TIDMAOF

Africa Opportunity Fund Limited (AOF.L)

Announcement of Annual Results for the year to 31 December 2008

The Board of AOF is pleased to announce its audited results for the

year ended 31 December 2008.

The Company

Africa Opportunity Fund Limited ("AOF" or the "Company") is a Cayman

Islands incorporated closed-end investment company traded on the AIM

market of the London Stock Exchange and is also listed and traded on

the Channel Islands Stock Exchange ("CISX"). Its net asset value on

December 31, 2008 was US$ 59.1 million and its market capitalization

was US$32.3 million.

Chairman's Statement

2008 Review

2008 was a difficult year for both world markets and the Africa

Opportunity Fund Ltd ("the Fund" or "AOF"). AOF 's audited net asset

value fell from $0.96 per share at the beginning of the year to $0.51

per share on 31 December 2008. Including dividends, the total NAV

return was a loss of 43%.

To provide some basis for comparison, in Africa Nigeria fell 54%,

South Africa fell 45%, Kenya fell 47%, and Egypt fell 54%. In

non-African emerging markets, China fell 63%, Brazil fell 55%, Russia

fell 73%, and India fell 49%. In developed markets, Japan fell 29%,

the US fell 39%, and the UK fell 49%.1

A key disappointment in 2008 was the lack of protection provided by

AOF's fixed income investments. Although the portfolio was weighted

equally between equity and debt, the overall NAV return was more in

line with an all-equity portfolio. Despite our recognition of the

widening impact of the global credit contraction soon after the

Fund's launch in 2007, and specific comment on it in the 2008

Chairman's statement, we did not anticipate either the severity of

the contraction or its outsized impact on African and other

developing markets.

Benjamin Graham and David Dodd wrote in 1934 that one of the most

disturbing features of the 1927-1933 period

"is not.wild gyrations of the common-stock averages but the

precipitate decline in the bond averages.which constitutes the really

novel and arresting feature of recent financial history-at least from

the standpoint of investment logic and practice". 2

Similarly for AOF, 2008 provided an important lesson that was last

taught some 80 years ago: in a liquidity driven panic, the

correlation of various securities moves towards 1.0 and the

diversification benefits of holding different asset classes is

severely diminished.

Looking forward over a longer time horizon, it is our opinion that

holding different asset classes will provide significant

risk-adjusted benefits to shareholders of AOF. Our conviction is

based on the fact that while AOF's fixed income portfolio is now

priced to provide equity returns it also enjoys the seniority of a

fixed income security. As of 31 December, AOF's debt investments

were priced collectively at 50% of par with a 21% current yield. At

that valuation, half of the debt portfolio could default with a

recovery of zero and half could mature normally, and AOF would still

earn a double digit return based solely on coupon payments.

Meanwhile, in the equity portfolio, AOF holds several companies that

are market leaders with little or no debt and significant free cash

generating capacity. Yet, the equity portfolio was valued at year

end on a single digit PE multiple and a double digit dividend yield.

With many holdings earning a return on equity in excess of 25%, it is

reasonable to anticipate that our equities portfolio could double in

market value over the next three years.

In December AOF concluded a prime brokerage relationship with

Newedge, a joint venture between the French banks Societe General and

Calyon. Our relationship with Newedge allows AOF to engage in short

sales or trade derivatives such as options and futures. In

retrospect, we would have benefited from having those hedging tools

at our disposal in 2008. Amidst the turmoil that consumed the prime

brokerage community at the end of the year, AOF is pleased to have

the support of Newedge and we look forward to working with them in

the future.

Permit me to end my 2008 review with one additional comment.

Certainly Francis Daniels and I, as principals of the Manager, made

our share of mistakes and we have been humbled by the market collapse

and AOF losses. Furthermore, we are painfully aware that the most

apt historical analogy to 2008 is found in the troubled 1930s. The

reasons for caution today are numerous, to say the least, and

worrisome imbalances persist in the world's debt position and trade

patterns. Still, Africa shines as a growing continent. Africa's

growth prospects combined with the continuing dislocations in several

markets are throwing up some of the most attractive investment

opportunities we have encountered in our careers. We make no

forecast about the general direction of markets, but are encouraged

by the deep value that has been revealed.

Tender Offer

Warren Buffet has written more than once that companies often "get

the shareholders they deserve".3 In this regard, 2008 was another

learning experience. When Francis and I set out to launch AOF in

2007, we had certain investors pushing us to increase the size of the

Fund. Soon after launch, many of those investors urged AOF to invest

quickly. Indeed, we were criticized at an investor conference held

in early 2008 by some shareholders for being too cautious in our

selection of investments.

When the market declines intensified in September and October 2008,

some of our largest shareholders requested a return of their money.

Rather than viewing the market fall as a great investing opportunity,

these shareholders found themselves in desperate need for liquidity.

Thus, as the Fund's NAV declined, a substantial discount to net asset

value materialized. At the end of the year the shares closed at

$0.28, an astonishing 47% below the NAV of $0.52.

The Manager and AOF's Board found this rather perplexing. It may be

historic to see world markets down by over 40% in a synchronous

fashion, but seeing Africa down this much should not have surprised

anyone. In fact, if asked to estimate the probability that African

markets could decline 30% in a year, we would answer 20%. In other

words, it is reasonable to expect it to happen one year out of five.

AOF's large discount confirmed that AOF's shares did not benefit from

trading on two markets. As a result, AOF delisted from the Channel

Islands Stock Exchange early in 2009 to reduce related expenses.

During the last months of the year, Francis and I substantially

increased our investment in the Fund. At the launch I purchased 2

million shares and Francis purchased 1 million shares. As of the end

of 2008 I own 8.2 million shares and Francis owns 2.1 million

shares.

It is an article of faith for Francis and I that AOF exists for the

benefit of its shareholders. When we realized that over 50% of its

shareholders needed an exit, we conducted a tender offer in February

2009 that allowed each and every shareholder to redeem 100% of their

holding. In my career I have never seen a company voluntarily

conduct such a tender. There existed a very real possibility that

the members of the Board of AOF would have ended up as the only

shareholders.

As it turned out, fully 37% of shareholders chose to remain invested

with AOF. There are now 42.6 million shares outstanding, and

collectively Francis and I own over 23%. Returning to Warren

Buffet's observation, AOF now finds itself with a smaller but

recommitted shareholder base: one which recognizes a discount to NAV

as an opportunity, and recognizes that investing in Africa involves

risk. It is a shareholder base, in other words, that we will work

hard to deserve. Thank you for your steadfast support.

Robert C. Knapp

Chairman

June 2009

1 Reference Indexes are calculated in US dollars using : Nigeria NSE

Index, South Africa Allshare, Nairobi NSE Index, Egypt Hermes Index,

Russia MICEX Index, Brazil IBOV Index, the Shanghai composite index,

the India SENSEX Index, the S&P 500, the FTSE 100, and the Nikkei

225.

2 Benjamin Graham and David Dodd, Security Analysis, (New York:

McGraw-Hill, 1934), p. 3.

3 See for example the 1979 Annual Report of Berkshire Hathaway,

Chairman's Letter, which states: "In large part, companies obtain the

shareholder constituency that they seek and deserve. If they focus

their thinking and communications on short-term results or short-term

stock market consequences they will, in large part, attract

shareholders who focus on the same factors..."

Manager's Report

The Fund became fully invested in 2008. Its end-of-year holdings

were in Angola, Cote d'Ivoire, Democratic Republic of the Congo,

Nigeria, Tanzania, Senegal, South Africa, Zambia, and Zimbabwe. It

had $25.4 million invested in debt securities, $31.7 million in

equity securities, and $2.7 million in cash.

The fears expressed in last year's report by Africa Opportunity

Partners ("we") about the spreading dramatic contraction in credit

and the high valuations on African stock markets were confirmed by

the steep declines in most African asset prices in 2008. In light of

those fears, we sought to maintain the capital value of the Fund's

portfolio by investing in debt securities denominated mainly in

African currencies such as the Tanzanian Shilling, the Ghanaian Cedi,

the Zambian Kwacha and the CFA Franc, coupled with equity investments

in industries expected to expand rapidly in Africa over the next

decade. Unfortunately, our fears were more than realized and our

expectations confounded. 2008 ended with the US Dollar strengthening

against most currencies and credit markets in virtual ice. The

prices of many of the Company's debt investments fell significantly,

as did the Company's investments in companies dependent on future

access to the capital markets. Most of the Fund's losses were

concentrated in the categories of African sovereign debt, high yield

corporate debt, and equity securities issued by development stage

resource companies. By the end of the year, the Company's debt

portfolio was valued at a 50% discount to its par value, had a

current yield of 21%, and a yield to maturity of 50%. Its equity

portfolio traded on a dividend yield of 6.3% and the overall

portfolio's free cash yield was 13.5%.

The 50% discount to par valuation for AOF's debt portfolio implies

that AOF's portfolio comprises distressed securities. Admittedly,

since year end, one debt instrument experienced a delay in the

payment of interest which has been cured. Nevertheless, to date, AOF

has not suffered any impairment in its debt portfolio. Yet, the

market behaves as if it believes that there is a 100% probability of

default in the case of some of our investments, with the probability

that AOF would recover only 33% of its investment. We use one bond in

the Fund's portfolio to illustrate the deep skepticism confronting

some of our debt instruments.

AOF invested $3.8 million in Marine Subsea bonds maturing in February

2012. Those bonds were valued at $1.25 million at the end of the

year, or 32% of par. AOF's bonds are part of a $110.5 million bond

issue which is secured by a 1st priority mortgage on a construction

support barge and a second priority mortgage on a well intervention

vessel to be used in the offshore oil industry of Angola. Both

vessels are scheduled for delivery to Marine Subsea in the second

half of 2009 after settlement of final installment fees due to the

shipyard. The barge has a construction cost of $30 million and the

intervention vessel a cost of approximately $140 million. The

intervention vessel has a 10 year contract with Sonangol guaranteeing

approximately $30 million per year in ebitda, and Marine Subsea

already has two similar barges working in Angolan waters. Marine

Subsea announced in 2009 that it has a funding shortfall to complete

the purchase and fitting out of its vessels of about $50 million. We

expect the final figure to be higher. But at 32% of par, the bond is

valued at $35 million, which is 1.2X a single year's ebitda from the

Sonangal contract, and the money required for completion could assume

the position of 1st lien against $140 million of construction cost.

In short, although asset values have fallen and vessel utilizations

in the oil services sector have fallen, in our view these bond prices

bear little relation to the business prospects and long term

contracts that Marine Subsea has in place. While the situation is

difficult, we believe the market is being too pessimistic.

Turbulent market conditions either confirm or confute an investor's

argument in support of a specific investment. We did make some

investing errors last year. For example, it is clear to us that, in

the case of African sovereign issuers, we underestimated their

willingness to maintain sober budgetary disciplines in the face of

elections in a year of rising food and oil prices. Thus, the Ghana

government ran a budget deficit exceeding 10 per cent of its Gross

Domestic Product with harmful effects on the external value of the

Cedi against the US Dollar. Our Ghanaian government bond holdings

endured not just material depreciation against the US Dollar, but

also a loss of value because the yield to maturity of local currency

denominated Ghanaian government debt obligations soared over 20%.

The development stage investments of AOF had an exceedingly poor

year. As credit contracted globally, the first to feel it were

companies dependent upon the capital markets to fund their work

programs. The mix of weak commodity prices proved lethal, and AOF

had two investments which became insolvent. Our response was to

refocus on companies with strong balance sheets and the ability to

fund themselves through an extended downturn. At the end of 2008,

with the exception of Moto Gold and Zimplats, all the equity holdings

of AOF were, and remain, strong free cash flow generators which

utilize modest amounts of debt. In addition, 27% of AOF's fixed

income portfolio was AAA rated. So, 2008 ended with AOF's portfolio

possessing a robust ability to generate free cash.

The remainder of this report comprises commentary on some of AOF's

larger equity investments and a restatement of the Manager's

investment philosophy.

Sonatel. This Senegalese integrated telephone operator listed on the

Bourse Regionale de Valeurs Mobiliers continues to be AOF's largest

investment. Its subscribers grew by 43% in 2008 to 7.3 million.

Sonatel has operations in Senegal, Mali, Guinea, and Guinea-Bissau.

It has 100% of Senegal's fixed line market, 90% of Senegal's internet

market, 71% of Senegal's mobile telephony market, 84% of Mali's

telephony market, 23% of Guinea's mobile telephony market, and 16% of

the mobile telephony market in Guinea-Bissau. Lest one concludes

from Sonatel's market share that its earnings potential is near

saturation, it is worth remembering that Senegal's penetration rate

for mobile telephony is about 43%. That ratio compares with an 80%

penetration rate in South Africa. At 29.6% for the 2008 financial

year, Sonatel's net margin was the second highest in Africa. It had

the second highest operating cash flow per telephone subscriber in

Africa of $69, the lowest debt to equity ratio in its industry of

14.5%, a debt to total assets ratio of 8.9%; and a return on equity

of 31.8%. Yet, as of May 29, 2009, with an enterprise value around

$2.4 billion and a market capitalization of $2.3 billion, it had the

second lowest African telephone operator valuation with a

Price/Earnings ratio of 7.7 and an enterprise value per subscriber of

$332. AOF has lost money so far on its investment in Sonatel. But,

we are happy to own it because it is a rapidly growing safe and cheap

company.

Gold Fields. At a price of 110 Rands per share on May 29, 2009 and

an enterprise value around $9.36 billion, Gold Fields, the 4th

largest gold producer in the world, was valued at less than 50% of

the present value of the cash flow that will be generated from its

existing reserves (assuming a gold price of $950). In essence, even

if the gold price stays flat, AOF should earn an attractive return,

and if the gold price rises, we would not have paid anything for the

option to earn a higher return. We will also benefit from any

reduction in US Dollar denominated production costs, which would

result if the Rand loses value against the US Dollar. Gold Fields

has 61.9 million gold ounces of proved and probable reserves and

156.8 million gold ounces in resources. It mines gold in South

Africa, Ghana, Peru, and Australia. Gold Fields had a bearable

debt/equity ratio of 24% at the end of 2008. It has the challenge of

refinancing more than half of that debt by 2011. It is expanding

annual production to a target of 4 million ounces in the same year

that it reduces both its maintenance capital expenditure and

production costs per ounce. We anticipate that it should generate at

least $150 per ounce in free cash flow at a gold price around $900

per ounce and a Rand/Dollar exchange rate of 10. Gold Fields is the

cheapest of the large gold producers.

African Bank Investment Limited. African Bank Investments Limited

("African Bank") is the largest consumer finance company in South

Africa and Africa. It grants unsecured loans to individuals, loans

secured by furniture to individuals, and sells furniture. Its

customers are members of the emerging middle class to whom it

provides loans of an average size of 7,000 Rands (or $700). By

acquiring a company called Ellerines Holdings, it has entered the

furniture retail market in South Africa. The market has been

uncomfortable with the pace of integration of Ellerines' stores into

African Bank, especially as the consumer sector of South Africa is in

recession. However, African Bank's 1639 branches constitutes the

largest financial branch network in South Africa. Unlike the four

major commercial South African banks, it has no exposure to the

mortgage market. Its funding strategy is rare. It funds itself long

term to make loans of shorter duration. As of the end of September

2008, its ratio of tangible shareholders equity to assets was 27.5%.

African Bank's tier 1 capital adequacy ratio was 21%. That high

capital ratio permits African Bank to incur high non-performing loans

and bad debts in its market. It has a return on average assets of

7.6% and a return on average equity of 21.0%. African Bank had a

market capitalization on May 29 of 20.6 billion Rands. It traded on

a Price/Earnings ratio of 12.8 and a Price/Book ratio of 1.75 and a

Price/Tangible Book of 3.79.

Addax Petroleum. Addax Petroleum ("Addax") is the largest independent

oil producer in Nigeria. Addax also produces oil from Gabon and has

development assets in Nigeria, Gabon, and Kurdistan. AOF owns some

convertible bonds and common stock issued by Addax. Addax is listed

on the Toronto and London stock exchanges and is headquartered in

Geneva, Switzerland. The enterprise value of Addax at the end of

2008 was $4.1 billion, of which $1.5 billion constituted debt. It

has 536.7 million barrels of proved and probable oil reserves, annual

2008 daily production of 136,500 barrels of oil, and net profits of

$774.9 million. 80% of its production comes from the Nigerian Delta

and the balance from Gabon. Addax trades on a historical

Price/Earnings ratio of 3.5 and an enterprise value per barrel of

reserves of $9 at the end of the year. Even after taking into

account the current low prices of crude oil, those valuations are

substantially lower than those of other top African oil producers.

Once again, we end with a restatement of our investing philosophy.

The key elements of the investment strategy for AOF are:

Material discounts to intrinsic value: AOF invests primarily where

and when an investment can be made at a material discount to the

Manager's estimate of that investment's intrinsic value.

Company preference: AOF prefers companies which demonstrate both high

real returns on assets and an earnings yield higher than the yield to

maturity of local currency denominated government debt.

Industry focus rather than country focus: AOF seeks to invest in

industries it finds attractive with little regard to national

borders.

National resource discounts: AOF seeks natural resource companies

whose market valuations reflect a discount to the spot and future

world market prices for those natural resources.

"Turnaround" countries: The African continent is home to a large

number of reforming or "turnaround" countries. "Turnaround"

countries combine secular political reform with the opening of

industries to private sector participation.

Balkanized investment landscape: AOF seeks to invest in companies

with low valuations in relation to peers across the continent and

uses an arbitrage approach to provide attractive investment returns.

Point of entry: AOF seeks the most favorable risk adjusted point of

entry into a capital structure, whether through financing the

establishment of a new company or acquiring the debt or listed equity

of an established company.

Africa offers several attractive investment opportunities. The

continuing turmoil in credit markets has revealed a number of debt

instruments trading at prices which offer equity-like returns. So,

despite the difficult experience of 2008, we consider African debt

instruments to constitute a fruitful investment arena. We remain

interested in industries which have products in short supply in

Africa that rely more on the domestic African economy than the global

economy. In addition, we think there are attractive investment

opportunities in countries recovering from severe civil discord or

civil war. We shall continue to build a portfolio that delivers both

capital growth and income to the shareholders of AOF.

Francis Daniels

Africa Opportunity Partners

June 2009

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 DECEMBER

2008

Note 2008 2007

USD USD

Revenue

Interest income 6,150,183 2,481,336

Dividend income 1,606,923 -

Other income 139,595 -

7,896,701 2,481,336

Expenses

Management fee 2,010,654 1,057,414

Custodian, secretarial and

administration fees 549,410 616,912

Brokerage fees and commissions 485,588 45,028

Audit fees 52,500 34,500

Directors' fees 120,000 54,658

Other operating expenses 129,362 186,027

Losses on financial assets at fair

value through profit or loss 53,856,788 656,347

Realised exchange loss 679,503 -

57,883,805 2,650,886

Loss for the period (49,987,104) (169,550)

Attributable to:

Equity holders of the Company (49,658,231) (166,028)

Minority interest (328,873) (3,522)

(49,987,104) (169,550)

Basic loss per share for loss

attributable to the equity holders of

the Company during the period (0.4056) (0.0013)

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER

2008

Notes 2008 2007

USD USD

ASSETS

Held-to-maturity financial assets - 4,535,754

Financial assets at fair value

through profit or loss 57,140,459 52,632,051

Trade and other receivables 1,294,247 2,553,189

Cash and cash

equivalents 2,671,415 61,827,336

Total assets 61,106,121 121,548,330

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 3 1,155,100 1,250,000

Share premium 107,741,068 119,489,981

Retained losses (49,824,259) (166,028)

Shareholders' interests 59,071,909 120,573,953

Minority interest 417,605 746,478

Total equity 59,489,514 121,320,431

LIABILITIES

Trade and other payables 1,616,607 227,899

Total equity and liabilities 61,106,121 121,548,330

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER

2008

ATTRIBUTABLE TO EQUITY HOLDERS OF THE

PARENT

Issued Share Retained Minority Total

capital premium losses Total interest Equity

USD USD USD USD USD USD

Issue of

shares 1,250,000 123,750,000 - 125,000,000 - 125,000,000

Issue costs - (4,260,019) - (4,260,019) - (4,260,019)

Capital

contribution - - - - 750,000 750,000

Loss for the

period - - (166,028) (166,028) (3,522) (169,550)

At 31

December

2007 1,250,000 119,489,981 (166,028) 120,573,953 746,478 121,320,431

Shares buy

back (94,900) (6,262,650) - (6,357,550) - (6,357,550)

Loss for the

year - - (49,658,231) (49,658,231) (328,873) (49,987,104)

Dividend - (5,486,263) - (5,486,263) - (5,486,263)

At 31

December

2008 1,155,100 107,741,068 (49,824,259) 59,071,909 417,605 59,489,514

AFRICA OPPORTUNITY FUND LIMITED

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER

2008

2008 2007

USD USD

Cash flows from operating activities

Loss for the year/ period (49,987,104) (169,550)

Adjustment for:

Interest income (6,150,183) (2,481,335)

Losses on financial assets at fair

value through profit or loss 53,856,788 656,347

Dividend income (1,606,923) -

Gain on disposal of held-to-maturity

investment (139,595) -

Operating loss before working capital

changes (4,027,017) (1,994,538)

Decrease/(increase) in other

receivables and prepayments 1,258,942 (2,215,921)

Increase in other payables and accrued

expenses 83,445 227,899

(2,684,630) (3,982,560)

Interest received 6,185,937 2,108,313

Purchase of financial assets at fair

value through profit or loss (76,022,332) (57,788,398)

Disposal of held-to-maturity financial

assets 4,639,595 -

Disposal of financial assets at fair

value through profit or loss 17,657,136 -

Dividend received 1,606,923 -

Net cash used in operating activities (48,617,371) (59,662,645)

Cash flows from financing activities

Proceeds from issue of shares - 120,739,981

Dividend paid (4,181,000) -

Shares buy back (6,357,550) -

Capital contribution - 750,000

Net cash flow (used in) / generated

from financing activities (10,538,550) 121,489,981

Net (decrease) / increase in cash and

cash equivalents (59,155,921) 61,827,336

Cash and cash equivalent at the start

of the year / period 61,827,336 -

Cash and cash equivalent at the end of

the year / period 2,671,415 61,827,336

AFRICA OPPORTUNITY FUND LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER

2008

1. GENERAL INFORMATION

Africa Opportunity Fund Limited (the "Company") was launched with an

Alternative Market Listing "AIM" in July 2007. A secondary listing

was obtained on the Channel Islands Stock Exchange ("CISX") in

November 2007.

Africa Opportunity Fund Limited is a closed-ended fund incorporated

with limited liability and registered in Cayman Islands under the

Companies Law on 21 June 2007 and with registered number MC-188243.

The Company is domiciled at PO Box 309 GT, Ugland House, South Church

Street, George Town, Grand Cayman, Cayman Islands.

The Company aims to achieve capital growth and income through

investment in value, arbitrage, and special situations investments in

the continent of Africa. The Company therefore may invest in

securities issued by companies domiciled outside Africa which conduct

significant business activities within Africa. The Company will have

the ability to invest in a wide range of asset classes including real

estate interests, equity, quasi-equity or debt instruments and debt

issued by African sovereign states and government entities.

The Company's investment activities are managed by Africa Opportunity

Partners Limited, a limited liability company incorporated in the

Cayman Islands and acting as the investment manager pursuant to an

Investment Management Agreement dated 18 July 2007.

To ensure that investments to be made by the Company, and the returns

generated on the realisation of investments, are both effected in the

most tax efficient manner, the Company has established Africa

Opportunity Fund L.P. as an exempted limited partnership in the

Cayman Islands. All investments made by the Company will be made

through the limited partnership. The limited partners of the limited

partnership are the Company, AOF CarryCo Limited and Millenium

Special Opportunities Holdings Ltd. The general partner of the

limited partnership is Africa Opportunity Fund (GP) Limited.

Copies of the annual report are being posted to shareholders on 24

June 2009 and copies will be available from the Company's registered

office and also from the Company's website

http://www.africaopportunityfund.com.

2. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

2008 2007

USD USD

Designated at fair value through profit

or loss:

At start of year 52,632,051 -

Additions 76,022,332 53,288,398

Disposals (17,657,136) -

Net loss on financial assets at fair

value through profit or loss (53,856,788) (656,347)

At 31 December 57,140,459 52,632,051

Net loss on financial assets through

profit or loss:

Realised (7,104,816) -

Unrealised (46,757,142) (656,347)

(53,861,958) (656,347)

Analysis of portfolio:

- Listed equity securities 31,698,660 16,342,573

- Listed debt securities 22,167,517 36,289,478

- Unlisted debt securities 3,274,282 -

57,140,459 52,632,051

3. SHARE CAPITAL

2008 2008 2007 2007

Number USD Number USD

Authorised

share capital

Ordinary

shares with a

par value of

USD 0.01 1,000,000,000 10,000,000 1,000,000,000 10,000,000

2008 2008 2007 2007

Number USD Number USD

Share capital

Opening balance 125,000,000 1,250,000 - -

Issue of share - - 125,000,000 1,250,000

Shares buy back (9,490,000) (94,900) - -

115,510,000 1,155,100 125,000,000 1,250,000

The directors have the general authority to repurchase the ordinary

shares in issue subject to the Company having funds lawfully

available for the purpose. However, if the market price of the

ordinary shares falls to a discount to the Net Asset Value, the

directors will consult with the Investment Manager as to whether it

is appropriate to instigate a repurchase of ordinary shares.

4. LOSS PER SHARE

Basic loss per share is calculated by dividing the loss attributable

to equity holders by the weighted average number of ordinary shares

in issue during the period excluding ordinary shares purchased by the

Company and held as treasury shares.

The Company's diluted loss per share is the same as basic loss per

share, since the Company has not issued any instrument with dilutive

potential.

2008 2007

Loss attributable to equity

holders of the Company USD (49,658,231) (166,028)

Weighted average number of

ordinary share in issue 122,431,041 125,000,000

Basic loss per share US cents (0.4056) (0.0013)

5. RELATED PARTY DISCLOSURES

The financial statements include the financial statements of Africa

Opportunity Fund Limited ("the Company") and the subsidiaries in the

following table:

Country of % equity interest

Name incorporation 2008

Africa Opportunity Fund (GP)

Limited Cayman Islands 100

Africa Opportunity Fund L.P. Cayman Islands 98.37

During the year ended 31 December 2008, the Company transacted with

related entities. The nature, volume and type of transactions with

the entities are as follows:

Balance at

Type of Nature of Volume 31 Dec 2008

Name of related

parties relationship transaction USD USD

Africa Opportunity

Partners Limited Investment Management fee 2,010,654 -

Manager expense

Key Management Personnel (Directors' fee)

Except for Francis Daniels and Robert Knapp who have waived their

fees, each director has been paid a fee of USD 30,000 per annum plus

reimbursement for out-of pocket expenses.

Francis Daniels and Robert Knapp who are directors of the Company are

also shareholders of the Investment Manager.

Francis Daniels and Robert Knapp who are directors of the Company

also form part of the executive team of the Investment Manager. They

have a beneficiary interest in AOF CarryCo Limited. The latter is

entitled to carried interest computed in accordance with the rules

set out in the Admission Document. The total carried interest is 20%

shared as follows: 19% to AOF CarryCo Limited and 1% to Millenium

Special Opportunities Holdings Ltd as set out in the side letter

agreement to the Partnership Agreement entered into by Africa

Opportunity Fund (GP) Limited, AOF CarryCo Limited, Africa

Opportunity Partners Limited and Millenium Special Opportunities

Holdings Ltd.

6. Summary Information

Investing objective

The investing objective of the Company and its subsidiaries (together

the "Group") is to achieve consistent capital growth and income

through investments in value, arbitrage, and special situations

opportunities derived from the continent of Africa. Therefore, the

Group may invest in securities issued by, or economic interests

created by, companies domiciled outside Africa which conduct

significant business activities within Africa or, if listed, listed

either on an African stock exchange or a non-African stock exchange.

The Group may invest in equity, quasi-equity or debt instruments,

debt issued by African sovereign states and government entities, and

real estate interests.

The Directors and the Manager believe that the diversity and

volatility of African economies present opportunities to earn

attractive returns when investments are made selectively, across

asset classes, and without pre-determined benchmarks or allocations.

By balancing the size and type of investment, the Directors and the

Manager believe that attractive returns may be made across asset

classes. Whilst the African capital markets can be volatile, by

ensuring diversity of investment across industries and countries, the

Investment Manager attempts to mitigate such risks.

The Group targets industries rather than countries to exploit

valuation discrepancies which can arise among African countries. The

Directors and the Manager believe also that Africa's status as a

continent containing a large number of reforming countries provides

investment opportunities in those countries.

Summary of Investment Strategy

The Group's investment strategy is opportunistic. The Group invests

primarily where and when the Manager believes that investments can be

made at a material discount to the Manager's estimate of an

investment's intrinsic value.

Company preference. The Group prefers companies which demonstrate

both high real returns on assets and an earnings yield higher than

the yield to maturity of local currency denominated government debt.

Industry focus rather than country focus. The Group seeks to invest

in industries it finds attractive with little regard to national

borders.

Natural resource discounts. The Group seeks natural resource

companies whose market valuations reflect a discount to the spot and

future world market prices for those natural resources.

"Turnaround" countries. The African continent is home to a large

number of reforming or "turnaround" countries. "Turnaround"

countries combine secular political reform with the opening of

industries to private sector participation.

Balkanized investment landscape. The Group seeks to invest in

companies with low valuations in relation to peers across the

continent and uses an arbitrage approach to provide attractive

investment returns.

Point of entry. The Group seeks the most favourable risk adjusted

point of entry into a capital structure, whether through financing

the establishment of a new company or acquiring the debt or listed

equity of an established company.

The Company intends to be a passive investor and will generally not

control or seek to control or be actively involved in the management

of any company or business in which it invest.

Investment Policies and Restrictions

The Manager adheres to the following policies and restrictions:

Geographical focus. The Group makes investments in companies or

assets with a material portion of their value derived from or located

in Africa. The geographic mix of investments varies over time

depending on the relative attractiveness of opportunities among

countries and regions.

Type of investment. The Group may invest in real estate interests,

equity, quasi-equity or debt instruments, which may or may not

represent shareholding or management control, and debt issued by

African sovereign states and government entities. Investments may be

made directly or through special purpose vehicles, joint venture,

nominee or trust structures. The Group may utilise derivative

instruments to hedge certain market or currency risks and may from

time to time engage in the short sale of securities.

Investment size. At the time of investment, no single investment may

exceed 15 per cent. of the Net Asset Value without the prior approval

of the Board. No one initial investment will exceed 20 per cent. of

the Net Asset Value at the time of investment.

Number of investments. The Group has, and expects to maintain, a

concentrated portfolio of approximately 10 to 20 investments,

excluding money market investments.

Borrowing. The Group may use overdraft and other short-term borrowing

facilities to satisfy short-term working capital needs, including to

meet any expenses or fees payable by the Group. The Manager

anticipates that borrowings may be utilised for investment purposes

with the prior approval of the Board. There are no limits on the

Group's ability to leverage itself.

Cash management. Cash will be placed in bank deposits, investment

grade commercial paper, government and corporate bonds and treasury

bills, in each case, of US and African issuers.

Distribution policy

The Directors will determine the Company's dividend policy. Subject

to having sufficient cash resources available for the purpose, the

Company is currently intending to pay an aggregate annual dividend of

an amount equal to the product of Net Asset Value on 1 January in

each year multiplied by the one year US Dollar LIBOR rate (as derived

from Bloomberg) on the same date, which amount will be payable in

four equal quarterly instalments in March, June, September and

December of that year.

Life of the Company

The Company does not have a fixed life, but the directors consider it

desirable that its shareholders should have the opportunity to review

the future of the Company at appropriate intervals. The Directors

will convene a general meeting in 2014 where a resolution will be

proposed that the Company will continue in existence. If the

resolution is not passed, the Directors will be required to formulate

proposals to be put to shareholders to reorganize, reconstruct or

wind up the Company. If the resolution is passed, the Company will

continue its operations and a similar resolution will be put to

shareholders every five years thereafter.

For further information please contact:

Africa Opportunity Fund Limited

Francis Daniels Tel: +2711 684

1528

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett Tel: +44 207

383 5100

=--END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

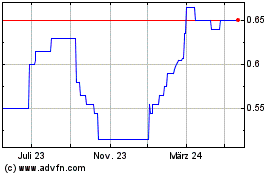

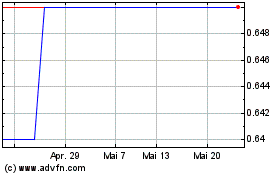

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Africa Opportunity (LSE:AOF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024