Virbac 2024 half-year results

- Exceptional business

momentum in the first half, with revenue up 16.1% at constant

exchange rates

- Strong growth in adjusted

current operating income1

- +3.4 points compared with

2023 to reach a record level at 21.4% of revenue

- 2024 targets

confirmed

- Revenue growth expected

between 7% and 9% at constant exchange rates and

scope

- Adjusted current operating

income1 expected to be

around 16% compared with 15.1% in 2023

CONSOLIDATED FIGURES AS AT JUNE 30

in € million |

|

2024 |

2023 |

2024/2023 change |

|

|

Revenue |

702.9 |

610.5 |

+15.1% |

|

|

Change at constant exchange rates |

|

|

+16.1% |

|

|

Change at constant exchange rates and

scope2 |

|

|

+11.3% |

|

|

Adjusted current operating

income1 |

150.4 |

109.9 |

+36.9% |

|

as a % of revenue

as a % of revenue at constant rates |

21.4%

21.3% |

18.0%

|

|

|

|

Amortization of intangible assets arising from acquisitions |

-1.7 |

-1.9 |

|

|

|

Current operating income |

148.7 |

108.0 |

+37.7% |

|

|

Non-current income & expenses |

-2,0 |

0,5 |

|

|

|

Operating income |

146.7 |

108.5 |

+35.1% |

|

|

Consolidated net income |

94.9 |

74.8 |

+26.9% |

|

|

Including net income - Group share |

94.7 |

75.0 |

|

|

|

Shareholders’ equity - Group Share |

994.3 |

898.5 |

+10.7% |

|

|

Net debt3 |

254.9 |

-52,44 |

- |

|

|

Operating cash flow before interest and

taxes5 |

172.6 |

132.4 |

+30.4% |

|

1adjusted current

operating income corresponds to the “current operating income

before amortization of assets arising from acquisitions”

2growth at constant exchange rates and

scope corresponds to organic growth of sales, excluding exchange

rate variations, by calculating the indicator for the financial

year in question and the indicator for the previous financial year

on the basis of identical exchange rates (the exchange

rate used is the previous financial year), and excluding material

change in scope, by calculating the indicator for the financial

year in question on the basis of the scope of consolidation for the

previous financial year. This change is calculated on the

actual scope of consolidation, including the impact of acquisitions

(Globion and Sasaeah), for

which the indicator in question is calculated on the basis of the

previous year's exchange rate

3net debt

corresponds to current (€187.3

million) and non-current

(€187.4 million) financial

liabilities as well as a lease obligation related to the

application of IFRS 16 (€37 million), less the

cash position and cash equivalents

(€156.8 million) as published

in the statement of financial position

4net cash position as of December 31,

2023

5operating cash flow corresponds

to adjusted current operating income

(€150.4 million) restated

for items having no impact on the cash position as well as

impact arising from asset disposal. This restates depreciation and

amortization of fixed assets before acquisitions

for €22.5 million (comprising €24.2 million in depreciation and

amortization of fixed assets and provisions, and €-1.6

million in amortization of assets from acquisitions), as well as

non-current income and expenses (€2 million), other non-cash income

and expenses (€0.4 million), and impact of disposals (€1.3

million)

The accounts were audited by the statutory

auditors and reviewed by the board of directors on September 13,

2024. The report of the statutory auditors is in the process of

being issued. The statements and detailed presentation of the

half-year results are available on the website at

corporate.virbac.com.

In the first semester, our revenue

amounted to €702.9 million compared to €610.5 million in

2023, an overall change of +15.1%. Excluding currency effects,

revenue rose significantly by +16.1%. The integration of recently

acquired companies (Globion in India and Sasaeah in Japan)

contributed +4.8 growth points. At constant exchange rates and

scope, first-half organic growth reached +11.3%, favorably impacted

by the concomitant increase in volumes and prices (price effect

estimated at ~3.5 growth points) despite a slowdown in inflation.

It should be noted that this half-year benefited from a favorable

basis for comparison, due in particular to the increase in our

production capacity for dog and cat vaccines since the beginning of

the year.

The Europe area (+12.3% at constant exchange

rates and scope) accounted for almost half of the Group's organic

growth, benefiting from a strong rebound in the dog and cat vaccine

range, as well as increased demand for our petfood/pet care ranges.

The excellent performance of North America (+22.2% at constant

exchange rates and scope) benefited from both a favorable base

effect (following distributors’ destocking effect in early 2023)

and sustained sales momentum on our specialty pet products. Latin

America (+10.5% at constant exchange rates and scope) benefited

from remarkable performances in Chile, Mexico and Central America,

which more than offset the slight downturn in Uruguay and Brazil.

India continues to fuel our expansion in the India, Middle East and

Africa region (+9.6% at constant exchange rates and scope), and

recorded a very significant increase (~20% at actual scope) thanks

to the expansion of our portfolio following the acquisition of

Globion's poultry vaccines. China and South-East Asian countries

were behind our growth in Asia (+8.8% at constant exchange rates

and scope). Despite a rebound in the second quarter, the Pacific

region ended the half-year slightly down (-0.8% at constant

exchange rates and scope), penalized by an unfavorable basis for

comparison, as business at the start of 2023 benefited from a

particularly favorable agricultural and climatic context (prices

and herd stock increase).

The current operating income before

depreciation of assets arising from acquisitions amounts

to €150.4 million, up sharply versus 2023 (€109.9 million). This

remarkable increase is due first and foremost to the improvement in

our gross margin (+2.7 points), resulting from volume-driven sales

growth and a price effect. In addition, we benefited from a base

effect, the first half of 2023 being impacted by the

under-absorption of our fixed costs linked to the production of our

companion animal vaccines. Net expenses rose by €36.8 million, €8.4

million of which relates to the integration of Globion and Sasaeah.

At constant scope, net expenses rose by €28.4 million, or 10.4%.

This increase in our operating expenses stems mainly from marketing

and travel costs in line with the growth in business, increased

R&D investments, and higher personnel costs following the

impact of salary increment and the strengthening of our workforce,

mainly in R&D, sales and manufacturing functions. Our

profitability thus continues to grow, with an improvement of 3.4

points to reach a record level of 21.4%. The integration of Globion

and Sasaeah had a slightly accretive impact of around 0.5 point on

Group profitability. It should be noted that the ratio of R&D

expenditure to sales remained stable in the first half of 2024

compared with 2023, due to a phasing effect (an acceleration is

expected in the second half of the year) and very strong sales

growth momentum.

Consolidated net income stood

at €94.9 million, up +26.9% compared to the same period in 2023.

Other non-current income and expenses represented a net expense of

€2.0 million. They include costs related to the acquisition of

Sasaeah (-€4.7 million), partly offset by an asset disposal (€2.5

million) and the unused portion of a restructuring provision. Net

financial expense amounted to -€4.8 million, compared with +€0.9

million as of June 30, 2023, a change mainly due to higher

borrowing costs of €2.4 million, as well as higher foreign exchange

losses (-€3.7 million) as a result of unhedged exposure in Chilean

pesos and the currency's depreciation over the period. Lastly, the

tax charge rose, mainly in line with business activity.

Net income - Group share

amounted €94.7 million, up +26.2% compared to the first half of the

previous year (€75.0 million).

On the financial side, our net

debt stood at €254.9 million, up €307.3 million compared to

December 31, 2023. In addition to the seasonal rise in our working

capital requirements and the payment of dividends, this significant

increase is due to the acquisition of Sasaeah in Japan on April 1

and the finalization of the buyout of minority interests in

Globion, India, on June 21. It should be noted that following our

request to activate the accordion clause in our syndicated

contract, our banks’ pool agreed to increase their commitment by

€150 million, bringing the total commitment to €350 million. This

syndicated contract has also been the subject of an amendment

unanimously accepted by our banks, including a new accordion clause

of €100 million, bringing the potential amount of our credit

facility to €450 million.

Outlook

We confirm our revised forecasts: in line with our press release of

July 8, 2024, at constant exchange rates and scope, we confirm

revenue growth between 7% and 9%, and an adjusted Ebit7

ratio of around 16%. The contribution of recent external growth

operations8 is expected to be around +5.5 growth points

on revenue, with a slightly accretive impact on Group

profitability. At constant exchange rates and scope, revenue growth

is therefore expected to be between 12.5% and 14.5%.

Besides, excluding acquisitions, our cash position should improve

by €60 million.

7“Current operating

income before amortization of assets arising from

acquisitions”

8acquisitions of Globion

in India and Sasaeah in Japan

ANALYSTS’ PRESENTATION -

VIRBAC

We will hold a virtual

analyst meeting on Monday, September 16, 2024 at 2:00 p.m. (Paris

time - CEST).

Information for

participants:

Webcast access link:

https://bit.ly/4caYWSu

This access link is

available on the corporate.virbac.com site, under the heading

“financial press releases.” This link allows participants to access

the live and/or archived version of the webcast.

You can ask questions

via chat (text) directly during the webcast or after

watching the replay at the following email address:

finances@virbac.com.

Focusing on animal health, from the

beginning

At Virbac, we provide innovative solutions to veterinarians,

farmers and animal owners in more than 100 countries around the

world. Covering more than 50 species, our range of products and

services enables to diagnose, prevent and treat the majority of

pathologies. Every day, we are committed to improving animals’

quality of life and to shaping together the future of animal

health.

Virbac: Euronext Paris - subfund A - ISIN code:

FR0000031577/MNEMO: VIRP

Financial Affairs department: tel. +33 4 92 08 71 32 - email:

finances@virbac.com - Website: corporate.virbac.com

APPENDIXES

1. Statement of

financial position

See attached PDF

2. Statement of cash

flow

See attached PDF

3. Reconciliation

tables for alternative performance indicators

3.1. Net debt

3.2. Operating cash

flow before interest and taxes

See attached PDF

- Virbac_2024 _half year results

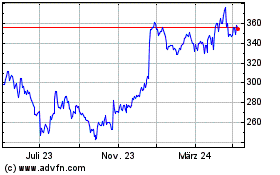

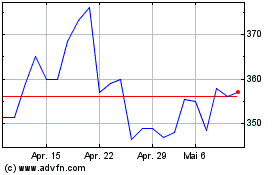

Virbac (EU:VIRP)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

Virbac (EU:VIRP)

Historical Stock Chart

Von Sep 2023 bis Sep 2024