Dollar Paring Gains After Yesterday's Surge

21 September 2017 - 5:11PM

RTTF2

The dollar is down against all of its major rivals Thursday

afternoon, easing back from the sharp gains of the previous

session. The buck surged yesterday afternoon following the release

of the Federal Reserve's policy statement.

The Fed left interest rates unchanged yesterday, but signaled

that another rate hike is likely this year. The Fed's projections

pointed to a quarter basis point rate increase later this year,

with the rate hike widely expected to come at the December

meeting.

The central bank also revealed that it will begin shrinking its

$4.5 trillion balance sheet in October, initially allowing $10

billion in bonds to roll off each month.

First-time claims for U.S. unemployment benefits unexpectedly

decreased in the week ended September 16th, according to a report

released by the Labor Department on Thursday. The report said

initial jobless claims fell to 259,000, a decrease of 23,000 from

the previous week's revised level of 282,000.

The continued decrease surprised economists, who had expected

jobless claims to climb to 300,000 from the 284,000 originally

reported for the previous week.

A report released by the Federal Reserve Bank of Philadelphia on

Thursday showed an unexpected improvement in regional manufacturing

conditions in the month of September. The Philly Fed said its index

for current manufacturing activity rose to 23.8 in September from

18.9 in August, with a positive reading indicating growth.

Economists had expected the index to drop to 17.2.

Reflecting large positive contributions from building permits,

the yield spread, and consumer expectations, the Conference Board

released a report on Thursday showing a bigger than expected

increase by its index of leading U.S. economic indicators.

The Conference Board said its leading economic index climbed by

0.4 percent in August after rising by 0.3 percent in July.

Economists had expected the index to edge up by 0.2 percent.

The dollar jumped to a high of around $1.1860 against the Euro

after the Fed announcement yesterday, but has since retreated to

around $1.1935.

Eurozone consumer confidence improved for a second straight

month in September to its highest level since 2001, preliminary

data from the European Commission showed Thursday.

The flash consumer confidence index rose to -1.2, marking the

highest score since April 2001, when the reading was -0.9.

Economists had expected the reading to remain unchanged at August's

-1.5.

The buck reached an early high of $1.3470 against the pound

sterling Thursday, but has since eased back to around $1.3575.

The UK budget deficit decreased to its lowest August level since

2007 on higher sales tax, official data revealed Thursday. Public

sector net borrowing excluding interventions decreased by GBP 1.3

billion from the previous year to GBP 5.7 billion in August, the

Office for National Statistics reported.

This was the lowest August borrowing since 2007. The deficit was

also well below the expected level of GBP 7.1 billion.

The Bank of Japan maintained its monetary stimulus but a new

member voted against the decision, as he demanded more easing, on

Thursday.

The BoJ policy board, led by Governor Haruhiko Kuroda, voted 8-1

to hold the central bank's target of raising the amount of

outstanding Japan government bond holdings at an annual pace of

about JPY 80 trillion.

The BoJ board also voted to retain the -0.1 percent interest

rate on current accounts that financial institutions maintain at

the bank.

The central bank said it will purchase government bonds so that

the yield of 10-year JGBs will remain at around zero percent.

The greenback climbed to a 2-month high of Y112.715 against the

Japanese Yen Thursday, but has since slipped to around

Y112.525.

Japan's all industry activity decreased slightly in July, after

rebounding in the previous month, data from the Ministry of

Economy, Trade and Industry showed Thursday. The all industry

activity index dropped 0.1 percent month-on-month in July,

reversing a 0.2 percent rise in June. The figure also matched

consensus estimate.

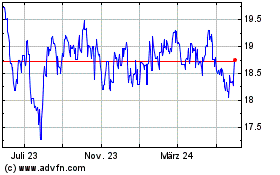

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

Von Nov 2024 bis Dez 2024

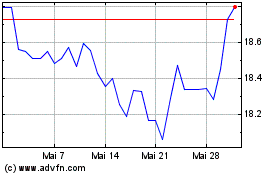

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

Von Dez 2023 bis Dez 2024