Crown Place VCT PLC Crown Place Vct Plc : Annual -7-

02 Oktober 2014 - 6:08PM

UK Regulatory

Net cash flows from investing activities (1,410) 1,337

Cash flows from financing activities

Issue of share capital (net of issue costs) 2,444 1,993

Equity dividends paid (net of costs of dividend reinvestment

scheme and unclaimed dividends returned) (1,966) (1,883)

Purchase of shares for treasury (174) (243)

Purchase of shares for cancellation (395) (416)

Net cash flows used in financing activities (91) (549)

(Decrease)/increase in cash and cash equivalents (1,314) 1,039

Cash and cash equivalents at the start of the year 2,780 1,741

Cash and cash equivalents at the end of the year 16 1,466 2,780

Company cashflow statement

Year ended Year ended

30 June 2014 30 June 2013

Note GBP'000 GBP'000

Operating activities

Loan stock income received 880 917

Deposit interest received 18 22

Dividend income received 3,416 934

Investment management fees paid (473) (453)

Intercompany interest paid (3,387) (900)

Other cash payments (267) (269)

Net cash flows from operating activities 17 187 251

Taxation

UK corporation tax paid - -

Capital expenditure and financial investments

Purchase of fixed asset investments (2,539) (1,062)

Disposal of fixed asset investments 1,129 2,399

Net cash flows from investing activities (1,410) 1,337

Equity dividends paid

Dividends paid (net of costs of shares issued under

the dividend reinvestment scheme and unclaimed dividends

returned) (1,966) (1,883)

Net cash flows before financing (3,189) (295)

Financing activities

Issue of share capital (net of issue costs) 2,444 1,993

Purchase of own shares for treasury

(including costs) (174) (243)

Purchase of own shares for cancellation (including

costs) (395) (416)

Net cash flows from financing 1,875 1,334

Cash flow in the year 16 (1,314) 1,039

Notes to the Financial Statements

1. Accounting policies

The following policies refer to the Group and the Company except where

noted. References to International Financial Reporting Standards

('IFRS') relate to the Group Financial Statements and United Kingdom

Generally Accepted Accounting Practice ('UK GAAP') relate to the Company

Financial Statements.

Basis of accounting

The Financial Statements have been prepared in accordance with

International Financial Reporting Standards ('IFRS') adopted for use in

the European Union (and therefore comply with Article 4 of the EU IAS

regulation), in the case of the Group, and in accordance with UK GAAP in

the case of the Company.

Both the Group and the Company Financial Statements also apply the

Statement of Recommended Practice: "Financial Statements of Investment

Companies and Venture Capital Trusts" ('SORP') issued by the Association

of Investment Companies ("AIC") in January 2009, in so far as this does

not conflict with IFRS. The Financial Statements have been prepared in

accordance with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS and UK GAAP. These Financial Statements

are presented in Sterling to the nearest thousand. Accounting policies

have been applied consistently in current and prior periods.

At the balance sheet date, the following International Accounting

Standards and interpretations were in issue but not yet effective:

-- IFRS 9 Financial instruments: Recognition and measurement (effective for

annual periods beginning on or after 1 January 2015)

-- IFRS 10 Consolidated Financial Statements (effective for annual periods

beginning on or after 1 January 2014)

-- IFRS 11 Accounting for Acquisitions of Interest in Joint Operations

(effective for annual periods beginning on or after 1 January 2014)

-- IFRS 12 Disclosure of Interest in Other Entities (effective for annual

periods beginning on or after 1 January 2014)

-- IFRS 14 Regulatory Deferral Accounts (effective for annual periods

beginning on or after 1 January 2016)

-- IFRS 15 Revenue from Contracts with Customers (effective for annual

periods beginning on or after 1 January 2017)

-- IAS 16/IAS 41 Clarification of Acceptable Methods of Depreciation and

Amortisation (effective for annual periods beginning on or after 1

January 2016)

-- IAS 19 Defined Benefit Plans: Employee Contributions (effective for

annual periods beginning on or after 1 July 2014)

-- IAS 27 Separate Financial Statements (effective for annual periods

beginning on or after 1 January 2014)

-- IAS 28 Investments in Associates and Joint Ventures (effective for annual

periods beginning on or after 1 January 2014)

-- IAS 32 Offsetting Financial Assets and Financial Liabilities (effective

for annual periods beginning on or after 1 January 2014)

-- IAS 36 Recoverable amounts disclosures for non-financial assets

(effective for annual periods beginning on or after 1 January 2014)

-- IAS 39 Novation of Derivatives and Continuation of Hedge Accounting

(effective for annual periods beginning on or after 1 January 2014)

The above International Accounting Standards and interpretations have

not been applied in this Annual Report and Financial Statements and are

not expected to have any material impact on the Financial Statements

although some changes may be required to the format of the Financial

Statements and disclosures.

Basis of consolidation

The Group consolidated Financial Statements incorporate the Financial

Statements of the Company for the year ended 30 June 2014 and the

entities controlled by the Company (its subsidiaries), for the same

period. Where necessary, adjustments are made to the Financial

Statements of subsidiaries to bring the accounting policies into line

with those used by the Group. All intra-group transactions, balances,

income and expenses are eliminated on consolidation.

As permitted by Section 408 of the Companies Act 2006, the Company has

not presented its own profit and loss account. The amount of the

Company's profit before tax for the year dealt with in the accounts of

the Group is GBP3,461,000 (2013: GBP706,000).

Segmental reporting

The Directors are of the opinion that the Group and the Company are

engaged in a single operating segment of business, being investment in

equity and debt. The Group and the Company report to the Board which

acts as the chief operating decision maker. The Group invests in smaller

companies principally based in the UK.

Business combinations

The acquisition of subsidiaries is accounted for using the purchase

method in the Group Financial Statements. The cost of the acquisition is

measured at the aggregate of the fair values, at the date of exchange,

of assets given, liabilities incurred or assumed, and equity instruments

issued by the Group in exchange for control of the subsidiaries, plus

any costs directly attributable to the business combination. The

subsidiary's identifiable assets, liabilities and contingent liabilities

that meet the conditions for recognition under IFRS 3 "Business

Combinations" are recognised at their fair value at the acquisition

date.

Estimates

The preparation of the Group's and Company's Financial Statements

requires estimates, assumptions and judgments to be made, which affect

the reported results and balances. Actual outcomes may differ from these

estimates, with a consequential impact on the results of future periods.

Those estimates and assumptions that have a significant risk of causing

a material adjustment to the carrying amounts of assets and liabilities

within the next financial year are those used to determine the fair

value of investments at fair value through the profit or loss.

The valuation of investments held at fair value through profit or loss

or measured in assessing any impairment of loan stocks is determined by

using valuation techniques. The Group and the Company use judgments to

select a variety of methods and makes assumptions that are mainly based

on market conditions and portfolio company performance at each balance

sheet date.

Investment in subsidiaries

Investments in subsidiaries are revalued at the balance sheet date based

on the underlying net assets of the subsidiary undertakings. Revaluation

movements are recognised in the unrealised reserve.

The Directors have not yet made a formal decision on the future of CP2

VCT plc, but the parent Company has undertaken to support the ongoing

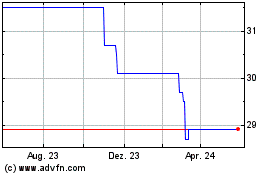

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024