Aveva Agrees to GBP9.48 Billion Takeover by Schneider -- Update

21 September 2022 - 9:08AM

Dow Jones News

By Ian Walker

Aveva Group PLC said Wednesday that it has agreed to a 9.48

billion pound ($10.79 billion) takeover by its major shareholder

French energy management and automation group Schneider Electric

SE.

Under the deal, accepting shareholders of the U.K. engineering

and industrial-software will get 3,100 pence in cash for each share

held. The offer price is a 41% premium to Aveva's closing price of

2,192 pence a share on Aug. 23, the day before Schneider disclosed

that it was considering a possible offer for the rest of Aveva that

it didn't already own.

Accepting shareholders will also be able to keep any interim

dividend of up to 13 pence a share declared by Aveva for the half

year ended Sept. 30 without any reduction in the share

consideration, Schneider said.

The offer prices puts an enterprise value on Aveva of GBP10.15

billion.

"By taking 100% ownership of Aveva, we will be able to grow the

business faster by simplifying decision-making, enabling seamless

interactions between teams, accelerating our investments in R&D

and enabling a more coordinated sales strategy, while respecting

the companies' particular strengths, and accelerating the

transition to a subscription business model under private

ownership," Schneider Chief Executive Jean-Pascal Tricoire

said.

Schneider currently owns 178.6 million shares in Aveva, or

59.14% of its issued share capital via its subsidiary Samos

Acquisition Company Ltd.

The acquisition is expected to complete in the first quarter of

2023.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

September 21, 2022 02:53 ET (06:53 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

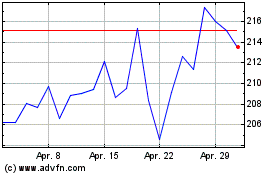

Schneider Electric (EU:SU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024