TIDMCOBR

RNS Number : 0434A

Cobra Resources PLC

21 September 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

21 September 2022

Cobra Resources plc

("Cobra" or the "Company")

Half Year Results for the Six Months Ended 30 June 2022

Cobra, a gold, rare earth and IOCG exploration company focused

on the Wudinna Project in South Australia , announces its financial

results for the six months ended 30 June 2022 ("H1 2022").

Highlights:

-- Announced on 7 February results from November 2021 Reverse

Circulation ("RC") drilling programme at the Clarke prospect,

where:

o The strike of intersected gold mineralisation was doubled to

over 400m

o All holes intersected Rare Earth Elements ("REE") within the

weathered saprolite horizon above or proximal to gold

mineralisation

o Follow-up X-Ray Diffraction ("XRD") analysis supports crustal

elution or Ionic Adsorption Clay ("IAC") style mineralisation, a

highly desirable style of mineralisation owing to its favourable

assemblage of REEs, minimal radioactive by-products, and

amenability to low-cost extraction techniques

-- Announced on 15 February a fundraise of GBP0.95 million

through an accelerated and oversubscribed book build to help fund

2022 exploration activities

-- Announced on 13 April and 25 July the granting of extensive additional exploration tenements, consolidating Cobra's position as a major landholder in the Gawler Craton tier 1 mining and exploration jurisdiction with a 3,261 km(2) land tenure

-- Implemented a low-cost approach to confirming and spatially

testing the extent of REE mineralisation through a staged

re-analysis of retained samples from historic drillholes,

confirming exceptional clay-hosted REE mineralisation proximal to

gold resources and defining a regionally scalable 4 km(2) footprint

of REE mineralisation

-- Confirmed the presence of leachable REE mineralisation, with

leach recoveries of up to 34.1% Total Rare Earth Element

("TREE")(+Y), with H2SO4 as lixiviant pH1

-- Executed an extensive 91-hole regional aircore drilling

programme designed to de-risk follow-up RC drilling and to test

prioritised areas for clay hosted REEs. Results reported post

period demonstrate:

o Further along-strike gold mineralisation

o An expanding high-grade REE footprint at Clarke

o Regionally extensive and high-grade REE mineralisation

-- Received South Australian Landing Pad grant, part funding

website improvements and the publication of a maiden Sustainability

Plan, reflecting the Board's commitment to developing an

industry-leading approach to Environmental, Social and

Governance

-- Received South Australian Accelerated Discovery Initiative

("ADI") grant to co-fund Loupe TEM and Controlled Source

Audio-frequency Magneto-tellurics ("CSAMT") geophysical surveys at

the Clarke prospect aimed at identifying low-cost techniques to

further define REE and gold mineralisation under cover

Greg Hancock, Chairman of Cobra, commented:

"The first half of 2022 has been transformational. The work

executed across our 2022 exploration programme has us poised to

increase our gold resources and establish a potentially world-class

rare earth asset.

The Company is well placed to achieve its Wudinna Project 75%

earn-in milestone in H2 2022 through delivering further

exploration. I commend the team for their ongoing efforts and

success in advancing the project and look forward to our upcoming

RC drilling programme.

The growing strategic, environmental, and economic importance of

rare earth metals, coupled with gold's unparalleled fiscal

stability, places Cobra in the enviable position of defining a

unique multi-mineral inventory within a tier 1 mining jurisdiction

serviced with exceptional infrastructure."

The full financial statements can be viewed on the Company's

website at: https://cobraplc.com/category/financial-reports/

Enquiries:

Cobra Resources plc via Vigo Consulting

Rupert Verco (Australia) +44 (0)20 7390 0234

Dan Maling (UK)

SI Capital Limited (Joint

Broker)

Nick Emerson

Sam Lomanto +44 (0)1483 413 500

Peterhouse Capital Limited

(Joint Broker)

Duncan Vasey

Lucy Williams +44 (0)20 7469 0932

Vigo Consulting (Financial

Public Relations)

Ben Simons

Charlie Neish

Kendall Hill +44 (0)20 7390 0234

About Cobra

Cobra is defining a unique multi-mineral resource at the Wudinna

Project in South Australia's Gawler Craton, a tier one mining and

exploration jurisdiction which hosts several world-class mines.

Cobra's Wudinna tenements, totalling 3,261 km(2) , contain

extensive orogenic gold mineralisation and are characterised by

potentially open-pitable, high-grade gold intersections, with ready

access to infrastructure. Cobra has 22 orogenic gold targets

outside of a current 211,000 Oz JORC Mineral Resource Estimate. In

2021, Cobra discovered rare earth mineralisation proximal to and

above gold mineralisation. The grades, style of mineralogy and

intersect widths are highly desirable while the mineralisation has

been demonstrated to be regionally scalable. The Company is also

advancing a pipeline of IOCG targets.

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/cobraresourcesplc

Twitter: https://twitter.com/Cobra_Resources

Subscribe to our news alert service:

https://cobraplc.com/news/

Operational Review

The November 2021 RC drilling programme delivered further

exceptional gold metrics from the Clarke prospect, demonstrating

the further growth potential to existing gold resources, with the

programme effectively doubling the intersected strike of gold

mineralisation to over 400m at the prospect that lies outside of

the Company's current mineral estimate.

The growing strategic, environmental, and economic importance of

rare earth metals, particularly magnet rare earth metals, last year

prompted Cobra to submit pulps from drilling at its Wudinna Project

for REE analysis. Significant intersections of TREO assays in

excess of 500 ppm were recognised within the kaolinised clays of

the saprolite across all 14 RC drillholes. In the first six months

of 2022, Cobra pursued the opportunity these results presented by

confirming the economic potential of mineralisation through:

-- Mineral identification : XRD analysis performed by the CSIRO

supports that a component of REE bursary is adsorbed to the primary

clay particles, being kaolin and montmorillonite, in similar

fashion to the highly desirable IAC hosted deposits of southern

China

-- Lithological analysis : HyLogger Spectral analysis performed

by GSSA on chips of five Clarke RC holes demonstrated strong

associations between elevated rare earths, kaolinite quantity, and

reducing crystallinity. The results also demonstrated strong

associations between muscovite and phengite to gold

mineralisation

-- Diagnostic metallurgical testing : test-work carried out by

ANSTO focused on extraction techniques adopted to ionic phase

mineralisation using H(2) SO(4) as a lixiviant, yielded recoveries

of up to 34% TREE from samples across two holes at Clarke

-- Demonstrating scalable resource potential : systematically expanded the recovery through the cost-effective re-analysis of historic drillhole samples, where a total of 2,231 samples have been re-analysed for lanthanides from over 190 drillholes that have produced significant intersections at 11 different prospects and defined a 4 km(2) mineralisation footprint across the Baggy Green and Clarke prospects

In June 2022, the Company executed a regionally extensive

aircore drilling programme aimed at:

-- De-risking follow-up RC drilling at Clarke through refining along-strike targeting

-- Testing priority regional rare earth mineralisation

-- Providing basement rock pathfinder chemistry to advance

targeting at regional gold and IOCG targets

Through this programme, Cobra has:

-- Defined further gold mineralisation at Clarke, where CBAC0014

intersected 12m at 1.25 g/t gold from 18m, increasing the

intersected strike extent at Clarke beyond 500m

-- Refined further gold targets at Clarke, where broad zones of

gold in saprolite has been defined north of previously intersected

gold mineralisation. In comparison to drilled mineralisation zones,

the anomalous zones northwest of Clarke are more significant,

supporting further mineralisation down-dip and along-strike

-- Expanded the zone of high-grade rare earth mineralisation at

Clarke, with significant intersections demonstrating basket

assemblages, lithologies and environmental conditions supportive of

ionic adsorption mineralisation

-- Yielded numerous rare earth intersections across nine

regional targets demonstrating regional scalability and

prospectivity for clay hosted rare earth mineralisation

-- Tested saprolite above three of the Company's IOCG

geophysical targets, where geochemical analysis demonstrates

prospectivity for copper/gold porphyry style mineralisation

The work completed in H1 2022 has yielded an exceptional

opportunity for Cobra to establish a potentially world-class rare

earth asset. The work completed to date has demonstrated potential

crustal elution style mineralisation at 18 prospects, where the

following prospects report exceptional metrics of grade, width, and

scale:

-- At Clarke, 85% of 88 holes drilled or re-analysed yield a

length weighted intersection of 15m at 707 ppm TREO

-- At Baggy Green, 90% of 71 holes re-analysed yield a length

weighted intersection of 16.3m at 521 ppm TREO

-- At Thompson, 65% of 26 holes drilled or re-analysed yield a

length weighted intersection of 15.2m at 839 ppm TREO

-- At Anderson, the re-analysis of six holes yields a length

weighted intersection of 17m at 995 ppm TREO

Further historic drillhole re-analysis is planned for Thompson

and Anderson to test the spatial continuity of mineralisation. The

Company will endeavour to incorporate these prospects into a maiden

rare earth resource before year-end.

Considerable research and sample testing has been conducted by

the technical team to best understand the genesis processes and the

exodermic conditions that best promote and maintain ionic

adsorption style mineralisation. The compiled dataset of sample

acidity/alkalinity and detailed interpretation of saprolite clays

puts the Company in a strong position to optimise REE

metallurgy.

Post Period-End

In July 2022, the Company carried out a Loupe TEM geophysical

survey at the Clarke prospect which was co-funded by a South

Australian ADI grant. The results of this survey will inform

follow-up RC drilling at the Clarke prospect. A further CSAMT

geophysical survey is planned as part of the ADI co-funding to test

deeper structural associations between gold and rare earth

mineralisation.

The Clarke prospect poses as a low-risk target to add to the

Company's current Gold Mineral Resource Estimate. A 2,000m drilling

programme is scheduled to commence in the coming weeks to test

strike extensions and validate lode interpretations with the

intention of informing a resource update by year end. Bulk samples

of defined REE mineralisation zones will also be taken to advance

metallurgical optimisation studies.

Corporate Development

The Company has matured in 2022 which has enabled us to secure

alternate funding from two grants awarded by the South Australian

Government. Cobra is grateful to be operating in a jurisdiction

that is not only rich in resources, but supportive of ethical

mineral exploration and mining.

Funding has been used to brand Cobra in alignment with its

values and ambitions: to develop a high-value, multi-mineral

resource capable of supporting global decarbonisation. Reflecting

our commitment to ethical and environmentally conscious

exploration, we published our maiden Sustainability Plan in June

2022, which introduces the Company's approach and vision for ESG

through its exploration activities.

The Company has expanded its landholding within the Southern

Gawler Craton to 3,261 km(2) through the successful application of

two additional exploration tenements. These tenements complement

our exploration strategy, which aims to provide shareholders with a

considered methodological approach enabling low-cost discoveries

across a range of commodities within a world-class mineral

province.

Cobra is positioned to achieve its Stage 3 earn-in under the

Wudinna Heads of Agreement in H2 2022, entitling the Company to 75%

of the Wudinna Project.

Financial Review

Cobra reported an unaudited operating loss for the six months

ended 30 June 2022 of GBP226,953 which equates to a loss per share

for the period of GBP 0. 0005. This compares to a loss for the six-

month period to 30 June 2021 of GBP842,631, which equated to a loss

per share for the period of GBP0.0025.

In February 2022, Cobra raised GBP0.95 million through an

accelerated placement of 63,000,000 new Ordinary Shares at

GBP0.015.

As at 30 June 2022, the Company had available cash of GBP788,192

(30 June 2021: GBP1.12 million), sufficient for the Company to

execute its planned exploration activities.

Outlook

Cobra's immediate focus for H2 2022 is a continuation of

exploration activities. This will involve further historic

drillhole re-analysis for rare earths at the Thompson and Anderson

prospects, followed by the execution of a 2,000m RC drilling

programme at the Clarke prospect.

Exploration success to date should enable an update to the

Company's 211,000 Oz Gold Mineral Resource and a maiden Rare Earth

Resource Estimate before year-end. This will demonstrate the value

of the exploration activities that the Company has executed and

will act as a platform for further future growth.

Greg Hancock

Chairman

20 September 2022

Consolidated Income Statement

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Administrative expenses (226,953) (232,626) (567,213)

IPO expenses - - -

Operating loss (226,953) (232,626) (567,213)

Loss on derecognition

of financial liability* - (610,005) (1,110,298)

Loss on ordinary

activities before

taxation (226,953) (842,631) (1,677,511)

Tax on loss on ordinary - - -

activities

---------- -------------- --------------

Loss for the financial

period attributable

to equity holders (226,953) (842,631) (1,677,511)

---------- -------------- --------------

Loss per share -

see note 4 GBP(0 GBP(0.0025) GBP(0.0073)

Basic and diluted . 0005)

* The loss on derecognition of financial liabilities is a

reflection of the Consideration shares paid to the previous Lady

Alice Mines unit holders upon completion of Stages 1 and 2 earn-in

as agreed upon at time of acquisition, and the market value of

shares issued at the time of settlement of the liability during the

period.

Consolidated Statement of Comprehensive Income

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (226,953) (842,631) (1,677,511)

Items that may subsequently

be reclassified to

profit or loss:

* Exchange differences on translation of foreign

operations 145,374 (66,640) (81,246)

Total comprehensive

loss attributable

to equity holders

of the parent company (81,579) (909,271) (1,758,757)

---------- ---------- -------------

Consolidated Statement of Financial Position

6 months 6 months Year ended

to 30 June to 30 31 December

2022 June 2021 2021

Unaudited Unaudited Audited

GBP GBP GBP

Non-current assets

Intangible assets 2,329,471 1,556,680 2,012,405

Property, plant and

equipment 1,428 2,040 1,680

-------------- -------------- --------------

Total non-current

assets 2,330,899 1,558,720 2,014,085

-------------- -------------- --------------

Current assets

Trade and other receivables 57,724 26,911 36,891

Cash and cash equivalents 788,192 1,121,787 264,480

-------------- -------------- --------------

Total current assets 845,916 1,148,698 301,371

-------------- -------------- --------------

Non-current liabilities

Deferred consideration - (187,500) -

-------------- -------------- --------------

Current liabilities

Trade and other payables (48,272) (85,414) (50,336)

Deferred consideration (187,500) (135,191) (187,500)

-------------- -------------- --------------

Total current liabilities (235,772) (220,605) (237,836)

-------------- -------------- --------------

Net assets/(liabilities) 2,941,043 2,299,313 2,077,620

============== ============== ==============

Capital and reserves

Share capital 4,231,103 3,283,845 3,601,104

Share premium 1,693,563 1,093,027 1,378,561

Share based payment

reserve 962,201 993,448 962,201

Retained losses (4,075,408) (3,069,823) (3,848,456)

Foreign currency

reserve 129,584 (1,184) (15,790)

-------------- -------------- --------------

Total equity 2,941,043 2,299,313 2,077,620

-------------- -------------- ==============

Consolidated Statement of Cash Flows

6 months 6 months Year ended

to to 30 June 31 December

30 June 2021 2021

2022

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Operating loss (226,952) (842,631) (1,677,511)

Equity settled share-based

payment - 20,000 45,000

Depreciation 250 360 719

Foreign exchange 145,374 (66,640) (78,137)

Loss on derecognition

of financial liability - 610,005 1,077,607

Decrease/(increase)/

in receivables (20,833) 42,496 32,517

(Decrease)/increase

in payables (2,064) (137,431) (118,978)

Shares issued in lieu

of cash - - 33,251

Net cash used in operation

activities (104,224) (373,841) (685,532)

------------ ------------ --------------

Cash flows from investing

activities

Payments for exploration

and evaluation activities (317,066) (61,161) (516,886)

Net cash (used)/generated

in investing activities (317,066) (61,161) (516,886)

------------ ------------ --------------

Cash flows from financing

activities

Proceeds from issue

of share 945,000 128,044 128,044

Shares issued in lieu - 89,894 -

of cash

Net cash generated

from financing activities 945,000 217,938 128,044

------------ ------------ --------------

Net (decrease)/increase

in cash and cash equivalents

Cash and cash equivalents 523,712 (217,064) (1,074,371)

at the beginning of

period 264,480 1,338,851 1,338,851

------------ ------------ --------------

Cash and cash equivalents

at end of period 788,192 1,121,787 264,480

------------ ------------ --------------

Consolidated Statement of Changes in Equity

Share Share Share Retained Foreign Total

capital premium based earnings currency

payment reserve

reserve

GBP GBP GBP GBP GBP GBP

At 31 December

2020 2,829,566 564,173 1,006,238 (2,239,982) 65,456 2,225,451

Loss for the

period - - - (842,631) - (842,631)

Translation

differences - - - - (66,640) (66,640)

---------- ---------- ---------- ------------ ---------- -----------

Total comprehensive

income - - - (842,631) (66,640) (909,271)

Share capital

issued 454,279 528,854 - - - 983,133

Transfer of

warrants exercised - - (12,790) 12,790 - -

---------- ---------- ---------- ------------ ---------- -----------

At 30 June 2021 3,283,845 1,093,027 993,448 (3,069,823) (1,184) 2,299,313

---------- ---------- ---------- ------------ ---------- -----------

Loss for the

period - - - (834,880) - (834,880)

Translation

differences - - - - (14,606) (14,606)

---------- ---------- ---------- ------------ ---------- -----------

Total comprehensive

income - - - (834,880) (14,606) (849,486)

Share capital

issued 317,259 285,534 - - - 602,793

Transfer of

warrants lapsed - - (56,247) 56,247 - -

Share options

charge - - 25,000 - - 25,000

----------------------

At 31 December

2021 3,601,104 1,378,561 962,201 (3,848,456) (15,790) 2,077,620

---------- ---------- ---------- ------------ ---------- -----------

Loss for the

period - - - (226,953) - (226,953)

Translation

differences - - - - 145,374 145,373

---------- ---------- ---------- ------------ ---------- -----------

Total comprehensive

income - - - (226,953) 145,374 (81,579)

Share capital

issued 629,999 315,002 - - - 945,001

At 30 June 2022 4,231,103 1,693,563 962,201 (4,075,408) 129,584 2,941,043

---------- ---------- ---------- ------------ ---------- -----------

Half-yearly report notes

1. Half-yearly report

This half-yearly report was approved by the Directors on 20

September 2022.

The information relating to the six-month periods to 30 June

2022 and 30 June 2021 are unaudited.

The information relating to the year to 31 December 2021 is

extracted from the audited financial statements of the Company

which have been filed at Companies House and on which the auditors

issued an unqualified audit report. The condensed interim financial

statements have not been reviewed by the Company's auditor.

2. Basis of accounting

The report has been prepared using accounting policies and

practices that are consistent with those adopted in the statutory

financial statements for the year ended 31 December 2021, although

the information does not constitute statutory financial statements

within the meaning of the Companies Act 2006. The half-yearly

report has been prepared under the historical cost convention.

Going concern

The Company's day-to-day financing is from its available cash

resources.

Post period-end in July 2022, the Company had GBP788K of cash at

hand. These funds will enable to Company to execute its planned

exploration campaigns across its key projects within the second

half of the year. The Directors are confident that adequate funding

can be raised as required to meet the Company's current and future

liabilities.

For the reasons outlined above, the Directors are satisfied that

the Company will be able to meet its current and future

liabilities, and continue trading for the foreseeable future, and,

in any event, for a period of not less than twelve months from the

date of approving this report. The preparation of these financial

statements on a going concern basis is therefore considered to

remain appropriate.

These half-yearly financial statements are prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union and the Disclosure and Transparency Rules of the

UK Financial Conduct Authority.

This half-year report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report should be read in conjunction with the annual report for the

year ended 31 December 2021, which have been prepared in accordance

with International Financial Reporting Standards (IFRS) as adopted

by the European Union.

The Company will report again for the full year to 31 December

2022.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in the Company's 2021 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Half-yearly report notes, continued

2. Basis of accounting, continued

Intangible assets

Exploration and development costs

All costs associated with mineral exploration and investments

are capitalised on a project-by-project basis, pending

determination of the feasibility of the project. Costs incurred

include appropriate technical and administrative expenses but not

general overheads. If an exploration project is successful, the

related expenditures will be transferred to mining assets and

amortised over the estimated life of economically recoverable

reserves on a unit of production basis.

Where a licence is relinquished or a project abandoned, the

related costs are written off in the period in which the event

occurs. Where the Group maintains an interest in a project, but the

value of the project is considered to be impaired, a provision

against the relevant capitalised costs will be raised.

The recoverability of all exploration and development costs is

dependent upon the discovery of economically recoverable reserves,

the ability of the Group to obtain necessary financing to complete

the development of reserves and future profitable production or

proceeds from the disposition thereof.

3. Intangible assets

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

At Beginning of the

period 2,012,406 1,495,519 1,495,519

------------- ---------- -------------

Additions 317,066 61,161 516,886

At End of the period 2,329,471 1,556,680 2,012,406

------------- ---------- -------------

The Directors undertook an assessment of the following areas and

circumstances that could indicate the existence of impairment:

-- The Group's right to explore in an area has expired, or will

expire in the near future without renewal;

-- No further exploration or evaluation is planned or budgeted

for;

-- A decision has been taken by the Board to discontinue

exploration and evaluation in an area due to the absence of a

commercial level of reserves; or

-- Sufficient data exists to indicate that the book value will

not be fully recovered from future development and production.

Following their assessment, the Directors concluded that no

impairment charge was necessary for the period ended 30 June

2022.

Half-yearly report notes, continued

4. Earnings per share

6 months 6 months Year ended

to to 31 December

30 June 30 June 2021

2021 2021

Unaudited Unaudited Audited

GBP GBP GBP

These have been calculated (1, 677,511

on a loss of: (226,953) (842,631) )

-------------- -------------- --------------

The weighted average

number of shares

used was: 423,110,510 328,384,591 360,110,510

-------------- -------------- --------------

Basic and diluted GBP(0. GBP(0. GBP(0.

loss per share: 0005 ) 0025 ) 0047 )

-------------- -------------- --------------

5. Events after the reporting period

There were no reportable events after the reporting period other

than those highlighted in the 'Financial Review'.

The Condensed interim financial statements were approved by the

Board of Directors on 20 September 2022.

By order of the Board

Rupert Verco

Managing Director

20 September 2022

Half-yearly Report

Copies of this half-yearly report are available free of charge

by application in writing to the Company Secretary at the Company's

registered office: 9(th) Floor, 107 Cheapside, London, EC2V 6DN, or

by email to info@london-registrars.co.uk .

Responsibility Statement

We confirm that to the best of our knowledge:

-- The interim financial statements have been prepared in

accordance with International Accounting Standard 34, Interim

Financial Reporting, as adopted by the UK;

-- Give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- The interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- The interim financial information includes a fair review of

the information required by DTR 4.2.8R of the Disclosure and

Transparency Rules, being the information required on related party

transactions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDCUUDDGDG

(END) Dow Jones Newswires

September 21, 2022 02:00 ET (06:00 GMT)

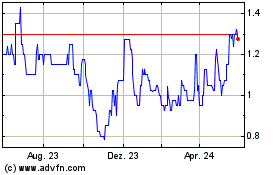

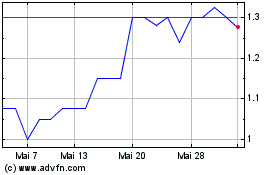

Cobra Resources (LSE:COBR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Cobra Resources (LSE:COBR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024