TIDMCRWN

As required by the UK Listing Authority's Disclosure and Transparency Rule 4.2,

Crown Place VCT PLC today makes public its information relating to the

Half-yearly Financial Report for the six months to 31 December 2009. This

announcement was approved by the Board of Directors on 26 February 2010. Please

click on the following link to view the full Half-yearly Financial Report (which

is unaudited) for the period to 31 December 2009, which will shortly be sent to

shareholders. The information contained in this link includes information as

required by the Disclosure and Transparency Rules, including Rule 4.2.

http://hugin.info/141806/R/1389130/347336.pdf

Alternatively you may view the Half-yearly Financial Report at

www.albion-ventures.co.uk by clicking on the 'Our Funds' section.

Financial highlights unaudited

+------------------------+-----------------+-----------------+-----------------+

| | 31 December 2009| 31 December 2008| 30 June 2009|

+------------------------+-----------------+-----------------+-----------------+

| |(pence per share)|(pence per share)|(pence per share)|

+------------------------+-----------------+-----------------+-----------------+

|Net asset value per | | | |

|share | 34.18| 36.29| 34.24|

+------------------------+-----------------+-----------------+-----------------+

|Dividends paid | 1.25| 1.25| 2.50|

+------------------------+-----------------+-----------------+-----------------+

|Revenue return per share| 0.31| 0.53| 0.93|

+------------------------+-----------------+-----------------+-----------------+

|Capital return/(loss) | | | |

|per share | 0.89| (4.14)| (5.41)|

+------------------------+-----------------+-----------------+-----------------+

+------------------------------------------------------------+-----------------+

|Net asset value total return to shareholders since launch: | |

+------------------------------------------------------------+-----------------+

| | 31 December 2009|

| |(pence per share)|

+------------------------------------------------------------+-----------------+

|Total dividends paid during the period from launch to 6 | 24.93|

|April 2005 (prior to change of manager) | |

+------------------------------------------------------------+-----------------+

|Total dividends paid during the year ended 28 February 2006 | 1.00|

+------------------------------------------------------------+-----------------+

|Total dividends paid during the period ended 30 June 2007 | 3.30|

+------------------------------------------------------------+-----------------+

|Total dividends paid during the year ended 30 June 2008 | 2.50|

+------------------------------------------------------------+-----------------+

|Total dividends paid during the year ended 30 June 2009 | 2.50|

+------------------------------------------------------------+-----------------+

|Total dividends paid during the six months ended 31 December| 1.25|

|2009 | |

+------------------------------------------------------------+-----------------+

|Total dividends paid to 31 December 2009 | 35.48|

+------------------------------------------------------------+-----------------+

|Net asset value as at 31 December 2009 | 34.18|

+------------------------------------------------------------+-----------------+

|Total net asset value return as at 31 December 2009 | 69.66|

+------------------------------------------------------------+-----------------+

+------------------------------------------------------------+-----------------+

In addition to the dividends paid above, the Board has declared a second

dividend for the year ending 30 June 2010, of 1.25 pence per Crown Place VCT PLC

share (0.25 pence to be paid out of revenue profits and 1.00 pence out of

realised capital gains), to be paid on 9 April 2010 to shareholders on the

register as at 12 March 2010.

Investment objectives

The investment objective and policy of the Company is to achieve long term

capital and income growth principally through investment in smaller unquoted

companies in the United Kingdom.

Financial calendar

Record date for second dividend 12 March 2010

Payment of second dividend 9 April 2010

Financial year end 30 June 2010

Directors Patrick Crosthwaite, Chairman

Rachel Beagles

Sir Andrew Cubie

Vikram Lall

Geoffrey Vero

Shareholder returns and shareholder value

+-----------------------+-----------------+-----------------+------------------+

| |Proforma ((i)) |Proforma ((i)) | |

| | | |Crown Place VCT |

| |Murray VCT PLC |Murray VCT 2 PLC |PLC* |

+-----------------------+-----------------+-----------------+------------------+

| |(pence per share)|(pence per share)|(pence per share) |

+-----------------------+-----------------+-----------------+------------------+

|Shareholder return from| | | |

|launch to April 2005 | | | |

|(date that Albion | | | |

|Ventures was appointed | | | |

|investment manager): | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total dividends paid to| 30.36| 30.91| 24.93|

|6 April 2005 ((ii)) | | | |

+-----------------------+-----------------+-----------------+------------------+

|Decrease in net asset | (69.90)| (64.50)| (56.60)|

|value | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total shareholder | (39.54)| (33.59)| (31.67)|

|return to 6 April 2005 | | | |

+-----------------------+-----------------+-----------------+------------------+

+-----------------------+-----------------+-----------------+------------------+

|Shareholder return from| | | |

|April 2005 to 31 | | | |

|December 2009: | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total dividends paid | 7.80| 9.13| 10.55|

+-----------------------+-----------------+-----------------+------------------+

|Decrease in net asset | (5.77)| (6.42)| (9.22)|

|value | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total shareholder | | | |

|return from April 2005 | 2.03| 2.71| 1.33|

|to 31 December 2009 | | | |

+-----------------------+-----------------+-----------------+------------------+

+-----------------------+-----------------+-----------------+------------------+

|Shareholder value since| | | |

|launch: | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total dividends paid to| 38.16| 40.04| 35.48|

|31 December 2009 ((ii))| | | |

+-----------------------+-----------------+-----------------+------------------+

|Net asset value as at | 24.33| 29.08| 34.18|

|31 December 2009 | | | |

+-----------------------+-----------------+-----------------+------------------+

|Total shareholder value| 62.49| 69.12| 69.66|

|as at 31 December 2009 | | | |

+-----------------------+-----------------+-----------------+------------------+

+-----------------------+-----------------+-----------------+------------------+

|Current dividend | | | |

|objective: | | | |

+-----------------------+-----------------+-----------------+------------------+

|Pence per share (per | 1.78| 2.13| 2.50|

|annum) | | | |

+-----------------------+-----------------+-----------------+------------------+

|Percentage tax free | | | |

|yield on net asset | | | |

|value as at 31 December| 7.3%| 7.3%| 7.3%|

|2009 | | | |

+-----------------------+-----------------+-----------------+------------------+

(i) The proforma shareholder returns presented above are based on the dividends

paid to shareholders before the merger and the pro-rata net asset value per

share and pro-rata dividends per share paid to 31 December 2009 since the

merger. This pro-forma is based upon the proportion of shares received by Murray

VCT PLC (now renamed CP1 VCT PLC) and Murray VCT 2 PLC (now renamed CP2 VCT PLC)

shareholders at the time of the merger with Crown Place VCT PLC on 13 January

2006.

Shareholders received 712 shares in Crown Place VCT PLC for every 1,000 shares

originally held in CP1 VCT PLC, and 851 shares in Crown Place VCT PLC for every

1,000 shares held in CP2 VCT PLC.

(ii) Prior to 6 April 1999, venture capital trusts were able to add 20% to

dividends, and figures for the period up until 6 April 1999 are included at the

gross equivalent rate actually paid to shareholders.

* Formerly Murray VCT 3 PLC

Interim management report

Results

In the six months to 31 December 2009, the Company recorded a positive total

return of 1.20 pence per share, or 3.5 per cent. After allowing for the first

dividend of 1.25 pence per share paid in November, net asset value per share

remained broadly unchanged at 34.18 pence per share (30 June 2009: 34.24 pence

per share). The return to a positive outcome is welcome and reflects the growing

maturity of the investment portfolio. During the period, the Company made a

revenue profit after tax of GBP226,000 and a capital profit after tax of GBP647,000

resulting in a total profit after tax of GBP873,000 or 1.20 pence per share.

Dividends

The Company's policy is to pay regular and predictable dividends to investors

out of revenue income and realised capital gains. The first dividend in the

current financial year of 1.25 pence per share was paid to shareholders on 6

November 2009. Subject to the performance of the investment portfolio, the Board

aims to maintain the current annualised dividend distribution of 2.5 pence per

share going forward.

The Directors have declared a second dividend of 1.25 pence per Crown Place VCT

PLC share (of which 0.25 pence is to be paid from revenue and 1.00 pence out of

realised capital gains) on 9 April 2010 to shareholders on the register as at

12 March 2010.

Dividends are paid free of tax to shareholders and qualifying shareholders who

elect to participate in the Dividend Reinvestment Scheme will be able, in

respect of further dividends, to receive their dividends in the form of new

shares rather than cash, which will entitle them to income tax relief at the

rate of 30 per cent. (New shares will need to be held for at least five years).

The Dividend Reinvestment Scheme was established in 2009 and further details are

included with this Half-yearly Financial Report. Details can also be found on

the Manager's websitewww.albion-ventures.co.uk

<http://www.albion-ventures.co.uk/>.

Portfolio review

During the half year, the Company made new and follow-on investments totaling

GBP1.8 million. Of this amount, GBP1.4 million was invested in Geronimo Inns VCT I

Limited and Geronimo Inns VCT II Limited. These companies, which have no bank

borrowings, own and operate four landmark freehold pubs in central London. The

pubs were acquired at an attractive valuation in July 2009, have since been

refurbished and re-launched and are currently trading ahead of budget. The

investments generate a yield of 8 per cent. to the Company and have potential to

deliver capital profits. The remaining GBP400,000 of new funds invested were used

to support existing portfolio companies, including two of our cinemas and three

of our technology businesses. During the period, the Company reduced its holding

in AIM listed Avanti Communications Group Plc. In addition, the investments in

Red-M Wireless Limited (previously Red-M Group Limited) and Green Energy

Property Services Limited (previously Vibrant Energy Assessors Limited) were

restructured.

Overall, the existing investment portfolio, which is well diversified, is

holding up against the background of continuing difficult economic conditions.

An important element of this is that, apart from the investments inherited from

the previous Manager (currently valued at GBP2.3 million, or 9.4 per cent. of net

asset value), the majority of investee companies have no bank gearing. In

addition, many of them are operating in sectors of the UK which are showing

signs of recovery, or in areas of the world economy that have strong prospects

for growth.

Trading in the hotel and health and fitness investments is broadly stable with

early indications of growth resuming, while the cinema and travel businesses

continue to trade well. Several of the technology investments, such as Helveta,

Blackbay and RFI Global Services, have made significant progress during the

period and are on course to deliver shareholder value in the longer term. More

recently there have been tentative signs that acquisition activity is returning

to the market, particularly in the technology sector, which bodes well for

future investment exits.

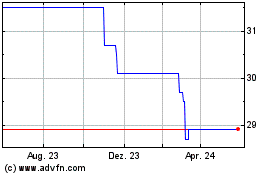

The chart below illustrates the composition of the portfolio by industry sector.

The majority of the investments in hotels, pubs, cinemas and fitness clubs are

backed by significant freehold or long leasehold property assets and it remains

our policy that investee companies should not have bank gearing.

http://hugin.info/141806/R/1389167/347361.pdf

Source: Albion Ventures LLP

Related Party Transactions

Details of material related party transactions for the reporting period can be

found in note 12 to this announcement.

Going concern

The Board's assessment is that liquidity risk is low, and remains as detailed on

page 32 of the Annual Report and Financial Statements for the year ended 30 June

2009. The Company has significant cash and liquid resources. The portfolio of

investments is diversified in terms of sector, and the major cash outflows of

the Company (namely investments, share buy-backs and dividends) are within the

Company's control. Accordingly, after making enquiries, the Directors have a

reasonable expectation that the Company has adequate resources to continue in

operational existence for the foreseeable future. For this reason the Directors

have adopted the going concern basis in preparing the accounts in accordance

with Going Concern and Liquidity Risk: Guidance for Directors of UK Companies

2009, published by the Financial Reporting Council.

Risks and Uncertainties

The key risks affecting the Company remain the continuing difficult outlook for

the economy in the UK and for the world economy in general. It remains our

policy that portfolio companies should not have external gearing, and as a

result, it is the Board's view that our portfolio is relatively well equipped to

cope with this broader, negative climate. Other risks and uncertainties remain

unchanged, and are as detailed on page 21 of the Annual Report and Financial

Statements for the year ended 30 June 2009.

Discount management and share buy-backs

It is the Board's policy to buy back shares in the market, subject to the

overall constraint that such purchases are in the Company's interest, including

the maintenance of sufficient resources for investment in existing and new

investee companies. The Company has not bought back any shares for cancellation

or treasury in the six months ended 31 December 2009.

Outlook

The UK economy now appears to be coming out of recession but the future remains

uncertain. Overall, the portfolio has held up reasonably in this difficult

period. Many of the investee companies address international markets and are

seeing potential growth opportunities, which is a cause for optimism. Against

this, the decline in interest rates to historically unprecedented low levels has

reduced the income generated by the Company's cash resources. This issue is

being addressed by seeking to employ a larger proportion of the Company's

capital in income generating investments, such as the recent investment in

Geronimo Inns VCT I Limited and Geronimo Inns VCT II Limited. The Board views

this VCT as a long term savings product and in this context, the Directors

consider that the Company remains well positioned to deliver long term

shareholder value.

Patrick Crosthwaite

Chairman

26 February 2010

Responsibility statement

The Directors, as listed in this announcement, are responsible for preparing the

Half-yearly Financial Report. The Directors have chosen to prepare this

Half-yearly Financial Report for the Group in accordance with International

Financial Reporting Standards ("IFRS").

In preparing the summarised set of financial statements for the period to 31

December 2009, we the Directors, confirm that to the best of our knowledge:

(a) the summarised set of financial statements has been prepared in accordance

with International Accounting Standard (IAS) 34 "Interim Financial Reporting"

issued by the International Accounting Standards Board;

(b) the interim management report includes a fair review of the information

required by DTR 4.2.7R (indication of important events during the first six

months and description of principal risks and uncertainties for the remaining

six months of the year);

(c) the summarised set of financial statements give a true and fair view in

accordance with IFRS of the assets, liabilities, financial position and of the

profit and loss of the Group for the six months ended 31 December 2009 and

comply with IFRS and Companies Act 1985 and 2006 and;

(d) the interim management report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties' transactions and changes

therein).

The accounting policies applied to the Half-yearly Financial Report have been

consistently applied in current and prior periods and are those applied in the

Annual Report and Financial Statements for the year ended 30 June 2009.

This Half-yearly Financial Report has not been audited or reviewed by the

auditors.

By order of the Board of Directors

Patrick Crosthwaite

Chairman

26 February 2010

Portfolio of investments

The following is a list of non-current investments with a carrying/fair value as

at 31 December 2009.

+------------------+-------------+------+---------+------------------------+------------------------+-------------+

| | | | | As at 31 December 2009| As at 30 June 2009| |

| | | | | (unaudited)| (audited)| |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| | | | | | | | |Change in |

| | | | | | | | |carrying/fair|

| | | | % voting| | | | |value for |

| | |% | rights|Investment|Total |Investment|Total |theperiod |

|Investment |Nature of |voting| of AVL*|to date |carrying/fair|to date |carrying/fair|net of |

|name |business |rights| managed|at cost |value |at cost |value** |investments |

| | | |companies| GBP'000 | GBP'000 | GBP'000 | GBP'000 |and exits |

| | | | | | | | |in the |

| | | | | | | | |period** |

| | | | | | | | | GBP'000 |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Unquoted | | | | | | | | |

|investments | | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

|The Crown Hotel |operator of | | | | | | | |

|Harrogate Limited |the Crown |15.0 |50.0 |2,976 |2,121 |2,976 |2,085 |36 |

| |Hotel, | | | | | | | |

| |Harrogate | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|ELE Advanced |Manufacturer | | | | | | | |

|Technologies |of precision |48.3 |48.3 |1,050 |1,712 |1,050 |1,759 |(47) |

|Limited |engineering | | | | | | | |

| |components | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

| |operator of | | | | | | | |

|The Stanwell Hotel|the Stanwell |11.1 |50.0 |1,400 |1,124 |1,400 |1,137 |(13) |

|Limited |Hotel at | | | | | | | |

| |Heathrow | | | | | | | |

| |Airport | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|The Charnwood Pub |Owner and | | | | | | | |

|Company Limited |operator of |7.0 |50.0 |2,204 |1,109 |2,204 |1,197 |(87) |

| |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

| |operator of a| | | | | | | |

|Kensington Health |health and |7.8 |50.0 |1,789 |1,036 |1,789 |1,035 |(1) |

|Clubs Limited |fitness club | | | | | | | |

| |in | | | | | | | |

| |West London | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

| |operator of | | | | | | | |

|Kew Green VCT |the 'Express | | | | | | | |

|(Stansted) Limited|by Holiday |2.0 |50.0 |1,000 |952 |1,000 |946 |6 |

| |Inn' at | | | | | | | |

| |Stansted | | | | | | | |

| |Airport | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Geronimo Inns VCT |Owner and | | | | | | | |

|I |operator of |9.0 |50.0 |720 |765 |- |- |45 |

|Limited |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Geronimo Inns VCT |Owner and | | | | | | | |

|II |operator of |9.0 |50.0 |720 |765 |- |- |45 |

|Limited |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

| |mobile data | | | | | | | |

| |solutions for| | | | | | | |

|Blackbay Limited |the logistics|3.9 |32.9 |423 |580 |423 |531 |49 |

| |and field | | | | | | | |

| |service | | | | | | | |

| |sectors | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|House of |Chocolate | | | | | | | |

|Dorchester |manufacturer |23.3 |23.3 |409 |558 |490 |689 |(48) |

|Limited | | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

| |operator of a| | | | | | | |

|Tower Bridge |health and | | | | | | | |

|Health |fitness club |9.5 |50.0 |591 |537 |591 |511 |26 |

|Clubs Limited |in | | | | | | | |

| |central | | | | | | | |

| |London | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Lowcosttravelgroup|Online travel|5.0 |26.0 |455 |494 |455 |290 |204 |

|Limited |business | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

| |software | | | | | | | |

| |solutions, | | | | | | | |

| |traceability | | | | | | | |

|Helveta Limited |and inventory|4.4 |26.6 |450 |465 |450 |368 |97 |

| |analysis to | | | | | | | |

| |the | | | | | | | |

| |timber | | | | | | | |

| |industry | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|CS (Brixton) |Cinema owner | | | | | | | |

|Limited |and |9.6 |50.0 |411 |434 |375 |430 |(32) |

| |operator | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Bravo Inns II |Owner and | | | | | | | |

|Limited |operator of |3.9 |49.6 |405 |383 |305 |289 |(6) |

| |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Prime Care |Provider of | | | | | | | |

|Holdings |domiciliary |7.5 |42.2 |357 |378 |357 |368 |10 |

|Limited |care services| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

| |conformance | | | | | | | |

|RFI Global |testing to | | | | | | | |

|Services |the cellular,|4.2 |27.3 |378 |323 |347 |186 |106 |

|Limited |wireless and | | | | | | | |

| |smart card | | | | | | | |

| |industries | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Developer of | | | | | | | |

| |medical | | | | | | | |

| |imaging | | | | | | | |

|Dexela Limited |technology |3.9 |34.8 |295 |300 |295 |300 |- |

| |for | | | | | | | |

| |the early | | | | | | | |

| |detection of | | | | | | | |

| |breast cancer| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of a| | | | | | | |

| |range of | | | | | | | |

| |drug | | | | | | | |

|Xceleron Limited |development |3.3 |45.1 |329 |290 |309 |216 |54 |

| |services to | | | | | | | |

| |the life- | | | | | | | |

| |science | | | | | | | |

| |industries | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Chichester |Drinks | | | | | | | |

|Holdings |distributor |9.1 |50.0 |600 |255 |600 |442 |(187) |

|Limited |to the | | | | | | | |

| |travel sector| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|The Dunedin Pub |Owner and | | | | | | | |

|Company VCT |operator of |7.8 |50.0 |398 |217 |398 |199 |18 |

|Limited |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

|Mi-Pay Limited |mobile |3.0 |38.5 |264 |214 |241 |188 |3 |

| |payment | | | | | | | |

| |services | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Compiler of | | | | | | | |

|Opta Sports Data |sports |1.4 |14.0 |150 |163 |150 |161 |2 |

|Limited |performance | | | | | | | |

| |data | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Developer, | | | | | | | |

| |manufacturer | | | | | | | |

| |and | | | | | | | |

| |seller of | | | | | | | |

|Forth Photonics |medical |1.7 |12.2 |210 |210 |210 |210 |- |

|Limited |devices for | | | | | | | |

| |the | | | | | | | |

| |detection | | | | | | | |

| |of epithelial| | | | | | | |

| |cancers | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

| |operator of | | | | | | | |

| |a freehold | | | | | | | |

|The Weybridge Club|health and |1.2 |50.0 |190 |162 |190 |162 |- |

|Limited |fitness club | | | | | | | |

| |in | | | | | | | |

| |Weybridge, | | | | | | | |

| |Surrey | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Developer of | | | | | | | |

|Mirada Medical |medical |6.9 |45.0 |128 |160 |77 |77 |32 |

|Limited |imaging | | | | | | | |

| |software | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

| |workforce | | | | | | | |

|Rostima Limited |management |4.7 |33.8 |403 |154 |363 |171 |(58) |

| |solutions | | | | | | | |

| |software | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|CS (Exeter) |Cinema owner | | | | | | | |

|Limited |and |9.6 |50.0 |157 |143 |145 |143 |(12) |

| |operator | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|GB Pub Company VCT|Owner and | | | | | | | |

|Limited |operator of |9.0 |50.0 |356 |132 |401 |182 |(5) |

| |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Owner and | | | | | | | |

|Bravo Inns Limited|operator of |2.6 |50.0 |230 |123 |230 |123 |- |

| |freehold pubs| | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Premier Leisure |Freehold |5.7 |50.0 |420 |108 |420 |111 |(3) |

|(Suffolk) Limited |cinema owner | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Developer and| | | | | | | |

| |producer of | | | | | | | |

| |industrial | | | | | | | |

|Oxsensis Limited |sensors used |1.6 |22.3 |145 |99 |145 |73 |26 |

| |in super- | | | | | | | |

| |high | | | | | | | |

| |temperature | | | | | | | |

| |environments | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Refurbisher | | | | | | | |

|Point 35 . |of | | | | | | | |

|Microstructures |semiconductor|1.7 |28.1 |130 |96 |130 |88 |8 |

|Limited |fabrication | | | | | | | |

| |equipment | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Red-M Wireless |Service and | | | | | | | |

|Limited |software |11.5 |41.0 |85 |89 |295 |49 |(45) |

| |provider | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Green Energy |Surveyor of | | | | | | | |

|Property |energy |3.1 |23.4 |85 |89 |267 |51 |(46) |

|Services Limited |performance | | | | | | | |

| |in buildings | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Provider of | | | | | | | |

|Process Systems |process | | | | | | | |

|Enterprise Limited|systems |1.1 |15.9 |100 |49 |100 |59 |(10) |

| |modelling | | | | | | | |

| |solutions | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Manufacturer | | | | | | | |

|Booth Dispensers |of | | | | | | | |

|Limited |vending |22.8 |22.8 |227 |45 |227 |52 |(7) |

| |machine | | | | | | | |

| |components | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|CS (Norwich) |Cinema owner | | | | | | | |

|Limited |and |3.8 |50.0 |60 |40 |60 |42 |(2) |

| |operator | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Evolutions |Provider of | | | | | | | |

|Television |TV post |0.3 |49.9 |61 |23 |61 |22 |1 |

|Limited |production | | | | | | | |

| |services | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Palm Tree |Software | | | | | | | |

|Technology |company |0.2 |0.7 |102 |15 |102 |15 |- |

|PLC | | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Driver Hire |Supplier of | | | | | | | |

|Investment |temporary |1.0 |1.0 |436 |12 |436 |9 |3 |

|Limited |drivers | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Operator of a| | | | | | | |

|River Bourne |health and | | | | | | | |

|Health |fitness club |5.5 |50.0 |9 |9 |110 |21 |(12) |

|Club Limited |in Chertsey, | | | | | | | |

| |Surrey | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| | | | |21,308 |16,933 |20,174 |14,987 |150 |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

|Other investments | | | |1,638 |- |1,637 |- |- |

|valued at nil | | | | | | | | |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

| | | | |22,946 |16,933 |21,811 |14,987 |150 |

+------------------+-------------+------+---------+----------+-------------+----------+-------------+-------------+

+--------------+--------------+------+---------+------------------------+------------------------+-------------+

| | | | | At 31 December 2009 | At 30 June 2009 | |

| | | | | (unaudited) | (audited) | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

| | | | | | | | | Change in|

| | | | | | | | |carrying/fair|

| | | | % voting|Investment| Total|Investment| Total| value for|

|Investment |Nature of | %| rights| to date|carrying/fair| to date|carrying/fair| the period|

|name |business |voting| of AVL*| at cost| value| at cost| value| net of|

| | |rights| managed| GBP'000| GBP'000| GBP'000| GBP'000| investments|

| | | |companies| | | | | and exits in|

| | | | | | | | | the period**|

| | | | | | | | | GBP'000|

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|AIM quoted | | | | | | | | |

|investments | | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Avanti |Supplier of | | | | | | | |

|Communications|satellite | 0.5| 0.5| 465| 993| 538| 625| 446|

|Group plc |communications| | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

| |Market | | | | | | | |

| |researcher, | | | | | | | |

|Cello Group |brand | 0.9| 0.9| 336| 115| 336| 115| -|

|plc |advertising | | | | | | | |

| |and direct | | | | | | | |

| |marketing | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Augean PLC |Waste | 0.5| 0.5| 590| 126| 590| 142| (16)|

| |management | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Investments | | | | | | | | |

|exited in the | | | | -| -| 81| 3| -|

|period | | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

| | | | | 1,391| 1,234| 1,545| 885| 430|

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Total | | | | | | | | |

|qualifying | | | | | | | | |

|non- current | | | | 24,337| 18,167| 23,356| 15,872| 430|

|asset | | | | | | | | |

|investments | | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Non-qualifying| | | | | | | | |

|AIM | | | | 10| 10| 11| 6| -|

|quoted | | | | | | | | |

|investments | | | | | | | | |

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

|Total | | | | | | | | |

|non-current | | | | | | | | |

|asset | | | | | | | | |

|investments | | | | 24,347| 18,177| 23,367| 15,878| 580|

+--------------+--------------+------+---------+----------+-------------+----------+-------------+-------------+

* AVL is Albion Ventures LLP

** Adjusted for business combinations during the period

Summary consolidated statement of comprehensive income

+--------------+-----+---------------------+-----------------------+-----------------------+

| | | Unaudited | Unaudited | Audited |

+--------------+-----+---------------------+-----------------------+-----------------------+

| | | Six months ended | Six months ended | Year ended |

| | | 31 December 2009 | 31 December 2008 | 30 June 2009 |

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

| | |Revenue|Capital|Total|Revenue|Capital| Total|Revenue|Capital| Total|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

| |Notes| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Gains/(losses)| | | | | | | | | | |

|on investments| 2| -| 811| 811| -|(3,232)|(3,232)| -|(3,869)|(3,869)|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Investment | | | | | | | | | | |

|income and | | | | | | | | | | |

|deposit | 3| 449| -| 449| 622| -| 622| 988| -| 988|

|interest | | | | | | | | | | |

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Investment | | | | | | | | | | |

|management | | | | | | | | | | |

|fees | | (55)| (164)|(219)| (63)| (187)| (250)| (118)| (354)| (472)|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Recovery of | | | | | | | | | | |

|VAT | | -| -| -| 92| 277| 369| 92| 277| 369|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Other expenses| | (168)| -|(168)| (147)| -| (147)| (280)| -| (280)|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Profit/(loss) | | | | | | | | | | |

|before | | 226| 647| 873| 504|(3,142)|(2,638)| 682|(3,946)|(3,264)|

|taxation | | | | | | | | | | |

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Taxation | | -| -| -| (114)| 114| -| -| -| -|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Profit/(loss) | | | | | | | | | | |

|for the period| | 226| 647| 873| 390|(3,028)|(2,638)| 682|(3,946)|(3,264)|

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

|Basic and | | | | | | | | | | |

|diluted | | | | | | | | | | |

|return/(loss) | | | | | | | | | | |

|per Ordinary | | | | | | | | | | |

|share | | | | | | | | | | |

| | 5| 0.31| 0.89| 1.20| 0.53| (4.14)| (3.61)| 0.93| (5.41)| (4.48)|

|(pence)* | | | | | | | | | | |

+--------------+-----+-------+-------+-----+-------+-------+-------+-------+-------+-------+

* (excluding treasury shares)

Comparative figures have been extracted from the unaudited Half-yearly Financial

Report for the period ended 31 December 2008 and the audited statutory accounts

for the year ended 30 June 2009.

The accompanying notes form an integral part of this announcement.

The total column of this statement represents the Group's Statement of

comprehensive income, prepared in accordance with International Financial

Reporting Standards ('IFRS'). The supplementary revenue and capital reserve

columns are prepared under guidance published by the Association of Investment

Companies.

All revenue and capital items in the above statement derive from continuing

operations.

The consolidated Statement of comprehensive income includes the results of the

subsidiaries CP1 VCT PLC and CP2 VCT PLC.

Summary consolidated statement of financial position

+--------------------------------------+-----+----------------+------------+

| | | Unaudited| Audited|

+--------------------------------------+-----+----------------+------------+

| | |31 December 2009|30 June 2009|

+--------------------------------------+-----+----------------+------------+

| |Notes| GBP'000| GBP'000|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Non-current assets | | | |

+--------------------------------------+-----+----------------+------------+

|Investments | 6| 18,177| 15,878|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Current assets | | | |

+--------------------------------------+-----+----------------+------------+

|Trade and other receivables | | 14| 55|

+--------------------------------------+-----+----------------+------------+

|Current asset investments | | -| 2,718|

+--------------------------------------+-----+----------------+------------+

|Cash and cash equivalents | | 6,829| 6,472|

+--------------------------------------+-----+----------------+------------+

| | | 6,843| 9,245|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Total assets | | 25,020| 25,123|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Current liabilities | | | |

+--------------------------------------+-----+----------------+------------+

|Trade and other payables | | (238)| (335)|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Net assets | | 24,782| 24,788|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Equity attributable to equityholders | | | |

+--------------------------------------+-----+----------------+------------+

|Ordinary share capital | 7| 7,976| 7,965|

+--------------------------------------+-----+----------------+------------+

|Share premium | 8| 15| 14,438|

+--------------------------------------+-----+----------------+------------+

|Capital redemption reserve | | 903| 902|

+--------------------------------------+-----+----------------+------------+

|Special reserve | | 46,522| 32,099|

+--------------------------------------+-----+----------------+------------+

|Own shares held | | (2,849)| (2,849)|

+--------------------------------------+-----+----------------+------------+

|Realised capital reserve | | (22,520)| (21,163)|

+--------------------------------------+-----+----------------+------------+

|Unrealised capital reserve | | (6,336)| (7,616)|

+--------------------------------------+-----+----------------+------------+

|Revenue reserve | | 1,071| 1,012|

+--------------------------------------+-----+----------------+------------+

|Total equity shareholders' funds | | 24,782| 24,788|

+--------------------------------------+-----+----------------+------------+

|Basic and diluted net asset value per | | 34.18| 34.24|

|share (pence)* | | | |

+--------------------------------------+-----+----------------+------------+

* (excluding treasury shares)

Comparative figures have been extracted from the audited statutory accounts for

the year ended 30 June 2009.

The accompanying notes form an integral part of this announcement.

The consolidated balance sheets include the balance sheets of the subsidiaries

CP1 VCT PLC and CP2 VCT PLC.

These financial statements were agreed by the Board of Directors, and authorised

for issue on 26 February 2010 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Company Number 3495287

Summary Company statement of financial position

+--------------------------------------+-----+----------------+------------+

| | | Unaudited| Audited|

+--------------------------------------+-----+----------------+------------+

| | |31 December 2009|30 June 2009|

+--------------------------------------+-----+----------------+------------+

| |Notes| GBP'000| GBP'000|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Fixed assets | | | |

+--------------------------------------+-----+----------------+------------+

|Fixed asset investments | 6| 18,177| 15,878|

+--------------------------------------+-----+----------------+------------+

|Investment in subsidiary undertakings | | 16,034| 15,149|

+--------------------------------------+-----+----------------+------------+

| | | 34,211| 31,027|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Current assets | | | |

+--------------------------------------+-----+----------------+------------+

|Trade and other debtors | | 14| 55|

+--------------------------------------+-----+----------------+------------+

|Current asset investments | | -| 2,718|

+--------------------------------------+-----+----------------+------------+

|Cash at bank and in hand | | 6,816| 6,255|

+--------------------------------------+-----+----------------+------------+

| | | 6,830| 9,028|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Total assets | | 41,041| 40,055|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Current liabilities | | | |

+--------------------------------------+-----+----------------+------------+

|Trade and other creditors | | (16,259)| (15,267)|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Net assets | | 24,782| 24,788|

+--------------------------------------+-----+----------------+------------+

+--------------------------------------+-----+----------------+------------+

|Equity attributable to equityholders | | | |

+--------------------------------------+-----+----------------+------------+

|Ordinary share capital | 7| 7,976| 7,965|

+--------------------------------------+-----+----------------+------------+

|Share premium | 8| 15| 14,438|

+--------------------------------------+-----+----------------+------------+

|Capital redemption reserve | | 903| 902|

+--------------------------------------+-----+----------------+------------+

|Special reserve | | 46,522| 32,099|

+--------------------------------------+-----+----------------+------------+

|Own shares held | | (2,849)| (2,849)|

+--------------------------------------+-----+----------------+------------+

|Realised capital reserve | | (22,572)| (21,216)|

+--------------------------------------+-----+----------------+------------+

|Unrealised capital reserve | | (5,361)| (7,525)|

+--------------------------------------+-----+----------------+------------+

|Revenue reserve | | 148| 974|

+--------------------------------------+-----+----------------+------------+

|Total equity shareholders' funds | | 24,782| 24,788|

+--------------------------------------+-----+----------------+------------+

|Basic and diluted net asset value per | | 34.18| 34.24|

|share (pence)* | | | |

+--------------------------------------+-----+----------------+------------+

* (excluding treasury shares)

Comparative figures have been extracted from the statutory accounts for the year

ended 30 June 2009.

The accompanying notes form an integral part of this announcement.

This Company balance sheet has been prepared in accordance with UK GAAP.

These financial statements were approved by the Board of Directors, and

authorised for issue on 26 February 2010 and were signed on its behalf by

Patrick Crosthwaite

Chairman

Company Number 3495287

Summary consolidated statement of changes in equity

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

| | | | | | |Realised| | | |

| |Ordinary| | Capital|Special| Own| capital|Unrealised|Revenue| |

| | share| Share|redemption|reserve| shares| reserve| capital|reserve| |

| | capital| premium| reserve| *| held*| *| reserve*| *| Total|

| | GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 1 July| | | | | | | | | |

|2009 | | | | | | | | | |

|(audited) | 7,965| 14,438| 902| 32,099|(2,849)|(21,163)| (7,616)| 1,012| 24,788|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Issue of | | | | | | | | | |

|equity (net | | | | | | | | | |

|of costs) | 11| 15| -| -| -| -| -| -| 26|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Cancellation| | | | | | | | | |

|of | | | | | | | | | |

|Share | | | | | | | | | |

|premium | | | | | | | | | |

|account | -|(14,438)| -| 14,438| -| -| -| -| -|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Transfer of | | | | | | | | | |

|reserves | -| -| -| (15)| -| -| -| 15| -|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Net realised| | | | | | | | | |

|losses | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| (469)| -| -| (469)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Unrealised | | | | | | | | | |

|gains on | | | | | | | | | |

|investments | -| -| -| -| -| -| 1,280| -| 1,280|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Management | | | | | | | | | |

|and | | | | | | | | | |

|performance | | | | | | | | | |

|fees | | | | | | | | | |

|charged to | | | | | | | | | |

|capital | | | | | | | | | |

|(net of tax)| -| -| -| -| -| (164)| -| -| (164)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Revenue | | | | | | | | | |

|profit for | | | | | | | | | |

|the period | -| -| -| -| -| -| -| 226| 226|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Dividends | | | | | | | | | |

|paid in | | | | | | | | | |

|the period | -| -| -| -| -| (724)| -| (181)| (905)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 31 | | | | | | | | | |

|December | | | | | | | | | |

|2009 | | | | | | | | | |

|(unaudited) | 7,976| 15| 903| 46,522|(2,849)|(22,520)| (6,336)| 1,071| 24,782|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 1 July| | | | | | | | | |

|2008 | | | | | | | | | |

|(audited) | 8,066| 14,422| 793| 32,421|(2,849)|(17,206)| (6,645)| 1,172| 30,174|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Purchase of | | | | | | | | | |

|own | | | | | | | | | |

|shares for | | | | | | | | | |

|cancellation| | | | | | | | | |

|(including | | | | | | | | | |

|costs) | (66)| -| 66| (219)| -| -| -| -| (219)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Net realised| | | | | | | | | |

|gains | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| 8| -| -| 8|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Unrealised | | | | | | | | | |

|losses | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| -| (3,240)| -|(3,240)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Management | | | | | | | | | |

|and | | | | | | | | | |

|performance | | | | | | | | | |

|fees | | | | | | | | | |

|charged to | | | | | | | | | |

|capital | | | | | | | | | |

|(net of tax)| -| -| -| -| -| (73)| -| -| (73)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Recovery of | | | | | | | | | |

|VAT | | | | | | | | | |

|capitalised | -| -| -| -| -| 277| -| -| 277|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Revenue | | | | | | | | | |

|profit for | | | | | | | | | |

|the period | -| -| -| -| -| -| -| 390| 390|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Dividends | | | | | | | | | |

|paid in | | | | | | | | | |

|the period | -| -| -| -| -| (257)| -| (661)| (918)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 31 | | | | | | | | | |

|December | | | | | | | | | |

|2008 | | | | | | | | | |

|(unaudited) | 8,000| 14,422| 860| 32,202|(2,849)|(17,252)| (9,885)| 901| 26,399|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|As at 1 July | | | | | | | | | |

|2008 | | | | | | | | | |

|(audited) |8,066|14,422|793|32,421|(2,849)|(17,206)|(6,645)|1,172| 30,174|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Issue of equity| | | | | | | | | |

|(net of costs) | 8| 16| -| -| -| -| -| -| 24|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Purchase of own| | | | | | | | | |

|shares for | | | | | | | | | |

|cancellation | | | | | | | | | |

|(including | | | | | | | | | |

|costs) |(109)| -|109| (321)| -| -| -| -| (321)|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Net realized | | | | | | | | | |

|losses on | | | | | | | | | |

|investments | -| -| -| -| -| (2,898)| -| -|(2,898)|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Unrealised | | | | | | | | | |

|losses | | | | | | | | | |

|on investments | -| -| -| -| -| -| (971)| -| (971)|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Management and | | | | | | | | | |

|Performance | | | | | | | | | |

|fees charged to| | | | | | | | | |

|capital (net of| | | | | | | | | |

|tax) | -| -| -| -| -| (354)| -| -| (354)|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Recovery of VAT| | | | | | | | | |

|capitalised | -| -| -| -| -| 277| -| -| 277|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Revenue profit | | | | | | | | | |

|for | | | | | | | | | |

|the year | -| -| -| -| -| -| -| 682| 682|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|Dividends paid | | | | | | | | | |

|in | | | | | | | | | |

|the year | -| -| -| -| -| (981)| -|(842)|(1,823)|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

|As at 30 June | | | | | | | | | |

|2009 (audited) |7,965|14,438|902|32,099|(2,849)|(21,163)|(7,616)|1,012| 24,788|

+---------------+-----+------+---+------+-------+--------+-------+-----+-------+

* Included within these reserves is an amount of GBP15,888,000 (December 2008:

GBP3,117,000; June 2009: GBP1,483,000) which is distributable. The Special reserve

has been treated as distributable in determining the reserves available for

distribution.

Summary company reconciliation of movements in shareholders' funds

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

| | | | | | |Realised| | | |

| |Ordinary| | Capital|Special| Own| capital|Unrealised|Revenue| |

| | share| Share|redemption|reserve| shares| reserve| capital|reserve| |

| | capital| premium| reserve| *| held*| *| reserve*| *| Total|

| | GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000| GBP'000|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 1 July| | | | | | | | | |

|2009 | | | | | | | | | |

|(audited) | 7,965| 14,438| 902| 32,099|(2,849)|(21,216)| (7,525)| 974| 24,788|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Issue of | | | | | | | | | |

|equity (net | | | | | | | | | |

|of costs) | 11| 15| -| -| -| -| -| -| 26|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Cancellation| | | | | | | | | |

|of | | | | | | | | | |

|Share | | | | | | | | | |

|premium | | | | | | | | | |

|account | -|(14,438)| -| 14,438| -| -| -| -| -|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Transfer of | | | | | | | | | |

|reserves | -| -| -| (15)| -| -| -| 15| -|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Net realised| | | | | | | | | |

|losses | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| (469)| -| -| (469)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Unrealised | | | | | | | | | |

|gains on | | | | | | | | | |

|investments | -| -| -| -| -| -| 2,164| -| 2,164|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Management | | | | | | | | | |

|and | | | | | | | | | |

|performance | | | | | | | | | |

|fees | | | | | | | | | |

|charged to | | | | | | | | | |

|capital | | | | | | | | | |

|net of tax) | -| -| -| -| -| (164)| -| -| (164)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Revenue loss| | | | | | | | | |

|for | | | | | | | | | |

|the period | -| -| -| -| -| -| -| (659)| (659)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Dividends | | | | | | | | | |

|paid in | | | | | | | | | |

|the period | -| -| -| -| -| (724)| -| (181)| (905)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 31 | | | | | | | | | |

|December | | | | | | | | | |

|2009 | | | | | | | | | |

|(unaudited) | 7,976| 15| 903| 46,522|(2,849)|(22,572)| (5,361)| 148| 24,782|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 1 July| | | | | | | | | |

|2008 | | | | | | | | | |

|(audited) | 8,066| 14,422| 793| 32,421|(2,849)|(17,206)| (6,645)| 1,172| 30,174|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Purchase of | | | | | | | | | |

|own | | | | | | | | | |

|shares for | | | | | | | | | |

|cancellation| | | | | | | | | |

|(including | | | | | | | | | |

|costs) | (66)| -| 66| (219)| -| -| -| -| (219)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Net realised| | | | | | | | | |

|gains | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| 8| -| -| 8|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Unrealised | | | | | | | | | |

|losses | | | | | | | | | |

|on | | | | | | | | | |

|investments | -| -| -| -| -| -| (3,240)| -|(3,240)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Management | | | | | | | | | |

|and | | | | | | | | | |

|performance | | | | | | | | | |

|fees | | | | | | | | | |

|charged to | | | | | | | | | |

|capital | | | | | | | | | |

|(net of tax)| -| -| -| -| -| (73)| -| -| (73)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Recovery of | | | | | | | | | |

|VAT | | | | | | | | | |

|capitalised | -| -| -| -| -| 277| -| -| 277|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Revenue | | | | | | | | | |

|profit for | | | | | | | | | |

|the period | -| -| -| -| -| -| -| 390| 390|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Dividends | | | | | | | | | |

|paid in | | | | | | | | | |

|the period | -| -| -| -| -| (257)| -| (661)| (918)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 31 | | | | | | | | | |

|December | | | | | | | | | |

|2008 | | | | | | | | | |

|(unaudited) | 8,000| 14,422| 860| 32,202|(2,849)|(17,252)| (9,885)| 901| 26,399|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 1 July| | | | | | | | | |

|2008 | | | | | | | | | |

|(audited) | 8,066| 14,422| 793| 32,421|(2,849)|(17,206)| (6,645)| 1,172| 30,174|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Issue of | | | | | | | | | |

|equity (net | | | | | | | | | |

|of costs) | 8| 16| -| -| -| -| -| -| 24|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Purchase of | | | | | | | | | |

|own shares | | | | | | | | | |

|for | | | | | | | | | |

|cancellation| | | | | | | | | |

|(including | | | | | | | | | |

|costs) | (109)| -| 109| (321)| -| -| -| -| (321)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Net realised| | | | | | | | | |

|losses on | | | | | | | | | |

|investments | -| -| -| -| -| (2,898)| -| -|(2,898)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Unrealised | | | | | | | | | |

|losses on | | | | | | | | | |

|investments | -| -| -| -| -| -| (880)| -| (880)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Management | | | | | | | | | |

|and | | | | | | | | | |

|performance | | | | | | | | | |

|fees charged| | | | | | | | | |

|to capital | | | | | | | | | |

|(net of tax)| -| -| -| -| -| (354)| -| -| (354)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Recovery of | | | | | | | | | |

|VAT | | | | | | | | | |

|capitalised | -| -| -| -| -| 224| -| -| 224|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Revenue | | | | | | | | | |

|profit for | | | | | | | | | |

|the year | -| -| -| -| -| -| -| 644| 644|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|Dividends | | | | | | | | | |

|paid in the | | | | | | | | | |

|year | -| -| -| -| -| (981)| -| (842)|(1,823)|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

|As at 30 | | | | | | | | | |

|June 2009 | | | | | | | | | |

|(audited) | 7,965| 14,438| 902| 32,099|(2,849)|(21,216)| (7,525)| 974| 24,788|

+------------+--------+--------+----------+-------+-------+--------+----------+-------+-------+

* Included within these reserves is an amount of GBP15,888,000 (December 2008:

GBP3,117,000; June 2009: GBP1,483,000) which is distributable. The Special reserve

has been treated as distributable in determining the reserves available for

distribution.

Summary consolidated statement of cash flows

+----------------------------+----+----------------+----------------+----------+

| | | Unaudited| Unaudited| Audited|

| | |Six months ended|Six months ended|Year ended|

| | | 31 December| 31 December| 30 June|

| | | 2009| 2008| 2009|

| |Note| GBP'000| GBP'000| GBP'000|

+----------------------------+----+----------------+----------------+----------+

+----------------------------+----+----------------+----------------+----------+

|Operating activities | | | | |

+----------------------------+----+----------------+----------------+----------+

|Investment income received | | 383| 591| 1,231|

+----------------------------+----+----------------+----------------+----------+

|Deposit interest received | | 30| 183| 200|

+----------------------------+----+----------------+----------------+----------+

|Administration fees paid | | (26)| (27)| (52)|

+----------------------------+----+----------------+----------------+----------+

|Investment management fees | | | | |

|paid | | (301)| (288)| (518)|

+----------------------------+----+----------------+----------------+----------+

|Recovery of VAT | | -| -| 457|

+----------------------------+----+----------------+----------------+----------+

|Other cash payments | | (161)| (123)| (257)|

+----------------------------+----+----------------+----------------+----------+

|Cash (expended)/generated | | | | |

|from operations | | (75)| 336| 1,061|

+----------------------------+----+----------------+----------------+----------+

+----------------------------+----+----------------+----------------+----------+

|Tax recovered | | -| 52| 52|

+----------------------------+----+----------------+----------------+----------+

| | | | | |

|Net cash flows from | | | | |

|operating activities | 9| (75)| 388| 1,113|

+----------------------------+----+----------------+----------------+----------+

+----------------------------+----+----------------+----------------+----------+

|Cash flows from investing | | | | |

|activities | | | | |

+----------------------------+----+----------------+----------------+----------+

|Purchase of non-current | | | | |

|asset investments | | (1,782)| (1,282)| (1,770)|

+----------------------------+----+----------------+----------------+----------+

|Disposal of non-current | | | | |

|asset investments | | 293| 25| 55|

+----------------------------+----+----------------+----------------+----------+

|Purchase of current asset | | | | |

|investments | | (2,217)| (3,835)| (3,835)|

+----------------------------+----+----------------+----------------+----------+

|Disposal of current asset | | | | |

|investments | | 5,018| -| 3,835|

+----------------------------+----+----------------+----------------+----------+

|Net cash inflow/(outflow) | | | | |

|from investing activities | | 1,312| (5,092)| (1,715)|

+----------------------------+----+----------------+----------------+----------+

+----------------------------+----+----------------+----------------+----------+

|Cash flows from financing | | | | |

|activities | | | | |

+----------------------------+----+----------------+----------------+----------+

|Issue of Ordinary shares | | | | |

|(net of costs) | | 25| -| 24|

+----------------------------+----+----------------+----------------+----------+

|Equity dividends paid | | (905)| (918)| (1,823)|

+----------------------------+----+----------------+----------------+----------+

|Purchase of Ordinary shares | | | | |

|for cancellation | | -| (261)| (364)|

+----------------------------+----+----------------+----------------+----------+

|Net cash flows used in | | | | |

|financing activities | | (880)| (1,179)| (2,163)|

+----------------------------+----+----------------+----------------+----------+

|Increase/(decrease) in cash | | | | |

|and cash equivalents | | 357| (5,883)| (2,765)|

+----------------------------+----+----------------+----------------+----------+

| | | | | |

|Cash and cash equivalents at| | | | |

|the start of the period | | 6,472| 9,237| 9,237|

+----------------------------+----+----------------+----------------+----------+

| | | | | |

|Cash and cash equivalents at| | | | |

|the end of the period | | 6,829| 3,354| 6,472|

+----------------------------+----+----------------+----------------+----------+

Notes to the summarised set of financial statements

for the six months ended 31 December 2009

1. Accounting policies

The following policies refer to the Group and the Company except where noted.

References to International Financial Reporting Standards ('IFRS') relate to the

Group financial statements and Financial Reporting Standards ('FRS') relate to

the Company financial statements.

Basis of accounting

The Half-yearly Financial Report has been prepared in accordance with the

historical cost convention, modified to include the revaluation of investments

and in accordance with International Financial Reporting Standards ('IFRS')

adopted for use in the European Union (and therefore comply with Article 4 of

the EU IAS regulation), in the case of the Group, and in accordance with

Financial Reporting Standards ('FRS') in the case of the Company. This

Half-yearly Financial Report has been prepared in accordance with IAS 34

'Interim Financial Reporting'.

Both the Group and the Company financial statements also apply the Statement of

Recommended Practice: "Financial Statements of Investment Companies and Venture

Capital Trusts" ('SORP') issued by the Association of Investment Companies

("AIC") in January 2009, in so far as this does not conflict with IFRS. The

financial statements have been prepared in accordance with those parts of the

Companies Act 2006 applicable to the companies reporting under IFRS and FRS. The

information in this document does not include all of the disclosures required by

IFRS and SORP in full annual financial statements, and it should be read in

conjunction with the consolidated financial statements of the Group for the year

ended 30 June 2009. This Half-yearly financial information has been prepared

applying the accounting policies and presentation that were applied in the

preparation of the Group's published consolidated financial statements for the

year ended 30 June 2009.

These financial statements are presented in Sterling to the nearest thousand.

Accounting policies have been applied consistently in current and prior periods.

Basis of consolidation

The Group consolidated financial statements incorporate the financial statements

of the Company for the period ended 31 December 2009 and the entities controlled

by the Company (its subsidiaries), for the same period. Where necessary,

adjustments are made to the financial statements of subsidiaries to bring the

accounting policies into line with those used by the Group. All intra-group

transactions, balances, income and expenses are eliminated on consolidation.

As permitted by Section 408 of the Companies Act 2006, the Company has not

presented its own profit and loss account. The amount of the Company's profit

before tax for the period dealt with in the accounts of the Group is GBP873,000

(31 December 2008: loss GBP2,669,000; 30 June 2009: loss GBP3,264,000).

Segmental reporting

The Directors are of the opinion that the Group and the Company are engaged in a

single segment of business, being investment business. The Group invests in

smaller companies principally based in the UK.

Business combinations

The acquisition of subsidiaries is accounted for using the purchase method in

the Group financial statements. The cost of the acquisition is measured at the

aggregate of the fair values, at the date of exchange, of assets given,

liabilities incurred or assumed, and equity instruments issued by the Group in

exchange for control of the subsidiaries, plus any costs directly attributable

to the business combination. The subsidiary's identifiable assets, liabilities

and contingent liabilities that meet the conditions for recognition under IFRS

3 "Business Combinations" are recognised at their fair value at the acquisition

date.

Estimates

The preparation of the Group and Company's Half-yearly Financial Report requires

estimates, assumptions and judgements to be made, which affect the reported

results and balances. Actual outcomes may differ from these estimates, with a

consequential impact on the results of future periods. The estimates and

assumptions that have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next financial year are

those used to determine the fair value of investments at fair value through

profit or loss.

The valuation of investments at fair value through the profit or loss is

determined by using valuation techniques. The Group and the Company use

judgements to select a variety of methods and makes assumptions that are mainly

based on market conditions at each balance sheet date. The movements in

valuations of investments during the period are shown in note 2.

Fixed and current asset investments

Quoted and unquoted equity investments

In accordance with IAS 39 'Financial Instruments: Recognition and Measurement',

and FRS 26 'Financial Instruments: Recognition and Measurement', quoted and

unquoted equity investments are designated as fair value through profit or loss

('FVTPL'). Investments listed on recognised exchanges are valued at the closing

bid prices at the end of the accounting period. Unquoted investments' fair value

is determined by the Directors in accordance with the International Private

Equity and Venture Capital Valuation Guidelines (IPEVCV guidelines).

Fair value movements on equity investments and gains and losses arising on the

disposal of investments are reflected in the capital column of the Statement of

comprehensive income in accordance with the AIC SORP. Realised gains or losses

on the sale of investments will be reflected in the Realised capital reserve,

and unrealised gains or losses arising from the revaluation of investments will

be reflected in the Unrealised capital reserve.

Warrants, convertibles and unquoted equity derived instruments

Warrants, convertibles and unquoted equity derived instruments are only valued