Voltalia consensus as of march 26, 2024

26 März 2024 - 7:11PM

Voltalia consensus as of march 26, 2024

Voltalia consensus as of march 26, 2024

Voltalia (Euronext Paris, ISIN code:

FR0011995588), an international player in renewable energies,

publishes the consensus of equity analysts, as of

March 26, 2024.

|

in millions of euros |

2023 (average) |

2024 (average) |

2024 (maximum) |

2024 (minimum) |

2024 (median) |

|

Contributions |

|

Turnover |

500 |

546 |

610 |

421 |

556 |

|

6 |

|

of which Energy sales |

305 |

387 |

423 |

336 |

382 |

|

5 |

|

of which Services et corporate |

545 |

370 |

563 |

195 |

341 |

|

5 |

|

eliminations |

-349 |

-210 |

-77 |

-379 |

-162 |

|

5 |

|

EBITDA |

238 |

255 |

264 |

245 |

255 |

|

6 |

|

of which Energy sales |

193 |

235 |

243 |

227 |

235 |

|

5 |

|

of which Services et corporate |

44 |

20 |

35 |

1 |

20 |

|

5 |

|

Depreciations and provisions |

-114 |

-129 |

-114 |

-136 |

-129 |

|

5 |

|

EBIT |

124 |

126 |

145 |

115 |

126 |

|

5 |

|

Financial result |

-69 |

-92 |

-84 |

-98 |

-92 |

|

5 |

|

Taxes |

-21 |

-16 |

-7 |

-30 |

-16 |

|

5 |

|

Net income |

31 |

17 |

21 |

11 |

17 |

|

5 |

|

Minority Interests |

1 |

0 |

4 |

-3 |

0 |

|

5 |

|

Net income (group share) |

32 |

21 |

37 |

10 |

19 |

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capex |

557 |

584 |

814 |

249 |

584 |

|

5 |

|

Free Cash Flow |

-226 |

-327 |

93 |

-547 |

-327 |

|

4 |

|

Gross debt |

1,330 |

1,543 |

2,313 |

1,671 |

1,543 |

|

4 |

|

Cash and equivalents |

696 |

682 |

980 |

0 |

682 |

|

2 |

|

Net debt |

1,335 |

1,726 |

1,954 |

1,334 |

1,726 |

|

6 |

|

|

|

|

|

|

|

|

|

|

Capacity in operation and in construction (in

MW) |

2,850 |

3,195 |

3,346 |

3,044 |

3,195 |

|

2 |

|

ow in operation (in MW) |

2,365 |

2,626 |

2,771 |

2,477 |

2,626 |

|

6 |

|

ow in construction (in MW) |

480 |

695 |

823 |

567 |

695 |

|

2 |

Note: The consensus is calculated by Voltalia,

based on estimates made by equity analysts who cover Voltalia as of

March 26, 2024. The estimates mentioned regarding the projected

performance of Voltalia represent only opinions and do not

represent forecasts or predictions of Voltalia or its management.

By publishing this consensus, Voltalia does not endorse this

information, conclusions or recommendations.

Next on the agenda: FY 2023

Results, on April 2nd, 2024 (before market opening)

About Voltalia

(www.voltalia.com)

Voltalia is an international player in the

renewable energy sector. The Group produces and sells electricity

generated from wind, solar, hydraulic, biomass and storage

facilities that it owns and operates. Voltalia has generating

capacity in operation and under construction of 2.8 GW and a

portfolio of projects under development representing total capacity

of 16.1 GW.

Voltalia is also a service provider and supports

its investor clients in renewable energy projects during all

phases, from design to operation and maintenance.

As a pioneer in the corporate market, Voltalia

provides a global offer to private companies, ranging from the

supply of green electricity and energy efficiency services to the

local production of their own electricity.

The Group has more than 1,850 employees and is

present in 20 countries on 3 continents and is able to act

worldwide on behalf of its clients.

Voltalia is listed on the regulated market of

Euronext Paris, compartment B (FR0011995588 – VLTSA). The Group is

also included in the Gaïa-Index, an index for socially responsible

midcaps.

Investor relationsEmail: invest@voltalia.comT.

+33 (0)1 81 70 37 00

|

Seitosei ActifinPress Contact: Jennifer JulliaEmail:

jennifer.jullia@seitosei-actifin.com T. +33 (0)1 56 88 11 19 |

- Voltalia consensus as of march 26, 2024

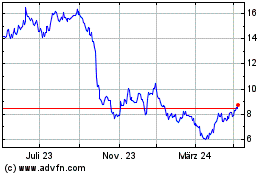

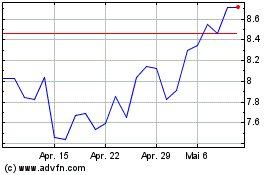

Voltalia (EU:VLTSA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Voltalia (EU:VLTSA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024