Crown Place VCT PLC Crown Place Vct Plc: Half-yearly Report

19 Februar 2016 - 12:02PM

UK Regulatory

TIDMCRWN

Crown Place VCT PLC

As required by the UK Listing Authority's Disclosure and Transparency

Rule 4.2, Crown Place VCT PLC today makes public its information

relating to the Half-yearly Financial Report (which is unaudited) for

the six months to 31 December 2015. This announcement was approved by

the Board of Directors on 19 February 2016.

The full Half-yearly Financial Report (which is unaudited) for the

period to 31 December 2015, will shortly be sent to shareholders. Copies

of the full Half-yearly Financial Report will be shown via the Albion

Ventures LLP website by clicking

www.albion-ventures.co.uk/ourfunds/CRWN.htm.

Investment objective

The investment objective and policy of the Company* is to achieve long

term capital and income growth principally through investment in smaller

unquoted companies in the United Kingdom.

In pursuing this policy, the Manager aims to build a portfolio which

concentrates on two complementary investment areas.

The first are more mature or asset-based investments that can provide a

strong income stream combined with a degree of capital protection. These

will be balanced by a lesser proportion of the portfolio being invested

in higher risk companies with greater growth prospects.

*The "Company" is Crown Place VCT PLC. The "Group" is the Company

together with its subsidiaries CP1 VCT PLC and CP2 VCT PLC.

Financial calendar

Record date for second dividend 4 March 2016

Payment of second dividend 31 March 2016

Financial year end 30 June 2016

Financial highlights

Six months ended Six months ended Year ended

31 December 2015 31 December 2014 30 June 2015

(pence per share) (pence per share) (pence per share)

Opening net asset

value 30.97 32.04 32.04

Revenue return 0.29 0.42 0.73

Capital return 0.25 1.07 0.67

Total return 0.54 1.49 1.40

Dividends paid (1.25) (1.25) (2.50)

Impact from issue of

share capital - - 0.03

Closing net asset

value 30.26 32.28 30.97

Shareholder returns and shareholder value

Crown Place VCT PLC*

(pence per share)

Shareholder return from launch to April 2005 (date

that Albion Ventures was appointed investment manager):

Total dividends paid to 6 April 2005 (i) 24.93

Decrease in net asset value (56.60)

Total shareholder return to 6 April 2005 (31.67)

Shareholder return from April 2005 to 31 December

2015:

Total dividends paid 25.55

Decrease in net asset value (13.14)

Total shareholder return from April 2005 to 31 December

2015 12.41

Shareholder value since launch:

Total dividends paid to 31 December 2015 (i) 50.48

Net asset value as at 31 December 2015 30.26

Total shareholder value as at 31 December 2015 80.74

Current dividend objective:

Pence per share (per annum) 2.50

Dividend yield on net asset value as at 31 December

2015 8.3%

Notes

(i) Prior to 6 April 1999, venture capital trusts were able to

add 20 per cent. to dividends and figures for the period up until 6

April 1999 are included at the gross equivalent rate actually paid to

shareholders.

* Formerly Murray VCT 3 PLC

The above financial summary is for the Company, Crown Place VCT PLC

only. Details of the financial performance of CP1 VCT PLC (previously

Murray VCT PLC) and CP2 VCT PLC (previously Murray VCT 2 PLC) which have

been merged into the Company, can be found at the bottom of the

annoucement.

Total shareholder value since launch:

31 December 2015

(pence per share)

Total dividends paid during the period from launch

to 6 April 2005 (prior to change of manager) 24.93

Total dividends paid during:

the year ended 28 February 2006 1.00

the period ended 30 June 2007 3.30

the year ended 30 June 2008 2.50

the year ended 30 June 2009 2.50

the year ended 30 June 2010 2.50

the year ended 30 June 2011 2.50

the year ended 30 June 2012 2.50

the year ended 30 June 2013 2.50

the year ended 30 June 2014 2.50

the year ended 30 June 2015 2.50

the six months ended 31 December 2015 1.25

Total dividends paid to 31 December 2015 50.48

Net asset value as at 31 December 2015 30.26

Total shareholder value as at 31 December 2015 80.74

In addition to the dividends paid above, the Board has declared a second

dividend for the year ending 30 June 2016 of 1.25 pence per Crown Place

VCT PLC share, to be paid on 31 March 2016 to shareholders on the

register as at 4 March 2016.

Interim management report

Results

In the six month period to 31 December 2015, the Company achieved a

total return of 0.54 pence per share (31 December 2014: 1.49 pence per

share) equivalent to an annualised return of 3.5% on opening net assets

(31 December 2014: 9.3%). Following payment of the first dividend for

the year of 1.25 pence per share on 30 November 2015, the net asset

value as at 31 December 2015 was 30.26 pence per share (30 June 2015:

30.97 pence per share). The total return for the period was GBP576,000,

compared to GBP1,366,000 at 31 December 2014, of which the revenue

profit was GBP314,000 and the capital profit was GBP262,000. Investment

income and deposit interest were GBP530,000 and realised and unrealised

net gains on investments totalled GBP481,000. Total expenses, including

Investment management fees, were GBP435,000 (31 Dec 2014: GBP400,000),

equivalent to an ongoing total expense ratio of 2.6% (31 December 2014:

2.7%).

Portfolio review

During the six month period, the Company continued its rate of

investment deploying a total of GBP1,964,000 into qualifying investments,

(31 December 2014: GBP2,261,000). Of this amount, GBP77,000 related to

two new investments and GBP1,887,000 in several existing portfolio

companies to support their continuing growth. The new investments are

Panaseer Limited, a cybersecurity company offering a visualisation and

data integration platform to the financial services sector and Dickson

Financial Services Limited (trading as Innovation Broking), a commercial

insurance broking business. Further investments in existing portfolio

companies included a total of GBP735,000 to fund the continued

construction of three care homes; Active Lives Care, Ryefield Court Care

and Shinfield Lodge Care and GBP585,000 to fund the purchase and

development of Combe Bank School in Sevenoaks, Kent, by Radnor House

School (Holdings).

Investments realised during the period totalled GBP3,079,000, of which

GBP1,771,000 related to the sale of the Company's investment in

Kensington Health Club, achieving return, including interest, of 1.4

times cost and GBP767,000 of proceeds from the sale of Lowcosttravel, an

element of which is deferred, against a cost price of GBP455,000,

achieving a return of 1.7 times cost. The other GBP541,000 was mainly

made up of loan stock repayments and more details can be found in the

realisations table below.

The portfolio remains well diversified and benefits from a high

proportion of asset-based investments (57% at the period end) with no

external gearing. Radnor House School (Holdings) continues to grow

profitably and saw a further increase in valuation in the period. The

three care home investments based in Middlesex, Berkshire and

Oxfordshire are in their construction phase and progressing well, and

are all expected to be completed and commence trading within the next

six months. The asset-based businesses in the renewable energy sector

as well as the healthcare, education and leisure sectors continued to

generate a good level of income for the Company.

In the growth portfolio, Abcodia, Egress and Masters Pharmaceuticals

have continued to grow strongly resulting in an increase in their

valuations and are well positioned to deliver further value. Exco

Intouch, a relatively new investment in the portfolio, also made

excellent progress. Against this, the valuations in Blackbay, Dysis

Medical and Proveca were reduced in the period as a result of their

current trading levels. Several companies in the growth portfolio are

young and, while they show good potential in exciting, fast growing

markets, their growth trajectory is not always smooth and predictable.

This results in some volatility in the individual valuations, although

the impact on the overall portfolio is small, given its diversification.

The investment portfolio by sector chart at the bottom of the

February 19, 2016 06:02 ET (11:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Net asset value as at 31 December 2015 21.53 25.75

Total shareholder value as at 31 December 2015 70.36 78.56

Current dividend objective:

Pence per share (per annum) 1.78 2.13

Dividend yield on net asset value as at 31 December

2015 8.3% 8.3%

Notes

1. The proforma shareholder returns presented above are based on the

dividends paid to shareholders before the merger and the pro-rata net

asset value per share and pro-rata dividends per share paid to 31

December 2015 since the merger. This pro-forma is based upon the

proportion of shares received by Murray VCT PLC (now renamed CP1 VCT PLC)

and Murray VCT 2 PLC (now renamed CP2 VCT PLC) shareholders at the time

of the merger with Crown Place VCT PLC on 13 January 2006.

2. Prior to 6 April 1999, venture capital trusts were able to add 20 per

cent. to dividends and figures for the period up until 6 April 1999 are

included at the gross equivalent rate actually paid to shareholders.

Crown Place VCT PLC Split of investment portfolio by sector:

http://hugin.info/141806/R/1987437/729472.pdf

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Crown Place VCT PLC via Globenewswire

HUG#1987437

http://www.closeventures.co.uk

(END) Dow Jones Newswires

February 19, 2016 06:02 ET (11:02 GMT)

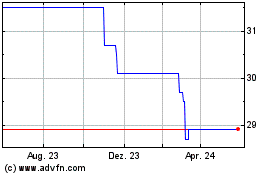

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024