumes

extracted from the western areas of the mine with lower ore grades.

We are increasing development in eastern areas with higher grades

albeit with narrower widths.

Quarterly silver production decreased 21.3% vs. 4Q22, mainly due

to the lower ore grade as explained above.

Full year silver production decreased 5.7% vs. FY22 driven by

the lower ore grade, partially mitigated by the increase in volume

of ore processed from the Candelaria, San Carlos, San Alberto and

Santa Elena areas.

Mine development rates increased quarter on quarter to an

average of 3,038m per month in 4Q23 (3Q23: 2,987m per month) as

productivity from unionised personnel increased after taking over

from contractors in 3Q23.

Quarterly by-product gold production decreased 8.5% vs. 3Q23

mainly driven by the decreased volume of ore processed and lower

ore grade.

Full year by-product gold production increased 7.5% vs. FY22

primarily as a result of the higher volume of ore processed.

Silver ore grade in 2024 is expected to be in the range of 180

to 200 g/t, while the gold ore grade is estimated to be

between 0.60 to 0.70 g/t.

The full amended text is shown below.

FOURTH QUARTER PRODUCTION REPORT

FOR THE THREE MONTHSED 31 DECEMBER 2023

Octavio Alvídrez, Chief Executive Officer, said:

" We achieved our full year guidance of 105.1 million silver

equivalent ounces. Notably gold, lead and zinc production were

within our guided ranges. Silver production was up 4.7% year on

year driven by the ramp up at Juanicipio and higher ore grade at

San Julián Veins, albeit it was slightly below expectations .

"This year we overcame many operational challenges, which is a

testament to the strong and determined teams we have across our

sites. We successfully ramped up production at our new mine,

Juanicipio, reaching full nameplate capacity.

"We continued to see the impact of inflation and the revaluation

of the Mexican peso affecting costs across the business.

"Our priorities for 2024 are clear. Safety is key and we will

continue working hard to instill a true culture of safety across

our operations. We will continue to identify cost reduction

initiatives to address inflation, while we will also focus on

efficiencies across all our mines."

HIGHLIGHTS

Silver

-- Full year attributable silver production of 56.3 moz

(including Silverstream) increased 4.7% vs. FY22, as a result of

the ramp-up at Juanicipio and higher ore grade at San Julián Veins,

partly offset by the lower ore grade at San Julián (DOB) and

Fresnillo.

-- Quarterly attributable silver production of 14.2 moz

(including Silverstream) remained at a similar level to 3Q23, as

the increased production driven by the higher ore grade and

increase in volumes of ore processed at Saucito and the higher ore

grade at San Julián Veins was offset by the decreased volume of ore

processed and lower ore grade at Fresnillo and the lower ore grade

at San Julián (DOB).

-- Quarterly attributable silver production (including

Silverstream) increased 13.1% vs. 4Q22, primarily due to the

ramp-up at Juanicipio, the higher ore grade at San Julián Veins and

a higher volume of ore processed at Saucito, partially offset by

the lower ore grade at Fresnillo and San Julián (DOB).

Gold

-- Full year attributable gold production of 610.6 koz, down

4.0% vs. FY22 mainly driven by the decrease in gold production at

Noche Buena as it approached the end of its mine life, partially

mitigated by the ramp up at Juanicipio and the higher ore grade at

Herradura.

-- Quarterly attributable gold production of 152.6 koz up 15.1%

vs. 3Q23, mainly driven by the higher volume of ore processed and

ore grade at Herradura.

-- Quarterly attributable gold production down 9.1% vs. 4Q22

primarily due to the decrease in the volume of ore processed at

Herradura and the mine closure plan at Noche Buena, partly

mitigated by the ramp-up at Juanicipio.

By-Products

-- Full year attributable by-product lead production increased

9.2% vs. FY22 due to a greater contribution from Juanicipio and

higher volume of ore processed and ore grade at Saucito partly

offset by the decreased production at Ciénega.

-- Full year attributable by-product zinc production increased

8.6% vs. FY22 due to the increased production from Juanicipio and

the higher volume of ore processed and ore grade at Saucito partly

offset by the lower ore grade at San Julián (DOB).

-- Quarterly attributable by-product lead production up 9.1% vs.

3Q23 primarily due to the higher ore grade and increased volume of

ore processed at Saucito.

-- Quarterly attributable by-product lead and zinc production up

24.6% and 25.1% vs. 4Q22 respectively, mainly due to the higher ore

grades and increase in volumes of ore processed at Saucito and the

ramp-up at Juanicipio, partially offset by the lower ore grades at

San Julián (DOB) and Ciénega.

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Silver (koz) 13,548 13,434 0.9 12,073 12.2 53,454 51,052 4.7

-------- -------- --------- -------- --------- -------- -------- ---------

Silverstream

(koz) 612 670 (8.6) 450 36.2 2,828 2,688 5.2

-------- -------- --------- -------- --------- -------- -------- ---------

Total Silver

(koz) 14,161 14,104 0.4 12,522 13.1 56,282 53,740 4.7

-------- -------- --------- -------- --------- -------- -------- ---------

Gold (oz) 152,605 132,627 15.1 167,969 (9.1) 610,646 635,926 (4.0)

-------- -------- --------- -------- --------- -------- -------- ---------

Lead (t) 15,895 14,575 9.1 12,756 24.6 57,833 52,950 9.2

-------- -------- --------- -------- --------- -------- -------- ---------

Zinc (t) 28,844 29,073 (0.8) 23,060 25.1 107,705 99,153 8.6

-------- -------- --------- -------- --------- -------- -------- ---------

SAFETY PERFORMANCE

As reported previously, we are deeply saddened by the fatal

accidents in 2023. Full investigations were undertaken to identify

the root causes of these accidents. The lessons learnt were shared

across the Group and additional safety workshops were carried out

to prevent these incidents from occurring again. Our safety

procedures and programmes continued to be reinforced across the

Group and we reiterate our commitment to guarantee a safe

environment for all our people. Safety remains the absolute

priority for the Board, the management and the Company. Work to

instill a true culture of safety across our contractor and employee

workforce is on-going and prioritised at every mine site.

ITEMS IMPACTING THE INCOME STATEMENT

Adjusted production costs in 2023 were impacted by:

1. The 11.7% average revaluation of the Mexican peso vs. the US

dollar from $20.1 pesos per US dollar in 2022 to $17.8 pesos per US

dollar in 2023, which is expected to have an adverse effect of c.

US$125 million.

2. Ongoing cost inflation of 3.9%, excluding the effect of the

revaluation of the Mexican peso vs. US dollar, which is expected to

have a negative impact of c. US$60 million.

In addition, cost of sales is expected to be impacted by a

decrease in inventories both at Juanicipio as a result of the start

up of the beneficiation plant, enabling additional volumes to be

processed and the historical stockpile to be depleted, and at Noche

Buena as it approached the end of its mine life. This, together

with the favourable effect of the reassessment of the gold

inventories at Herradura, resulted in an estimated reduction in

inventories of c. US$55 million in 2023. Otherwise, the reduction

in inventories would have been c. US$85 million.

Administrative expenses are expected to increase by c. US$35

million vs 2022, mainly due to the adverse effects of the

revaluation of the Mexican peso vs the US Dollar on administrative

expenses denominated in pesos, including personnel salaries, and

the increase in corporate expenses as a result of the review of the

Shared Services Agreement with Peñoles in line with the increased

services provided.

Depreciation is expected to be very similar to 2022 at c. US$500

million.

2024 OUTLOOK

Our 2024 outlook is in line with previous expectations:

-- Attributable silver production expected to be in the range of

55.0 to 62.0 moz (including Silverstream)

-- Attributable gold production expected to be in the range of 580 to 630 koz.

Expressed in silver equivalent ounces [1] , production is

expected to be 101-112 million ounces.

FULL YEAR FINANCIAL RESULTS

Fresnillo will announce its full year 2023 results on 5th March

2024.

For further information, please visit our website

www.fresnilloplc.com or contact:

FRESNILLO PLC Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Mark Mochalski

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

POWERSCOURT Tel: +44 (0)7793 858 211

Peter Ogden

MINING OPERATIONS

FRESNILLO MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed

(t) 609,135 673,233 (9.5) 624,105 (2.4) 2,618,509 2,462,409 6.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 2,781 3,201 (13.1) 3,605 (22.9) 12,772 13,609 (6.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 8,149 9,013 (9.6) 8,314 (2.0) 36,909 34,432 7.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 5,226 5,175 1.0 5,609 (6.8) 21,373 21,756 (1.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,592 12,003 (11.8) 11,097 (4.5) 45,386 43,342 4.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 160 166 (3.6) 197 (18.9) 170 189 (9.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.59 0.59 (1.1) 0.58 1.3 0.62 0.61 0.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.03 0.90 14.5 1.05 (2.2) 0.96 1.05 (8.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.42 2.33 4.0 2.37 1.9 2.32 2.38 (2.6)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production decreased 13.1% when compared to

3Q23, mainly due to a decreased volume of ore processed as

development ore was not processed as a measure to increase head

grades to the mill along with a higher proportion of volumes

extracted from the western areas of the mine with lower ore grades.

We are increasing development in eastern areas with higher grades

albeit with narrower widths.

Quarterly silver production decreased 22.9% vs. 4Q22, mainly due

to the lower ore grade as explained above.

Full year silver production decreased 6.2% vs. FY22 driven by

the lower ore grade, partially mitigated by the increase in volume

of ore processed from the Candelaria, San Carlos, San Alberto and

Santa Elena areas.

Mine development rates increased quarter on quarter to an

average of 3,038m per month in 4Q23 (3Q23: 2,987m per month) as

productivity from unionised personnel increased after taking over

from contractors in 3Q23.

Quarterly by-product gold production decreased 9.6% vs. 3Q23

mainly driven by the decreased volume of ore processed and lower

ore grade.

Full year by-product gold production increased 7.2% vs. FY22

primarily as a result of the higher volume of ore processed.

Silver ore grade in 2024 is expected to be in the range of 180

to 200 g/t, while the gold ore grade is estimated to be

between 0.60 to 0.70 g/t.

SAUCITO MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed (t) 576,189 552,872 4.2 508,455 13.3 2,163,982 2,072,812 4.4

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,399 2,892 17.5 3,026 12.3 12,102 11,977 1.0

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 17,256 15,427 11.9 18,076 (4.5) 72,763 73,497 (1.0)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 6,311 4,973 26.9 3,859 63.6 19,535 17,816 9.6

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 10,335 9,663 7.0 5,868 76.1 32,991 28,415 16.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 204 183 11.5 208 (2.0) 195 201 (3.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.20 1.14 5.2 1.39 (13.8) 1.34 1.40 (4.3)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 1.27 1.06 19.7 0.90 40.5 1.06 1.01 5.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 2.29 2.22 3.1 1.56 46.8 1.96 1.78 10.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly silver production increased 17.5% vs. 3Q23 mainly

driven by the higher ore grade due to the timely access to high

grade areas and decreased dilution through better ground control,

and the increase in volume processed.

Quarterly silver production increased 12.3% vs. 4Q22 primarily

due to the higher volume of ore processed driven by improved

productivity and increased equipment availability.

Full year silver production slightly increased vs. FY22 as the

higher volume of ore processed was partly offset by a lower ore

grade.

Quarterly by-product gold production increased 11.9% vs. 3Q23

mainly driven by the higher ore grade and increase in volumes of

ore processed.

Quarterly and full year by-product gold production decreased

4.5% and 1.0% vs. 4Q22 and FY22 respectively, driven by the lower

ore grade and recovery rate, partly mitigated by the higher volumes

of ore processed.

Mine development rates remained stable quarter on quarter at

2,810m per month in 4Q23 (3Q23: 2,840m per month). As reported,

additional equipment arrived and development rates returned to

3,000 m per month in December.

The silver ore grade for 2024 is expected to be in the range of

200-220 g/t, while the gold grade is estimated to be between

1.10-1.30 g/t.

PYRITES PLANT

4Q23* 3Q23* % Change 4Q22 % Change FY23* FY22 % Change

Pyrite Concentrates

Processed (t) 48,167 46,934 2.6 32,211 49.5 162,344 135,044 20.2

------- ------- --------- ------- --------- -------- -------- ---------

Production

------- ------- --------- ------- --------- -------- -------- ---------

Silver (koz) 328 225 45.8 111 195.1 861 529 62.6

------- ------- --------- ------- --------- -------- -------- ---------

Gold (oz) 599 597 0.3 374 60.2 1,960 1,959 0.1

------- ------- --------- ------- --------- -------- -------- ---------

Ore Grades

------- ------- --------- ------- --------- -------- -------- ---------

Silver (g/t) 331 220 51.0 145 128.4 248 164 51.0

------- ------- --------- ------- --------- -------- -------- ---------

Gold (g/t) 1.71 1.46 16.9 1.19 42.8 1.59 1.44 10.4

------- ------- --------- ------- --------- -------- -------- ---------

*Includes concentrates of Fe from Saucito and Fresnillo.

Quarterly silver production increased 45.8% and 195.1% vs. 3Q23

and 4Q22 respectively, mainly due to the ramp up of the pyrites

plant at Fresnillo.

Similarly, gold production increased 60.2% vs. 4Q22 mainly due

to the reason explained above partly offset by the lower recovery

rate and decreased volume of iron concentrates processed from

Saucito.

Full year silver production increased 62.6% vs. FY22, mainly due

to contribution of the pyrites plant at Fresnillo, partly offset by

the decrease in volume of iron concentrates processed from Saucito

and lower recovery rate.

Following some tests and technical work, it was decided to only

process the historical tailings as recovery rates improved

significantly when doing so. We will continue implementing this

strategy in 2024, which means that volumes processed will

inevitably be lower than originally planned but recovery rates and

profitability will be higher than when processing both current and

historical tailings.

CI É NEGA MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed (t) 292,612 270,531 8.2 256,928 13.9 1,064,543 1,114,232 (4.5)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 9,187 9,314 (1.4) 9,122 0.7 35,934 37,466 (4.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 1,213 1,131 7.3 982 23.5 4,335 4,709 (8.0)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 693 683 1.4 930 (25.5) 2,881 3,518 (18.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 723 906 (20.3) 1,372 (47.3) 3,550 5,387 (34.1)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.07 1.16 (8.3) 1.20 (11.1) 1.14 1.14 0.3

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 151 151 0.0 139 8.2 147 152 (3.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.39 0.42 (8.2) 0.56 (30.0) 0.44 0.49 (11.2)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 0.47 0.64 (25.5) 0.94 (49.9) 0.63 0.86 (26.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Quarterly gold production slightly decreased 1.4% vs. 3Q23

mainly due to the lower ore grade partly mitigated by the higher

volume of ore processed driven by the timely preparation of

stopes.

Quarterly gold production remained stable vs. 4Q22 as the higher

volume of ore processed was offset by the lower ore grade.

Full year gold production decreased 4.1% vs. FY22 mainly due to

the decreased volume of ore processed in accordance with the mine

plan.

Quarterly silver production increased 7.3% vs. 3Q23 due to the

increase in volume of ore processed.

Quarterly silver production increased 23.5% vs. 4Q22 driven by

the increase in the volume of ore processed and the higher ore

grade.

Full year silver production decreased 8.0% vs. FY22 mainly due

to the decrease in volume of ore processed in accordance with the

mine plan and lower ore grade.

The gold and silver ore grades for 2024 are estimated to be in

the ranges of 1.1-1.3 g/t and 160-180 g/t respectively.

SAN JULIÁN MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed Veins

(t) 291,661 292,391 (0.2) 294,582 (1.0) 1,142,309 1,175,764 (2.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Processed DOB

(t) 525,081 498,607 5.3 517,733 1.4 2,073,847 2,092,971 (0.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Total production

at San Julián

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 11,034 11,161 (1.1) 11,907 (7.3) 44,487 46,727 (4.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 3,156 3,186 (0.9) 3,113 1.4 13,349 14,252 (6.3)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 10,117 10,428 (3.0) 11,062 (8.5) 41,009 43,397 (5.5)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 1,719 1,359 26.5 1,288 33.5 5,559 4,638 19.8

-------- -------- --------- -------- --------- ---------- ---------- ---------

Production DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (oz) 918 733 25.2 845 8.6 3,478 3,330 4.5

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (koz) 1,437 1,826 (21.3) 1,825 (21.3) 7,791 9,614 (19.0)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (t) 1,332 1,595 (16.5) 1,712 (22.2) 6,843 7,105 (3.7)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (t) 3,362 3,273 2.7 3,604 (6.7) 14,410 17,487 (17.6)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades Veins

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 1.13 1.18 (3.8) 1.23 (8.1) 1.17 1.21 (2.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 200 158 26.5 149 34.3 166 135 23.1

-------- -------- --------- -------- --------- ---------- ---------- ---------

Ore Grades DOB

-------- -------- --------- -------- --------- ---------- ---------- ---------

Gold (g/t) 0.08 0.08 5.6 0.08 7.9 0.08 0.08 3.7

-------- -------- --------- -------- --------- ---------- ---------- ---------

Silver (g/t) 100 134 (25.1) 130 (23.3) 136 168 (18.9)

-------- -------- --------- -------- --------- ---------- ---------- ---------

Lead (%) 0.33 0.42 (21.0) 0.43 (21.7) 0.43 0.43 0.2

-------- -------- --------- -------- --------- ---------- ---------- ---------

Zinc (%) 0.86 0.90 (5.4) 0.93 (8.0) 0.94 1.09 (13.8)

-------- -------- --------- -------- --------- ---------- ---------- ---------

SAN JULIÁN VEINS

Quarterly silver production increased 26.5% vs. 3Q23 and 33.5%

vs. 4Q22 mainly due to the increased development at the San Antonio

and Elisa areas with a higher silver ore grade, whilst quarterly

gold production decreased 3.0% and 8.5% vs. 3Q23 and 4Q22

respectively, as a result of the lower gold ore grade.

Full year silver production increased 19.8% vs. FY22

respectively, mainly due to higher ore grade at the San Antonio,

Elisa and San Atanasio areas.

Full year gold production decreased 5.5% vs. 4Q22 mainly driven

by the lower ore grade and a decrease in volume of ore processed

due to the lower availability of trucks to haul ore to the

beneficiation plant.

We expect the 2024 silver and gold ore grades to be in the

ranges of 160-180 g/t and 1.00-1.20 g/t, respectively.

SAN JULIÁN DISSEMINATED ORE BODY (DOB)

Quarterly silver production decreased 21.3% vs. 3Q23 and 4Q22 as

a result of lower ore grade in the periphery of the ore body,

partly mitigated by the increased volume of ore processed.

Full year silver production decreased 19.0% vs. FY22 mainly due

to the expected lower ore grade in the areas in the periphery of

the ore body and structural geological features which slowed down

the long hole drilling cycles.

The 2024 silver ore grade is expected to average c. 90 g/t.

Recent development

On 10 January 2024, Fresnillo learnt that Mexico's Supreme Court

granted a ruling in a case in which Fresnillo, as an affected third

party, expects an impact to the water concessions that supply water

to Minera San Julián that were granted by the Mexican State. The

Mexican State is identified as the defendant in this case.

The Company has not yet been formally notified of this ruling.

Nevertheless, the Company expects to be formally notified of the

same in the coming weeks and will thereafter assess in full detail

the ruling itself and its potential implications. This ruling

affects Minera San Julián and, based on current information, impact

to the Company's production is expected to be immaterial.

HERRADURA TOTAL MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed

(t) 4,534,745 3,983,615 13.8 7,084,437 (36.0) 20,223,914 22,195,187 (8.9)

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Total Volume

Hauled (t) 24,409,823 24,462,202 (0.2) 27,446,767 (11.1) 99,541,551 120,370,290 (17.3)

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Production

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Gold (oz) 93,432 72,184 29.4 103,826 (10.0) 355,485 349,715 1.6

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Silver (koz) 147 120 22.6 191 (22.9) 611 776 (21.3)

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Ore Grades

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Gold (g/t) 0.84 0.73 13.9 0.71 18.4 0.76 0.69 9.9

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Silver (g/t) 1.69 1.51 11.9 1.35 24.8 1.57 1.65 (4.6)

----------- ----------- --------- ----------- --------- ----------- ------------ ---------

Quarterly gold production increased 29.4% vs. 3Q23 mainly driven

by the higher ore grade in the sulphides and the increase in volume

of ore processed as 3Q23 was impacted by an electrical fault.

Quarterly gold production decreased 10.0% vs. 4Q22 due to the

lower volume of ore processed driven by the limited operation at

the Dynamic Leaching Plants (I and II) with reduced capacity at the

beginning of the quarter following the electrical fault in 3Q23,

partly mitigated by the higher ore grade as mentioned above and the

improved recovery rate.

Full year gold production increased 1.6% vs. FY22, primarily

driven by the higher ore grade in the sulphides and positive

variations with the geological model, partially offset by the

decreased volume of ore processed at the Dynamic Leaching Plant (I

and II) as a result of the electrical fault in 3Q23 as mentioned

previously.

The gold ore grade in 2024 is expected to be in the range of

0.60-0.70 g/t.

NOCHE BUENA TOTAL MINE PRODUCTION

4Q23 3Q23 % Change 4Q22 % Change FY23 FY22 % Change

Ore Processed

(t) 0 0 N/A 1,232,125 N/A 2,510,639 7,428,189 (66.2)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Total Volume

Hauled (t) 0 0 N/A 7,296,832 N/A 8,424,676 26,854,547 (68.6)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Production

------ ------ --------- ---------- --------- ---------- ----------- ---------

Gold (oz) 7,017 9,642 (27.2) 13,331 (47.4) 42,537 79,669 (46.6)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Silver (koz) 1 2 (53.3) 3 (75.9) 10 20 (48.0)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Ore Grades

------ ------ --------- ---------- --------- ---------- ----------- ---------

Gold (g/t) 0.00 0.00 N/A 0.51 N/A 0.47 0.53 (10.7)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Silver (g/t) 0.00 0.00 N/A 0.21 N/A 0.17 0.22 (26.0)

------ ------ --------- ---------- --------- ---------- ----------- ---------

Gold production decreased against all comparable periods as the

mine closure process, which started in May 2023, continued as

planned.

JUANICIPIO - ATTRIBUTABLE

4Q23* 3Q23* % Change 4Q22** % Change FY23* FY22** % Change

Ore Processed

(t) 194,189 180,460 7.6 92,840 109.2 710,504 361,843 96.4

-------- -------- --------- ------- --------- -------- -------- ---------

Production

-------- -------- --------- ------- --------- -------- -------- ---------

Silver (koz) 2,523 2,678 (5.8) 1,042 142.2 9,415 5,180 81.8

-------- -------- --------- ------- --------- -------- -------- ---------

Gold (oz) 5,931 5,289 12.1 3,020 96.4 20,570 12,461 65.1

-------- -------- --------- ------- --------- -------- -------- ---------

Lead (t) 2,334 2,150 8.6 647 260.7 7,202 2,755 161.4

-------- -------- --------- ------- --------- -------- -------- ---------

Zinc (t) 3,832 3,227 18.8 1,119 242.5 11,368 4,521 151.5

-------- -------- --------- ------- --------- -------- -------- ---------

Ore Grades

-------- -------- --------- ------- --------- -------- -------- ---------

Silver (g/t) 467 523 (10.7) 415 12.5 472 520 (9.1)

-------- -------- --------- ------- --------- -------- -------- ---------

Gold (g/t) 1.37 1.32 3.5 1.31 4.1 1.27 1.39 (8.7)

-------- -------- --------- ------- --------- -------- -------- ---------

Lead (%) 1.35 1.33 1.5 0.84 61.0 1.15 0.90 27.3

-------- -------- --------- ------- --------- -------- -------- ---------

Zinc (%) 2.44 2.25 8.3 1.60 52.6 2.06 1.72 19.8

-------- -------- --------- ------- --------- -------- -------- ---------

* Includes ore processed from initial tests during the

commissioning of the Juanicipio plant and ore processed at the

Fresnillo and Saucito beneficiation plants.

** Ore processed at the Fresnillo and Saucito beneficiation

plants.

Attributable quarterly silver production decreased 5.8% vs. 3Q23

as stopes with lower silver ore grade were mined from November in

accordance with the mine plan. This was partially mitigated by the

higher volume of ore processed.

Attributable quarterly silver and gold production increased

142.2% and 96.4% vs. 4Q22 respectively, due to the ramp-up

following the commissioning completed in 1Q23, and to a lesser

extent, a higher ore grade.

Full year attributable silver and gold production increased

81.8% and 65.1% vs. FY22 respectively, mainly due to the

commissioning and subsequent ramp up to full nameplate capacity at

the flotation plant, partly offset by the lower ore grades in

accordance with the mine plan.

Attributable quarterly gold production increased 12.1% vs. 3Q23

mainly due to the higher volume of ore processed.

The silver and gold ore grades for 2024 will be provided at the

time of the Company's preliminary results.

SILVERSTREAM

Quarterly silverstream production decreased 8.6% vs. 3Q23 mainly

due to the decrease in volumes of ore processed

and lower ore grade.

Quarterly silverstream production increased 36.2% vs. 4Q22

mainly due to a technical stoppage in December 2022.

Full year silverstream production increased 5.2% vs. FY22 as a

result of the higher volume of ore processed, partly offset by the

lower recovery rate and lower ore grade.

Silver production in 2024 is estimated to be in the range of

2.5-3.5 moz.

ABOUT FRESNILLO PLC

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has eight operating mines, all of them in Mexico -

Fresnillo, Saucito, Juanicipio, Ciénega, Herradura,

Soledad-Dipolos(1) , Noche Buena and San Julián (Veins and

Disseminated Ore Body) and four advanced exploration projects -

Orisyvo, Rodeo, Guanajuato and Tajitos as well as a number of other

long term exploration prospects.

Fresnillo plc has mining concessions and exploration projects in

Mexico, Peru and Chile.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company and Mexico's largest gold

producer.

(1) Operations at Soledad-Dipolos are currently suspended.

FORWARD-LOOKING STATEMENTS

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation, general economic and

business conditions, industry trends, competition, commodity

prices, changes in regulation, currency fluctuations (including the

US dollar and Mexican Peso exchanges rates), the Fresnillo Group's

ability to recover its reserves or develop new reserves, including

its ability to convert its resources into reserves and its mineral

potential into resources or reserves, changes in its business

strategy and political and economic uncertainty.

[1] Au:Ag ratio of 80:1

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBUGDBUBDDGSS

(END) Dow Jones Newswires

January 24, 2024 10:23 ET (15:23 GMT)

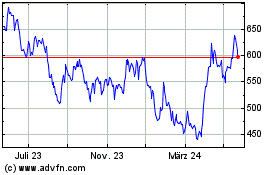

Fresnillo (LSE:FRES)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

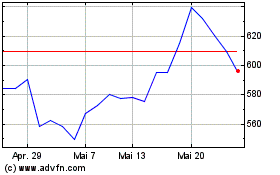

Fresnillo (LSE:FRES)

Historical Stock Chart

Von Dez 2023 bis Dez 2024