2023 provisional sales - unaudited

figures -

- Annual sales: €8,006m, +5.3% LFL* (+0.6% as reported)

- In line with full-year outlook

- Continued recovery of the Consumer business

- Outstanding performance by the Professional business

- A strong fourth quarter: sales of €2,474m, up 8.5% LFL

(+3.1% as reported)

- 2023 Operating Result from Activity now expected to grow by

more than 15% (vs. more than 10% previously)

Regulatory News:

Groupe SEB (Paris:SK):

Statement by Stanislas de Gramont, Chief Executive Officer of

Groupe SEB

"In 2023, Groupe SEB's sales returned to a good organic growth

dynamic, and its sales are back above the €8 billion mark in this

financial year.

As expected, our Consumer business returned to a good level of

organic growth as of the second quarter and since then continued on

this trajectory. This performance is primarily the result of

constant investment in a sustained innovation policy, and a solid

commercial dynamic. The Small Domestic Equipment market

demonstrated its resilience in 2023, in a complex macro-economic

environment.

In a very buoyant market, the Group's Professional business

achieved a record year, driven by commercial successes in the

Coffee business in its main geographies, allowing the Group to

consolidate its world leading position.

Based on these solid sales performances and rigorous operational

management, the Group is revising upwards its growth forecast for

its 2023 Operating Result from Activity, from an increase of at

least 10% to at least 15%. "

* LFL: on a like-for-like basis (= organic)

GENERAL COMMENTS ON GROUP SALES

Groupe SEB generated sales of €8,006m in 2023, up 0.6% (i.e.

€46m) as reported. Organic growth was of a good level at 5.3%, i.e.

+€420m. It was counterbalanced by a negative currency effect of the

same magnitude, resulting from the depreciation of a number of

currencies against the euro (in particular, the Chinese yuan). The

revenue also includes a limited scope effect linked to the

integration of the acquired companies, Zummo, La San Marco and

Pacojet.

In a generally unfavorable macro-economic environment, this

performance is very satisfactory. It is in line with the Group's

objective of achieving mid-single digit organic sales growth in

2023, reflecting a return to growth for the Consumer business and

strong sales growth for the Professional business.

Over 2023, Consumer sales reached €7,045m, up 3.2% LFL from

2022. The fourth quarter saw organic growth of 7.7%, compared with

5.5% in the third quarter and 5.2% in the second quarter. Hence,

the Group was back on a good LFL growth trajectory in 2023 in a

resilient Small Domestic Equipment market, despite an uncertain

macro-economic environment.

This positive performance was fueled by our continued

development dynamic based on innovation, a constantly enhanced

offering, the roll-out of our flagship products in our markets, and

an efficient sales execution. In terms of products, the growth was

notably driven by linen care, versatile vacuum cleaners, fans,

oil-less fryers, rice cookers, kettles, full-automatic coffee

machines and cookware (in particular the Ingenio range).

Sales generated by the Professional business amounted €962m in

2023, up 26.5% LFL from 2022, driven by the continued growth of the

Professional Coffee business across all major geographies,

including in China, the United States, the United Kingdom and the

DACH region (Germany, Austria and Switzerland). It was fueled by

the roll-out of large contracts and by dynamic core business

activity.

The Group's organic growth in the fourth quarter was +8.5%

with:

- sales increase of 7.7% LFL in the Consumer business, in all

regions, with, in particular, a significant improvement in Western

Europe (+6.1%), continued buoyant momentum in other EMEA countries

(+21.7%) and growth in business activity in China (+3.3%);

- sustained excellent dynamic in the Professional business

(+16.2%), despite demanding comparison base.

REVENUE BY REGION - 2023 Unaudited figures

Revenue in €m

2022

2023

Change 2023/2022

As reported

LFL

EMEA

Western Europe

Other countries

3,444

2,416

1,028

3,475

2,401

1,074

+0.9%

-0.6%

+4.5%

+6.6%

-0.4%

+23.2%

AMERICAS

North America

South America

1,130

797

333

1,113

767

345

-1.5%

-3.7%

+3.7%

+1.4%

-2.8%

+11.5%

ASIA

China

Other countries

2,660

2,101

559

2,457

1,966

492

-7.6%

-6.5%

-12.1%

-0.6%

+1.0%

-6.5%

TOTAL Consumer

7,234

7,045

-2.6%

+3.2%

Professional

725

962

+32.6%

+26.5%

GROUPE SEB

7,960

8,006

+0.6%

+5.3%

Rounded figures in €m

% calculated on non-rounded figures

REVENUE BY REGION - FOURTH QUARTER Unaudited figures

Revenue in €m

Q4

2022

Q4

2023

Change 2023/2022

As reported

LFL*

EMEA

Western Europe

Other countries

1,142

791

350

1,192

839

353

+4.4%

+6.0%

+0.9%

+10.9%

+6.1%

+21.7%

AMERICAS

North America

South America

326

240

86

335

232

103

+2.6%

-3.3%

+19.1%

+7.0%

+0.0%

+26.3%

ASIA

China

Other countries

711

557

154

682

536

146

-4.0%

-3.7%

-5.1%

+2.9%

+3.3%

+1.6%

TOTAL Consumer

2,179

2,209

+1.4%

+7.7%

Professional

221

264

+19.6%

+16.2%

GROUPE SEB

2,400

2,474

+3.1%

+8.5%

Rounded figures in €m

% calculated on non-rounded

figures

COMMENTS ON CONSUMER SALES BY REGION

Revenue in €m

2022

2023

Change 2023/2022

Q4 Change 2023/2022

As reported

LFL

As reported

LFL

EMEA

Western Europe

Other countries

3,444

2,416

1,028

3,475

2,401

1,074

+0.9%

-0.6%

+4.5%

+6.6%

-0.4%

+23.2%

+4.4%

+6.0%

+0.9%

+10.9%

+6.1%

+21.7%

WESTERN EUROPE

In the fourth quarter, the Group's sales were up 6.1% LFL thanks

to improved performances in its main markets, particularly in

France and Germany. This positive momentum was driven by most

product categories, in particular cookware, electrical cooking and

floor care. Furthermore, the negative impact related to destocking

from European distributors is mostly over.

Over the year, revenue fell slightly by 0.4% LFL. The European

Small Domestic Equipment market demonstrated a certain degree of

resilience, in a difficult economic environment.

In France, the Group generated organic growth of around 5% over

the year, driven by strong momentum in cookware (supported by a

significant loyalty program in the first half of the year), floor

care and electrical cooking (in particular, oil-less fryers).

In Germany, sales decreased in 2023 in a gloomy economic

environment. However, the Group ended the year on a much more

positive note, delivering double-digit growth in the fourth

quarter, confirming an improvement in sell-out in the second half

of the year.

The Group generated higher revenue in 2023 in several countries

in the region, including Spain, Belgium and the Nordics, benefiting

from favorable markets.

OTHER EMEA COUNTRIES

The Group's sales in other EMEA countries increased by 21.7% LFL

in the fourth quarter and by 23.2% LFL over the year as a whole,

with markets in the region generally posting growth. The reported

rise in revenue in 2023 was only 4.5%, mainly due to the

significant devaluations of the Turkish lira and the Egyptian

pound.

In Central and Eastern Europe, the Group's sales were up sharply

in 2023. Throughout the year, the Group leveraged its strong

relationships with its main distributors and its excellent

commercial execution, both online and offline. It also continued to

strengthen its competitive positions in important categories, such

as oil-less fryers, floor care or linen care and to roll-out its

flagship products such as Optigrill, Ingenio, and Cookeo.

Organic growth has also been robust in Turkey and Egypt,

countries in which the Group quickly applied price increases in

highly inflationary environments. In Turkey, the Group capitalized

on the strong momentum of the Small Domestic Equipment market,

particularly in cookware and oil-less fryers. In Egypt, it

continued to expand and consolidated its position, particularly in

fans, linen care, food preparation and cookware.

Revenue in €m

2022

2023

Change 2023/2022

Q4 Change 2023/2022

As reported

LFL

As reported

LFL

AMERICAS

North America

South America

1,130

797

333

1,113

767

345

-1.5%

-3.7%

+3.7%

+1.4%

-2.8%

+11.5%

+2.6%

-3.3%

+19.1%

+7.0%

+0.0%

+26.3%

NORTH AMERICA

In the fourth quarter, sales in North America were stable on a

LFL basis (down by 3.3% as reported), after a very strong third

quarter (+14,9% LFL). The Group thus delivered an improved sales

growth level of 6.8% LFL in the second half.

Over the year, sales decreased by 2.8% LFL and by 3.7% as

reported.

In the United States, in a volatile consumer environment marked

by retailers’ very cautious stock management, the Group continued

to outperform the cookware market. Hence, it further strengthened

its leadership based on its three complementary brands (T-fal,

All-Clad and Imusa).

As in 2022, the Group generated double-digit organic growth in

Mexico, fueled by the constant consolidation of its leading

position in cookware, and by enhanced market shares in linen care,

food preparation (in particular, blenders) and fans. The Group also

successfully pursued the roll-out of its full-automatic coffee

machine offering and innovations.

SOUTH AMERICA

Revenue grew by 26.3% LFL in the fourth quarter, due in

particular to an excellent season for sales of fans in Colombia and

Brazil driven by the El Niño climate phenomenon.

Annual sales rose by 11.5% LFL, driven by a solid second half of

the year, after a stable first half.

In Colombia, the Group continued to gain market share in a

difficult environment due to a strong inflation. As such, it

strengthened its leadership in cookware. Moreover, excellent

performance in fans and strong market share gains in food

preparation (blenders) gave the Group a leading position in small

electrical appliances in 2023.

In Brazil, demand for fans fueled growth. Despite an intense

competitive context, the Group also successfully increased its

sales volumes, particularly in oil-less fryers and single-serve

coffee machines.

Revenue in €m

2022

2023

Change 2023/2022

Q4 Change 2023/2022

As reported

LFL

As reported

LFL

ASIA

China

Other countries

2,660

2,101

559

2,457

1,966

492

-7.6%

-6.5%

-12.1%

-0.6%

+1.0%

-6.5%

-4.0%

-3.7%

-5.1%

+2.9%

+3.3%

+1.6%

CHINA

In the fourth quarter, sales in China increased by 3.3% LFL.

Over the year, Supor's domestic sales grew by 1.0% LFL and declined

by 6.5% as reported, with the difference between the two figures

being due to the depreciation of the yuan against the euro over the

period.

These annual and quarterly performances reflect Supor’s

strengthened leadership position, in a context of weak consumer

confidence in China. Supor consolidated its market position in all

its major categories thanks to its numerous assets: a less

discretionary product mix than its competitors, significant

innovation capabilities with fast roll-out of new products and

proven and recognized online expertise in sales activation.

Supor continued to enrich its product offering by constantly

revitalizing its flagship categories such as woks, rice cookers,

electric pressure cookers, and kettles, and by developing new

segments, such as portable coffee machines, auto-frying machine,

insulated mugs and floor washers.

OTHER ASIAN COUNTRIES

Group sales in the other Asian countries grew 1.6% LFL in the

fourth quarter, thanks to an improved performance in several key

markets in the region, such as Japan, South Korea, Australia and

Thailand. This stronger momentum at the end of the year was notably

underpinned by the commercial success of our kettles in Japan,

solid sales of cookware in South Korea and sales upturn in

Australia. The pick-up in organic sales growth in the fourth

quarter seems to point to a normalization of retailers’ inventory

levels.

Over the year, revenue were down 6.5% LFL, in a complicated

macro-economic environment for most countries in the region. The

high levels of inflation and the significant increases in interest

rates weighed on consumer demand, while encouraging distributors to

reduce their inventory levels. The best performing categories in

2023 were kettles, oil-less fryers, linen care, and floor care.

COMMENTS ON PROFESSIONAL BUSINESS ACTIVITY

Revenue in €m

2022

2023

Change 2023/2022

Q4 Change 2023/2022

As reported

LFL

As reported

LFL

Professional

725

962

+32.6%

+26.5%

+19.6%

+16.2%

The Group's Professional business continued its excellent

trajectory, generating organic sales growth of 16.2% in the fourth

quarter, despite more demanding comparison base. This business

encompasses Professional Coffee, which accounts for more than 90%

of sales, hotel equipment, Krampouz, Zummo and Pacojet.

In 2023, revenue from the Professional business was €962m, up

26.5% LFL from the previous year.

This outstanding performance was mainly due to record sales of

both machines and services in Professional Coffee, achieved in the

Group's main markets (China, the United States, Germany and the

United Kingdom). Sales of machines relied on an ever broader and

more diversified client portfolio, supporting sales recurrence, and

on the roll-out of major contracts with key customers such as

Luckin Coffee in China, Greggs in the United Kingdom and QuikTrip

in the United States. The continuous development of services and

their digital dimension are improving the attractiveness of the

Group's offering and contributing to its strong revenue growth.

In 2023, the Group also made significant progress in developing

its Professional strategy. The acquisition of La San Marco broadens

the Group's product offering into traditional coffee machines,

while the acquisition of Pacojet strengthens the Group's presence

in professional kitchens.

2023 ORFA GROWTH EXPECTATIONS REVISED UPWARDS

As a result of the solid growth in sales in 2023, the continued

recovery in its gross margin, and the disciplined management of its

operating costs, the Group now expects its Operating Result from

Activity to increase by at least 15% over the year (vs. at least

10% previously).

This press release may contain certain forward-looking

statements regarding Groupe SEB’s activity, results and financial

situation. These forecasts are based on assumptions which seem

reasonable at this stage, but which depend on external factors

including trends in commodity prices, exchange rates, the economic

climate, demand in the Group’s large markets and the impact of new

product launches by competitors. As a result of these

uncertainties, Groupe SEB cannot be held liable for potential

variance on its current forecasts, which result from unexpected

events or unforeseeable developments. The factors which could

considerably influence Groupe SEB’s economic and financial result

are presented in the Annual Financial Report and Universal

Registration Document filed with the Autorité des Marchés

Financiers, the French financial markets authority. This press

release may contain individually rounded data. The arithmetical

calculations based on rounded data may present some differences

with the aggregates or subtotals reported.

GLOSSARY

On a like-for-like basis (LFL) – Organic The amounts and

growth rates at constant exchange rates and consolidation scope in

a given year compared with the previous year are calculated:

- using the average exchange rates of the previous year for the

period in consideration (year, half-year, quarter)

- on the basis of the scope of consolidation of the previous

year.

This calculation is made primarily for sales and Operating

Result from Activity.

Operating Result From Activity (ORFA) Operating Result

From Activity (ORFA) is Groupe SEB’s main performance indicator. It

corresponds to sales minus operating expenses, i.e. the cost of

sales, innovation expenditure (R&D, strategic marketing and

design), advertising, operational marketing as well as sales and

marketing expenses. ORFA does not include discretionary and

non-discretionary profit-sharing or other non-recurring operating

income and expense.

Adjusted EBITDA Adjusted EBITDA is equal to Operating

Result From Activity minus discretionary and non-discretionary

profit-sharing, to which are added operating depreciation and

amortization.

Free cash flow Free cash flow corresponds to adjusted

EBITDA, after accounting for the change in the operating capital

requirement, recurring investments (CAPEX), taxes and financial

expense, as well as other non-operational items.

Net financial debt This term refers to all recurring and

non-recurring financial debt minus cash and cash equivalents, as

well as derivative instruments linked to Group financing. It also

includes debt from application of the IFRS 16 standard “Lease

contracts” in addition to short-term investments with no risk of a

substantial change in value but with maturities of over three

months.

Loyalty program (LP) These programs, run by distribution

retailers, consist in offering promotional offers on a product

category to loyal consumers who have made a series of purchases

within a short period of time. These promotional programs allow

distributors to boost footfall in their stores and our consumers to

access our products at preferential prices.

Conference with management on January 30 at

6:00 p.m. CET

Please click on the following

link to access the live webcast

The webcast will also be available at

www.groupeseb.com on January 30 as of 8:00 p.m. CET

Access (audio only): From France: +33 (0)1 7037

7166 – Password: SEB From other countries: +44 (0) 33 0551 0200 –

Password: SEB From USA: +1 786 697 3501 – Password: SEB

Next key dates – 2024

February 22 | before

market

2023 results

April 25 | after

market

Q1 2024 sales and financial

data

May 23 | 2:30 p.m.

Annual General Meeting

July 25 | before

market

H1 2024 sales and results

October 24 | after

market

9-month 2024 sales and financial

data

Find us on www.groupeseb.com

World reference in small domestic equipment, Groupe SEB operates

with a unique portfolio of 35 top brands including Tefal, Seb,

Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor,

marketed through multi-format retailing. Selling more than 400

million products a year, it deploys a long-term strategy focused on

innovation, international development, competitiveness and client

service. Present in over 150 countries, Groupe SEB generated sales

of €8 billion in 2023 and has more than 33,000 employees

worldwide.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240130081457/en/

Investor/Analyst relations GROUPE SEB Financial

Communication and IR Dept

Raphael Hoffstetter Guillaume Baron

comfin@groupeseb.com

Tel. +33 (0) 4 72 18 16 04

Media Relations

GROUPE SEB Corporate Communication Dept

Cathy Pianon Anissa Djaadi Marie Leroy

presse@groupeseb.com

Tel. + 33 (0) 6 33 13 02 00 Tel. + 33 (0) 6 88 20 90

88 Tel. + 33 (0) 6 76 98 87 53

Image Sept Caroline Simon Claire Doligez

Isabelle Dunoyer de Segonzac

caroline.simon@image7.fr

cdoligez@image7.fr

isegonzac@image7.fr

Tel. +33 (0) 1 53 70 74 70

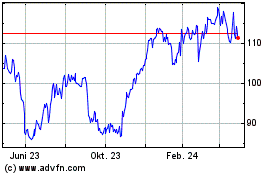

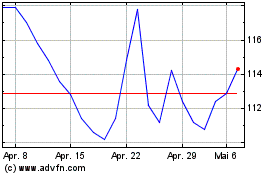

SEB (EU:SK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SEB (EU:SK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024