Crown Place VCT PLC Crown Place Vct Plc : Interim Management Statement

21 Mai 2018 - 5:48PM

UK Regulatory

TIDMCRWN

Crown Place VCT PLC

Interim Management Statement

LEI Code: 213800SYIQPA3L3T1Q68

Introduction

I am pleased to present Crown Place VCT PLC's interim management

statement for the period ended 31 March 2018.

Performance and dividends

The Group's unaudited net asset value (NAV) as at 31 March 2018 was

GBP52.59 million or 32.14 pence per share (excluding treasury shares),

after accounting for a dividend of 1 penny per share which was paid on

29 March 2018 to shareholders on the register on 9 March 2018.

After taking account of the total 2.00 pence per share of dividends paid

on 30 November 2017 (1 penny) and 29 March 2018 (1 penny), the

comparable ex-dividend NAV as at 30 June 2017 was 28.98 pence per share.

Therefore, the NAV has risen by 3.16 pence per share or (10.90 per

cent.) since 30 June 2017.

Share issues

During the period from 1 January 2018 to 31 March 2018, the Company

issued the following new Ordinary shares under the Albion VCTs

Prospectus Top Up Offers 2017/18:

Aggregate

Number of nominal value Issue price per

shares of shares share (including Net proceeds

Date issued GBP'000 costs of issue) GBP'000

31 January 2018 4,349,218 435 31.5p 1,336

The Board announced on 26 February 2018 that the Company had reached its

GBP6 million limit under its offer pursuant to the Prospectus dated 6

September 2017, and so was closed.

The proceeds of the Offer are being used to provide further resources to

the Company at a time when a number of attractive new investment

opportunities are being seen.

In addition, the following new Ordinary shares were issued under the

dividend reinvestment scheme on 29 March 2018:

Aggregate

Number of nominal value Issue price per

shares of shares share (including Net invested

Date issued GBP'000 costs of issue) GBP'000

29 March 2018 888,509 9 30.47 269

Share buy-backs

During the period from 1 January 2018 to 31 March 2018, the Company

purchased 495,000 shares for GBP143,000 including stamp duty at an

average price of 28.68 pence per share. All of the shares are to be held

in treasury.

It remains the Board's policy to buy back shares in the market, subject

to the overall constraint that such purchases are in the Company's

interest, including the maintenance of sufficient resources for

investment in existing and new portfolio companies and the continued

payment of dividends to shareholders. It is the Board's intention for

such buy-backs to be at around a 5 per cent. discount to net asset value,

so far as market conditions and liquidity permit.

Reduction in share capital and cancellation of capital redemption and

share premium reserves

As noted in the Half-yearly Financial Report to 31 December 2017, the

Company obtained authority to reduce the nominal value of its ordinary

shares from 10 pence to 1 penny and cancel the amount standing to the

credit of its share premium and capital redemption reserves at the

Annual General Meeting on 8 November 2017. The purpose of the proposal

was to increase the distributable reserves available to the Company for

the payment of dividends, the buy-back of shares, and for other

corporate purposes.

The proposal received the consent of the Court on 13 February 2018, and

the changes have been registered at Companies House. Therefore, with

effect from 13 February 2018, the share capital of the Company will have

a nominal value of 1 penny per share.

New share certificates will not be issued following these changes and

existing certificates will remain valid.

Portfolio

The following investments have been made during the period from 1

January 2018 to 31 March 2018:

New qualifying investments GBP'000 Activity

Online marketplace connecting

Koru Kids Limited 200 parents and nannies

Total new qualifying investments 200

Follow on investments into

existing portfolio companies GBP'000 Activity

Provider of cyber security

Panaseer Limited 141 services

Convertr Media Limited 120 Digital lead generation software

Total further investments 261

Disposals

The following disposal proceeds, including loan stock repayments, were

received during the period from 1 January 2018 to 31 March 2018:

Portfolio company GBP'000

The Crown Hotel Harrogate Limited 2,033 Disposal of investment

Radnor House School (Holdings) Limited 45 Loan stock repayment

Total proceeds 2,078

Top ten holdings as at 31 March 2018:

% of

net

Carrying value asset

Investment GBP000s value Activity

Radnor House

School

(Holdings)

Limited 6,133 11.7 Independent schools for children aged 3-18

Shinfield

Lodge Care Owns and operates a 66 bed care home in Shinfield,

Limited 3,801 7.2 Berkshire

Chonais River

Hydro Owner and operator of a 2 MW hydro-power scheme in

Limited 3,294 6.3 the Scottish Highlands

ELE Advanced

Technologies

Limited 2,987 5.7 Manufacturer of precision engineering components

Active Lives Owns and operates a 75 bed care home in Cumnor Hill,

Care Limited 2,499 4.8 Oxfordshire

Ryefield

Court Care Owns and operates a 60 bed care home in Hillingdon,

Limited 2,140 4.1 Middlesex

Gharagain

River Hydro Owner and operator of a 1 MW hydroelectricity plant

Limited 1,671 3.2 in Western Scotland

Earnside

Energy Anaerobic digestion and composting plant located in

Limited 1,236 2.4 Scotland

Proveca

Limited 1,235 2.3 Reformulation of paediatric medicines

Grapeshot

Limited 1,220 2.3 Provider of digital marketing software

A full breakdown of the Company's portfolio can be found on the

Company's webpage on the Manager's website at

www.albion.capital/funds/CRWN, by following the 'Portfolio of

Investments' link under the 'Funds reports' section.

Material events and transactions after the period end

Portfolio

After the period end, the Company undertook the following investment

transactions:

-- Investment of GBP128,000 in an existing portfolio company, Black Swan

Data Limited, which provides data analysis that supports corporate

decision making;

-- Investment of GBP120,000 in an existing portfolio company Sandcroft

Avenue Limited, which provides flexible access to gyms trading as

PayasUgym.com;

-- Investment of GBP105,000 in an existing portfolio company, InCrowd Sports

Limited, which is a developer of mobile apps for professional sports

clubs;

-- Investment of GBP75,000 into a new portfolio company, Healios Limited,

which provides online delivery of mental health therapy services;

-- Investment of GBP60,000 in an existing portfolio company, Abcodia Limited,

which focuses on the validation and discovery of serum biomarkers;

-- Investment of GBP28,000 in an existing portfolio company, DySIS Medical

Limited, which is a developer of medical devices for the detection of

cervical cancer; and

-- As announced on 24 April 2018, contracts were exchanged for the sale of

Grapeshot Limited, which subsequently completed on 15 May 2018. The

valuation of the holding as at 31 March 2018 includes discounts to the

total estimated consideration to reflect completion and other risks.

Albion VCTs prospectus Top Up Offers

The following new Ordinary shares of nominal value 1 penny per share

were allotted under the Albion VCTs prospectus Top Up Offers 2017/18

after 31 March 2018:

Aggregate

Number of nominal value Issue price per

shares of shares share (including Net proceeds

Date issued GBP'000 costs of issue) GBP'000

5 April 2018 1,980,778 20 31.3p 605

11 April 2018 436,012 4 31.0p to 31.3p 133

There have been no further significant events or transactions between 1

April 2018 to 21 May 2018 that the Board is aware of which would have

had a material impact on the financial position of the Company.

Further information

The Company continues to offer a Dividend Reinvestment Scheme to

existing shareholders. Details of this Scheme can be found at

www.albion.capital/funds/CRWN.

Further information regarding historic and current financial performance

and other useful shareholder information can be found on the Company's

webpage on the Manager's website at www.albion.capital/funds/CRWN.

Richard Huntingford, Chairman

crownchair@albion.capital

21 May 2018

For further information please contact:

Albion Capital Group LLP - Tel: 020 7601 1850

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Crown Place VCT PLC via Globenewswire

http://www.closeventures.co.uk

(END) Dow Jones Newswires

May 21, 2018 11:48 ET (15:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

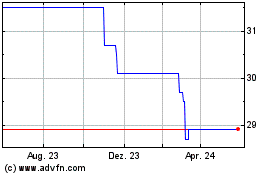

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024