Regulatory News:

Xilam Animation (Paris:XIL), Academy Award®-nominated

French animation studio, has successfully completed a capital

increase with preferential subscription rights to raise

€3,683,621.25 in cash by issuing 982,299 new shares at a unit price

of €3.75.

The funds raised will allow the company to optimise its

financial structure by rebalancing its balance sheet to improve its

debt ratio to offset the rising cost of borrowing and more

demanding lending conditions.

Subscription demand by the end of the offer period totalled

1,067,608 shares, representing 108.7% of the initial amount,

distributed as follows:

- 638,171 shares based on existing holdings

(irreducible);

- 429,437 additional subscriptions

(reducible).

All subscriptions on an irreducible basis will be fulfilled.

Subscriptions on a reducible basis will be filled for 344,128

shares. The reduction coefficient is 0.179647990 and the allocation

scale for shares subject to reduction will be published in a

Euronext notice.

This led to a gross transaction value of €3.68 million,

resulting in the creation of 982,299 new shares at €3.75 per share,

corresponding to 100% of the number of shares initially

offered.

The company's share capital following the capital increase will

amount to €589,379.90 split between 5,893,799 shares, each with a

par value of €0.10.

New shares are scheduled for settlement-delivery and admission

to trading in Compartment B of the Euronext Paris market on 12

January 2024. They will be directly assimilated into existing Xilam

shares, already traded on Euronext Compartment B under ISIN

FR0004034072, with the ticker symbol XIL.

Dilution for shareholders who did not exercise their

subscription rights represents 16.7%.

LEGAL FRAMEWORK FOR THE OFFERING

This capital increase through the issuance of new shares with

preferential subscription rights was decided on 12 December 2023 by

the Chief Executive Officer, following the sub-delegation of powers

to him by the Board of Directors at its meeting on 12 December

2023, in accordance with the delegation of authority granted by the

15th resolution adopted at the Annual General Meeting of

shareholders on 23 June 2022.

Marc du Pontavice—a direct and indirect shareholder through MDP

Audiovisuel (421 603 473 RCS Créteil) and Xilam Group (539 985 788

RCS Créteil) (Marc du Pontavice, MDP Audiovisuel and Xilam Group,

collectively referred to as the "Concert")—had made clear

his intention to underwrite the capital increase up to 75% of its

anticipated amount in the event that other Company shareholders did

not subscribe to the offering.

On completion of the capital increase, the Concert, whose

holdings in equity securities were between 30% and half of the

Company's share capital, was thus in a position to increase its

shareholding by at least 1% of Company's total equity securities

within less than twelve consecutive months, which would have

triggered an obligation to file a public offer in accordance with

Article 234-5 of the AMF General Regulation.

Furthermore, following the capital increase, MDP Audiovisuel,

which individually held theoretical voting rights representing

between 30% and half of the total voting rights of the Company, was

thus in a position to increase its theoretical voting rights by at

least 1% of the total theoretical voting rights of the Company

within less than twelve consecutive months and exceed the threshold

of 30% of the Company's share capital, triggering the requirement

to file a mandatory public offer in accordance with Articles 234-2

and 234-5 of the AMF General Regulation.

On 12 December 2023, the Autorité des Marchés Financiers

(“AMF”) granted the Concert a waiver from the obligation to

file a mandatory public offer following the threshold crossings

resulting from its subscription to the capital increase, in

accordance with the provisions of Articles 234-5, 234-9, 6°, and

234-10 of the AMF General Regulation (Decision No. 223C2030).

Completion of the capital increase was subject to the absence,

within the legal timeframe, of any appeal against the waiver

obtained from the AMF. The Company has not been notified of any

appeal in this respect.

DILUTION

How the issuance affects consolidated equity per

share

Portion of equity per share

(in euros)

Undiluted basis*

Before issuance of new shares through the

capital increase

14.48

After issuance of 982,299 new shares

through the capital increase

12.80

* based on consolidated equity of €71.13

million as of 30 June 2023

How the issuance affects the position of shareholders

Shareholder ownership (as

%)

Undiluted basis

Before issuance of new shares through the

capital increase

1.00%

After issuance of 982,299 new shares

through the capital increase

0.83%

There are no financial instruments granting access to the

Company's capital in the future.

BREAKDOWN OF CAPITAL BEFORE AND AFTER THE TRANSACTION

Xilam Animation shareholdings

as of 20 December 2023

Shareholder

Number of shares

% of capital

Number of theoretical voting

rights

% of theoretical voting

rights

Number of exercisable voting

rights(1)

% of exercisable voting

rights

MDP Audiovisuel

1,319,092

26.86%

2,608,684

38.32%

2,608,684

38.97%

Xilam Group

498,745

10.15%

997,490

14.65%

997,490

14.90%

Marc du Pontavice

1

0.00%

2

0.00%

2

0.00%

“Concert” Total

1,817,838

37.01%

3,606,176

52.97%

3,606,176

53.88%

Xilam Animation Treasury Shares

114,917

2.34%

114,917

1.69%

-

0.00%

Other registered shares

127,807

2.60%

236,375

3.47%

236,375

3.53%

Free float

2,855,938

58.05%

2,850,938

41.87%

2,850,938

42.59%

Total

4,911,500

100.00%

6,808,905

100%

6,730,453

100.00%

(1) In accordance with AMF position-recommendation No. 2021-02,

the total number of voting rights exercisable at the general

meeting is calculated based on all shares to which exercisable

voting rights are attached and does not include shares deprived of

voting rights.

Shareholder structure after

capital increase (to the Company’s knowledge)

Shareholder

Number of shares

% of capital

Number of theoretical voting

rights

% of voting rights

Number of exercisable voting

rights(1)

% of exercisable voting

rights

MDP Audiovisuel

1,819,881

30.88%

3,109,473

39.91%

3,109,473

40.51%

Xilam Group

688,092

11.67%

1,186,837

15.23%

1,186,837

15.46%

Marc du Pontavice

1

0.00%

2

0.00%

2

0.00%

“Concert” Total

2,507,974

42.55%

4,296,312

55.15%

4,296,312

55.97%

Xilam Animation Treasury Shares

114,917

1.95%

114,917

1.48%

0

0.00%

Other registered shares

127,807

2.17%

236,375

3.03%

236,375

3.08%

Free float(2)

3,143,101

53.33%

3,143,101

40.34%

3,143,101

40.95%

Total

5,893,799

100%

7,790,705

100%

7,675,788

100%

- In accordance with AMF position-recommendation No. 2021-02, the

total number of voting rights exercisable at the general meeting is

calculated based on all shares to which exercisable voting rights

are attached and does not include shares deprived of voting

rights.

- Including shares issued as part of the transaction, excluding

those subscribed by the Concert.

NOTICE

In accordance with the provisions of Article 1, Paragraph 5 of

the Prospectus Regulation (EU) 2017/1129 of the European Parliament

and the Council of 14 June 2017, this issuance did not require a

Prospectus approved by the Autorité des Marchés Financiers (AMF),

as it represents less than 20% of the number of shares of the same

category already admitted to trading on a regulated market.

A notice to shareholders regarding this transaction was

published on 15 December 2023 in the Bulletin des Annonces Légales

Obligatoires (BALO).

TRANSACTION PARTNER

EuroLand Corporate

Advisor

About Xilam

As a major player in animation, Xilam is an integrated studio

founded in 1999 that creates, produces and distributes original

programmes in more than 190 countries for children and adults. Its

content is broadcast on television, and is also available on SVoD

platforms including Netflix, Disney+ and Amazon, and AVoD streaming

platforms including YouTube and Facebook. With a global reputation

for creativity and innovation, coupled with cutting-edge editorial

and commercial expertise, Xilam has cemented its position as a key

player in a fast-growing market. Every year, Xilam builds on

soaring successes and capitalises on flagship franchises (Oggy and

the Cockroaches, Zig & Sharko and Chicky) and new brands (Oggy

Oggy, Mr Magoo and Karate Sheep), which are strengthening and

expanding a substantial catalogue of more the 2,700 episodes and

three feature films, including the Oscar-nominated I Lost My Body.

Xilam has unique expertise in 3D animation. The Group employs more

than 600 people, including 400 artists, across its studios in

Paris, Lyon and Angoulême in France and Ho Chi Minh City in

Vietnam. Xilam was ranked France's leading animation studio for the

2018-2022 period in a report by the French national centre for

cinema and animation (CNC)

For more information, visit www.xilam.com

Name: Xilam

ISIN: FR0004034072

Symbol: XIL

Number of ordinary shares comprising share

capital: 4,911,500 shares

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240111455963/en/

Marc du Pontavice – Chairman and CEO Cécile Haimet – CFO Phone:

+33 (0)1 40 18 72 00

Image Sept Agency xilam@image7.fr Karine Allouis (Media

Relations) – Phone: +33(0)1 53 70 74 81 Laurent Poinsot (Investor

Relations) – Phone: +33(0)1 53 70 74 77

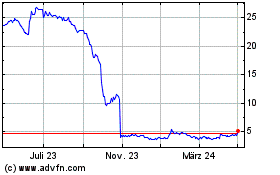

Xilam Animation (EU:XIL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Xilam Animation (EU:XIL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024