Crown Place VCT PLC Crown Place Vct Plc : Annual -10-

02 Oktober 2014 - 6:08PM

UK Regulatory

Opening accumulated unrealised losses (1,777)

Transfer of previously unrealised gains to realised

reserves on disposal (227)

Transfer of previously unrealised losses to realised

reserves on investments written off but still held 751

Movement in unrealised gains 1,802

Closing accumulated unrealised gains 549

Historic cost basis

Opening book cost 26,262

Purchases at cost 2,539

Disposals at cost (945)

Cost of investments written off but still held (777)

Closing book cost 27,079

Closing cost is net of amounts of GBP1,881,000 (2013:

GBP1,104,000) written off in respect of investments

still held at the balance sheet date.

30 June 2013

GBP'000

Opening valuation as at 1 July 2012 24,333

Purchases at cost 1,030

Disposal proceeds (2,254)

Realised gains 374

Movement in loan stock accrued income -

Unrealised gains 1,084

Closing valuation as at 30 June 2013 24,567

Movement in loan stock accrued income

Opening accumulated movement in loan stock accrued

income 82

Movement in loan stock accrued income -

Closing accumulated movement in loan stock accrued

income 82

Movement in unrealised losses

Opening accumulated unrealised losses (3,914)

Movement in unrealised gains 1,084

Transfer of previously unrealised gains to realised

reserves on disposal (51)

Transfer of previously unrealised losses to realised

reserves on investments written off but still held 1,104

Closing accumulated unrealised losses (1,777)

Historic cost basis

Opening book cost 28,164

Purchases at cost 1,030

Disposals at cost (1,828)

Cost of investments written off but still held (1,104)

Closing book cost 26,262

The Directors believe that the carrying value of loan stock measured at

amortised cost is not materially different to fair value. The Company

does not hold any assets as the result of the enforcement of security

during the year, and believes that the carrying values for both impaired

and past due assets are covered by the value of security held for these

loan stock investments.

Additions and disposal proceeds included in the cash flow statement

differ from the amounts shown in the note above, due to deferred

consideration and settlement creditors and the restructuring of

investments.

A schedule of disposals during the year is shown on page 18 of the full

Annual Report and Financial Statements.

IFRS 13 'Fair value measurement' and IFRS 7 'Financial Instruments:

Disclosures' requires the Company to disclose the valuation methods

applied to its investments measured at fair value through profit or loss

in a fair value hierarchy according to the following definitions:

Fair value hierarchy Definition of valuation method

Level 1 Unadjusted quoted (bid) prices applied

Level 2 Inputs to valuation are from observable sources and

are directly or indirectly derived from prices

Level 3 Inputs to valuations are not based on observable market

data

Quoted AIM investments are valued according to Level 1 valuation

methods. Unquoted equity, preference shares, convertible loan stock and

debt issued at a discount are all valued according to Level 3 valuation

methods.

The Company's investments measured at fair value through profit or loss

(Level 3) had the following movements in the year to 30 June 2014:

30 June 2014 30 June 2013

Discounted Discounted

debt and debt and

convertible convertible

Equity loan stock Total Equity loan stock Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening balance 9,582 2,824 12,406 8,711 2,140 10,851

Additions 773 1,337 2,110 216 530 746

Disposal

proceeds (193) (293) (486) (1,400) (244) (1,644)

Transfer to

Level 1 (473) (193) (666) - - -

Representation

of convertible

debt - 417 417 - - -

Debt/equity

conversion 342 (342) - 812 - 812

Realised

(losses)/gains (12) 12 - 329 18 347

Unrealised

gains/(losses) 2,142 (131) 2,011 914 374 1,288

Accrued loan

stock

interest - 4 4 - 6 6

Closing balance 12,161 3,635 15,796 9,582 2,824 12,406

Unquoted investments held at fair value through profit or loss are

valued in accordance with the IPEVCV guidelines as follows:

30 June 2014 30 June 2013

Investment valuation methodology GBP'000 GBP'000

Net asset value supported by independent valuation 6,000 4,675

Cost (reviewed for impairment) 2,313 522

Net asset value 2,288 2,319

Earnings multiple 1,990 2,069

Revenue multiple 1,664 1,829

Agreed sale price/Offer price 993 408

Recent investment price 548 584

15,796 12,406

Level 3 valuations include inputs based on non-observable market data.

IFRS 13 requires an entity to disclose quantitative information about

the significant unobservable inputs used. Of the Company's Level 3

investments, 23 per cent are held on an Earnings or Revenue multiple

basis, which have significant judgment applied to the valuation inputs.

The table below sets out the range of Earnings and Revenue multiples and

discounts applied. The remainder of Level 3 investments are held at cost

(reviewed for impairment), recent investment price, net asset value

(supported by independent valuation) or net assets.

Travel and Support Healthcare

leisure services (growth) Software

Earnings

multiples

PE multiple

range 6.0 8.9-11.0 15.2 10.0

Marketability

discount range 65% 20%-50% 50% 50%

Revenue

multiples

Revenue multiple

range - - 1.3 - 3.3 0.1 - 2.4

Marketability

discount range - - 35% 30% - 96%

IFRS 13 and IFRS 7 requires the Directors to consider the impact of

changing one or more of the inputs used as part of the valuation process

to reasonable possible alternative assumptions. After due consideration

and noting that the valuation methodology applied to 62 per cent. of the

Level 3 investments (by valuation) is based on third party independent

evidence, recent investment price, agreed sale price/offer price and

cost, the Directors believe that changes to reasonable possible

alternative input assumptions for the valuation of the remainder of the

portfolio could lead to a significant change in the fair value of the

portfolio. The impact of these changes could result in an increase in

the valuation of the equity investments by GBP1,545,000 or a decrease in

the valuation of equity investments by GBP1,094,000.

The unquoted equity instruments had the following movements between

investment methodologies between 30 June 2013 and 30 June 2014:

Value as at Explanatory

Change in investment valuation methodology (2013 to 30 June 2014 note

2014) GBP'000

Net asset value supported by independent valuation 731 Agreed

to Agreed sale price/Offer price offer

price

Earnings multiple to revenue multiple 501 More

appropriate

methodology

after

reduction

in

earnings

Net assets to Agreed sale price/Offer price 262 Agreed

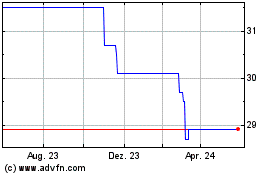

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024